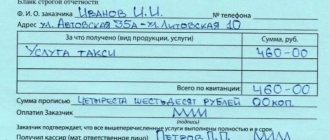

Having received a certain amount of cash from an individual (buyer) as payment for a product, service, or work, an economic entity (seller) must certify this fact by issuing an appropriate payment document.

According to the requirements of the current legislation, such a document can be either a cash receipt (CR) or a strict reporting form (SRF), which is a kind of analogue of a cash receipt.

The compilation of BSO is carried out in accordance with certain rules, the obligatory observance of which is provided for by current regulations.

It is necessary to understand how and by whom strict reporting forms are filled out, often used in cash payments between a business entity (recipient of money) and an individual (payer of money).

Law on BSO

The production and use of strict reporting forms is regulated by Resolution of the Ministry of Finance of the Russian Federation No. 359 of May 21, 2008. The main points of the resolution are as follows:

- the old forms of strict reporting forms that were previously used are no longer valid;

- Entrepreneurs must develop new forms of forms independently, except for certain types of activities

- Certain details must be present on the form

- when producing BSO by printing method, the printing house's output data must be indicated

How to get BSO?

Each entrepreneur must have a document confirming payment for the services he provides. If an individual entrepreneur does not have a cash register, there must be a BSO. The individual engaged in commercial activities is responsible for the production and printing of these forms.

Here you can download the strict reporting form in word format to get acquainted with its approximate appearance.

It is recommended to print this document only in printing organizations that have the appropriate license.

Approved BSO forms

For certain types of activities, the relevant departments that supervise them took care of approving uniform SSB forms for all, relieving entrepreneurs of the need to develop them independently. Among them:

| Kind of activity | Form | Approved |

| Tourist services | Tourist package | Order of the Ministry of Finance of Russia dated July 9, 2007 No. 60n |

| Insurance | Receipt for receipt of insurance premium (contribution) (Form No. A-7) | Order of the Ministry of Finance of Russia dated May 17, 2006 No. 80n |

| Veterinary services | Receipt for veterinary payments class=”aligncenter” width=”874″ height=”620″[/img] | Order of the Ministry of Finance of Russia dated April 9, 2008 No. 39n |

| Pawnshop services | Pledge ticket, safety receipt | Order of the Ministry of Finance of Russia dated January 14, 2008 No. 3n |

| Budgetary organizations | Receipt, form 0504510 | Order of the Ministry of Finance of Russia dated December 30, 2008 No. 148n |

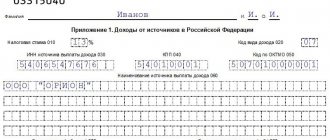

How to draw up an act

The document records the composition of the commission, the details of the order on its creation and the period for which the write-off is carried out.

BSO are listed in the table with the following marking:

- series;

- numbers;

- reasons for deregistration;

- dates of destruction.

Obsolete and damaged BSO after write-off must be burned in the presence of members of the commission, who confirm the fact of liquidation with signatures. The act is approved by the head of the organization.

Marks and corrections in the documentation are not allowed.

When drawing up an act on the write-off of strict reporting forms (form 0504816), it is required to indicate:

- number; date of compilation;

- Name of the organization;

- INN, KPP and OKPO code of the enterprise;

- Full name MOL;

- accounting correspondence.

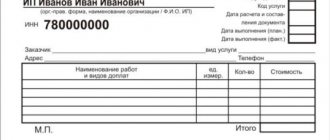

How to develop your own form

If there is no approved form for your type of activity, then you need to develop it yourself. On the one hand, you have the opportunity to take into account all the features of your work, but on the other hand, it is necessary that the form meets all the requirements for BSO. The most reasonable solution, obviously, is to take as a basis the old form that was previously used for your activities and, based on it, develop your own, taking into account the following points:

- The form must contain all the details explicitly specified in Resolution No. 359 (they are listed below)

- the form must contain the output data of the printing house that printed it

- no need to indicate the old form number (BO-1, BO-3, etc.), because Various ministries have repeatedly issued letters emphasizing that the old forms are invalid. Thus, to avoid unnecessary problems, it is better not to refer to old forms on your form.

In some cases, a line like this is added to the form: “Approved by IP Ivanova A.N. 04/15/2009 by order No. 32"

Penalties for failure to issue BSO

If, as a result of a thorough check by the Federal Tax Service, non-compliance with the rules for providing these forms is revealed, the individual entrepreneur may be punished under Article 14.5 of the Code of Administrative Offenses of the Russian Federation. The fact is that the absence of a completed BSO (or its illiterate completion) is equivalent to non-issuance of a check.

In this case, the individual entrepreneur can expect one of the following types of punishment:

- warning (usually assigned for a primary offense);

- a fine in the amount of 3,000–4,000 rubles.

At the same time, 1,500–2,000 rubles may also be recovered from an employee who did not issue a BSO or filled it out incorrectly.

How to draw up form p21001 sample filling? How to obtain a travel certificate https://urmozg.ru/trudovoe-pravo/komandirovochnoe-udostoverenie-blank/?

Payments to employees upon liquidation of an enterprise.

Details that must be present on the form

The current Resolution of the Ministry of Finance of the Russian Federation No. 359 states that the strict reporting form must contain:

- document name, six-digit number and series;

- name and legal form - for the organization; last name, first name, patronymic - for an individual entrepreneur;

- location of the permanent executive body of the legal entity (in the absence of a permanent executive body of the legal entity - another body or person entitled to act on behalf of the legal entity without a power of attorney);

- taxpayer identification number assigned to the organization (individual entrepreneur) that issued the document;

- type of service;

- cost of the service in monetary terms;

- the amount of payment made in cash and (or) using a payment card;

- date of calculation and preparation of the document;

- position, surname, name and patronymic of the person responsible for the transaction and the correctness of its execution, his personal signature, seal of the organization (individual entrepreneur);

- other details that characterize the specifics of the service provided and with which the organization (individual entrepreneur) has the right to supplement the document.

Requirements for registration of BSO

By registering a BSO, a business entity (seller) has the right to confirm the fact of receiving funds from an individual (buyer).

It is noteworthy that in this case the buyer can pay either in cash or with a bank card. Accordingly, the seller can receive the funds paid either in cash or in non-cash form.

The requirement for strict accounting of all SSO documents is of particular importance. This indicates the need to comply with certain rules by the person drawing up and taking into account strict reporting documents when receiving money from the buyer.

The strict reporting form is considered an official payment document; its legal force fully corresponds to a cash (fiscal) check.

A typical example of a BSO can be considered a transport ticket. This document officially certifies the fact of provision of transport services to the passenger. The issuance and presentation of a travel ticket confirms payment for the service provided.

Where to get the series and number for the form

As stated above, the strict reporting form must have a six-digit number and series of the form. There are very specific rules for recording strict reporting forms, the consideration of which is beyond the scope of this article. Their essence boils down to the fact that each form you use must be unique, so each one is assigned a separate number.

It is assumed that when producing BSOs, the series is assigned to them by the entrepreneur independently when submitting an order for the production of forms to the printing house, and the number of a specific form within the series is assigned by the printing house. However, in practice, an entrepreneur can order forms from different printing houses and it is impossible to trace the uniqueness of the number and series for each case. Therefore, you must independently ensure that your form number is not repeated. You can assign any series (of two capital letters) and not change it.

If you are ordering forms for the first time, then you can start numbering from number 000001. The series can be set, for example, AA, or in accordance with your initials. After you run out of the ordered batch of forms, you repeat the print run in the same or another printing house and say that your numbering has ended, say, at No. 001000 and in the new batch the numbering must begin with No. 001001. Thus, you independently determine the numbers and series to be entered on strict reporting forms.

conclusions

Thus, strict reporting documents in settlements between business entities and individuals are analogous to a cash (fiscal) receipt.

The use of BSO is permitted in situations where an economic entity does not legally use CCP in its activities.

Filling out the BSO is carried out by organizations and individual entrepreneurs performing settlements with individuals, according to the rules provided for by special legislation.

Compliance with these standards is an important requirement, since the form in question is subject to strict accounting.

Which printing houses have the right to print BSO

Currently, printing activities are not subject to licensing. The only exceptions are protected products, for the production of which special equipment, materials and technologies are used, for example, shares, bills, money, etc. When producing strict reporting forms, security methods are not used, so they can be produced in any printing house that has equipment for printing and consistent numbering.

Moreover, it is possible to produce a BSO using a computer and print it out on a printer, but for this it is necessary to use special programs that guarantee the uniqueness of the form being produced. This is mentioned in the law, but what specific programs need to be used is unknown. Therefore, to avoid misunderstandings on the part of the tax authorities, most entrepreneurs print forms using a typographic method.

This issue is discussed in more detail in a separate article.

Write-off procedure

By order of the enterprise, a special commission is created, which draws up an act for deregistration of strict reporting documents. The frequency of write-offs is established by the accounting policy of the institution. Before drawing up the document, the commission is obliged to verify the intended use of the forms provided by the MOL for deregistration.

The following are considered confirmation:

- stubs or copies of receipts;

- entries in the accounting book of form 0504045 with the signatures of the recipients;

- employee receipts for receiving a pass or certificate;

- journals for issuing waybills, work books and others.

Form options

Since the forms are made individually, a variety of options are possible. In order to decide what you need, consider the following points:

format

The format of the form can be arbitrary. The most commonly produced forms are the following formats: A4 : 210x297 mm, A3/3 : 140x297 mm, A5 : 210x148 mm A6 : 148x105 mm, A4/3 : 210x99 mm

paper/layers

In most cases, BSO is printed on self-copying paper and has 2-3 layers. One copy remains with the person who issued it, the second is transferred to the customer, the third is sent to the accounting department, warehouse, etc. If the form is supposed to be made from plain paper, then it is necessary to provide tear-off parts for the same purposes.

Registration of BSO with the tax office

Quite a frequently asked question to me. There is no need to register BSO forms with the tax office!!!

Ask how then the tax office will control your BSO forms? No way, the state initially trusts entrepreneurs and believes that there will be no deception.

I recommend doing everything according to the law and not using the trust of the state for your machinations. If the deception is revealed, then you can seriously get caught.

Previously, BSO forms once had to be registered with the tax office, but now they don’t. The state simplifies the life of an ordinary entrepreneur, for which special thanks to it (the state).

COMPLETING STRICT REPORTING FORMS

The strict reporting form (SRF) must be filled out clearly and legibly; corrections are not allowed. An incorrectly completed form is considered damaged and must be handed over to the employee responsible for storing the BSO (clause 10 of the Regulations on cash payments without cash registers).

When paying for services in cash or with a plastic card, the employee responsible for conducting cash payments (clause 20 of the Regulations on cash payments without cash register): 1) fills out the BSO, but does not yet put a personal signature on it; 2) receives money from the client, names its amount and places it separately in front of the client. When paying with a plastic card, inserts the card into a device for reading information from payment cards and receives confirmation of payment; 3) signs the BSO (except for the BSO approved for cultural institutions); 4) keeps a copy (tear-off part, spine) of the BSO and gives the BSO to the client: - if services are paid for in cash - along with the change, naming its amount; - if services are paid for with a plastic card - together with a document confirming the transaction with a plastic card; 5) at the end of the working day (shift) presents copies (tear-off parts, counterfoils) of all BSO issued to clients to the cashier or chief accountant of the organization simultaneously with the transfer of cash proceeds; 6) after formalizing the acceptance of cash, transfers copies (tear-off parts, counterfoils) of the BSO issued to clients and damaged forms to the person responsible for the storage of the BSO.

What information is contained in this form?

Connect to Yandex Taxi and start earning from 120,000 rubles per month!

Connect The legislation specifies what data must be included in the BSO. This:

- Information about the taxation option used by the seller of the service;

- Internet site address of the fiscal operator that provides information;

- License plate of the fiscal drive - it is assigned to each device individually at the factory;

- The date the service was provided (taxi ride), as well as the place and time when and where the payments were made;

- Payment method – cash or non-cash;

- Name of service;

- Of course, you will also need to indicate the exact amount of the calculation - with data on the rate and amount of VAT;

- The telephone number of the client himself , preferably also an e-mail - so that if necessary, you can send an electronic version of the form;

- Name of the receipt , its series and number;

- Name of the company that provides the service;

- Full name of the entrepreneur , taxi driver, his data, as well as the data of the person who was authorized to carry out the calculation.

Every entrepreneur who wants to conduct their commercial activities on a completely legal basis and not have any problems with tax and other services needs to use the BSO form for Yandex taxi.

Sample BSO for LLC and individual entrepreneur

Here you can find BSO forms for individual entrepreneurs and LLCs: (if the printing house does not have developed forms, you can use the one you download. It is also worth considering how to fill out BSO forms for LLCs and individual entrepreneurs. Also see how to keep records of BSO forms.

This is where I probably end my article. Any questions can be addressed in the comments to this article or in the VK group “”.

Happy business everyone! Bye!

ACCOUNTING FOR STRICT REPORTING FORMS

In accounting, BSO is reflected in off-balance sheet account 006 “Strict reporting forms” in a conditional valuation. It is easier to evaluate BSO in the amount of actual costs for their production.

In tax accounting, expenses for the purchase of BSO from organizations applying the general taxation regime will reduce taxable profit as part of other expenses. And VAT on them can be safely deducted if there is an invoice from the printing house.

And simplified organizations can take into account the costs of SSO as part of either material or office expenses.