Why do you need a checkpoint?

The reason code is an individual nine-digit code. It contains encrypted information about the reasons for registering a particular enterprise with the Tax Service. Also, using the checkpoint, you can find out what activities the organization is engaged in.

A legal entity can be registered with several Federal Tax Service Inspectors at once, for example, at the place of residence, at the location of the unit, at the location of the real estate, and so on. In order to store information about each of the reasons, they are assigned separate codes.

Also, the reason code is very important for enterprises because thanks to it they can conclude large transactions and participate in important tenders. For example, to participate in tenders from structures that are affiliated with the state, the organization that participates in the tender is required to fill out a line with a checkpoint. If the organization does not have a reason code for the statement, then most likely the application will not even reach the consideration stage.

This code may be needed when registering payment orders, accounting reports, and taxes.

IMPORTANT!

Checkpoint and Taxpayer Identification Number are two different things. There can only be one TIN, but there can be several checkpoints at once and they can change in different situations. For example, if, along with a change of address, there is a change of the Federal Tax Service, the tax service will assign a different checkpoint to the legal entity.

Archival extract

| OGRN | 1067759959585 |

| TIN | 7726554107 |

| OKPO | 98257015 |

| OKATO | 45296561000 |

| Registration date | November 21, 2006 |

| Registrar | Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW |

| Property type | Private property |

| Organizational and legal form | Limited Liability Companies |

| Authorized capital | 10,010,000 rub. |

| CEO | Kuznetsova Lyudmila Borisovna |

Mini-information about KPP LLC

KPP LLC, registration date - November 21, 2006, registrar - Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW. The full official name is LIMITED LIABILITY COMPANY “KPP”. Legal address: 117105, MOSCOW, VARSHAVSKOE highway, 33. The main activity is: “Wholesale trade of alcoholic and other beverages.” The company is also registered in such categories as: “Wholesale trade through agents (for a fee or on a contractual basis)”, “Wholesale trade of agricultural raw materials and live animals”, “Wholesale trade of non-food consumer goods”. General Director - Lyudmila Borisovna Kuznetsova. Organizational and legal form (OPF) - limited liability companies. Type of property - private property.

Contacts

| Address | 117105, MOSCOW, VARSHAVSKOE highway, 33 |

| Phones | 495-348-39-19 |

| Faxes | 348-39-19 |

Other companies in the region

“BIZNESTORG”, LLCOther wholesale trade125373, MOSCOW, YAN RAINIS boulevard, 2, bldg. 3

“LIGA”, LLC, MOSCOW Other wholesale trade 127081, MOSCOW, DEZHNEVA Ave., 38A, building 1

“TRADE CONSULTING”, LLCConsulting on commercial activities and management109316, MOSCOW, st. TALALIKHINA, 41, building 9, room. I, room 12

“CONSULT PLUS”, LLCProduction of general construction works127254, MOSCOW, OGORODNY pr-d, 5, building 7

“KRISMASH” JSC Other wholesale trade 109428, MOSCOW, st. STAKHANOVSKAYA, 20, building 11A

“BEST KO”, LLC Non-specialized wholesale trade of food products, including drinks, and tobacco products 117218, MOSCOW, st. KRZHIZHANOVSKOGO, 24/35, bldg. 4

“TONZHET”, LLC Activities of agents for wholesale trade of a universal assortment of goods 103001, MOSCOW, st. SADOVAYA-KUDRINSKAYA, 32, building 2

“AGROPLEMSOYUZ”, LLC, MOSCOWFinancial intermediation, not included in other groups107139, MOSCOW, st. SADOVAYA-SPASSKAYA, 13, building 2

“FEXIMA”, ZAO Activity of agencies for real estate transactions 125040, MOSCOW, LENINGRADSKY Ave., 8

“CONNECT LINE”, LLC Activities in the field of telecommunications 109451, MOSCOW, st. BRATISLAVSKAYA, 5

“VMS-OKTAN”, CJSC, MOSCOWWholesale trade in fuel103062, MOSCOW, MAKARENKO st., 2/21, building 1

“BUILDING SYSTEMS”, LLC, MOSCOWPreparation of construction site 109144, MOSCOW, st. BRATISLAVSKAYA, 19, bldg. 2

“PROMSTROYPOLYMERY”, LLC Activities of agents in the wholesale trade of building materials 105062, MOSCOW, per. LYALIN, 4, building 1

“FRAY”, LLC, MOSCOWWholesale beer trade121165, MOSCOW, KUTUZOVSKY Ave., 35, office. 1

“TSARITSYNO-DENT”, LLC Dental Practice 115516, MOSCOW, KAVKAZSKY boulevard, 58, building 1

What information is encrypted in the checkpoint

Upon registration, each payer is automatically registered with the Federal Tax Service. During registration, he is issued a unique identification number. In addition to the TIN, the payer is assigned a code of the reason for which the registration order occurred. If you know how to read the checkpoint, you can learn some information from it.

The reason code for the decision consists of nine digits in the format XXXXYYZZZ. Each sequence says something:

- The first digits store information about the tax office with which the person was registered.

- The next two signs indicate the reason for the registration. If these values are in the range from 01 to 50, then the company is Russian, if from 51 to 99, then it is foreign.

- The last three digits show the number of companies that have already registered for this reason.

Example of checkpoint decoding

And so, let's see what data can be obtained by knowing the checkpoint of any organization. For example, let’s take checkpoint “773601001”. This is a Sberbank checkpoint, let's decipher it:

- the first four digits are 7736, this is Federal Tax Service code No. 36 for the city of Moscow, South-Western Administrative District;

- the next two digits are 01, this value corresponds to the registration order at the taxpayer’s location;

- the last three digits are 001. From them you can understand that Sberbank is the first taxpayer that was registered by Federal Tax Service Inspectorate No. 36 at its location.

Main bank codes

Large banks have their branches in different regions. Each regional branch has its own checkpoint. Sberbank branch codes:

- Moskovskoe - 773643001;

- North-West - 784243001;

- South-West - 616143001;

- Siberian - 540602001;

- Far Eastern - 272143001;

- Povolzhskoe - 631602001;

- Srednerusskoye - 775002002;

- Baikalskoe - 380843001;

- Volgo-Vyatskoe - 526002001;

- Uralskoe - 667102008.

VTB Bank branch codes:

- Moskovskoe - 770943002;

- St. Petersburg - 783543011;

- Ekaterinburgskoe - 665843003;

- Yuzhno-Sakhalinskoye - 650143001;

- Novosibirsk - 540643001;

- Nizhne Novgorod - 526043001;

- Stavropolskoe - 263443001;

- Rostov-on-Don - 616443001.

Details in corporate documentation

It is worth noting that there are different ways of specifying information in contracts. The details are mandatory; if they are not specified, the document will be invalid. Different types of documents require different data, but some of them are required in any case:

- telephone, email;

- reason code and TIN;

- details of the bank that services the organization;

- legal address.

IMPORTANT!

The code is always issued at the same time as the TIN. In most cases, these combinations are written on one line separated by a slash.

Archival extract

| OGRN | 1097746395174 |

| TIN | 7703702479 |

| OKPO | 62172881 |

| OKATO | 45268554000 |

| Registration date | July 20, 2009 |

| Registrar | Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW |

| Property type | Private property |

| Organizational and legal form | Limited Liability Companies |

| Authorized capital | 12,000 rub. |

| CEO | Kimsanov Saparbek Sabirovich |

Mini-information about KPP LLC

KPP LLC, registration date - July 20, 2009, registrar - Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW. The full official name is LIMITED LIABILITY COMPANY “CROISSANT PARIS-PARIS”. Legal address: 121059, MOSCOW, UKRAINSKY boulevard, 7. The main activity is: “Production of bread and flour confectionery products for non-durable storage.” The company is also registered in such categories as: “Wholesale trade of sugar”, “Wholesale trade of sugary confectionery products, including chocolate, ice cream and frozen desserts”. General Director - Kimsanov Saparbek Sabirovich. Organizational and legal form (OPF) - limited liability companies. Type of property - private property.

Contacts

| Address | 121059, MOSCOW, UKRAINSKY boulevard, 7 |

Other companies in the region

“BIZNESTORG”, LLCOther wholesale trade125373, MOSCOW, YAN RAINIS boulevard, 2, bldg. 3

“LIGA”, LLC, MOSCOW Other wholesale trade 127081, MOSCOW, DEZHNEVA Ave., 38A, building 1

“TRADE CONSULTING”, LLCConsulting on commercial activities and management109316, MOSCOW, st. TALALIKHINA, 41, building 9, room. I, room 12

“CONSULT PLUS”, LLCProduction of general construction works127254, MOSCOW, OGORODNY pr-d, 5, building 7

“KRISMASH” JSC Other wholesale trade 109428, MOSCOW, st. STAKHANOVSKAYA, 20, building 11A

“BEST KO”, LLC Non-specialized wholesale trade of food products, including drinks, and tobacco products 117218, MOSCOW, st. KRZHIZHANOVSKOGO, 24/35, bldg. 4

“TONZHET”, LLC Activities of agents for wholesale trade of a universal assortment of goods 103001, MOSCOW, st. SADOVAYA-KUDRINSKAYA, 32, building 2

“AGROPLEMSOYUZ”, LLC, MOSCOWFinancial intermediation, not included in other groups107139, MOSCOW, st. SADOVAYA-SPASSKAYA, 13, building 2

“FEXIMA”, ZAO Activity of agencies for real estate transactions 125040, MOSCOW, LENINGRADSKY Ave., 8

“CONNECT LINE”, LLC Activities in the field of telecommunications 109451, MOSCOW, st. BRATISLAVSKAYA, 5

“VMS-OKTAN”, CJSC, MOSCOWWholesale trade in fuel103062, MOSCOW, MAKARENKO st., 2/21, building 1

“BUILDING SYSTEMS”, LLC, MOSCOWPreparation of construction site 109144, MOSCOW, st. BRATISLAVSKAYA, 19, bldg. 2

“PROMSTROYPOLYMERY”, LLC Activities of agents in the wholesale trade of building materials 105062, MOSCOW, per. LYALIN, 4, building 1

“FRAY”, LLC, MOSCOWWholesale beer trade121165, MOSCOW, KUTUZOVSKY Ave., 35, office. 1

“TSARITSYNO-DENT”, LLC Dental Practice 115516, MOSCOW, KAVKAZSKY boulevard, 58, building 1

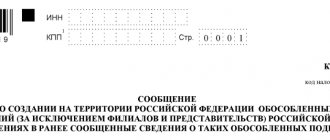

In which documents should the checkpoint be indicated?

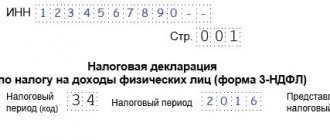

This code must be indicated on all official documents related to taxes or insurance premiums. Such documents include:

- declarations, calculations or income certificates form 2-NDFL;

- payment orders for payment of insurance premiums, penalties, fines, fees and taxes. In such documents, the checkpoint is a mandatory bank detail. In the case when the money goes to the counterparty, it is not necessary to indicate the checkpoint;

- invoices, books of purchases and sales, journals for recording issued and received invoices. Such documents must indicate the checkpoints of the buyer and supplier.

Where is it used?

Checkpoint is one of the ways to identify an enterprise and its structural units. It is traditionally used as one of the details when drawing up forms, contracts, powers of attorney and other documents. In addition, this OP attribute is used in the invoice. The invoice form contains fields for indicating the code of the seller and the buyer; the place where the checkpoint of a separate division is indicated in the invoice is marked with red arrows.

According to Letter of the Ministry of Finance of Russia dated 04/03/2012 N 03-07-09/32, when making a sale through an OP, the invoice indicates its code, and not the digital designation of the main organization. The same rule applies to purchasing goods through OP. When carrying out such transactions, the organization's TIN is indicated on the invoice, since separate divisions are not assigned this code.

Legal documents

- Article 83 of the Tax Code of the Russian Federation. Accounting for organizations and individuals

- Article 23 of the Tax Code of the Russian Federation. Responsibilities of taxpayers (payers of fees, payers of insurance premiums)

- Article 55 of the Civil Code of the Russian Federation. Representative offices and branches of a legal entity

- Order of the Federal Tax Service of Russia dated June 29, 2012 N ММВ-7-6/ [email protected]

Who is assigned the checkpoint?

It can only be assigned to an organization or its division. KPP cannot be assigned to individual entrepreneurs, since this is neither necessary nor useful. An individual entrepreneur has his own TIN, which is enough to carry out various operations in the process of work.

Reasons for assigning a checkpoint:

- Registration of an enterprise with the tax office at its location.

- Reorganization of the organization in the tax authority at its location.

- When the address of the organization's location changes, as a result of which the tax authority to which the legal entity is attached changes.

- At the location of individual divisions of the enterprise. To do this, the organization itself must write an application to the tax office at the location of the branch or office.

- At the location of the head office or transport enterprise.

- According to the new location of the unit, in the case when it is located on the territory of another department of the Federal Tax Service.

Reason code for registration when changing legal address

After changing the legal address, the TIN does not change. It is assigned once and forever. Tax organizations carry out all other actions with the company’s checkpoint independently.

Over a certain period of time, the organization is removed from tax registration and registered in a new location. That is, the enterprise does not directly participate in the process itself. Usually this procedure takes about a month . Depending on the situation and other conditions, the period may increase or decrease .

How to change organization details in 1C? The answer is below in the instructions.

Does the IP have a code?

According to the law, a reason code can only be assigned to an organization; an individual entrepreneur does not have one, and it cannot be assigned to him. If it happened that during the conclusion of the contract, among all the information you noticed a checkpoint, then this is information about the bank in which the entrepreneur has an account. An individual entrepreneur must indicate it, since when issuing a payment order, the individual entrepreneur is required to indicate the checkpoint of the recipient, in our situation, the recipient bank.

If it happens that when preparing documents it is still unclear what the bank’s reason code is and where exactly it is located in the details, then the simplest solution is to ask your partner for help. He must have all the information about the credit institution in which his money is located.

There are several other options for solving this problem, for example, finding information about the bank using the TIN. This can be done using the Federal Tax Service website. You can also contact the bank directly, call the hotline, or find information on the bank’s official website, but this method will take the most time.

How to find out the checkpoint of an organization

The checkpoint can be found out from the notice or certificate issued by the inspection. Also, the reason code for registration must be indicated in the Unified State Register of Legal Entities, which is issued to the company upon registration.

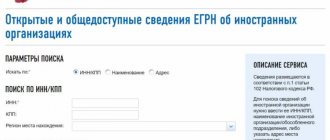

If you want to find out the checkpoint of an organization, knowing only its TIN, there are several ways to do this:

- Official website of the Federal Tax Service. You can use various sites to online search for checkpoints of both Russian and foreign organizations. You can also use your browser's regular search engine. When using a browser, it is worth considering that you will not receive information from official sources, which means it may not be reliable or outdated.

- Information systems and databases of legal entities. This method is paid. Special systems collect data on all legal entities that are registered on the territory of the Russian Federation. In order to find a checkpoint, you need to enter your Taxpayer Identification Number (TIN) in the search bar. It is possible to configure filtering of the results obtained, and you will also see all the changes: opening and closing of branches, change of checkpoints, opening and closing of divisions, change of managers.

- If you need the most accurate information, it is better to contact the Federal Tax Service directly and request an extract from the Unified State Register of Legal Entities. This extract is the most accurate and reliable source.

Also, do not forget that the checkpoint, unlike the TIN, can change. It is important to receive updated information in a timely manner.