All cash transactions of organizations must be carried out through cash register equipment. Strict reporting forms (SSR) are required for those institutions that accept cash directly, without using cash registers (Article 2 54-FZ of May 22, 2003). Budgetary institutions are no exception in this matter. All cash movements made without the use of cash registers are necessarily reflected in a special book - a journal of strict reporting forms, a sample of which we will consider step by step.

Where can I get the BSO accounting journal form?

The current legislation does not provide for a unified journal format, so organizations have the opportunity to independently compile such a register. However, budgetary institutions are recommended to use the unified form 0504045, in which the structural and content parts have been worked out, clearly reflecting the movement of strict reporting forms (Order of the Ministry of Finance of the Russian Federation No. 52n dated March 30, 2015). The unified journal of strict reporting forms can be downloaded for free on our website.

Results

The book intended for accounting for BSO is maintained by government agencies on a specially established form (form 0504045). Other legal entities and individual entrepreneurs have the right to use this form or create their own, subject to compliance with the mandatory requirements for the details of such a document.

The employee who makes entries in the BSO accounting book is appointed by order of the manager and is the financially responsible person.

Entries in the book are kept in chronological order. Attached to it are the BSO counterfoils and their damaged/unused forms. The general rules for drawing up a BSO accounting book are similar to the rules for drawing up a cash book. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out

It is necessary to follow certain rules that are established at the legislative level:

- Each sheet of the book must be stitched and numbered in order.

- All sections are signed by the head and chief accountant of the institution.

- When filling out, indicate not only the name of the BSO, but also its series and number.

Step 1. First of all, fill out the title page or header of the document. Here you must indicate the name of the register - the journal of strict reporting forms, as well as the reporting period. Next, enter the full (short) name of the institution, the necessary details and the structural unit responsible for maintaining the book.

Step 2. After completing the title page, fill out the tabular part. The following information must be entered into the table:

- date of receipt or issue of BSO;

- name of the counterparty;

- document details - grounds for issuing the form;

- quantity, series and number of BSO by receipt;

- quantity, series and number of BSO for consumption;

- quantity, series and number of sheets remaining in the institution;

- total values for income, expenses and balance.

IMPORTANT!

Inaccuracies, corrections and distortions of information when filling out the book are not allowed. If the responsible employee made a mistake, corrections are made as follows: the incorrect information is crossed out, then the correct data and the phrase “Believe the corrected information” are indicated, the responsible person’s signature, stamp and date are affixed.

Step 3. The completed BSO accounting log (you can download a sample for free at the end of the article) is numbered and stitched, certified by the manager’s signature and seal (if used in the organization).

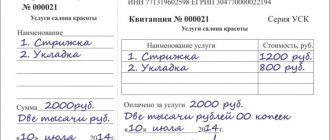

Accounting book of strict reporting forms: sample filling

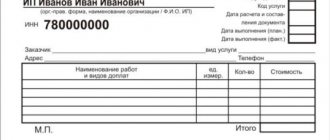

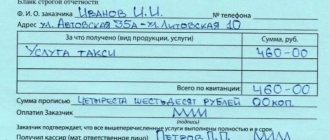

Example of filling out the sheet:

Sample of filling out the back sheet (the magazine must be bound and numbered):

Don't forget about important nuances:

- It is necessary to conclude a written agreement with the employee supervising the BSO on full financial responsibility in accordance with Art. 244 of the Labor Code of the Russian Federation (clause 14 of Resolution No. 359);

- form a commission for the reception of BSO (clause 15 of Resolution No. 359);

- forms are accepted on the day they are received from the printing house (clause 15 of Resolution No. 359);

- draw up an act of acceptance of documents and have it approved by the manager (clause 15 of Resolution No. 359).

Relevance of BSO in 2021

Until July 1, 2021, the registration of BSO will continue in the same manner as described in this article. From July 1, 2021, strict reporting forms will need to be prepared in the same way as cash receipts. The details of the cash receipt and the CO form will be identical.

The next change for the design of BSO is the ban on the use of printed forms. From July 1, the BSO will need to be generated through an automatic system and with data transferred through an operator to the Federal Tax Service. Those. There will be no differences between a cash receipt and a BSO from July 1, 2021.

In this regard, it will be relevant to resolve the issue of choosing between online cash register and online BSO . In our opinion, it would be preferable to opt for cash registers, since it is likely that the next change regarding cash payments may be a ban on the use of BSO. Moreover, at present, the production of devices for registering BSO and transferring BSO data to the Federal Tax Service has not been established, i.e. It is not possible to buy such a device in the near future.

How long is it stored?

When storing receipts and accounting journals, it is necessary to ensure that the documentation is protected from damage or loss. Only authorized persons have access to such documents. At the end of the working day, the place where the primary documentation is left is sealed and sealed.

There is a special procedure for storing used sheets and magazines. In accordance with the law, strict reporting forms are stored for at least 5 years. Consequently, the storage period for the Accounting Book will also be 5 years.

Documents transferred to the archive are stored in special sealed bags. When the 5-year period comes to an end, the papers must be destroyed. First, an act on their write-off is prepared. The document is drawn up in the presence of the appointed commission. After the forms are destroyed, a write-off entry is made in the Accounting Book.

The procedure for storing unused SSBs and the accounting journal corresponds to the form of safety of cash or securities. To protect against theft, a special room or safe is allocated, which is sealed at the end of the working day. Copies of used forms must be archived within the period established for primary documents.

The storage period for the journal is not clearly established by law. An enterprise can independently determine the storage period and fix it in its accounting policies. The archiving time cannot be less than the period established for the BSO. Primary accounting documents must be preserved for at least 5 years.

Legislative norms

All organizations providing services to the public must use cash registers and strict reporting documents in their work, information about which must be entered into the register of strict reporting forms. This is indicated in the Federal Law dated May 22, 2003 No. 55-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards.” The head of the company has the right to independently choose the most convenient method of settlements with consumers.

If an organization uses strict reporting documents (BSO) in its work, it must maintain a BSO accounting book, which should be filled out in a timely manner.

The use of BSO in the work should be based on Regulation No. 359 of 05/06/2008 on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment. It contains basic information about such forms.

Should BSO be taken into account?

The main purpose of the book is to reflect data on received and issued strict reporting forms.

Its completion is mandatory for all legal entities using similar forms when making payments to the public.

There is a standard form of the book - OKUD 0504045.

Who does it?

Russian legislation limits the range of enterprises that have the right to carry out their activities without using cash registers, but this category has a fairly wide range of activities.

The following can work without CCP:

- private entrepreneurs;

- business entities whose activities are aimed at providing services to the population;

- organizing public catering in schools;

- trade kiosks, collection of glass containers;

- retail outlets of non-food products at markets, exhibitions, fairs;

- tire service;

- Shoe repair;

- dry cleaning;

- veterinary clinics.

Organizations that receive funds from customers use strict reporting forms.

You can print them on your own if you have an automated software package with a sufficient level of protection from unauthorized access by unauthorized persons.

A cash register without registration with the tax office is also used, which can be purchased at city printing houses.

The enterprise is obliged to take into account the forms in accordance with Decree of the Government of the Russian Federation No. 359 of May 6, 2008.

Who's leading it

Maintaining the accounting book is entrusted to an employee of the company appointed by the manager. The procedure for making an entry and the responsible person are fixed in the accounting policy of the enterprise, approved by order of the manager. Traditionally, maintaining the form is entrusted to an accounting employee - a cashier . The responsible employee is included in the list of accountable persons. In the absence of employees, the individual entrepreneur maintains the book independently.

The head of the enterprise enters into a liability agreement with the employee. It provides:

- posting, storage of BSO;

- accepting cash from the public and issuing a form;

- making entries in the accounting book.

In the automatic mode of processing independently developed BSO, the manager similarly appoints a responsible person. The responsibility is assigned to a specific employee while simultaneously limiting the access of other employees to the document flow.

The loss of unfilled strict accounting forms does not entail punishment for the responsible employee. The manager can take disciplinary measures and recover the cost of the forms from the employee. If a violation is discovered by a Federal Tax Service inspector during an inspection, the responsible person may be fined for violating the rules for storing documents.

Introduction

A strict reporting form is a document that confirms payment for goods or services provided from a private person in the form of cash or using a payment card. According to legal requirements, stores and other retail outlets must be equipped with cash registers, so cash registers are used only in limited cases:

- In peddling or fair trade.

- When selling tickets, magazines, newspapers.

- When selling ice cream, seasonal fruits and vegetables.

- When selling live fish, kvass, vegetable oil, milk from tank trucks.

- When selling folk art products (if the sale is carried out by the author himself).

- When selling shares or securities.

- In case of acceptance of glass containers or recycled materials.

- When providing services for carrying things at railway stations, airports, river and sea stations.

- Sale of services or goods to the population in remote and hard-to-reach places.

- Providing small household services: shoe repair, plowing gardens, digging holes, collecting firewood, etc.

The book is filled out by the entrepreneur or responsible person

Attention:

BSOs are used only when working with the public - issuing them to entrepreneurs, companies or organizations is prohibited, but the procedure for mandatory verification of the status of the other party is not provided for by law.