The use of BSO allows certain categories of sellers to legally refuse to use cash register machines. However, since July 1, 2018, tangible and serious changes have occurred in this area. For example, starting from July 1, 2018, BSOs are being transferred to electronic circulation everywhere.

In other words, strict reporting forms can now be compiled and used only in digital format.

New requirements of the current legislation provide that BSO can no longer be printed in paper form through a printing house.

The use of such forms at the sole discretion of the business entity is also not permitted. BSOs are now formed exclusively through special technical devices.

Until July 1, 2019, certain exceptions to the above rules apply. For some categories of business entities, until July 1 (first), 2021, it is still possible to use paper payment forms that are subject to strict accounting. Accordingly, the transition to electronic circulation of BSO will be carried out gradually.

It is important to understand what electronic SSRs are, as well as find out how they are designed, used and accounted for.

Simplicity

There are no paper contracts required and it is completely legal. We are always nearby, and you are always confident during inspections!

our clients

Our pride is our clients who print strict reporting forms with us. These are real companies that you can check by TIN, and which use BSO-123. You can contact them to find out how they are working with us, for example.

IP Smirnov Alexey Petrovich

Phone: +7 (926) 466-3397 Taxpayer Identification Number: 771540369359

IP Marchuk Evgeniy Aleksandrovich

Phone: +7 (911) 300-1073 Taxpayer Identification Number: 519014114974

IP Biryukova Ksenia Andreevna

Phone: +7 (905) 583-3847 Taxpayer Identification Number: 772084364993

IP Nyrenkov Alexander Viktorovich

Phone: +7 (929) 667-7270 Taxpayer Identification Number: 503112568961

Individual entrepreneur ALEXEY ALEKSANDROVICH

Phone: +7 (961) 320-1020 Taxpayer Identification Number: 645393216594

IP Borodin Anton Alexandrovich

Phone: Taxpayer Identification Number: 772195130327

IP Miftakhova Radmila Raisovna

Phone: +7 (927) 665-8316 Taxpayer Identification Number: 027708629761

Here is only a small part, more in the general list.

Blog

- Happy New Year! [ February 5, 2021 15:51 ]

- We're alive! [ February 26, 2021 11:36 ]

- The law on the extension of BSO-123 has been adopted! [ 9 January 2021 09:35 ]

- Happy New Year 2018! [ December 30, 2021 16:48 ]

- BSO-123 remains with you until July 2021 [ November 22, 2017 17:09 ]

Go to Blog

Is it possible to use strict reporting forms electronically?

The fact is that from July 1, 2018, business entities obliged to use cash register machines in cash payments with individuals must massively switch to using online cash registers.

A notable feature of such an online cash register is its ability to automatically transmit to the tax service all the necessary information via the Internet.

However, information is transmitted to the fiscal authority not directly, but through the mediation of a specialized structure - the fiscal data operator (abbreviated as OFD).

This innovation applies not only to ordinary retail stores and service points that traditionally work with individuals in cash, but also to business entities engaged in online trading with citizens.

All sellers are required to provide retail customers with cash receipts, which now become electronic documents, printed immediately or sent to the e-mail of the paying citizen.

From July 1 (first) 2021, strict reporting forms (SRF) are also compiled, used and accounted for as electronic documents.

To generate and issue electronic payment documents that are subject to strict accounting, special technical devices are used, in many ways similar to the above-mentioned online cash registers.

The technical system that composes, provides and takes into account electronic strict reporting forms must necessarily meet the following requirements:

- Availability of an electronic storage device for fiscal information.

- Information about completed transactions must be instantly and automatically transmitted to the tax service through the OFD.

- It is necessary to provide the option of sending (forwarding) an electronic BSO to the client’s e-mail.

- The electronic BSO must generate and contain a QR code with the ability to automatically read all the necessary information.

It is obvious that the above requirements completely eliminate the difference between the use of online cash registers and the generation of electronic BSO documents.

It turns out that BSOs are not abolished by law, but in terms of cost and technology of use they will be similar to fiscal receipts issued by online cash registers.

Thus, an electronic strict accounting form, which is a full-fledged payment document, becomes a type of fiscal (cash) receipt generated by an updated cash register machine (online cash register).

What do they look like and use?

From 07/01/2019, business entities that previously used BSO in cash payments with individuals will have to switch to the updated digital format of these documents.

Electronic payment forms, subject to strict accounting, are issued through automated systems, which practically does not distinguish them from fiscal checks issued by an online cash register.

The requirements of the current legislation provide for the following details required for electronic SSO:

- name of the settlement document;

- serial number assigned to the work shift;

- name/full name of the business entity;

- Taxpayer INN code;

- tax regime applied by the business entity when making payments;

- purpose of the settlement transaction (expense, receipt, return of expense/receipt);

- a list of purchased/paid for goods/services/works, indicating for each item its name, quantity, unit cost, total cost, total amount, VAT (amount/rate);

- form of payment (cash, electronic means of payment) indicating the amounts paid by each of the available methods;

- information about the employee who made the settlement with the client (position, full name);

- registration number assigned to the automated system intended for the formation of SSO;

- number of the fiscal information storage device used;

- fiscal attribute for the compiled document;

- name (address) of the online resource for checking the payment document;

- e-mail of the sender of the payment document (if necessary);

- e-mail of the recipient of the payment document (if necessary);

- telephone number of the recipient of the payment document (if necessary);

- other details provided for by the specifics of the business entity.

Combination with paper

Experts believe, however, that it will be difficult for many business entities to completely abandon paper BSO media, having finally and forcibly switched to electronic forms from 07/01/2019.

In some areas of activity (for example, the sale of theater tickets), where paper BSO documents are still actively used, such a transition can be very problematic.

Experts are convinced that legislation in this area will still be revised and finalized, and automated systems for SSO will be modified and updated.

Can BSOs remain only in electronic form?

The use of an automated system for accepting payments in cases where it is necessary to issue BSO to the buyer means that the paper form of such forms is becoming a thing of the past, since they are generated automatically at the time of settlement. The electronic form of strict reporting forms is being legalized. But how applicable is this in practice?

BSO in its purpose is still somewhat different from a cash register check.

You can read more about the previous BSO form here: “What applies to strict reporting forms (requirements)?”

The main difference lies in the discrepancy between the moment of payment for services and the moment of actual provision of the services themselves. Let's look at the examples of BSO given in regulation No. 359: tickets, travel documents, subscriptions, etc. Two general aspects are clearly visible:

- At the moment when the buyer has paid the money and received the BSO, the services have almost always not yet been provided. That is, the BSO, as a rule, confirms receipt of an advance payment from the buyer.

- At the time of actual provision of the service, the buyer in most cases presents the BSO in order to use the service. In addition, the fact of presentation is also recorded on both sides: the one who provides the service tears off the stub intended for this (like a ticket to a theater or a sporting event) or compares the original of the presented BSO with a copy stored by the performer (as, for example, when provision of household services or auto repair services). That is, in practice, the use of a paper SSO form is often the most convenient, including for the purposes of accounting for the provision of SSO services.

From these aspects, some ambiguities arise with the practical application of the updated Law No. 54-FZ:

- There are discrepancies about what BSO actually is.

Within the meaning of Regulation No. 359, these are documents that, in most cases, confirm receipt of an advance for a service and are presented in order to receive this service.

According to the amendments made to Law No. 54-FZ after the entry into force of Law No. 290-FZ, the BSO is a document “generated at the time of payment for services rendered.” The new legislation does not yet offer an explanation of how season tickets, tickets for theater and sports and entertainment events and other BSOs defined “in the old way” are now considered.

- The use in practice of only the electronic form of BSO will lead to a complete (and not yet very clear) restructuring of the work system in some areas of activity. For example, in the sale of tickets for entertainment and cultural events, it is unlikely that all ticket takers will be equipped with computers. And the availability of only electronic tickets, which will then need to be printed at home, will provide too much scope for creating counterfeits. Most likely, the new legislation will be finalized in those moments where there are ambiguities and dangers, and the paper form of the BSO will remain where it is most convenient.

Who issues BSO

Organizations in the field of services to the public have the right not to use cash registers, but instead of checks, issue strict reporting forms or BSO.

The service sector includes the activities of hundreds of enterprises:

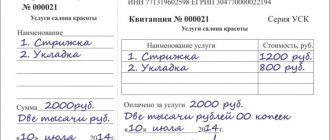

- hairdressing salons and ateliers,

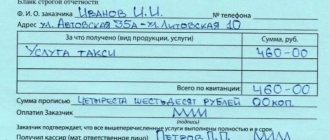

- taxi and passenger transport,

- Homeowners associations and repair and cleaning companies,

- ticket offices, etc.

An almost complete list of activities is listed in the All-Russian Classifier of Services. Enterprises whose activities are listed in the classifier can use forms.

For some BSO, special forms have been approved: for example, railway tickets can only look as specified in the order of the Ministry of Transport of the Russian Federation. The appearance of BSOs for parking lots, tourist and excursion bureaus, pawnshops and veterinarians is regulated.

For other enterprises, the law regulates only the required details, and the organization or entrepreneur can develop the form independently. Forms can be generated using a special system or purchased at a printing house or stationery store. In the second case, information about the manufacturer must be indicated on the form.

On July 15, 2021, the law on online cash registers came into force. Now strict reporting forms are issued not only for the provision of services, but also for the performance of work. Assembling a cabinet or transporting it is both a service and a job. In addition, there are additional details that must be indicated in the BSO.

What is BSO

The forms mentioned are not just computer-printed forms. BSO must be generated and printed by printing or using an automated system. Each form must contain a number of mandatory details:

- name, unique number and series;

- the name of the seller and its legal form, for an entrepreneur - full name;

- permanent address;

- TIN;

- type of service provided;

- its cost;

- amount of payment;

- date of compilation of the BSO;

- the position and name of the person making the payments, as well as his signature, seal of the organization or individual entrepreneur (if any).

Will all BSOs be affected by changes in legislation on cash register systems?

Until now, we have been talking about BSO as documents confirming the fact of accepting cash. However, BSO also refers to other documents not related to cash payments. Thus, the instructions for the application of the Chart of Accounts, approved by Order of the Ministry of Finance dated October 30, 2000 No. 34n, states that the BSO accounted for in off-balance sheet account 006 includes subscriptions, diplomas, certificate forms, etc.

Law 54-FZ does not regulate the circulation of these types of BSO. At the same time, in Art. 1.1 of the new edition of this law states that the BSO is a document containing information about the monetary settlement and confirming the fact of its implementation.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Therefore, all types of BSO that are not related to the execution of settlements in 2018 will be formed and used in the old way - on the basis of current regulatory accounting documents.

How are BSOs filled out correctly?

Strict reporting forms have a unified form that contains fields to fill out. Each organization has the right to slightly modify the form for its own convenience, without losing the required details.

The forms printed on paper have their own list of details:

- information about the batch of forms left by the printing house;

- name of the document, its series and serial number, according to the accounting register;

- name of the organization providing the service;

- INN of the seller, registration address of the LLC, in the BSO for individual entrepreneurs the residential address of the entrepreneur is indicated;

- date of transaction;

- information about the customer and the service provided;

- signatures of responsible persons;

- printing in BSO.

There are no difficulties in filling out strict reporting forms; the seller can enter the necessary information into a ready-made form by hand or using printing technology.

Certificate of income: why is it needed and how to draw it up correctly?

The BSO consists of two parts: the main part and the spine. After making the payment and filling out the document, the spine is torn off along the line and given to the buyer, replacing the cash receipt; if necessary, it serves as a full-fledged report.

Filling out the main part of the form begins with the header of the document. Usually, information about the seller is initially printed in the printing house, so you just need to put down the date, number and series of the document.

After completing the header, you can proceed to filling out the tabular part:

- The last name, first name and patronymic of the customer are written.

- In the column “Name of service” it is written down what the payment was made for. The table has several rows, so several services can be located in one document.

- The “Amount” column indicates the cost of each service.

- Below, in the table there is a line “Total”; if there were several positions, their cost must be summed up and entered into this line.

After the table there is another field, the following is filled in:

- Enter the total amount paid in words, kopecks in numbers;

- Signatures with transcripts from both sides.

- Date of payment made.

- Seal.

Rules for accepting cash

Law 54-FZ determines that all payments in cash, as well as using payment cards, must be carried out through cash register equipment. An exception has been made:

- for certain types of activities;

- for entities using UTII and the patent system (temporary);

- for subjects of the service sector for the population (subject to the mandatory issuance of BSO by them).

The types of activities exempt from the use of a cash register are listed in paragraph 2 of Article 2 of Law 54-FZ. This is mainly non-stationary trade - fairs, peddlers, sales of periodicals and ice cream in kiosks, trade in seasonal vegetables and fruits, as well as the sale of individual food products from tanks. In addition, shoe repair, care for the elderly and children, renting out your own home, selling homemade folk art items, and some others are exempt from the use of CCT.

As for the service sector, entrepreneurs and organizations that carry out absolutely any type of service can work without a cash register, regardless of the tax system applied. Provided that they formalize the acceptance of funds from the population by the BSO.

Advantages of using BSO for individual entrepreneurs

What is the superiority of strict reporting forms for private entrepreneurs over cash receipts? Everything is obvious:

- Firstly, there is no need to buy a cash register, which, for a moment, does not cost two hundred rubles at all. A new cash register will cost the company owner an amount equal to at least ten thousand rubles.

- Secondly, the entrepreneur receives an exemption from the necessary registration of cash register equipment with the tax office, not to mention training of all employees to work with cash register systems.

- Thirdly, if an entrepreneur is not tied to a specific place and he has to go, for example, to a client’s house to do hair or makeup, then filling out a receipt will be more comfortable than carrying around a cash register for knocking out receipts .

- Fourthly, the absence of a cash register automatically eliminates the need to pay for its service.

There are many advantages of using strict reporting forms. What can you say about the shortcomings?

What changes in the accounting procedure for BSO?

Based on clause 4 of Art. 5 of Law No. 54-FZ (as amended by Law No. 290-FZ), which prescribes the transfer of data on the use of cash registers to the tax office in electronic form, it is logical to assume that now records of issued BSO and cash register receipts are kept in the memory of cash register equipment or automatic devices, forming into files suitable for transfer to the Federal Tax Service. In addition, fiscal drives, which should be installed on cash registers and automatic payment acceptance systems, generate such data and transmit it to fiscal data operators.

The procedure for installing fiscal drives is described by Law No. 290-FZ. First of all, this applies to organizations and individual entrepreneurs that are subject to the general taxation system and the simplified tax system. Last but not least, the transition to an automatic procedure for the transfer of fiscal data has been established for those who use UTII and PSN - until 07/01/2019, such entrepreneurs may not use fiscal drives and form BSO according to the old procedure: print in a typographical way or using existing AS for BSO .

The accounting of forms by everyone who uses BSO instead of cash receipts is carried out in the manner prescribed in Decree of the Government of the Russian Federation dated May 6, 2008 No. 359. Interestingly, this resolution prohibits keeping a BSO accounting journal in electronic form. Clause 13 of the resolution prescribes keeping records in a special book, which must be laced, its sheets numbered, signed by the head and chief accountant of the enterprise or individual entrepreneur and sealed. This order is consistent with the above-described features of the practical use of printed BSOs. And this same procedure demonstrates another nuance associated with the ability to use only electronic BSOs.

More information about the procedure for recording and storing BSO that exists today can be found in the material “Procedure for recording and storing strict reporting forms.”

Let's take the situation with tickets to entertainment events again. The vast majority of such BSOs are sold through intermediaries. For example, the leader in ticket sales MDTZK (Moscow Directorate of Theatrical and Entertainment Events) once made a “technological breakthrough” - it organized automated ticket sales. All MDTZK ticket offices are equipped with special electronic equipment; “tickets” from theaters and similar enterprises are received, in fact, in the form of electronic information about the availability and cost of seats. The BSO printout upon purchase is carried out by the MDTZK cash desk employee (he also accepts money). A report on tickets sold, which the theater will use to calculate its revenue, is generated only later.

That is, electronic BSOs are quite common between the theater and the distributor. But another question arises: at what point and how will the theater itself generate revenue from tickets sold through an intermediary, which should be recorded in the fiscal accumulator? And what should be recorded in the storage device of the intermediary who prints out the ticket on his speaker? Moreover, the intermediary is neither the owner of the tickets being sold, nor the one who will actually provide services for the sold BSO.

Similar questions will arise in all areas where BSO is traditionally implemented through intermediaries - in sports and entertainment, health resorts, tourism, transport services for the population, etc.

More information about the procedure for recording and storing BSO that exists today can be found in the material “Procedure for recording and storing strict reporting forms.”

Type of form

Previously, it was allowed to use BSO only for certain services for which unified forms were developed. These include: receipts, travel tickets, subscriptions, coupons, work orders, and so on. For certain types of activities, special forms still exist. However, for the majority they can be developed by organizations and entrepreneurs themselves.

The standard strict reporting form consists of two parts. One of them is issued to the buyer, and the second remains with the seller and is subject to accounting.

How the online cash register for BSO is used, taking into account changes in 2021

The use of strict reporting forms when dealing with cash proceeds remains the right of the seller, and not an obligation. The abolition of the typographic format is proof of this.

Details of cash receipts and BSO also indicate that documents generated using cash register equipment have equal legal force. They are allowed to be used starting in 2021. Sellers of alcohol and excisable goods require a receipt indicating the nomenclature.

If the region in which the businessman works is officially recognized as a remote area (there are interruptions in the Internet), then the details include the address of the site where the authenticity of the purchase is verified.

The main indicator is the requirements for those businessmen who are obliged to make the transition to online cash registers within a certain time frame, to make cash payments as transparent and legal as possible.

In turn, manufacturers of cash register equipment have provided the possibility of generating forms not only using a cash register, but also a fiscal registrar. Printing can be done on a regular printer.

For those who combine several types of activities: services and trade, issuing cash receipts is more convenient, where the nomenclature can include the type of work, services, as well as the taxation system that is applied (PSN, UTII).

For those entrepreneurs who only provide services to the public, the transition to online cash registers gives them the opportunity to compare the cost of devices and legal requirements, making a decision to continue using or abandon BSO.

conclusions

BSO electronic documents are already being actively introduced into the practice of cash payments with individuals. From July 1, 2019, it is planned to finally switch to online cash registers and automated systems that create digital bank accounts.

The electronic format of the BSO implies the presence in it of mandatory details, the composition of which, in principle, is similar to the list provided for fiscal receipts generated through online cash registers.

Thus, electronic BSOs and online cash register receipts largely correspond to each other. Many points related to the electronic circulation of settlement documents will still be clarified and finalized at the legislative and technical levels.