Value added tax payers are required to maintain purchase books and sales books to account for value added tax amounts. Companies that issue and receive invoices as intermediaries, such as those providing transportation services or acting as real estate developers, must maintain logs of all invoices.

The procedure for maintaining and filling out, as well as the form of books and accounting journals are set out in the Resolution. All documents should be registered: primary, corrected, adjusting. They can be electronic or paper.

Where do you register?

The current forms of documents intended for registration of invoices were approved on December 26, 2011 by Decree of the Government of the Russian Federation No. 1137.

It came into force on January 30, 2012, but new forms began to be used on April 1, 2012 (Letter No. 03-07-15/11 dated January 31, 2012).

Paper and electronic types of invoices are subject to registration . Now the company needs to keep 3 books instead of 4:

- invoice journal;

- Book of purchases;

- sales book.

Tax officials explained that the preparation of invoices is allowed both on paper and in electronic form (Article 169 of the Tax Code of the Russian Federation).

Read more about why an invoice is needed for both sellers and buyers here.

Book of purchases and sales

The new format of the purchase book is given in Appendix 4 of Decree No. 1137. The changes made to it are not so global.

Changes in the purchase and sales ledger:

- There are 3 new columns (2a, 2b, 2c) provided for information on corrections.

- The names of columns 6 to 12 have changed slightly.

- Column 6 – country of origin code.

The book consists of line and tabular parts. The entered data must correspond to the information given in the 2nd part of the accounting log. Registration is carried out after receiving invoices from the seller (for more details on how to process an invoice if it arrives late, read here).

The issued invoice is entered into the sales book . Visually, it is similar to the purchase book (Appendix 4 of Resolution No. 1137). The contents of columns 4-9 are identical to the titles of columns 6-12 of the purchase book.

The chronological book is filled out. The information must correspond to section 1 of the accounting log.

If prices decrease, an adjustment invoice must be created. The supplier records it in the purchase ledger. When the price rises, the buyer needs to correct the sales book.

Another innovation is additional sheets. Sheets are convenient to use for recording corrective invoices . If the books are kept in electronic form, then additional sheets are endorsed with the manager’s digital signature. But this does not cancel the requirement to compile books on paper (clause 22 and clause 24 of Resolution No. 1137).

Both books are signed by the head of the organization. They must be numbered, laced and sealed. They are issued for one quarter. Therefore, they need to be put in order before the 20th of the next month.

Magazine

Resolution No. 1137 made it possible to combine 2 journals - issued and received invoices - into one. Now, according to Appendix 3 of Resolution No. 1137, the magazine consists of 2 parts.

It is now possible to make changes by creating new copies of invoices . The name, identification code and checkpoint of the taxpayer are entered in the header. A journal is compiled for one quarter. You must have 4 magazines per year.

The design of the magazine is similar to books: management signature, numbering, stitching, sealing. This must be done before the 20th day of the following month after the end of the reporting period.

You can also keep a journal using special computer programs. But if the manager does not have an electronic signature, then he will need to print the document at the end of the quarter.

What other documents?

During the same period, the documents listed in clause 11 of the Rules for filling out an invoice must be stored:

| Documents received |

| Copies of invoices (including adjustments, corrected ones) received by the principals (principals) on paper, issued by the seller of goods (works, services), property rights (hereinafter referred to as TRU) to the commission agent (agent), certified in the prescribed manner by the commission agent (agent) when purchasing goods and services for the principal (principal) and transferred by the commission agent (agent) to the principal (principal). If the seller issues invoices electronically, the principal (principal) must store invoices issued by the seller of goods and services to the commission agent (agent), received by the commission agent (agent) and transferred by the commission agent (agent) to the principal (principal) |

| Copies of invoices (including adjustments, corrected ones) received by buyers (investors) on paper, issued by the seller of goods and materials to the developer when purchasing goods and services for the buyer (investor) and transferred by the developer to the buyer, certified in the prescribed manner by the developer (customer performing the functions of the developer) (to the investor). If the seller issues invoices electronically, the buyer (investor) must keep the invoices issued by the seller of the specified GWS to the developer, received by the developer and transferred by him to the buyer (investor) |

| Copies of invoices (including adjustments, corrected ones) received by clients on paper, issued by the seller of goods and services to the forwarder when purchasing goods and services for the client and transferred by the freight forwarder to the client, certified in the prescribed manner by the forwarder. If the seller issues invoices electronically, the client must store the invoices issued by the seller of the specified GWS to the forwarder, received by the forwarder and transmitted by the forwarder to the client |

| Customs declarations or their copies, certified by the head and chief accountant of the organization (individual entrepreneur), payment and other documents confirming payment of VAT - in relation to goods imported into the territory of the Russian Federation |

| Applications for the import of goods and for the payment of indirect taxes or their copies, certified by the head and chief accountant of the organization (individual entrepreneur), copies of payment and other documents confirming the payment of VAT - in relation to goods imported into the territory of the Russian Federation from the territory of a member state of the EurAsEC |

| Strict reporting forms filled out in accordance with the established procedure (copies thereof) with the VAT amount highlighted as a separate line - when purchasing services for the rental of residential premises during the period of business trips of employees and services for transporting employees to the place of business trips and back, including services on trains for provision for use bedding |

| Documents that formalize the transfer of property, intangible assets, property rights and which indicate the amount of VAT recovered by the shareholder (participant, shareholder) in the manner established by clause 3 of Art. 170 of the Tax Code of the Russian Federation , or their notarized copies |

| Primary documents for changes in the direction of reducing the cost of purchased goods (work performed, services rendered), property rights in order to restore the amount of VAT in the manner established by paragraphs. 4 p. 3 art. 170 Tax Code of the Russian Federation |

| Transmitted documents |

| Notarized copies of documents that formalize the transfer of property, intangible assets, property rights and which indicate the amount of VAT recovered by the shareholder (participant, shareholder) in the manner established by clause 3 of Art. 170 Tax Code of the Russian Federation |

| Other documents |

| Primary accounting documents, other documents containing summary (consolidated) data on transactions performed during a calendar month (quarter), subject to registration in the sales book, including those compiled by the taxpayer - accounting certificate-calculation for restoring the amount of VAT in accordance with Art . 171.1 Tax Code of the Russian Federation , that is, in relation to acquired or constructed fixed assets |

How to fill out an account book?

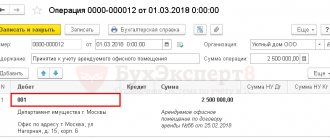

When receiving/issuing an invoice, an entry is made in the appropriate book . This action confirms the right to a VAT tax deduction. In addition to the book, you also need to fill out a logbook.

If there was no invoice for the entire quarter, only the name, INN, KPP of the tax payer are entered into the journal and indicate the reporting period. Column 3 indicates the digital code of the invoicing method:

- 1 – paper version;

- 2 – electronic media – no need to print it.

Changes in the past quarter are made using additional sheets . They cannot be used for ongoing adjustments. It is recommended to enter the tax amount and the cost of the canceled invoice with a minus sign, and register a new document (read more about the features of canceling an invoice here).

When the primary document is written for several operations, the encoding for each of them is indicated, separated by a semicolon.

Read more about accounting for received and issued invoices here.

Invoice journals

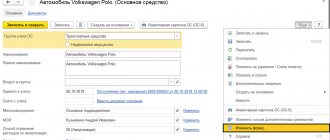

The accounting journal is filled in automatically when you make sales or accept incoming invoices. Documents are registered by date of issue in the “Exhibited” section. When invoices are not transferred to counterparties, registration occurs based on the date of issue. In the “Received” section, documents are registered by the date they were received. This is how the journal displays the dates of issuance and receipt of documents.

Intermediary companies are required to keep an accounting log, even if they are not a VAT payer and do not accept it for deduction. Such organizations provide journals to tax inspectorates. Using these data, the Federal Tax Service controls whether the accrued VAT amounts correspond to the tax amounts accepted for deduction. And vice versa, do the amounts declared by the principals correspond to the VAT amounts that sellers of goods accrued for payment to the budget.

Preparing documents for long-term maintenance

The invoice must be kept in the same version in which it was issued to the buyer. If in paper format, then a printed form must be stored (Article 169 of the Tax Code of the Russian Federation).

You need to add up invoices according to journal entries . To do this, use a hole punch and folders with special holders. In places where data on electronic options was entered into the journal, you will need to insert a sheet listing these invoices. On the cover, indicate the name of the company and the period.

Accounting at the junction of periods

According to clause 1.1 of Art. 172 of the Tax Code of the Russian Federation (as amended by Federal Law No. 382-FZ of November 29, 2014), upon receipt of an invoice by the buyer from the seller after the end of the tax period in which the goods were registered, but before the submission of the tax return for the specified period, the buyer has the right accept for deduction the amount of tax in respect of such goods in the tax period in which these goods were registered. If the invoice is received after filing the declaration, then it must be attributed to the new tax period.

How to hem?

“Binders” need to be prepared once a quarter, or rather by the 20th of the next month after the end of the reporting period. But if the document flow for an enterprise is voluminous, then this procedure can be performed once a month.

Magazine

Previously, it was required that the invoice be filed with the accounting books. There are no such instructions in the new rules. Therefore, it is more practical to stitch the accounting journals in a separate pile according to chronology. The pages will need to be numbered and laced.

Invoices

2 invoice binders are created:

- exposed;

- received.

Corrected documents are filed in a folder for the corresponding period when the adjustments were made.

Place

The storage space for primary documentation must meet the following requirements:

- Be inaccessible to unauthorized persons.

- Suitable for ambient air conditions.

- Possess fire-fighting properties.

The storage space can be a metal cabinet that is locked . A responsible person is appointed whose responsibilities include ensuring the safety of archival documentation. After the document storage period has expired, a commission is convened at the enterprise. She must decide whether the papers can be destroyed.

What are the deadlines?

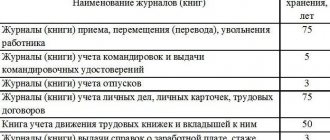

How many years should they be stored? The storage period for purchase and sales books, accounting journal and invoices in the organization is the same - 4 years (clause 1, article 23 of the Tax Code of the Russian Federation). This requirement applies to documentation in paper and electronic versions. If necessary, this period can be extended.

Initially, the invoice must be recorded in the journal, purchase and sales books. Records can be kept in paper or electronic form. Since 2012, invoice forms must be stapled separately from the accounting journal. Issued and received forms must be folded separately in chronological order. Documents are bound for each quarter and stored for 4 years .

After the introduction of innovations, the procedure for preparing documents for storage has become simpler and more practical.

Location of seller and buyer

According to the edition, valid until October 2021, in lines 2a and 6a of the invoice it is necessary to indicate the locations of sellers and buyers - legal entities in accordance with the constituent documents.

If the sellers and buyers are entrepreneurs, then in lines 2a and 6a you need to indicate your place of residence. Carry out automatic reconciliation of invoices with counterparties

The wording will change from October. Line 2a will need to reflect the supplier’s address indicated in the Unified State Register of Legal Entities, or the address of the entrepreneur indicated in the Unified State Register of Legal Entities. In line 6a you should put the buyer’s address indicated in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. In addition, from October the rule will disappear, according to which a commission agent purchasing goods from several sellers for the principal must list the addresses of all sellers separated by a semicolon in line 2a. It is difficult to say what this innovation is connected with. In our opinion, it does not mean that commission agents will be prohibited from listing the addresses of suppliers. Most likely, in practice everything will remain the same as it was. Perhaps official comments will appear soon in which officials will clarify this issue.