Payment

Deferred expenses (hereinafter referred to as FPR) are expenses that are incurred in the current period,

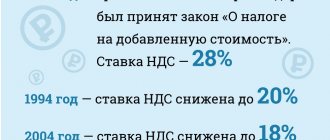

The procedure for determining the VAT rate from an advance payment When receiving an advance payment, the VAT rate is determined by the estimated

Environmental fee, in accordance with Article 24.5 of Law No. 89-FZ “On Industrial Waste” dated June 24

Since 2021, the Federal Accounting Standard FSBU 5/2019 “Inventories” has been in force, approved. by order of the Ministry of Finance

Deductions from wages include personal income tax and insurance premiums, and their percentage

Mineral extraction tax – 2021 All rates for calculation in 2021

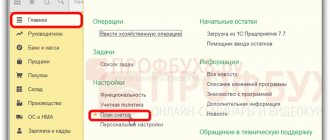

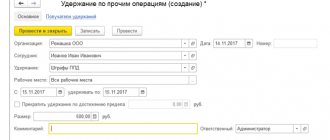

After personal income tax and amounts under executive documents have been withheld from wages,

Svetlana Hello. Please tell me in this situation. I am an individual entrepreneur using the simplified tax system (15%) without hiring.

Deadlines for payment of insurance premiums for individual entrepreneurs Insurance premiums accrued from salaries/other payments to employees, employer

A person who wants to run his own business, as a rule, immediately pays attention to the activities of retail stores.