Organizational and procedural aspects of storing strict reporting forms (SRF) are regulated by the norms of current legislation.

These rules are generally binding - they apply to all business entities that use payment documents that are subject to strict accounting. First of all, we are talking about the correct registration of such papers and ensuring their safety. The basic regulatory requirements for the storage of BSO should be considered in more detail.

Basic rules for storing strict reporting forms

The traditional way to produce BSO is to go to a printing house. The legislation of the Russian Federation requires the issuance of forms when using automated systems.

According to the law “On the use of cash register equipment,” all individual entrepreneurs and LLCs are required to record information about payments through a fiscal drive (including in the form of a cash receipt or BSO), transfer such information to the tax authority (including through a fiscal data operator) and subsequent storage of the fiscal drive. Other responsibilities in 2021, for example, for storing cash register receipts or BSO (including counterfoils) on paper, maintaining a BSO accounting log or rules for their destruction by analogy with documents confirming payment in hard-to-reach areas (clause 4 of article 2 Law No. 54-FZ, Decree of the Government of the Russian Federation of March 15, 2017 No. 296), in our opinion, the legislation of the Russian Federation does not establish the use of cash register equipment.

Until July 1, 2021, printing BSOs have the right to use only individual entrepreneurs without hired employees. After this date, all individual entrepreneurs are required to use online cash register, incl. for registration of BSO.

Let's consider the rules according to which Russian taxpayers were required to store BSO earlier, before the provisions on the mandatory use of cash registers came into force.

See also “What applies to strict reporting forms (requirements)”.

As for BSOs produced by printing methods, they should have been placed in safes or in special premises of the enterprise, where the safety of the forms was guaranteed. Every day, the place where the BSO was stored was subject to sealing or sealing (clause 16 of the Regulations).

The functions of ensuring the safety of strict reporting forms must be performed by a financially responsible person (hereinafter referred to as the MOL) - an employee of the organization, with whom the employer must sign an agreement on full financial responsibility (clause 14 of the Regulations).

The MOL begins to perform its functions from the moment the BSO becomes available to the organization (for example, from a printing house). His tasks at the time of receipt of the forms are to:

- check the number of forms, their series and numbers with the data specified in the accompanying documents;

- issue an act of acceptance of forms;

- enter information about the accepted forms into the book of strict reporting forms.

All three actions of the MOL must be carried out in the presence of a commission, which is created on the basis of an order from the head of the company (clause 15 of the Regulations).

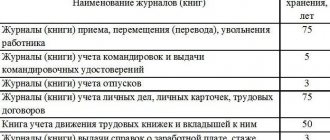

As a BSO accounting book (or the basis for its creation), commercial companies can use a form corresponding to number 0504045 according to OKUD. For state and municipal organizations, its use is mandatory (Order of the Ministry of Finance of the Russian Federation No. 52n dated March 30, 2015).

The acceptance certificate (a little later we will look at the basis on which form it should be drawn up) must be signed by all members of the commission. It must also be approved by the supervisor. The book of records of strict reporting forms should be stitched and numbered. It must be signed by the head of the company, the chief accountant, and also sealed.

You can learn about filling out the book from the article “How to fill out the book of strict reporting forms.”

How to store BSO in an organization - accounting and order

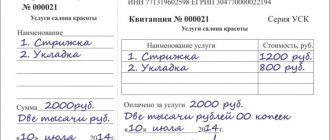

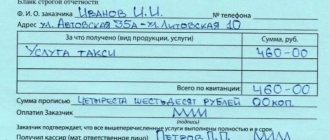

BSO documents, the production of which is carried out in the manner established by generally binding regulatory requirements, are purchased directly from the supplier or, alternatively, through a postal service organization.

Each batch of such papers must be accompanied by a copy of the invoice or other documentation, which indicates the names, series/numbers, quantity and purchase price of strict reporting forms.

Acceptance of BSO documents received from the supplier (manufacturer) must be carried out by an authorized official in the presence of a special commission, the composition and powers of which are determined by an administrative act of management.

Such acceptance is carried out on the day of receipt of strict reporting forms. The appointed commission compares the actual quantity, series and numbers of received documents with the corresponding data of the accompanying documentation.

An act is drawn up certifying the enrollment of the BSO in the parish. The same act is considered the documentary basis for accepting strict reporting documents for accounting.

If during the acceptance process the commission discovers any inconsistencies (excess, deficiency, defects), a copy of the drawn up report is sent to the supplier (manufacturer) in the form of a written complaint.

The received and posted forms are transferred to the warehouse for their further storage. The receipt of BSO at the warehouse is formalized by a receipt order, which reflects the names, series, numbers and quantity of payment documents (receipts, checks, other forms).

Quantitative accounting of strict reporting forms is carried out by warehouse workers according to the names of the forms.

The necessary information is indicated in special cards, usually drawn up in a standard form and used for inventory accounting.

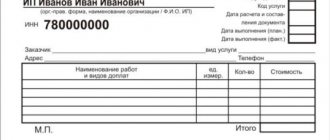

Receipt books, check books and other BSO are provided to the official upon request in a standard form.

Receipt books and other BSO are recorded by the cashier by their names, series, and numbers.

The relevant information is reflected in a special accounting book.

All sheets of this book are subject to numbering/lacing, signed by the chief accountant/head of the business entity, and sealed (if any).

When receipt books, check books and other bound type BSO are registered in the account book, the official checks the completeness and serviceability of each such booklet.

The head of the organization must necessarily enter into agreements on liability with officials authorized to accept, store, issue and apply BSO.

Each such agreement must provide for the personal and full responsibility of the official - chief accountant, storekeeper, supply manager, cashier. For such an agreement, a regulated form is usually used.

The manager is obliged to create adequate conditions to ensure the storage of funds and BSO. Such conditions are always created for employees authorized to accept cash proceeds, as well as issue, store and use BSO.

Officials authorized to accept, store, issue, apply, take into account strict reporting forms, as well as document all these procedures, are guided by the current regulations and instructions of the chief accountant of the organization.

Where should the documents be located?

Strictly recorded documents must be stored in special metal cabinets (safes). As an option, it is allowed to store BSO directly at the cash register, since its equipment is considered suitable for the location and content of valuables.

An organization’s large number of documentary forms often leads to the fact that they are stored in separate secure premises, properly equipped and excluding the possibility of loss of BSO.

Deadlines

The current Russian legislation does not limit the period of time during which strict reporting forms are considered valid.

An organization or individual entrepreneur using BSO for cash payments with individuals independently establishes the serviceability period for the forms used.

Copies/stubs of used payment documents, damaged/defective BSO must be stored for five years.

When the five-year mandatory storage period ends, the organization will be able to destroy (liquidate) the relevant forms.

The date of such liquidation cannot occur earlier than one month from the date of the last inventory of strict reporting documents.

Storing forms using automated systems

The “innovative” scenario for manufacturing BSO - using automated systems (AS) - significantly simplifies the task of organizing the storage of forms for the company’s management. If the corresponding system meets the criteria contained in clause 11 of the Regulations (is protected from unauthorized access, identifies and records transactions with BSO for five years or more, stores data on the form in memory), then there is no need to carry out the above procedures, because:

- BSO from a third party is not accepted;

- copies of the BSO remain in the memory of the computer and other devices as part of the system;

- Suppliers of modern AS for organizing the circulation of BSO, as a rule, include in the software package solutions that allow you to maintain a book of records of strict reporting forms in electronic form.

At the same time, once printed using AS, but for one reason or another damaged, BSOs should, like those created by printing, be stored in the organization’s safes or in other safe places.

The functions of the MOL in the case of using an automated system are most often assigned to an accountant trained in working with the appropriate software, and less often to a system administrator managing the automated system.

Attention! In connection with the transition to online cash registers, the taxpayer is obliged from 07/01/2018, and in some situations from 07/01/2019, to form a BSO using automated systems for strict reporting forms capable of transmitting information about mutual settlements to the Federal Tax Service online. For more details, see the material “Law on online cash registers - how to apply BSO (nuances)” . The BSO is issued to the buyer on paper or sent by email or to the client’s phone number.

Tax authorities control the completeness of revenue accounting. Find out what rights they have when checking the cash balance in the cash register, the BSO machine and generated forms from the materials of ConsultantPlus experts by getting trial access. It's free.

Transfer of forms to the organization's employees

If the calculations in which the BSO is used are carried out not by the MOL, but by another employee of the company, then the transfer of the relevant forms to his disposal is carried out by the financially responsible person on the basis of a written application. Data on issued BSOs are entered by the MOL in the book of records of strict reporting forms.

Copies of the BSO issued to the organization's clients, or the counterfoils of the forms (depending on which specific form of the BSO is used) are transferred by the employees to the financially responsible person. Data about this is also recorded in the BSO accounting book. If any of the previously issued forms is damaged, it is crossed out and then attached to the accounting book.

BSO inventory

The organization is obliged to carry out an inventory of forms at the frequency established by law. During the audit, the number of documents is recalculated and those whose storage period is about to expire are identified. Conducting an audit is the responsibility of the inventory group, which is selected by the head of the enterprise from among the employees.

Recounting of documents must be carried out in the presence of the person responsible for their storage. Based on the results of the inspection, an inventory list is compiled in two copies.

If the audit reveals a shortage, its causes must be identified. First, the degree of guilt of the person responsible is determined. If guilt has been established, disciplinary measures may be taken against this employee.

If shortages in an organization are a frequent occurrence, it is recommended to seek help from law enforcement agencies.

Do GMEC protocols have legal force?

Some provisions of the legislation regulating the circulation of BSO are contained in the minutes of the meeting of the State Interdepartmental Expert Commission (GMEC) No. 4/63-2001 dated June 29, 2001. Do they have legal force that applies to all Russian organizations?

Despite the fact that GMEC ceased to exist on 08/09/2004, its decisions, which were made during the period when this institution exercised its powers, are generally binding (letter of the Federal Tax Service of the Russian Federation No. ED-18-2/947 dated 06/17/2014).

So, with regard to the form of the BSO acceptance certificate, you should use the form that corresponds to number 070000 according to OKUD. The order to use this form includes clause 18 of the GMEC protocol No. 4/63-2001.

Similarly, other provisions of the GMEC Protocol No. 4/63-2001 retain legal force. In particular, those that regulate BSO accounting.

conclusions

Many aspects of the use of SSR by business entities are regulated by current norms that are generally binding. The procedure for storing such forms is no exception.

The regulatory act provides clear rules in accordance with which the storage of BSO is organized and carried out, and their safety is ensured.

Demands are being made for full financial liability of authorized officials. Criteria are established to ensure the safety and integrity of documentary forms. The rules for accepting BSO for storage are determined.

Accounting for strict reporting forms

BSO turnover is recorded in off-balance sheet account 006, which is called “Strict Reporting Forms”. BSO accounting is carried out through entries reflecting the amount of costs for the production of forms (clause 22 of the minutes of the GMEC meeting No. 4/63-2001). As a rule, these are the postings:

- Dt account 26 “General business expenses”;

- Kt account 60 “Settlements with suppliers and contractors.”

In some cases, BSO accounting involves the creation of subaccounts for account 006. This is possible if the forms capitalized by the accounting department are subsequently issued to other employees who actually manage the BSO (we examined a similar scenario above). In this case, subaccount 006-1 “BSO in accounting”, as well as subaccount 006-2 “BSO from executors” can be formed.

How to correctly write off BSO in accounting and what documents to prepare? The answer to this question was given by 2nd class State Civil Service Advisor I. O. Gorchilina. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Criteria for correct numbering of strict reporting forms

An important criterion characterizing the accounting and storage of BSO is the correct numbering of the relevant forms.

The main requirement for a BSO is the presence of a unique 6-digit serial number and a series consisting of 2 letters. At the level of federal legislation, the noted criteria are not fixed, but they are regularly found in departmental legal acts regulating the production of BSO (for example, in the letter of the Ministry of Culture of the Russian Federation No. 2344-01-39/03-E4 dated April 13, 2009). These provisions can be applied by subjects of legal relations in other industries on the principle of legal analogy.

The relevant details of the forms - series, number - will need to be recorded in the marked forms (BSO acceptance certificate, BSO accounting book).

As we noted at the beginning of the article, BSOs must be produced using the printing method or using automated systems. In the first case, the organization, as a rule, orders the production of forms from a third-party contractor who has the necessary printing equipment. If such an order is being made for the first time, then you can start producing BSO with series AA and number 000001. But in subsequent orders, printed forms must begin with the number following the one that was present on the last BSO of the previous edition.

The use of automated systems for issuing forms assumes that the correct numbering of the BSO (in correlation with entering the necessary information into the system registers) will be carried out automatically by the corresponding software.

Accounting and storage of BSO

There is no single form for the BSO accounting book, so you can develop it yourself or borrow the form from the GMEC Directives. The sheets of the book must be numbered, laced, signed by the manager and chief accountant and sealed with the seal of the organization.

The BSO must be stored in a safe, which is sealed at the end of the working day. The BSO inventory must be carried out simultaneously with the inventory of cash in the cash register.

Copies and stubs of used and damaged forms, packed in sealed bags, must be stored for at least 5 years from the end of the year in which they were used. When this period ends, they can be destroyed by creating a commission and drawing up an act on the destruction of the forms.

Inventory and write-off of BSO

The tasks that the process of storing strict reporting forms includes includes inventory. This procedure involves reconciling existing copies of the BSO, as well as their counterfoils, with the data contained in the book of strict reporting forms. The inventory of BSO must be carried out simultaneously with a similar procedure established in relation to cash at the cash desk (clause 17 of the Regulations).

After five years of storage of forms (including damaged or incomplete ones) in the organization, it is necessary to write off the BSO. This procedure is carried out by drawing up a separate act (you can use the form corresponding to OKUD number 0504816, and for state and municipal structures its use is mandatory). This document is drawn up with the participation of a commission created on the basis of an order from the head of the company.

For more information about the act, see “Act on the write-off of strict reporting forms - sample.”

The structure of modern automated systems, as a rule, contains solutions that make it possible to issue the necessary acts on inventory and write-off of BSO in electronic form. Also, the corresponding systems provide algorithms for excluding decommissioned digital BSOs from hardware registers.

For more information about other types of inventory provided for by the legislation of the Russian Federation, read the article “How to conduct an inventory before annual reporting.”

Reflection of BSO in the accounting department of an enterprise

The legislation does not provide for uniform rules for accounting forms, but the rules for their receipt by the organization and storage are set out fully and clearly.

BSO arrives at the company along with an accompanying document (consignment note), which indicates their quantity, type, series, number and other details. Admission is carried out by a commission that counts documents and checks their numbers. If no errors are found, an acceptance certificate is drawn up in free form. It is signed by the head of the enterprise and serves as the basis for accepting the BSO for accounting.

There are two types of acceptance certificates: temporary (responsible persons receive BSO for a clearly defined period) and quantitative (company employees are given an indefinite number of forms). The act must contain information about the number of papers received from the printing house, their series and numbers.

In the chart of accounts, there is a separate group for reflecting strict reporting forms. Costs associated with their printing are deducted from the income tax base. At the frequency established by law (usually once a month), an inventory of documentation is carried out.

Results

BSO are equivalent to cash receipts and must be generated using automated systems capable of transmitting information to the Federal Tax Service online. In this case, the forms are also recorded using such systems. Some taxpayers are legally allowed to switch to using online devices from 07/01/2019, and individual entrepreneurs without employees in some cases - from 07/01/2021. Before this, they have the right to use printed forms. The purchase of such forms is carried out on cost accounting accounts (25, 26, 44 - depending on the department), and subsequent accounting is carried out using balance sheet account 006.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.