BSO or strict reporting form is a document that formalizes the receipt of cash (or payments using payment cards) from a client when providing services to the public. In fact, BSO is an alternative to a cash register receipt, so until July 1, 2021, you can choose whether to use a cash register when providing services [/anchor] or issue such a form.

BSO can be issued not only when providing services to ordinary individuals, but also to individual entrepreneurs who, as consumers of services, are treated as citizens (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16). If your clients are legal entities, then you cannot issue them a BSO .

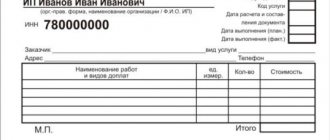

BSO details in accordance with the old version of 54-FZ

- indication of the name of the form

- indication of the six-digit number, series

- indication of the name of the company that issued the BSO to the client, full name of the individual entrepreneur

- indication of the address of the company or individual entrepreneur

- indication of the TIN of the company or individual entrepreneur

- indication of the type of service and its cost

- indication of payment for the service

- settlement terms of the company and the client

- indication of the position and full name of the cashier, his signature

- company seal

BSO forms in accordance with Resolution No. 359 are produced in a printing house or generated using special automated systems.

The list of details is provided in two copies.

Business entities (transport enterprises, cinemas, zoos) can use simplified forms of BSO.

BSO to provide services to the population in 2021

The Decree of the Government of the Russian Federation “On the procedure for making cash payments...” dated 05/06/2008 No. 359 provides a list of possible options for the production of BSO forms:

- printed forms;

- forms produced using automated systems.

In this case, the BSO must contain the details listed in paragraph 3 of Resolution No. 359. If a mandatory form is not approved for the form by law, the BSO can have an arbitrary form with the inclusion of the mandatory details provided for the BSO. The BSO form chosen by the enterprise for conducting cash payments must be approved by the accounting policy.

More information about what constitutes a BSO, based on the provisions of Resolution No. 359, can be read in the publication “What applies to strict reporting forms (requirements)?”.

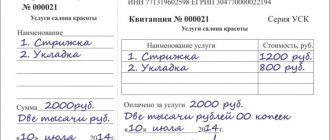

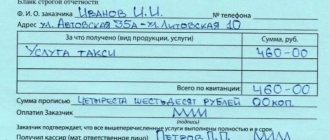

Let's look at what BSOs issued when paying for services look like, using forms for medical and plumbing services as an example.

How to take into account forms according to the old version of 54-FZ

It is necessary to take into account BSOs that are produced in the printing house. If they are produced using an automated system, their accounting is carried out through hardware and software tools, as well as under the supervision of the taxpayer.

To work with printed forms, you need a special BSO accounting book. Its sheets must be stitched, numbered, certified by the director and chief accountant of the company, and stamped by the organization.

The head of the company and his subordinate enter into an agreement. From now on, an employee of the company must maintain a BSO and receive funds from the company’s clients to whom services are provided. The employee must fill out the BSO in accordance with Resolution No. 359.

Reception of printing BSOs at the enterprise is carried out by a special commission.

BSOs are always stored in a safe place.

Strict reporting form according to the new version of 54-FZ

BSO and cash receipt are similar. The main difference between the BSO is that it is generated electronically, and an automated system is used that sends data on settlements between companies and clients via the Internet to the tax service.

Advantages of the new type of BSO

However, you need the Internet to use it. |

How has the BSO form changed to provide services to the public in 2021?

Law No. 290-FZ provides a clear definition of BSO and provides a list of BSO forms that should be used by everyone who works with cash register equipment from 07/01/2018. These may be forms:

- on paper printed by an automated system;

- in electronic form generated by an automated settlement system.

As you can see, according to Law No. 290-FZ, it is assumed that from 07/01/2018 the need to use printed BSOs will disappear.

The definition of an automated settlement system given in Art. is also of interest. 1.1 of Law No. 290-FZ. According to it, an automated settlement system is a cash register used for printing BSOs and/or for generating them in electronic form. Both printing and generation of the electronic form of the BSO must be carried out immediately at the time of settlement.

Law No. 290-FZ also made changes to the register of mandatory details, which must contain the BSO. Now this list is the same for BSO and cash register checks, which has made these two forms of payment documents even closer. Cash documents, which can also be issued electronically, must contain from 16 to 19 details - their full list can be found in clause 1 of Art. 4.7 of Law No. 290-FZ. It is mandatory that the text and all details on printed paper documents be preserved for at least 6 months.

IMPORTANT! The requirements regarding VAT given in the list of details in Art. 4.7 (paragraph 9, clause 1), are introduced for all VAT payers from 01.02.2017 (clause 14, article 7 of Law No. 290-FZ), and for individual VAT payers using special tax regimes - from 01.02. 2021 (Clause 17, Article 7 of Law No. 290-FZ).

At the same time, the state reserved the right, if necessary, to introduce an additional detail - the product line number, and also provided organizations and individual entrepreneurs with the opportunity to independently supplement the list of mandatory details of cash documents, if this is dictated by the peculiarities of their field of activity.

Is it necessary to register a BSO with the tax office in 2021? Read the article “Is it necessary to register a BSO with the tax office in 2016?”

BSO details according to the new version of 54-FZ

- indication of name

- indication of the serial number for the cashier's work shift

- indication of the address of the organization where the payment was made

- indication of the company name, full name of the individual entrepreneur

- Taxpayer INN

- indication of the taxation system

- indication of a specific calculation indicator

- name of the services provided to the client

- indication of cost per unit of service provided

- indication of the total invoice amount for services

- indication of a specific form of payment

- indication of the position and full name of the person who accepted the payment from the client

- indication of the registration number of the automated BSO generation system

- indication of the serial number of the drive

- indication of the fiscal indicator of the BSO

- indication of the website address where you can request information about the calculation

- telephone or email (when transmitting BSO only electronically)

- indication of data on the fiscal document

- specifying information about the work shift

- indication of the fiscal indicator for the message

Application of strict reporting forms when providing services

Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16 “On some issues of the practice of applying administrative liability provided for in Art. 14.5 of the Code of the Russian Federation on Administrative Offenses…” it is approved that settlements using BSO can be carried out when providing services to individuals, including individual entrepreneurs.

The use of strict reporting forms in the provision of services will undergo changes as certain provisions of Law No. 290-FZ come into force. By 07/01/2018, organizations and individual entrepreneurs providing services to individuals need to acquire automated payment systems capable of not only generating and printing BSO in paper form, but also transmitting them at the buyer’s request in electronic form, as well as generating fiscal data for the Federal Tax Service.

With the entry into force of Law No. 290-FZ, the list of services provided to the population that allow you to work without a cash register and without the mandatory issuance of BSO has been significantly limited:

- food services in educational institutions during classes;

- acceptance of waste materials from the population (except for scrap non-ferrous metals, precious stones and scrap metal);

- shoe repair and painting;

- metal haberdashery services (production and repair of keys and small metal products);

- nanny and nurse services;

- splitting firewood and plowing household plots and garden plots;

- porter services,

- rental of housing by entrepreneurs.

As for the mandatory use of automated settlement systems equipped with fiscal data transmission systems when providing services to individuals and individual entrepreneurs, until July 1, 2018, merchants who have the right to work without the use of cash registers with the mandatory issuance of BSO when making cash payments can work according to the old rules. Let's remember them.

For more information about the use of CCT by merchants on PSN and UTII in 2016, read the article “Imputation and PSN are exempt from CCT until July 1, 2021.”

Who may not use forms and cash receipts

BSO is a document that is issued only when services are provided to you. But entrepreneurs may not formalize it and not use other types of cash register systems during:

- shoe repair, painting

- providing services for carrying things at train stations, airports, sea and river ports, etc.

It should also be remembered that 54-FZ in the old and new versions allows some persons not to use cash registers if they are selling:

- goods at fairs

- tickets, newspapers, magazines

- ice cream

- seasonal vegetables, fruits and goods in tank trucks

In what cases can you replace a cash receipt with a BSO?

- cash payments are made to the population

- provision of services

- activities on UTII or PSN before the deadline established by law for the transition to online cash registers

When you cannot replace a cash receipt with a BSO:

- if the client is a legal entity,

- if there is no sale of goods.

Watch the video, which explains in detail in what cases BSO should not be used

Conclusion

The strict reporting form is an excellent alternative to online cash register in cases where this is permitted by law. The choice between online cash registers and BSO depends on the specifics of a particular type of business.

GO TO ONLINE CASH CATALOG

By contacting our company, you can receive a full range of necessary services:

- Electronic signature for registering an online cash register.

- Connection to OFD

- Registration of an online cash register with the Federal Tax Service

- Connection and support of EGAIS

- Subscriber support for Online cash registers

- Submission of declarations on alcohol and beer to FSRAR.

Did you like the article? Share it on social networks.

- Larisa 02.02.2021 17:13

Comment Good afternoon. Please tell me whether it is possible to issue both a cash register receipt and a voucher (BSO) at the same time. Or from 01.01.21 only BSO is allowed for use. Sanatorium. Thank you.Answer

- Anyuta 02/03/2021 13:10

Comment Hello. A check is equivalent to a BSO, so punching a check at the online cash register is mandatory, and issuing a BSO in the form of a voucher is at the request of the organization.

Comment Good afternoon, tell me, is it still not clear that in 2020 BSO for laundry services can be used in printing or only online?

Answer

- Anyuta 03/06/2020 15:58

Comment Hello. Online only.

Add a comment Cancel reply

Also read:

Restaurant automation programs

Restaurant automation is the process of implementing hardware and software in a catering enterprise.

Its goal is to simplify and speed up business processes by replacing manual labor with automated systems. Automation programs Ready-made functional software for restaurant automation from official developers at low prices - from 200 rubles. Find out more Results of restaurant automation Manual work of staff is associated with low speed... 338 Find out more

Labeling of hookah tobacco in 2021

Labeling of hookah tobacco is mandatory in 2021.

At the legislative level, hookah tobacco is considered part of tobacco products, and to be more specific, it is included in the list of alternative tobacco products. Its labeling started in July last year and became one of the points of a large-scale project to label all tobacco. The stage of labeling hookah tobacco is not easy, since certain documentation and regulations... 578 Find out more

How the Federal Tax Service will monitor tax payments in 2021

Tax control by the Federal Tax Service is regulated by Article 54.1 of the Tax Code of the Russian Federation.

Back in March 2021, the Tax Service published a letter in which it clearly outlined the rules for applying this article to entrepreneurs who evade tax payments. But how exactly will tax evasion be controlled? In this article we will try to figure out what questions tax inspectorates may have regarding entrepreneurs and... 352 Find out more

This might also be useful:

- Opening a current account for individual entrepreneurs

- Production of company letterhead

- Application for registration of individual entrepreneurs (form No. P21001)

- Registration of an individual entrepreneur cash register in 2021

- What taxes does the individual entrepreneur pay?

- Documents for registration of individual entrepreneurs

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!