Author: Ivan Ivanov

When carrying out work activities in organizations, enterprises and companies, it is often necessary to draw up acceptance certificates. The act of acceptance and transfer of strict reporting forms is a fairly important document that must be used in the process of receiving strict reporting forms received from the printing house.

It should be said that the document has certain features in the drafting process. If it is drawn up incorrectly, certain difficulties may arise that contribute to problems in the operation of the enterprise.

What is a BSO acceptance certificate?

Let’s immediately make a reservation that paper BSOs, which will be discussed in the article, are gradually being forced out of monetary document flow. Currently (and until July 1, 2021), they have the right to be used by a limited circle of people, from among those who, before the amendments to the Law “On Cash Registers” dated May 22, 2003 No. 54-FZ introducing online cash registers, were free from using KKT.

You can find out who these individuals are here.

If you still have the right to work with BSO on paper, consider the following.

Strict reporting forms (SRF), used in calculations without the use of cash registers, can be produced in a printing house. In this case, the BSO sheets record, in particular, information about the institution that issued them, as well as the circulation of the forms (among other mandatory BSO details specified in clause 3 of the regulations approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359).

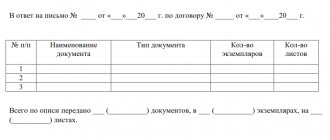

As a rule, the printing house that produces the BSO and the user of these forms are different business entities. The transfer of printed forms from the printing house to the customer must be confirmed by a separate primary document - for example, an acceptance certificate. This document can be drawn up in any structure that is optimal for the parties to the legal relationship. In particular, it is common practice to use the form from Appendix No. 4 to Appendix No. 2 to the GMEC protocol No. 4/63-2001 dated June 29, 2001.

Download the act of acceptance of strict reporting documents

The forms accepted and capitalized on the basis of the acceptance certificate are subsequently used to issue BSO to employees who accept money from clients.

Results

The turnover of SSO in an organization can be carried out using various acts - acceptance, transfer to an employee. How one or another sample of an act of acceptance of a BSO or a transfer of a form will be drawn up is determined mainly by the accepted norms of internal corporate document flow. If we are talking about the acceptance of printed BSO from the printing house, the form of the act approved in the GMEC protocol No. 4/63-2001 can be used.

You can learn more about the features of using BSO in the articles:

- “Strict reporting form instead of a cash receipt (nuances)”;

- “What mandatory details must be indicated in the BSO?”;

- “What applies to strict reporting forms (requirements)?”;

- “What part of the BSO should be given to the client?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample of filling out an acceptance certificate for strict reporting forms: document structure

A sample act of acceptance of strict reporting forms may contain, in particular:

- information about the commission that accepts BSO from the printing house;

- information on the results of checking a batch of forms by circulation;

- information about primary documents drawn up as part of the acceptance and delivery of the circulation;

- information on the number of forms - according to the fact, according to the invoice, indicating their series;

- information about surpluses, shortages, defects;

- the cost of forms received from the printing house;

- the fact of posting BSO in the accounting book and transferring them for storage to the accounting department.

The document is signed by the members of the commission, as well as by the accountant.

Who can apply

Various companies and individual entrepreneurs have the right to issue BSOs, because these documents are equivalent to checks issued by cash registers. Most often, BSOs are used when conducting activities aimed at providing services to the population.

The company must complete the form before receiving funds. The form is also properly completed in the case when the money transfer is carried out using payment cards or bank transfer. However, this rule does not apply to all tax payers. BSO is used by those individual entrepreneurs and companies that are legally allowed to conduct their activities without using cash registers.

Do not forget that BSOs should be used by organizations that carry out cash payments. Whether it is a seller or a buyer does not matter. Thus, organizations that also act as buyers must also apply SSR.

Not long ago, the law defining the rules for the use of BSO was adjusted. According to the old rules, you can use forms instead of cash receipts until July 2021. Currently, online cash registers are being widely introduced, which obliges companies and private entrepreneurs to process documents using automated systems.

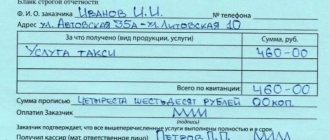

Required details

As already mentioned, many individual entrepreneurs and companies have the opportunity to use BSO developed independently. However, the law obliges all mandatory points to be included in the document:

- what is the name of the document, for example, is it a ticket, coupon or receipt;

- the document must be assigned a series and number of six digits;

- name of the company or full name of the individual;

- TIN of the company or individual entrepreneur;

- the type of services for which the customer pays;

- cost of services or goods;

- the total amount that the customer pays in cash or via bank transfer;

- calculation characteristics - return, income, expense;

- data of the person who is responsible for the correct execution of the document. This includes full name, position, personal signature;

- if a document is drawn up by an organization, it is certified not only by the signatures of the responsible persons, but also by a seal;

- list of services and goods, their quantity and cost, taking into account markups or discounts.

Do not forget that companies do not have the right to personally develop forms if the law obliges them to use only approved forms. When developing your own form, the head of an organization or an individual entrepreneur has the right to enter additional data. Perhaps with their help it will be possible to characterize as accurately as possible the specifics of the services or goods provided.

Of course, many organizations already use automated systems to generate forms. Otherwise, a printed form is used. In this case, the document must contain detailed information about the printing house, its tax identification number, address, year of execution and order number, circulation size.

Certificate of transfer of BSO to an employee sample

Related publications

The use of strict reporting forms in the process of business activities involves the transfer of documents to the responsible person for registration and issuance of signed copies to clients. Receipt of BSO by an employee must be accompanied by the fulfillment of a number of conditions. The fact of transfer and acceptance of forms by the employee is recorded in the act.

Fines for failure to issue BSO

In all cases where the issuance of BSO is necessary, it must be carried out. Otherwise, regulatory authorities will equate this to failure to issue a cash register receipt. If for any reason the seller does not issue a correctly executed strict reporting form in paper or electronic form, he faces penalties. There are different fines for specific situations:

- for individual entrepreneurs, a fine is charged in the amount of 1/4 to 1/2 of the transferred amount. But the fine cannot be less than 10 thousand rubles;

- for legal entities 3/4 of the amount. In this case, the minimum fine is 30 thousand rubles.

In addition, the law provides for punishment if the seller repeatedly commits these offenses. So, if the total amount of funds received without registering a BSO has reached 1 million or more, sanctions are provided:

- officials on the seller's side are suspended from fulfilling these obligations for a period of up to two years;

- Legal entities and individual entrepreneurs will be prohibited from conducting this activity for three months.

Penalty cannot be avoided if, at the buyer’s request, the form is not handed over or sent by email. Here the seller faces:

- the official is issued a fine in the amount of 2 thousand rubles. In addition, the culprit receives an official reprimand and warning;

- if the violation was on the part of the organization, there is a warning and a fine, the amount of which can reach 10 thousand rubles.

BSO are documents that must not only be prepared properly, but also stored correctly. If regulatory authorities reveal a violation of the rules for storing and recording BSO, a fine of 2-3 thousand rubles is provided.

Do not forget that these forms refer to documents that require strict reporting. That is why a special book is used to record them. All actions performed with the forms are monitored by a responsible employee. In case of violations in accounting and storage, responsibility falls not only on the shoulders of the manager, but also on the employee who is responsible for the forms.

Penalties for incorrect structure

If an organization has issued a form, the sample of which is unknown, then, in accordance with the law, the Federal Tax Service may impose a fine in the amount of 30,000 to 40,000 rubles on the organization. If the fine is imposed on the person responsible for compliance with strict reporting forms, then the amount of the fine ranges from 1,500 to 2,000 rubles.

To prevent such a situation from arising, it is necessary to ensure that the forms issued comply with the established standards.

Where can I find a certificate of acceptance and transfer of BSO and a sample act of transfer of BSO to an employee?

On our website you can find:

- with a sample act of acceptance and transfer of BSO from the printing house to the customer;

- with a sample act of transferring strict reporting forms to an employee who is the financially responsible person.

What is hidden under the term "checkbook"

A checkbook is understood as a number of cash checks stapled into a booklet (usually 50 or 25 pieces), upon presentation of which to the bank the owner of the current account has the opportunity to withdraw cash from it. Most often, this document is used when it is necessary for management to issue money “on account”, pay employees, business expenses and other current needs.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

A checkbook is issued to the account holder only after he writes a special application.

Sample application for issuance of a check book

An application for a checkbook is a fairly simple document.

- First, you should indicate the name of the organization whose representative is preparing it.

- Next, assign a number to the form (this is not always required) and set the date it was generated.

- After this, you need to enter the actual request for the issuance of a checkbook, indicating the account number from which its owner will withdraw money.

- You should immediately give an undertaking to keep the document properly and indicate information about who is authorized to receive the checkbook (i.e., a representative of the organization).

- Next you need to verify his signature.

- Finally, the form must be signed by the company director and chief accountant and, if necessary, stamped.