Author: Alena Donmezova – Specialist in RKO

Date of publication: 07/08/2019

Current for May 2021

Most modern banks offer us to use their services remotely. This simplifies our work, reduces the amount of working time to resolve business issues, but at the same time increases problems and errors. Increasingly, erroneous translations can be found. In this article, we will share with you techniques on how to return money to your checking account if you suddenly make a mistake.

Refunds for goods

Refunds for goods occur for the following reasons:

- consequences of buying and selling goods of inadequate quality. The timing and procedure for the return of funds in this situation is regulated by Art. 475 of the Civil Code of the Russian Federation “Consequences of the transfer of goods of inadequate quality” and Art. 18 “Consumer rights when defects are detected in a product”, Art. 24 “Settlements with the consumer in the event of the purchase of goods of inadequate quality” of the Law on the Protection of Consumer Rights;

- consequences of violating the terms of the contract on the quantity of goods. In this situation, the procedure for returning funds is regulated by Art. 466 of the Civil Code of the Russian Federation “Consequences of violation of the condition on the quantity of goods”;

- consequences of violation by the seller of the deadline for transferring prepaid goods to the consumer. The situation is regulated by Art. 487 of the Civil Code of the Russian Federation “Advance payment for goods” and Art. 23.1 of the Consumer Protection Law.

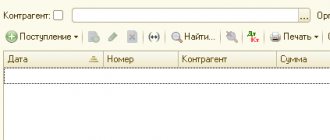

Below are typical accounting entries that reflect the return of funds under sales contracts:

- Refunds to buyers and customers. The transaction reflects the debiting of money from the organization’s current account;

- Refunds from suppliers. The operation reflects the crediting of returned funds to the organization’s current account.

Who is required to use CCP

All legal entities and individual entrepreneurs are required to use cash register equipment when making payments, including non-cash payments.

The cash register, included in the register of cash register equipment, is used on the territory of the Russian Federation without fail by all organizations and individual entrepreneurs when making payments.

The definition of the term “settlements” is given in Article 1.1 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as Law No. 54-FZ). In particular, settlements mean the acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, work, and services.

CCT is not used for non-cash payments between organizations and individual entrepreneurs, with the exception of settlements using an electronic means of payment (for example, a bank card) with its presentation.

The receipt of erroneously transferred funds from an individual to the organization's current account without the sale of goods (work, services) to him is not a settlement within the meaning of Law No. 54-FZ. Therefore, in this case there is no need to run a cash register check.

Refund of erroneously transferred or written off amounts of money

Let's consider the situation of an unjustified bank debiting funds from a client's account. In this case, according to Art. 395 of the Civil Code of the Russian Federation and Art. 856 of the Civil Code of the Russian Federation, the bank is obliged to pay interest on the erroneously written off amount in the amount of the refinancing rate established by the Central Bank of the Russian Federation on the day the funds are returned to the organization’s account, unless otherwise provided by the terms of the banking service agreement.

Since, according to PBU 10/99 and PBU 9/99, the write-off and return of funds without the organization’s instructions is not recognized as an expense or income, settlements with the bank are recorded in the subaccount “Settlements for claims” of account 76 “Settlements with various debtors and creditors”. Also, in accordance with Art. 41 of the Tax Code of the Russian Federation and Art. 252 of the Tax Code of the Russian Federation, unjustified write-off and subsequent return of funds are not taken into account for profit tax purposes.

Interest accrued by the bank for the use of the organization’s money is reflected in other income on the date the amount of interest is credited to the organization’s current account under the credit of subaccount 91-1 “Other income”. In terms of calculating income tax, the amount of accrued interest is included in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation) on the date the bank recognizes its obligations to pay this interest, i.e. on the date of crediting the amount of interest to the organization’s current account (clause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

By following the link you can familiarize yourself with the accounting entries that reflect in the organization’s accounting records the return of funds erroneously written off by the bank.

sprbuh.systecs.ru

BASIC

Regardless of the method for determining the tax base for income tax, do not include erroneously received amounts in the taxable income of the organization (Article 248 of the Tax Code of the Russian Federation). They do not relate to either sales income or non-sales income (Articles 249, 250 of the Tax Code of the Russian Federation). These amounts are not recognized as the economic benefit of the organization (Article 41 of the Tax Code of the Russian Federation). Such clarifications were given by the Russian Ministry of Finance in letter dated November 7, 2006 No. 03-11-04/2/231. This letter explains the procedure for reflecting erroneously received funds when calculating the simplified single tax. However, the conclusions set out in the letter are also applicable for the purposes of calculating income tax.

If the bank has written off erroneously received funds from the organization’s account, then there is no need to reflect them in expenses either. This is due to the fact that the indicated amounts do not meet the expense criteria specified in paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

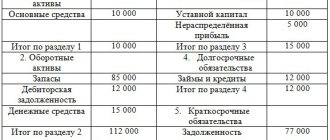

An example of reflection in accounting and taxation of funds erroneously credited and subsequently debited from the organization’s current account

On January 19, when checking a bank statement, an accountant at Alfa LLC discovered that 118,000 rubles had been credited to the organization’s current account at JSCB Nadezhny. (including VAT – 18,000 rubles). The money came from Torgovaya LLC. Since there were no contractual relations between Alpha and Hermes, the accountant took into account 118,000 rubles. as erroneously received funds.

The Alpha accountant did not calculate VAT payable to the budget on the specified amount. The organization's accountant wrote a corresponding statement to the servicing bank.

The bank account agreement concluded between Alfa and JSCB Nadezhny contains a condition for the direct debiting of amounts that were mistakenly credited to Alfa’s current account. After the bank reviewed the application, the erroneously credited funds were debited from Alpha’s current account on January 21 and returned to Hermes’ current account.

"Alpha" pays income tax monthly.

Alpha's accountant made the following entries in the accounting.

January 19:

Debit 51 Credit 76-2 – 118,000 rubles. – funds mistakenly credited to the organization’s current account are taken into account.

January 21:

Debit 76-2 Credit 51 – 118,000 rub. – funds previously mistakenly credited to the organization’s current account are written off.

When calculating income tax for January, the accountant did not take into account the amounts erroneously received and subsequently written off from the current account (RUB 118,000).

Situation: is it necessary to charge VAT on amounts received into the organization’s current account by mistake?

No no need.

Funds received into the organization's current account by mistake are not associated with settlements for payment for goods sold (work performed, services rendered). Therefore, do not charge VAT on them. This conclusion follows from the provisions of Article 162 of the Tax Code of the Russian Federation. It is confirmed by the Ministry of Finance of Russia in a letter dated August 2, 2010 No. 03-07-11/329, as well as arbitration practice (see, for example, the determination of the Supreme Arbitration Court of the Russian Federation dated March 30, 2011 No. VAS-214/11, the resolution of the FAS Moscow District dated February 7, 2013 No. A40-30908/12-107-147, East Siberian District dated March 13, 2007 No. A10-4085/06-F02-330/07-S1).

Posting a refund

According to current legislation, the seller of goods or service provider is obliged to provide the buyer (customer) with a product (service, work) of the quality and range specified in the contract and allowing the product or the result of the services (work) provided to be used for its intended purpose.

Postings for the return of money and goods in the buyer’s accounting department

If significant deficiencies or defects are identified, the buyer may refuse to fulfill the terms of the contract in full and demand the supplier to return the money paid.

In such a situation, the buyer must send a written claim to the supplier to terminate the contractual relationship with a demand for a refund of the money paid.

The seller, in turn, has the right to return the goods refused by the buyer.

If the need to return the goods and money occurred after the buyer had posted material assets, then if the issue of returning the goods and money is resolved positively, entries will be made in the buyer’s accounting department to the appropriate sub-accounts, based on the claim to the seller and the invoice for the returned goods:

- D-t 62 invoices and K-t 90 invoices - for the amount of the returned goods,

- Invoice Dt 90 and Invoice Dt 68 - VAT is charged on the returned goods.

A refund from the supplier (seller) to the buyer’s bank account for a low-quality product (service) or a product of the wrong assortment will look like this:

- D-t 51 invoices and K-t 62 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund by the seller (supplier) was made directly at the buyer's (customer) cash desk, then the posting of the refund will look like a debit of 50 and a credit of 62 accounts.

Postings for the return of money and goods in the accounting department of the supplier (seller)

The receipt of returned goods in the supplier's accounting department is carried out on the basis of an invoice issued by the buyer for the return of materials (goods):

- D-t 60 invoices and K-t 10, 41 invoices - for the amount of the returned goods,

- Invoice Dt 19 and Invoice Dt 60 - VAT is reflected on the returned goods.

A refund to the buyer’s bank account for a low-quality product or product of the wrong range from the supplier will look like this:

- D-t 60 invoices and K-t 51 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund to the buyer was made directly at the seller’s cash desk, then the postings will look like debit 60 and credit 50 to the account.

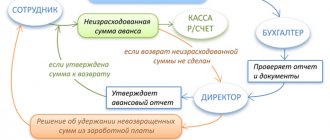

Refund of erroneously (excessively) paid funds

Refunds of funds transferred to the supplier by mistake are made on the basis of a letter from the customer, which indicates the payment document, its number, date and the amount paid by mistake.

The party that received the erroneous amount reconciles the calculations and deliveries. If excess money is discovered, the supplier returns it to the customer.

In the accounting department of the customer (buyer), the erroneously transferred money is reflected in account 76, the corresponding subaccount.

Posting a refund of funds erroneously transferred to the seller to the customer’s bank account will look like:

- D-t 51 accounts and K-t 76 accounts - in the amount of excessively (erroneously) transferred funds.

The return of money through the customer's cash desk is recorded as turnover on the debit of account 50 and the credit of account 76.

Consultation on accounting entries for financial returns can be obtained from organizations specializing in consulting accountants or tax authorities. Qualified employees of these organizations will answer any questions you may have regarding accounting for the company’s funds.

www.vsemvsud.ru

Postings when returning an erroneously transferred payment from a counterparty

For the payer, the amount transferred to the wrong counterparty or transferred in a larger volume also goes to account 76: Dt 76 Kt 51 (52) or Dt 76 Kt 60 (if it is no longer possible to correct the posting made on the payment order).

The return of incorrectly transferred funds from the counterparty in the postings will be expressed as Dt 51 (52) Kt 76. For currency payments, here you will also need to take into account the exchange rate difference, the amount of which will be charged either to the debit or credit of account 91 (Dt 91 Kt 76 or Dt 76 Kt 91).

If, in relation to an erroneous payment, a decision is made to offset it against payment for a delivery within the framework of an existing relationship with the counterparty, then the payment recorded on account 60 will simply change the analytics due to internal posting. In this case, it will be possible to take into account VAT in deductions for both advance payment and delivery.

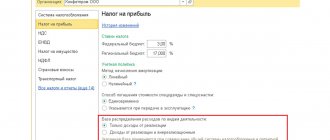

VAT refund to the current account: procedure, application form, postings

VAT refund to the current account is an option that the taxpayer has the right to use when submitting a declaration to the Federal Tax Service, where such tax is reflected for reimbursement. The process itself is prescribed in the Tax Code of the Russian Federation (Articles 176 and 176.1). To receive the full amount, the taxpayer fills out an application (letter) in which he asks to return the value added tax. Based on the practice of applying such norms, the procedure considered raises a lot of controversy. To avoid difficulties, it is worth knowing a number of nuances, which will be discussed in the article.

How to refund VAT to a current account - step-by-step instructions

It was noted above that the nuances of this issue are considered in the Tax Code of the Russian Federation (Article 176). The procedure takes up to three months and involves a number of difficulties that the applicant has to face. The reason for the problems is that the result of the decision can be positive, negative and partial.

- An application for VAT refund to the current account is filled out and submitted to the Federal Tax Service simultaneously with the tax return. The latter specifies the excess of the amount of deductions over the amount of tax accrued from the sale transaction.

- The Federal Tax Service organizes a desk audit, based on the results of which it gives an answer - to refund the tax or refuse the service. In case of refusal, a report is drawn up where representatives of the tax service indicate the company’s violations.

- If approval for the refund is received, the VAT is refunded to the bank account. Another option is possible - using these funds to pay off other debts.

Is it worth writing a statement?

Previously, there was no need to complete an application. Today, in order to avoid problems and disputes with the Federal Tax Service, it is recommended to spend time filling out the paperwork. It is drawn up in any form. The letter for VAT refund to the current account must contain the following information:

- Company name.

- Postal address of the enterprise and Taxpayer Identification Number.

- Director's signature and transcript. If another person signs, the power of attorney is invalidated.

- The company's stamp, if the application is made on the organization's letterhead.

If the specified details are not on the paper, the Federal Tax Service refuses to consider it. The situation is different when the letter is issued for partial or full credit. The application must indicate the BCC of the tax against which VAT is applied. The amount of VAT itself, which must be offset, is also reflected.

An application for a VAT refund to a current account must contain account details for crediting money if the taxpayer has a group of accounts or one is located in a problematic financial institution.

Subtleties of accounting entries

To obtain a VAT refund, the company submits an application (as noted above). In this case, the company’s accounting department makes the following entries:

- D/K - 02/68/19 - the amount of VAT that is paid from the budget. The operation is described as submitting VAT for reimbursement.

- D/K - 51/68.02 - funds that were credited to the current account.

If the company decides to pay other obligations to the Federal Tax Service at the expense of the refundable tax, it is required to fill out a corresponding application and instruct the accounting department to make the following entries - D/K - 68 (tax offset against the refund amount) / 68 (VAT).

Refunding VAT to a current account requires attention when collecting papers and correct execution. To speed up the process, it is worth checking the missing amount in advance. To do this, by the time the three-month period allotted for the desk audit is calculated, the calculations must be verified (you should contact the Federal Tax Service and fill out an application in any form).

raschetniy-schet.ru

Return of funds to the current account

Returning funds to a current account is a situation that may arise in a number of cases:

- Payment for low-quality goods.

- Violation of delivery deadlines.

- Incorrect crediting of money to the current account.

- Accidental debiting of funds from the account.

In all of the above cases, a refund to the bank account is required. Moreover, each of the options requires a separate approach from individual entrepreneurs or companies (primarily from the standpoint of reporting and paying taxes).

Features of accounting for returns when combining tax regimes

The main feature of returning funds to the buyer’s bank card is that the acquiring bank does not explicitly write off the refund amount from the organization’s current account, but withholds it from subsequent deposits under the acquiring agreement.

A taxpayer who does not keep separate records may have problems accounting for income if the tax treatment of the refund and subsequent sales paid for with cards do not match.

According to the Tax Code of the Russian Federation, when combining the simplified tax system and UTII, the taxpayer must organize separate accounting of income and expenses within each type of activity (clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation). At the same time, for the purpose of calculating and paying UTII, tax accounting of income and expenses is not required. After all, the tax base—the amount of imputed income—is fixed.

Consequently, the main task when combining these regimes is to correctly determine the tax base and calculate the tax when applying the simplified tax system. This rule applies not only to “simplified” people with the object “income minus expenses,” but also to those who count only income.

For example, goods sold as part of activities on UTII are returned, and the following card payments are made for sales on the simplified tax system. This means that when the acquirer credits funds, it is necessary to recognize income under the simplified tax system in the full amount, without deducting the withheld return. And for the amount of the withheld refund - reverse the income on UTII.

We will consider the procedure for reflecting refunds to customers’ payment cards from “simplified” companies when combined with UTII using the following example.

Refund of funds to the current account for services (goods)

In business activities, the following reasons for returning products are possible:

- The object of the transaction is of low quality. The legislation provides for the following articles of the Civil Code of the Russian Federation:

- Article 18 - about the consequences of transferring low-quality products.

- Article 24 - according to settlements with the consumer in case of detection of defects in the goods.

- Violation of the terms of the agreement on the volume of supplied products. In such a situation, the refund to the bank account is made taking into account Article 466, which concerns the elimination of the consequences of the transfer of goods of poor quality.

- Failure to fulfill contractual obligations regarding the timing of provision of the transaction object. Such cases are regulated by two articles of the Civil Code of the Russian Federation (487 and 23.1).

Refunds to the current account are made taking into account the following transactions:

- Reverse transfer of funds to customers and buyers - 62.01 and 51 (debit/credit).

- Transfer of advances - 62.02 and 51 (debit/credit).

The peculiarity of the operation is the reflection of the write-off of funds from the company’s account.

Refund of money received from suppliers to the bank account:

- Receipt of funds that were previously paid to contractors and suppliers - 51 and 60.01 (debit and credit).

- Return from contracting companies and suppliers of previously transferred advances - 51 and 60.02 (debit/credit).

Such transactions are shown by the fact that money is credited to the company's account.

Incorrect receipt of funds

The second situation is that money arrives in the current account by mistake. This is possible in the following cases:

- The payer made a mistake (for example, he registered the wrong recipient of funds).

- Banking institution error.

What to do? How is a refund made to a bank account?

- The recipient learns about the amount that ended up on the account by mistake. The source of information is a bank statement. In this case, the client notifies the banking institution within ten days, after which a reverse transfer of funds is made. There are no clear deadlines, but it is recommended to carry out this operation as quickly as possible.

- The bank provided information about the erroneous deposit of money. In this case, the reference day is the moment when the owner of the account received the corresponding notification. In this case, the company must prove that it was impossible to find out about the false enrollment from the statement. As in the previous case, a return to the bank account from which the receipt came is required.

The bank does not have the right to independently write off the erroneously credited amount. In addition, the company may not return funds in situations:

- If the deadline for fulfilling obligations has not arrived.

- The statute of limitations has expired.

Results

All actions with a payment transferred to a counterparty by mistake are carried out with a written indication of their nature on the part of the payer. In this case, the funds can be offset against settlements on existing relationships. In the accounting of both the recipient and the payer, the amount of the erroneous payment is reflected in account 76. In correspondence with this account, both parties will show the cash flow for the return: Dt 76 Kt 51 (52) - for the returning party, Dt 51 (52) Kt 76 - at the recipient of the refunded funds. Returning an erroneous payment has no tax consequences.

Incorrect transfer (write-off)

The credit institution mistakenly debits money from the client’s account. In such a situation, the bank is obliged to return the funds to the current account. In this case, interest must be paid, calculated at the refinancing rate (set by the Central Bank). The situation may develop differently if the contract specifies individual conditions.

Returning (writing off) money from an account without an order from the company does not fall into the category of profit or expense. Consequently, all financial transactions with the bank are carried out through a sub-account (Claims settlements). Also, in case of erroneous withdrawal and subsequent return of money to the current account, accounting in the taxation sector is not carried out.

Interest accrued by a credit institution for an incorrectly performed transaction is reflected in the other income subaccount 91-1. As for income tax, the amount received from the bank is included in unrealized income at the time the credit institution recognizes its liabilities.

Algorithm of actions if the sender made a mistake

We advise you to immediately call your bank and ask to cancel the payment. Most of them carry out the transaction after a certain amount of time, and the client has a chance to withdraw the payment.

If the operation has already been performed:

- Take a document that will confirm your actions that the payment was made;

- Next you need to try to get the contacts of the person to whom the money was sent. By calling the organization, you will not be able to immediately return the money, but at least you will find out what actions need to be taken.

- Contact the recipient of the payment, send him an official letter where you demand a refund, indicate the details of where to return the money. You can also duplicate your message over the phone.

- Wait for the recipient's response. If he doesn't rush to send it, you will most likely have to go to court.

If you made mistakes when filling out the bank details, the payment will not go through at all, because the bank automatically checks the order and identifies errors.

How to make accounting entries for refunds to a buyer or supplier

The legislation provides that when concluding an agreement between the buyer and the supplier, the latter is obliged to supply the customer with goods, provide a service or perform work in strict accordance with the quantity, quality and assortment provided for in these agreements.

If the above conditions are not met, the buyer has the right to return products that do not meet the requirements, and the supplier undertakes to return the previously paid funds to the customer. This article describes standard transactions that reflect the procedure for refunding funds in the buyer's and supplier's accounts, as well as the documents on the basis of which they are carried out.

The procedure for settlements with customers when returning goods

When paying in cash with the buyer, the procedure for returning funds depends on the day on which the goods are returned. In relation to payments via bank cards, the procedure for returning funds must be specified in the agreement with the bank. Revenue received using a plastic card is reversed, and the payment document is taken from the buyer. If the buyer does not have a cash receipt, he still has the right to receive his money from the seller (when he returns the goods), proving the fact of purchasing the goods in this store with other documents or testimony.

In practice, the following situations are possible when a product is returned:

- on the day of purchase, the goods were paid for in cash;

- on the day of purchase, the goods were paid for by bank card;

- later than the day of purchase, the goods were paid for in cash;

- later than the day of purchase, the goods were paid for by credit card.

The procedure for cash payments made using payment cards is regulated by Bank of Russia Regulation No. 266-P dated December 24, 2004 “On the issuance of payment cards and on transactions carried out using them” (hereinafter referred to as Regulation No. 266-P).

If the returned goods were previously paid for by a bank card, then the money is returned to the buyer by bank transfer by transfer to the buyer’s card, since cash can be returned only if payment for the goods was made in cash (clause 2 of the Bank of Russia Directive dated 10/07/2013 No. 3073-U “On cash payments”). According to the letter of the Federal Tax Service of Russia for Moscow dated September 15, 2008 No. 22-12/087134, when returning goods not on the day of purchase, operations for issuing funds are carried out in accordance with the concluded acquiring agreement (agreement between a credit institution and a trade organization).

Documentation of refund to the buyer

According to Article 466 of the Civil Code of the Russian Federation, the buyer has the right to return the goods if they are delivered in quantities less than those provided for in the contracts. If there are discrepancies in the assortment, the return is carried out on the basis of Article 468 of the Civil Code of the Russian Federation. If a product is found to be of inadequate quality, the customer issues a return in accordance with Article 475 of the Civil Code of the Russian Federation.

When returning goods, the buyer draws up the following documents:

- A report on identified discrepancies, drawn up in the TORG-2 form (for imported goods - TORG-3 form). This document is drawn up if, upon shipment of the goods and after payment, the customer identifies deviations in the quality or quantity of products, as well as if inconsistencies are detected in the shipping documents.

- Invoice (form TORG-12), which is used to issue a return if a product is found to be defective or the product does not comply with the approved state or contractual standard.

These documents are transferred to the supplier along with a letter of refund, on the basis of which the supplier accepts the products, and the buyer is credited with the previously made prepayment.

Regulatory regulation of the return of goods from customers in retail trade

When selling goods using payment cards, a situation may arise when a previously purchased product is returned by the buyer back to the seller.

The buyer has the right to exchange non-food goods of good quality within fourteen days (unless a longer period is announced by the seller), not counting the day of its purchase. If the seller does not have the goods necessary for exchange, then the buyer has the right to return the purchased goods and receive the amount of money paid for it (clause 1 of Article 502 of the Civil Code of the Russian Federation, clause 1, clause 2 of Article 25 of the Law of the Russian Federation dated 02/07/1992 No. 2300 -1 “On the protection of consumer rights”).

The procedure for the seller when returning goods by the consumer, as well as the list of documents that the buyer must provide, is given:

- in the Standard Rules for the Operation of Cash Registers when Carrying Out Cash Settlements with the Population, approved. Ministry of Finance of Russia 08/30/1993 No. 104;

- in the Methodological recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved. by letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5.

According to these sources, the procedure for the seller and buyer when returning goods is as follows:

- the buyer provides an application for the return of goods in any form accompanied by a receipt for the purchase of goods. The buyer’s application must be endorsed by the head of the organization or another authorized person to obtain permission to return funds to the buyer;

- a cash receipt order must be issued for the funds returned to the buyer;

- at the time of acceptance of the returned goods, the seller issues an invoice for the return of goods in two copies: one copy for the seller, the second for the buyer.

In the case of the return of goods by the buyer, the amount of VAT paid by the selling organization upon the sale of these goods is subject to tax deduction in full after the corresponding adjustment operations are reflected in the accounting in connection with the return of goods (clause 5 of Article 171 of the Tax Code of the Russian Federation, clause 4 . Article 172 of the Tax Code of the Russian Federation), but no later than one year from the date of return or refusal.

Refunds to the buyer: accounting with the customer and the supplier

Let's consider each wiring option.

Return postings from the supplier

For convenience, let's look at accounting for a return transaction from a supplier using an example. An agreement was concluded between Phobos LLC and Demos LLC for the supply of paint and varnish products, where Phobos is the supplier and Demos is the buyer. The products were sold at a price of 155,000 rubles. at a cost of 88,000 rubles. "Demos" made 100% payment for the goods. Due to non-compliance with the quality characteristics, Demos returned the entire consignment of goods, having issued a TORG-2 act. Upon the return of the products, Phobos credited the previously paid funds to the Demos bank account.

The following entries were made in the accounting of Phobos LLC:

saldovka.com

This is interesting:

- VAC approval order Information on the readiness of diplomas of doctor and candidate of sciences, certificates of professor and associate professor, certificates of recognition of foreign academic degrees and academic titles (their duplicates) Updated August 08, 2021 All diplomas, certificates […]

- Income tax benefit for children in 2014 Tax deductions for children in 2014 Tax deductions for children in 2014 are provided, as before, to those who are officially employed, pay taxes and have children under the age of 18 as a general rule or 24 years, […]

- Certificate of income tax benefits What are the income tax benefits for children in 2021? The income tax benefit for minor children makes it possible to significantly reduce its amount and reduce the tax burden. It has been provided since 2015, [...]

- Tax benefits for children of students Tax deductions for children in 2018 (personal income tax, etc.) Send by mail The tax deduction for children in 2018 includes several benefits that have different origins, while one type of deduction is guaranteed to anyone with [ …]

- The disability benefit has not arrived WHAT IS IMPORTANT TO KNOW ABOUT THE NEW DRAFT LAW ON PENSIONS Payment of pensions is suspended in the following cases: if the established pension is not received for six months in a row - for six months starting from the 1st day of the month, […]

- Tax reporting forms Tax reporting forms Tax reporting forms have a clear structure and cannot be replaced by similar documents. At the same time, they themselves often change, which makes the work of an accountant much more difficult. Any businessman is concerned [...]

How to issue a refund to the cashier

When a claim is received from the buyer, the seller may decide to satisfy it. If the application is related to the requirement to transfer the funds spent, this should be completed correctly.

To arrange the transfer of money to the buyer, several rules must be followed:

- The goods must first be accepted and inspected. If it is not damaged and is in technically sound condition, you need to issue cash from the cash register;

- this operation is documented in a special document. As a rule, this is a receipt. This document indicates that the consumer has received his funds. And for the store, this document will be the basis for writing off funds;

- You should obtain the client's signature on the return of cash. This will avoid mutual claims and further development of the conflict situation. In addition, the signature actually certifies agreement with the amount and indicates the absence of claims against the store.

At the client's request, he must be provided with a copy of his receipt. However, the main copy must be left with the seller. Since he needs to check expenditure and receipt transactions and the receipt will confirm the correct expenditure of funds.

Cash refunds from the cash register for returned customer checks only on the day of purchase are carried out upon transfer to the food store. In fact, the purchase and sale transaction is terminated.

For this category of goods, the store is obligated to immediately issue cash from the cash register to the client. If for some reason the required amount is not available, the refund must be made at the first opportunity. This is the seller's responsibility and should not concern the buyer.

Cash transfers must be based on objective facts. These include inadequate quality of the product and its incompleteness.

In this case, the seller has the right to make sure that the goods were purchased exactly in his retail facility and exactly at the time indicated by the client.

This means that the client, upon request of the seller, is obliged to present such documents. This could be a cashier's check. As a rule, these checks are presented when handing over expired food products, items of clothing or shoes, perfumes, and so on.

The basis will also be a sales receipt. After all, it indicates the amount spent and the date of registration.

If there are no such documents, then there are two ways to achieve the transfer of cash:

- present a printout from your personal account. This is true when paying by credit card. Such a document will be an excellent and irrefutable proof of purchase;

- it is permissible to resort to witness testimony. This option is expressly provided for by law and the seller will have no grounds for refusal.

Thus, the client has many opportunities to prove his right to transfer the funds spent to him.

Returning non-cash money to the buyer is very difficult. Therefore, such transactions occur by transferring cash. But it often happens that it is simply impossible to give away cash. For example, when the parties are moving away from each other, a wire transfer seems to be the only convenient option.

In this case, the usual transfer of funds from the account to the bank card occurs. In this case, the client will have to confirm such an operation by entering a special code that the bank will send to him.

You should be extremely careful here. Often, under the guise of returning money to the buyer, scammers receive information about the code and withdraw everything from the person’s account. Therefore, under no circumstances should you report the one-time code sent by the bank for the transaction.

There is no special form for such a document. Therefore, each consumer has the right to fill out this application himself. When compiling it, you need to correctly reflect information about the name of the retail facility, as well as indicate your data.

In addition, you should express your desire to receive money for a certain product. In this case, you must indicate the name of the product and its value, which is subject to return.

This is possible if there is not enough cash in the cash register. In this case, the seller is obliged to make arrangements to transfer the cash as soon as it becomes available. This should happen no later than the next day after the client’s request.

Refund of money from the cash register to the buyer on the day of purchase

This is precisely the option provided for in the law. After all, if there are grounds for transferring cash, its presence with the seller is, in fact, the use of someone else’s money. And this is already a basis for filing a corresponding claim.

The procedure for returning goods sold by a store that uses an online cash register requires the use of documents

- Fiscal - created at the online cash register and used to inform the Federal Tax Service about the refund operation.

First of all, these are certain types of cash receipts. Depending on the content of the transaction between the seller and the buyer, these may be:

- correction check;

- ordinary checks containing special details that allow identification of the transaction.

- Formed for the purpose of legal substantiation of the legality of the return operation.

These documents may be subject to the jurisdiction of civil law, regulations governing the protection of consumer rights and other sources of rules applied depending on the content of the specific legal relationship between the buyer and the seller.

- Used as cash accounting documents.

Such documents include expenditure and incoming cash orders and the Cash Book, which reflects information about PKO and RKO.

- Accounting registers (relevant for legal entities).

Let's take a closer look at how these types of documents are used when returning goods in practice.

Fiscal

So, when returning goods, the seller must generate the necessary fiscal documents. These include:

- A cash receipt, which is issued to the buyer after the return is made - in cash or in the form of a transfer of funds to the card.

The main thing when generating such a check is to select the correct value for the “settlement attribute” variable in the cash register program. Specifically, when returning a product, it can be presented in the only correct form - as a “return of receipt”. Another very similar property, “expense,” is applicable only if the store itself purchases something from the buyer (for example, vegetables grown by him for resale).

- Cash receipts, which are used to adjust the amount of payments between the seller and the buyer.

We can talk about scenarios in which:

- the cashier mistakenly reduced (increased) the cost of goods on the receipt;

- the cashier told the buyer an amount greater (less) than what was “written down” on the receipt.

In these cases it is necessary:

- “cancel” the proceeds from the check issued to the buyer (by generating a “return of receipt” check for an amount equal to that reflected in the issued check);

- generate a new regular check (with the “Receipt” sign) with the correct amount.

Afterwards, both checks - a “cancellation” one (with the “return of receipt” sign) and a regular one with the correct amount must be given to the buyer (sent to the provided contacts electronically).

An incorrect amount on the receipt is one of the possible reasons for returning goods. The buyer may quite rightly express dissatisfaction with the “shortcut”. The task is to somehow compensate for this cost and, at the same time, to correctly reflect the procedure for returning goods legally.

Note that the above “adjustment” operations have a very indirect relationship to the events during which a special fiscal document is generated - a correction check. Its purpose is to fiscalize unaccounted revenue (or a shortage that has arisen for unknown reasons). As a rule, unaccounted revenue appears:

- due to the impossibility of using the online cash register directly at the time of payment (for example, if the electricity is turned off);

- due to the fact that the seller announced to the buyer an amount greater than that recorded in the check, he took it, but did not complete the adjustment procedures described above.

A shortage may occur if the seller, on the contrary, told the buyer an amount less than that reflected in the receipt.

In both cases, a correction check is used - a document, in general, corresponding to the main features of a regular check, except that the correction check does not reflect the details of the goods (since in most cases their exact list is extremely difficult to determine). The check is generated at the end of the shift.

- “receipt” - if a surplus is detected at the cash register;

- “consumption” - if a shortage is detected.

The values “return of receipt” or “return of expense” do not apply in this case - even if there is confidence that the surplus or shortage was the result of transactions that actually correspond to the specified details.

Exculpatory

Apart from a cash receipt (one or more, depending on the situation) with the correct indication of payment, the seller must prepare, in addition to the “fiscal” files, a number of supporting documents. Their lists can be very different. Among the most frequently used documents are the following:

- Application for return of goods from the buyer.

This document is needed in order to prove to the tax authorities, in the event of an inspection by the Federal Tax Service, that the cancellation of revenue due to the fact that the corresponding amount is withdrawn from the cash register is due to objective factors, and not the desire of the store to reduce the tax base.

The application must be signed by the buyer himself - who will have a cash receipt (or other evidence that the product was purchased in the store to which it is being delivered). The fact of its receipt practically eliminates possible duplication of the return operation on the part of unscrupulous citizens - who may, for example, have an electronic copy of the receipt and a similar broken product.

The application can be filled out in free form. Many stores develop them independently and approve them in internal corporate regulations. It is advisable that the application reflect:

- Full name, passport details of the individual who is returning the goods;

- reasons for return;

- date, signature of an individual.