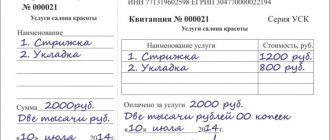

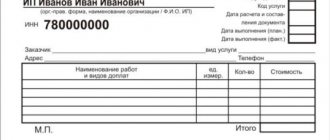

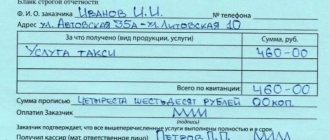

Business entities that provide various services to the population (individuals) can make cash payments without using cash register machines and issuing cash (fiscal) receipts.

However, such organizations and entrepreneurs are obliged to draw up and issue to clients (customers) appropriate strict reporting forms (SSR), which, as is known, are official payment documents.

A BSO of the appropriate type is a replacement for a cash register (fiscal) receipt in situations where the seller does not legally use the cash register machine to record the facts of receipt of funds from customers.

Strict accounting of settlement documents related to BSO implies correct filling out by the responsible person - a representative of an economic entity accepting cash from the population as payment for services rendered.

At the same time, in practice, situations often arise when the strict reporting form is recognized as damaged.

What actions are taken in relation to damaged BSO, how invalid forms are written off - all these points require more detailed consideration.

The legislative framework

The writing off of strict reporting forms is regulated by law by Government Decree No. 359 of May 6, 2008. It describes all the nuances of the procedure. Also, recommendations for working with BSO are described in Order of the Ministry of Finance No. 52N dated March 30, 2015. These are the two main documents and should be referred to when you have questions about the topic.

The rules require that acts of this kind be kept for 5 years (or rather, their roots). Even if a mistake was made when filling out the BSO, it cannot be destroyed immediately. Once a document has been completed, it should automatically be stored until written off.

Key facts about the abolition of the BSO in 2019

- Not all paid services have SSO forms developed for them;

- Failure to use BSO accounting leads to administrative liability in the form of a fine from 3 to 40 thousand rubles.

- For many types of services, the entrepreneur must independently develop the type of SSO, taking into account the requirements specified in the law;

- You can use strict reporting forms only when providing paid services to individuals;

- Potential savings on registration and maintenance of cash registers;

- Three laws regulating the use of BSO were adopted in 2019;

- Replacing a cash register with strict reporting forms does not depend on the adopted form of taxation;

- Mandatory transfer of data on issued BSOs in electronic form to the tax office;

Transport tax in 2021.

List of cars with increased taxation

Is this form required?

Municipal and state institutions successfully use form 0504816 according to OKUD for these purposes. For them, it is approved by law and recorded as the only possible one. With commercial organizations, the procedure may be softer. The company has the right to develop and reserve the right to use one or another form to fill out the act of writing off strict reporting forms. But for this you need to include it in the accounting policy and develop an order.

Thus, the prospect of independent formation is rarely considered. Most often, the usual form 0504816, which is accepted with a bang by inspection authorities, is downloaded. It has gained a foothold in business circles. In addition, it is convenient and has columns for placing all the necessary data.

Normative legal acts

For an accountant, the fundamental regulatory legal acts (RLA) that regulate the accounting of strict reporting forms in budgetary institutions are several instructions:

- instructions for the use of a unified chart of accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n;

- instructions for using the chart of accounts for budget accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n;

- instructions for using the chart of accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n;

- instructions for using the chart of accounts for accounting of autonomous institutions, approved by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n.

In addition, it is necessary to know industry regulations that regulate the structure of specific forms, the rules for filling them out, recording and storing them. So, if the form of a school certificate is approved by a state body (order of the Ministry of Education and Science of Russia dated August 27, 2013 No. 989 “On approval of samples and descriptions of certificates of basic general and secondary general education and appendices to them”), it should be used. Similar orders apply to documents of higher education, work records, certificates of incapacity for work and other BSO.

Document elements

The act of writing off strict reporting forms is quite simple. At the beginning there is:

- A reference to the legislative act that prescribes its use. It is contained only in those forms that are not formed by organizations independently. The slightest discrepancy with the standard form - and the organization does not have the right to publish a link to the law in the upper right corner.

- Visa of the head of the institution. It includes: signature, transcript of the signature, position of the boss, seal of the organization (if any).

- The name of the document with the number assigned to it. It is this number, together with the date of signing the act, that is its identification mark when entered in subsequent registration documents.

- Mini table with codes. There are located: the OKUD code (it is already entered in the attached form), the date of signing the act, the OKPO code.

- Name of the organization. If necessary, the name of the structural unit. This point is especially relevant when writing off strict reporting forms when conducting an inventory within one division of the company.

- Full name of the financially responsible person, his position.

- Accounting information: credits and debits of the account to which the act is posted. This information is filled in after the act of writing off strict reporting forms is received by the accounting department.

- Listing the composition of the commission. It includes the full name of the chairman (separately) and members of the commission indicating their positions.

The document continues with a reference to the order that formed the listed commission for the destruction of the BSO. The period during which the documents will be written off must be indicated below.

The main part of the act of writing off strict reporting forms is a table listing documents suitable for destruction. The convenience of a table lies in the abundance of data that can be placed in it. Although the table given in the form requires the following to be indicated in each line:

- Numbers and series of the form to be written off.

- Reasons for write-off.

- Dates of document destruction.

The duration of the table is determined only by specific conditions, in particular, the number of SSBs, the difficulty of making a decision on their write-off, etc.

The final part of the document, which can be located either on the same page or at a considerable distance from the beginning (depending on the size of the attached table), is the signature of the commission headed by the chairman. Each signature requires decryption. The positions of everyone who signs their “autographs” are also indicated here.

How to fix a log error

This document, oddly enough, is where the largest number of errors are often made.

The legislation of the Russian Federation provides for the presence of this document at the enterprise, but does not oblige the employer, represented by a legal entity or in the person of an individual entrepreneur, to enter this register into the production workflow. There is no clearly established form for filling out the register of employment contracts.

The legislation of the Russian Federation provides for the presence of this document at the enterprise, but does not oblige the employer, represented by a legal entity or in the person of an individual entrepreneur, to enter this register into the production workflow. There is no clearly established form for filling out the register of employment contracts. However, this document includes the following entries:

- Date of conclusion/termination of the employment contract, as well as signature.

- Numbers of documents entered in chronological order. It is in this elementary part of the magazine that inexperienced personnel officers make serious mistakes, which can only be corrected by eliminating the current magazine and creating a new one.

- Information about the form of this work: permanent or part-time.

- The structural unit to which the employee belongs.

- Position held, category or rank.

- Additional Information.

- Personal data of the employee (full name, date of birth).

- Dates of contracts and their numbers.

Let's return to the first point - number in order. As was said, this column is the most problematic.

The thing is that, due to inexperience, ignorance or inattention, the responsible employee of the personnel service, instead of the serial number of the entry made, indicates the number of the document: employment contract, agreement, labor, insert into it.

It is clear that the “paper” number does not correspond in any way to a certain chronology of events in the employee’s work life. The only solution to this problem can only be to force the completion of entries in the wrong version of the journal and create a new one. On the last page of the journal, the following entry is made randomly by hand:

“This journal is being closed early due to incorrect completion”

.

The culprit should not be surprised at the disciplinary punishment received. Activities related to the design of a new magazine are not considered illegal.

Under what conditions are BSO subject to destruction?

The organization has the right to destroy any of the strict reporting forms only if its five-year storage period has expired. In addition to this, the organization should not conduct an inventory.

According to existing legislation, writing off strict reporting forms is only possible if the inventory was carried out more than a month ago. However, it is precisely the fact of conducting an inventory in practice that serves as the starting point for writing off the stubs of strict reporting forms that have expired.

Causes

The write-off of BSO carried out by an economic entity is regulated by generally binding norms of the current legislation. This circumstance is caused by the need for strict accounting of settlement documents classified as BSO.

So, for example, in order to deregister these documents, the management of an enterprise or an individual entrepreneur needs compelling reasons.

Write-off of payment document forms that are subject to strict accounting by an economic entity can be carried out for the following main reasons:

- completion of the regulated storage period officially established for used forms and settlement documents that were damaged when filled out - rules and sample for filling out the BSO;

- other grounds, the occurrence and identification of which determine the need to write off documentary forms from the register (loss, damage, theft).

Used BSO - their counterfoils or copies of documents issued to clients - are subject to storage by the business entity for a five-year period, counted from the end of the year in which the corresponding form was filled out.

For example, if a payment document subject to strict accounting was issued by the seller on January 5, 2015, its liquidation is allowed only after December 31, 2021.

The liquidation procedure in this case implies a special audit of the BSO, a month after which the written-off forms can be destroyed - the destruction process.

Payment document forms that are damaged during completion are written off and liquidated in the same way.

Other grounds (loss, damage, theft) refer to emergency incidents.

Identification and official statement of such circumstances are usually carried out through a planned/unscheduled inventory of the BSO.

The commission, which is created by the management of the business entity and conducts such an audit, must take the following actions:

- establish and confirm the fact of loss of forms;

- determine the probable cause of the detected shortage - the absence of forms listed according to accounting data;

- assess the degree of guilt of the entity responsible for the safety and integrity of the audited documentary forms at the enterprise;

- record the results of the audit in the necessary documentation (inventory list, matching sheet, inventory report).

Documentary grounds

You can write off strict reporting forms for one reason or another from a business entity on the basis of certain documentation that must be completed.

Which document should you use to write off strict reporting forms:

- Documentation related to the mandatory audit of the BSO, based on the results of which the forms are written off: management order to conduct the audit, which indicates the reasons for the audit, the timing of its implementation, as well as the composition of the inventory commission;

- inventory list, which contains actual information about the availability of strict reporting forms, compared with accounting data;

- a comparison (reconciliation) statement drawn up when discrepancies are identified between actual information and accounting data (surpluses, shortages);

- an audit act, the execution of which summarizes the results of the audit.

- administrative act of the management of an economic entity on the appointment and powers of a special write-off commission (write-off order);

If the form is damaged

A damaged form, contrary to popular belief, cannot be destroyed immediately. By law, it is stored in the same way as the spines of existing BSOs, for 5 years. It is also recorded in the organization's books. This is necessary to maintain chronological order, create and maintain a system in the document flow of strict reporting forms.

Thus, this action is enshrined in law for a reason. Any randomly taken strict reporting form from registration documents no older than 5 years must be available for study.

The head of the organization is responsible for filling out the act of writing off strict reporting forms. However, in most cases, he delegates these responsibilities to his employees. This could be a personnel officer, accountant or any other employee. The main thing is that this functionality is included in the employee’s employment contract.

The procedure for destroying strict reporting forms in accordance with Resolution No. 359

In accordance with paragraph 19 of Resolution No. 359, organizations are required to store copies of the SSR or the counterfoils of forms (tear-off parts of the SSR that the service provider retains) in a systematic form for 5 years or more. After the specified period has passed, as well as after the expiration of a month from the date of the last inventory, copies of the BSO or the counterfoils of the forms must be destroyed. The basis for this procedure should be, as we noted above, an act drawn up by a commission, which is formed by the head of the company or individual entrepreneur. A similar procedure has been established for the destruction of incomplete or damaged BSO.