Form 3-F for Rosstat

In 2021, a new form of Form 3-F “Information on overdue wages” was put into effect by order of Rosstat dated July 24, 2020 No. 412. It also contains the rules for filling it out and submitting it.

Information is submitted in Form 3-F to the territorial body of Rosstat, depending on the location of the organization. Only legal entities are required to provide reporting. That is, individual entrepreneurs do not have to fill out this statistical form. In addition, small businesses are exempt from submitting these reports.

Form 3-F in 2021 is submitted by an organization only if there is an overdue debt in payment of wages to employees. If there are no overdue wages, then the company does not have the obligation to submit a 3-F statistical report.

Statistical reporting is completed and submitted by an official whom the head of the enterprise appoints responsible for this activity.

Find out for free what the consequences of delay or non-payment of wages are from the ConsultantPlus review.

Form 3-F: instructions for filling out

Monthly Form 3-F is designed for those employers who have overdue wages for their workers.

In this article, our specialists tell you how to fill out this form correctly. 06.06.2014Russian tax portal

Form 3-F refers to one of the methods of statistical observation of federal significance. Its full name is “Information on overdue wages.” Rosstat has developed special Instructions for filling it out, which is confirmed by the corresponding order No. 349 of August 29, 2013.

The report submitted on this form consists of a title page and one section, which contains eleven lines.

Let us consider in detail how to correctly fill out Form 3-F:

1. The title page is filled out in accordance with paragraph No. 5 of the Instructions (Rosstat, order No. 349):

- if a company-organization is reporting, then its full name is indicated, which corresponds to the constituent documents, and a short name (next to it in brackets);

- in the “Postal Address” section the name of the subject of the Russian Federation, its legal address along with the postal code and the actual address of the company are recorded;

- the code of the company-organization according to OKPO is entered (it is also in the notification from the local territorial branch of Rosstat, which the company receives monthly);

- if the reporting form is filled out for a separate division, its name and the name of the legal entity (to which it belongs) shall be indicated;

- in the “Postal Address” section, if there is no legal address for a given unit, only its postal address with a postal code is indicated;

- the identification code of this unit is affixed (it is established by the local territorial body of Rosstat).

2. Filling out line “01” - this line is intended to reflect the amount of overdue wage payments for the company’s workers (this includes their paid and unpaid employees, external part-time workers, dismissed workers, individuals who work in accordance with concluded civil contracts - Instructions, point No. 7, paragraph 1). The debt is established as of the reporting date, which is indicated taking into account all deductions (including personal income tax) and vacation amounts (for all vacation days) - Instructions, paragraph No. 8. When filling out this line you do not need to indicate:

- advances – Instructions, paragraph No. 7, paragraph 1;

- arrears on personal income tax (the period when this debt was repaid) - Instructions, paragraph No. 7, paragraph 2.

3. Filling out line “02” - it indicates the amount of overdue wages, which corresponds to the last calendar month when the corresponding accruals of funds were made, that is, from the 1st to the 30th (31st) day of the month (for February - from the 1st to the 28th (29) number). In this case, the amounts of vacation payments are taken into account (for all vacation days included in the reporting month) - Instructions, paragraph 9.

4. Filling out lines “03” - “06” - the data entered in these sections should reveal the indicators of line “01”. Here we are clarifying the amount of overdue wages that occurred as a result of late receipt of funds from budget funds:

- “03” - the amount of delay in wages of budgetary workers, for commercial firms-organizations the delay is due to the funds received not in full (for completed government orders and services for budgetary organizations);

- “04” - the amount of overdue wages accrued to workers who fulfilled government orders or provided services for budgetary organizations - Instructions, paragraph No. 10.

5. Filling out line “07” - data on the salary fund for the last calendar month is entered here (they were accrued for paid and unpaid workers, together with part-time workers - Instructions, paragraph No. 11). This data can be written out from form P-4 “Information on the number and salary of employees” - the final line of column No. 7, section 1. The peculiarity is that the information in columns “02” and “07” must be given for the same reporting period. Even if on a certain date the data from these columns has not changed (that is, they are the same as in the previous report), they are duplicated.

6. Filling out line “08” - this section reflects the number of workers (on the first day of the month) to whom the company-organization has arrears in wages (this data is already in line “01”) - Instructions, paragraph No. 12:

- payroll;

- non-scheduled personnel;

- dismissed employees;

- individuals who performed work in accordance with civil contracts.

7. Filling out lines “09”-“10” - the amount of salary arrears for previous years is written down - Instructions, paragraph No. 13:

- if the data remains unchanged, then in these columns the information taken from the report for the past month is duplicated - Instructions, paragraph No. 14;

- for individual company-organizations, the information in these columns may coincide with column “01”.

8. Filling out line “11” - this column is of a clarifying nature, it reflects the full amount of arrears on debt that was not repaid last year, on wages to workers of this company who were fired for various reasons in previous years - Instructions, paragraph No. 15 . This information may be duplicated if the amount remains unchanged.

To control the correct completion of this 3-F report, you need to consider the following points:

- Section 02, column 3 ≤ line 01, column 3.

- Line 03, column 3 ≤ line 01, column 3.

- Line 03, column 3 = sum of lines 04, 05, 06, column 3.

- Line 03, column 4 = sum of lines 04, 05, 06, column 4.

- Each of lines from 03 to 06, column 4 ≤ each of lines from 03 to 06, column 3.

- Line 07, column 3 – 0.

- Line 07, column 3 ≥ line 02, column 3.

- If line 01, column 3 is 0, then lines 07 and 08, column 3 are 0.

- Each of lines 09, 10, 11, column 3 ≤ line 01, column 3.

- Line 11, column 3 ≤ the sum of lines 09 and 10, column 3.

- The sum of lines 09 and 10, column 3 ≤ line 01, column 3.

- Lines 01, 02, 07, 08, 09, 10, 11, column 4 = 0.

Post:

Comments

What is the procedure for submitting a statistical report 3-F

Reporting is submitted to the territorial body of Rosstat at the location of the organization. If a legal entity has separate divisions in its structure: branches, representative offices and others, then it is obliged to submit a report:

- at the location of the parent organization - without data on separate divisions;

- at the location of each unit - information on each individual unit is included in each separate report.

Foreign companies that have branches and representative offices on the territory of the Russian Federation are included in those who submit 3-F on overdue arrears under the salary when overdue arrears in wages arise.

Temporarily idle organizations and bankrupt organizations are not exempt from submitting Form 3-F. They are obliged to provide it on a general basis.

Who submits the form 3-F

The form must be filled out by all legal entities, with the exception of small enterprises. The types of activities of enterprises reporting the 3-F questionnaire are presented in the Instructions for filling out. The list of species is extensive and consistent with OKVED2.

The completed form is submitted to the nearest statistics department using various methods. The main thing in registration is the reliability of the information and timely submission of the report, since the latter is considered an administrative offense, which is punishable by a fine.

In addition to small businesses, individual entrepreneurs are also exempt from submitting a report on delayed wages.

The questionnaire includes a clause about outstanding debt, in this case to an employee, where the manager prescribes the total amount of debt to workers for the reporting period. This information is automatically sent to the Federal Tax Service, so it is more profitable for management to pay employees on time.

What is the responsibility for failure to submit a statistical form?

Responsibility for failure to provide statistical reporting is established by Article 13.19 of the Code of Administrative Offenses of the Russian Federation. It recognizes as a violation:

- failure to submit a report;

- submission of reports untimely;

- provision of false statistical data.

The fines are quite significant:

| Person fined | Fine amount | |

| Primary violation | Repeated violation | |

| Officials | From 10,000 to 20,000 rubles | From 20,000 to 50,000 rubles |

| Organizations | From 20,000 to 70,000 rubles | From 100,000 to 150,000 rubles |

What is the deadline for submitting statistical form 3-F?

Form 3-F statistics for 2021 is monthly. The statistical reporting form must be submitted to Rosstat the next day after the reporting date. Thus, the due date is the first day of the month following the reporting month (for example, for January reports are submitted before February 1, for April - on the first working day after the May holidays).

You can submit a report on arrears of wages:

- on paper: the report is signed by the manager, if available, a stamp is affixed to it;

- in electronic form: the report is signed with an electronic digital signature and sent to Rosstat through a telecommunications operator.

Reporting according to form 0409303 “Information on loans provided to legal entities”

- When acquiring rights of claim.

Columns 3 and 4 of Section 3 indicate the nominal value of the acquired rights of claim of the credit institution against the borrower, which corresponds to the total volume of acquired rights of claim, including principal, interest, penalties (fines, penalties) (accounted for in off-balance sheet account 91418 “Nominal value of acquired rights of claim "), in order to monitor the complete repayment by the debtor (borrower) of obligations under the primary agreement.

Section 5 indicates the date on which the acquired rights of claim are recorded on the balance sheet (in column 1) and the amount of actual costs for their acquisition (in column 3).

If the agreement on the acquisition of rights of claim provides for a condition on a partial deferment of payment, then at the time of partial payment under the agreement on the acquisition of rights of claim, the amount actually paid is indicated in column 3 of Section 5; when repaying the remaining amount of obligations after the expiration of the deferred payment period, in column 3 of Section 5 it is indicated the total amount of acquisition costs incurred (the sum of all paid parts), while the date in column 1 of section 5 does not change, and in column 15 of section 3 code “K” is indicated only in the reporting period in which the additional payment for the deferred payment occurred, in the event that this period does not coincide with the reporting period in which the acquired rights of claim were taken into account on the balance sheet.

The debt of the credit institution to the counterparty from whom the rights of claim were acquired, resulting from a partial deferment of payment, is not reflected in the Report.

- When selling loan debt, including with deferred payment.

For a loan sold in the reporting period in which the sale occurred, Section 10 is filled out, which reflects all the information related to the assignment of claims. In this case, in column 1 of section 10 you should indicate code 1 (when selling a loan without a deferred payment) or code 2 (when selling a loan with a deferred payment), in column 2 - the amount of the assigned funds. In columns 3 and 4 of Section 6 of the Report, upon complete sale of the loan, it is necessary to reflect the amount of debt 0. Section 9 is not completed if in the reporting month before the assignment of the rights of claim there was no repayment of funds from the sources listed in clause 12.10 of the Procedure for drawing up and presentation of the Report.

If the agreement on the assignment of rights of claim provides for the provision of a counterparty - a legal entity (including an individual entrepreneur) with the right to defer payment, then, in response to a claim arising against the counterparty for deferred payment, in the same reporting period in which the assignment occurred, a new ID is entered indicating type of loan 7 in column 1 of section 3. The specified agreement is subject to reflection in the Report until the counterparty has fully repaid the claims. Section 9 is completed in accordance with the repayment schedule established for the counterparty and actual repayment.

Procedure for filling out the report

The form consists of two sheets:

- Title page.

- The tabular part in which the data is reflected.

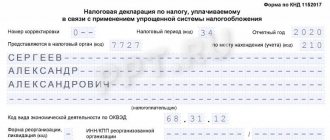

On the title page when filling out Form 3-F the following is indicated:

- the period for which reporting is provided;

- name and postal address of the reporting organization;

- OKPO must be indicated in the tabular part of the title page.

The main part of the report consists of 11 lines. Instructions for form F-3 are given in the table:

| Line number | Filling procedure |

| 01 | The entire amount of overdue wages and other payments (vacation pay) not repaid as of the reporting date is reflected. This amount includes not only debts incurred during the reporting month, but also carryover balances from previous periods. The report includes debts to all employees: full-time employees, part-time employees, employees hired under the GPA, dismissed. |

| 02 | Overdue debt is shown only for the last (reporting) calendar month. For example, the report as of October 1, 2020 reflects overdue debt that arose from September 1 to September 30, 2021. |

| 03, 04, 05, 06 | Overdue debt is shown only for the last (reporting) calendar month. For example, the report for October 1, 2020 reflects overdue debt that arose from September 1 to September 30, 2021. |

| 07 | The payroll for the last calendar month is reflected. It corresponds exactly to the indicator indicated in the statistical form P-4. |

| 08 | The number of employees (paid and unpaid) to whom the organization has overdue wages as of the reporting date. |

| 09, 10 | Debts for previous periods are separated from the total amount of overdue debt. |

| 11 | From the total amount, debts are allocated to persons dismissed from the organization in 2021 and earlier. |

Form F-3, sample filling

Reporting according to form 0409704 “Information on the debt burden of borrowers – individuals”

In accordance with clause 5.1 of the procedure for drawing up and submitting reports in form 0409704, in column 1 of section 1 and section 2 of the Report, the month and year of occurrence of claims for credits (loans) is indicated in the format “mm.yyyy”, where “mm” is the month, “yyyy” " - year.

In this case, each transaction made by the borrower using the bank card with which the loan was issued should be considered as a newly issued loan.

Thus, in relation to loans provided using bank cards, including on overdraft terms, column 1 of section 1 of the Report indicates the period of the next transaction. Considering that an increase (decrease) in the credit limit on a loan provided using a bank card does not affect previously made transactions, this information is not subject to inclusion in Column 1 of Section 1 of the Report.

In accordance with clause 5.2 of the procedure for drawing up and submitting reports in form 0409704, in column 2 of section 1 and section 2 of the Report, the interval to which the PDN value corresponds, calculated when making the decision provided for in clause 1.1 of Appendix 1 to Bank of Russia Directive No. 4892-U for the most a later date (in particular, when increasing the credit limit on a credit (loan) provided using a bank card).

Taking into account the above, section 1 of the Report on a credit (loan) provided using a bank card from the example given must be completed in accordance with the table below.

| Period in which the claims arose | Interval of borrower's personal income tax, % | Debt without overdue payments, thousand rubles. | |

| calculated when making a decision | calculated during the term of the credit (loan) agreement1 | ||

| 1 | 2 | 3 | 10 |

| 04.2020 | (10;20] | 70 | |

| 05.2020 | (10;20] | 10 | |

| 06.2020 | (10;20] | 30 | |

At the same time, we note that taking into account the provisions of paragraph two of clause 5.1 of the procedure for drawing up and submitting reports in form 0409704, if a credit institution makes decisions that affect the procedure for repaying previously made transactions (for example, when restructuring debt on a credit (loan)), then the period for the occurrence of claims is indicated taking into account the period of implementation of the relevant decisions.

1 In the above example, the provisions of the Bank’s PDN Calculation Methodology do not provide for the recalculation of PDN during the validity period of the credit (loan) agreement provided using a bank card.

Test relations

To control the correct completion of statistical form 3-F, Rosstat has established control ratios that are mandatory for how to fill out form 3-F “Information on overdue wages.” If at least one control ratio is not met, Rosstat will refuse to accept the report. The following ratios must be observed:

- page 02 gr. 3 ≤ page 01 gr. 3;

- page 03 gr. 3 ≤ page 01 gr. 3;

- page 03 gr. 3 = sum of lines 04, 05, 06 gr. 3;

- page 03 gr. 4 = sum of lines 04, 05, 06 gr. 4;

- each of the lines from 03 to 06 gr. 4 ≤ each of the lines from 03 to 06 gr. 3;

- page 07 gr. 3 > 0;

- page 07 gr. 3 ≥ page 02 gr. 3;

- if page 01 gr. 3 > 0, then pages 07 and 08 gr. 3 > 0;

- each of the lines 09, 10, 11 gr. 3 ≤ page 01 gr. 3;

- page 11 gr. 3 ≤ sum of lines 09 and 10 gr. 3;

- sum of lines 09 and 10 gr. 3 ≤ lines 01 gr. 3;

- lines 01, 02, 07, 08, 09, 10, 11 gr. 4 = 0.

Where to submit a report on Form 3-F

The Federal Statistics Service has a single center for receiving statistical reports in each region. If the unit is located far from the receiving center, then it is more convenient to report by Russian Post or by TKS. Before sending a report in any way, you need to register with a single reception center.

The 3-F salary form is filled out for each additional office separately, as well as for the head office. For example, a company has a head office and 4 divisions. This organization submits 5 reports - one report for each branch.