Document year: 2018

Document group: Forms, Checks

Type of document: order, form

Download formats: DOC, EXCEL, PDF

The unified PKO form (cash receipt order), which can be downloaded for free on this page in Word format, will allow you to organize the delivery/reception of cash at the cash desk of a company or individual entrepreneur on an absolutely legal basis. The presence of such a simple document in combination with a cash book and cash register system makes it possible to correctly construct direct accounting of cash flows within any business structure.

In what case is a receipt order used?

A cash receipt order is a document that is issued by an accountant or other specialist when money is received at the cash desk.

Its standard form is in force, but enterprises can rebuild it in accordance with the specifics of their activities.

The legislation establishes that companies and entrepreneurs must issue a cash receipt order every time money is posted to the cash register.

Such situations include:

- Registration of cash receipts from buyers and customers. A receipt order must be issued even when cash is received via BSO. In this case, it is compiled for the total amount of revenue either per day or per shift.

- When the amount previously received unused by the accountable person is returned.

- When money is received at the cash desk from a current account to finance business expenses, as well as to pay salaries.

- Return of funds previously provided under the loan agreement.

- Payments by founders for contributions to the authorized capital.

- Refunds of erroneously paid wages, compensation for material damage, etc.

- In other cases established by law.

Attention! It is allowed not to issue PKO only to entrepreneurs who, in accordance with the rules of law, carry out accounting according to a simplified scheme. When issuing money from the cash register, an expense cash order in the KO-2 form is used.

Design features

A cash receipt order is issued:

- chief accountant;

- an accountant or other employee (including a cashier), determined by the manager in agreement with the chief accountant (if any) by issuing an administrative document of the organization, individual entrepreneur (hereinafter referred to as the accountant);

- manager (in the absence of a chief accountant and accountant).

In this case, the cash receipt order is signed by the chief accountant or accountant, and in their absence - by the manager or cashier.

In the case of conducting cash transactions and drawing up cash documents by the manager, cash documents are signed by the manager.

A cash receipt order can be issued on paper or using technical means designed for processing information, including a personal computer and software.

The PKO, as the main document reflecting cash receipt transactions, is filled out by the cashier or a person authorized by the administrative document for the enterprise.

In addition to the authorized person, filling out a cash receipt order has the right to:

- chief accountant (during his absence, the person replacing him);

- supervisor

In the context of individual entrepreneurship or in cases where the execution of cash transactions and the preparation of cash documentation is carried out by the manager, the PKO is written out and signed by the manager.

Only one receipt can be issued for each receipt transaction. The executed document is certified by the signatures of officials and the seal of the cashier.

An individual entrepreneur (hereinafter referred to as an individual entrepreneur) must independently determine and appoint a person whose responsibilities will include the preparation of cash documents. This is one of the elements of cash discipline.

Such persons at the enterprise may be:

- chief accountant or accounting employee.

- cashier or senior cashier. This option is possible if there is no position on the staff. accountant.

- the individual entrepreneur himself - in the absence of ch. accountant and cashier on staff.

PKO form (example)

To correctly fill out and execute a document (PKO), you need to know and follow a number of established rules.

Below we consider the main ones:

- A cash receipt order has legal force only if it is signed by an official such as an accountant, cashier or head of the enterprise. Thus, the PKO must be signed by an official who performs the duties of maintaining and maintaining cash discipline. It is possible to sign the PQS using an electronic signature. An example when this option occurs in practice: the cash register is located remotely from the location of the accounting department or the director’s office, and the cash receipt order can be signed with an electronic signature.

- The manager is obliged to provide the cashier with a stamp or seal, cards of sample signatures of officials and assign him the responsibility for their storage. This tool is used to confirm the fact of a cash transaction, namely, it is affixed by the cashier to the cash register after the cash arrives at the cash desk.

- There are two options for maintaining and registering the PQS: on paper or electronically. A convenient option for maintaining primary accounting documents, including cash registers, is chosen independently by the management of the enterprise. The main difference: when executed on paper, the form is filled out manually, and when executed electronically, technology and special software are used. So special. Equipment includes computers and printers.

- When PKO arrives at the enterprise’s cash desk, the cashier is required to perform a number of actions before accepting cash, in accordance with the established procedure.

What points in the PQS should he pay attention to:

- the presence of all necessary signatures on the order and their compliance with the samples specified in the cards. Sample cards are always kept in the cash register;

- the amount indicated in figures must fully correspond to the amount indicated in words;

- After accepting cash, the cashier must sign the order and put a stamp or seal and give the receipt to the person depositing funds into the cash register.

- make an entry for PKO in the cash book. An entry is made for each order.

In practice, an individual entrepreneur is faced not only with the registration of PKO, which reflects the receipt of cash at the enterprise’s cash desk, but also with PKO during cash services at the bank. The procedure for issuing such a receipt order is enshrined in the Regulation of the Central Bank of the Russian Federation No. 318-P dated April 24, 2008. The said Regulation assigned a document form number (strict reporting) - 0402008.

We invite you to familiarize yourself with: Sample statement of claim for the Rosregistry

PKO form according to form 0402008

An example of operations in which a cash receipt order is used (strict reporting form 0402008):

- acceptance by the bank of cash from individual entrepreneurs for the purpose of crediting to current accounts;

- payment of individual taxes;

- acceptance by the bank of funds for crediting to deposit accounts, etc.

The preparation and formation of this document (strict reporting form 0402008) is carried out by a bank employee.

What should an individual entrepreneur pay attention to when carrying out the above operations:

- the bank teller must issue a receipt;

- Individual entrepreneurs should check the correctness of the details of the recipient and the sender (current account number, name) in the PKO;

- the issued receipt must have the cashier's signature and must have a seal or stamp.

Sample of filling out the PKO according to form 0402008 (example)

You should also consider enterprises that use special equipment (cash register) in their work with the issuance of a fiscal receipt. For example, a grocery store issues a cash receipt to its customers. At the end of the working day, based on the control tape containing information for each check, one cash receipt order is drawn up in strict reporting form 0310001 for one total amount.

Let us note that if an individual entrepreneur works with cash register equipment and is obliged to issue cash receipts, then even if it breaks down, he does not have the right to issue another document confirming payment instead of a fiscal receipt. In this case, you need to pause work until the problem is corrected. This requirement is regulated by law and cannot be violated.

Procedure for using the receipt

The Central Bank of the Russian Federation has approved a unified procedure for conducting cash transactions for business entities. According to it, all incoming cash transactions must be processed using a receipt order (PKO). The document can be generated either manually or using software, for example, the 1C program.

When writing out this document, the cashier or other responsible person should not make any errors in its execution. Since corrections in the PQS are not allowed. If suddenly an error is discovered, the document should be reissued.

A cashier, an accountant, a chief or senior accountant, as well as a manager can issue cash receipt orders. In addition, third-party specialists may be hired to prepare documents. It must be remembered that they do not have the right to sign documents.

The completed document is sent to the cash desk to a specialist who checks its correctness and then registers it in the journal.

You might be interested in:

Online cash register for an online store: which one to choose and how to work with them

After checking all the required details, the cashier accepts cash, the amount of which must correspond to the amount specified in the document. If the receipt is income, then the amount must be entered according to the cash register. Money can be transferred to the cash desk using a register or receipt. In this case, they go as an attachment to the software and must be indicated in it.

If the depositor has transferred the correct amount, the cashier tears the receipt from the depositor, puts all the necessary stamps and his visa on it and hands it to him.

Attention! When the working day or shift comes to an end, all cash documents, including PKO, are submitted along with the cashier’s report to the accounting department to check and reflect their business transactions.

Related documents

- Receipt order. Form No. m-4

- Receipt order. Form No. m-4

- Promissory note (solo)

- Payment order (sample)

- Payment request

- Payment request-order

- Account cash warrant. Form No. ko-2

- Account cash warrant. Form No. ko-2

- Request for release of materials. Form No. m-11

- Form of a bill of exchange with a period of so much time upon presentation and with a dated inscription of acceptance (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Form of a bill of exchange with a period of so much time upon presentation and with a dated inscription of acceptance (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Form of a bill of exchange for a certain day, indicating the year, month and day and a non-negotiable personal endorsement (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Form of a promissory note for a certain date and a guarantee inscription to a credit institution (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Form of a promissory note for a period of so much time upon presentation (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Form of a promissory note for a certain day and a non-recourse blank endorsement (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Form of a promissory note for a certain day, indicating the year, month and date and a personal endorsement (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

- Check card

- Sample of filling out a payment order for transferring funds to the deposit account of the arbitration court

- Sample payment order for payment of arrears of insurance contributions for compulsory pension insurance

- Invoice form for payment

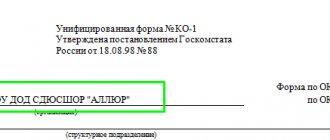

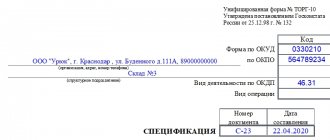

Receipt order KO-1 and sample filling

Forms: Cash receipt order form download Word for free.

Receipt cash order form free download Excel.

Samples of filling out the PQS:

A sample of filling out form KO-1 when receiving trading proceeds.

Return of accountable money.

Receiving cash from the bank.

Payment for services provided.

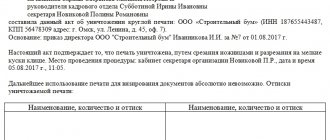

Receipt cash order sample filling

Let's look at an example of filling out the PKO.

Main part

Filling out the document must begin by recording the company name or full name. entrepreneur. Also, in a separate field you need to enter the OKPO code that was assigned to the organization by Rosstat. If there is no such code, then you can put a dash in the column.

If the parishioner was registered in a separate structural unit, his name must be indicated in the next field. If division into departments is not used, then a dash should be placed here.

Next, the form contains the title of the document. After it you need to indicate its serial number and date of registration. The date is entered into the document in the format DD.MM.YYYY.

Then the document contains a table that displays accounting data - debit and credit accounts, analytical accounting. Then there is a column in which you need to write off the amount of the document in numbers.

The last column contains the target funding code. Information is entered into it if such encoding is accepted at this enterprise.

In the “Accepted from” field, information about who hands over the money to the cash register is recorded. This is indicated in the genitive case. If the person or employee is handing over, you must enter your full name here.

Sometimes a situation arises that he, the person of the company, makes payments to its employees. Then it is best to first indicate the name of the company, and then after the word “through” - full name. this employee. For example, “LLC Slavia through Gennady Fedorovich Ivantsev.”

In the “Base” field, the reason why the money is handed over to the cashier is written down. The name of a specific product, service, return of a report or salary, etc. may be indicated here.

The “Amount” field duplicates the received amount of money previously indicated in numbers. Only this time it needs to be described in words. Kopecks, if any, are written in numbers.

If a company accepts payment for goods and services with VAT included, then the amount of tax in the amount received is indicated after the words “Including VAT...”.

Attention! If the company operates without VAT (exempt or uses a preferential regime), then here you need to write “Without VAT” or “VAT not subject to.”

In the “Attachment” field, you can write down the names of the documents that accompany the delivery of money to the cashier. This could be a shift closing report, an order, a statement, etc. If there are no such documents, then the field is simply crossed out.

After drawing up the document, it must be checked and signed by the chief accountant, and then the cashier himself must sign.

Receipt for cash receipt order sample filling

The information entered on the receipt must completely duplicate the data from the main part of the receipt.

The company name is written at the top. Next, in the “To the receipt order” field, the document number and the date on which it was drawn up are indicated.

The “Accepted from” and “Bases” fields duplicate information that was entered in similar fields in the main part of the form.

Then the amount of funds accepted according to the document is entered. This must be done first in numbers and then in written words.

If the accepted funds include tax, then in the “Including” field you must write down its amount. If there is no tax, then it is written here with a phrase, for example, “Without VAT tax.”

At the very end there is a place where you need to indicate the date of the transaction.

The cash receipt order is certified by the chief accountant, who checks the correctness of the document. After this, the cashier himself signs it.

What form can I use to fill out?

For the posting of cash, the State Statistics Committee of Russia approved a special form (KO-1) dated August 18, 1998.

What does the KO-1 form look like (according to OKUD 0310001)? The form contains the cash receipt order itself and a receipt for it, which is a tear-off coupon.

Procedure and rules of registration

The receipt order may be drawn up in handwriting or using technical means intended for data processing (personal computer, software)

Form KO-1 is drawn up by an accountant in a single copy, signed by the chief accountant or an employee vested with similar powers.

You should pay attention to the numbering of forms: it should not be interrupted throughout the entire calendar year. This requirement is often neglected by entrepreneurs.

Most employers are familiar with the obligation to prepare receipts, but the specifics of their preparation are not known to everyone.

The point that is often ignored is that on the day the KO-1 is issued, the money must arrive at the cash desk, otherwise the order is not considered valid.

In practice, situations arise when a receipt order is issued first, and the funds are deposited into the cash register after some time, or vice versa - the money appears first, and the necessary papers are drawn up later.

It is prohibited to make changes or amendments to the document; if they occur, the document must be drawn up again.

How to correctly fill out the details of the unified form KO-1?

It should be noted that a cash receipt order includes 2 components: an order and a receipt.

Registration is carried out in a general copy, the receipt is handed over to the citizen who transferred the cash.

To accurately fill out the approved order form, you should enter data sequentially, one after another, starting from the top line.

The first block should begin with an introductory line, where the full name of the enterprise, structural unit and its code is recorded in accordance with the statutory documentation.

If the latter is missing, then a dash is placed in the line. Information about the OKPO code is also entered in accordance with the information of the State Statistics Committee.

In the line “Document number” a serial number is entered based on the register of cash documentation, the numbering of which begins from the beginning of the year.

When entering the date of compilation, the writing sequence must be observed: day, month, year. Arabic numerals are used for filling, with a “zero” placed before the single digit. The fixed date must correspond to the receipt of money.

The second block is the main one and includes information about financial receipts to the company’s cash desk.

Information about cash accounting and its amount is presented in the columns:

- “debit” - enter the number of the accounting account on the debit of which funds are received (as a rule, 50 is indicated - “Cash”), the cell is not required to be filled in and can be left empty;

- “credit” - enter the code of the department where the cash is received (if it is absent, a dash is placed) and the number of the corresponding account reflecting the receipt of cash at the cash desk (71 - return of accountable amounts, 51 - withdrawal of an amount from a credit institution, 90 - revenue, 62 - receipts from customers, 73 - other settlements with employees, 75 - contributions to the authorized capital).

- “Analytical accounting code” is filled in if the enterprise has approved codes for analytics;

- “amount” - indicates the amount of money received (in numbers);

- “targeted purpose code” - used only by non-profit institutions where targeted funding is implied.

Individual entrepreneurs can leave columns with data on loans blank.

Below the table is the last name, first name and patronymic of the person from whom the cash was received, as well as the reasons for its transfer.

What to write in the bottom? The basis can include the return of unspent funds, payment under the contract, retail revenue, payment of invoices.

Next, the amount deposited into the cash register is written down again, but using a letter designation.

Whole numbers are written with capital letters, fractions after the decimal point are written in numbers, and currency is written without abbreviations.

If after writing the amount there is an empty space left in the column intended for writing it, then you need to fill it with a dash. This will protect against the possibility of order falsification.

It is also necessary to indicate whether VAT is allocated or not (the tax rate is written down in numbers, or there is a note about exemption from it).

The data of the attached primary papers (advance report) is indicated as an attachment; copies of them are attached to the form.

How to fill out a receipt?

Having filled out the receipt order, you can begin to enter information into the receipt - a tear-off coupon for the PKO. All information is recorded in the same way as an order.

After the cash arrives at the cash register, the cashier tears off the receipt along the cut line and hands it to the person who deposited the money. The order itself remains with the cashier.

A corresponding note is made in the cash book (KO-4) about accepted cash.

After checking all the details, the cashier accepts the funds and enters them according to the cash register, if this is the company’s income.

Who is authorized to sign?

Form KO-1 is prepared by:

- Chief Accountant;

- accountant or cashier specified by the company's administrative document;

- director of the organization (if the company does not have an accountant on staff).

The PKO must contain the signatures of the chief accountant and accountant or the manager and the cashier.

If the immediate manager of the enterprise is involved in conducting cash transactions, all documentation is signed by him personally.

How to put a seal correctly?

The seal impression must be placed on the o located on the receipt.

The current regulations do not provide for the possibility of simultaneously putting an imprint on the receipt and on the order.

Download a free blank form and a completed sample in Word and Excel format

cash receipt order KO-1 form according to OKUD 0310001 – in word, excel format.

filling out the application for making a contribution to the authorized capital - sample.

registration for receiving cash from the bank - excel.

Example for receiving money from a buyer - excel.

Sample PKO for making a contribution:

Sample PQR for receiving cash from the bank:

Sample PKO for receiving money from the buyer:

Features of filling out the PKO

The law establishes that legal entities can pay each other in cash amounts of no more than 100 thousand rubles under one agreement.

If the cashier is offered to accept a larger amount than this, he must refuse. Otherwise, penalties may be imposed on the company and on him, as a responsible person, for violation of cash discipline.

Attention! However, there is a way out of this situation - accept the amount, but do not receive it immediately, but in installments of 90-95 thousand rubles per day. If the number exceeds 100 for one contract, enter into a new contract with the counterparty.

If a company receives revenue by punching checks on a cash register, or by issuing a BSO, then at the end of the day it is allowed to draw up one cash receipt order for the entire amount at once. In this case, in the “Base” column you can write down the details of the shift closing report at the end of the day, or the range of numbers of issued receipts.

Every professional should know this

Recently, or rather since 2011-2012, recipients began to receive letters labeled “PKO FM (city name),” which, like any innovation, caused misunderstanding among recipients. Since the similarity of the first part of the abbreviation, namely “PKO...” caused an association with the already-become-standard working abbreviation of a cash receipt order, recipients had natural questions - how is the abbreviation PKO FM correctly deciphered, what is it and does this mysterious document have any relation to a regular cash receipt order?

Correct decoding of the abbreviation “Collective Service Point for Franking Equipment (Machine)”. The organization behind this name is a dedicated division of the Russian Post, specializing in the distribution of tax service items - notifications, as well as receipts for the payment of various types of taxes.

Taking this into account, it is quite obvious that the unified accountant KO-1 has nothing to do with PKO FM, these documents are not interrelated, and these two abbreviations cannot be confused.