Is it possible to return the money spent on restoring health? Good for a family with a high stable income. When you can barely make it from paycheck to paycheck, the treatment prescribed by the doctor and the volume of medications required for it force you to save on what is necessary.

A trip to a pharmacy or clinic for young people is a rare episode in an eventful life. Over the years, the body malfunctions more often, and older people spend most of their earnings on medications. Health is always more valuable. The desire to quickly get rid of pain or physical limitations does not allow you to reckon with the amount printed on the check.

Doctors work miracles. They restore strength and cheerfulness to a patient broken by illness, but, unfortunately, not for free. However, the amounts spent on treatment are returned by the state. It is for such purposes that citizens are provided with a special tax deduction.

Who is entitled to a deduction for expensive treatment?

Anyone who had an official salary in the year when they paid for treatment can receive 13% of the cost of expensive treatment. You can return it for:

- your treatment;

- treatment of children/wards under the age of 18;

- husband/wife treatment;

- treatment of their parents.

A deduction can be obtained from any paid medical services provided by a Russian institution licensed to carry out medical activities. These can be paid dental services, consultations, examinations, tests, operations, IVF, paid childbirth, etc.

Related links: Deduction for spouse's treatment

We get one deduction in different ways

It is possible that the employee will not receive a full “medical” deduction from the employer by the end of the year.

This can happen if the amount of income, starting from the moment the deduction was received from the employer, turned out to be less than the amount of the deduction. This is most likely to happen if the employee applied to his company for a deduction in the last months of the year. Does this mean that the unused balance of the deduction will be “disappeared”? No, it doesn't mean that. Paragraph 2 of Article 219 of the Tax Code of the Russian Federation clearly states that if, at the end of the tax period, the amount of the taxpayer’s income received from the tax agent is less than the amount of the deduction, then the individual has the right to receive the remainder of the deduction through the tax office. To do this, he will need to draw up a declaration in form 3-NDFL and, along with the necessary documents, contact the Federal Tax Service.

What is expensive treatment?

The cost of a medical service is not a criterion for classifying it as expensive. A medical service is considered expensive if its name is in the list of expensive types of treatment (PDF), approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201.

It is easy to find out that the service was classified as expensive from the certificate of payment for medical services. This certificate must be issued at the medical office. institution (do this after each payment or based on the results of treatment (but not later than over the past 3 years) - it’s up to you). It is a mandatory item among the list of documents submitted to the tax office. Based on this certificate, 3-NDFL is issued for deduction for treatment.

conclusions

If a citizen-taxpayer actually paid for his own treatment or the medical care of his relative, he has the right to request and receive a legal refund of 13 (thirteen) percent of the expenses incurred.

This compensation is provided to an individual as a social deduction for personal income tax amounts paid. If a citizen did not actually pay personal income tax during the reporting year, issuing a social tax payment for him in this case is not possible.

The specified compensation will not be provided to an individual if the paid medical care was provided by an unlicensed institution. The purchase of medicines is reimbursed to an individual only if the paid drug is on the approved list.

Drawing up 3-NDFL is a prerequisite for processing this social tax. The reporting declaration for 2021 should be sent to the local office of the Federal Tax Service during 2021, attaching all the necessary papers. The relevant data is correctly entered into certain pages of 3-NDFL.

Only the current form, regulated by the current order of the fiscal department, must be filled out.

Amount of deduction for expensive treatment

The amount of deduction for expensive treatment depends on several factors:

- the deduction amount is 13% of treatment expenses incurred during the year;

- The deduction is provided for an amount not exceeding the annual salary.

- The tax deduction for treatment is not carried forward to the next year, the remainder of the deduction is lost.

- if treatment expenses turn out to be higher than the annual salary, then the remainder of the deduction can be transferred to the spouse so as not to lose it.

When receiving a deduction for the treatment of a child, the deduction can also be distributed between the parents, as in the case of receiving a deduction for the treatment of a spouse.

To issue a deduction for several people for one patient, it is necessary to draw up contracts, checks and certificates of medical payment. services for each applicant, distributing payment for treatment among themselves according to the income received for the year.

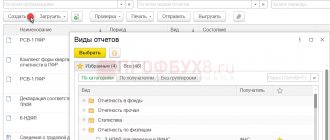

New declaration form 2019

To successfully process a refund of funds paid through the Federal Tax Service, you must fill out exactly the 3-NDFL form that is current.

Please note that this declaration form is frequently updated.

The current template used by individuals to fill out in the current 2021 for reporting in 2021 has changed and is regulated by order of the fiscal department No. ММВ-7-11/ [email protected] , registered on 10/03/2018.

about the new 3-NDFL declaration form here.

Download the new 3-NDFL form for registration in 2021 - excel.

How to fill out the personal income tax return (13 percent) correctly?

In order to partially compensate an individual’s expenses for treatment using the personal income tax deduction, it is necessary to fill out and provide the following pages of 3-personal income tax:

- title page (introductory part, on page 1);

- first section of the form (resulting data, on page 2);

- second section of the form (tax base/amount, on page 3);

- first appendix (for domestic sources of income of an individual, on page 4);

- second appendix (for foreign sources of income of an individual, on page 5);

- fifth appendix (for calculating the social deduction, on page 8).

The recommended procedure for entering the necessary information into 3-NDFL is as follows:

- Stage I: the income of an individual is recorded (first application).

- Stage II: tax deduction is calculated (fifth appendix).

- Stage III: the tax base and the amount of income tax are calculated (second section).

- Stage IV: the amount of tax refund is specified (first section).

- Stage V: general information is entered (introductory part).

How to create the First Application?

This application contains information about the domestic sources of income (income, earnings) of the applicant’s individual in the reporting year 2021. These can be either the citizen’s employers or other sources.

The following lines are filled in for each employer source:

- 010 – the tax rate is entered (the value is 13 percent in this case);

- 020 – the corresponding type of income received is coded (value 07 – for an individual’s salary);

- 030-050 – these fields contain specific values of TIN, KPP and OKTMO for the corresponding employer (source);

- 060 – the exact name of the source of income is written here (individual/legal entity);

- 070 – shows the amount of income received by an individual from this source (employer);

- 080 – shows income tax withheld from income received in field 070, at the rate specified in field 010.

An example of filling out the first application of the declaration:

How to apply for the Fifth Appendix?

Here the amount of social tax deduction for paid expenses of an individual taxpayer for medical services is directly calculated.

These may be monetary costs associated with the purchase of medications, medical operations and medical procedures, and the use of other medical services.

The first subparagraph of this appendix cannot be completed in this situation, since it is used to compensate for personal income tax through standard deductions.

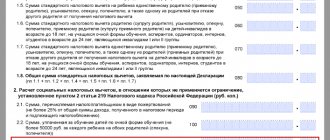

The second subparagraph of this appendix in the declaration is filled out by the individual applicant solely for monetary expenses for expensive treatment (the list of such services is regulated by a special government decree, and in field 110 of this appendix the amount of the corresponding expenses is indicated).

The third subparagraph of this appendix in 3-NDFL must be completed for other types of paid medical care.

It should be noted that in this part of the application, not all proposed fields must be filled out, but only those that are related to treatment and the purchase of medications. These could be the following lines:

- 140 – the amount of the tax deduction is reflected in the amount of the individual’s actual expenses for treatment for a specific reporting year (cannot exceed the actual amount of expenses incurred, taking into account the regulated restrictions - 120,000 rubles for one’s own treatment and 50,000 rubles for the medical care of a relative);

- 180 – the amount of social deduction to be used is prescribed (cannot exceed the amount of regulated restrictions);

- 181 – fill in the amount of personal income tax deduction that has already been used by an individual during the reporting year by notifying the Federal Tax Service through the employer;

- 190 – the final deduction value is determined here (the value of the 181-field is subtracted from the sum of the values of the 110-field and 180-field);

- 200 – the value of the 190 field is transferred here if an individual is not expected to receive standard deductions.

Sample of filling out the fifth Appendix 3-NDFL for treatment:

Example of the design of the Second Section

Guided by the information in the tax return appendices described above, the individual applicant fills out the following fields in this section of 3-NDFL:

- 001 – 13% (thirteen percent) is registered;

- 002 – value 3 is entered;

- the income value from field 070 of the first application is transferred to field 010 and field 030;

- 040 – the social deduction amount transferred from the 200 field of the fifth application is filled in;

- 060 – the tax base is calculated (the value of field 040 is subtracted from the value of field 030);

- 070 – the amount of income tax to be paid is determined (the value of field 060 is multiplied by the value of field 001);

- 080 – the amount of transferred and withheld tax is indicated (the value from field 080 of the first application is transferred);

- 160 – the amount of income tax to be refunded from the budget is calculated (the value of field 080 is subtracted from the value of field 070).

An example of filling out the second section of 3-NDFL:

First section

In this part, the individual indicates the following data:

- 010 – symbol 2 is written here (corresponds to tax refund);

- 020 – BCF value (corresponding);

- 030 – OKTMO value (corresponding);

- 050 – income tax refundable is indicated (the amount reimbursed to an individual from the budget as a social deduction for the actual payment for treatment and medicines).

Title page

The title page of the reporting form 3-NDFL is filled in with information about the individual taxpayer (full name, passport information, place of residence, contact information, residence status), the reporting period, as well as other data provided by the template.

It should be clarified who exactly submits this declaration - the citizen-taxpayer himself or his authorized representative.

Filling example:

Process of receiving a deduction

In order to receive a deduction for treatment you need:

- Save all contracts for the provision of paid medical services and receipts for them

- At the end of the year, contact each medical center. the institution where paid services were provided to you, for a certificate of payment for medical services. You need to take with you: TIN, passport, contracts, checks.

- Fill out the 3-NDFL declaration for tax deduction (order registration at VseVychety.Ru)

- Submit all documents listed below to the tax office.

We recommend taking a certificate of payment for medical services at the end of the year. During the year, you can still apply for a service, and then you will again have to take out a certificate for each service provided, and there can be many such trips, which increases the number of documents. The certificate taken at the end of the year will include all amounts of payments made during the year.

Deduction through employer

So, all the necessary documents are in hand.

What are your next steps? And then you need to write an application, the form of which is given in the Letter of the Federal Tax Service dated December 7, 2015 No. ZN-4-11 / [email protected] This form is recommended. It contains a table in which the employee must select the desired line and indicate the deduction amount there. After the sign you should enter the name of your organization, its tax identification number and checkpoint. You will need to submit this application, along with the collected documents, to the tax office.

Within 30 calendar days, the inspection must confirm your right to receive a social deduction by issuing a corresponding notice drawn up in the form approved by Order of the Federal Tax Service dated October 27, 2015 No. ММВ-7-11 / [email protected] You submit this notice to your accounting department, and From now on, your salary will be given to you without personal income tax withholding. Until the entire deduction is used in the current year, within, of course, the limit.

At the same time, in contrast to Article 220 of the Tax Code of the Russian Federation, Article 219 of the Tax Code of the Russian Federation clearly states that the tax agent can calculate tax taking into account the social deduction starting from the month in which the notification and the corresponding application “for deduction” are submitted to the employer. This means that the employee will not be able to claim a refund of personal income tax withheld from his salary for the past months of the current calendar year.

Documents for paying premiums under voluntary health insurance contracts

If you paid premiums under voluntary health insurance agreements, you will additionally need: 1) a copy of the concluded insurance agreement (insurance policy). 2) a copy of the insurance company's license.

If you paid premiums under voluntary health insurance agreements for your family members (parents, spouse, child), you will need a copy of a document confirming kinship, guardianship or trusteeship, or marriage (for example, a copy of a birth certificate or marriage certificate).

deduction for treatment documents tax return