Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

Kazakhstan and Russia are members of the EAEU customs union, so they have a single customs territory. This makes importing easier: there is no need to go through customs clearance, declaration, or pay duties. At the same time, the import of goods from the countries of the customs union differs from imports from third countries in the procedure for paying VAT and the rules for preparing documents. Read the article on how to register the import of goods from Kazakhstan and pay taxes.

What is special about importing from Kazakhstan?

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Kazakhstan is a member of the EAEU, as are Russia, Belarus, Armenia and Kyrgyzstan. There is no customs border between these countries, and the rules for the movement of goods within the customs union are established by the “Treaty on the EAEU”.

Reference. Imports from third countries are subject to customs laws and pass through customs. VAT is calculated at the time of export and, accordingly, is paid to customs.

The following rules apply between the EAEU countries:

- the importer calculates VAT independently and pays it to his tax authority;

- the tax base for VAT is determined at the time the imported goods are accepted for accounting;

- at the end of each month in which goods were imported, a set of documents must be submitted to the Federal Tax Service;

- Import VAT can be deducted.

Zero VAT rate for export, who is entitled to it

The possibility of using a zero VAT rate in the Republic of Kazakhstan is regulated by the Tax Code. The 0% rate applies to:

- sales of products imported for export;

- performing manipulations according to the re-export procedure;

- sale in a free customs zone;

- sales of products transported outside the Republic (only for EAEU countries);

- withdrawal of oil production products and natural gas;

- supply of electricity to the systems of other countries;

- international passenger and baggage transportation;

- sale of precious metals in case of independent mining and production of products and compliance with government funds;

- transportation from the country of fuel intended for use by international air transport.

The list of non-taxable turnovers includes the following goods and services related to land plots and residential buildings, international transport and air transportation. This also includes the implementation of financial transactions, leasing of real estate and movable property and some other types of turnover that are exempt from taxation.

Foreign trade contract with Kazakhstan

Although Russia and Kazakhstan have a single customs territory, the legislation of the countries is not uniform. When concluding a supply agreement, the parties must determine the law applicable to the concluded agreement; they can be guided by Incoterms.

Foreign economic activity begins with the preparation of a foreign trade contract. It takes into account the legislation of both parties to the transaction and includes:

- names of companies of the parties to the contract;

- purpose of the agreement;

- terms of payment: payment currency, contract amount, payment terms, fines, liability for delay;

- delivery conditions;

- procedure for action in case of force majeure;

- details of organizations;

- settlement of disputes.

If any conditions were missed, they can be included in an additional agreement to the contract.

According to the rules, all clauses of the contract must be interpreted unambiguously and the contract must be drawn up in two languages - Kazakh and Russian. Each contract has a number, place and date of signing, these are indicated in the specifications.

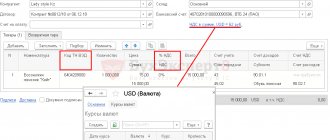

Payment under the contract can be made in rubles or tenge; in any case, you will need a foreign currency account for settlements. Submit to the bank a payment order, a certificate of currency transactions and other documents that the bank requests.

There are no more transaction passports, but contracts must be registered with the bank. Moreover, only those that exceed the limit - 3 million rubles for imports to Russia and 6 million rubles for exports.

Presence of documents

According to customs legislation, the import action occurs during the period of submission to the customs authorities of the declaration and all documents necessary for the registration of goods.

It ends with the release of products by a customs officer, who provides the appropriate marks on the declaration and other related documentation - transport, commercial, etc.

This means that imported products will be considered released from customs territory only when the importer has a customs declaration in hand. As well as other necessary accompanying documents with a record of customs officials allowing release.

VAT when importing goods from Kazakhstan

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

If you import goods from Kazakhstan to Russia, you become a VAT payer. In this case, VAT must be paid to your tax authority at the place of registration, and not to customs. Even in cases where:

- you work in special mode;

- you are exempt from VAT under Art. 145 Tax Code of the Russian Federation;

- you have entered into an agreement with a counterparty from another country, but you are importing goods from the territory of Kazakhstan;

- the goods were produced outside the customs union, but were previously imported into its territory.

If, according to the laws of our country, a product or transaction is exempt from VAT, then there is no need to pay tax. This applies to goods:

- listed in Article 149 of the Tax Code of the Russian Federation, 150 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation dated April 30, 2009 No. 372;

- transferred under an agreement within one Russian organization;

- purchased from a Russian supplier, but delivered through an EAEU country.

You will have to calculate VAT for imports from EAEU countries yourself (for imports from third countries this is done by customs). The calculation of import VAT has features:

- the tax base is calculated on the date the imported product is accepted for accounting;

- the tax base is determined based on the transaction price under the contract + excise taxes, if the goods are excisable; if the transaction amount is in foreign currency, it must be recalculated at the Central Bank exchange rate on the date the goods were accepted for accounting;

- tax rates are standard for the Russian Federation: 20% and 10% for a number of goods (Article 164 of the Tax Code of the Russian Federation).

Pay import VAT by the 20th day of the month following the month the goods were accepted for accounting. In the payment order, indicate KBK - 182 1 0400 110.

VAT and the peculiarities of exporting goods to Kazakhstan

By selling products in Kazakhstan, Russian companies receive enormous economic benefits, since the organization exporting the goods does not charge value added tax on such sales. When delivering products to Kazakhstan, the tax is simply refunded; all that remains is to confirm the rate of 0%.

In this case, it is necessary to take into account the specifics of importing products into Kazakhstan, in accordance with current legislation. Taking these factors into account, several groups of taxpayers can be distinguished:

- Persons registered are private entrepreneurs, legal entities (not counting government agencies and organizations), stateless residents conducting business activities in the country in existing branches, structural divisions of private organizations that are considered independent VAT payers.

- Persons engaged in importing goods into the territory of the state.

Trade turnover should also be taken into account. If it is minimal, then you do not need to register for taxation at all. The minimum turnover is equal to the MCI multiplied by 30,000. This also includes fines, social payments, tax rates and other payments. If this value is exceeded, then registration for VAT is mandatory, otherwise you will have to pay hefty penalties. Tax payment is due by the 25th of each month.

Reporting for imports from Kazakhstan

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Before the date of payment of import VAT, prepare and submit to the tax office:

- Declaration of indirect taxes. This declaration is needed to import goods from the countries of the customs union. It includes information about VAT and excise taxes and is completed for the month in which imported goods are recorded. For goods not subject to excise taxes, fill out only the first section and the title page. The declaration form was approved by order of the Federal Tax Service of the Russian Federation dated September 27, 2017 No. SA-7-3/ [email protected]

- Application for the import of goods and payment of indirect taxes is another document required for imports from the EAEU countries. Fill it out according to the form approved by order of the Federal Tax Service of the Russian Federation dated November 19, 2014 No. ММВ-7-6/ [email protected] , and submit 4 paper copies and one electronic one or only one electronic one, but certified by electronic signature, to the tax office. There is no need to fill out the second section; the tax office will do this. Within 10 working days they will review the application and return certified copies to you. Keep one for yourself to get a deduction, and give two to a foreign supplier so that he can confirm the 0% rate for export VAT.

In addition, prepare:

- bank statement or other document confirming tax payment;

- transport and accompanying documents;

- invoices or other documents confirming the cost

- a foreign trade contract or other agreement confirming the basis for the acquisition;

- contracts of assignment, commission or agency;

- A complete list of additional documents and the grounds for their preparation are listed in clause 20 of Appendix 18 to the Treaty on the EAEU.

The rate in the Republic of Kazakhstan for the current year

The VAT rate in Kazakhstan in 2021 is 12 or 0 percent. The first option is relevant for taxable trade turnover and import of goods. The second option is a minimum turnover when selling goods for export outside the country (not counting scrap metal). Zero percent is due to persons engaged in international transportation and provision of services.

To transport products to the territory of the Republic of Kazakhstan from Russia, you must provide the following correctly executed documents:

- an agreement that was concluded with a Kazakh counterparty;

- an application allowing import upon payment of VAT in the Republic of Kazakhstan from the buyer;

- accompanying documents for vehicles and goods.

Zero tax is also applied to turnover on the sale of export goods, fuels and lubricants, which are used by airports for air fleets performing international flights. This rule also applies to goods sold within special economic zones, refined gold.

Accounting for imported goods from the Republic of Kazakhstan

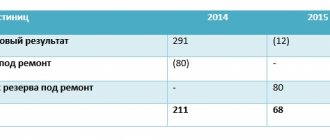

The order is presented in the table:

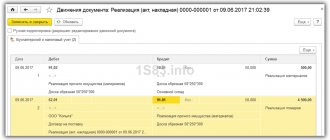

| Operation | Debit | Credit |

| Price of goods imported from the Republic of Kazakhstan | 42 | 61 |

| Paid imported products | 61 | 52 |

| Tax accrued for payment | 20 | 69 |

| Return of sales proceeds | 63 | 90-2 |

Example.

In July, Slon LLC imported products from Kazakhstan to Russia for further resale. The cost under the supply agreement is 500.0 thousand rubles.

The amount of VAT that was paid by the company to the budget of the Russian Federation amounted to 90.0 thousand rubles. (at a tax rate of 18%).

How is tax calculated?

The price of products that are imported into Russia can be determined under a sales contract. The transaction price reflected in the contract and the one paid to the seller by the buyer are taken into account. The tax base for VAT does not increase due to the presence of expenses for the transportation of goods.

The final tax amount that is paid to the budget can be calculated using the following formula:

price of imported products + excise taxes (relevant for excisable products) x tax rate (10–18%).

Probability of error

The tax amount is billed by the seller according to the documentation, in accordance with current legislation.

Against this background, the person purchasing the goods determines the VAT independently and then makes payments to the Federal Tax Service.

The tax base is necessarily calculated on the date when the goods were accepted for accounting.

It is necessary to proceed from the final price of the product. If it was purchased for foreign currency, then the amount in rubles can be determined by converting it into foreign currency at the Central Bank exchange rate. In this case, the date when the imported products were accepted for accounting is taken into account.

This base is multiplied by the tax rate. Then the amount to be deposited is determined.