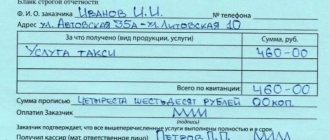

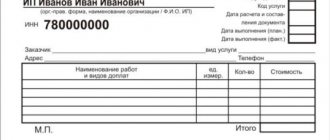

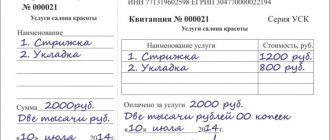

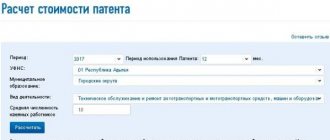

Strict reporting forms or a strict accounting form (BSO) for LLC, BSO for individual entrepreneurs on the simplified tax system for the provision of services in Moscow, are produced in the printing house (from 2250-00). Buying a strict accounting BSO form means ordering it with already printed details of the LLC or individual entrepreneur (you will not need to do this yourself with a pen or put a special stamp with the details).

Moreover, the cost of BSO depends on the size of the form (A4-A5), circulation, number of layers of self-copying paper and number of numbering places. In cases provided for by law, strict reporting forms replace a cash register when providing services to the public (BSO receipt or BSO + for services).

IN

In accordance with the Law, BSOs must be made in the established form, and the numbering must be done in a typographical way using special printing equipment that is not available in the office. At the bottom of the form, the printing house puts the following marks: circulation, order number, TIN, year of issue, name and address of the printing house that printed the BSO .

When preparing the layout, it is necessary to leave space for the number applied using letterpress printing on an automatic numbering machine. Buy BSO or order BSO forms? You decide. The cost can be seen below.

Cost of production of self-copying strict reporting forms (SSR), rub.:

| Circulation/format | layers | 100 | 200 | 500 | 1000 | 2000 | 5000 | 10000 |

| A4 | 2 layers | 2300 | 2850 | 4050 | 7000 | 9250 | 22000 | 38000 |

| 3 layers | 2800 | 3250 | 5500 | 8500 | 13000 | 29500 | 55500 | |

| A5 | 2 layers | 2100 | 2500 | 2950 | 4500 | 7750 | 14500 | 24250 |

| 3 layers | 3400 | 3750 | 4700 | 6250 | 11400 | 18750 | 32500 | |

| A6 (horizontal position only) | 2 layers | 2000 | 2200 | 3500 | 4000 | 5750 | 10750 | 17000 |

| 3 layers | 2300 | 2450 | 4200 | 4500 | 6750 | 12500 | 26250 | |

| Layout | +500 | |||||||

| Numbering | for free | |||||||

The strict accounting form is printed in black. The standard period for printing BSO is 3 business days. Circulations of 100 to 500 forms can be produced in 2 business days or less. Larger runs require more time. When printing on both sides, a coefficient of 1.25 is applied, but not less than 500-00. For circulations up to 2000 A4 (in terms of A4 format), the colors of the paper layers are used from those that are available in the printing house. Starting from 2000 A4, we are ready to purchase self-copying paper in the required colors.

In what ways can BSO be made?

The legislation establishes 2 methods of manufacturing BSO:

- Typographic. To do this, you need to choose a printing house, bring your own template of the form, or use ready-made samples. The BSO indicates not only the customer’s details, but also information about the printing house: its name, Taxpayer Identification Number, order number, year of execution and circulation size (clause 4 of Resolution No. 359).

- Using an automated system. It must be protected from unauthorized access, and all transactions with forms must be stored and recorded for at least 5 years. Tax authorities have the right to request information about BSO from the system (clause 11 of resolution No. 359).

If you were going to make forms yourself on a regular computer and printer, read the letter of the Ministry of Finance of Russia dated November 25, 2010 No. 03-01-15/8-250. Officials indicate in it that BSOs can only be printed in a printing house or through an automated system; other methods of their production are prohibited.

The taxpayer does not need to register the BSO circulation with the Federal Tax Service - see the publication “Do I need to register the BSO with the tax office in 2016?”

NOTE! From 07/01/2018, the algorithm for registration and issuance of BSO will change: forms can only be printed via online cash register. The new rules will affect all taxpayers who can now issue printed BSOs to clients (Article 7 of the Law “On Amendments...” dated July 3, 2016 No. 290-FZ).

Numbering (separate service without BSO stamp)

We produce 1-7 digit numbering using an automatic numberer. Simultaneous numbering with 4 numbering heads is possible. Maximum format - A3 (297x420 mm). The minimum is a5.

Attention! Usually there is 1 number on the form. If you need to number in 2 places, the cost of the form will increase slightly, so before ordering the BSO, check this position. The total cost of BSO printing = production cost + numbering cost.

When ordering a BSO, the sample form below will help you choose the one you need, or based on the BSO samples presented, we can develop an individual type for you.

The main area of application of BSO forms for services to the public is for individual entrepreneurs and LLCs - the provision of services. Instead of a sales receipt, the client is issued a BSO form - a receipt, one of the layers of a strict accounting form.

Results

With the entry into force of Law No. 290-FZ, electronic BSOs are gradually being introduced into circulation. According to the new rules, BSO and cash receipts have the same set of mandatory details, and cash registers and automated systems for generating BSO must be registered with the Federal Tax Service.

Accordingly, as intended by legislators, BSO accounting should be electronic, with an electronic BSO sent to the client, with the generation of appropriate reporting files for the Federal Tax Service and with electronic transmission of this data to the tax office.

However, the current state of affairs and the procedure for practical work with many types of BSO demonstrates that:

- completely abandoning paper forms can be quite problematic;

- it is not clear how AS for BSO should turn into cash registers for BSO and how the required accounting of individual transactions will be carried out with their help (for example, the implementation of BSO through intermediaries). At the same time, we can already conclude that the previously existing AS for BSO practically do not comply with the requirements of Law No. 290-FZ.

Based on these conclusions, it can be assumed that the procedure for working with electronic BSO and AS for BSO will be further standardized and clarified.

And the material and technical base of the AS for BSO will be updated and brought into line with the requirements of the updated laws. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Numbering cost

| Circulation | up to 1000 | 1001-5000 | 5001-10000 | 10001-30000 |

| Price per room | 1,5 | 1,3 | 1,15 | 0,85 |

| Makeready (adjusting equipment to the required format and numbering location on the product area) | +1000-00 | |||

The numbering can be 1-6 digits, the font is ArialCyr, the font size and type do not change. The positioning of the number on the sheet may differ with an accuracy of 1-5 mm. The minimum length of a product for numbering is 150 mm, there are technical restrictions on the distance from the number to the edge of the product, etc., you must consult with the printing house manager and send a layout.

The minimum order for numbering is 2000-00.

How to take into account BSO?

Upon receipt of BSO from the printing house, an acceptance certificate should be drawn up in a free form, taking into account the requirements of the law on mandatory accounting documentation details (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Forms received from the printing house should be taken into account in the book of document forms (clause 14 of Resolution No. 359).

An employee who conducts transactions with BSO is a financially responsible person; an appropriate agreement must be concluded with him. An example of its preparation can be found in the article “Liability Agreement - sample 2015”.

Forms must be stored in a safe or special room to prevent the possibility of damage or theft. The BSO storage area is sealed at the end of the day every day. Forms should be stored for 5 years.

Printed forms must be checked regularly - during the cash inventory period.

For more information on how to conduct a BSO inventory, read the article “Procedure for recording and storing strict reporting forms.”

If you print BSO from an automated system, then they are recorded and stored in it. They need to be printed at the time of the transaction itself. Accordingly, there is no need to purchase a safe or equip a special room for forms. Also, the automated system provides the user with the opportunity to maintain a BSO accounting book in electronic form.

BSO accounting has one nuance: the forms must be taken into account in off-balance sheet account 006 “Strict reporting forms” of the chart of accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). The BSO should be reflected in the conditional valuation. The company prescribes the procedure for determining it in its accounting policies.

Accounting entries for accounting of BSO produced in the printing house:

| Debit | Credit | Contents of operation |

| 10 | 60 | The receipt of BSO into the organization is reflected |

| 19 | 60 | VAT included on purchased forms |

| 68 | 19 | Accepted for deduction of VAT according to BSO |

| 006 | Capitalized by BSO for balance in conditional valuation | |

| 20, 44 | 10 | Forms were issued to the responsible employee |

| 006 | BSO issued to customers are written off |

In a situation where forms are printed by an automated system, accounting reflects the acquisition of non-exclusive rights to use the system by making an entry in the debit of account 97 and the credit of account 60 or 76. Then the costs of the program are written off to the debit of account 20 or 44 according to the methodology approved by order of the manager in the accounting policy for accounting purposes.

If an organization has received the rights to use an automated system under a license agreement, such a system is recognized as intangible assets received for use (clause 39 of PBU 14/2007, approved by Order of the Ministry of Finance of Russia dated December 21, 2007 No. 153n). The system must be reflected on the balance sheet in a separate account, which the organization will independently put into use and record in its accounting policies.

VAT on the purchased automated system is taken into account in the usual manner.

When using an automated system, the company incurs costs for ink and paper for forms. Such expenses are written off as follows:

- Dt 10 Kt 60 — consumables for the automated BSO printing system were purchased;

- Dt 20, 44 Kt 10 - consumables are included in costs.

In tax accounting, expenses for the production of BSO can be written off as expenses for stationery (subclause 24, clause 1, article 264 of the Tax Code of the Russian Federation) or material expenses (subclause 2, clause 1, article 254 or subclause 5, clause 1, article 345.16 of the Tax Code) RF for simplified firms). The company indicates the method of writing off costs in its accounting policy for tax purposes.

The OSN company takes into account the costs of a special system for printing BSO on the basis of subclause. 26 clause 1 art. 264 of the Tax Code of the Russian Federation as part of other costs. If the documentary agreement for the acquisition of a non-exclusive license to work with the system specifies the period for using the acquired rights, the enterprise recognizes such expenses evenly over this period (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-03-06/2/95).

If there is no deadline in the documents, the company’s accountant records the period for writing off expenses in the accounting policy (letter of the Ministry of Finance of Russia dated March 18, 2013 No. 03-03-06/1/8161). Simplified people recognize the costs of the system on the basis of subparagraph. 19 clause 1 art. 346.16 Tax Code of the Russian Federation.

form BO-1

(layer 1)(layer 2)(layer 3)| BSO sample |

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Household problems. subjects - activities, creation, liquidation, debts » Is it required for an entrepreneur to have a seal and use it in strict reporting forms for the provision of ski rental services if the entrepreneur works without a seal?

Question

Is it required for an entrepreneur to have a seal and use it in strict reporting forms for the provision of ski rental services if the entrepreneur works without a seal?

Answer

Civil legislation does not oblige an entrepreneur to have a seal. However, according to some provisions of the law, a seal is required.

For example, a mandatory requisite of a strict reporting form is the seal of an individual entrepreneur (clause “and” clause 3 of the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment, approved by the Decree of the Government of the Russian Federation dated 05/06/2008 N 359).

Without the entrepreneur’s seal, the strict reporting form will be invalid (Letter of the Ministry of Finance of Russia dated March 2, 2009 N 03-01-15/2-69).

“Individual Entrepreneur” (Karsetskaya E.V.) (“IC Group”, 2013) {ConsultantPlus}

Subparagraph “i” of clause 3 of the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment, approved by Decree of the Government of the Russian Federation dated 06.05.2008 N 359 reads:

Receipts, tickets, travel documents, coupons, vouchers, subscriptions and other documents equivalent to cash receipts are drawn up on strict reporting forms intended for making cash payments and (or) payments using payment cards without the use of cash register equipment in the case of providing services to the population. checks.

The document must contain the following details, except for the cases provided for in paragraphs 5 - 6 of these Regulations:

a) name of the document, six-digit number and series;

b) name and legal form - for the organization;

last name, first name, patronymic - for an individual entrepreneur;

c) location of the permanent executive body of the legal entity (in the absence of a permanent executive body of the legal entity - another body or person entitled to act on behalf of the legal entity without a power of attorney);

d) taxpayer identification number assigned to the organization (individual entrepreneur) that issued the document;

e) type of service;

f) the cost of the service in monetary terms;

g) the amount of payment made in cash and (or) using a payment card;

h) date of calculation and preparation of the document;

i) position, surname, name and patronymic of the person responsible for the transaction and the correctness of its execution, his personal signature, seal of the organization (individual entrepreneur);

j) other details that characterize the specifics of the service provided and with which the organization (individual entrepreneur) has the right to supplement the document.

Decree of the Government of the Russian Federation dated 05/06/2008 N 359 (as amended on 04/15/2014) “On the procedure for making cash payments and (or) payments using payment cards without the use of cash register equipment” {ConsultantPlus}

Thus, in this situation, strict reporting forms must be stamped with the seal of an individual entrepreneur.

Selection of documents:

Article: Seal of an individual entrepreneur: not mandatory, but desirable (Sukhovskaya M.G.) (“General Book”, 2012, No. 12) {ConsultantPlus}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, November 2015.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().