Admission

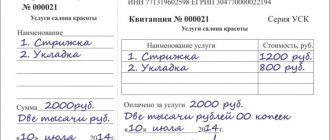

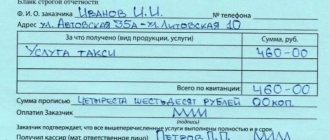

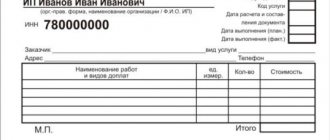

Strict reporting forms are printed or generated using automated systems (clause 4 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359).

Forms produced by printing must be recorded by name, series and numbers in the document form accounting book. The form of such a book for commercial organizations has not been approved. Therefore, the organization needs to develop it independently. You can take the following as a basis for developing your own document form:

- book form for recording documents of strict reporting OKUD 0504819;

- form of the book of accounting of strict reporting forms OKUD 0504045.

The sheets of the book of accounting forms must be numbered, laced, signed by the head and chief accountant of the organization, and also sealed.

This follows from paragraph 13 of the Regulations, approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359, and letter of the Ministry of Finance of Russia dated August 31, 2010 No. 03-01-15/7-198.

Accounting for forms produced using automated systems is carried out automatically using software that allows you to obtain information about issued strict reporting forms. In this regard, when generating strict reporting forms in an automated way, the organization must comply with the following requirements:

- the automated system must be protected from unauthorized access, identify, record and store all operations with the document form for at least five years;

- When filling out and issuing a document form, the automated system stores the unique number and series of its form.

This is stated in paragraph 11 of the Regulations, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Receive the BSO on the same day with an acceptance certificate. It can be drawn up, for example, according to the form approved by the GMEC protocol of June 29, 2001 No. 4/63-2001. The act must be approved by the head of the organization and signed by members of the commission for the acceptance of strict reporting forms. The composition of the BSO acceptance committee is fixed by order of the head of the organization. Such rules are provided for in paragraph 15 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Transfer of forms to the organization's employees

If the calculations in which the BSO is used are carried out not by the MOL, but by another employee of the company, then the transfer of the relevant forms to his disposal is carried out by the financially responsible person on the basis of a written application. Data on issued BSOs are entered by the MOL in the book of records of strict reporting forms.

Copies of the BSO issued to the organization's clients, or the counterfoils of the forms (depending on which specific form of the BSO is used) are transferred by the employees to the financially responsible person. Data about this is also recorded in the BSO accounting book. If any of the previously issued forms is damaged, it is crossed out and then attached to the accounting book.

Storage

The head of the organization must, by order, appoint someone responsible for the storage and issuance of strict reporting forms. An agreement on full financial responsibility must be concluded with this employee and conditions must be created for him to store SSO. Strict reporting forms must be stored in metal cabinets, safes or specially equipped rooms, which are sealed or sealed daily. Such rules are established by paragraphs 14 and 16 of the Regulations, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Situation: when organizing the accounting and storage of strict reporting forms, is it necessary to apply the instructions approved by the protocol of the State Interdepartmental Expert Commission on Cash Registers (GMEC) dated June 29, 2001 No. 4/63-2001?

Answer: yes, it is necessary.

Minutes of the GMEC dated June 29, 2001 No. 4/63-2001 have not been canceled to date. However, it was drawn up on the basis and during the validity of regulatory legal acts that have lost their force. Therefore, it can be applied to the extent that does not contradict the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

How to keep a BSO accounting book

Both organizations and individual entrepreneurs are required to maintain this document if they do not use an automated BSO printing and accounting system. There is no single standard book for commercial structures, such as LLCs and individual entrepreneurs, so it is possible to use the BSO accounting book form for state and municipal institutions. You can download it here or develop your own document design.

The following requirements must be met:

- all sheets are numbered;

- the book is stitched;

- signed by the head of the organization and the chief accountant or individual entrepreneur.

Only the person responsible for accepting and issuing strict reporting forms is authorized to make entries in the book.

The book contains information about the following events:

- receiving BSO forms from the printing house;

- issuing forms to persons working with clients;

- the number of remaining forms;

- write-off of BSO.

Important: an entry in the accounting book must be made when handing over the BSO form to an employee working with clients, and not when accepting payment from the client.

The book must reflect information about each copy of the BSO received by the organization or individual entrepreneur, including defective ones, filled in with errors and damaged. They are not thrown away, but crossed out and attached to the accounting book.

Accounting: acquisition of BSO

Reflect the purchase of strict reporting forms in accounting with the following entries:

Debit 10 (15) Credit 60

– the receipt of strict reporting forms is reflected;

Debit 20 (23, 25, 26, 44...) Credit 10 (16)

– strict reporting forms were transferred to the organization’s divisions for use (at the time of transfer of the forms for reporting).

Such rules are established by paragraph 22 of the instructions approved by the GMEC Protocol of June 29, 2001 No. 4/63-2001, and paragraph 15 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

The receipt of strict reporting forms should also be reflected in off-balance sheet account 006. This is explained by the fact that the movement of such documents requires additional control (Chart of Accounts). Reflect the BSO on the balance sheet in a conditional valuation. Such rules are established in the Instructions for the Chart of Accounts. The conditional valuation can be equal to the actual price or any other value, for example 1 rub. The procedure for determining the conditional valuation is fixed in the accounting policy for accounting purposes (clause 4 of PBU 1/2008).

Organize analytical accounting on account 006 according to the places where strict reporting forms are stored (divisions, responsible persons), for example, you can enter the following subaccounts: “BSO in accounting”, “BSO in the department” (Chart of Accounts). Reflect the movement of the BSO on the balance sheet based on the intake control sheet. It is on the basis of this document that it is necessary to conduct turnover on account 006. Check the data on the control sheets monthly with the accounting book of strict reporting forms. Such rules are established by paragraph 22 of the instructions approved by the GMEC Protocol of June 29, 2001 No. 4/63-2001.

Inventory and write-off of BSO

The tasks that the process of storing strict reporting forms includes includes inventory. This procedure involves reconciling existing copies of the BSO, as well as their counterfoils, with the data contained in the book of strict reporting forms. The inventory of BSO must be carried out simultaneously with a similar procedure established in relation to cash at the cash desk (clause 17 of the Regulations).

After five years of storage of forms (including damaged or incomplete ones) in the organization, it is necessary to write off the BSO. This procedure is carried out by drawing up a separate act (you can use the form corresponding to OKUD number 0504816, and for state and municipal structures its use is mandatory). This document is drawn up with the participation of a commission created on the basis of an order from the head of the company.

For more information about the act, see “Act on the write-off of strict reporting forms - sample.”

The structure of modern automated systems, as a rule, contains solutions that make it possible to issue the necessary acts on inventory and write-off of BSO in electronic form. Also, the corresponding systems provide algorithms for excluding decommissioned digital BSOs from hardware registers.

For more information about other types of inventory provided for by the legislation of the Russian Federation, read the article “How to conduct an inventory before annual reporting.”

Accounting: BSO movement

In accounting, reflect the movement of strict reporting forms with the following entries:

Debit 006 subaccount “BSO in accounting”

– strict reporting forms were capitalized in off-balance sheet accounting in conditional valuation;

Debit 006 subaccount “BSO in the department” Credit 006 subaccount “BSO in accounting”

– strict reporting forms were handed over to the department employee for reporting;

Credit 006 subaccount “BSO in the division”

– strict reporting forms in off-balance sheet accounting were written off.

In addition to the forms issued to customers instead of a cash register receipt, on account 006 take into account:

- check books;

- liter petrol coupons;

- work books;

- vouchers received by the organization in the branches of the FSS of Russia;

- other similar documents.

Once the BSO is completed, it becomes the primary document. If such a document was paid for at the expense of the organization and indicates an unfulfilled obligation in relation to it, then such documents are called monetary and are recorded in account 50-3 “Cash documents”. Such documents include:

- travel documents (air and train tickets);

- cash coupons for gasoline;

- vouchers purchased by the organization;

- other similar documents.

An example of reflecting in accounting and taxation the receipt and use of strict reporting forms

CJSC Alfa provides laundry services and uses strict reporting forms.

On August 23, Alpha purchased 100 strict reporting forms “Work Order”, the total cost of which was 236 rubles, including VAT - 36 rubles. During the remainder of the month, 28 forms were issued. The organization keeps records of materials without using accounts 15 and 16. On the off-balance sheet account, strict reporting forms are taken into account in the conditional valuation of 1 ruble.

Alpha determines income and expenses using the accrual method. Income tax is paid monthly. Due to the fact that the procedure for accounting for expenses on strict reporting forms is not established in Chapter 25 of the Tax Code of the Russian Federation, the accounting policy for tax purposes of Alpha stipulated that these expenses are included in material expenses and are indirect when calculating income tax.

The purchase of forms was reflected in accounting with the following entries:

Debit 10 Credit 60 – 200 rub. (236 rubles – 36 rubles) – strict reporting forms have been capitalized;

Debit 19 Credit 60 – 36 rub. – VAT is allocated from purchased forms;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 36 rubles. – accepted for deduction of VAT on forms;

Debit 006 – 100 rub. – strict reporting forms were capitalized for the balance sheet in the conditional valuation;

Debit 20 Credit 10 – 56 rub. (200 rubles/piece: 100 pieces × 28 pieces) – strict reporting forms were handed over to the responsible person;

Credit 006 – 28 rub. – strict reporting forms issued to clients were written off.

The accountant recorded these printed forms in the book of strict reporting forms.

In tax accounting, the cost of 28 issued forms is 56 rubles. was included in expenses in August.

The concept of strict reporting forms

Strict reporting forms are paper documents that some organizations issue instead of sales and cash receipts to confirm the acceptance of money from the public. There are many types of forms, and examples include train tickets, theater tickets, shoe repair receipts, etc.

At the moment, the use of strict reporting forms (abbreviated as BSO) is possible when providing any services, even those not listed in OKUN.

Organizations using such documents must keep strict records of them, since BSOs are a form of reporting to the tax authorities.

BASIC: income tax

Situation: how to take into account the costs of purchasing strict reporting forms when calculating income tax?

The answer to this question depends on the type of forms.

For some strict reporting forms, special expense items are provided. Thus, take into account the costs of purchasing check books as part of the costs of banking services (subclause 15, clause 1, article 265 of the Tax Code of the Russian Federation). The financial department recommends using this approach for organizations using the simplified approach (letter of the Ministry of Finance of Russia dated May 25, 2007 No. 03-11-04/2/139). This conclusion can be extended to organizations that apply the general taxation system (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). Both with the accrual method and with the cash method, take into account the costs of purchasing check books at the time of payment (subclause 3, clause 7, article 272, clause 3, article 273 of the Tax Code of the Russian Federation). See also the entries reflecting the costs of bank services.

According to strict reporting forms used instead of cash registers, the tax accounting procedure is not clearly established in the legislation.

On the one hand, the costs of purchasing strict reporting forms can be classified as material costs on the basis of subparagraph 2 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. This is explained by the fact that these costs are associated with payments for services rendered, i.e., the purchased forms are used for production needs.

On the other hand, these costs can be taken into account as part of office expenses and attributed to other expenses (subclause 24, clause 1, article 264 of the Tax Code of the Russian Federation). A similar point of view is expressed by the Russian Ministry of Finance in a letter addressed to organizations using the simplified system (letter dated May 17, 2005 No. 03-03-02-04/1/123). The conclusions of the financial department can be extended to organizations that apply the general taxation system (clause 2 of article 346.16 of the Tax Code of the Russian Federation).

Thus, the organization must independently decide whether to classify such expenses as material or other (clause 4 of Article 252 of the Tax Code of the Russian Federation). Fix your choice in your accounting policy for tax purposes (Article 313 of the Tax Code of the Russian Federation).

Normative legal acts

For an accountant, the fundamental regulatory legal acts (RLA) that regulate the accounting of strict reporting forms in budgetary institutions are several instructions:

- instructions for the use of a unified chart of accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n;

- instructions for using the chart of accounts for budget accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n;

- instructions for using the chart of accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n;

- instructions for using the chart of accounts for accounting of autonomous institutions, approved by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n.

In addition, it is necessary to know industry regulations that regulate the structure of specific forms, the rules for filling them out, recording and storing them. So, if the form of a school certificate is approved by a state body (order of the Ministry of Education and Science of Russia dated August 27, 2013 No. 989 “On approval of samples and descriptions of certificates of basic general and secondary general education and appendices to them”), it should be used. Similar orders apply to documents of higher education, work records, certificates of incapacity for work and other BSO.

BASIS: VAT

VAT on purchased strict reporting forms can be deducted if the following conditions are met:

- the tax is presented by the supplier;

- strict reporting forms were purchased for transactions subject to VAT;

- strict reporting forms are accepted for registration;

- there is an invoice for them.

This is stated in Article 171 of the Tax Code of the Russian Federation.

For more information about this, see Under what conditions can input VAT be deducted?

The exception to this rule is when:

- the organization enjoys VAT exemption;

- uses forms in VAT-free transactions.

In these cases, include input VAT in the cost of strict reporting forms. This follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

Reflection in accounting (budget) accounting

From 2021, in accordance with clause 11.4.8 of the Procedure for applying the classification of operations of the public administration sector, approved by order of the Ministry of Finance of the Russian Federation dated November 29, 2017 No. 209n, expenses for the acquisition (production) of gift and souvenir products not intended for further resale, strict forms statements refer to subarticle KOSGU 349 “Increase in the cost of other disposable inventories.”

In accordance with paragraph 98 of Instruction No. 157n, the material assets acquired (created) for use (consumption) in the course of the institution’s activities, including those received for storage, are taken into account as part of the group of material inventories in the corresponding analytical accounting accounts of account 010500000 “Material inventories”. in respect of which a financially responsible person has been determined.

Such material assets include, in particular, valuable gifts, souvenirs, other material assets intended for the purposes of rewarding (donation), strict reporting forms purchased by the institution for the purpose of performing functional activities.

Consequently, material assets in the form of BSO and valuable gifts acquired (created) for use in the course of the institution’s activities and kept in its storage are subject to reflection in accounting (budget) accounting on account 105 36 349 “Increase in the value of other material inventories of one-time use” .

simplified tax system

If a simplified organization pays a single tax on income, then the costs of purchasing strict reporting forms do not affect the tax base. Such organizations do not take into account any expenses (clause 1 of article 346.14, clause 1 of article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, include the input VAT presented by the supplier when purchasing strict reporting forms as expenses (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Situation: how can a simplified organization take into account the cost of strict reporting forms? The organization pays a single tax on the difference between income and expenses.

The answer to this question depends on the type of forms.

For some strict reporting forms, special expense items are provided. Thus, take into account the costs of purchasing checkbooks as part of the costs of banking services (subclause 9, clause 1, article 346.16 of the Tax Code of the Russian Federation). A similar point of view is expressed by the Russian Ministry of Finance in letter dated May 25, 2007 No. 03-11-04/2/139. Take these expenses into account when calculating the single tax after they have been paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

According to strict reporting forms used instead of cash registers, the tax accounting procedure is not clearly established in the legislation.

On the one hand, the costs of purchasing strict reporting forms can be classified as material costs (subclause 5, clause 1 and clause 2, article 346.16, subclause 2, clause 1, article 254 of the Tax Code of the Russian Federation). This is explained by the fact that these costs are associated with payments for services rendered, i.e., the purchased forms are used for production needs.

On the other hand, these expenses can be classified as office expenses (subclause 17, clause 1, article 346.16 of the Tax Code of the Russian Federation). A similar point of view is expressed by the Russian Ministry of Finance in letter dated May 17, 2005 No. 03-03-02-04/1/123.

What is BSO

Strict reporting forms (SRF) are a type of documents that are used to record the status or right to something, confirm the received status, etc. SRF are subject to special accounting, therefore they necessarily contain a set of identification parameters:

- information about approval of the form;

- Title of the document;

- serial number.

Duplicating series and numbers on forms with tear-off parts is prohibited. The exception is forms that are filled out in duplicate using carbon paper. There the identification parameters are repeated. (Also see the article on BSO in commercial organizations “How to create and account for strict reporting forms”).

Start using the Kontur-Accounting Budget program for free

In the activities of the institution, three areas related to taking into account strict reporting forms can be distinguished:

- current financial and economic activities;

- registration of labor relations with employees;

- settlements with the population.

There is no unified register of BSOs in Russia yet. The main forms of forms that are often used in the budget sector:

- receipts (issued instead of a cash register receipt when making payments to the public for services rendered);

- tickets and passes for entertainment events;

- work books and inserts for them;

- certificates;

- military tickets;

- medical books;

- birth certificates;

- certificates of incapacity for work;

- health resort vouchers;

- certificates, diplomas;

- securities;

- fuel cards, etc.

Strict reporting forms are most actively used in medical and educational institutions. However, documents such as work books or certificates of incapacity for work are required in institutions of any industry. This means that the accountant must have a full range of knowledge about the circulation, accounting and storage of financial statements. A specific set of documents for a particular organization depends on the specifics of its activities and is approved by the head.

OSNO and UTII

Strict reporting forms can be used both in the activities of an organization subject to UTII and in activities on the general taxation system. As a rule, it is known what type of activity the calculations for which a strict reporting form is drawn up, used instead of cash registers, are related to. Accordingly, the costs of purchasing forms and the amount of VAT paid can be determined on the basis of direct calculation. This procedure follows from paragraph 4 of Article 149, paragraph 9 of Article 274 and paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

In some cases, it is impossible to determine in what type of activity BSOs are used. Therefore, the costs of their acquisition cannot be directly allocated. In this case, distribute them in proportion to the share of income from each type of activity (clause 9 of Article 274 of the Tax Code of the Russian Federation). The need to use this method may arise, for example, when distributing expenses according to a checkbook.

VAT, which can be deducted on distributed expenses for social security, is calculated according to the methodology established in paragraphs 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation.

To the received share of expenses for the activities of an organization subject to UTII, add the amount of VAT that cannot be deducted (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

Latest changes in legislation

A strict reporting form (SRF) is a fiscal document that is equivalent to a cash receipt. According to Art. 1.1 Federal Law No. 54 The BSO must confirm the fact of the payment, contain information about this operation and comply with legal requirements for the use of cash register equipment.

BSO can be prepared:

- electronic;

- printed using a special automated system.

The document is drawn up at the time of settlement between the client and the seller.

Until July 1, 2019, all business entities could refuse to use a cash register in favor of strict reporting forms that were printed in printing houses.

From July 1, 2019, a paper form cannot be used instead of a cash receipt. The latter must be issued to the client without fail. The check must be prepared automatically or using an online cash register.

Explanations from the Ministry of Finance of the Russian Federation

The Ministry of Finance of the Russian Federation explained that it is necessary to ensure a unified approach when reflecting in accounting (budget) accounting transactions related to the purchase of memorable gifts (souvenir products), strict reporting forms from 2019 (Letter dated April 26, 2019 No. 02-07-07 /31230 “On the application of the sub-article of KOSGU when reflecting in accounting (budget) accounting transactions related to the acquisition of memorable gifts (souvenir products), strict reporting forms”).

When issuing material assets in the form of BSO to an employee of the institution who is responsible for their registration and issuance, the specified MTs are reflected in off-balance sheet account 03 “Strict reporting forms” until they are provided with a document confirming their issuance (destruction of damaged forms). In this case, the Ministry of Finance of the Russian Federation recommends simultaneously attributing the cost of strict reporting forms issued from storage sites to the expenses of the current financial period - by debiting account 401 20 272 “Expenses of inventories of the current financial year.” When the institution’s commission for the receipt and disposal of assets makes a decision on the write-off of BSO as a result of their damage or theft, it is necessary to draw up an Act on the write-off of strict reporting forms (f. 0504816) in accordance with the procedure established by Order of the Ministry of Finance dated March 30, 2015 No. 52n “On approval of forms primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions and Guidelines for their application.” At the same time, if a decision is made to write off strict reporting forms that are in the storage (warehouse) of the institution, their cost is charged to the debit of account 401 10 172 “Income from transactions with assets.”

From the moment of issuance of valuable gifts (souvenirs) from storage places to an employee of the institution who is responsible for organizing the protocol (ceremonial) event and (or) their delivery, the specified MCs are reflected in off-balance sheet account 07 “Awards, prizes, cups and valuable gifts, souvenirs” until the moment of their transfer (delivery). According to the explanations of the Ministry of Finance, upon the fact of documentary confirmation of the issuance of valuable gifts, their cost must be attributed to the expenses of the current financial period - by debiting account 401 20 272 “Expenses of inventories of the current financial year.” Upon delivery of valuable gifts as part of protocol and ceremonial events, the employee responsible for the delivery of valuable gifts must ensure that a document confirming the delivery is prepared.

Such a document, according to the Ministry of Finance of the Russian Federation, can be an act of delivery, drawn up in the form and manner established by the institution in the regulations for conducting protocol and ceremonial events and enshrined in the accounting policy of the institution. In this case, the form of the act of delivery must comply with the mandatory requirements for the composition of the details, with the permissibility of the absence of a signature of the person to whom the gift was given.

If the holding of ceremonial and protocol events, approved by the protocol of the institution, does not provide for the storage in the warehouses of the institution of valuable gifts purchased for rewarding or giving, in accounting upon the simultaneous presentation by those responsible for the acquisition of the specified MC and for organizing the event and (or) delivery of valuable gifts and documents , which confirm the purchase and delivery, information about such MCs is not reflected in off-balance sheet account 07 “Awards, prizes, cups and valuable gifts, souvenirs”. In this case, the cost of gifts upon receipt is immediately charged to the expenses of the current financial period - by debiting account 401 20 272 “Expenses of inventories of the current financial year.”

Since the above-described procedure for reflecting BSO and gifts in budget accounting is an explanation from the Ministry of Finance, and not a regulatory act, the institution needs to consolidate it in its accounting policy.