How to fill out the BSO for a taxi depends on how the driver works. Taxi drivers from the taxi company staff receive a CCP for BSO printing from the employer. Taxi drivers who open individual entrepreneurs and work for themselves can issue printed BSOs to passengers as a payment document until July 1, 2021.

In the article we will look at who can issue old taxi receipts and where to buy them, who is obliged to print new BSOs and work with cash registers. We will also provide a sample BSO, the possibility of a BSO in word format for example.

Why are BSOs needed and what benefits does it provide?

Since a driver working for the Yandex taxi service does not carry a cash register with him, he must have strict reporting forms with him. They serve as substitutes for checks or receipts.

In accordance with Federal Law of the Russian Federation No. 259 dated November 8, 2007, passengers must receive BSO from the driver for each train. If he did not do this, a fine of 1,000 rubles is imposed on the citizen. In addition, the official supervising the taxi driver will pay a fine of 10,000 rubles, and the organization where he works will pay 30,000 rubles.

The strict reporting form gives a good advantage to the driver and the organization itself. After all, they do everything according to the law, which means there should be no complaints from the inspection authorities. The main thing is to fill out the forms correctly and do not forget to give them to passengers.

What is a strict reporting form?

BSO is an official document that has a strict numerical sequence. Each form confirms receipt of funds from the client and replaces a cash receipt.

In theory, individual entrepreneurs or LLCs are required to submit each copy to the tax office. And also report on how many forms are left and the reasons for damage, if any. Those drivers who worked for some taxi company probably damaged the slip at least once. And they didn’t pat him on the head for it. And this happens because the company is obliged to account for each form and prove that it was spoiled by mistake, and not on purpose.

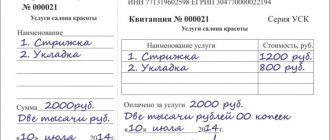

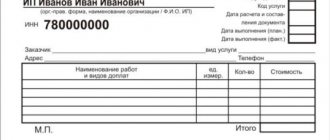

What information is contained in the BSO?

The information contained in the BSO must strictly comply with the stated requirements.

In this form, the driver must indicate:

- That the paper issued is a receipt for payment for the use of a passenger taxi. Next, indicate the license plates and series of the car.

- The name of the company providing passenger transportation services.

- Details of the organization (its address, individual tax number, telephone).

- In addition, the document number and date of issue (travel) are entered.

- You are also required to indicate the cost of taxi services in capital letters and numbers.

- If there are additional details that are needed for non-standard transportation, they also need to be indicated in the BSO.

If the organization decides to print the number of the issued document, then the driver or other employee of the company must enter all numbers of strict reporting forms in a journal specially designed for this.

When is the driver required to provide the form to the passenger?

If the passenger has chosen a non-cash form of payment through the application, then the driver is not required to issue a form (receipt). The client receives a check electronically through the application, can download it, print it and provide it at the place of demand (for example, to the organization’s accounting department).

In case of paying for the order in cash, the passenger has the right to demand the provision of a strict reporting form. In this case, the driver must fill out and issue the document upon arrival at the destination. If a Yandex Taxi employee does not have the forms, the passenger can contact the taxi company and demand that they issue the document necessary for reporting.

Self-employed taxi drivers must take care of their own forms.

Real BSO checks for taxi drivers

If the driver thinks that he does not need a strict reporting form, he can work just fine without this document, then he is very mistaken. After all, Yandex taxi employees often have all the necessary papers checked, including the BSO. They are produced by highway patrol officers.

If the taxi driver does not have the required document or does not offer it to the client, the traffic police officer has the right to remove the driver from the line for the whole day. In addition, he will draw up a protocol on the basis of which the driver, official and company will have to pay a fine.

You should beware of scammers

It is also worth warning both drivers and taxi fleet owners against the danger of falling for scammers. After all, today some resources offer downloads of supposedly updated forms at quite inflated prices. At the same time, it is certainly indicated that this must be done as quickly as possible, so as not to run into large fines...

Of course, you should not trust such offers. Firstly, because the slightest changes in the format and rules for maintaining BSO are certainly indicated in advance, for some time outdated forms are used on a par with new ones. This allows entrepreneurs to make a painless transition to new documentation.

Secondly, the forms themselves cost mere pennies. While fraudulent resources offer them quite expensively.

Thirdly, it is not surprising that when tested, such forms of a “new” design turn out to be banal fakes that do not comply with accepted standards. Therefore, it is not surprising that they will be invalid.

In short, it never hurt anyone to exercise a certain amount of caution...

Where can I get the form?

Beginners who have just started working as a taxi driver in Yandex Taxi have a question: where can I get a strict reporting form? Typically, the employer must provide the employee with all the necessary documents. After all, the company is interested in ensuring that all its activities are legal.

There are ready-made forms available on the main Yandex taxi website. They can be downloaded by simply clicking on one of the links. Next, the BSO needs to be printed on a printer in the quantity required for work.

You can also purchase forms at an office supply store. They are made from special printing paper and are authentic.

By the way, a taxi driver has the right to fill out the BSO using any shade of ink. The main thing is to do it correctly, legibly and accurately.

It is worth remembering that since 2021, genuine strict reporting forms are no longer freely available. After all, the requirements for them have become more serious, so only a registered organization can get access to these documents. After this, it is obliged to provide its drivers with the received papers.

Therefore, it is important to know that there are now many scammers counterfeiting BSOs and selling them to others. In addition, they offer to download forms from the site for a fee. Don’t be fooled by these offers and download the BSO only from the official Yandex taxi website or ask for forms from your manager.

How to fill out the form correctly

There are a large number of samples on the Internet showing what data should be entered into the form. It is better to study several examples, since different checks differ from each other.

If the BSO was issued by the employer on letterhead, the details should already be printed.

Assistance for Yandex.Taxi drivers will be provided by The Cab service, the official partner of the company. Specialists will register in the system and give clear recommendations on the workflow. Also, drivers who contact The Cab have full legal protection and regular payments to a plastic card without delays or deductions. The series and number of each receipt are recorded in the employer's database. Also, if the taxi was called through the application and the client specified his email during registration, a payment report will be sent to him.

During photo control, the taxi meter requested BSO - what to do in this case?

When a taxi driver undergoes photo control at the Yandex taxi fleet, he must present the following documents:

- driver's license photo;

- car pictures;

- driver's photo;

- A snapshot of the strict reporting form.

If the driver did not have the last document at the time of the check for objective reasons, this is excusable. Instead, the employee can present a vehicle registration certificate.

Of course, it is still better for the taxi driver to have a strict reporting form. The employee has the right to stock up on several copies of the BSO in advance and take a photograph of one of them during the inspection.

It happens that the driver does not have a strict reporting form when checking several times. Of course, Taximeter will temporarily block such an employee and deny access to orders. The rating of the driver himself will also be reduced. And this will lead to a lack of good and profitable travel applications.

Therefore, a conscientious taxi driver always has all the necessary papers and permits with him, the car is washed, the interior is tidy, and the passengers are happy.

Photo control of the presence of a strict reporting form in Yandex Taxi

Photo control is carried out already at the first exit on the route. The absence of BSO on the first playthrough is not considered critical. The main thing is to demonstrate that you have a driver’s license and a vehicle registration certificate. To do this, you need to take a photo of the necessary documents and upload the photo to the application. In the future, such a check will occur only if the driver is absent from calls for a long time or when personal data is changed.

BSO should be prepared for subsequent checks, since the Yandex Taxi service has made the presence of these receipts a mandatory requirement. The absence of a strict reporting form negatively affects the driver’s rating.

Share and save ↓

Secrets to successfully passing photo control

I would like to share the secrets for passing photo control the first time. 6. For photographs, it is better to choose the optimal lighting and not use a flash, since documents may be overexposed, and laminated ones will glare. 7. It is prohibited to take photos from copies of documents - only originals. 8. If the first check was successful, then the next one can be scheduled in three days. If the second one also has a positive result, then Taxometer prescribes photocontrol ten days later. Well, the further you go, the less often. 9. The vehicle is photographed at right angles from several angles. Photos that were taken at an oblique angle or from any unusual angle, as well as cropped images, are not allowed. 10. The application indicates the order in which you need to take a photo of the car. It must be adhered to. 11. When photographing the interior, it is advisable that the interior lighting be turned on. 12. All information specified in the documents, license plate - everything must be readable and understandable.

Thus, Yandex Taxi does everything to ensure that passengers use the services of professional drivers. And a taxi ride brought comfort rather than leaving unpleasant memories.

Filling rules

The legislation of the Russian Federation specifies what information should be reflected on the strict reporting form. When filling out this document, which is a kind of receipt, the following basic information is indicated on paper:

- Information about the taxation method used by a specific taxi company.

- The date of the service provided, the place and time when the taxi passenger paid the driver.

- Selected payment option: cash.

- Name of the service provided.

- Exact amount including VAT.

- Passenger's telephone number and email address.

- Receipt name, number and series.

- The name of the company for which the taxi driver works.

- Full name of the taxi driver or entrepreneur.

Every individual entrepreneur or taxi company partner must use BSO if they want to operate completely legally. Otherwise, there may be problems with Rospotrebnadzor.

How long is a taxi waybill valid?

The driver must be issued a waybill before the start of the trip (clause 10 of the appendix to order No. 152):

- single, if its length exceeds the duration of the shift (working day);

- the first, if several or only one flights are made during a shift (working day).

Thus, the validity period of a taxi waybill is tied to the shift (working day). This means that it should be completed not only daily, but also in shifts. If the transport is not served by a single driver, then each driver is issued his own waybill (clause 11 of the appendix to order No. 152). The last requirement is a prerequisite for ensuring the correctness of taxation of waybill data. Each sheet reflects the working conditions of a particular driver, allowing you to check:

- time spent on the work itself, downtime, repairs;

- the presence of fault in downtime and unfulfilled flights;

- the correctness of entering data about each of the flights carried out;

- correct fuel consumption and display of fuel readings.

The specified information is taken into account when calculating the driver’s salary, and data on consumed fuel serves as the basis for attributing fuel costs to expenses.

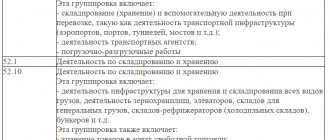

What are the alternative solutions? Is it possible to save money?

Can! Using the MOBIKA cash service, which allows you to use 1 cash register for 100 or more cars. The technology is simple:

- The cash register is installed in the office (or garage) of the company, where it will be most convenient. The only thing you need is a constantly working communication channel to the Internet. If it is not possible to install a cash register in the office, then the cash register can be rented (1800 rubles/month).

- install the “MOBIKA - mobile cash register” software on the driver’s smartphone

- install a mobile printer in your car (average cost from 5 thousand rubles)

A small calculation for a taxi fleet of 50 cars that decided to use the MOBIKA cash service:

- Monthly payment:

- 1,800 rubles - rent of 1 cash register Oblako-1F

- 20,000 rubles/month - cost of a license for Mobika software (400 * 50 machines)

- One-time purchase:

- 7,000 rubles - fiscal accumulator, for 15 or 36 months in accordance with the requirements of the law, in the future the FN is changed free of charge.

- 250,000 rubles - mobile printer (5000 rubles * 50 machines)

And let’s compare the cost of using standard mobile cash registers:

- 1,500,000 rubles (average cost of a mobile cash register 30,000 * 50 cars)

- 350,000 rubles - Fiscal drives, 50 pcs.

- 40,000 rubles - Monthly maintenance of mobile cash registers.