Recently adopted changes in the rules for the use of cash register equipment entail additional requirements for cash receipts and strict reporting forms. This is logical, since a new link has appeared in the chain of interaction between entrepreneurs and the tax office - the fiscal data operator. Therefore, the OFD data to which the seller-user of the online cash register is connected is included in the mandatory details of the BSO and cash receipt in 2021. And since changes in legislation are aimed at increasing business transparency, in addition to the date and time of purchase, the place of payment and many other parameters appear in the documents.

Switching to online cash registers is not just about buying new cash register equipment. To register a cash register with the tax office, you will have to connect to the OFD. Product names are now required on receipts, so you need a cash register program. From us you can purchase a complete solution: cash register with financial tax, CFD for a year and a cash program.

There are no unified forms for new details in online cash register receipts and strict reporting forms, but they must contain certain data. This is data that was added with the entry into force of law 54-FZ. Here are the new details in online cash register receipts:

- The taxation system used by the organization.

- Settlement indicator: sale/return.

- Serial number of the fiscal drive.

- Serial number of fiscal data.

- Fiscal data sign.

- List of purchased goods with cost, price and applied discounts.

- VAT for each item.

- Serial number of the fiscal drive.

- Fiscal document number.

- Fiscal data transfer code.

- VAT amount and tax rate.

- Title OFD.

- OFD website address.

- QR code, which serves as an additional verification of the authenticity of the check.

At the same time, the law does not include a QR code in the list of mandatory details of an online cash register receipt, however, in the section of requirements for cash register equipment it is stated that the cash register must “provide the ability to print a two-dimensional bar code (QR) on a cash receipt (strict reporting form) - code with a size of at least 20X20 mm), containing in encoded form the details of verifying a cash receipt or a strict reporting form in a separate dedicated area of a cash receipt or a strict reporting form.” Thus, there may well not be a QR code on new online cash register receipts, but online cash registers must be able to print it.

What should be encrypted in the QR code on a cash receipt according to the new rules? The law says that it must contain information about the purchase (date and time of payment, serial number of the fiscal document, payment attribute, settlement amount, serial number of the fiscal drive, fiscal attribute of the document).

The strict reporting form receives the status of a check

A strict reporting form is a primary accounting document, equivalent to a cash receipt, generated in electronic form and (or) printed using an automated system for strict reporting forms at the time of settlement with the client (Article 1.1 of Law No. 54-FZ).

To print and generate electronic BSOs, you need to use a type of cash register equipment - an automated system for strict reporting forms.

An automated system for strict reporting forms is a cash register technology used to generate strict reporting forms in electronic form, as well as print them on paper (Article 1.1 of Law No. 54-FZ).

So, from July 1, 2021, BSOs in electronic and paper form are generated at the time of settlement with the buyer. To do this, by this date it will be necessary to modernize the currently available automated payment systems. They need to be brought into compliance with the requirements of Law No. 54-FZ for CCP:

— the system must be equipped with a fiscal storage device; - have an Internet connection; — be able to interact with the fiscal data operator; — transfer electronic BSO to the subscriber number and e-mail of the buyer (in the first case it is mandatory, in the second case - if technically possible); — be able to print a QR code that contains BSO verification details.

Formation rules

When working with BSO, the same rules as when generating a cash receipt:

- BSO is issued at the time of settlement;

- if the client left an email address or subscriber number, the document can be sent to him electronically and not printed;

- if payment for services occurs remotely, you can create a BSO no later than the next day.

These are general rules, but there are some exceptions :

- Payments outside the office . When providing services to clients on the road, you don’t have to take a mobile cash register with you to print the BSO, but rather generate forms on a remote device. The document can be sent to the client in electronic form if he provides a phone number or email. Alternatively, you can show him a QR code, which he reads on his mobile devices.

- Payments through automatic machines . You can use a cash register installed outside the device, including remotely, for example, in the office. You need to knock out a check or BSO at the time of settlement, but it is not necessary to issue or send it to the client. But from February 1, 2021, the device must be equipped with a display on which the QR code of the receipt or BSO will be broadcast. The client will be able to scan it with his smartphone and receive the document through the Federal Tax Service service.

- Calculations in transport . When selling tickets, it is not necessary to immediately issue a BSO or a cash receipt to the client. Instead, you can issue a paper ticket, on which certain details will be indicated. Using them, the client will be able to find a fiscal document on the OFD or Federal Tax Service website and keep it for himself. A check or BSO must be generated on the day of settlement. All other methods of transmission are also permitted - sending an electronic BSO, a check or information that will allow it to be identified by e-mail (phone number), as well as providing a QR code for scanning.

- Public utilities . When accepting payment for utilities and major repairs by non-cash payment, by default a check or BSO need not be sent to the client. To receive it, he must make a written request. This must be done within 3 months after settlement. If payment is made in cash or by bank card with presentation, then a check or BSO must be issued immediately.

- Housing and communal services, communications and other services with advance payment . To offset or return an advance, you can generate one check or BSO per billing period, for example, per week, per decade or per month (this is the maximum period). This must be done no later than 10 calendar days after this period ends.

Let us remind you that in accordance with Law 129-FZ of June 6, 2019, a deferment was provided for the use of online cash registers for entrepreneurs in the service sector . They have the right not to print checks or form BSO for another 2 years if they do not have employees. In addition, some services are completely exempt from the use of cash registers. You can find them in Article 2 of Law 54-FZ.

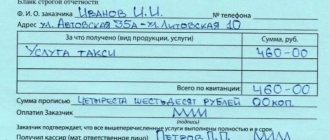

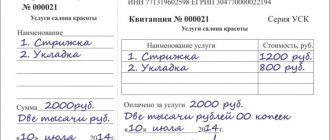

BSO details

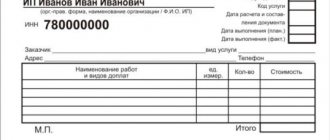

Like new checks, the BSO must contain the mandatory details listed in paragraph 1 of Article 4.7 of Law No. 54-FZ:

— Name of the document, serial number for the shift, shift number. — Date, time, place of payment (address/website/vehicle number). — Name (full name), taxpayer identification number. — Taxation system. — Calculation indicator (receipt/expense, return of receipt/expense). — Name of goods/services, quantity, unit price, cost, total amount, VAT rate/amount. — Payment form (cash/card) and payment amount. — Position and surname of the cashier. — Registration number of the cash register (or automated system for BSO), fiscal storage number, serial number of the device for payments, fiscal sign of the document. — Address of the check verification service. — Phone number or e-mail for sending an electronic receipt to the buyer. Seller's email.

The only exception is established for individual individual entrepreneurs - users of special regimes regarding the range of goods and services. Thus, individual entrepreneurs on the simplified tax system, UTII, PSN, Unified Agricultural Tax have the right not to print on the BSO the name of the product (work, service), as well as their quantity, until February 1, 2021 (Clause 1, Article 4.7 of Law No. 54-FZ).

The strict reporting form may contain additional details taking into account the specifics of the organization’s field of activity (for example, contract number, customer details).

Which BSOs are allowed from July 1, 2019

Companies and individual entrepreneurs providing services to the public can choose to form:

- regular cash register receipts;

- strict reporting forms on the automated BSO system.

After July 1, 2021, old-style automated systems were banned. Now the document can only be generated on the so-called BSO-KKT . However, today there is no such equipment in the register of the Tax Service.

How to create forms? Everything is very simple - any cash register that has the letter “F” in its name . When registering with the Federal Tax Service, you must indicate that this CCP will be used for services. Then at this cash desk you can generate BSOs like regular checks. After setting up the cash register to print these forms, you will not be able to issue receipts for goods on it.

Nomenclature details

Companies are wondering whether it is necessary to print all the names of goods, because there can be a lot of them. The answer is yes, absolutely all names of goods and services that the buyer pays for must be reflected in the BSO.

We will allow only one scenario, when a receipt or BSO may not fully detail all goods and services. The fact is that in Russia there is no unified nomenclature of goods and services. Therefore, if, for example, an organization sells gift sets that include a large number of items, they can be called “Set 1”, “Set 2” and so on. However, such names may attract the attention of tax inspectors who will want to figure out what these sets represent.

How to correct an error on a cash receipt

To correct an error in a check, a correction cash receipt (CSR) is generated. It must be completed no later than the shift closing report. In what cases it is necessary to issue a correction check (BSO), is determined by the Law on Cash Register as amended by Federal Law No. 192-FZ dated July 3, 2018 (Clause 4, Article 4.3 of Law No. 54-FZ). It consists of:

- when calculating without cash register,

- if the CCT was used in violation of the law.

Let us recall that before Law No. 192-FZ came into force, it was believed that a correction check was only used to post revenue at the cash register that was not reflected earlier (for example, if you forgot to punch a check or punched it for a smaller amount). Moreover, the procedure for correcting errors in a cash receipt depends on what format of fiscal documents the company uses (letter of the Federal Tax Service of Russia dated August 6, 2018 No. ED-4-20 / [email protected] ).

For example, if you are using the fiscal document format (FFD) version 1.1, correct the error in the check by generating a correction check. Moreover, you are not obliged to generate a correction check on the same cash register on which the erroneous calculation was made.

The correction check must contain enough information so that tax authorities can identify the calculation for which you are making the correction. For example, you need to indicate the fiscal indicator of an incorrectly formed document.

If you are generating a correction check for a settlement for which the check was not punched, in addition to the required details of the correction check itself, indicate the details of the “unpunched” settlement. In particular, the settlement date, name of the product (work, service), settlement address, and others.

If you are using FFD version 1.05, then when correcting an error in a previously punched check, do not generate a correction check. For example, to correct a check with the “receipt” attribute, first generate exactly the same check, but with the “receipt return” attribute. Indicate in it the fiscal indicator of an incorrect check. After this, generate a new correct receipt for receipt.

Please note: each amount that needs to be corrected must be indicated on a separate line on the adjustment check.

If you do make an adjustment to the total amount, in addition to the corrective cash receipts, send to the Federal Tax Service information and documents sufficient to identify each calculation. This must be done to avoid an administrative fine.

Responsibility for violation of the settlement procedure

Failure to issue a BSO to a buyer or client from January 1, 2021 may result in a fine. Its size depends on the amount of the settlement for which the BSO was not issued. Thus, an employee who has not completed and transferred the BSO to the client may be fined up to 50% of the amount of the calculation itself, but not less than 10,000 rubles. The fine for legal entities is higher - up to the full settlement amount, but not less than 30,000 rubles (Clause 2 of Article 14.5 of the Administrative Code of the Russian Federation). Repeated violation entails even more serious sanctions from the Federal Tax Service, up to and including suspension of the organization’s activities (clause 3 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

The use of the BSO form or automated systems for generating forms that do not comply with the requirements of Law No. 54-FZ is recognized as a violation from July 1, 2021. It entails a warning or fine in the amount of 1,500 - 3,000 rubles for employees, or a warning or fine in the amount of 5,000 - 10,000 rubles for legal entities. The same sanctions can be applied if the BSO is not transferred to the Federal Tax Service through the fiscal data operator (clause 4 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

It is important to note that, as in the case of cash receipts, the buyer may request that the BSO be sent electronically to his email address or via SMS. Failure to send such an electronic BSO may result in a warning or a fine of up to 10,000 rubles (clause 6 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

Source kontur.ru

What products are subject to mandatory labeling?

Product marking is a barcode that is applied to a fabric or paper label. This barcode is read by a special device or software application on a smartphone. Thus, the buyer receives complete information about the product: country of origin, manufacturing company, production date, expiration date and other information. And the state Regulatory acts for accountants No. 5, March 5, 2021 75 CASH CONTROL EQUIPMENT

can detect counterfeit products. For selling goods without labeling, the company faces a fine of 50,000 to 300,000 rubles and confiscation of these goods. In case of sale of tobacco products without labeling, the minimum fine will be 4 times larger, that is, 200,000 rubles.

A product code or a unique number of a product instance is an identification code that is provided for by Federal Law No. 381-FZ of December 28, 2009. The list of groups of goods for which mandatory labeling by means of identification will be introduced in 2019 was approved by Decree of the Government of Russia dated April 28, 2018 No. 792-r.

For tobacco and tobacco products, labeling will be introduced from March 1, 2019, for shoes from July 1, 2021. The remaining groups of goods from the list will be labeled from December 2021:

- bed linen, table linen, toilet linen and kitchen linen;

- leather clothing (including work clothes);

- outerwear for men, women and children (coats, jackets, raincoats, etc.);

- women's blouses, blouses and blouses (knitted and knitted);

- cameras, flashes and flash lamps;

- new pneumatic rubber tires and tires;

- perfumes and eau de toilette.

After three months after the introduction of mandatory labeling, the “product code” attribute must appear in cash register receipts and BSO.

In the “product code” detail you will need to indicate a special identification code.

Cash registers as before

Until 2021, the procedure for working with strict reporting forms (SSR) for cash settlements with individuals was determined by the Decree of the Government of the Russian Federation “On the procedure for making cash payments...” dated 05/06/2008 No. 359. In accordance with it and the previously valid version of the law “On the use of cash registers” ..." dated March 25, 2003 No. 54-FZ, entrepreneurs and legal entities could issue BSO instead of cash receipts when receiving money from the population for services rendered.

There were two options for manufacturing BSO - printing and printing using automated systems (clause 4 of resolution 359). The forms were stored in a safe (or metal cabinet) and recorded in a special journal. In addition, copies or BSO counterfoils confirming the receipt of money and the amount of receipt had to be kept for 5 years.

If an automated system was used to print the BSO, then it was not required to register it with the tax office. But the taxpayer was obliged to provide tax authorities with information from this system upon request.