Money is the most liquid part of operating assets and represents money on hand, as well as in settlement, current, currency, deposit and special accounts. The main source of data on their movements is Form No. 4 of the accounting report Cash Flow Report in 1C, which provides the ability to maintain analytical accounting in the context of DDS items. Cash flow items in 1C are additional analytics (subconto) for some accounting accounts, for example, accounts 50/Cash and 51/Settlement accounts.

Another source of information about the movement of money is the management report “Cash Flow Analysis”. To generate a cash flow tax form or such a report, you need to set up cash flow items in 1C 8 (set up DDS items in the “DDS Items” directory). Its correct maintenance and timely completion of the required DDS items in the relevant documents of the “Bank and Cash Office” section is the key to the correctness of the report, which in turn will support the correctness of budgeting and treasury operations in 1C.

Free consultation with an expert on treasury automation based on 1C

So, let's look at the tools for maintaining records in the context of DDS in the 1C Enterprise Accounting 8.3 program.

Setting up a chart of accounts

To work with the directory of articles, you must first complete the settings, which are located in the section “Administration/Accounting parameters/Setting up the chart of accounts/Accounting for DDS: By account and DDS items” or in the section “Main/Chart of accounts/Setting up the chart of accounts”.

Fig.1 Setting up DDS accounting by item

Setting up treasury in any 1C programs for your business processes

Procedure for compiling BDDS

BDDS answers the question about changes in the financial position of the organization, presenting the said change in the context of current, investment and financial activities.

As you know, ODDS can be compiled by direct or indirect method. At the same time, the direct method is most suitable for planning problems, the indirect method - for analysis problems. This is why the BDDS is usually compiled using the direct method.

The technology for forming BDDS is quite simple. First, the data of the income and payment plan for current activities is filled in (at large planning intervals it is close to the income and expenditure plan of the BDS), then the investment budget is added, and based on the resulting excess or deficit of money, finally, the financial section of the BDS is compiled. The financial section must ensure a minimum balance of money (balance) throughout the entire planning period, for which the BDDS is divided into smaller time intervals.

Form No. 4 “Cash Flow Statement”

Accounting statements for the year using the fourth form can be generated in the section “Manager/Monitor of taxes and reporting/Accounting statements”.

Fig.6 ODDS form

When creating a report form, the monetary amounts registered by item will be attributed to one or another type of movement of assets, depending on the items specified when posting the relevant documents.

Let's demonstrate the above with an example. Let’s assume that through “Receipts to account” under the movement item “Receipts from the sale of products and goods, performance of work, provision of services” a payment from the buyer was recorded in the amount of 102,135.00 rubles, including VAT of 15,579.92 rubles.

Fig.7 Details “DDS Article” of the document “Receipt on account”

In the setting of the article we are considering, the type of movement of the same name is indicated.

Fig.8 Setting up the item sales receipts

Thus, the registered payment from the buyer under the DDS article with the type of movement “Receipts from the sale of products and goods, performance of work, provision of services” on form No. 4 of the report will be included in the total amount on line 4111 “Receipts from the sale...”.

Fig.9 Payment from the buyer in ODDS

Decoding line 4111 allows you to see the components of the total amount for this line. In our example, the final amount of 87 thousand rubles was obtained as the difference between the amount of payment from the buyer of 102,135.00 rubles and VAT of 15,579.92 rubles (86,555.08 ~ 87 thousand rubles).

Fig. 10 Explanation for line 4111 “Proceeds from the sale...”

How to check the report?

You can check the obtained figures using the balance sheet of accounts 51 and 50. (Fig.3)

Fig.3

As we can see, the data does not converge. According to form No. 4, the total amount is 267 thousand rubles, and in the balance sheet the total amount is much higher - 731 thousand rubles. What's the matter? The reason is that the amount is 450,000 rubles. posted without indicating the DDS article (Fig. 4).

Fig.4

Thus, correct completion of DDS articles is a guarantee of correct cash flow reporting.

However, DDS items can be used not only for regulated reporting, but also to control the cash flows of an enterprise.

In Fig. 5 we see a directory of DDS articles presented in the form of a tree. Several articles with the same type of movement are combined into groups and subgroups. This grouping allows you to obtain and compare totals for different types of business activities.

Fig.5

A summary report for groups of articles can be seen in Fig. 6.

Fig.6

The report settings are shown in Fig. 7.

Fig.7

Cash flow analysis report

This management analytics is available to “Manager/Cash”.

In order for the information in the report to be grouped by DDS items, you should select the “Cash flow item” checkbox in the report settings on the “Grouping” tab. The report settings are hidden under the “Show settings” function button.

Fig. 11 Report “Analysis of cash flows”

Fig.12 Report settings

Cash flow accounting programs - minimizing the occurrence of cash gaps and ensuring the effective use of cash flows

PRO filling in the details “DDS Article” in payment documents

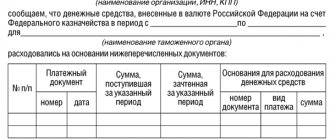

The detail “DDS Article” (Cash Flow Item) is present in all payment documents reflecting the cash flow in a government institution. The cash flow item is used to maintain analytical accounting in the accounts of section 1000 “Cash and cash equivalents”.

Such accounting is one of the requirements for automatically filling out the reports “Summary report on expenses according to budget classification (Form 4-20)”, “Card of analytical accounting of planned assignments (form 294-a)”, as well as forms of regulated reporting “Report on movement money in the accounts of government agencies by funding sources. Form 3".

In this regard, the details “DDS Article” are required to be filled out for all payment documents reflecting the movement of money both at the cash desk and in the current accounts of the institution.

In order for this detail to be filled in automatically, it is possible to configure the filling of the cash flow item for each type of payment document and type of transaction of the document. The setup is carried out using the information register “DDS items in payment documents”. You can go to the information register through the menu “Treasury\Bank – Cash flow items – DDS items in payment documents”.

This register is intended for the initial installation of cash flow items, which will subsequently be automatically filled in payment documents depending on the type of transaction of the payment document.

Each entry in this register contains the following information:

- Organization;

- Document (name of payment document);

- Type of transaction of the payment document;

- Cash flow item.

If the organization is not filled in, the setting will apply to all organizations. If the operation type is not filled in, the specified setting will be applied to all operations in the document.

When determining a cash flow item for substitution in documents, the priorities of the settings are distributed as follows:

- Priority 1 (highest): The organization is full. The operation type is complete.

- 2nd priority: Organization is full. The transaction type is not filled in.

- 3 priority: Organization is not full. The operation type is complete.

- 4th priority: Organization is not full. The transaction type is not filled in.

Thus, for each payment document in the context of its types of transactions, it is possible to establish cash flow items, which will subsequently be automatically inserted into the documents, which will significantly increase the speed of document processing, and will also reduce the number of errors when filling out reports.

Payment schedule

Cash flow occurs constantly, which forces us to optimize cash flow every day. The most successful way to manage payments, according to general opinion, is a payment calendar. As an operational management tool, the payment calendar brings BDDS indicators to life. The payment calendar is compiled for a month, decade, week, day. The payment calendar is easily automated and is a common way of interaction within an organization.

The payment calendar in the process of its execution from the budget document becomes reporting due to the transformation of planned indicators into actual data. In the payment calendar, BDDS items are detailed down to specific transactions, indicating the amount, counterparty and term. The payment calendar is a tool for controlling “cash gaps”, to prevent which payments are either postponed, or efforts are made to collect revenue, or loans are attracted. A universal tool for covering “cash gaps” is an overdraft – a bank loan to cover the lack of funds in a current account.

The payment calendar improves the quality of operational financial management, which is expressed in solving the following tasks:

- formation of a unified payment base;

- planning cash flows for a period from one day to one month;

- ensuring liquidity;

- smoothing out cash flow fluctuations;

- determination of needs for short-term loans;

- determining the possibilities of placing temporarily available funds on short-term deposits;

- determining the priority of payments in case of cash shortages;

- presenting a picture of liquidity for interested users;

- using the payment calendar as an interface for interaction between services and employees;

- increasing the transparency of monetary transactions;

- reduction of decision-making time.

Cash flow budget structure

Structurally, the BDDS consists of the following sections:

- cash balances;

- cash flow from core activities;

- cash flows from investing activities;

- cash flows from financing activities.

Current activities reveal the monetary content of profits, investment activities show the trend in the long-term development of the organization, financial activities reflect the organization’s ability to attract money from outside.

Cash balances

. The planned amount of the cash balance at the beginning and at the end of the period, on the one hand, should be positive (preventing cash gaps), on the other hand, should not be excessive (preventing the “death” of funds in current accounts). That is, the cash balance should be optimal, without a deficit or surplus.

Organizations independently decide which indicators to include in cash. In addition to traditional balances on current accounts and cash registers, funds in transit and accountable amounts can be included in the amount of money. It is also useful to supplement the form with background information reflecting off-balance sheet liquidity, in other words, the organization’s ability to raise funds without concluding new agreements (open but unused limits on credit lines and overdrafts).

Section “Operational Activities”

. Current activity is the activity of an organization pursuing profit as its main goal. Funds received from buyers, customers, as well as funds used to pay for purchased goods, are indicated together with VAT.

Typically, interest expenses are related to current activities, and the repayment of previously received loans and borrowings are classified as financial expenses. You can choose a different classification by including interest expenses in the financial section of the BDDS.

Net cash

from current activities show the difference between money received and spent as a result of current activities. It is important that over long periods of time the organization demonstrates its ability to generate cash flow from its core activities.

Section “Investment activities”

. Investment activity is the activity of an organization related to the acquisition and sale of non-current assets (real estate for own needs, equipment, intangible assets), the implementation of its own construction, and the implementation of financial investments (purchase of securities, contributions to authorized capital, provision of loans to other organizations).

The line “Net cash from investing activities” reflects the difference between the money received and spent on investment activities. As a rule, a developing organization is characterized by a negative result in investment activities. This suggests that the funds are being allocated to new projects and the organization has no intention of winding down its business.

Section “Financial activities”

. Financial activity is considered to be the activity of an organization, as a result of which the size and composition of the organization’s equity capital and borrowed funds change (receipts from the issue of shares, bonds, the provision of loans and borrowings by other organizations, repayment of borrowed funds, etc.). This section shows the organization’s ability to attract resources for its development in external markets and demonstrates in numerical format the presence of a credit of trust on the part of lenders.

Net cash from financing activities

– the difference between the money that was received and the money that was spent on financial activities. As a rule, the result from financial activities is derived from the sum of the results from core and investing activities. Lack or excess of liquidity is regulated by attracting or repaying loans.

It is this section that the financial service directly works with. The main task of the BDDS is to provide such an amount of funds that would guarantee the timely fulfillment of the organization’s obligations. In order to prevent “cash gaps,” loan agreements are being concluded with banks, and it is planned to issue their own securities. In case of excess funds, they are subject to investment, for example, in securities or bank deposits. A competent liquidity management policy allows an organization to gain additional profit due to the effect of the time value of money.

Net increase (decrease) in cash and cash equivalents

– the result of inflows and outflows within all types of activities of the company (current, investment and financial).

An example of filling out the BDDS, taking into account its execution

| Article code | Index | Plan | Fact |

| 1 | Cash balance at the beginning of the period: | 554 | 1 258 |

| 1.1 | on current accounts | 500 | 234 |

| 1.2 | at the box office | 50 | 46 |

| 1.3 | cash on the way | 0 | 966 |

| 1.4 | funds issued on account | 4 | 12 |

| 1.5 | Unused credit lines and overdraft (for reference) | 2 500 | 1 247 |

| Operating activities | |||

| 2 | Receipt of cash from current activities | 175 572 | 159 728 |

| 2.1 | Funds received from buyers and customers | 173 108 | 157 403 |

| 2.2 | Other supply | 2 464 | 2 325 |

| 3 | Cash payments for current activities | -186 007 | -168 245 |

| 3.1 | Payment for purchased goods, works, services, raw materials and other current assets | -134 225 | -118 759 |

| 3.2 | Fare | -917 | -890 |

| 3.3 | Salary | -20 924 | -19 424 |

| 3.4 | Other personnel costs | -1 022 | -1 450 |

| 3.5 | Taxes and fees | -23 373 | -21 832 |

| 3.6 | Administrative expenses | -2 979 | -3 672 |

| 3.7 | Business expenses | -1 640 | -1 244 |

| 3.8 | Marketing expenses | -840 | -904 |

| 3.9 | other expenses | -87 | -70 |

| Net cash from current operations | -10 435 | -8 577 | |

| Investment activities | |||

| 4 | Receipts from investment activities | 268 | 107 |

| 4.1 | Proceeds from the sale of fixed assets and other non-current assets | 215 | 105 |

| 4.2 | Proceeds from the sale of securities and other financial investments | 0 | 0 |

| 4.3 | Dividends received | 3 | 2 |

| 4.4 | Interest received | 0 | 0 |

| 4.5 | Proceeds from repayment of loans provided to other organizations | 50 | 0 |

| 5 | Payments for investment activities | -1 686 | -945 |

| 5.1 | Acquisition of fixed assets, profitable investments in tangible investments and other intangible assets | -1 636 | -945 |

| 5.2 | Purchase of securities and other financial investments | 0 | 0 |

| 5.3 | Loans provided to other organizations | 50 | 0 |

| Net cash from investing activities | -1 418 | -838 | |

| Financial activities | |||

| 6 | Income from financial activities | 15 757 | 11 749 |

| 6.1 | Proceeds from the issue of shares and other equity securities | ||

| 6.2 | Proceeds from loans and credits provided by other organizations | 15 757 | 11 749 |

| 7 | Payments for financial activities | -4 140 | -2 312 |

| 7.1 | Repayment of loans and credits (no interest) | -1 955 | -600 |

| 7.2 | Payment of dividends, interest | -2 185 | -1 712 |

| Net cash from financing activities | 11 617 | 9 437 | |

| Net increase (decrease) in cash and cash equivalents | -236 | 82 | |

| 8 | Cash balance at the end of the period: | 318 | 1 340 |

| 8.1 | on current accounts | 300 | 964 |

| 8.2 | at the box office | 17 | 281 |

| 8.3 | cash on the way | 0 | 91 |

| 8.4 | funds issued on account | 1 | 4 |

| 8.5 | Unused credit lines and overdraft (for reference) | 2 500 | 1 942 |

Analysis of BDDS implementation

BDDS is intended primarily for managing liquidity and solvency. With its help, you can determine and analyze the following cash flow parameters:

- sources of money;

- main areas of spending money;

- need for external financing;

- level of solvency and liquidity;

- sufficiency of fund balances at budget dates.

As a rule, indicators are not calculated based on BDDS or ODDS, but logical conclusions from their consideration are used. Is the cash flow generated from core activities sufficient for the development of the organization? Is there inflow from current activities? What activities bring in the greatest cash flow? Where is the inflow from current activities directed: to purchase long-term assets or to repay loans? Does the organization create cash reserves (in the form of deposits, securities) in case of a decrease in liquidity? Can the organization attract loans and borrowings without problems?

In order to answer the question of whether the organization receives enough money from current activities, it is necessary to compare the inflow from current activities with the profit from the income statement. This problem is solved by the ODDS, compiled by the indirect method, in which from the “net profit” indicator, through adjustments, they move to the “inflow from core activities” indicator.