As follows from the provisions of Article 168 of the Tax Code, the seller of goods, works or services, if he applies the general taxation system and is a VAT payer, is obliged to issue invoices in the name of his buyer for goods shipped, work performed or services rendered. A similar obligation arises when receiving an advance payment - full or partial - for upcoming deliveries. In both cases, a 5-day period is given for issuing the document.

At the same time, anything can happen in business, and the shipped goods may be partially not accepted by the buyer, the total volume of work or services is reduced at the time of their acceptance, and the payer may request the advance received back, for example, by refusing the transaction. In this case, the originally executed document will lose its relevance, since it will simply contain incorrect data. An adjustment invoice will be a kind of replacement for it. Its design, as well as the reflection of this situation in accounting, will be discussed in our article.

Adjustment invoice for decrease or increase

The Tax Code provides for four cases where an obligation arises when it is necessary to issue an adjustment invoice from the seller. This is a change in the price of goods, works or services specified in the original document, a change in their quantity, simultaneous adjustments in both price and quantity, or the return of part of the goods from a buyer who is not a VAT payer.

If such changes occurred within 5 days from the date of initial shipment, and the original invoice has not yet been issued, then there is no need to issue a CSF. You can reflect the agreed changes in a regular invoice, because the deadline for its execution has not yet been violated. If, after shipment, a more impressive period of time has passed, and the buyer has already received all the required paperwork for the transaction, then paragraph 3 of the same Article 168 of the Tax Code prescribes issuing an adjustment invoice also within 5 days from the date of execution of the primary documentation on the basis of which the data changes are happening. The calculation is made from the date of registration, for example, of a new invoice or an additional agreement that changes the volume or cost of work, or provides a discount.

An adjustment invoice is not a document replacing the original invoice. This is a kind of annex to it, which reflects only changes. Its form, like the form of a regular document, was approved by Decree of the Government of the Russian Federation of the Government of the Russian Federation of December 26, 2011 No. 1137.

The CSF is also drawn up in two copies - for the seller and for the buyer. Indicate in detail the data for each transferred item of goods, works or services, the price or quantity of which has been changed. Moreover, the data is indicated in the context of changes, that is, the previous information about the cost or quantity is recorded, and its new, current version. The cost of goods, works or services, as well as the amount of tax on them before and after the changes agreed upon by the parties to the transaction, are separately summed up.

The seller has the right to make a consolidated adjustment, that is, to combine in one invoice data on changed items from different documents, if initially these items were billed at the same price, and changes in them occurred either in terms of quantity or at the same price same delta in price.

Six major changes to invoices

Added product type code

Column 1a “Product type code” was added to the invoice. A similar column appeared in the adjustment invoice under number 1b. The column must be filled out in accordance with the unified product nomenclature of foreign economic activity of the EAEU (Appendix to the Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54).

The codes are grouped into sections by type of activity, 21 sections in total. These columns 1a are not filled in by all taxpayers, but only by exporters who export goods from the Russian Federation to the territory of the EAEU countries.

Who will sign the invoice?

An individual entrepreneur (IP) now has the right to sign an invoice not only personally, he can delegate the corresponding authority to another person. To do this, you need to issue a notarized power of attorney. Let us recall that the corresponding norm has existed in the Tax Code of the Russian Federation since 2014, and now it has simply been included in the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

How to specify the counterparty's address

Addresses of counterparties are indicated according to the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, and not by location, as was before. The address according to the Unified State Register of Legal Entities can be found by ordering an extract, for example, on the Federal Tax Service website egrul.nalog.ru. However, an error in the address should not be a reason for refusing a VAT deduction. Inspectors can identify counterparties by TIN and other details. This position was conveyed in letters of the Ministry of Finance of Russia dated April 2, 2015 No. 03-07-09/18318, dated November 15, 2017 No. 03-07-09/75380.

Where is the adjustment invoice reflected for decrease and increase?

Issuing an adjustment invoice does not lead to the need to clarify an already filed VAT return, regardless of the tax period - in this case, the quarter in which the relevant changes were agreed upon.

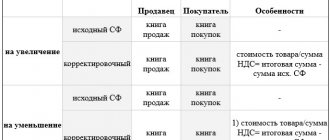

The supplier's sales book does not reflect the adjustment invoice for the reduction. In this case, if there is a decrease in the total amount of the sale and the tax on it, then the CSF is reflected in the seller’s purchase book in the period in which the adjustment document was drawn up. On this basis, the right to deduct VAT arises. Conversely, if the totals of the original invoice were increased, then an additional entry is made in the sales ledger and tax must be paid additionally.

For the second party to the transaction, the situation is exactly the opposite. An adjustment invoice for a reduction from the buyer is reflected in the sales book; as a result, the amount of tax previously accepted for deduction must be restored. If the transaction price has increased, this is recorded in the purchase book and the buyer is entitled to an additional deduction. Both entries are also made in the quarter in which the supplier issued an adjustment invoice for a decrease or increase.

It is also worth noting that in cases where the seller or buyer has the right to deduct VAT, it is not necessary to realize it exactly in the quarter in which the adjustment invoice was issued. Such deductions can be applied within three years from the date of drawing up such a document (Clause 10, Article 172 of the Tax Code of the Russian Federation), and without reference to the time of initial shipment.

How to enter entries for adjustment invoices in the purchase and sales books

In the purchase book, one or another party to the transaction (depending on the above circumstances, changes in its key conditions) records in the columns:

- No. 2 - code 18;

- No. 3 - data copied from line 1b of the adjustment;

- No. 5 - data copied from line 1 of the adjustment;

- No. 15 - data copied from column 9 of the adjustment for the indicator “Sum of lines B” (increase in delivery cost) or for the indicator “Sum of lines D” (decrease in delivery cost);

- No. 16 - data copied from column 8 of the adjustment for the indicator “Sum of lines B” (increase in cost) or for the indicator “Sum of lines D” (decrease in cost).

When reflecting an adjustment invoice in the sales book, the seller or buyer records in the columns:

- No. 2 - code 18;

- No. 3 - data copied from line 1b of the adjustment account;

- No. 5 - data copied from line 1 of the adjustment;

- No. 13b - data copied from column 9 of the adjustment for the indicator “Sum of lines B” (if the cost of delivery increases) or for the indicator “Sum of lines D” of the adjustment (if the cost of delivery decreases);

- No. 14 - data copied from column 5 according to the indicator “Sum of lines B” (if the cost increases) or according to the indicator “Sum of lines D” of the adjustment (if the cost decreases);

- No. 17 - data copied from column 8 according to the indicator “Sum of lines B” (if the cost increases) or according to the indicator “Sum of lines D” of the adjustment (if the cost decreases).

According to other principles, corrected invoices are recorded in the books of sales and purchases, which are filled out by the parties to the transaction.

How to reflect an adjustment invoice for a decrease in accounting

A change in the amount of tax billed upon initial shipment will entail the need for adjustments, including in accounting.

We will not dwell on situations with an increase in the sales amount: this is, in general, a standard situation in which, on the date of drawing up the adjustment invoice, the seller makes additional entries for the accrued VAT, and the buyer – for the deductible VAT.

In this case, it is worth dwelling on the question of how to carry out an adjustment invoice for a reduction. If the total amounts in the FSC turn out to be less than the initial ones, then the entries previously recorded in the accounting records must also be adjusted.

In this case, the seller will record the following entries in his accounting:

- REVERSE Debit 62 - Credit 90.1 - sales revenue is reduced by the agreed difference in the cost of goods, work or services;

- REVERSE Debit 90.3 - Credit 68 - accepted for deduction of VAT in the amount of the difference between the original and adjustment invoices

The buyer, after receiving the adjustment invoice for the reduction, will have the following postings:

- REVERSE Debit 20 - Credit 60 - the amount of debt to the supplier has been reduced;

- REVERSE Debit 19 - Credit 60 - reflects the difference in VAT on the original and adjustment invoices;

- Debit 19 – Credit 68 – the difference amount previously accepted for VAT deduction was restored.

Sales of goods

Complete the document Sales (act, invoice) transaction type Goods (invoice) .

Postings

Cost adjustment

Complete the document Adjustment of sales based on the document Sales (act, invoice) .

Please pay attention to filling out the fields:

- Type of operation - Adjustment by agreement of the parties , since the cost decreased due to the use of a retro discount, and not due to incorrectly issued documents;

- Reflect the adjustment - In all sections of accounting , since changes in value are reflected not only according to VAT, but also in accounting and tax accounting.

Products tab will be filled with automatically sold products for which you need to change the line amount after the change .

Postings

Exhibition of KSF

Create a CSF using the Write adjustment invoice .

Acceptance of VAT for deduction

Accept VAT for deduction using the document Generating Purchase Ledger Entries in the Operations - Period Closing - Regular VAT Operations section. To automatically fill out the Reducing sales cost , you must use the Fill .

Postings

See also How to protect yourself from accidental adjustments in closed periods

Adjustment invoice and income tax

VAT payers, as is known, apply the general taxation system, and, therefore, are also payers of income tax (if we are talking, of course, about organizations). A change in the price of a product or its quantity also leads to a change in the tax base for this tax, which in most cases is determined on the basis of shipment, and is also calculated by companies on a quarterly basis.

Such changes, however, are reflected in tax accounting not according to the compiled adjustment invoice, but on the basis of new data in primary documents - invoices or acts. As for the date of making such amendments, here again the period in which documents with a new agreed price or with a quantitative change that led to an adjustment to the final value were issued plays a role. If the tax base for previous periods was determined on the basis of originally issued invoices or acts, then it is considered that it was calculated correctly. There is no need to recalculate past tax payments or file an amended return. All changes should be taken into account in the current period on the basis of primary scientific documents (letter of the Ministry of Finance of Russia dated June 29, 2010 No. 03-07-03/110. At the same time, based on the norms of Articles 54 and 81 of the Tax Code in such situations, the taxpayer has the right to adjust earlier submitted an income tax return voluntarily. Of course, in this case he will also have to revise the amount of tax paid.