Unfinished production

If production expenses were incurred during the period, but there was no output (semi-finished products, production services), or it was incomplete, then account 20 is not closed, the value of work in progress (WIP) remains on it and is transferred to the next month. Accounting for work in progress can be configured in the form of the organization’s accounting policy, on the “WIP” tab. The default method is usually “In the absence of release, consider direct expenses as WIP expenses”:

If, in the accounting policy, the WIP accounting method “Using the WIP Inventory” document is selected, then if there is work in progress, it will be necessary to enter the “WIP Inventory” document before closing the month. Here you manually indicate the amounts of work in progress for each item group:

Closing accounts

At the end of the reporting period, the accountant is faced with new tasks related, first of all, to closing the accounts used during the period, as well as calculating the full actual cost of goods released.

To solve them, the 1C program contains a universal tool - “Month Closing”. Its use allows you to determine which regulatory operations, based on the data reflected in the 1C registers, must be carried out at the end of the period. In addition, the program provides algorithms that allow you to carry out the corresponding operations automatically. Just click on the “Close” button.

Upon completion of these operations, the accountant can generate reference and analytical documents, for example:

- certificate of calculation of direct costs in the cost of production;

- certificate of cost calculation (which will reflect the distribution of indirect costs).

Examples of direct production costs

The “Requirement-invoice” document (menu or “Production” tab) reflects the write-off of materials for production. The cost account and analytics are listed on the Cost Account tab. When posting the document, posting Dt 20.01 Kt 10 will be generated, with the corresponding analytics for account 20 (division, item group, cost item).

Method of reflecting depreciation expenses (menu or tab “OS” or “Intangible assets”). If you choose this method when accepting a fixed asset for accounting (accepting intangible assets for accounting, transferring work clothes into operation), then depreciation for this fixed asset (depreciation of intangible assets, repayment of the cost of work clothes) will be assigned to the specified account and cost analytics. In this case, the posting Dt 20.01 Kt 02.01 will be generated.

Method of reflecting wages in accounting (menu or “Salary” tab). If you specify this method in the accrual, the employee’s salary and payroll taxes will be charged to the appropriate account and cost analytics. In this case, when accruing salary, the posting Dt 20.01 Kt 70 will be generated.

At the end of the month, direct expenses collected on accounts 20 and 23 are distributed between manufactured products and work in progress by item groups (types of activity). Distribution occurs through routine month-end closing operations.

In addition, there are general production and general business expenses, which are accounted for in accounts 25 and 26, respectively.

General production expenses during the month are charged to account 25. To reflect them, the same documents can be used as to reflect direct costs. At the end of the month, costs collected on account 25 are distributed to account 20 by item groups (types of activity), within a specific division, in accordance with the distribution base, using routine operations.

General business expenses during the month are charged to account 26. To reflect them, the same documents can be used as to reflect direct costs. At the end of the month, expenses collected on account 26 can be written off in two ways. They can be distributed to account 20 according to item groups (types of activity) of the entire enterprise, in accordance with the selected distribution base. Or, if the “direct costing” method is used, general business expenses are written off directly to account 90.08 “Administrative expenses” in proportion to sales revenue.

Cost accounting is set up in the form of the organization’s accounting policy (menu or “Enterprise” tab).

On the “Production” tab, the methods for distributing general and general production expenses are indicated using the “Set distribution methods...” button. In the form that opens, you need to indicate for each account the distribution base, which can be the volume of output, the planned cost of production, wages, material costs, revenue, direct costs, and individual items of direct costs. If necessary, you can detail the methods of distribution by departments and cost items.

Here you can configure the use of the direct costing method and the distribution of production costs for services.

On the “Product Output” tab, you select the method of accounting for the output of finished products (semi-finished products, production services) - with or without using account 40. Here you must also specify the definition of the sequence of redistributions for closing accounts, which is important for multi-distribution production. It is recommended to select automatic detection. If production is accounted for at planned cost using account 40, then automatic calculation of the sequence of redistributions is impossible. In this case, you need to select the manual method, and then manually set the order of divisions for closing accounts (using the button).

Automatic determination of the sequence of processing steps is set:

A manual determination of the sequence of repartitions has been set, the order of divisions has been established:

Finished products in 1C with examples

Standard documents in 1C 8.3 for reflecting production operations are available in the “Production” section (see the “Product Release” subsection).

Product output is reflected in the “Shift Production Report”. Despite the name, this program object is not a report, but a standard document.

It is first necessary to enter the manufactured products into the “Nomenclature” directory, indicating the type of nomenclature for them – Products. If an organization uses different nomenclature groups to record its activities, you must also fill out the “Nomenclature group” field (by selecting an item from the directory).

An example of accounting for finished products in 1C without account 40

Example 1. A furniture factory produced “Director” tables and “Clerk” tables. The accounting policy prescribes accounting for manufactured products on account 43, without account 40.

- Output. In order to reflect output, we will create a standard document “Production Report for a Shift”. In the “header” details we will indicate the warehouse (if the organization maintains warehouse records) and the cost account. On the “Products” tab, in the rows of the table, we indicate the manufactured products and manually enter their planned price. By default, the accounting account is filled in - 43.

Document 1C will generate accounting entries for accounts Dt 43 Kt 20 for the amount of the planned cost of production.

- Sales of finished products. Registered in the program in a standard way using the standard “Implementation” document.

- Closing the month and adjusting costs. At the end of the period (month), we will perform routine automatic processing “Closing the month” in the program. It will calculate the cost of production based on the amount of actual costs posted to the debit of account 20 for the item group of products (if item groups are not used, costs are calculated as a whole for account 20). Costs usually include the cost of raw materials, wages of production workers, etc. Then the program will adjust the cost of production. To view the postings of this operation, you need to click on the link “Closing accounts 20, 23, 25, 26” in the month closing form and select “Show postings”:

We see that in 1C an accounting entry has been generated that adjusts the cost of production: Dt 43 Kt 20. Moreover, the amount of the entry can be negative, depending on which cost is greater - planned or actual.

If the manufactured products were sold, then during the closing of the period the program also adjusts the cost of its write-off, creating a debit entry in accounting account 90.02 “Cost of sales”:

The program allows you to generate convenient analytical reports and calculations “Calculation of cost” and “Cost of manufactured products”. They are also available in the month closing form (after the closing has been completed) using the link “Closing accounts 20, 23, 25, 26”.

The “Cost Cost Calculation” reflects the costs incurred for each unit of production:

Another calculation certificate - “Cost of manufactured products” - shows the value of the actual cost, the planned one, as well as the deviation of the “fact” from the “plan”:

Results

The 1C program is a universal tool for automating the accounting of production operations. This solution allows a company engaged in the production of products to quickly create the necessary accounting registers within the framework of the adopted accounting policy, conduct the necessary analytics, and create analytical and reference reports.

You can learn more about the use of the 1C program in accounting from the articles:

- “How to generate a SZV-M report in 1C (nuances)?”;

- “The procedure for forming 6-NDFL in the 1C program”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Formation of the document

The hyperlink “Sales of goods and services” is located in the “Sales” menu. When you click on the link, a list of documents will open. You need to click the “Sales” button and select “Goods, services, commission” from the drop-down list. The program will open a window for a new document that needs to be filled out. The header of the document is filled in first.

Note 1

Required fields are underlined with a red dotted line. They must be specified first, all other fields if necessary.

One of the required fields to fill out is “Price Type”. This item is responsible for the price at which the product will be sold. If the counterparty agreement previously specified the price type, then this item will be filled in automatically. If the price type was not previously specified, and the person responsible for filling out the document has rights to edit sales prices, then when creating the table, the price can be specified manually.

Finished works on a similar topic

- Course work Accounting for sales of products, goods and services in 1C 460 rub.

- Abstract Accounting for sales of products, goods and services in 1C 260 rub.

- Test work Accounting for sales of products, goods and services in 1C 190 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Note 2

If the program keeps records of only one organization, then the “Organization” field does not need to be filled in, because the program will simply hide this field. The same situation applies to the warehouse.

After filling out the header of the document, you can proceed to filling out the table. In the tabular part, you can use the “Add” button and fill it out line by line. But then the program will not show the remaining goods in the warehouse. For the convenience of selecting products, it is better to use the “Selection” button. The program will open the “Item Selection” window, where you will see the remaining product that you can select. When selected, the program will ask for the quantity and price of the selected product.

At the bottom of the window, those positions that were selected for transfer are reflected and, using the “Transfer to Document” button, are moved to the document.

To add a service to a document, go to the “Services” tab and click on the “Selection” button. And in the same way, like goods, we move information about quantity and cost into the document. In order to formalize the provision of one service to multiple contractors, it is best to use one document “Provision of services”. This design is convenient for enterprises that provide periodic “subscription services”.

Do you need proofreading or review of academic work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

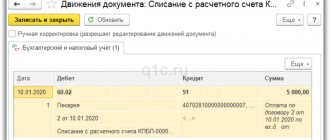

Once completed, the document can be processed. When carried out, the program will generate transactions reflecting the fact of sale of goods in accounting. To view the transactions, you need to click on the “DtKt” button. All transactions can be edited manually, but this is not recommended. To edit, you need to check the “Manual adjustment” checkbox.

Report Disposal of goods. Development by 1BIT specialists

The report is executed in various versions and allows enterprise specialists to analyze shipments in various required indicators.

The report reflects movements in the sale and movement of finished products and goods between warehouses. Since the enterprise has many warehouses and many item groups, the report allows for multi-variant customization.

This report was a priority when installing the 1C ERP program, as it allows you to control turnover in sales prices, thereby keeping track of customer accounts receivable and planning daily sales for each store, depending on the daily shipment between the manufacturing warehouse and retail stores.

The report allows you to control the assortment, since the enterprise has many types of products and many production divisions.

Figure 5. Report Disposal of goods for the director

Figure 5_2. Option for setting up the Goods disposal report

Figure 5_3. Option for setting up the Goods disposal report

Figure 6. Report Disposal of goods. Sales of cheeses.

Figure 7. Report Disposal of goods. Lots of customization options.

Figure 8. Report Retirement of goods for a bakery

Figure 8_2. Report Retirement of goods for bakery

The option to set up a sales report for a Dairy allows you to analyze the sales amount and quantity for each type of product.

Since sales are carried out both to contractors and through transfer to our own divisions - retail stores, it was necessary to collect all the data in a single report.

Figure 9. Report Disposal of goods. Report for a dairy plant

Figure 9_2. Setting option for the Goods disposal report. Report for a dairy plant

Production accounting in the 1C program: costs

When studying the principles of cost accounting in 1C, first of all, you should pay attention to the fact that accounting for production costs using the tools of this software is more convenient to carry out in the most suitable version of 1C. For example:

- if you need to keep records in production, you must select the “1C” configuration specifically for production;

- if there is specialized software designed for a specific industry, you should select “1C” to account for production in the relevant industry (this configuration will contain the entire necessary set of tools and algorithms).

The list of main activities must first be entered into the program directory.

To group certain costs by type of activity, the 1C reference book “Nomenclature Groups” is used. Provided that specific types of nomenclature items in connection with types of activities are entered into this directory, they can be selected when generating documents.

Examples of common 1C documents through which production costs can be reflected:

- form “Demand-invoice”;

- form “Receipt of goods and services”;

- "Payroll" form.

The ability to use relevant documents with a simple data entry algorithm is one of the key competitive advantages of 1C.

Thus, when entering a new document, it is assumed that the necessary transactions will be automatically generated using current accounts and subaccounts of accounting in connection with a specific product group, as well as, for example, with storage locations for materials used in production.

Among other important tools for accounting for production in 1C is an option with the capacious name “Production”. Before starting work, it should indicate what methods are used by the enterprise to distribute various expenses: main, auxiliary production, general production, general business costs. That is, for 1C to work correctly, before you start entering transactions, you should enter information from the applicable accounting policy of the enterprise into the directories.