Carrying out operations with damaged inventory items is not difficult for an experienced accountant, however, those who draw up the Write-Off Certificate for Worn-Out Assets for the first time may experience difficulties due to the lack of a single approved form.

Inventory and materials are understood as property of an organization that is used in business activities, has a material value and a monetary value; for accounting purposes they are divided:

- Raw materials and materials.

- Unfinished production.

- Finished products.

When carrying out business activities, there is a need to get rid of property that has become unsuitable for use due to its loss of consumer properties due to damage, expiration, or detected defects. If repairs are impractical and impossible to use, there is no point in keeping them on the balance sheet.

The commission is created on the basis of an order from the director; usually one of the deputy heads of the enterprise is appointed as chairman; the composition includes the person who is responsible for the inventory and materials, an accounting employee, and heads of structural divisions.

The objectives of the created body are:

- Inspection of tangible assets that are expected to be written off.

- Identification of the circumstances of the breakdown.

- Determining the circle of persons guilty of damage and making proposals for bringing to justice.

- Determining the feasibility of using individual parts.

- Preparation of inspection and write-off reports.

If there are no objections, the act is signed in two copies and submitted for approval.

Form of compilation

If damaged property is identified on the basis of a memo from the responsible person, such assets must be written off with the obligatory execution of a special document, an act of write-off of property that has become unusable. Without such a document, accounting will not write off damaged valuables.

This document allows you to solve several important problems for the enterprise:

- Report to the tax authorities, but it should be remembered that for incorrect execution of the act, if this is revealed during a tax audit, the enterprise and officials may be subject to fines.

- Organize reporting and correctly display the financial results of the organization.

- Write off the valuables listed on him from the financially responsible employee.

There is no single form of act for commercial enterprises; the document is developed and approved by the company itself on the basis of Order No. 162n of the Ministry of Finance dated December 6, 2010.

For budgetary organizations, such a form exists; it was approved by Order of the Ministry of Finance No. 52n dated March 30, 2015, and this form of document can be used or taken as a basis for other companies.

When developing independently, the following data must be included in the form in accordance with the Federal Law “On Accounting”:

- Document's name.

- Date of registration.

- Name of the organization.

- Operation description.

- Quantity, price, cost.

- Job title, full name.

- Signatures with transcripts.

- Other data reflecting the specifics of the enterprise.

Rules

The main purpose of the document is to prove the legality of writing off assets from the balance sheet of the enterprise.

Typically, the initiator of writing off damaged valuables is the employee who is responsible for them. He submits a memo addressed to the manager, who appoints someone responsible for creating a write-off commission.

The order creates a commission including a financially responsible person and an accounting employee.

The commission examines damaged valuables, identifies and inspects defects and draws up a document with all details filled in:

- Business name.

- Date of completion.

- Position and full name of the manager.

- List of damaged valuables, quantity, price, amount.

- Cause.

- At the end of the list, the amount is entered, in numbers and in words.

- Fill in information about the members of the commission with the title of the position and full name.

- The commission signs the document in duplicate and submits it to the manager for approval.

Synonyms for the word "fallen into disrepair"

69 synonyms found. You can find more synonyms by clicking on the words.

- download

- Synonyms for string

- Hide phrases

| № | Synonym | Qty | Initial form |

| 1 | hors de combat | 20 | |

| 2 | broken | 7 | break down |

| 3 | break down | 7 | break down |

| 4 | runaway | 10 | go haywire |

| 5 | go haywire | 10 | go haywire |

| 6 | shabby | 24 | get jabbering |

| 7 | get jabbering | 24 | get jabbering |

| 8 | broken | 30 | break |

| 9 | break | 29 | break |

| 10 | worn out | 49 | wear out |

| 11 | wear out | 48 | wear out |

| 12 | worn out | 8 | travel around |

| 13 | travel around | 8 | travel around |

| 14 | disabled | 2 | disabled |

| 15 | spoiled | 241 | go bad |

| 16 | spoil | 251 | spoil |

| 17 | go bad | 141 | |

| 18 | spoiled | 138 | spoil |

| 19 | threadbare | 35 | get worn out |

| 20 | get worn out | 35 | get worn out |

| 21 | kicked | 14 | |

| 22 | refused | 24 | refuse |

| 23 | refuse | 24 | |

| 24 | damaged | 55 | get damaged |

| 25 | get damaged | 55 | get damaged |

| 26 | moonlighting | 3 | earn extra money |

| 27 | earn extra money | 3 | earn extra money |

| 28 | worn out | 6 | wear out |

| 29 | wear out | 6 | wear out |

| 30 | flying | 110 | fly |

| 31 | fly | 68 | fly |

| 32 | broken | 29 | break down |

| 33 | break down | 29 | break down |

| 34 | spoiled | 34 | spoil |

| 35 | spoil | 20 | spoil |

| 36 | spoiled | 11 | spoiled |

| 37 | fallen into disrepair | 5 | |

| 38 | fallen into disrepair | 10 | |

| 39 | crashed | 49 | crash |

| 40 | broken | 112 | broken, break |

| 41 | smash | 165 | broken, break |

| 42 | crash | 49 | crash |

| 43 | collapsed | 71 | collapse |

| 44 | collapse | 70 | collapse |

| 45 | gone away | 25 | leave |

| 46 | leave | 25 | leave |

| 47 | disheveled | 28 | get disheveled |

| 48 | get disheveled | 27 | get disheveled |

| 49 | unraveled | 2 | unravel |

| 50 | unravel | 2 | unravel |

| 51 | burnt | 45 | burn out |

| 52 | burn out | 44 | burn out |

| 53 | passed | 46 | pass |

| 54 | pass | 50 | pass |

| 55 | screwed up | 78 | get screwed |

| 56 | get screwed | 39 | get screwed |

| 57 | broken | 57 | break down |

| 58 | break down | 66 | |

| 59 | demolished | 45 | communicate |

| 60 | communicate | 46 | communicate |

| 61 | worked together | 12 | work together |

| 62 | worked out | 14 | work |

| 63 | work | 18 | work |

| 64 | work together | 12 | work together |

| 65 | fallen into disrepair | 8 | |

| 66 | become faulty | 5 | |

| 67 | become unfit | 8 | become unfit |

| 68 | become faulty | 5 | become faulty |

| 69 | stunned | 3 |

Write-off procedure

After filling out and approving the act by the manager and identifying the culprits, guided by clause 30 of the Methodological Instructions, the accounting department assigns the amounts recorded in account 94 to:

- if the amount is not higher than the rate of natural loss by 20,26, 44 accounts;

- if the guilty person is determined, then compensation at his expense;

- if the perpetrators are not found or the court refuses to assign compensation to the perpetrator, then to account 91, subaccount “Other expenses”.

If the written-off property is sold or there is an opportunity to use it in business activities, such property is accounted for at the market price, and the reflected amounts of losses are reduced by the cost of receipt (clause “b”, clause 29 of the Methodological Instructions).

In the closed list listed in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation, the unworthiness of valuables does not apply to cases when VAT is restored; the organization is not obliged to restore VAT on written-off property.

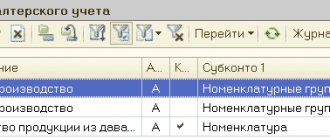

Accounting entries

Here are a few examples of what wiring might look like in this case:

Chart of accounts.

Write-off of materials in the presence or absence of culprits.

Inventory

Inventory and materials refer to current assets used in the implementation of statutory activities, spent in the production of products and provision of services and attributable to the increase in the cost of manufactured products with a useful life of up to one year.

International standards classify the following assets as inventory:

- Goods for sale or finished products.

- Currently in production.

- Inventories in the form of inventories for production, raw materials.

Domestic accounting divides inventory items into seven types:

- Materials.

- Fattening animals.

- IBP.

- Unfinished production.

- Finished products.

- Goods for sale.

- Goods shipped.

Accounting provides:

- Timeliness and reliability of the reflection of operations on the movement of property of the enterprise.

- Control and accounting of safety of inventory items.

- Identification and sale of surplus inventories.

- Distribution of inventory items by location and accounting items.

Due to the share in the cost of finished products and work in progress, accounting for inventory items is an important accounting task; reflecting the movement of current assets makes it possible to see where, how much and in what condition the values are located. Timely and correct reflection of the receipt and consumption of materials and other current assets makes it possible to ensure optimal financial results and prevent the acquisition of excess inventory.

Synonyms for the phrase “fall into disrepair” (as well as words and expressions similar in meaning)

Making the Word Map better together

Hello!

My name is Lampobot, I am a computer program that helps you make Word Maps. I can count perfectly, but I still don’t understand very well how your world works. Help me figure it out! Thank you!

I will definitely learn to distinguish widely used words from highly specialized ones.

How clear is the meaning of the word Menshevik

(noun):

Related words and expressions

Related words (by topic)

- People: messenger, guest, hostess, acquaintance, friend

- Places: they say, one, lunch, scrap, old

- Items: volume, roller, address, spare parts, junk

- Actions: arrival, tomorrow, arrival, return, departure

- Abstract concepts: today, badness, day, time, hour

Associations to the word “come”

Sentences containing the phrase “fall into disrepair”

- Only here the lights on the instruments do not blink, there are no viewing screens, and all the wonders of technology, which in ancient times saved the lives of a handful of survivors, have long since fallen into disrepair

.

Quotes from Russian classics with the phrase “fall into disrepair”

- And so, when he is convinced that he has nothing to support Bazhanov’s job position, that the working tool, for the acquisition of which he sacrificed his personal comfort, is personally falling into disrepair, that the cattle are kept untidy and stink (“there’s no censer!” the cowgirl grumbles about what was done a reminder on this matter) and promises in the near future to completely degenerate, that he himself is finally tired of everyone, because he “possesses himself everywhere”, but cannot say anything “real” - then he is suddenly attacked by that brave cowardice that gives a person has the determination to spit in one minute on all the fruits of many years of long-suffering.

Conjugation of the word "come"

Associations to the word "unsuitable"

Meaning of the word "come"

COME, I will come, you will come; past

came, - went, - went;

prib.

past arrived;

deepr.

come;

owls

(

nesov.

come). 1. Walking, following somewhere, to achieve something. places; arrive. (Small Academic Dictionary, MAS)

The meaning of the word "unfitness"

UNUSABILITY, -i, f.

Property and state by value

adj. waste.

Make a thing unusable.

(Small Academic Dictionary, MAS)

Submit Comment

Additionally

Meaning of the word "come"

COME, I will come, you will come; past

came, - went, - went;

prib.

past arrived;

deepr.

come;

owls

(

nesov.

come). 1. Walking, following somewhere, to achieve something. places; arrive.

The meaning of the word "unfitness"

UNUSABILITY, -i, f.

Property and state by value

adj. waste.

Make a thing unusable.

Sentences containing the phrase “fall into disrepair”

Only here the lights on the instruments do not blink, there are no viewing screens, and all the wonders of technology, which in ancient times saved the lives of a handful of survivors, have long since fallen into disrepair

.

The rich left the city in search of fresh air, and their houses quickly fell into disrepair

because of the poor people who occupied them.

– For some reason the body was preserved, but the clothes fell into disrepair

.

Source of the article: https://kartaslov.ru/%D1%81%D0%B8%D0%BD%D0%BE%D0%BD%D0%B8%D0%BC%D1%8B-%D0%BA-% D1%81%D0%BB%D0%BE%D0%B2%D1%83/%D0%BF%D1%80%D0%B8%D0%B9%D1%82%D0%B8+%D0%B2+%D0 %BD%D0%B5%D0%B3%D0%BE%D0%B4%D0%BD%D0%BE%D1%81%D1%82%D1%8C

Identification of property that is out of order

Members of the commission personally inspect the PPE. After this, they confirm that the clothing is indeed not suitable for further use. It doesn't have to be worn out items. For example, some workwear has an expiration date. Upon completion, the workwear is written off. If the commission determines that the damage to things was the result of negligence, the culprits are determined. The written-off clothing is confiscated, and the chairman of the commission draws up a corresponding report.

Issuance of an order

The manager can only familiarize himself with the act. If it is indicated here that personal protective equipment is indeed subject to write-off, the manager has to agree with this. There is no reason not to trust the commission and check its work. Therefore, having received the completed act, the manager must issue an order obliging him to write off some specific protective equipment. You should try to ensure that there are no errors in the act. But even if they were allowed, corrections are allowed. However, this must be done correctly. There is no need to try to write the necessary characters over the wrong ones. Also, you should not make corrections in “bold”. The identified error should be neatly crossed out with one line. After this, the correct information is entered nearby. Such a correction must be certified by autographs of responsible employees.

( Video : “Workwear: accounting and tax accounting in 1C Accounting 8”)

Write-off of property

A copy of the act is transferred to the accounting department, which removes this workwear from the register. There is no need for discarded clothing to be disposed of. It can simply be thrown into a landfill, or used for other household needs.

What needs to be done before filling out the form?

First, an audit of the property at disposal is carried out at the warehouse of material assets. During this procedure, they simply count how many quality units have accumulated and how many have already been damaged.

When the inventory is completed, they proceed to compiling a statement in the M29 form. It also displays materials for which write-off has become a mandatory requirement.

The next stage is the organization of a special inspection by the company’s technical department . The reports are sent a second time to accounting staff for additional study.

They already indicate the exact amount of material assets to be written off. A group of objects that have become completely unusable are separately identified.

When drawing up an act, separate isolation of materials that have become unusable is required. A separate room is used to accommodate them. Then they move on to sealing.

Persons who have become financially responsible put their signatures on the document. Without this, it is impossible to establish the very fact of loss of assets in the enterprise. And find out the full value of these assets.

There are several ways to determine the cost of materials.

- Calculation for specific units, for each separately. This is necessary to calculate materials with higher value.

- According to primary documents with later dates. To do this, divide by the total quantity by units of the total amount, which is reflected in the invoice upon receipt.

Without what is it impossible to draw up an act?

- A memo with information on the issuance and material movement over a certain period of time.

- The responsible person provides a separate report on the movement of materials from the warehouse.

The accounting employee prepares the document form.

What are the responsibilities of a storekeeper? The job description for a storekeeper can be found in this publication.

The main thing is that it complies with the policies adopted by the enterprise.