What are extra-budgetary funds

These are institutions that operate independently of budgets at any level. Their purpose is to satisfy the socio-economic needs of citizens, such as:

- provision of pensioners;

- health protection;

- support for motherhood and childhood.

They help realize the constitutional rights of the population. Transfer of contributions is mandatory for employers. Individual entrepreneurs also pay them for themselves.

In accordance with Article 419 of the Tax Code of the Russian Federation, individuals can also be payers. This applies to self-employed citizens who do not officially work anywhere, but want to have social guarantees.

Timing and sequence of payment of stipulated funds to extra-budgetary funds

The period of time that determines the payment of STV has remained unchanged for several years. All ETS must be deposited into the appropriate funds by the 15th of the following month. This date is the final date. But if it falls on a holiday or weekend, then the deadline is moved to the next working day.

It is important not to forget that:

- STV accounting is maintained and payment is made in rubles. and kop.;

- The employer maintains an STV registration card for each employee.

STV payment sequence: (click to expand)

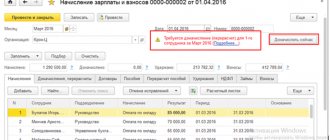

- The amounts are recorded during the payroll process.

- The policyholder pays them within the stipulated period of time - fills out payment slips with the relevant details and amounts, and sends them through the bank.

- The payer draws up the appropriate entries and keeps records of accruals and payments of STV.

- Relevant reports are generated quarterly and sent to the Federal Tax Service and the Social Insurance Fund.

You should constantly check the existence of debt under the STV. To do this, you can send a written application requesting a certificate of debt or find the necessary information online using the information service on the website of the Pension Fund of the Russian Federation or the Federal Tax Service (

Object of taxation, calculation base, reporting deadlines

The object is the income of workers, which is paid under labor, civil law contracts, contracts for the alienation of intellectual property and copyright. Income related to property transactions is not included here.

Individual entrepreneurs make contributions in a fixed amount (see Article 430 of the Tax Code of the Russian Federation). It is revised annually and until this year was tied to the minimum wage.

The procedure for filling out and the form for submitting calculations for insurance premiums (DAM) are approved by Order No. ММВ-7-11 of October 10, 2016 / [email protected] The employer carries out calculations for each employee after the end of the calendar month. Reporting periods are quarter, half-year, nine months and year. In 2021, reporting will be provided by:

- until May 3 (including postponement, usually until April 30);

- until July 30;

- until October 30;

- until January 30.

The billing period is a calendar year.

Accounts and transactions

Account 69 is intended for keeping records of settlements with extra-budgetary funds. To separate insurance premiums by type, sub-accounts are introduced:

- for calculations within the framework of social insurance, subaccount 69.1 is used;

- Account 69.2 has been introduced for contributions to the compulsory or voluntary pension insurance system;

- 69.3 reflects the status of settlements with the Compulsory Medical Insurance Fund;

- through subaccount 69.11, calculations for contributions for injuries and accident insurance are disclosed (the interest rate for employers is set in relation to the risk class assigned to them).

FOR YOUR INFORMATION! Transactions for the calculation of all types of insurance premiums are shown as credit turnover in account 69. Repayment of the employer's obligations is carried out by debiting subaccounts of account 69.

Typical correspondence in the field of settlements with funds:

- D20 (25 or 26) – K69 – in a production organization, contributions have been accrued on the income of the working personnel;

- D44 – K69 – contributions accrued by a trade organization;

- D08 – K69 – the value of insurance premiums adjusts the cost of the asset under construction (the wages of the involved personnel and insurance premiums from it are added to the total cost of the object);

- D69 – K51 – funds were transferred from the current account to repay obligations on insurance premiums;

- D91 – K69/Fine – reflects the accrual of penalties on insurance premiums;

- D69/Fine – K51 – the accrued penalty for late payment of insurance premiums was repaid from the bank account of the business entity;

- D69 - K70 - reflects the amount of benefits subject to reimbursement from the Social Insurance Fund (accrual of part of the sick leave, which is payable by the social insurance fund).

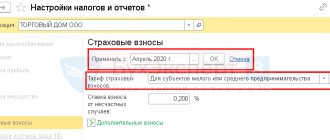

Rates

Current rates can be found on the official website of the Federal Tax Service. They are established by Article 425 of the Tax Code of the Russian Federation:

- on OPS - 26%;

- for compulsory medical insurance - 5.1%;

- for compulsory health insurance due to maternity or temporary disability - 2.9%;

- for OSS, but for foreigners and stateless persons - 1.8%.

For a number of payers (including individual entrepreneurs on the simplified tax system) reduced rates have been established. For workers in harmful or dangerous conditions, an increased tariff is applied. The size of the increase depends on the subclass of working conditions (from 2 to 8%). This is stated in Article 428 of the Tax Code of the Russian Federation.

How are contributions to state extra-budgetary funds made?

In order for an accountant to correctly calculate and accrue SV in accounting, it is necessary to make calculations for each employee separately. Such calculations are performed monthly, and to control the maximum values of the limits, the tax base is calculated on an accrual basis. If the employer has the right to apply reduced (non-preferential) interest rates, on an amount exceeding the limit, it is necessary to deduct not 22%/2.9%, but 10%/0%, respectively, to OPS/OSS.

Contributions made to state extra-budgetary funds are included in the cost of production. Postings are recorded on the credit account. 69 (broken down by subaccounts of types of insurance) and the debit of cost accounts - 20, 44, 25, 26, 23, etc. Account grouping 69 for subaccounts of the second and third order helps to track what type of SV is accrued - social (69.1), medical (69.3) or pension (69.2) insurance. The standard deadline for payment of amounts is set as the 15th day of the month following the billing month (clause 3 of Article 431 of the Tax Code of the Russian Federation).

Features of payment for individual entrepreneurs

In addition to the fixed size already mentioned, individual entrepreneurs should know the following:

- they make contributions to the Social Insurance Fund voluntarily if they enter into an appropriate agreement;

- when calculating maternity payments, payments for the previous year are taken into account, and not for two years, as in the case of hired work;

- if the amount of an individual entrepreneur’s annual income exceeds 300,000 rubles, you will have to pay an additional 1% of the difference to the Pension Fund;

- if an individual entrepreneur does not have employees, he can reduce the tax base under the simplified tax system by the full amount of contributions to extra-budgetary funds (if any, then only by half).

Late payments lead to the inability to reduce the tax base in the reporting quarter.

Legal documents

- Federal Law of July 3, 2016 N 243-FZ

- Article 419 of the Tax Code of the Russian Federation. Payers of insurance premiums

- Article 430 of the Tax Code of the Russian Federation. The amount of insurance premiums paid by payers who do not make payments and other remuneration to individuals

- Article 425 of the Tax Code of the Russian Federation. Insurance premium rates

- Article 428 of the Tax Code of the Russian Federation. Additional insurance premium rates for certain categories of payers

Accounting and tax accounting of settlements with extra-budgetary funds

Insurance premiums must be paid to the budget taking into account the KBK codes. An exception is made for contributions related to injuries - the monitoring functions remain with the Social Insurance Fund. Employers charge four types of contributions: pension type, social and medical insurance, and injury payments. For the category of self-employed business entities that do not have hired employees, the obligation to pay contributions for health and pension insurance has remained.

How can an organization obtain a certificate of absence of debt on insurance contributions to extra-budgetary funds ?

Payments related to the control and regulation of different funds must be shown separately in accounting. Insurance contributions are subject to the amount of income of individuals who:

- accrued by the employer and paid to personnel on the basis of concluded employment contracts;

- are formed in accordance with the terms of existing civil law agreements.

IMPORTANT! All insurance premiums are reported quarterly. A generalized RSV-1 form is submitted to the Federal Tax Service based on the results of each.

In accounting registers, insurance accruals are displayed in relation to the income of each employee. Clause 3 art. 431 of the Tax Code of the Russian Federation obliges employers to transfer the amount of contributions no later than the 15th day of the month following the payroll period.

What are the features of the calculation and payment of mandatory insurance contributions to extra-budgetary funds by persons carrying out entrepreneurial activities without hiring hired labor?

The basis for calculating the amount of contributions is formed cumulatively for the year. The new countdown begins on January 1 of the next tax period. For each type of contribution, limits are established, if exceeded by the end of the year, obligations to accrue and pay insurance amounts to the budget are terminated. The limits are calculated separately for each employee by summing all his income.

There are fixed rates for contributions:

- for funds accrued in favor of pension insurance, the approved rate is 22% (if the employee’s accumulated income is within the limit) and 10% (for amounts outside the limit);

- for social contributions intended to cover the costs of the Social Insurance Fund, the rate is at 2.9% (a reduced rate of 1.8% applies to foreign citizens);

- For health insurance, deductions are made in the amount of 5.1%.

NOTE! If the employer is an individual entrepreneur, then settlements with extra-budgetary funds will be carried out separately based on the income of hired personnel and the earnings of the entrepreneur himself.

In 2021, individual entrepreneurs, when calculating insurance premiums for themselves, should be guided by updated limit indicators. Previously, they were tied to the minimum wage and adjusted annually using deflator coefficients. Starting this year, increased income limits for which contributions should be calculated have been legislatively approved. These values were fixed for several years, their value lost its connection to the level of the minimum wage.

All accrued contributions for insurance coverage by employers and self-employed persons are included in accounting as other expenses. This rule is applicable to business entities operating under the general taxation scheme. If a company has made the transition to UTII or simplified tax system, then due to insurance premiums it is possible to reduce the tax base. In the case of the simplified tax system, a prerequisite is the use of a special regime with the attribute “income minus costs”.

REMEMBER! Under the patent taxation system, the amount of insurance premiums does not affect the amount of tax liabilities.

In situations where payments are made to personnel that are not related to the production activities of the enterprise and do not participate in the calculation of the income tax base, insurance premiums must be calculated and transferred from this type of income without fail. The norm is confirmed by the Letter of the Ministry of Finance dated 04/08/2010 No. 03-03-06/1/244. The costs of paying non-production benefits to personnel cannot reduce the company’s income for tax purposes, and the amount of insurance premiums accrued on these incomes can be offset when calculating the tax base.

If an obligation to pay for sick leave arises, the employer’s action plan can be of two types. In the first option, the employer acts as an intermediate link between the Social Insurance Fund and the sick employee, funds are transferred to the employee’s account by the fund (that part of the benefit that is payable from the employer’s funds is paid by the enterprise). This option is relevant for regions with an existing pilot project.

If the employer is registered in a constituent entity of the Russian Federation in which a pilot project for direct interaction between the Social Insurance Fund and employed citizens has not been implemented, then the algorithm of actions will be as follows:

- The employer's accounting department checks the certificate of incapacity for work.

- The average earnings and benefits are calculated at the expense of the Social Insurance Fund and at the expense of the enterprise.

- The amounts of Social Insurance contributions to be transferred in the reporting period are displayed.

- If the amount of insurance premiums is sufficient to pay off the obligations under the certificate of incapacity for work, then the enterprise pays benefits and reduces the amount payable on contributions by its amount.

- If the amount of contributions is not enough to cover the entire amount of social benefits, then the enterprise pays benefits, and for the missing funds submits an application for compensation from the Social Insurance Fund.

According to the norms of Art. 431 (clause 4) of the Tax Code of the Russian Federation, payers of insurance premiums are required to maintain detailed records of accrued contributions for each employee. For this purpose, a free form of an individual registration card is used. It contains monthly data on accrued income for a specific employee, contributions from this earnings and cumulative results for the year. Such a document is necessary to track the moment when the accumulated income of an individual reaches the limit, after which insurance premiums must be calculated at a reduced rate or their accrual is suspended.

The form of the insurance premium accounting card requires entering numerical values in rubles and kopecks. The recommended form template is given in the Letter of the Pension Fund of the Russian Federation dated December 9, 2014 No. AD-30-26/16030 and duplicated in the Letter of the Social Insurance Fund No. 17-03-10/08/47380. This document belongs to the category of accounting registers. Its absence is a gross violation of the accounting procedure - a measure of liability was introduced by Art. 120 Tax Code of the Russian Federation. The fine for a one-time violation will be 10 thousand rubles, for a repeated violation – 30 thousand rubles; if it is discovered that the insurance settlement base has been understated, a sanction will be imposed in the amount of 20% of the amount of underpayment.

Postings for transferring STV amounts and calculation formula

The STV accounting accounts remain unchanged. It just doesn’t hurt to take into account the possibility of additional assessments of contributions for periods that have already passed. It is reasonable to introduce additional subaccounts to the account. 69.

Basic bu. STV records are as follows:

| Contents of operation | Debit | Credit |

| STV accrued | 20 (25, 26, 44) | 69 (plus subaccounts for each type of insurance) |

| STV paid | 69 | 51 |

| Benefits accrued at the expense of the Social Insurance Fund | 69 | 70 |

| Benefits reimbursed by social insurance | 51 | 69 |

To determine the STV calculation base, the formula is used:

STV is calculated as follows:

STV = Calc. base · tariff

Example 2. The marketer of Vector LLC, R.L. Litvinova, received a salary of 32,250 rubles in April. She was ill for ten days. The benefit amount is 10,750 (at the expense of the employer - 3225, and the Social Insurance Fund - 7525). Postings:

| Debit | Credit | Amount, rub. | Operation |

| 44 | 70 | 32 250 | Calculation of earnings for April |

| 44 | 69.1 | 935,25 | Accrual of STV by time. disability and maternity |

| 44 | 69. 2 | 7 095,0 | STV for pension insurance. |

| 44 | 69,3 | 1 644,75 | Medical fees insurance |

| 44 | 69.11 | 258,00 | Insurance premiums against accidents. cases |

| 44 | 70 | 3225,0 | Sickness benefit accrued at the expense of the employer |

| 69.1 | 70 | 7525,0 | Benefit from the Social Insurance Fund has been accrued |

| 69.2 | 51 | 7 095,0 | Pension Fund contributions paid |

| 69.3 | 51 | 1 644,75 | Payment of STV for medical insurance |

| 69.11 | 51 | 258,00 | Payment of contributions to the Social Insurance Fund for injuries |

| 51 | 69.1 | 6589,75* | Reimbursement received from the Social Insurance Fund |

*When making compensation, the Social Insurance Fund takes into account the amount of stipulated time period. disability and motherhood.

Payment order for insurance contributions to extra-budgetary contributions

When transferring insurance contributions to extra-budgetary funds, the accountant must draw up a payment order in accordance with all the rules for the formation of such documents. If you incorrectly indicate the number of the Federal Treasury of the Russian Federation, the name of the recipient's bank or KBK, the funds will not go to the corresponding budget. As a result of this moment, the business entity will have a debt, for which penalties will be charged in accordance with paragraphs. 4 p. 4 art. 45 of the Tax Code of the Russian Federation.

General rules for processing a payment order

The rules for filling out a payment order for the transfer of insurance contributions to extra-budgetary funds are regulated by the following regulations:

- Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P;

- By Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

The first regulatory legal act includes a list and description of the payment details, and the second includes special rules for processing “payments” to the budget.

Information about the organization

“Payments” reflect the following information about the business entity:

- payer status (field 101). When transferring contributions to the Federal Tax Service, code 01 is used, and to the Social Insurance Fund - 08;

- name of the organization (field 8). Information is taken from the constituent documentation;

- INN and KPP of the company (fields 60 and 102). Information must be taken from the certificate of registration with the Federal Tax Service;

- OKTMO code of the municipality (field 105). This code is taken from the All-Russian Classifier, approved by Order of Rosstandart dated June 14, 2013 No. 159-ST. The code can be 8-digit (for the municipal formation of districts) or 11-digit (for settlements that are part of the municipal formation of the region). The second type of codes (11-digit) does not need to be recorded in field 105.

Type and type of payment

This information is reflected in fields 106-109, and it concerns only contributions to the Federal Tax Service. When transferring contributions to the Social Insurance Fund, zeros are entered in these fields. A “payment” cannot contain more than one code based on the basis or type of payment.

The main payment indicator (line 106) includes two acquaintances. The following codes are indicated in this field:

- “TP” - when transferring contributions for the current year;

- “ZD” - in case of voluntary repayment of debt;

- “TR” - when paying a debt at the request of the Federal Tax Service;

- “AP” - when transferring debt according to the inspection report;

- “AR” - when paying the amount under the writ of execution.

Period of transfer of insurance premiums to extra-budgetary funds

Information on the period for transferring contributions is reflected in field 107, which has 10 characters. The first 2 of them are to indicate the code “MS” (monthly payments), a dot is placed in the third, 4 and 5 are intended to indicate the numerical month, a dot is placed in the sixth again, 7-10 are used to indicate the year. For example, when transferring insurance premiums for September 2021, field 107 is filled in as follows - “MS.09.2018”.

When voluntarily transferring debt by a business entity as of January 1, 2021, “GD.00.2017” must be entered in field 107. If the debt is repaid at the request of the tax inspectorate, on the basis of an inspection report or an executive document, “0” is entered in field 107.

The basis document for the transfer of insurance premiums to extra-budgetary funds

Information about the basis document is indicated in field 108, where its number is entered. In this case, the basis document may be a request from the tax inspectorate, an inspection report or a writ of execution. The date of the document is entered in field 109: the day is entered in the first two familiar places, the month in 4 and 5, the year from 7 to 10, and dots are placed in the familiar places between them.

If the current insurance premium is transferred, then zeros are entered in fields 108 and 109.

Purpose of payment for insurance premiums

In the field intended to reflect the purpose of the payment, you need to enter information about insurance premiums (or penalties) transferred to the Federal Tax Service or Social Insurance Fund. When transferring current payments, their purpose and accrual period are indicated. For contributions “for injuries” it is also necessary to indicate the registration number of the organization in the Social Insurance Fund.

KBK on insurance contributions to extra-budgetary funds

After 104 is intended to reflect the BCC, new values of which have been established since 2021 in connection with the transfer of insurance contributions to the jurisdiction of the Federal Tax Service. Read more about KBK in this article, which indicates specific codes for each type of insurance.

Transfer of insurance premiums for payers

Third parties can also transfer insurance premiums for payers. They must generate payment orders in accordance with the rules of Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

Common mistakes in paying STV

In practice, mistakes often occur regarding the payment of STV. They are encountered not only by entrepreneurs. For example, Pension Fund specialists may incorrectly post payments in their system. Or an accounting employee of the enterprise made a mistake of this kind. As a result, part of the STV was not included in the calculation.

It happens that the amount of the incoming STV balance does not match.

Other common errors include: (click to expand)

- Inconsistency between the employee’s passport data and his full name, SNILS. Such distortions are detected automatically and the calculation is not accepted. The taxpayer receives information about the presence of an error. He should make corrections and submit an updated calculation. In this case there is no penalty.

- Discrepancies between the total amount of PTS and their amounts for individual employees. An updated calculation is submitted in this case as well.

- The calculation of the STV for a foreign specialist of a company temporarily residing in the country and working under a contract was done at the wrong rate. The accountant did not take into account that the employee is a highly qualified specialist. For such foreign workers, contributions should be calculated only for injuries. There are no other STVs. The accountant will need to recalculate and send an additional report.