Types of bonuses and terms of their payment

There are two types of awards:

- Production. They reduce the tax base on profits.

- Non-productive. They relate to net profit and are paid for services that are not related to work responsibilities.

Non-production incentives include cash payments to employees who have recently become retirees or as government awards. This category also includes incentives for employee holidays and anniversaries.

Production incentives can be issued regularly or one-time. As the name suggests, regular benefits are issued on a regular basis, such as monthly or quarterly. The frequency of payments is regulated by internal local acts of the organization and they do not require special conditions for the payment of bonuses. If all requirements are fully met, the employee receives a regular bonus to income.

By regulating irregular incentives, they can also be approved by internal local acts, but to obtain them it is necessary to reach special peaks and achieve high indicators. One-time incentives are usually issued by a separate order explaining the reason for paying the bonus. They are awarded for achievements such as completing a project, developing seniority in the company, improving product quality, increasing sales, and participating in events. And for certain results of work that exceed the standard.

For the correct calculation and calculation of bonuses, it is necessary to draw up the Regulations on remuneration and bonuses. In this document, you must fill out all the indicators and requirements to receive incentives. This file must include the following clarifications:

- the number of people who can receive bonuses;

- types of bonuses paid in the organization;

- requirements and frequency of payments;

- formulas, calculations, criteria for evaluating indicators;

- an operation to review or challenge the results of an assessment.

Taking into account this VLA and the order, incentives are paid by the accounting department.

Holiday bonus: accounting and tax accounting, insurance premiums

Employers can pay their employees one-time bonuses not for a certain period of work and production results, but upon the occurrence of a specific event. For example, these could be bonuses for a professional holiday, an organization’s anniversary, for the employee’s birthday, or for holidays established by Article 112 of the Labor Code of the Russian Federation. The basis for paying such a bonus is the order (order) of the head of the organization to reward the employee. Such bonuses, as a rule, are not included in the remuneration system.

Accounting

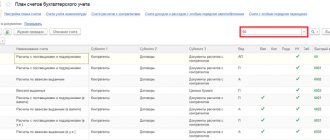

Accounting for settlements with employees of the organization for the accrual and payment of bonuses is kept on account 70 “Settlements with personnel for remuneration” (see Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia on October 31, 2004 No. 94n).

The source of payments for holiday bonuses can be undistributed earnings from previous years (account 84 “Retained earnings (uncovered loss)”) or other expenses incurred by the organization to pay such bonuses (account 91.02 “Other expenses”).

The accounting procedure for such payments should be reflected in the accounting policies of the organization.

Personal income tax

A bonus paid to an employee for a holiday is his income and, accordingly, is subject to personal income tax. The date of actual receipt of income in the form of a holiday bonus is the day of its payment, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). The date of tax withholding is the day of actual payment of the premium (clause 4 of Article 226 of the Tax Code of the Russian Federation). It is necessary to transfer the amount of tax withheld from the holiday bonus no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

The income code for the holiday bonus is 2003 “Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues.” In a letter dated 08/07/2017 No. SA-4-11/ [email protected] , the Federal Tax Service of Russia explained that the income code “2003” reflects remunerations (bonuses) for anniversaries, holidays, bonuses in the form of additional material incentives and other bonuses that are not related to the performance of work duties.

Income tax

Bonuses awarded to employees on holidays do not reduce the tax base for income tax (see letters from the Ministry of Finance of Russia dated July 22, 2016 No. 03-03-06/1/42954, dated July 9, 2014 No. 03-03-06/1/ 33167, dated 03/15/2013 No. 03-03-10/7999, dated 04/24/2013 No. 03-03-06/1/14283). At the same time, permanent differences arise in accounting (clause 4 of PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, hereinafter referred to as PBU 18/02). Permanent differences lead to the formation of a permanent tax liability (clause 7 of PBU 18/02).

As for judicial practice, opinions differ. Some courts conclude that bonuses to employees paid on holidays can be taken into account as expenses for corporate income tax purposes if they are provided for in an employment agreement, collective agreement or other local regulation, while others make the opposite conclusion.

If an organization takes into account the bonus for holidays in expenses when calculating income tax, then, most likely, it will have to defend its point of view in court.

Insurance premiums

In accordance with paragraph 1 of Article 420 of the Tax Code of the Russian Federation, the object of taxation with insurance premiums is payments and other remuneration in favor of individuals made within the framework of labor relations. Article 422 of the Tax Code of the Russian Federation establishes a list of amounts not subject to insurance premiums. Payments in the form of bonuses for holidays are not mentioned in the mentioned list and, therefore, are subject to insurance premiums in the generally established manner. A similar opinion is given in the letter of the Ministry of Finance of Russia dated 02/07/2017 No. 03-15-05/6368.

In accordance with Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ, the object of taxation of contributions for compulsory social insurance against accidents at work and occupational diseases (AS and Occupational Diseases) are payments and other remunerations accrued by insurers in favor of the insured within the framework of labor relations and civil contracts. Article 20.2 of Law No. 125-FZ names the amounts that are not subject to contributions for compulsory social insurance from NS and PZ. Payments in the form of bonuses for holidays are not included in this list, therefore, they are subject to insurance contributions for compulsory social insurance from the National Social Security and Labor Protection.

1C:ITS

In the “Legislative Consultations” section, see more details: how to set and pay a premium; Is it possible to take into account bonuses for holidays and anniversaries if they are established by collective or labor agreements; How to take into account a bonus in expenses if it is not expressly provided for in the employment contract with the employee.

How to calculate a bonus in 1C

To calculate, for example, a monthly bonus in 1C Accounting 8.3, you need to go to “Salaries and Personnel”. It is important to remember that the reward is not calculated in the system itself, but the already calculated amount is registered.

If, for example, a company awards bonuses every month, then the program only needs to add this type of bonus.

In the “Salary and Personnel” window, in the “Directories and Settings” section, there is a “Salary Settings” window, in which you need to click on “Payroll Calculation”, and then on “Accruals”. In this section it is easy to view the settings and types of accounting in the program.

Let's give an example that we need to prescribe monthly incentives for employees. Since this bonus applies to all employees, it is only necessary to apply for it once. It can only be used once a month when calculating payroll.

To complete the installation, click “Create”.

In a new window you need to enter a name, for example, “Monthly Premium”, and then a code of letters. For example, "EPR". It should also be stated that personal income tax is taken into account and is “other income from employment.” For the production type of bonuses, you need to click on code 2002 from the new list that appears when you touch the arrow.

In this case, cash payments are considered, so the checkbox next to “Income in kind” is not needed.

Afterwards it should be stated that all income is subject to insurance premiums. And note that they are included in labor costs for the purpose of calculating income tax under Art. 255 Tax Code of the Russian Federation. A prerequisite is the choice of paragraph 2 of this article. This paragraph spells out everything about the calculation of bonuses and other incentives.

It is important to carefully consider the way in which the system is reflected. It's best not to push any metrics if the rewards are going to be extended to all employees. This is necessary due to the fact that most often wage costs “fall” on accounts 25 “General production expenses” or 26 “General expenses” for administrative employees in the organization. At enterprises specializing in trade, account 44 is used. That is, incentives will be accrued for different categories of employees, which automatically include the initial account for accounting for salary expenses.

However, you can set a certain indicator that will take into account the established score. Therefore this field must be empty.

Click on “Record and close”, then the accrual will be created and activated.

Payment with bonuses for wholesale sales

In the flagship 1C configurations (Trade Management, Integrated Automation, Enterprise Management ERP), in addition to traditional payment methods, it is possible to make payments to customers using bonus points. For this purpose, bonus loyalty programs are used. However, there is one nuance - bonuses can only be used in retail sales.

Many times I have heard requests from users about the need to use bonus payment (and bonus accrual) in wholesale sales. This extension is intended to solve the described problem.

The extension replaces the functionality of manual discounts, so it will not be possible to use bonus accrual and manual discounts SIMULTANEOUSLY in one document.

The first thing you need to do is check that the use of manual discounts is enabled in your accounting settings.

In addition to manual discounts, the use of loyalty cards, automatic discounts and bonus programs should be included.

We create a bonus program, fill in the following fields:

- bonus points currency,

- rate for converting points into currency,

- filter of items that can be paid for with bonuses,

- the need to accrue bonuses on goods, which in turn are paid for with bonuses,

- maximum percentage of payment with bonuses.

Next, we create a type of loyalty cards and be sure to select a bonus program.

We set up a discount with the type Accrual of bonus points, indicate the percentage and bonus program.

We link the discount to the type of loyalty card, then register the client’s loyalty card.

We create an implementation document (you can act through a customer order, or you can immediately issue an implementation; new functionality is available in both documents). We choose a partner and read the loyalty card.

We fill out the tabular part with the goods.

On the Additional tab, a new block Bonus points is displayed.

Here you can see what balance of bonuses the client has (converted to the document currency). Enter the amount of payment with bonuses and click Calculate bonuses. After this, the program will show the number of bonuses to be accrued, and in the tabular part with the goods you can see in detail which products are paid with bonuses and exactly how much will be awarded for each item sold.

We navigate and close the document. Now let’s make sure that bonuses are credited correctly. To do this, we will use the Remaining bonus points report.

Accrued bonuses can now be used to pay for your next purchases.

For the extension to work correctly, you must disable Safe Mode.

If you have constructive criticism or suggestions for improving the development, welcome to comment.

Release 1.1.1.2 from November 25, 2019

New features added:

- referral program - accrual of bonuses when selling not only to the buyer, but also to the intermediary partner (referral) who brought this buyer,

- using other people's loyalty cards (if the client does not have a loyalty card, then you can use the manager's or cashier's bonus card to accrue/write off bonuses for sales. In this case, the accrual/debition will be carried out using the manager's card.

New functions are managed on the settings form.

The use of other people's cards can be disabled completely, enabled only for users with full rights, or for all users.

To accrue referral rewards, you must select a referral card and reward percentage in your partner’s bonus card.

If you want to select someone else's loyalty card, you can do this on the Additional tab.

Release 1.1.1.3 from 12/18/2019

A separate checkbox has been added to disable the use of bonuses in sales documents. This is done so that it is possible to use the functionality of manual discounts.

Release 1.1.1.4 from 11/21/2020

Two important features have been added that have received a lot of comments.

Distribution of bonus payments by line

Now the amount of payment with bonuses is distributed among different lines in proportion to the sales amount. The financial outcome will now be more plausible.

For example, if you partially pay for an order with bonuses in the amount of 100 rubles, the distribution will occur as follows:

Accounting for returns from the buyer

When a customer returns a product that was paid for with bonuses (or for which bonuses were accrued), the current balance of bonus points is automatically adjusted.

For the extension to work correctly, the compatibility version of your configuration must be at least 8.3.12.

If you have an older release, some of the improvements from the extension will need to be transferred to the configuration itself (I can help with this as part of warranty support).

How to set a bonus for an employee in 1C

It was previously mentioned that regular remuneration is indicated in the organization’s VLA. The bonus is prescribed at the moment when an order is created for hiring an employee.

In the “Salaries and Personnel” section, select “Personnel Documents” and click on the “Create” button, which will open the “Hiring” window.

This form specifies the name of the organization or department in which the employee begins to work. Afterwards, the position of the employee should be noted. Indicate the type of employment, for example, the main place of work.

Write down the salary in the table template. Using the “Add” option, select the UPR and its volume.

Provided that no one previously received such a bonus, and it was registered with a new date, the employment contracts of employees in the system should be changed, an order for the transfer (change) of personnel should be created, which will lead to document flow.

For example, we will make a new personnel transfer to a worker and register the specified remuneration in the program. To do this, in the “Salaries and Personnel” section, click on “Personnel Documents”, and then on “Create”, where you need to click on “Personnel Transfer”.

In the new window, select the desired employee, check the box next to the “Change accruals” option.

Next, click on “Add”, after which the accrual directory will appear. Then highlight the EPR and click on “Select”. In the spreadsheet template, indicate the bonus amount.

When you have completed all operations, click on “Perform and close”.

Now the salary will be calculated with a bonus.

How to calculate salary and bonus in 1C

Salaries and allowances are calculated on the last day of the month. Incentives are calculated in a separate document for an interval of 1 month, and not in the system. An incentive bonus can be accrued either separately or together with wages.

In the same section, you need to click on “All accruals” and on “Create”, where you should select “Salary accruals”.

In the new template, write down the name of the organization and the month of calculation. Next, click on “Fill”, which will display a list of all employees. Then click on “Accrue”.

Let's take, for example, accounting for the wages of one employee who received a personnel transfer.

You need to click on “Add” and select the required employee. The accrual line will indicate the amount of the person’s salary. When clicked, a full description will appear: salary 35,000 rubles. and ERP 10,000 rub.

By clicking on “Salt slip”, you can open a document with the appropriate name, which will indicate the exact amount of wages, bonuses and personal income tax.

Therefore, if a regular bonus was registered in the program, then its amount will be automatically added to the employee’s salary every month. However, if the amounts do not match, you will have to record them manually during settlement.

At the same time, if you click on personal income tax and insurance premiums in the table, a new window will open with their data, and you will see what payments they are calculated from.

Click on “Post and close”, after which the procedure will be reflected in the accounting and tax registers.

Using this algorithm of actions, you can arrange the calculation of monthly remuneration in the 1C Accounting 8.3 program.

How to calculate the annual bonus in the program

In the same way, it is necessary to check the presence of such type of remuneration as an annual bonus in the system. In the “Salary and Personnel” section in the “Directories and Settings” window, select “Salary Settings” and click “Accruals”.

Using the “Create” button, enter the name “Annual bonus”, “GPR”, fill out the remaining forms in the same way.

In the personal income tax code window you can enter 2000 or depending on the type of premium. It is also important not to forget to click on the checkbox indicating that the regional coefficient and the northern supplement are calculated.

It should also be remembered that salary should be taken into account only if the annual bonus is set only for a separate circle of people, for example, the sales department. Because the amount of reward will fall only on the 44th account. Or rather, to the account that was originally selected in the Employees directory.

When all the forms are completed, you need to record and close using the buttons with the same name.

Next, we will talk about the process of calculating the annual premium and what transactions are created in the program.

Annual bonus in 1C

The process is similar to applying for a monthly bonus - first open the "Payroll" window. Enter the required information and click on “Fill” to display the wages of all employees. Then you should choose one of two options.

If you are going to follow the first method, then select the employee and click “Accrue” and select “Annual Bonus”.

In the second method, click on the salary amount and add the GP in the new window using the “Add” button.

However, in both cases you must enter the reward amount yourself. After filling out the form, post the document. Click on “Dt Kt”, after which postings according to these procedures are started.

Here you can see the delineated amounts of salary and annual, quarterly bonus. The tabs next to it reflect accounting for taxes and insurance premiums.

It was previously mentioned that when registering bonuses in directories, you should not indicate the method of reflection in accounting. But we'll look at what happens if this method is used.

Let’s imagine that when applying for the annual incentive, the accounting method “Reflection of wages in trade” was chosen. Also, the company chosen is the same as in the top example.

Enter information for one employee in payroll.

You can see that salary and GP have been added. After posting the file, click “Dt Kt” to view the types of transactions that were reflected due to the procedure in accounting.

You can notice that the salary went to account 26, and the bonus fell to the trade account - 44.01, which is incorrect from the point of view of accounting and tax accounting.

It is very important to remember that when registering a new type of remuneration and bonuses, you should not indicate the method of recording.

Features of forming a reserve of expenses for the payment of annual bonuses

Organizations can create reserves in tax accounting to pay for vacations and to pay remunerations based on the results of work for the year.

Despite the fact that one article of the Tax Code, Article 324.1, is devoted to these two types of reserves, the procedure for creating reserves is different.

Thus, there are often cases when all vacation pay for the current year has already been paid, for example, by the summer, and the reserve for vacation pay is accrued until December 31 of the current year.

In contrast, bonuses based on the results of work for the year during the current year are not paid for the same year, since the accounting department will set their size only after summing up the work results for the year. That is, not until next year. In this case, as a rule, the amount of the annual bonus due to the employee is determined only after the approval of the annual financial statements.

However, paragraph 6 of Article 324.1 of the Tax Code equalized the procedure for the formation of these two reserves. It provided that deductions to the reserve for future expenses for the payment of annual remunerations based on the results of work for the year should be made in a manner similar to the procedure for forming reserves for vacation pay.

Based on this, the tax authorities demanded that the organization include the unused part of the reserve at the end of the year in the income of the reporting period (Resolution of the Ninth Arbitration Court of Appeal dated July 17, 2018 No. 09AP-27328/2018).

However, taking into account such conclusions, it turned out that the entire reserve for the payment of remunerations had to be included in income at the end of the year, i.e. as of December 31 of the current year.

Also on topic:

We study the 2021 changes in income tax