To receive a VAT deduction, collect a dossier on the counterparty

Inspectors deny organizations a VAT deduction, charge them more to pay, plus penalties, and issue a fine.

Inspectorate employees ignore that the transaction with the counterparty is real. Over the past year, courts have begun to support inspections. The payer must prove that he purchased goods or services from a counterparty who had the resources to execute the transaction. Read the article on how to convince judges under the new practice that the company has rightfully saved on VAT.

Careless choice of partners

A frequent and very convenient reason for the Federal Tax Service why a VAT payer may be denied a deduction is failure to exercise due diligence when choosing a counterparty. At the same time, the law does not establish any clear procedure by which one can unambiguously verify the reliability of a partner. According to tax legislation, the minimum set of documents confirming the reality of the company is an extract from the Unified State Register of Legal Entities and statutory documents. According to experts, it is also worth familiarizing yourself with the documents confirming the authority of the company’s management.

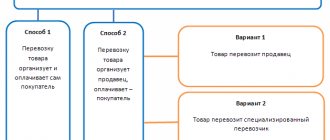

If we turn to judicial practice, we can see that there is no consensus on in what cases we can talk about a company’s failure to exercise prudence when choosing a partner for a transaction. Thus, according to the Resolution of the Arbitration Court of the Moscow District No. A41-2153/11 dated 06/05/2012 and the Resolution of the Arbitration Court of the Volga-Vyatka District No. A11-2369/2012 dated 03/04/2013, you should make sure that the potential counterparty has the necessary funds to fulfill the obligations yourself obligations. For example, transport or a contract with a transport company, as well as labor. Most often, this is enough to assess the reliability of a partner.

Some courts believe that the presence of a counterparty in the state register is for reference only and cannot indicate the actual conduct of business. Therefore, simply reviewing the constituent documents of a potential partner will not be sufficient to exercise diligence. Before a transaction, it is worth assessing its commercial attractiveness, as well as the business reputation of the counterparty and its solvency. The buyer should also take into account the possible risk of failure to fulfill the terms of the contract on the part of the supplier and insure against it by obtaining security for the fulfillment of obligations.

In addition, there is always a risk that the counterparty conducts activities in violation of the procedure established by law, for example, uses cash register equipment that is not registered with the Federal Tax Service. According to some courts (Resolution of the Arbitration Court of the Far Eastern District No. F03-1576/2012 dated 05/23/2012, Resolution of the Arbitration Court of the Moscow District No. A40-116146/12-115-834 dated 06/05/2013) this may also be the reason for refusing to provide a deduction according to VAT.

To obtain a VAT deduction, it is not enough to prove that the transaction is real

Courts have begun to recognize the expenses of organizations to reduce the tax base for paying deductions on profits as justified, but at the same time they refuse to deduct VAT for the same transactions. Now it is not enough for firms to prove only the reality of the transaction.

In order to maintain deductions, it is necessary to convince inspectors and the court that the transaction was actually completed by the counterparty specified in the contract.

Example: it is not enough to prove that the cars that are recorded in the waybill entered the territory of the organization. You need to convince the court that the transport belongs to the counterparty. It is also not enough to simply provide data on the number of employees who usually order from the counterparty. It is necessary to prove that the employees who provide services are on the staff of the counterparty.

A new trend in judicial practice is clearly visible within the framework of transport expedition and transportation contracts.

Example: to prove its right to deduct VAT, an organization submitted an agreement for forwarding services, transport invoices, forwarder reports, invoices, delivery and acceptance certificates for transport services, applications.

At the same time, the Federal Tax Service established, but the organization did not deny, that the forwarder did not have vehicles, the names of the drivers and employees of the disputed counterparty do not match, the cars belong to entrepreneurs and citizens who do not pay VAT.

The court concluded: since the counterparty did not have the resources, it means that the service was performed by another organization. The cassation declared VAT deductions illegal.

The Supreme Court also confirms the findings of the lower courts. The LLC must prove not only the reality of the transaction itself, but also that it purchased the service from the counterparty, who is recorded in the documents.

In cases involving transactions with goods, judges also do not accept VAT deductions. Example: The Federal Tax Service removed the deduction from the organization because the counterparty did not have material and labor resources. This means that he signed the papers, but in fact the transaction was executed by someone else. That is, the company did not fulfill the condition regarding the reliability of documents from Article 169 of the Tax Code.

When forming a position on a dispute with fiscal authorities, use a special argument. It lies in the fact that it is impossible to simultaneously recognize a transaction as real in order to calculate the amount of deductions for profit, and at the same time unreal in order to refuse a VAT deduction. Arb made this conclusion. Central district. The decisions of this authority generally stand out from general judicial practice.

The judges justify their decisions with the following argument: if the inspectors recognized the transaction as legal and saved the organization’s expenses, then they cannot deduct VAT from it. Indeed, regarding the same operations, inspectors should not make mutually exclusive conclusions.

Top 15 recent court decisions on VAT disputes

The company fulfilled its obligations under the contract, shipping goods worth more than 13 million rubles to the buyer. Despite the fact that all the necessary documents for shipment and the reconciliation report were signed, the counterparty paid only 5 percent of the transaction value. To return the remaining amount of the debt, the seller went to court, but the decision of the first instance was unexpected.

During the consideration of the case, the buyer reported that in reality there was no transaction and could not have happened, because the terms under the contract were too short to have time to deliver 12 thousand tons of grain.

He also stated that in almost all UPDs, the signatures of the buyer’s official were forged, which the company’s management had already reported to the investigative authorities. On this occasion, the arbitrators ordered a handwriting examination, which confirmed the falsification of the autograph.

Doubting the seller’s honesty, the court requested a tax certificate and learned that the company employed only three people. As a result, the judges recognized the transaction as imaginary, and the tax benefits received from it as unfounded and, of course, refused to collect the debt.

However, the seller appealed the decision to higher authorities, and the RF Supreme Court did not accept his opponent’s complaint. Starting with the appeal, the arbitrators condemned the gullibility of their colleagues: the reconciliation acts, the signatures on which had no claims, confirmed the entire amount of debt to the seller. The buyer partially repaid it with two transfers, which double-confirmed the reality of the transaction. The seller provided documents confirming the purchase of goods from the supplier in full for resale to the buyer. And most importantly, the trial judges did not take into account that the current legislation and established judicial practice do not allow condonation in relation to contradictory and dishonest behavior that does not correspond to ordinary commercial honesty (the estoppel rule). Such conduct, the arbitrators noted, is, in particular, conduct that is inconsistent with prior statements or conduct of a party, provided that the other party reasonably relied on them in its actions.

Taking into account the fact that the buyer began to deny the transaction only after appearing in court as a defendant in a financial claim, the trial judges should not have blindly trusted his contradictory arguments. From the unscrupulous counterparty, Femida recovered the entire amount of the debt, penalties, legal costs and the cost of services of the plaintiff’s representative.

DECISION of the Supreme Court of the Russian Federation dated 01/09/2019 No. 304-ES18-22027

The document is included in the ConsultantPlus ATP

Free meals for employees

The organization provided its employees with free food on the basis of employment contracts in accordance with internal administrative documents.

To achieve this, the company entered into agreements with third-party specialized organizations. If an employee refused food, no monetary compensation was paid to him. Free meals for employees were due to production needs. Since the employees’ workplaces were located at a considerable distance from populated areas and it was impossible to organize other meals, the company decided to provide employees with free food.

The cost of food was included in the income of employees for the purpose of calculating personal income tax and insurance premiums, and was also taken into account as expenses when calculating income tax.

The tax inspectorate conducted an on-site audit of the organization, as a result of which the company was assessed additional VAT, penalties and a fine.

The Federal Tax Service justified its decision by the fact that additional payments to employees in kind in the form of free food are not provided for by labor legislation. This means that these relations are civil, and the provision of free food is subject to VAT as a gratuitous transfer of goods.

Disagreeing with the inspection findings, the organization went to court.

The courts of the first, appellate and cassation instances upheld the company's claim, indicating that meals were provided for in the regulations on remuneration of employees and employment contracts.

The arbitrators emphasized that in relation to the free food received, the company employee does not have the rights of the owner provided for in Article 209 of the Civil Code. After all, food is provided directly at the enterprise, and at the time of eating, the employee cannot leave it. He actually cannot dispose of the free food he receives other than to consume it.

Consequently, relations regarding the provision of free meals to employees are not civil law, but labor relations; they are stipulated by the Regulations on the remuneration of employees and employment contracts. Therefore, free meals for employees should not be subject to VAT (resolution of the Arbitration Court of the North Caucasus District dated May 18, 2015 in case No. A32-37604/2014).

The Supreme Court refused to apply a 10% rate when importing goods, since it is not in the list of Commodity Nomenclature for Foreign Economic Activity

The organization imported into the territory of the Russian Federation “equipment for blood transfusion - a leukocyte system for collecting blood with bags for plasma, blood bags, adapters with air valves, needles for collecting blood for research, art. 791-05u". This medical product was not in the list of HS, but it was listed in the OKP, and the company applied a tax rate of 10%.

A reduced VAT rate is applied when importing and selling into the Russian Federation goods from the lists approved by the Government (clause 2 of Article 164 of the Tax Code of the Russian Federation):

- for imported goods - codes according to the Commodity Nomenclature of Foreign Economic Activity;

- for sale in Russia - codes according to OKPD2 (until 2021 - OKP).

The SAC considered it sufficient if the product is listed in at least one of the lists (Resolution of the Plenum of the SAC of the Russian Federation dated May 30, 2014 No. 33). And the customs authorities, which challenged the application of the 10% rate, lost in courts of three instances.

But the Supreme Court decided that the position of the Supreme Arbitration Court of the Russian Federation was outdated (decision of the Supreme Arbitration Court of the Russian Federation dated March 14, 2019 No. 305-KG18-19119 in case A41-88886/2017). In 2014 and earlier, there were many inconsistencies in the lists: the same product could be called and described differently. Errors were interpreted in favor of the taxpayer. Literally a month later, the Ministry of Finance gave similar clarifications regarding dried egg whites (letter of the Ministry of Finance dated April 11, 2019 No. 03-07-07/25566).

When importing, apply a VAT tax rate of 10% only for goods from the Commodity Nomenclature of Foreign Economic Activity list. If your product is named only in the OKPD2 list, you will have to pay tax at a rate of 20%.

The Supreme Court supported the exclusion of VAT from the cadastral value of property, but with nuances

The organization challenged the cadastral value of the property in court, which as a result was calculated together with VAT. The case was sent for a new consideration, since VAT should not increase the cadastral value (Cassation ruling of the RF Armed Forces dated July 10, 2019 No. 5-KA19-15 in case No. 3a-1270/2018).

But you cannot independently exclude VAT from the cadastral value indicated in the register when calculating property tax. The courts decide such disputes not in favor of the companies (see: A40-19545/2018, A40-19545/2018, A40-136153/2018). And the Constitutional Court, in its Ruling No. 2604-O dated September 30, 2019, did not support the applicant’s excessive independence, noting that the taxpayer did not exercise his legal right and did not challenge the cadastral value through the court.

If you dispute the cadastral value of real estate, during the examination, demand not only to separate VAT from the market valuation, but also to exclude it. Otherwise, you will have to pay an inflated amount of property tax, including VAT.

Tatyana Panfilova, VAT expert, SKB Kontur

When dismantling equipment and selling the resulting scrap metal, there is no need to recover VAT

When purchasing equipment, the company accepted VAT as a deduction. Before the end of its useful life, the equipment was deemed unusable and dismantled. Scrap of ferrous and non-ferrous metals remaining after the destruction of under-depreciated equipment was sold. Based on the results of a desk audit, the tax inspectorate found that the company did not restore the input VAT accepted for deduction when purchasing equipment. In this regard, the inspectorate considered that the organization had unlawfully underestimated the VAT tax base.

The tax authorities' arguments were as follows: the sale of scrap ferrous and non-ferrous metals is an operation not subject to VAT (clause 25, clause 2, article 149 of the Tax Code of the Russian Federation), therefore the organization was obliged to restore the amount of tax. The basis is subparagraph 2 of paragraph 3 of Article 170 of the Tax Code, according to which in the event of further use of fixed assets in operations not subject to VAT, the input tax previously accepted for deduction should be restored.

Disagreeing with the tax authorities’ decision, the company went to court.

The courts of three instances supported the organization. Scrap metal generated after the destruction of under-depreciated fixed assets (dismantling) is not a product produced by the organization. The company did not purchase this scrap metal as a raw material needed to manufacture the product. Sold scrap differs in its characteristics from acquired fixed assets that are used in the organization's activities.

The arbitrators indicated that the organization sold not fixed assets, but waste that was generated during their dismantling and destruction. This means that there are no grounds for applying the norm of subparagraph 2 of paragraph 3 of Article 170 of the Tax Code.

In addition, the judges noted that the list of situations in which the taxpayer must restore the VAT accepted for deduction is closed. And the obligation to restore lawfully deductible amounts of tax on fixed assets that were subsequently destroyed is not provided for by the Tax Code (resolution of the Federal Antimonopoly Service of the West Siberian District dated April 1, 2013 in case No. A27-15357/2012).

A similar conclusion regarding the obligation to restore VAT on the sale of scrap metal obtained during the dismantling of a fixed asset is contained in the resolution of the Federal Antimonopoly Service of the North-Western District dated March 21, 2013 in case No. A44-5530/2012.