Is a one-time bonus included in the minimum wage?

In 2021, federal law fixed the minimum wage at 11,280 rubles. This means that the employee cannot receive wages below the established standard. What is included in the minimum wage is decided by the law and, in some cases, by the employer himself. For example, whether a one-time bonus is included in the minimum wage is determined by the manager. The total monthly payment should not be lower than 11,280 rubles. The manager has the right to lower or increase the salary in order to achieve the desired figure. The law allows the inclusion of additional payments to obtain the minimum wage. An employee who has worked the required number of hours in a month (without sick leave, vacations, absenteeism) can count on the minimum remuneration, which includes:

- one-time;

- monthly;

- incentive payments, social charges.

The minimum wage and bonuses are interconnected; it is allowed to pay extra bonuses in order to get the required figure and not violate the law that protects workers' rights. The exception is overtime and overtime, which are paid separately.

Is the monthly bonus included in the minimum wage?

When wondering whether it is legal to include a bonus in the minimum wage, managers and employees can turn to the Labor Code of the Russian Federation and other regulatory acts. Based on the available evidence, the answer is yes, it is legal and acceptable. However, the one-time incentive and minimum wage after withholding tax payments may be less than the established 11,280 rubles. Also, employees working part-time or combining official positions receive an amount lower than that established by law.

It’s simple to answer the question whether a bonus is included in the minimum wage or not. Yes, it is allowed to make additional payments in order for the monthly salary to correspond to the specified minimum. The decision remains with the employer, as well as the question of whether it is possible to pay a bonus in excess of the minimum wage. This is not prohibited by law. The main thing is that an employee engaged in work on a permanent and full-time basis does not receive a salary lower than the existing standard. A similar answer is whether it is possible to include a bonus in the minimum wage to raise it to the established level.

What the law says

An employee who has fulfilled the full scope of his duties for the required working hours per month should not receive payment for work less than the minimum level established in the state. But what does the minimum wage consist of? Is the bonus included in the minimum wage in 2021? The basis of the minimum level of payment is salary with possible bonuses and additional payments “for hazardous production”. In each case, the fact of whether the minimum wage can eat up the bonus or whether it is accrued above it depends on the frequency of bonus payments. Their frequency is determined in the regulatory documents of the organization (under Article 135 of the Labor Code of the Russian Federation):

- employment contract;

- collective agreement;

- regulations on bonuses for employees, etc.

Payment of one-time and periodic incentives occurs on the basis of an order signed by the head of the organization.

Is it possible to include a quarterly bonus in the minimum wage?

According to the resolution of the Ministry of Labor of the Russian Federation, it is allowed to include monthly and one-time payments to employees to raise wages to a legitimate level. However, is it possible to include a quarterly bonus in the minimum wage? There is an explanation that says that this is not possible, since it will not be possible to distribute these accruals by month. The manager should figure out whether the employee’s salary corresponds to the minimum without taking into account quarterly additional payments.

If the salary is below the established one, are bonuses included in the minimum wage? Of course yes. This is a common practice. The salary is set by the employer in accordance with the employment contract. It is allowed to use monthly and one-time additional payments to raise an employee’s salary to 11,280 rubles per month worked. The days and hours worked during the month are taken into account. Employees who miss work time may lose bonus payments and receive a final figure below the standard.

An interesting situation arises with the question of whether it is possible to issue remuneration in excess of the minimum and whether this will be regarded as an overpayment in budgetary organizations. On the one hand, this is not prohibited by law, especially when it comes to quarterly and annual additional payments. In some cases this is not the case. This is indicated in Articles 129 and 133 of the Labor Code of the Russian Federation. You can avoid problems if the bonus is paid separately from overtime hours. The main thing is that the salary amount is at least 11,280 rubles. The remaining additions are established by the decision of the employer and the statutory provisions of the enterprise.

The impact of the minimum wage on wages

The concept of “minimum wage” itself speaks about its purpose: it is used to regulate wages. This is also indicated in Article 3 of the Federal Law of June 19, 2000 No. 82-FZ “On the minimum wage”. This is confirmed by the Constitution of the Russian Federation and the Labor Code of the Russian Federation. Thus, the Constitution of the Russian Federation provides for:

• establishment of a guaranteed minimum wage (clause 2 of article 7); • that remuneration for work should not be lower than the minimum wage established by federal law (clause 3 of article 37). The wage cannot be lower than the minimum wage established by federal law.

Federal minimum wage The system of basic state guarantees for the remuneration of workers also includes the minimum wage in the Russian Federation (Article 130 of the Labor Code of the Russian Federation). Article 133 of the Labor Code of the Russian Federation specifies that the monthly wage of an employee who has worked the full working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage. At the same time, the minimum wage is established simultaneously throughout the entire territory of the Russian Federation by federal law and cannot be lower than the subsistence level of the working population.

The resolution of the Constitutional Court of the Russian Federation dated November 27, 2008 No. 11-P emphasizes that the institution of the minimum wage, by its constitutional and legal nature, is intended to establish the minimum amount of money that should be guaranteed to the employee as remuneration for the performance of labor duties, taking into account the cost of living minimum.

By Federal Law dated December 2, 2013 No. 336-FZ “On Amendments to Article 1 of the Federal Law “On the Minimum Wage,” the legislator increased the minimum wage from January 1, 2014 to 5,554 rubles. The increase compared to the previous minimum wage, 5205 rubles, occurred at the inflation rate of 2013, 6.7%, as specified by the Ministry of Economic Development of Russia. So we got the approved 5554 rubles. (RUB 5,553.74 (RUB 5,205 ? (100% + 6.7%))).

Article 421 of the Labor Code of the Russian Federation stipulates that the procedure and timing for a gradual increase in the minimum wage to the subsistence level are established by federal law. 11 years have passed since the introduction of the Labor Code of the Russian Federation, but such a law has not yet been adopted.

Let us recall that the cost of living is of a social nature and is used to assess the standard of living of the population. In 2013, according to preliminary estimates, the ratio of the minimum wage to the cost of living of the working-age population was 67% (5,205 rubles / 7,769 rubles ? 100%) (taking into account the assessment of the Ministry of Economic Development of Russia of the cost of living of the working-age population on average for 2013 - 7,769 rubles per month).

Therefore, employers currently have no obligation to pay employees wages in an amount corresponding to or exceeding the subsistence level; they only need to comply with the minimum wage requirement.

As you can see, the main task of the minimum wage is to protect workers from unjustifiably low wages.

Let us note that in the mid-2000s, for about a year (from October 6, 2006 to August 31, 2007), in the mentioned Article 133 of the Labor Code of the Russian Federation there was a more stringent standard for employers - the sizes of: • tariff rates; • salaries (official salaries); • basic salaries (basic official salaries); • basic wage rates - for professional qualification groups of workers could not be lower than the minimum wage (Part 4 of Article 133 of the Labor Code of the Russian Federation).

This rule protected the interests of unskilled workers when paying for their labor. In addition to the salary, in many cases the employee is also paid other amounts of money - additional payments, bonuses, incentive payments. The likelihood of these workers receiving them regularly was not that great. When working off the standard working hours, the employee was supposed to be paid a salary every month, the amount of which could not be lower than the minimum wage. Accordingly, if an employee showed the best work results, which were encouraged by the employer, then the remuneration received for work should have exceeded its established amount.

But, unfortunately, the mentioned part 4 of Article 133 of the Labor Code of the Russian Federation was abolished by the Federal Law of April 20, 2007 No. 54-FZ “On Amendments to the Federal Law “On the Minimum Wage” and other legislative acts of the Russian Federation.”

Wages in accordance with Part 1 of Article 129 of the Labor Code of the Russian Federation consist of: • remuneration for labor depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed; • compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal); • incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Many employers have decided that with an increase in the minimum wage, it is not so necessary to increase salaries. An employee can be paid, for example, for additional work during and outside the working day or overtime according to a schedule. Thus, the employee received the minimum wage established by law not for the monthly working hours worked and the performance of job duties, but for the additional workload, the limits of which were determined by the employer himself.

Specialists from the Ministry of Health and Social Development of Russia have repeatedly emphasized that after September 1, 2007, the monthly salary accrued to an employee who has fully worked the standard working hours (fulfilled the labor standards), including: • salary (tariff rate); • compensation payments (additional payments and bonuses of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other payments of a compensatory nature); • incentive payments (additional payments and allowances of an incentive nature, bonuses and other incentive payments) and other types of payments provided for by the remuneration system - must be no less than the minimum wage established by law.

The validity of the above approach when determining the amount of wages based on the size of the minimum wage was also confirmed by the panel of judges of the Supreme Court of the Russian Federation. According to senior judges, from this date employers are freed from the need to maintain the ratio of tariff rates, salaries and the minimum wage. Tariff rates, salaries, and basic wage rates for professional qualification groups of workers for certain categories of workers may be set below the minimum wage.

However, monthly payments made to the employee for the full time worked in the aggregate cannot be less than the minimum wage (determination of the RF Armed Forces dated September 10, 2008 No. 83-G08-11).

This position can be traced to this day (definitions of the Armed Forces of the Russian Federation dated 05.17.13 No. 73-KG13-1, dated 12.21.12 No. 72-KG12-6, dated 11.16.12 No. 72-KG12-2, dated 07.29.11 No. 56 -B11-10).

The fact that wages, including incentive and compensation payments, cannot be lower than the minimum wage established by federal law, and it is permissible to establish a tariff rate, salary (official salary) below the minimum wage, is also confirmed in the rulings of the Constitutional Court of the Russian Federation dated December 17, 2009 No. 1557-О-О, dated 10/01/09 No. 1160-О-О.

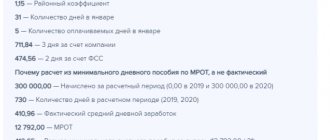

Example 1 An organization employs four watchmen (they are on duty 24 hours a day) with a salary of 4,500 rubles. For them, a summarized time recording with a quarterly accounting period is established. In February 2014, one employee went on vacation; this month he was supposed to work 7 shifts, which were distributed among the remaining comrades. As a result, two guards worked 198 hours this month, of which 72 hours were at night, and the third one worked 176 hours, of which 64 hours were at night. The additional payment for each hour of night work is 20% of their hourly salary. According to the original schedule, all employees were required to work 154 hours in February. The standard working time in February is 160 hours. When calculating the wages for February for each of the watchmen, the employer added to their salary an additional payment for night work. The cost of an hour of work, depending on the calculation method, is 27.40 rubles/hour (4500 rubles: (1971 hours: 12 months), where 1971 is the number of working hours in 2014 with a 40-hour work week) or 28.13 rubles /h (4500 RUR: 160 h). The amount of additional payment to the first two employees in the second option for calculating the cost of an hour of work is 405.00 rubles. (4500 rubles / 160 hours x 72 hours ? 20%), the third - 360.00 rubles. (4500 rubles: 160 hours x 64 hours x 20%). When recording working hours in aggregate, the fact of overtime work, according to officials, can be revealed only after the end of the accounting period (letter of the Ministry of Health and Social Development of Russia dated August 31, 2009 No. 22-2-3363). The employer followed the recommendations of officials and in February did not make any additional payments for overtime work to security guards, since the accounting period is a quarter. And only at the end of March will the number of hours of overtime work for each employee be determined. Total accrued for February: the first two employees - 4905.00 rubles. (4500.00 + 405.00), the third - 4860.00 rubles. (4500.00 + 360.00). The calculated wages for all of them are less than the minimum wage (4905.00 (4860.00) < < 5554.00). Therefore, the employer accrued to each of them for February the amount missing to the minimum amount of accruals established by law: the first two employees - 649.00 rubles each. (5554.00 - 4905.00 (4860.00)), the third - 694 rubles. (5554.00 – 4860.00). In total, the employer allocated 16,662.00 rubles for the guards’ salaries in February. (5554 + 5554 + 5554 rub.). If all four watchmen worked this month, the employer’s expenses for their salaries would be 22,216 rubles. (5554 ? 4). Each of them would be entitled to a salary of 4,500 rubles. and an additional payment for night time, the amount of which will be 292.50 rubles. (1170 rub. : 4), where 1170 rub. (405 + 405 + 360) - additional payment for the total number of hours of night work. Since the totality of these values for the month is 4792.50 rubles. (4500 + 292.50) do not exceed the minimum wage, then the employer would be forced to add to each of the employees the amount missing to the minimum amount of accruals of 761.50 rubles. (5554.00 – 4792.50).

The wages of employees of organizations located in the regions of the Far North and equivalent areas, in the opinion of senior judges, should be determined in an amount not less than the minimum wage. After which the regional coefficient and an allowance for work experience in these areas or localities should be added to it (the specified definitions of the Constitutional Court of the Russian Federation No. 1557-OO, the Supreme Court of the Russian Federation No. 73-KG13-1, 72-KG12-6, 72-KG12-2, 56 -B11-10). Thus, the regional coefficient and the percentage bonus for continuous work experience must be added to wages in excess of the minimum wage established by federal legislation.

The reason for the abolition of the norm of Part 4 of Article 133 of the Labor Code of the Russian Federation, in our opinion, was the ongoing policy to save expenditures of budgetary funds at the federal level. Since September 1, 2007, government bodies have been exempted from the need to maintain the ratio of tariff rates, salaries (official salaries) and the minimum wage.

Consequently, they could set tariff rates, salaries (official salaries), and basic wage rates for professional qualification groups of workers for certain categories of workers below the minimum wage.

It all started two years earlier, when it was excluded from the system of basic state guarantees for the remuneration of workers, defined by Article 130 of the Labor Code of the Russian Federation (clause 4 of Article 138 of the Federal Law of August 22, 2004 No. 122-FZ “On Amendments to Legislative Acts”). of the Russian Federation and the recognition as invalid of certain legislative acts of the Russian Federation in connection with the adoption of the Federal Laws “On Amendments and Additions to the Federal Law “On General Principles for the Organization of Legislative (Representative) and Executive Bodies of State Power of the Subjects of the Russian Federation” and “On General Principles organizations of local self-government in the Russian Federation“) the norm of paragraph 2 of part 1, concerning the minimum tariff rate (salary) for employees of public sector organizations in the Russian Federation.

The minimum wage, as mentioned above, is the lower limit of wages for a full month with full compliance with working hours and labor standards. If an employee did not work for a full month (for example, he did not get a job on the first day of the month, or quit on the last day of the month, or was sick, or was on vacation, etc.), then the amount of wages accrued to him for a given month may be and below the minimum wage.

Labor legislation allows work on a part-time basis - part-time (shift) or part-time work week (Article 93 of the Labor Code of the Russian Federation). Part-time work is initially part-time work (Article 284 of the Labor Code of the Russian Federation). In such cases, the employee is paid in proportion to the time he works or depending on the amount of work he performs. Accordingly, compliance with the requirements of Article 133 of the Labor Code of the Russian Federation regarding the calculation of wages should be checked in the same proportion.

Example 2 According to the statement of Kamova’s secretary E.K., she was given a part-time work schedule, lasting 5 hours daily. In February she worked all 20 working days. The standard working time (in hours) for a 40-hour work week in February is 160 hours. According to the established work schedule, Kamova worked 100 hours this month (5 hours/day x 20 days). The amount of wages accrued to her cannot be less than 3,471.25 rubles. (5554 rubles / 160 hours x 100 hours).

When paying the average salary, the Labor Code of the Russian Federation in some cases provides for comparison with the minimum wage. Thus, for employees who are mastering state accreditation: • bachelor's, specialist's or master's programs in part-time and part-time forms of study for a period of up to 10 academic months before the start of the state final certification (Part 4 of Article 173 of the Labor Code of the Russian Federation); • educational programs of secondary vocational education in full-time and part-time forms of study, within 10 academic months before the start of the state final certification (Part 4 of Article 174 of the Labor Code of the Russian Federation); • educational programs of basic general or secondary general education in full-time and part-time forms of study, during the academic year (Part 3 of Article 176 of the Labor Code of the Russian Federation), - a shortened working week is established at their request (Part 4 of Article 173, Part 4 Article 174, Part 3 of Article 176 of the Labor Code of the Russian Federation). In the first and second cases - for 7 hours, in the third - for one working day or the corresponding number of working hours (if the working day (shift) is reduced during the week). During the period of release from work, the mentioned employees must be paid 50% of the average earnings at their main place of work, but not lower than the minimum wage.

Example 3 Mamonov graduates from college in evening classes in June of this year. From February to May, by agreement with the employer, he has a work week shortened by 7 hours (every day on weekdays from Monday to Thursday he leaves work an hour earlier, Friday - three hours earlier). Mamonov’s average hourly earnings amounted to 69.74 rubles/hour in February, in March, April and May (assuming) - 69.48, 69.82 and 69.36 rubles/hour, respectively. 50% of the average earnings to be retained by the employee during release from work: in February - 34.87 rubles / hour (69.74 rubles / hour x 50%), March - 34.74 rubles / hour (69.48 rubles / h x 50%), April - 34.91 rubles/hour (69.82 rubles/hour x 50%), May - 34.68 rubles/hour (69.36 rubles/hour x 50%). The amount of retained earnings should not be lower than calculated on the basis of the minimum wage. In accordance with the production calendar for 2014, with a 40-hour work week, working time (in hours) in February is 160 hours, March - 159 hours, April - 175 hours, May - 151 hours. Based on this, the minimum amount that Mamonov had to retain for each hour of release from work during the period of application of the shortened working week in connection with the completion of studies at an educational institution of secondary vocational education was 34.71 rubles / hour in February (5554 rubles: 160 h), March - 34.93 rubles/hour (5554 rubles: 159 hours), April - 31.74 rubles/hour (5554 rubles: 175 hours), May - 36.78 rubles/hour (5554 rubles: 175 hours). 151 h). Thus, in fact, for every hour of release from work on the basis provided for in Article 174 of the Labor Code of the Russian Federation, Mamonov had to accrue:

- in March and May - amounts based on the minimum wage - 34.93 and 36.78 rubles / hour, respectively, since the value calculated from it in these months exceeds half of the employee’s actual average hourly earnings (34.93 > 34.74 and 36 .78 > 34.68);

- in February and April - amounts based on 50% of the actual average hourly earnings, that is, 34.87 and 34.91 rubles / hour, since in these months they exceed the minimum amount calculated based on the minimum wage (34.87 > 34. 71 and 34.91 > 31.74).

Another case where a similar comparison is necessary is the payment of stipends to students during the apprenticeship period. Its size is determined by the apprenticeship contract depending on the profession, specialty, qualification received, and it cannot be lower than the minimum wage (Article 204 of the Labor Code of the Russian Federation).

Regional minimum wage Since September 1, 2007, Article 133.1 was introduced into the Labor Code of the Russian Federation by the aforementioned Law No. 54-FZ, establishing provisions on the amount of the minimum wage in the region of the Russian Federation. From now on, the minimum wage in a constituent entity of the Russian Federation can be established by a regional agreement on the minimum wage. It is established: • taking into account socio-economic conditions and the cost of living of the working-age population in the corresponding region; • for employees performing their labor functions on the territory of the relevant constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

At the same time, the minimum wage in the region of the Russian Federation cannot be lower than the minimum wage established by federal law. Slightly less than half of the constituent entities of the Russian Federation have not taken advantage of the right granted and continue to use the federal minimum wage. Among these are the majority of subsidized regions, in particular the republics of Chuvashia, Adygea, Tyva, Krasnoyarsk and Stavropol territories, Bryansk, Kirov and Yaroslavl regions, but there is also a donor - the Republic of Tatarstan.

But in 42 out of 83 regions at the beginning of this year there was a regional minimum wage. Thus, in the Kaliningrad region, from January 1 of this year, the minimum wage is 7,500 rubles, and from July 1, its size will increase by another 500 rubles. and will reach 8000 rubles. (regional agreement “On the minimum wage in the Kaliningrad region” dated April 24, 2013). This agreement applies to employers operating in the Kaliningrad region - both legal entities (organizations) and individual entrepreneurs.

The only exceptions are organizations financed from the federal budget.

In the Moscow region, from October 1, 2013, the minimum wage was established at 11,000 rubles. (agreement on the minimum wage in the Moscow region between the Government of the Moscow region, the Moscow regional association of trade union organizations and associations of employers of the Moscow region dated 04/02/13 No. 10). In Moscow, from January 1, 2014, the minimum wage is 12,600 rubles, and from July 1, its size will increase to 12,850 rubles. (agreement on the minimum wage in the city of Moscow for 2014 between the Moscow Government, Moscow trade union associations and Moscow employer associations dated 11/13/13).

After concluding a regional agreement on the minimum wage, the head of the authorized executive body of a constituent entity of the Russian Federation invites employers operating in the territory of this constituent entity and who did not participate in the conclusion of this agreement to join it. The specified proposal is subject to official publication in the printed publication of the constituent entity of the Russian Federation along with the text of this agreement. The agreement is also posted on the regional government website.

At the same time, the manager notifies the publication of the said proposal and agreement to the federal executive body that carries out the functions of developing state policy and legal regulation in the field of labor, which is currently the Ministry of Labor of Russia (clause 1 of the Regulations on the Ministry of Labor and Social Protection of the Russian Federation , approved by Decree of the Government of the Russian Federation dated June 19, 2012 No. 610), and before that it was the Ministry of Health and Social Development of Russia (clause 1 of the Regulations on the Ministry of Health and Social Development of the Russian Federation, approved by Decree of the Government of the Russian Federation dated June 30, 2004 No. 321).

If employers operating in the territory of the relevant constituent entity of the Russian Federation, within 30 calendar days from the date of official publication of the proposal to join the regional agreement on the minimum wage, have not submitted to the authorized executive body of the constituent entity of the Russian Federation a reasoned written refusal to join it, then the specified agreement is considered to apply to these employers from the date of official publication of this proposal and is subject to mandatory execution by them.

The monthly salary of an employee performing labor duties in the territory of the relevant constituent entity of the Russian Federation and who is in an employment relationship with an employer in respect of whom a regional minimum wage agreement is in force cannot be lower than the minimum wage in this constituent entity of the Russian Federation, provided that the specified employee has fully worked during this period, the standard working hours and labor standards (job responsibilities) are fulfilled.

Only those employers who have refused to join it in writing may not be governed by the agreement (but only temporarily). Namely, those who, within the specified 30 calendar days from the date of official publication of the text of the agreement, sent to the authorized executive body of the constituent entity of the Russian Federation (usually a ministry, committee or department for labor and employment under the regional government): • reasoned refusal to join; • protocol of consultations with the elected body of the trade union organization (if any); • proposals on the timing of increasing the minimum wage of employees to the amount provided for in the specified agreement.

Employers who refuse to join then come under the close attention of their labor inspectorate, because it is there that a copy of the refusal to join will be sent. It is also possible that the manager may be invited to the authorized executive body of a constituent entity of the Russian Federation for clarification.

In most regions, the components of the regional minimum wage are identical to the federal one. It usually includes the tariff rate (salary), compensation payments, incentive payments (additional payments and incentive allowances, bonuses and other incentive payments) and other types of payments provided for by the remuneration system.

But there are regions where the minimum wage does not include compensation and incentive payments. These are, for example, St. Petersburg and the Leningrad region. And in Moscow, the minimum wage is established without taking into account compensation and bonuses for harmful (hazardous) work, overtime work and work on weekends and holidays, as well as for combining professions and positions.

In a number of constituent entities of the Russian Federation, the regional minimum wage is not set as a fixed amount, but is equated to the subsistence level of the working-age population in the region (for example, Oryol, Tver regions, Krasnodar Territory) or is set as a certain percentage or coefficient to such a minimum (for example, Volgograd region). In this case, the employer needs to know the size of the corresponding subsistence level in the territory of the constituent entity of the Russian Federation.

The cost of living for a quarter is determined at the end of each quarter. When the regional government’s decree on establishing a living wage for the next quarter comes into force, an employer whose employees’ wages were slightly higher than or equal to the previous regional minimum wage will need to issue an order to increase wages for employees in connection with the increase in the cost of living in the region.

In some regions, the agreement establishes a rule for counting the start date of a new minimum wage equal to the established subsistence level. The start of action is possible from the 1st day of the month following the month of entry into force of the resolution establishing the cost of living (Kaluga region.) There is an option when the minimum wage is calculated based on the cost of living that was established for the quarter preceding the quarter that includes the month payroll calculations (Novgorod region).

A reduction in the cost of living for the next quarter in regions where the minimum wage is linked to its value does not give the employer the opportunity to automatically reduce workers’ wages. The norms of the Labor Code of the Russian Federation do not allow him to do this.

The content of the employment contract is determined by Article 57 of the Labor Code of the Russian Federation. Mandatory for inclusion in an employment contract by virtue of Part 2 of Article 57 of the Labor Code of the Russian Federation are the terms of remuneration (including the amount of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments).

Article 74 of the Labor Code of the Russian Federation allows changes, at the initiative of the employer, to the terms of the employment contract, with the exception of changes in the employee’s labor function in the case when, for reasons related to changes in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, other reasons), certain the terms of the contract cannot be preserved by the parties. In the case under consideration there are no such changes.

Changing the terms of an employment contract determined by the parties in accordance with Article 72 of the Labor Code of the Russian Federation is allowed only by agreement of the parties to the employment contract, with the exception of cases provided for by the Labor Code of the Russian Federation. Therefore, the employer does not have the right to reduce the tariff rate or salary (official salary) established by the employment contract.

It is not so rare to find cases when an organization has a branch in another region of the Russian Federation. At the same time, each region has its own minimum wage.

Russian labor legislation, prohibiting any kind of discrimination when establishing wage conditions, obliges the employer to provide employees with equal pay for work of equal value (paragraph 6, part 2, article 22 of the Labor Code of the Russian Federation), making the wages of each employee dependent only on his qualifications, the complexity of the work performed, the quantity and quality of labor expended (Article 132 of the Labor Code of the Russian Federation).

If the head of a branch of an organization has the right to independently establish the staffing structure and approve the staffing table, then when establishing official salaries for employees of the branch, he is not bound by legislative norms regulating the minimum wage in the region where the parent organization is located. Only the requirement of regional legislation on the minimum wage in the region must be met (Part 2 of Article 133.1 of the Labor Code of the Russian Federation).

Based on this, official salaries in a branch of the organization (and in its other separate structural divisions) may legitimately differ from salaries for similar positions in the parent organization, taking into account the specifics of the division’s activities, including due to differences in the minimum wage in the constituent entities of the Russian Federation, in which the parent organization and its separate divisions are located.

Sanctions for violations Payment of wages below the minimum established by law and (or) regional agreement is a violation of labor laws.

Tax officials once explained that the calculation and payment of wages in an amount less than the legally established minimum wage is not a tax offense, which results in liability under Article 122 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia dated March 19, 2009 No. 3 -6-04/66). Let us recall that the specified Article 122 of the Tax Code of the Russian Federation provides for the imposition of penalties for non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction).

At the same time, the management of the tax service ordered its subordinates to pay special attention to tax agents paying wages below the regional subsistence level (letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722 “On the work of tax authorities’ commissions on the legalization of the tax base” ). We fully expect such employers to be called to the commission. Based on the results of the review, fiscal officials can send information about the payment of wages below the minimum wage to the local administration and territorial labor inspectorates (letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722).

It was stated above that control over the correctness of wage calculations by the employer is entrusted to territorial labor inspectorates.

It is the labor inspectorate, based on the results of inspection activities, that has the right to impose a sanction in the form of an administrative fine on both the employer and the head of the organization, in particular for the violation in question (Article 51 and Chapter 57 of the Labor Code of the Russian Federation, Article 23.12 of the Code of Administrative Offenses of the Russian Federation).

If an employer pays a salary below the federal or regional minimum wage, then he faces an administrative fine provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation: • a legal entity may be fined in the amount of 30,000 to 50,000 rubles; • official of the organization - from 1000 to 5000 rubles; • individual entrepreneur - from 1000 to 5000 rubles. At the same time, imposing a fine on an organization does not relieve the official from liability, and vice versa.

If an official of the organization is repeatedly caught in non-compliance with the legislation on wages, he may be disqualified for a period of one to three years.

Inspectors, of course, can, in the presence of mitigating circumstances, limit themselves to only issuing an order to establish wages no less than the regional (federal) minimum wage. For failure to comply with such an order within the specified period, in accordance with paragraph 1 of Article 19.5 of the Administrative Code of the Russian Federation, a fine of 10,000 to 20,000 rubles may be imposed on the organization, and a fine of 10,000 to 20,000 rubles may be imposed on an official of the organization and an individual entrepreneur - from 1,000 to 2,000 rubles.

IMPORTANT:

One of the basic principles of legal regulation of labor relations, enshrined in Article 2 of the Labor Code of the Russian Federation, is to ensure the right of every employee to timely and full payment of fair wages, ensuring a decent human existence for himself and his family.

Employers currently do not have an obligation to pay employees wages in an amount corresponding to or exceeding the subsistence level; they only need to comply with the minimum wage requirement.

Tariff rates, salaries, and basic wage rates for professional qualification groups of workers for certain categories of workers may be set below the minimum wage.

The wages of employees of organizations located in the regions of the Far North and equivalent areas, in the opinion of senior judges, should be determined in an amount not less than the minimum wage. After which the regional coefficient and a bonus for work experience in these areas or localities should be added to it.

If an employee did not work for a full month (for example, he did not get a job on the first day of the month, or quit on the last day of the month, or was sick, or was on vacation, etc.), then the amount of wages accrued to him for a given month may be and below the minimum wage.

On September 1, 2007, the aforementioned Law No. 54-FZ introduced Article 133.1 into the Labor Code of the Russian Federation, establishing provisions on the amount of the minimum wage in the region of the Russian Federation.

In Moscow, the minimum wage is established without taking into account compensation and bonuses for harmful (hazardous) work, overtime work and work on weekends and holidays, as well as for combining professions and positions.

Reducing the cost of living for the next quarter in regions where the minimum wage is linked to its value does not give the employer the opportunity to automatically reduce workers' wages. The norms of the Labor Code of the Russian Federation do not allow him to do this.

Based on the results of inspection activities, the labor inspectorate has the right to impose a sanction in the form of an administrative fine on both the employer and the head of the organization, in particular, for the violation in question (Article 51 and Chapter 57 of the Labor Code of the Russian Federation, Article 23.12 of the Code of Administrative Offenses of the Russian Federation).

Vladimir FEDOROVYCH, expert "PBU"