Hotel form.

Hotel account form NN 3-G, 3-GM (form)

- is a strict reporting form. To be filled in when making payment for a reservation, accommodation, as well as for additional paid hotel services. The invoice is issued in three copies: the first is issued to the client (resident), the second is submitted to the accounting department, the third is stored until the guest leaves in the checkout area of the hotel in a special file cabinet. With the mechanized method of conducting payments, the invoice is filled out in 2 copies. It records payment for the entire period of stay. Both copies are stored in the control file until the guest leaves.

Is it possible for hotels to use only form 3-d when making payment for accommodation, without a KKM check, and for organizations to accept it as a supporting document confirming expenses?

Form 3-d is indeed approved and is a BSO, but previously there was a list of organizations that had the right to work without a cash register. This list included hotels. Now they are not there. And today, almost all hotels issue the client both a cash register receipt and an invoice in form 3-g. In this situation, account 3-g is simply a transcript of the cash register receipt, with a detailed description of the services provided. Those. he lost his BSO function.

On the other hand, formally, he is a BSO - it seems that no one has canceled this. Therefore, if the employee brought only invoice 3-d, then it seems that it can be attributed to expenses. Another thing is that the hotel did not have the right to issue only the 3rd and not issue a KKM check.

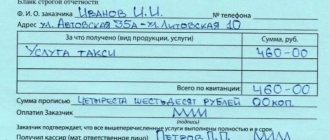

By the way, the court believes that any document that contains the necessary details will do to confirm expenses. That is, the paper needs to indicate the name of the hotel, the cost of living, a signature and date (clause 2 of article 9 of the law of November 21, 1996 No. 129-FZ; clause 8 of the Rules for the provision of hotel services in the Russian Federation, approved Government Decree of April 25, 1997 No. 490). However, such a document does not necessarily have to be a strict reporting form.

Download other forms on our website:

Hotel invoice form 3-G cannot be used

O., the organization that sent it, its address, details, contacts, date of arrival and departure. For a more detailed display of the period of stay, check-in/check-out times are indicated. All hotels use the concept of checkout time. Usually this is 12 -14 pm. The days of the client's stay are calculated from this time of day. It is also convenient for detailed calculation of partial days of stay. So, for example, when a tenant checks in several hours earlier than the check-out time, this time is added to his period of stay. It could be a whole day, or maybe half a day. The situation is similar with late check-out (check-out after check-out time). Adding a day or half a day is a purely internal matter of the hotel itself. The main thing is that the client is informed about this in advance and does not find himself in an uncomfortable situation.

In the central field of the hotel invoice there is a table that displays the main characteristics of the stay. The period of stay at the hotel itself can be duplicated here. Other accommodation parameters include reservation, resort fee, availability of a refrigerator, air conditioning, telephone and other equipment in the room. Also, a separate column indicates meals (breakfasts, lunches), use of dry cleaning services, tailoring. Hotels with their own parking can provide their clients with a secure parking space for an additional fee. The list of additional services can be listed endlessly, it all depends on the type of hotel, its financial category, purpose, and territorial location. The main thing is that all these services are included correctly and in detail in the invoice.

Depending on the client’s wishes, the hotel invoice can be issued in different quantities. Previously, before the advent of electronic data processing, it was compiled in triplicate. One copy was provided to the client’s accounting department, the second was given directly to the tenant himself, the third remained in the hotel and was stored in a special client file. With the widespread use of computers, paper hotel records have been successfully replaced by an electronic customer database. The format of the electronic database remains similar to the old card index and is replenished with the same accounts of the same form, only in electronic form. At the client's request, he takes one or two copies of the invoice. He may not take it for himself, but one set for accounting is required.

You can buy reporting documents for your hotel stay and consider some important points in the appropriate section. The entire list of reporting documents for accommodation is described in detail here. In addition to the aforementioned hotel invoice, it must include a cash receipt. Other forms of reporting may also be present.

Since 2009, account 3-g as a strict reporting document has been abolished. That is, it cannot be used in its only form to close a business trip. Another acceptable option is a set of documents, where in addition to the invoice for accommodation, a hotel cash receipt is required. Most hotels still issue documents to their clients in this form to this day.

The mandatory use of form 3-g has been abolished since 2008. Such a form as a mandatory confirmation of hotel accommodation no longer exists. This is a memory of something long gone.

Despite the fact that in some accounting departments they continue to persistently demand “form 3-d” as a hotel receipt. The fact is that, according to current legislation, the use of this form is left to the choice of the hotel issuing documents for accommodation. The hotel, at the request and accepted internal regulations, can provide supporting documents both in form 3-d and in any other form.

Where to get a hotel form

And if in scientific language, then this is “form 3-d hotel receipt form 2018”. possible below.

Let us immediately note that this form 3-g is no longer a sample of a strict reporting document and is not mandatory for use by owners and employees of the hotel business. Based on it, you can develop your own strict reporting form (SRF).

For example, hotel employees often use BO-18. Also, when forming your own BSO, you should take into account the requirements of Resolution No. 359.

What is this form and how is it used?

A receipt-agreement for the services of motels, campsites, and hotels is the official name of the BO-18 form (reporting form). This form has always been used along with 3-g to process payment for accommodation. BO-18 was never legally approved, unlike 3-g, but in practice it is very common.

3-g was very often used by business travelers to confirm the intended use of funds. However, times have changed, and the documents also needed to be amended. Let's start with the fact that previously a receipt for a hotel stay, the form of which is presented below, could independently confirm the fact of payment; an additional cash receipt was not required.

Previously, hotels, campsites or motels could operate without cash register equipment (CCT), but this provision has now been abolished. Many hotel workers issue both a KKT check and 3-g or BO-18, since it is quite convenient and can replace a cumbersome contract.

If a citizen intends to buy some additional products at a place of temporary residence or pay for services, a simple cash receipt can be used. When making a reservation, hotel workers usually issue an invoice and then issue documents confirming the stay and full payment.

Contract details

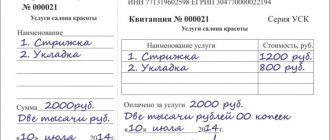

The hotel receipt must include some of the details recommended in the above resolution:

- document name and series with number code;

- full name of the hotel (camping, motel) and owner (legal entity or individual entrepreneur), its details, INN, ORGN, legal address;

- type of service and cost including taxes;

- the amount received on the receipt;

- an indication of from whom and for what the funds were received;

- the date of drawing up this agreement, the seal and signature (with transcript) of the responsible person who accepted the funds.

Additional columns may be included indicating the time of stay (check-in and check-out), a full list of services provided at the campsite, and the room occupied at the motel, but this is not necessary.

Receipts can be produced in any printing house according to the sample.

Form 3 G - forms and description of documents from the hotel for accommodation with downloading

Business trips in many companies are an integral part of their activities, which require special documentation and registration. An employee who was on a business trip needs to report not only about hotel accommodation, but also about expenses incurred during his stay in another city. He must provide official documents from the hotel for his stay, forms 3g are one of them, but now they are no longer required to be presented. What is 3g? A hotel invoice in form 3g is a hotel receipt for accommodation; this form is necessary for accounting reporting. This document is filled out when making payment for the reserved room and for staying in it. In addition, hotel receipt forms are filled out for other paid hotel services provided. At the moment, this form has been canceled, however, at some enterprises it is necessary to provide this form for reporting. Reporting form n 3g, a sample of which is presented in any hotel, must contain certain details, including:

- Name;

- date of completion;

- name of the organization that issued the form;

- content of the cost transaction;

- meter of the content of the transaction in monetary terms;

- name and signatures of responsible persons, etc.

Invoice form 3g, which is available on the hotel website, is usually filled out in triplicate. One remains in the hands of the client, the second hotel invoice for accommodation, form 3g, is submitted for reporting to the accounting department, and the third is stored in the hotel file cabinet until the client leaves. An invoice for payment for hotel accommodation and a form confirming this were used without fail until the system of mutual settlements using a cash register appeared. Previously, payment was made only in cash, while the Form 3d document and the hotel form with stamps and signatures of the hotel management were the only documents confirming the costs. Today, any enterprise that provides paid services must use cash registers. Each cash register is registered with the tax authority, so checking the receipt will not be difficult. This cash receipt contains all the information on the form or receipt for payment for hotel accommodation; you can download it for free. Therefore, additional confirmation of all expenses in Form 3d, which is a strict reporting form, is not required.

Hotel bill

3rd hotel invoice was used as the main document of strict reporting This type of hotel reporting was introduced into the document flow in December 1993 by the corresponding decree of the Ministry of Finance of the Russian Federation. Throughout this entire period of time, until the end of 2008, this account was a document of strict accountability. This means that account 3-g itself had fiscal power and could be used to write off business travel expenses by organizations.

In practice, this type of document for a hotel was drawn up on A-4 format. At the top it contained directly identifying information about the form number, the date of approval, the decree number and the authority that approved it. Next, the invoice contains the name of the hotel, the serial number of the invoice itself, and the room number. It is mandatory to indicate the client's information on the invoice: Full name.

What can replace form 3g?

Approval of document flow in each organization is regulated by the head and governing body. Management has the right to decide that a hotel receipt will not be sufficient to report travel expenses. Now it is unclear whether form 3g works or not. What to do in such a case? Responsible hotel officials can download a hotel check form and sign a standard agreement for the provision of specific services with a traveling employee. A signed official contract and an available KKM receipt can serve as confirmation of payment for hotel services. They will be confirmation that a company employee lived in this hotel and used its services during a specific period of time. If it is not possible to download a sample hotel invoice in form 3d and draw up an agreement, you can ask the hotel complex employees to draw up a document in free form confirming all expenses incurred. In most Russian hotels today, departing people are given an official invoice and a cash receipt. These documents confirming travel expenses correspond to the hotel invoice form in Form 3g, which can be downloaded for free. Such documents can include not only the cost of accommodation, but also payment for additional hotel services for a given period. In addition, if necessary, the hotel management is ready to offer company employees staying at the hotel, in addition to a cash receipt and an invoice for services, an invoice for strict accounting reporting.

Strict reporting forms for hotels, hotels, motels, etc.

Many hotels, in their daily work with the population, use strict reporting forms for maintaining and accounting for funds, which are regulated by Decree of the Russian Federation No. 359 of 05/06/2008. Number according to the All-Russian Classifier of Services to the Population (OKUN) - 062100 - Services of hotels and similar accommodation facilities, clubs, furnished rooms, motels, hostels.

Popular forms for hotels, hotels

Hotels use these forms in their business. These forms are used by both large hotels and small hotels.

Despite the fact that in some accounting departments they continue to persistently demand “form 3-d” as a hotel receipt. The fact is that, according to current legislation, the use of this form is left to the choice of the hotel issuing documents for accommodation. The hotel, at the request and accepted internal regulations, can provide supporting documents both in form 3-d and in any other form. Below in this article you can read the legally confirmed non-compulsory provision of Form 3-g.

This form is currently not valid. It was approved by order of the Ministry of Finance of the Russian Federation dated December 13, 1993 No. 121. The form was canceled by clause 2 of the Government of the Russian Federation Resolution No. the entry into force of Decree of the Government of the Russian Federation of March 31, 2005 N 171 “On approval of the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment”, can be applied until December 1, 2008.”

In the absence of cash register equipment, hotels must independently develop a form of document confirming the receipt of money for accommodation. The document must contain the mandatory details specified in the regulations on cash payments without the use of cash registers, namely: a) name of the document, six-digit number and series; b) name and legal form - for the organization; last name, first name, patronymic - for an individual entrepreneur; c) the location of the permanent executive body of the legal entity (in the absence of one, another body or person having the right to act on behalf of the legal entity without a power of attorney); d) TIN assigned to the organization (individual entrepreneur); e) type of service; f) cost of the service; g) the amount of payment made in cash and (or) using a payment card; h) date of calculation and preparation of the document; i) position, surname, name and patronymic of the person responsible for the transaction and the correctness of its execution, his personal signature, seal of the organization (individual entrepreneur); j) other details that characterize the specifics of the service provided and with which the organization (individual entrepreneur) has the right to supplement the document.

- When using cash registers as a reporting mechanism, the fiscal burden lies on the cash register receipt, and only on it. All additional forms and forms have no legal force before the tax authorities.

- The presence of seals and stamps for individual entrepreneurs is not regulated by law in the Russian Federation.

Confirmation of the legal actions of an individual entrepreneur is carried out by handwriting the documents. And most hotels currently belong to individual entrepreneurs.Currently, the law obliges companies and individual entrepreneurs to use cash register equipment that issues online receipts. The deadline for the transition of all enterprises engaged in sales and providing hotel services and rental housing is July 1, 2021.

We provide business travelers with accounting documents for their accommodation. Hotel checks in form BO-17 and fiscal cash receipt (54-FZ 2017).

Based on materials from the sites Garant Plus and Quitocru

Business trips in many companies are an integral part of their activities, which require special documentation and registration. An employee who was on a business trip needs to report not only about hotel accommodation, but also about expenses incurred during his stay in another city. He must provide official documents from the hotel for his stay, forms 3g are one of them, but now they are no longer required to be presented. What is 3g? A hotel invoice in form 3g is a hotel receipt for accommodation; this form is necessary for accounting reporting. This document is filled out when making payment for the reserved room and for staying in it. In addition, hotel receipt forms are filled out for other paid hotel services provided. At the moment, this form has been canceled, however, at some enterprises it is necessary to provide this form for reporting. Reporting form n 3g, a sample of which is presented in any hotel, must contain certain details, including:

- Name;

- name of the organization that issued the form;

- content of the cost transaction;

- meter of the content of the transaction in monetary terms;

- name and signatures of responsible persons, etc.

date of completion;

Invoice form 3g, which is available on the hotel website, is usually filled out in triplicate. One remains in the hands of the client, the second hotel invoice for accommodation, form 3g, is submitted for reporting to the accounting department, and the third is stored in the hotel file cabinet until the client leaves. An invoice for payment for hotel accommodation and a form confirming this were used without fail until the system of mutual settlements using a cash register appeared. Previously, payment was made only in cash, while the Form 3d document and the hotel form with stamps and signatures of the hotel management were the only documents confirming the costs. Today, any enterprise that provides paid services must use cash registers.

Each cash register is registered with the tax authority, so checking the receipt will not be difficult. This cash receipt contains all the information on the form or receipt for payment for hotel accommodation; you can download it for free. Therefore, additional confirmation of all expenses in Form 3d, which is a strict reporting form, is not required.

Types of settlements with hotel clients. Strict reporting forms

For payments by bank transfer, traveler's and personal checks can also be used.

For reference, it should be noted that recently in Russia this type of payment has begun to be used, such as payment by plastic card, but for these purposes the hotel must be equipped with a special electronic terminal. It is no secret that not every enterprise can yet afford such expensive equipment, and therefore, for the most part, in our country, cash payments still come first.

Therefore, we must not forget about the requirements of the Federal Law of May 22, 2003, which came into force. No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards.”

In accordance with paragraph 1 of Article 2 and Article 5 of this law, organizations when making cash payments are required to use cash register equipment (CCT) and issue cash register receipts printed by cash register equipment to buyers (clients) when making such payments at the time of payment. For the purposes of this Law, cash payments mean payments made using cash for goods purchased, work performed, and services rendered.

However, paragraph 2 of Article 2 of this law establishes that*

* Organizations and individual entrepreneurs, in accordance with the procedure determined by the Government of the Russian Federation, can carry out cash payments and (or) payments using payment cards without the use of cash register equipment in the case of providing services to the population, provided that they issue the appropriate strict reporting forms.

The procedure for approving the form of strict reporting forms equated to cash receipts, as well as the procedure for their recording, storage and destruction, is established by the Government of the Russian Federation.*

Since hotel activity is a process of providing a service, when working with individuals (citizens), it can use strict reporting forms approved by the Order of the Ministry of Finance of the Russian Federation dated December 13, 1993. No. 121.

Note!

Federal Law No. 54-FZ allows the use of strict reporting forms when organizations and individual entrepreneurs provide services to the population. For legal entities, the Law on CCP does not establish calculations using strict reporting forms. Therefore, if an organization enters into an agreement for the provision of services with a legal entity and payment is made in cash, the presence of a cash register is mandatory.

Considering the primary documents that hotels use when providing services, it is no coincidence that we drew the reader’s attention to the fact that some of them are strict reporting forms (SSR). The hotel accountant should properly organize the accounting and storage of such forms.

The procedure for using strict reporting forms of approved forms and the types of activities for which the use of such forms is permitted will have to be approved by the Government of the Russian Federation.

Until the new strict reporting forms are put into effect, the current ones approved by the Russian Ministry of Finance can be used.

Forms must be produced only by typographical method with the obligatory indication of the output typographical data.

Strict reporting forms are developed and approved by the Ministry of Finance of the Russian Federation. General requirements for BSO and the procedure for their registration are given in the Letter of the Ministry of Finance of the Russian Federation dated August 23, 2001. No. 16-00-24/70 “On strict reporting documents when making monetary settlements with the population.”

The strict reporting form must, along with indicators characterizing the specifics of the transactions being processed, contain the following mandatory details:

- approval stamp, name of the document form;

- six-digit number;

- series;

- form code according to the All-Russian Classifier of Management Documentation (OKUD);

- date of settlement;

- name and code of the organization according to the All-Russian Classifier of Enterprises and Organizations (OKPO);

- TIN code;

- type of work (services) provided;

- units of measurement of services provided (in kind and in monetary terms);

- the name of the position of the person responsible for carrying out the business transaction and the correctness of its execution with a personal signature.

Each form is numbered in a typographical manner, and if it was accidentally damaged when making a cash payment, it should be saved and crossed out.

A form with all required details filled in, signed by an official, acquires legal force and is the primary accounting document. Strict reporting forms are equivalent to a cash register receipt.

In accordance with the “Regulations on documents and document flow in accounting”, approved by the USSR Ministry of Finance on July 29, 1983. No. 105, forms of primary documents classified as strict reporting forms must be numbered in the order established by ministries and departments by numerator or typographic method.

Strict reporting forms, like other primary accounting documents, in accordance with Federal Law of November 21, 1996 No. 129-FZ “On Accounting” must contain the following mandatory details:

- Title of the document;

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons;

The check or insert (backing document) issued to buyers (clients) must contain the following details:

- Title of the document;

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons.

In addition, in addition to indicators characterizing the specifics of the transactions being processed, the following must be indicated in the form of strict reporting forms:

- approval stamp of the form;

- code of the form according to the All-Russian Classifier of Management Documentation (OKUD);

- name and code of the organization according to the All-Russian Classifier of Enterprises and Organizations (OKPO);

- TIN of the organization.

An integral requisite is the presence on each copy of the form of its serial number. When affixing a number, some of the characters can be alphabetic (series), and some can be digital.

Strict reporting forms for carrying out monetary settlements with the population without the use of cash registers are produced in printing houses according to orders (available samples approved by the Ministry of Finance of Russia) of ministries and departments, as well as the organizations themselves.

Note!

Computer (independent production using existing computer equipment) production of strict reporting forms is unacceptable.

On February 11, 2002, the Federal Law of August 8, 2001 No. 128-FZ “On licensing of certain types of activities” came into force, introducing significant changes to the “old” version of the law on licensing. Previously, it was legislatively approved that a license was required to carry out printing activities. This meant that the production of strict reporting forms by printing, which are printed products, was subject to mandatory licensing. The new Federal Law has significantly reduced the list of activities for which licenses are required.

According to Article 17 of Law No. 128-FZ, a license is required to carry out activities for the production of counterfeit-proof printed products, including forms of securities, as well as trade in these products.

This means that strict reporting forms with security elements must be produced by printing enterprises that have the appropriate license issued by the federal executive body (in this case, the Ministry of Finance of Russia). Consequently, from February 11, 2002, printing activities for the production of strict reporting forms (not protected against counterfeiting) and activities for trading in these forms are not subject to licensing.

SINCE STRICT REPORTING FORMS FOR HOTELS DO NOT HAVE PROTECTION, CONSEQUENTLY, A LICENSE IS NOT REQUIRED FOR THEIR PRODUCTION AND SALE.

So, strict reporting forms must be published in printing. When producing BSO, the series is assigned to them by the organization independently when submitting an order for the production of forms to the printing house. The number of a specific form within the corresponding series is assigned by the printing house.

Recently, taxpayers have been concerned about the question of whether strict reporting forms need to be registered with local tax authorities?

The answer is simple, there is no need to do this, since the current Russian legislation does not provide for such an obligation. Therefore, the corresponding demands of local tax inspectorates are unfounded and illegal.

In addition, those who work with BSO are probably concerned about how to properly store, record and destroy these documents. Today, there are no such rules, so we can only recommend that taxpayers use the “Regulations on Documents and Document Flow in Accounting” (approved by the USSR Ministry of Finance on July 29, 1983 N 105 in agreement with the USSR Central Statistical Office) to the extent that does not contradict current Russian legislation.

Accounting and tax accounting of strict reporting forms.

The costs of acquiring BSO are classified as expenses associated with the provision of services.

In accounting, these expenses are reflected in accordance with the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, as expenses of the organization for ordinary activities.

To summarize information about the availability and movement of BSO that are in storage and issued for reporting, the Chart of Accounts provides off-balance sheet account 006 “Strict reporting forms.”

The acquisition of BSO (including by accountable persons) is reflected in the debit of account 006 in a conditional valuation (for example, 1 ruble), write-off - in the credit of account 006 on the basis of relevant documents on their use, etc. Analytical accounting is maintained for each type of BSO and their storage locations.

When acquiring BSO, the following entries are made in accounting:

Debit 26 “General business expenses” Credit 60 (71, 76) - purchased by BSO at actual cost;

Debit 006 “Strict reporting forms” - capitalized by BSO for storage;

Debit 19 “Value added tax on purchased material assets” Credit 60 “Settlements with suppliers and contractors” - VAT on purchased BSO is taken into account;

Debit 60 “Settlements with suppliers and contractors” Credit 51 “Current account” - the debt to the supplier for the purchased BSO is repaid;

Debit 68 “Calculations for taxes and fees” subaccount “VAT” Credit 19 “Value added tax on acquired material assets” - VAT is reimbursed to the budget;

Credit 006 “Strict reporting forms” - used SSBs are written off.

The organization's expenses for the acquisition of BSO reduce the tax base for the organization's profit tax in accordance with paragraph 24, paragraph 1, article 264 of the Tax Code of the Russian Federation. Moreover, the amounts spent on the acquisition of BSO must be expensed immediately, and not as they are used in the course of business activities.

As for individual entrepreneurs, in accordance with clause 1 of Article 221 of the Tax Code of the Russian Federation, they have the right to a professional tax deduction in the amount of expenses incurred for the purchase of BSO.

Responsibility for non-use of BSO.

In Article 14.5. The Code of Administrative Offenses of the Russian Federation provides for administrative responsibility for the provision of services by organizations, as well as citizens registered as individual entrepreneurs, without the use of cash registers in cases established by law.

The punishment for this offense is an administrative fine in the amount of:

- for citizens - from 15 to 20 minimum wages;

- for officials - from 30 to 40 minimum wages;

- for legal entities - from 300 to 400 minimum wages.

What can replace form 3g?

Approval of document flow in each organization is regulated by the head and governing body. Management has the right to decide that a hotel receipt will not be sufficient to report travel expenses. Now it is unclear whether form 3g works or not. What to do in such a case? Responsible hotel officials can download a hotel check form and sign a standard agreement for the provision of specific services with a traveling employee. A signed official contract and an available KKM receipt can serve as confirmation of payment for hotel services. They will be confirmation that a company employee lived in this hotel and used its services during a specific period of time. If it is not possible to download a sample hotel invoice in form 3d and draw up an agreement, you can ask the hotel complex employees to draw up a document in free form confirming all expenses incurred. In most Russian hotels today, departing people are given an official invoice and a cash receipt.

These documents confirming travel expenses correspond to the hotel invoice form in Form 3g, which can be downloaded for free. Such documents can include not only the cost of accommodation, but also payment for additional hotel services for a given period. In addition, if necessary, the hotel management is ready to offer company employees staying at the hotel, in addition to a cash receipt and an invoice for services, an invoice for strict accounting reporting.

How easy is it to get a hotel form form 3g?

Thanks to close cooperation with various hotels, a set of documents can be issued with or without confirmation. We deliver forms 3d not only in Moscow, but also using transport companies to any region of the country. Therefore, if necessary, everyone can use the services.

We will make sure that the hotel form form 3d is filled out correctly. For this purpose the following will be written:

- passport details,

- registration address,

- information about the hotel,

- types of payments.

The latter can be specified, for example, indicating early check-in or late check-out, booking or receiving a discount.

Features of filling out form 3g

The document also indicates how much was paid in cash, by payment card and who received the funds. Therefore, using the hotel form Form 3d it is easy to check how reliable the information is.

All of them are entered into the database. Therefore, when choosing a company to entrust with the preparation of all documents, pay attention to ours. We cooperate with many hotels, so if necessary, Form 3G, which the hotel allegedly provided, will withstand any verification.

In conclusion, it should be noted that if you are not sure which forms are required for the report, call our specialists. They will tell you about the types of documents that must be provided. All information provided by clients is important solely for filling out Form 3g for the hotel.

We never use information for other purposes. Almost all hotels have cash registers, so the original receipt will be received without any problems. The hotel form form 3g is filled out quickly and for a minimal fee.

Rules for filling out form 3-G

September 22, 2015

A special form for hotels - Form 3-G was originally intended for issuing a reporting form from business travelers staying in a hotel for the entire duration of their business trip. This document began to operate from the time of its approval, which was agreed upon by the Ministry of Finance of the Russian Federation at the end of 1993. But at the end of 2008, the Government of the Russian Federation issued a decree No. 359, according to which the number of this account was canceled. At the same time, it is still profitable for certain hotels to issue a form for this number when making payments to clients.

- After returning from a business trip, providing only this form to the accounting department of your company will not be enough.

It is imperative to accompany Form 3-G with cash receipts, and you can buy hotel receipts on the website (c-hek.ru). At the same time, they must record all amounts of money spent during your stay.

Form 3-G must be printed in a printing house in a standard way, and it must be filled out in clear, understandable handwriting using blue ink. The coordinates, contact number and the name of the hotel itself are usually stamped in the upper left corner of the form with a seal specially made for this purpose.

it is necessary to record in a certain column of the form the day, month and year when the payment was made. And be sure to note the index of the area in which the hotel is located. If the hotel has a numbering machine, then with its help all accounting account numbers are simply stamped on the 3-G form.

Under the name of the hotel, you must indicate its class and, in specially stamped lines, indicate the number of the hotel building and, necessarily, the number of the room where the client lived during the entire business trip.

It is necessary to print the cash receipt, if you have a cash register, and attach it to Form 3-G.

ACCOUNT (Form No. 3-G)

Approved

By order of the Ministry of Finance

Russian Federation

dated December 13, 1993 N 121

Form N 3-G

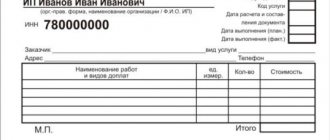

Hotel __________________________________________________________ City ____________________________________________________________ 000000 ACCOUNT N —————— from “___” ____________________ 19__ Gr. ________________________ Settlement index ____________________ (Last name, first name, country) N room _________________________ Check-in ____________________ (date, hours) N building _________________________┌────┬───────────────── ───┬────┬────┬──────────────┬──────────── ┐│ N │ Types of payments │Unit. │Quantity│ Price │ Amount ││p/p │ │change│unit-├──────┬───────┼──────┬──── ─┤│ │ │ │nits │ rub. │ kop. │ rub. │kop. │├────┼────────────────────┼────┼────┼─── ───┼───── ──┼──────┼─────┤│1. │Reservation │ % │ │ │ │ │ ││ │ │ │ │ │ │ │ ││2. │Reservation │k/s │ │ │ │ │ ││ │ │ │ │ │ │ │ ││3.

Hotel strict reporting form (sample)

Related publications

With the release of Government Resolution No. 359 dated May 6, 2008, the rules for settlements with individuals when providing them with paid services changed. There was a need to use CCP. An alternative option for confirming a payment transaction is strict reporting forms. For hotels, the Form 3-G account is considered obsolete, it is not recommended to use it in practice, but it is allowed to develop your own BSO on its basis.

Results

Until July 1, 2019, in order to process payments to clients without using cash register systems, hotels can use strict reporting forms. The main thing is that they comply with the requirements of Resolution No. 359 of April 6, 2008. From July 1, 2019, hotels will have to issue BSOs in accordance with the requirements of Law No. 54-FZ of May 22, 2003.

You can learn more about the use of BSO in the articles:

- “What is the responsibility for non-use or loss of BSO?”;

- “Production of strict reporting forms - article of KOSGU.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

BSO for hotels: mandatory details

There are no legally established unified forms of BSO in the hotel industry. Each enterprise creates them independently, taking into account the requirements of Decree No. 359. The second option is to use form BO-18 - a strict reporting form for hotels, you will find a sample below.

Document BO-18 was developed by the private enterprise Rosbytsoyuz. The version of the proposed form turned out to be successful - it suits both legal entities and tax authorities (letter issued by the Federal Tax Service of the Russian Federation for the Krasnodar Territory, under registration number 23-12/31467-472 dated December 10, 2008).

When creating your own BSO project, you should adhere to the rules of Resolution No. 359:

- the document must have a title and series with a number code;

- in one of the fields of the form it is necessary to provide space for the name of the legal entity and indication of its details and legal address;

- the BSO must specify the types of services and their costs;

- the amount received from the individual in fact is entered in a separate column;

- the date of the transaction, the signature and transcript of the signature of the official who accepted the cash from the client, the seal are integral elements of the executed strict reporting form.

BSO for a hotel taking into account legal requirements

The BSO issued by the hotel to the client (according to the rules until July 1, 2019) must record:

- name of the form, its series and number;

- name of the hotel organization;

- hotel address, its TIN;

- type of service provided, its cost;

- actual amount received from the hotel client;

- the date of settlements with the client, as well as the preparation of the SSB;

- Full name, position of the hotel employee who made the payment to the client, signature of this employee, seal of the organization.

The form can also record other data that is significant for hotel owners regarding settlements with the client. For example:

- date of entry and exit of the guest;

- room number;

- lists of services provided to the guest.

Which strict reporting form can a hotel use?

The sample in form BO-18, as we wrote above, is that form. It can be used:

- companies whose main activity is the provision of accommodation services in hotel rooms;

- enterprises acting as intermediaries between hotels and their guests.

The strict reporting form for hotels (you can download it below) consists of the following sections:

- A block with information about the service provider company, within which the name of the company, its address and TIN are entered into the document.

- Columns for the name of the document and a unique 6-digit number code, series of the form.

- The main part of the document, which identifies the guest, provides the numbers of the building and the room he occupies, the exact date of arrival, and fills out a table block. The table contains cells for types of payments, the cost of each service and the amounts actually accrued for payment.

- The hotel must present the strict reporting form to the guest for signature. There must be three signatures of the client: confirming familiarization with the contents of the document being filled out, knowledge of the norms of the Civil Code of the Russian Federation, and the fact of providing specific services.

- Signature and information about the official completing the transaction.

- Information on payment of the invoice indicating the total amount in figures and words, the date of receipt of money.

There is a place for printing at the end of the form.

How to obtain reporting documents for hotel stays

A business trip is required to resolve pressing issues for the employer’s company. Therefore, when sending an employee on a trip, the company reimburses him for expenses, including accommodation. Often the most convenient option for an employee is a hotel located close to the business trip.

At the end of the client’s stay, the hotel issues reporting documents for business travelers to confirm the fact of their stay at the hotel on certain days. Letter of the Ministry of Finance of the Russian Federation dated February 25, 2015 No. 03-07-11/9440 indicates that in the case when the hotel does not use cash register payments, the accommodating party is obliged to draw up a strict reporting form, which is developed independently. This form can have any name, for example, a voucher or a hotel check.

Upon returning from a business trip, you must provide documents issued by the hotel to the accounting department, which confirm your accommodation there. A cash receipt is also required for the advance report. The basic requirements for the form provided by the hotel enterprise are as follows:

- The strict reporting form must necessarily contain the following details: name of the document, six-digit number and series of the document, full name of the organization providing the services, address, TIN of the organization and seal.

- It is necessary that the strict reporting form be produced using a printing method or generated using automated systems. System requirements: mandatory protection from unauthorized access, identification and preservation of the number and series of the form for at least 5 years (Resolution of the Government of the Russian Federation of May 6, 2008 No. 359). Forms printed on a computer without the use of automated systems will not be accepted by the organization as confirmation.

Sample receipt confirming hotel accommodation

Payment for accommodation on a business trip in a budgetary organization and in a commercial one is equally made on the basis of a hotel invoice or an invoice and a cash receipt.

It is important to note that if a seconded employee provides his organization with a document on hotel accommodation that does not meet the specified requirements, and the organization takes these expenses into account in tax reporting, the Federal Tax Service may have claims. In this case, the company can defend its expenses in court. To do this, we recommend that you read the Resolution of the Federal Antimonopoly Service of the North-Western District dated November 1, 2010 in case No. A52-3413/2009.

In a situation where a hotel-type enterprise uses cash registers, the reporting includes a check and invoice or other documentation about the employee’s stay at the hotel.

Payment for hotel accommodation on a business trip in the absence of supporting documents is made on the basis of a request to a hotel-type enterprise to confirm the fact of the employee’s residence during the specified period of time and obtain a certificate.

Please note that in Moscow this request is allowed to confirm an employee’s expenses, which is confirmed by letter from the Federal Tax Service for Moscow and the Moscow Region dated August 26, 2014 No. 16-15/084374. The certificate must contain details of the services provided and confirmation of payment. And the company must have other documentation confirming the employee’s business trip, for example, a business trip order, travel documents, etc.

Payment for a hotel on a business trip based on a certificate received upon request may not be accepted by the tax authorities. It is important to note that clause 1 of Art. 252 of the Tax Code of the Russian Federation allows for indirect confirmation of expenses to be taken into account, so the company can appeal the decision of the tax authorities.

Decree of the Government of the Russian Federation 1085 dated October 09, 2015 approved new Rules for the provision of hotel services. This resolution indicates the obligation to issue a strict reporting form or check.

Also, documents on hotel accommodation may be missing if a company rents residential premises to accommodate employees during a business trip. In this case, payment for the premises is made by the employer himself, so payment of expenses and reporting documents for living in an apartment on a daily basis are not provided.

What is a QR code on a cash receipt and how can I check it for correctness?

From July 1, 2021, almost all entrepreneurs and organizations must use modern cash register equipment - online cash register in accordance with 54-FZ. A fiscal drive must be present at the cash register. It stores all information about transactions and transmits it in encrypted form via the Internet to the Federal Tax Service (Federal Tax Service).

Thus, using the Federal Tax Service application, you can check whether the check is real or not. To do this, just install the application on your smartphone and hold the camera to the QR code on the receipt. After that, click check the receipt; if it shows that the receipt is correct, it means it is real and valid. If not, it's fake. Our company produces correct checks. Activities according to the TIN comply with 55.1 OKVED, i.e. activities of hotels and other places for temporary residence.

Attention! If you need a correct backdated receipt, just call us. Perhaps we will come up with something, since we have our own base. We strongly ask you to contact us in advance before or during your business trip, as in this case you are guaranteed to receive a check with the correct QR code.

Answers to the most frequently asked questions about issuing hotel checks

Who and how will confirm that I stayed at your hotel if my company makes a request?

At the moment when hotel checks are issued, data about each client is recorded in the hotel database , and is also duplicated in a special register of residents. All data is stored for at least two years. If an accountant or other interested parties of your company contact the hotel with a question about your stay there (the request can be written, in the form of an email or verbal), then the administration will find the necessary records. A certificate confirming your hotel accommodation will be immediately sent to your management.

I want to buy hotel checks, what is the cost of the services?

The minimum commission for a set of documents in Moscow and St. Petersburg is 1,500 rubles. , in other cities - from 1500 to 2500 rubles. When the total amount exceeds 10,000 rubles. — the cost is 13-16% (in St. Petersburg) and 14-17% (in Moscow), in other cities from 15 to 20%. The exact cost of issuing hotel checks in Moscow, St. Petersburg and other cities can be found out by calling or leaving a request using the form on the website. The price is indicated for official registration, with receipt directly at the hotel reception. Regular customers can count on a discount. Please note that checks passed on the street are fakes; we do not do such things. If our price seems high to you, ask for it directly at the hotel reception from those who do it “cheaply”.

How long does it take to make hotel checks in Moscow and St. Petersburg?

Registration of reporting documents on the fact of residence of a business traveler takes about one hour. In very urgent cases - 15 minutes. Our clients are issued a new sample cash receipt from the online cash register, with a QR code , indicating the amount of payment for services and all the necessary details. Dates of stay must be indicated. The necessary documents are issued at the hotel or by courier delivery.

Is it possible to purchase receipts for a specific hotel through your company?

has its own hotels and also cooperates with certain hotels. There is a list of hotels and constant contacts are maintained with them. If your hotel is on this list, then no problem.

Is it possible to buy a check retroactively?

You can buy a hotel check retroactively, but not always , so remember this! After all, receipts with the correct QR code are processed at the online checkout. All data about the operation in real time goes into the Federal Tax Service database. We can only select similar previously issued checks for you, or issue them with a current or future date. Unfortunately, there are no other options.

How likely is it that after paying for services via electronic payment, I will receive hotel receipts and a new check?

We value our reputation and look forward to long-term cooperation with our clients. There is no point in lying. Making a check for a hotel and sending it to the customer is not particularly difficult for us. We also first send off the QR code, which, by the way, is already correct and tax deductions for it went to the Federal Tax Service. In this case, no advance payment is taken from you. Although our competitors act in a different manner, they take full advance payment, and then come what may - in most cases they act in bad faith. That is, it makes no sense for us to somehow deceive anyone, because we have already spent our time, as well as money for transferring tax fees, and we are glad to have regular customers at any time of the day or night. Courier delivery allows you to control the movement of a letter with documents from our office to your home online using the track number.

If I do not want to check into a hotel, but for the period of my stay in your city I want to rent a living space or rent an apartment, will you be able to prepare the necessary documents to pay for the accommodation?

Our company will help you in this case too. From us you can buy hotel receipts with a QR code, as well as draw up the necessary documents for renting residential premises or an apartment for temporary residence during a business trip. Our database contains a number of addresses of rental housing - apartments for those who want to stay not in a hotel, but in a separate apartment or house. Everything will be done in accordance with current rental laws.

My organization has requested an invoice from me. What do I need to send to receive the documents I need?

To receive an invoice, you must obtain the following: details of the company where you work (full name), legal and postal addresses, tax identification number, etc. In some cases, it is possible to make it for an individual, but usually the employer requires registration for a legal entity.

Is there a QR code on the checks you send?

Yes, there is! From July 1, 2021, the requirement for the presence of a QR code on all types of payment documents has been approved. These requirements are strictly observed not only when selling goods. The QR code is present on receipts for the provision of services. Therefore, it is definitely present in the hotel business.

Discussion of the topic

203 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Ivan, from

08/28/2017 at 19:07 Writes:

What percentage of the check amount do you have? I need a hotel check and what comes with it. Hotel in Ekaterinburg

1035 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Admin, from

08/29/2017 at 08:45 Writes:

Hello. The set of documents includes: – Account 3G – Cash receipt – Certificate of provision of services – Price list – Other documents are possible at your request. The percentage is negotiable, depends on the total cost of living and other nuances, call us and we’ll discuss it.

1084 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Alexander, from

12/13/2017 at 18:34 Writes:

Hello! Give an idea of how much it will cost and what the time frame is. You need 2 sets of hotel checks (for two people). Hotel in Rostov-on-Don Duration ~ 33 days. Price per day – 3100. Now we are in Rostov. We will return to St. Petersburg after 24.12 - Best regards, Alexander.

1113 Reviews “HOTEL RECEIPT” Kamennoostrovsky Prospekt, 16, office 37

Alexey Vladimirovich, from

13.12.2017 at 19:29 Writes:

Hello, Alexander. The answer has been sent to you by email.

1102 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Andrey, from

02/12/2018 at 18:38 Writes:

I was in St. Petersburg on a business trip. I lived with a friend for a week (we studied together at university). And when he is in Moscow, he stays with me. Very convenient by the way. Naturally, we needed a check for the hotel with confirmation to our accounting department. The guys did everything correctly and received the order the next day. The checks are real with QR codes - they are beating, the salary increase is substantial. Who would refuse such a bonus?))

908 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Dmitry, from

02/26/2018 at 14:42 Writes:

Greetings. Tell me, do you now make checks with online check confirmation?

1130 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Ekaterina Romanova, from

02/26/2018 at 16:30 Writes:

Good afternoon, Dmitry. We do all our receipts with a QR code. Call!

1173 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Victor, from

04/16/2018 at 14:29 Writes:

I often go on business trips all over Russia and at work the requirement for documents confirming accommodation is one condition - the receipt from the hotel must have a QR code from the tax office. Tell me, please, do you have such a service?

1180 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Admin, from

04/16/2018 at 17:23 Writes:

Good afternoon, Victor. Naturally, all checks with QR codes, as has been customary since July 1, 2021. You will receive a more detailed answer by email.

1250 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Ilya, from

04/27/2019 at 11:50 Writes:

For me, the most convenient way is to order documents confirming hotel accommodation in Moscow on this website. The fact is that the accounting department requires a report on business trips, and I live with a friend. Everything goes without question.

1297 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Alexander, from

11/15/2019 at 18:09 Writes:

No matter how many business trips I traveled, I often had disagreements with my employer regarding compensation for hotel accommodation expenses. Either the check is wrong or something else. Just not to compensate. I started ordering correct hotel receipts with confirmation, with the correct QR code, and with the required type of activity here. The guys helped out more than once. They will earn the same amount. Honest and transparent. They don’t ask for much for their help – everything is humane.

1375 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Alexey Viktorovich, from

06/12/2020 at 21:28 Writes:

The other day I returned from another business trip and submitted my reports. Everything was successful as always! Before this, business trips were in Yalta and St. Petersburg, and the last one was in Moscow. In all cases, I received documents directly at the hotels. Receipts with real codes, which are of course correct. At the reception, administrators enter into the database. The percentages are divine. Thank you for the services provided, I will definitely contact you again, I recommend it to everyone, others could not do this!

5.0 rating

1377 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Victor, from

06/13/2020 at 13:24 Writes:

I contacted this company in February and May, the documents successfully passed the checks, so I am writing the promised review. The only negative is that there is no delivery for small amounts and you have to go to the hotel. Thank you for helping out!

4.0 rating

1383 Reviews “CHECKS FOR HOTEL” Kamennoostrovsky Prospekt, 16, office 37

Alexander, from

06/15/2020 at 23:09 Writes:

The other day I returned from a business trip from Stavropol and issued checks for reporting through this service. I submitted the documents to the accounting department - everything is fine. QR codes are correct. Thank you for the mutually beneficial cooperation.

5.0 rating

3

Is it possible to include breakfast on the bill?

If breakfast costs are included in the bill as a separate item, it is not recommended to include them in accommodation costs. Subclause 12, clause 1, art. 264 of the Tax Code of the Russian Federation indicates that additional services may be included in the cost of accommodation, with the exception of service in bars and restaurants, in the room, and use of recreational and health facilities.

Also, the letter of the Ministry of Finance dated October 14, 2009 No. 03-04-06-01/263 explains that if the cost of food is allocated as a separate item, the employee receives income in kind. According to the Ministry of Finance, compensation for food does not apply to reimbursement of living expenses, and therefore may be subject to personal income tax and insurance payments.

If breakfast is not indicated as a separate item on the hotel bill, including it as an expense is fraught with tax risks. This situation has conflicting judicial precedents, so tax authorities can charge personal income tax on the specified amount. Insurance premiums in this case cannot be calculated, as indicated by letters from the Ministry of Health and Social Development of the Russian Federation dated 05.08.2010 No. 2519-19, FSS of the Russian Federation dated 17.11.2011 No. 14-03-11/08-13985

Latest publications

September 18, 2019

Doctors who have carried out medical activities to protect public health for at least 25 years in health care institutions in rural areas are assigned an old-age insurance pension before reaching retirement age. Should periods of completion of advanced training courses for medical workers be included in the length of service for early retirement purposes?

Cost is a monetary assessment of the natural resources, raw materials, materials, fuel, energy, fixed assets, labor resources and other costs used in the production of finished products (performance of work, provision of services). Typically, government agencies calculate the cost of finished products (work, services) within the framework of income-generating activities. We will talk about the basic principles of cost formation and its reflection in accounting in the article.

The Ministry of Finance has prepared a draft federal law “On Amendments to the Code of the Russian Federation on Administrative Offenses”, which provides for the extension of the statute of limitations and prosecution for violation of budget legislation, increasing the size of sanctions for misuse of funds, as well as introducing liability for a number of violations of budget legislation. The changes are planned to come into force on 01/01/2020. Details are in the article.

September 16, 2019

Based on the results of the audit, the FSS presented the organization with a requirement to pay contributions for injuries. The company complied with the requirement, and challenged the decision of the regulatory body in court. The court sided with the policyholder and declared the decision of the Social Insurance Fund invalid. According to the organization, the fund returned the contributions paid, but the company also wanted to receive interest (for the overcharged amounts). It was because of them that the repeated litigation arose: the FSS insisted that the contributions were excessively paid, and not excessively collected, and there were no grounds for charging interest.

The Ruling of the Supreme Court of the Russian Federation dated June 24, 2019 No. 310-ES19-8828 addressed the issue of the procedure for imposing insurance premiums on payments made to students for practical work performed under an apprenticeship contract. The organization believed that since these payments were not made within the framework of an employment contract, they should not be subject to insurance premiums. Inspectors from the Pension Fund of the Russian Federation considered that the company unlawfully did not include piecework wages under apprenticeship contracts in the base for calculating insurance contributions (the paid scholarship, in their opinion, is not subject to insurance contributions).