Strict reporting forms today are used by many individual entrepreneurs and organizations to process cash payments when providing services to the public. BSOs allow you to save on the purchase and maintenance of cash register equipment. It is enough to print them in a printing house in compliance with the requirements set out in Resolution of the Ministry of Finance of the Russian Federation No. 359 of May 21, 2008.

Attention! The use of paper BSOs for many types of activities has been extended until July 1, 2021.

However, on July 15, 2021, a new law, Federal Law No. 54, came into force, establishing new rules for the use of cash register equipment. Key points of this law:

- all cash register equipment must transmit information about all completed transactions via the Internet to the tax office

- from July 1, 2021, everyone who previously used cash registers must replace them with new ones and connect to online data transfer

- everyone who has used the BSO can continue to do so until July 1, 2018, after which the BSO will be valid only in electronic form

Typographic forms have been extended their life

In fact, with regard to the application of BSO, one should be guided by another rule - paragraph 8 of Article 7 of the Federal Law of June 3, 2016 No. 290-FZ on amendments to the basic law on CCP. It stipulates that BSO can be issued in the same manner until July 1, 2021. This means, as before, one should be guided by the Decree of the Government of the Russian Federation dated May 6, 2008 No. 359 “On the procedure for making cash payments and (or) settlements using payment cards without the use of cash register equipment.”

Paragraph 4 of Resolution 359 allows the use of both printed forms and forms generated using automated systems. At the same time, the requirements for automated systems are established by paragraphs 11 and 12 of Resolution 359. They are not talking about a printing device at all, but about a system that provides protection, recording, and storage of information about the document form. Please note: similar requirements apply to cash register equipment. Therefore, a simple computer cannot be used to generate strict reporting forms (letter of the Ministry of Finance of the Russian Federation dated November 7, 2008 No. 03-01-15/11-353). However, no one has canceled the BSO typographic forms.

Consequently, the definition of BSO presented in Law No. 54-FZ does not apply until July 1, 2021.

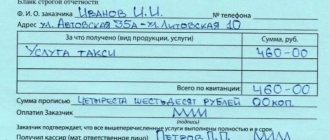

Procedure for filling out and issuing BSO

Some samples have a tear-off part. It contains fields for specifying all the details reflected in the main sheet. When completing a transaction, the seller hands the buyer a tear-off spine. If the client was not issued a document, this is equivalent to failure to provide a cash receipt.

When the strict reporting form for an LLC does not have a tear-off spine, after filling out all the fields, you need to make a copy of it. In accordance with Decree No. 359, duplication of the series and sheet number is not allowed.

We list a few design recommendations that are relevant in 2018.

- The form is filled out immediately after receiving payment from the client.

- The document is prepared without errors or corrections.

- Information about the form (name, number, series) is entered into a special Accounting Book.

What to do if an error still creeps into the text? The damaged sheet is crossed out and a new copy is filled out in its place. The draft is later entered into the Account Book. You can attach an explanatory note with the reason for the damage.

To control the circulation of forms at the enterprise, a special commission is appointed by order of the manager. Filling out and issuing forms is the responsibility of an employee, also selected by management. To store strict reporting forms, a safe is allocated, access to which is provided only to a narrow circle of employees. To ensure the safety of documents, responsible persons seal the office.

Trust but check

Based on the norms of Law No. 54-FZ, the Ministry of Finance of Russia, by letter dated 04/27/2017 No. 03-01-15/25765, explained that strict reporting forms issued by organizations and individual entrepreneurs “after 07/01/2018 must be generated using cash register systems.” On the main point, officials are certainly right: an automated system for strict reporting forms will be considered cash register equipment (as defined by the legislator). However, some of the wording of this letter requires clarification.

Firstly, formally the procedure for applying the BSO will change not after July 1, 2021, but starting from this date. From the standpoint of civil legislation, “before” means that the action can be performed before the specified date (Article 190, paragraph 1 of Article 194 of the Civil Code of the Russian Federation). In turn, Federal Law No. 107-FZ dated June 3, 2011 “On the calculation of time” (clause 7, Article 2) defines a calendar day as a period of time lasting twenty-four hours, having a serial number in the calendar month. The onset of an inevitable event indicating the end of the period - 00 hours 00 minutes on July 1.

note

The letter from the Russian Ministry of Finance gives the impression that the BSO can be sent to the buyer by email. However, this procedure is not currently in effect.

As a result, the expiration date for the use of printing BSOs is June 30, 2021, but this is Saturday. Consequently, the last day of the deadline is postponed to the first working day - Monday, that is, to July 2, 2021. The basis is Article 193 of the Civil Code of the Russian Federation. It turns out that the new procedure will come into effect after July 1, 2018. The officials were not mistaken.

Secondly, the letter states that BSOs “are issued by organizations and individual entrepreneurs performing work and providing services to the population.” The authors of the letter merely reproduced the wording used in Law 299-FZ. But the use of BSO when paying for work performed was never allowed. The forms can still be used only when providing services to the public.

Third, the letter gives the impression that the SSR can be sent to the buyer by email. However, this procedure is not currently in effect. BSOs in electronic form receive the right to exist after July 1, 2021.

How is accounting carried out?

To take into account the completed forms, an accounting book is opened at the enterprise. In itself it has no set form. Its sample is approved by the head of the organization. The pages of the Book are numbered, stitched and sealed.

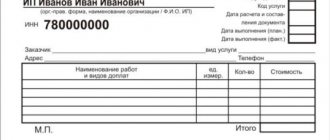

For accounting purposes you will need to indicate:

- full name of the form;

- number;

- series.

During the acceptance of completed forms, their actual quantity is assessed, their details are verified with the data in the accompanying documentation. The transfer of completed sheets is recorded in the acceptance certificate. This document is signed by the head of the company in the presence of members of the commission. After the expiration of the storage period, they are disposed of, about which a corresponding act is issued.

Important! The storage period for strict reporting forms is 5 years.

Using BSO has its advantages. An entrepreneur does not have to spend money on purchasing a cash register and make an extra visit to the tax office to register it. The form is filled out during settlements with clients. All completed documents are entered into the Accounting Book. Next, you can download the form and examples of filling it out.

Strict reporting form for LLC

Post Views: 309

What are “services to the public” and who is the “public”

In order to apply BSO legally, it is necessary to decide what is meant by services to the public. You will find the answer in Rosstat’s order No. 244 dated May 23, 2016 “On approval of collective classification groups “Paid services to the population.” The document is normative, since it is registered with the Russian Ministry of Justice. Thus, the list of services to the population is closed.

Please keep in mind that it is prohibited to process settlements under contracts concluded with legal entities and individual entrepreneurs using BSO. The latter are not considered the population. The fact is that, on the basis of Article 783 of the Civil Code of the Russian Federation, the provisions on household contracts are applied to the contract for the provision of paid services to the population. In turn, Article 730 “Household contract” of the Civil Code of the Russian Federation characterizes the customer as a citizen who applies for the satisfaction of household or other personal needs not related to business activities. Disputes with the “population” are regulated by the Law of the Russian Federation of 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights”.

BSO is a common receipt

BSO or strict reporting forms are, first of all, a document that confirms the fact of receipt of payment for services. Moreover, payment can be made either in cash or non-cash, that is, using a card. We can say that BSOs are successfully replacing cash receipts.

The most common BSOs are various types of receipts. The receipt reflects the fee for services received.

Also acting as BSO are:

- subscriptions to the gym, swimming pool, fitness club, etc.;

- tourist vouchers (both abroad and to the nearest tourist route);

- coupons;

- tickets (concert, bus, tram, etc.);

- other receipts.

Cancellation of BSO from July 1, 2021

The requirements for the new automated system for issuing forms are similar to those that the law imposes on cash register systems that generate online checks. The system must be registered with the Federal Tax Service. But you can only use it if you provide services to the public. Therefore, it may be more profitable to simply buy a regular online cash register. It can be used for all sales occasions.

From July 1, 2021, it is impossible to apply BSO in the form to which we are all accustomed. Starting from the specified date, strict reporting forms must be generated and issued using online cash registers. It is better to purchase the appropriate electronic equipment in advance. The history of the issue and the new current procedure are in our article. The article contains a sample BSO from July 1, 2021.

Strict reporting forms for individual entrepreneurs

Acceptance takes place in the presence of the appointed commission on the day the documents are received by the enterprise. Documentation verification is carried out through an actual assessment of the number of forms and reconciliation of the numbers and series of provided papers with the accompanying document . Based on the results of the inspection, the authorized representative writes an acceptance certificate for the BSO. Only after it is signed by the owner of the individual entrepreneur is it allowed to use the received forms.

- Typographic method. Before downloading a sample for it, you need to make sure that it complies with the established procedure and all the necessary requirements. The form must necessarily reflect the following information about its manufacturer: its name in abbreviated form, taxpayer identification number, address, order number, circulation size and year of printing. The above information is required information. Downloading samples from the Internet does not raise any questions, and the cost of printing them in a printing house in Moscow is about three rubles per piece (the price may vary slightly in regions or in the sizes and types of forms, as well as the required circulation volume). In a printing house, for any service there will most likely be ready-made BSO templates - both standard and tear-off (their cost fluctuates around a hundred rubles), so it will not be difficult to find where to buy BSO for individual entrepreneurs.

- Application of an automated system. This method does not imply anything complicated - it is a special device, which means an inventory that looks similar to a cash register, but has a lower cost and different functionality. It is used to store accurate reports on forms for the required five-year period and boasts protection against unplanned infiltration by intruders, as well as completing and issuing BSOs, providing numbering indicating the current series. You can buy it for about 5 thousand rubles, and the instructions can be easily downloaded on the Internet.

We recommend reading: Do you need checks to receive school uniform compensation in 2021?

Topic: Is it necessary to register strict reporting forms?

Good afternoon A question. Today, our Federal Tax Service refused to register strict reporting forms, citing the fact that the declared type of activity according to OKVED “Providing secretarial, editorial and translation services” does not fall under the concept of “services to the public”, and that I need to purchase a cash register. Tell me, are they right or wrong? Thanks in advance.

Do I need to register strict reporting forms?

The federal legislation on cash registers does not establish the obligation to register strict reporting forms by tax authorities. In accordance with clause 1 of the List, individual entrepreneurs using strict reporting forms must use them only in forms approved by the Ministry of Finance of Russia. Some inspectorates have this opinion - they believe that only those organizations for which these forms are approved have the right to apply BSO. If the BSO form is not approved for a specific type of service, then the organization is obliged to use cash register. This position seems unlawful and contradicts the position of the Ministry of Finance of the Russian Federation. Thus, mandatory registration of BSO with the tax authority is illegal.

Trade at exhibitions

Question : A retail space: a table, a chair and two or three display cases. The safety of the goods is ensured by the legal entity providing the exhibition space. Need a cash register? Answer : Yes, when trading at fairs, markets, exhibitions, if the trading place ensures the display and safety of the goods, CCT must be used.

Question : If an individual entrepreneur plans to participate in an exhibition in the fall, where will there be cash trading, when do you need to purchase a cash register? Individual entrepreneur on the simplified tax system, without employees, works through a current account with LLC and individual entrepreneur. Answer : The cash register can be purchased in advance and registered closer to the fall.

It is necessary to submit the BSO to the Internal Revenue Service annually

Read more about the innovation. Contents For certain types of activities, there are specially developed and approved forms of BSO, for example, BSO, used in the provision of services for the transportation of passengers and luggage or in the provision of services by cultural institutions. But in most cases, organizations and individual entrepreneurs can independently develop their own forms of strict reporting forms.

However, for persons who have not previously used cash registers (and these include those who make payments through BSO), Law No. 290-FZ, which contains the rules for the transition to the application of the updated Law No. 54-FZ, set the start date for the mandatory use of cash registers later than the total (07/01/2021) – from 07/01/2021 (p.

What kind of fiscal storage is needed?

Question : The individual entrepreneur operates seasonally: a canteen, renting out housing. I will be purchasing a cash register, I have to take it for 36 months. or for a year? Answer : If you work seasonally, you can use the FN for 13 months. There is Federal Tax Service Letter No. ED-4-20/ [email protected] dated 05/28/2018 on this matter.

Question : An individual entrepreneur using the simplified tax system is a bank payment subagent, which financial tax code should I take? For 36 months? Answer : FN for 36 months, because Government Resolution No. 70 speaks only about payment agents (subagents), but not banking ones.

Question : Individual entrepreneur on UTII, shopping islands in shopping centers, selling soft ice cream, cocktails, juice, water. We purchased personal funds for 13 months, what are the consequences if we register them? In two weeks we will not be able to exchange them for a 36-month FN.

Answer : The Letter of the Federal Tax Service No. ED-4-20/ [email protected] dated May 28, 2018 states that for work that is seasonal or temporary, you can apply a tax fund with a validity period of less than 36 months. The terms “seasonal nature of work” and “temporary nature of work” can be defined by the taxpayer independently.

Question : Individual entrepreneur on UTII + OSNO. Activities: retail trade of UTII only. Should I use a fiscal accumulator for 15 months? Answer : Yes, for 13, 15 or 18 months.

It is necessary to submit the BSO to the Internal Revenue Service annually

The exceptions will mainly include institutions that: - are located in areas with slow Internet (the list of such areas has not yet been determined), that is, remote and difficult to access; - have very specific features of conducting business; - will continue to use BSO.

As a rule, printing houses already have developed BSO templates for each type of service (the cost of a layout is approximately 100 rubles). If none of the ready-made forms suits you, then you can find a free template on the Internet and bring your developed form to the printing house. In the future, you will need to keep strict records of printed forms.