How to switch to UPD?

How to switch to UPD Suppose you have decided to switch to working with UPD.

Here is a step-by-step algorithm of actions in case you decide to work with a universal document. Decide under which agreements your company will use the UTD. To begin with, we advise you to decide on what specific types of contracts the company will issue UTD to clients. Or he wants to receive a universal document from counterparties. Tax authorities believe that universal documents can be used under contracts of supply (purchase and sale), exchange, donation, provision of services, contract, commission, assignment, agency. As well as assignments of the right to claim, factoring, storage, trust management, R&D, transport expeditions, licensing agreements, transactions for the alienation of exclusive rights, commercial concessions. This follows from Appendix 2 to the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96.

February 20, 2018

The universal transfer document (UTD) appeared four years ago, but some companies are still postponing the transition to a new form of document flow. Chief accountant Nina Kazachkova told why it is necessary to use UPD today.

The UPD has been in effect since October 2013, it was introduced and legalized by the Federal Tax Service letter dated October 21, 2013 No. ММВ-20-3/ [email protected] Since then, this document can and, as the InfoSoft expert emphasized, should be used. With the help of UPD, you can formalize the supply of goods, services and works, as well as the transfer of property rights. The UPD form of innovation has both pros and cons. On the positive side, the number of documents we receive when transferring or receiving a product/service is reduced.

“When purchasing or transferring goods, we use the TORG-12 document,” says Nina Kazachkova. – If an organization works with VAT, then it must issue an invoice. That is, I need to transfer two physical documents, which in themselves say that I am transferring the same goods. The universal transfer document combined the invoice and TORG-12/Act of provision of services.

Switching to UPD eliminates confusion in documents

The signature of the responsible person confirming the fact of the transaction appeared in the UPD. Previously, it was “shipped cargo” and “received cargo”; now a signature has been added confirming the fact of economic life. The appearance of new signature fields has made the work a little more complicated, but at the same time it eliminates fictitious transactions.

– Nowadays, with electronic document management (EDF), we encounter various problems. When sending certificates of service provision, there are more and more cases where the document does not go away for some technical reason, but in the case where the UPD is entered, it goes out very well. When we started to deal with the EDF operator, they told us that this is an unspoken rule of 1C.

I assume that in the near future we will be forced to switch to UPD, the wave has already begun. Now we are dictated by rules that electronic document flow should increase. I only support this, why do we need these papers if there is the possibility of electronic exchange. 1C, as always, implements changes in a timely manner, which many do not even know about yet.

How to switch to UPD?

In order to make the transition to UPD, the company must resolve several issues.

Approve the form of the transfer document. To do this, you can take as a template the official form, provided by the Letter of the Federal Tax Service of October 21, 2013 N ММВ-20-3 / [email protected] If necessary, the official form can be modified to suit your specific needs and supplemented with details. It is important that all mandatory details required by law are in such a document. The official form contains them.

Organize the work of the company’s structural divisions with the transfer document. Here you can develop regulations for the work, execution, and storage of such documents (you can do without regulations by developing a memo for employees or preparing appropriate instructions). Establish in which cases universal transfer documents should be used when registering business transactions.

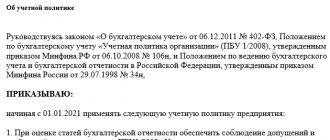

The company's decisions should be reflected in its accounting policies

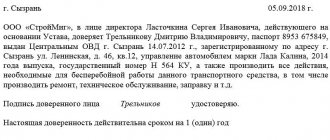

After internal organizational issues have been resolved, it is recommended to send a notice of the transition to UPD to the main counterparties. It is for informational purposes only and does not oblige you to anything. But it is better to direct it in order to prepare counterparties in advance for the new order of interaction and, if there are disagreements, resolve all existing issues. The letter can be prepared in any form.

We suggest you read: Criminal liability for battery

You can also switch to using transfer documents in calculations for already concluded and executing contracts. But here it may be necessary to draw up an additional agreement to the contract. Often, in the terms of the contract, the parties stipulate that payments are made on the basis of invoices, TORG-12 and an act of provision of services.

Is it possible to start using the universal transfer document from the middle of the year?

– As a rule, we apply accounting policies at the beginning of the year. In it, the chief accountant sets himself the rules for maintaining records according to accounting standards,” Nina Kazachkova answers the question. – We choose the accounting method and documents that we will use in the work process. If I wrote an act there, then logically I should work on the act for a whole year.

But there is an article that states what changes in legislation can take place during the year; the UPD is the same change. If I decide to switch to UPD in February or at any other time, I can make changes to the accounting policy, not rewrite it completely, but make a change. We are legally allowed to do this.

There are some minor difficulties in the transition, and you can’t cross it with one wave of a magic wand, but it can be done, and the sooner the better

Description

Surgeonfish are usually kept in reef marine aquariums. They search for food throughout the entire aquarium.

Surgeonfish get their name due to the presence at the base of the caudal fin, hidden in a calm situation, a poisonous lancet-shaped spine. Used to intimidate the enemy. In extreme cases, it can hit. It is not fatal to humans, but it is painful.

If you get hit by a “hot” tail, wash the wound with hot water or heat it in another way. Heating causes the breakdown of toxins. Don't stop the bleeding, let the poison come out.

Appearance

The body shape is an elliptical disk, the color is from light blue to blue with a dark purple pattern. The back and anal fins are the same color as the body, with an outer dark border. The caudal fin is trapezoidal, lemon yellow, with a body pattern continuing along the edges. In some cases, the pectoral fins and abdomen of the blue tang have a yellowish tint.

The mouth is small and directed forward. The eyes are large. The typical length in an aquarium is 20–22 cm.

Lifestyle

Active during the day, young fish gather in schools, adults are solitary. The exception is the harem. Territoriality is expressed, but is not aggressive outside the domain.

They love to nibble on algae. Resting in the bushes. Not shy. They fight back against aggressive neighbors. They sleep in an upright position or on their side. Need shelters. Hepatus do not dig the soil, do not damage equipment and do not encroach on corals.

Lifespan

In captivity they live 12–20 years.

Drawing up an order to switch to UPD - sample filling

In a universal transfer document with status 1, lines (1)-(7), as well as columns 1-11, must be filled out in the same way as in a regular invoice, that is, in accordance with Resolution No. 1137. Moreover, for line (2) “Seller” and lines (6) “Buyer” are provided with special features.

In the case of shipment of goods, sellers and buyers are understood to be the parties to the purchase and sale agreement or supply agreement (Chapter 30 of the Civil Code of the Russian Federation). If the seller is a commission agent, agent or attorney, then in line (2) the commission agent, agent or attorney must be indicated. If the goods are transferred to the carrier, in line 6 you need to indicate not the carrier, but the buyer.

When transferring property rights, lines (2) and (6) are filled in depending on the content of the transaction. If this is an alienation of an exclusive right, then the copyright holder and the recipient of the rights should be entered in these lines (Article 1234 of the Civil Code of the Russian Federation). If this is a licensing agreement, then the licensor and the licensee (Article 1235 of the Civil Code of the Russian Federation).

When providing services, lines (2) and (6) are also filled in based on the content of the transaction. If these are “simple” services, then in these lines you should indicate the contractor and the customer (Article 779 of the Civil Code of the Russian Federation), if this is a transport expedition, then the forwarder and the client (Article 801 of the Civil Code of the Russian Federation). In the case of a commission agreement, the commission agent and the principal are indicated (Art.

When transferring the results of completed work, the contractor or subcontractor must be named in line (2), and the customer or general contractor in line (6) (Article 702 of the Civil Code of the Russian Federation).

In the case where the commission agent purchased the goods on his own behalf, but in the interests of the principal, then when transferring the goods from the commission agent to the principal, lines (2) and (6) are filled in as follows. Line (2) indicates the third-party seller, and line (6) indicates the principal. These rules also apply to the situation when the agent transfers to the principal a product purchased for him from a third-party supplier.

Recommendations for filling out other UPD details are given in Table 1.

In the universal transfer document with status 2, you can omit filling in fields that are mandatory exclusively for the invoice. It is permissible to either leave such rows and columns empty or put a dash in them. This applies to line (7) “To the payment and settlement document”, to columns 6 and 7, intended for the amount of excise duty and tax rate, and to columns 10, 10a and 11, intended for information about the country of origin of the imported goods and the customs declaration.

It is possible that UTD with status 2 will be companies or entrepreneurs that are not VAT payers. In this case, column 7 “Tax rate” and column 8 “Tax amount presented to the buyer” do not need to be filled out. Then, despite the name “invoice”, the universal document will not entail the obligation to calculate and pay VAT.

Also, UPD with status 2 can be filled out by consignors, principals and principals who transfer their goods to commission agents, agents or attorneys for sale to third-party clients. Such a universal document will act as a “primary document” confirming the transfer of values without transfer of ownership of them.

Table 1

Recommendations for filling out some UPD details

| No. of row, column | Name of row, column | Filling rules | |

| Status 1 | Status 2 | ||

| Lines (1) – (7) Columns 1-11 | Filled out in accordance with Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 It is permissible to supplement lines (3) and (4) with information about the TIN and KPP of the consignor and consignee | It is acceptable not to fill in (or put a dash) in line (7), in columns 6, 7, 10, 10a and 11 | |

| Column A | Serial number of the record in the table | Not required Designed for ease of searching and visual highlighting of positions | |

| Column B | Code of goods/works, services | Not required to be filled out, the absence of an indicator does not have tax consequences It is convenient to fill out for unambiguous identification of works/services in order to designate special regimes, tax benefits, reduced rates of insurance premiums, etc. For goods, an article is given, for work - the type of activity, for services - the OKVED, OKUN code | |

| Line (8) | Basis for transfer (delivery) / receipt (acceptance) | Information about the transaction (type of transaction, details of contracts, agreements, instructions, etc.) | |

| Line (9) | Transportation and cargo data | Not required You can specify the details of transport documents (bill of lading, waybill), instructions to forwarders, warehouse receipts, etc. You can also indicate the following additional information: the delivery basis, taking into account which the contract price is formed (selection, shipment, delivery, etc. with the possible use of INCOTERMS 2000), the organization bearing the delivery costs, net/gross weight, etc. | |

| Line (10) | Goods (cargo) transferred/services, results of work, rights handed over | You can indicate the position of the person who made the shipment and (or) the person authorized to act on the transaction, his signature and full name. If this person signed the invoice on behalf of the manager or chief accountant, it is permissible to indicate only his position and full name without repeating the signature | |

| Line (11) | Date of shipment, transfer (handover) | Not required You can specify the date of shipment of goods, provision of services, transfer of results of work performed, transfer of property rights In general, this date coincides with or will be later than the date of preparation of the UPD specified in line (1) | |

| Line (12) | Other information about shipment, transfer | Not required You can specify related information: data on passports, certificates and any other documents that are integral annexes to the UPD Convenient to fill out with a large number of applications | |

| Line (13) | Responsible for the correct execution of the transaction, operation | Position, full name and signature of the responsible person on the seller’s side If this person is indicated in line (10), it is permissible to indicate only his position and full name without repeating the signature If this person signed the invoice on behalf of the manager or chief accountant, it is permissible to indicate only his position and full name without repeating the signature If there are several responsible persons, an additional line should be added to the UPD, for example, line (13a) | |

| Line (14) | Name of the economic entity that compiled the document (including the commission agent (agent)) | You can indicate the name and details of the entity that compiled the UTD on the seller’s side. This may be the person keeping the seller’s accounts, a commission agent or agent transferring goods to the principal or principal, etc. It is acceptable not to fill in if there is a stamp with the full name of the entity that compiled the UTD on the part of the seller | |

| Line (15) | Goods (cargo) received/services, results of work, rights accepted | You can indicate the position of the person who accepted the goods, the results of work or services and (or) the person authorized to act on the transaction on the part of the buyer, his signature and full name | |

| Line (16) | Date of receipt (acceptance) | Not required You can indicate the date of receipt of goods, acceptance of the results of work performed, receipt of property rights It cannot be earlier than the date of preparation of the UTD (line (1)) and the date of transfer recorded by the seller in line (11) | |

| Line (17) | Other information about receipt, acceptance | Not required You can specify information about the presence/absence of claims; data on documents prepared by the buyer (customer), which are integral annexes to the UPD Convenient to fill out if the buyer has significant additional information | |

| Line (18) | Responsible for the correct execution of the transaction, operation | Position, full name and signature of the responsible person on the buyer’s side If this person is indicated in line (15), it is permissible to indicate only his position and full name without repeating the signature If there are several responsible persons, an additional line should be added to the UPD, for example, line (18a) | |

| Line (19) | Name of the economic entity that compiled the document | You can indicate the name and details of the entity that compiled the UPD on the buyer’s side. This may be the person keeping the buyer's accounts. It is acceptable not to fill in if there is a stamp with the full name of the entity that compiled the UTD on the part of the buyer | |

| M.P. | Not required You can put the seals of the economic entities who compiled the document If all the required details provided for in Article 9 of Federal Law No. 402-FZ dated 06.12.11 are present, the absence of stamps is not a basis for refusing to accept UTD for tax registration | ||

We suggest you read: Can a relative be a witness in court? || Can the defendant's mother be his witness in court?

What is UPD and how the transition is implemented in practice, we will consider in our article. What is UPD? Algorithm for switching to UPD Standard set of documents when switching to UPD Results What is UPD?

On October 21, 2013, the Federal Tax Service of Russia issued a letter

No. ММВ-20/ According to the explanations given in this letter, taxpayers are given the opportunity, instead of a standard set of documents: accounting (TORG-12, TTN, M-15, OS-1 and the like) and invoices, to use one document containing all necessary details.

This is a universal transfer document (UDD), and the form recommended by the Federal Tax Service letter is based on the invoice. The main thing is that they contain all the mandatory details that are listed in Article 9 of this law.

For example, is it necessary to issue a check if an individual pays for a legal entity and vice versa? When to generate an “expenses” cash receipt? {amp}lt; ... Forgiveness of an interest-free loan: we charge personal income tax According to the rules in force from 01/01/2016, when issuing an interest-free loan to an employee, personal income tax must be charged on the individual’s financial benefit from savings on interest on a monthly basis.

Universal transfer document - an alternative to an invoice and delivery note

Two years ago, the Federal Tax Service, in its letter dated October 21, 2013 No. ММВ-20-3/ [email protected] , recommended that taxpayers use a universal transfer document (UDD), which replaces the waybill (act) and invoice. Many accountants treated this possibility with caution, because the Tax Code does not contain such a rule.

The universal transfer document contains all the details of the invoice, completely duplicating it. It is this fact that allows VAT to be deducted on the basis of the UTD. In addition, the analyzed document includes the main elements of the TORG-12 invoice: basis for shipment, dates of shipment and receipt of goods (services, rights), signatures of responsible persons.

In general, the UPD can replace other transfer documents: an act of completed work (services), an invoice for the release of materials to the M-15 side, an acceptance and transfer certificate of fixed assets OS-1 (letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/ [email protected] ). The universal transfer document meets all the requirements for the primary accounting document, therefore the buyer has the right to recognize expenses on the basis of the UPD.

Detailed conditions of application, the procedure for filling out and reflecting the UTD in the book of purchases and sales are contained in the letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3 / [email protected] Let's consider the main nuances of using universal documents.

Table 1

We invite you to read: Alimony in 2021. New law on alimony

Part 2 lists the required details:

- name of the organization or surname of the entrepreneur who compiled the document;

- Title of the document;

- the value of the natural or monetary measurement of a fact of economic life, indicating the units of measurement;

- date of document preparation;

- the name of the position of the person who completed the transaction, operation and is responsible for the correctness of its execution, or the name of the position of the person responsible for the accuracy of the execution of the event;

- content of the fact of economic life;

- signatures of the above-mentioned persons indicating their surnames and initials or other details necessary to identify these persons.

The forms of primary accounting documents are approved by the head of the economic entity on the recommendation of the official who is entrusted with maintaining accounting records (Part.

4 tbsp. 9)

What is UPD

According to Letter of the Federal Tax Service No. ММВ-20/ [email protected] dated 10/21/13, the UPD is a single document that combines all the mandatory details of the invoice and the primary form.

The form was developed in accordance with stat. 169 Tax Code and stat. 9 of Law No. 402-FZ of December 6, 2011. The use of UPD is advisory in nature. Enterprises have the right to independently decide how to conduct document flow of business operations - using a universal document or in a familiar format. In turn, UTD can be issued to replace an invoice and a primary form (status code “1”) or only as a primary form (status code “2”). Detailed explanations on how to fill out the form are given in the appendices to the Letter from the Federal Tax Service. Thus, the preparation of UPD is allowed in the following cases (the list is open):

- When shipping products or goods.

- When performing work, as well as for providing services.

- For intermediary operations (commission, agency agreements, etc.).

- When transporting the subject of the transaction.

- When transferring property rights, etc.

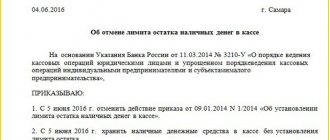

If the UPD is filled out in accordance with all the rules and contains mandatory data, on the basis of this document, you can deduct VAT, justify the company’s expenses (for profit or other tax purposes), and reflect the business operation in accounting. It is mandatory to compile a universal document in the accounting policies of the organization.

How to take into account issued UTD

In the “basement” of the sales document (Sales of goods and services, Provision of services or Adjustment of sales) a special toggle switch has appeared, which should be set to the UPD position if, under an agreement with the buyer, the organization issues a universal transfer document (Fig. 1).

Rice. 1. Setting up UPD

In this case, the UTD (issued invoice in the form of UTD) is automatically registered with a number that is assigned by the program when numbering the issued invoices in chronological order. When issuing UPD to the buyer, the composition of printed forms is limited - by clicking the Print button, the user will be able to print the UPD, but invoices, acts and invoices will not.

If the toggle switch is not switched to the UPD position, then the invoice is registered separately using the Write invoice button, as was the case in previous versions of the program. In this case, all printed forms are available to the user.

The UPD toggle switch is also present in documents for the transfer of fixed assets and intangible assets (Transfer of fixed assets or Transfer of intangible assets).

In subsequent documents issued to customers, the UPD toggle switch will be installed automatically (or will not be installed) in accordance with the previously made settings.

How to take into account received UPD

UPD received from the supplier are reflected according to the same principle. In the “basement” of receipt documents (Receipt of goods and services, Receipt of additional expenses, Adjustment of receipt, etc.), the toggle switch should be set to the UPD position if a universal transfer document has been received from the supplier. In this case, the UPD is automatically registered (the received invoice in the UPD form) with the number and date of the document specified in the Document No. field. If the toggle switch is not switched to the UPD position, then the order of reflecting documents from the supplier remains the same: the number of the primary document is registered separately, and the number and date of the invoice are registered separately in the corresponding field.

The UPD toggle switch is now also present in documents for the receipt of fixed assets and intangible assets.

The program remembers the settings made for a specific contract with a counterparty. In subsequent documents received from suppliers, the UPD toggle switch will be installed automatically (or will not be installed) in accordance with the previously made settings.

How to generate reconciliation reports with UPD

Now acts of reconciliation of settlements with counterparties can be generated indicating the details of the UTD with which the transaction was executed.

Let us remind you that in order to display the full details of the set of issued and received documents in the settlement reconciliation act, in the document Reconciliation act of settlements with the counterparty (Purchases section or Sales section - Settlement reconciliation acts) on the Additional tab, you need to set the following flags:

- Display the full names of documents;

- Issue invoices.

In this case, the Statement of Reconciliation of Settlements with the Counterparty will display both the number of the primary document and the invoice number (both for received documents and for issued ones).

But in previous versions of the program, when issuing the UTD, two numbers were indicated in the Statement of Reconciliation of Settlements with the Counterparty:

- system document number - as the number of the exposed primary document;

- The number specified in the Invoice field is used as the invoice number.

In reality, the buyer received only one document - UPD with a number corresponding to the number of the issued invoice. Therefore, counterparties experienced difficulties in conducting reconciliations. Now, in the Acts of reconciliation of settlements with the counterparty, the names of the program documents and explicitly either the invoice number or the UPD number are indicated (Fig. 2).

Rice. 2. Reflection of the UPD in the act of reconciliation of settlements with the counterparty

How to find the number of an issued invoice or UPD in the list of documents

In previous versions of the 1C: Accounting 8 program, edition 3.0, the list of sales documents indicated only the number of the primary accounting document issued to the buyer (system document number) and the status of the invoice (Posted, Not posted, Missing or Not required). Invoice numbers were not displayed in the list. Now, in the journal of documents for the sale of goods and services (section Sales - Sales of goods and services), information about the numbers of invoices or a universal transfer document is displayed in a separate column (Fig. 3).

Rice. 3. UPD and invoice numbers in the list of sales documents

Universal transfer document: nuances of application

The UPD form can be used by organizations and individual entrepreneurs in any taxation system. Legal entities and individual entrepreneurs using the simplified tax system and unified agricultural tax can use the UPD as a primary document with status 2 to confirm expenses for tax purposes (letter of the Federal Tax Service of Russia dated March 5, 2014 No. GD-4-3/3987).

UTD with status 2 can be made by consignors when shipping goods and by sellers carrying out transactions not subject to VAT.

If you decide to use a universal document for accounting and tax purposes, record this decision in your accounting policies. Also approve the UPD form that the organization will use.

It is not necessary to completely switch to using UPD. Even under one contract, which involves several deliveries, you can draw up both the usual documents (invoice, delivery note, act) and UPD. This is confirmed by the letter of the Federal Tax Service of Russia dated May 27, 2015 No. GD-4-3/8963. The legality of tax deductions on the basis of a universal document, in particular, is stated in the letter of the Ministry of Finance of the Russian Federation dated June 16, 2014 No. 03-07-09/28664.

If an organization has switched to using universal transfer documents, it is not at all necessary to inform customers about this. In turn, buyers do not have the right to demand that the supplier issue invoices instead of UPD. Some supply agreements contain the name of the documents that the seller draws up when shipping goods (works, services). In this case, you need to draw up an additional agreement to the contract, which specifies the conditions for applying the UPD.

For example, a company can switch to working with UPD under work contracts, and for other types of contracts continue to use invoices and standard source documents. However, according to the explanations of the Federal Tax Service, mixed application of UTD within the framework of the same agreement is allowed.

For example, when, during periodic deliveries, a UTD is issued for one batch, and a delivery note is issued for another. This conclusion is substantiated in Letter No. GD-4-3/8963 dated May 27, 2015.

Types of UPD UPD can be used in 2 options:

- or simultaneously as an invoice and a transfer document;

- or only as a document confirming the transfer of material assets.

In the first case, the UPD indicates document status 1, in the second – 2. Depending on the use case, there are different rules for filling out these documents.