Organizations and individual entrepreneurs that have received the right to use strict reporting forms (SSR) instead of a cash register document when paying the population include consumer service enterprises.

Regulatory documents regulate this as follows:

1. Individual entrepreneurs and legal entities must use cash register equipment for settlements with the population - the requirements of the Federal Law of 05/22/2003 54-FZ.

2. Some categories of performers are exempt from the obligation to use CCP - paragraphs. 2.3/Article 2 54-FZ dated 22/05/2003

3. Suppliers of services to the public have the right not to use CCT - closed list.

4. All entrepreneurs and organizations exempt from the requirement to use cash registers are required to fill out strict reporting forms (SRF).

5. For consumer service enterprises, it is mandatory to fill out the BSO household service form from BO-1 to BO-13.

6. Only BSO BO forms approved by the Ministry of Finance of Russia are allowed for use - letters 16-00-30-33 dated 04/20/1995 and 16-00-27-15 dated 07/11/1997.

The consumer services sector is characterized by the following features of accounting and reporting operations:

- The presence of a cash register does not exempt enterprises providing consumer services to the public from drawing up an agreement - Rules for Consumer Services, clause 4, approved. by Decree of the Government of the Russian Federation 1025 of 08/15/1997. A receipt of one of the forms of strict reporting forms BO-1 - BO-13 can be used as a contract. Thus, when providing household services to the population, BSOs are required both to replace cash registers and to formalize contractual relations.

- Forms BO-1 - BO-13 must be filled out in accordance with the Methodological Instructions developed by Rosbytsoyuz OJSC in coordination with the Ministry of Finance of Russia - see letter of the State Tax Service of Russia VK-6-16/210 dated 03/31/1998. MU data are linked to the BSO of consumer services and OKUN, approved. Resolution of the State Standard of Russia 163 dated 06/28/1994. Thus, organizations performing shoe repairs according to OKUN 011100 have the right to use BSO forms BO-2, BO-91, BO-11, and enterprises engaged in the field of sewing and knitting according to OKUN 012500 only BO-4.

Let's take a closer look at filling out BSO forms for consumer service enterprises.

Form BO-2 “Work order”, “Receipt”, “Copy of receipt”

Company stamp Series AB

— ORDER N 034501 Form BO-1____________¦___¦Division_________¦___¦Service code____________¦___¦Customer______________________________ Reception date___________¦___¦Street___________________________ Date of completion (plan.)¦___¦House___________Bldg._____Apt.____________ Date of completion (actual.

); The work order was issued___________________________ N_____________________¦___¦ (surname of the performer) (tab.

N) N_____________________¦___¦———————————————————————-¦Name of work and types of additional payments ¦ No. position¦ Cost¦¦ according to price. ¦ work ¦__________________________________________¦____________¦__________¦__________________________________________¦____________¦__________¦___________________________________________¦____________¦__________¦___________________________________________¦____________¦__________¦Urgency__________________________________________¦____________¦__________¦Field service______________________¦____________¦__________¦Home delivery____________________________________¦____________________¦__________¦Total ¦ __________¦———————————————————————-¦Name ¦Nomen- ¦Unit.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

¦Quantity- ¦Price ¦ Cost of materials ¦materials ¦claturn.¦meas.¦quality ¦ ————————¦(parts) ¦ number ¦ ¦ ¦ ¦ input. in ¦ paid-¦¦ ¦ ¦ ¦ ¦ list price¦ ¦¦ ¦ ¦ ¦ ¦ cost¦ customer- || | | | | | com ¦————— ——— —- ——- —— ———- ————¦______________¦_________¦____¦_______¦_____¦__________¦____________¦______________¦_________¦____¦_______¦_____¦ __________¦____________¦______________¦_________¦____¦_______¦_____¦__________¦____________¦______________¦_________¦____¦_______¦_____¦__________¦____________¦______________¦_________¦____¦_______¦_____¦__________¦____________¦Total for materials ¦ __________¦____________________¦Estimated cost of the service ¦__________¦____________¦Full cost of the service ¦__________¦____________¦__________________________________________________________________________received upon acceptance of the order (amount in words) (receiver) I undertake to make payment in full _________________________ (customer) Work completed "___" ______________ Issuance authorized "___" ____________ (mechanic) (signature) Sealed N _____»___»_______________19___

Warranty period________________________________________________________________________________received upon issuance of the order (amount in words) (receiver) Received the order and replaced defective parts (remaining materials). The product was checked in my presence “___” ________________ (customer)———————————————————————¦¦Teared off when “unsatisfactory” fulfillment of “order” and “service” ¦————————————————————————

———- Team code ____________¦__________¦ Shift code _______________¦__________¦ ———-

————— ———— ——— ——— ——— ———-Last name ¦ Category ¦Personal record¦Cost¦Rate ¦ Amount¦ of employees ¦service number ¦(percentage ¦ wages.¦ ¦ ¦ ¦payment ) ¦ boards————— ———— ——— ——— ——— ———-______________¦____________¦_________¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦________________________¦____________¦_________ ¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦______________¦____________¦_________ ¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦________________________¦____________¦_________¦_________¦_________¦__________Master (foreman)________________________signature

Company stamp Series AB

— RECEIPT N 034501 Form BO-1____________¦___¦Division_________¦___¦Service code____________¦___¦Customer______________________________ Reception date___________¦___¦Street_________________________________ Completion date (plan.)¦___¦House___________Bldg._______Apt._________ Completion date (actual.

). ¦The work order was issued __________________________ N_____________________¦___¦ (surname of the performer) (tab.

N) N_____________________¦___¦———————————————————————-¦Name of work and types of additional payments ¦ No. position¦ Cost¦¦ according to price. ¦ work ¦__________________________________________¦____________¦__________¦__________________________________________¦____________¦__________¦___________________________________________¦____________¦__________¦___________________________________________¦____________¦__________¦Urgency__________________________________________¦____________¦__________¦Field service______________________¦____________¦__________¦Home delivery____________________________________¦____________________¦__________¦Total ¦ __________¦———————————————————————-¦Name ¦Nomen- ¦Unit.

¦Quantity- ¦Price ¦ Cost of materials ¦materials ¦clature¦measurement¦quality ¦ ————————¦ (parts) ¦number ¦ ¦ ¦ ¦ entrance to ¦ payment-¦¦ ¦ ¦ ¦ ¦ price list. costs ¦_________¦____¦_______¦_____¦____________¦__________¦______________¦_________¦____¦_______¦_____¦____________¦__________¦______________¦_________¦____¦_______¦_____¦____________¦__________¦Total for materials ¦____________¦__________¦Approximate cost of the service ¦____________¦__________¦Full cost of the service ¦____________¦__________¦_________________________________________________________________________received upon acceptance of the order (amount in words) (receiver) I undertake to make payment in full) ________________________ (customer) The work was completed"___"_____________ Issuance authorized"___"______________ (mechanic) (signature) Sealed N _____»___»_________19___

I received the order and replaced defective parts (remaining materials). The product was checked in my presence “___”_________________(customer)———————————————————————¦¦¦¦034501 ¦ 034501¦¦¦¦———— ———————————————————

— COPY OF RECEIPT N 034501 Form BO-1____________¦___¦Division_________¦___¦Service code____________¦___¦Customer______________________________ Reception date___________¦___¦Street_________________________________ Completion date (plan.)¦___¦House___________Bldg._______Apt._________ Completion date (actual.

). ¦The work order was issued __________________________ N_____________________¦___¦ (surname of the performer) (tab.

N) N_____________________¦___¦———————————————————————-¦Name of work and types of additional payments ¦ No. position¦ Cost¦¦ according to price. ¦ work ¦__________________________________________¦____________¦__________¦__________________________________________¦____________¦__________¦___________________________________________¦____________¦__________¦___________________________________________¦____________¦__________¦Urgency__________________________________________¦____________¦__________¦Field service______________________¦____________¦__________¦Home delivery____________________________________¦____________________¦__________¦Total ¦ __________¦———————————————————————-¦Name ¦Nomen- ¦Unit.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

¦Quantity- ¦Price ¦ Cost of materials ¦materials ¦clature¦measurement¦quality ¦ ————————¦ (parts) ¦number ¦ ¦ ¦ ¦ entrance to ¦ payment-¦¦ ¦ ¦ ¦ ¦ price list. cost ¦_________¦____¦_______¦_____¦____________¦__________¦______________¦_________¦____¦_______¦_____¦____________¦__________¦______________¦_________¦____¦_______¦_____¦____________¦__________¦Total for materials ¦____________¦__________¦Approximate cost of the service ¦____________¦__________¦Full cost of the service ¦____________¦__________¦__________________________________________________________________________received upon acceptance of the order (amount in words) (receiver) (I undertake to make payment in full) ______________________ (customer) Work completed"___"_____________ Authorized delivery"___"______________ (mechanic ) (signature) Sealed N _____»___»_________19___

Legislative framework of the Russian Federation

valid Editorial from 22.06.1995

detailed information

| Name of document | LETTER from the State Tax Service of the Russian Federation dated June 22, 1995 N YUU-4-14/29N “ON DOCUMENT FORMS OF STRICT ACCOUNTABILITY FOR ACCOUNTING CASH WITHOUT THE USE OF CASH MACHINES” (together with “METHODOLOGICAL INSTRUCTIONS FOR COMPLETING AND APPLYING FORMS B LANKS OF STRICT ACCOUNTABILITY WHEN PERFORMING HOUSEHOLD WORKS SERVICES FOR ENTERPRISES OF ALL FORMS OF OWNERSHIP, AS WELL AS IN INDIVIDUAL LABOR ACTIVITIES") |

| Document type | letter, guidelines |

| Receiving authority | State Tax Service of the Russian Federation |

| Document Number | YuU-4-14/29N |

| Acceptance date | 01.01.1970 |

| Revision date | 22.06.1995 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

LETTER from the State Tax Service of the Russian Federation dated June 22, 1995 N YUU-4-14/29N “ON DOCUMENT FORMS OF STRICT ACCOUNTABILITY FOR ACCOUNTING CASH WITHOUT THE USE OF CASH MACHINES” (together with “METHODOLOGICAL INSTRUCTIONS FOR COMPLETING AND APPLYING FORMS B LANKS OF STRICT ACCOUNTABILITY WHEN PERFORMING HOUSEHOLD WORKS SERVICES FOR ENTERPRISES OF ALL FORMS OF OWNERSHIP, AS WELL AS IN INDIVIDUAL LABOR ACTIVITIES")

METHODOLOGICAL INSTRUCTIONS FOR COMPLETING AND APPLYING STRICT ACCOUNTABILITY FORMS WHEN PROVIDING HOUSEHOLD SERVICES BY ENTERPRISES OF ALL FORMS OF PROPERTY, AS WELL AS IN INDIVIDUAL LABOR ACTIVITIES

1. Introduction

These Guidelines for filling out and applying strict reporting forms when performing household services by enterprises of all forms of ownership, as well as during individual labor activities (hereinafter referred to as the Guidelines) prescribe the procedure for filling out strict reporting forms for all types of household services in accordance with the All-Russian Classification of Services to the Population (OKUN ), introduced on 01.01.94, the Rules of consumer services for the population of the Russian Federation, approved by Resolution of the Council of Ministers - Government of the Russian Federation dated June 8, 1993 N 536, the features of technological processes for the provision of consumer services, taking into account the Regulations “On the use of cash registers in the implementation of monetary settlements with the population”, approved by Resolution of the Council of Ministers - Government of the Russian Federation of July 30, 1993 N 745.

The classification of services as household services is determined by OKUN. In this regard, the use of certain types of strict reporting forms is tied to OKUN codes.

The rules of consumer services for the population in the Russian Federation (clause 7) establish that an order for the provision of a service (performance of work) is formalized by an agreement (receipt) or other document of the established form, in which all the details specified in it are filled in:

— legal address of the contractor, surname and initials of the customer, his telephone number or address;

— date of acceptance of the order, start and end dates for execution of the order, advance amount (full amount), signatures of the person who accepted and handed over the order;

— type of service (work), full name of materials (things) of the performer and consumer, their cost and quantity required to provide the service (perform the work), serial number of the product being submitted for repair;

- other details.

Orders can also be placed by issuing a token, coupon, cash receipt, etc.

In accordance with the Regulations on the use of cash registers when making cash settlements with the population, the customer of household services is obliged to receive a check from a cash register for the service provided, if he is not given a receipt of the established form. The presence of a receipt of the established form for the corresponding type of household services does not require the presence of a cash register. However, the presence of a cash register does not exempt the service provider from drawing up an agreement (receipt) in accordance with clause 7 of the Rules for Consumer Services of the Russian Federation, if the details specified there are not printed on the receipt of the cash register. Only some types of household services performed in the presence of the customer, specified in Section 2 of these Instructions, can be issued by a check from a cash register, which indicates only the date and amount received for the order without filling out a contract (receipt) of the established form. For these types of household services, a special “Coupon” can be used instead of a receipt from a cash register. When using a coupon, a cash register is not required for this enterprise.

2. Application of strict reporting forms in the provision of household services in accordance with OKUN

To provide household services, strict reporting forms from BO-1 to BO-11 are used, the description of which is given in section 3 of these Instructions. The number of the strict reporting form used for a specific type of household services is determined by the technological features of the provision of this service and the Rules for the provision of household services in the Russian Federation.

In accordance with OKUN, a hierarchical classification has been adopted, dividing all types of services into groups. Each group is divided into subgroups, which, in turn, are divided into types of activities according to purpose or functional purpose. The general structure of the code designation of the classifier of services to the public has the following scheme.

| XX | X | X | XX | CC | ||||||

| Group | ||||||||||

| Subgroup | ||||||||||

| View | ||||||||||

| Service | ||||||||||

| Check number | ||||||||||

All types of household services are in group 01. For example, we give the designations (code 015104).

| 01 | 5 | 1 | 04 | 1 | ||||||

| Domestic services | ||||||||||

| Dry cleaning and dyeing | ||||||||||

| Dry cleaning | ||||||||||

| Dry cleaning of natural fur products | ||||||||||

| Check number | ||||||||||

In accordance with OKUN and in accordance with technological features, all types of household services are distributed into groups using the same forms of strict reporting forms, as follows:

| Service code (without counter number) | Name of service | Number of the strict reporting form used |

| 011100 | Shoe repair | BO-2, BO-9* |

| 011200 | Shoe coloring | BO-2, BO-9* |

| 011300 | Sewing shoes | BO-2 |

| 011400 | Other shoe repair services | BO-2, BO-9* |

| 012100 | Repair of clothing, fur and leather goods, hats and textile haberdashery | BO-4, BO-9* |

| 012200 | Sewing of clothing, fur and leather goods, hats and textile haberdashery products | BO-4 |

| 012300 | Other services for repair and tailoring of clothing, fur and leather goods, hats and textile haberdashery products | BO-4, BO-9* |

| 012400 | Repair of knitwear | BO-4, BO-9* |

| 012500 | Sewing and knitting knitwear | BO-4 |

| 012600 | Other services for sewing and knitting knitwear | BO-4, BO-9* |

| 013100 | Repair and maintenance of household radio-electronic equipment | BO-1, BO-3*, BO-9** |

| 013200 | Household machine repair | BO-1, BO-3, BO-9** |

| 013300 | Repair of household appliances | BO-1, BO-3, BO-9** |

| 013400 | Repair and production of metal products | BO-1, BO-3, BO-9** |

| 014100 | Furniture making | BO-1 |

| 014200 | Furniture repair | BO-1, BO-3 |

| 014300 | Other furniture repair and manufacturing services | BO-1, BO-3 |

| 015100 | Dry cleaning | BO-5 |

| 015200 | Other dry cleaning services | BO-5 |

| 015300 | Dyeing | BO-5 |

| 015400 | Laundry services | BO-3 |

| 016100 | Repair of housing and other buildings | BO-4 |

| 016200 | Construction of housing and other buildings | BO-4, agreement |

| 016300 | Other services provided during the repair and construction of housing and other buildings | BO-4, agreement |

| 017100 | Maintenance of passenger cars | BO-1, BO-3* |

| 017200 | Car repair | BO-1, contract |

| 017300 | Maintenance of trucks and buses | BO-1, BO-3* |

| 017400 | Repair of trucks and buses | BO-1, contract |

| 017500 | Maintenance and repair of motor vehicles | BO-1, contract |

| 017600 | Other services for maintenance and repair of motor vehicles | BO-1, BO-3* |

| 018100 | Services of photo studios, photo and film laboratories | BO-3, BO-9* |

| 018200 | Transport and forwarding services | BO-3 |

| 018300 | Other production services, including: gasification services; | |

| 018301 — | BO-1, BO-3* | |

| 018307 | ||

| 018308 — | services for processing agricultural products...; | |

| 018319 | BO-3 | |

| 018320 | making felted shoes; | BO-2 |

| 018321 — | engraving works, manufacturing and rem. | |

| 018324 | wooden boats, toy repair; | BO-3 |

| 081325 | dyeing leather coats and jackets; | BO-5 |

| 018326 — | repair tourist equipment, | |

| 018331 | sawing wood, making business cards, invites. tickets, bookbinding, stitching, edging, cardboard work, charging gas cartridges, replacing batteries | BO-3 |

| 019100 | Baths and showers services | BO-3 |

| 019200 | Other services provided in baths and showers | BO-3 |

| 019300 | Hairdressing services | BO-11 (01), |

| BO-11 (02) | ||

| 019400 | Rental services | BO-6, BO-9, BO-3 |

| 019501 — | Services for organizing funerals, burials, crematoria, etc. | |

| 019506 | BO-3 | |

| 019507 — | Grave care services, production of coffins, monuments, wreaths, etc. | |

| 019517 | BO-4 | |

| 019600 | Ritual services | BO-3 |

| 019700 | Other non-production services. character | BO-3 |

| except: | ||

| 019701 — | Pawnshop storage | BO-8 |

| 019712 | ||

| 019713 — | Acceptance of items against loan collateral from the public | |

| 019724 | BO-7 |

BO-3* - used for maintenance or minor repairs of household radio-electronic equipment, household machines and appliances, motor vehicles, repair and manufacture of metal products, etc., which do not require the use of materials.

BO-9* - the BO-9 form is used for minor repairs of shoes, clothing, knitwear, etc. in the presence of the customer.

BO-9** - used for maintenance or minor repairs of household radio-electronic equipment, household machines and appliances, repair and manufacture of metal products at home or in the presence of the customer.

The conclusion of an agreement for types of services 016200 - 016300, 017200, 017400, 017500 is carried out in the case of the provision of services that require a large amount of work using a significant amount of component materials or products (major repairs of motor vehicles, apartments, houses, house construction, etc.) .

The use of strict reporting forms with numbers that do not correspond to those given in Table 1 is not allowed.

3. Instructions for filling out and using strict reporting formsForm BO-1

Form BO-1

Form BO-1 is used for placing orders in both preliminary and subsequent forms of payment to the population for services and repair work on radio and television equipment, household machines and appliances, watches, repair and maintenance of cars, repair and construction of housing, gasification services, manufacturing and repair of furniture, etc. if there are material costs. Issued in 3 copies.

A special feature of the use of this form is the registration of work on the repair of household appliances and cars (hereinafter referred to as devices) carried out in a hospital setting:

When the device is accepted for repair, the estimated cost of repair is determined and a partially completed form with reference data of the product and the customer is sent to:

the first copy (work order) and the second copy (receipt) - for production and are subsequently used: the first copy for accounting for revenue and calculating wages to workers performing the work, and the second copy for writing off material assets spent on repairs and assessing quality;

the third copy (copy of the receipt) with partially filled in details is transferred to the customer as confirmation of the delivery of the product for repair.

In the process of executing an order (service), the first and second copies are filled out as carbon copies and, after completion of the repair, are handed over to the receiver. Data from the first and second copies are entered into the third copy, according to which the customer receives the product for repair. A completed copy is given to the customer as confirmation of the repairs performed and the materials (parts) used.

In addition, the second copy has special tear-off coupons that are attached to the apparatus and chassis (compressor, unit, electric motor, body, etc.), the serial numbers of which are indicated in the main form of the form in the upper right zone on the two lower lines.

The first copy has a tear-off coupon, which is used to assess the quality, i.e. in case of unsatisfactory fulfillment of the order (service), the customer has the right to cancel it.

On the third copy in a special area there is a warranty card, which is issued to the customer for a certain period in accordance with the Rules for Consumer Services.

When providing repair work at home, all three copies of form BO-1 are filled out as carbon copies. The use and purpose of the copies is the same as for repairs in a hospital setting.

Form BO-2

Form BO-2

Form BO-2 is used when placing orders for the manufacture, large and medium repair of shoes. Issued by the receiver in three carbon copies.

The first copy (work order - order) accompanies the order in production and is used for payroll. This same copy has special coupons that are glued to the shoes to ensure safety.

The second copy (receipt) is issued to the customer. After completing the service, the customer returns the receipt and, in case of unsatisfactory completion of the order, tears off a special coupon from it. The copy is used for quality accounting.

The third copy (copy of the receipt) is used to record revenue.

Minor shoe repairs in the presence of the customer are drawn up on form BO-9 “Cash receipt receipt receipt”, and the customer is given a tear-off part of form BO-11 (02) or a receipt from a cash register.

Form BO-3

Form BO-3

Form BO-3 is used when placing orders in photographs, washing clothes, renting items for hourly use, as well as all types of repair work that do not require the use of materials. Issued by the receiver in three carbon copies.

The first copy (work order - order) accompanies the order in production and is used for payroll.

The second copy (receipt) is issued to the customer. After completing the service, the customer returns the receipt and, in case of unsatisfactory completion of the order, tears off a special coupon from it.

The third copy (copy of the receipt) is used to record cash revenue.

Form BO-4

Form BO-4

Form BO-4 is used when placing orders for services and work with preliminary and subsequent forms of payment for individual tailoring, updating and repairing clothing, knitting knitwear, manufacturing hats, fur products, granite monuments, repair and construction of housing, etc. Issued by the receiver in 2 carbon copies.

The first copy (work order - order) consists of three parts: work order - order, the first stub of the receipt and the passport for the order.

The second copy (receipt) consists of four parts: receipt, second receipt stub, warranty card, material requirement for the order.

The order passport is separated from the order and filled out by the cutter (designer). On the front side of the passport, general measurements (dimensions) are given, and a place for a drawing (silhouette, diagram) of the product is determined.

On the reverse side, changes at the request of the customer are indicated, a full description of the product listing the number of complicating elements, grouped by cost.

The order passport serves as a technological document and provides control over the movement of orders in production.

Based on the order passport, the receiver fills out a carbon copy of the order - the order and the receipt.

On the reverse side of the work order, the contractor calculates wages for the work performed.

After filling out the work order and receipt, the receiver begins to draw up the receipt stubs, which are filled out on lines 1, 2, 5 as a carbon copy when accepting the order.

The executed first copy of the counterfoil - the receipt - is torn off from the order - the order, transferred to the cash desk for registration in the “Statement of Cash Flows and Sold Services”.

After making payments, it is necessary, on the basis of the work order, to fill out a tear-off coupon “Order Requirement”, which, together with the work order, is transferred to production and serves as the basis for writing off inventory items from the warehouse.

Upon receiving the finished products, the customer returns a receipt to the receiver, which includes changes to the order and cost. After this, the receiver fills out the second stub of the receipt on lines 3, 4, 6, tears it off and passes it to the cashier to fill out the form “Statement of cash flows and services sold” at the time of sale.

The customer is given a “Warranty Card” along with the finished product and is asked to evaluate the quality of the service provided.

Form BO-5

Form BO-5

Form BO-5 is used when placing orders for dry cleaning, dyeing and repair work performed by dry cleaning enterprises, both with preliminary and subsequent forms of payment. Form BO-5 is issued by the receiver in three carbon copies.

The first copy (work order - order) accompanies the order into production and is the basis for writing off material assets and calculating wages.

The second copy (receipt) is given to the customer to confirm the order and its cost (if payment is made in advance). Upon receipt of the order, the customer returns the receipt to the receiver. The receipt serves as the basis for assessing the quality of the service (if the order is unsatisfactorily completed, the customer tears off a special coupon from the receipt).

The third copy (copy of the receipt) is used to record revenue. For the subsequent form of payment, the order payment information is entered as a carbon copy in all three copies when paying for the order. Then a copy of the receipt is transferred to the accounting department of the enterprise according to the register and serves as a control document for both the accounting of receipts and the accounting of orders.

Form BO-6

Form BO-6

Form BO-6 is used when registering the issuance of rental items, as well as receiving money for extending the rental period, repairs, damage to rental items, etc.

The first copy (obligation - receipt) is sent to the salon's file cabinet, where it is stored until the rental items are returned.

The second copy (copy of the obligation - receipt) is transferred by the tenant to confirm the rented items, the rental cost, as well as to control surcharges and is returned to them at the time of return of the rental items. On the reverse side of this copy, notes are made about payment for the extension of the period, additional payment for damage to rental items and their repair.

In case of repeated or subsequent additional payment, a cash receipt order is issued, the number of which is indicated in the upper right part of the back side of the form.

The tear-off stub of the obligation - receipt is registered in the accumulative sheet of receipt and delivery of revenue and, together with it, is transferred to the accounting department. The rental of items for hourly use is documented on the cash register using the BO-9 form, with the customer issuing a receipt from the cash register or the tear-off part of the BO-11 form (02). It is also possible to use the BO-3 form, depending on the mass scale of the service and the location of the rental point.

Form BO-7

Form BO-7

Form BO-7 is used to register pawnshop services when issuing a loan secured by things and jewelry; it is issued by the controller in triplicate as a carbon copy.

The first copy (pledge ticket) is given to the pledgor when putting things (jewelry) as collateral and receiving a loan, and is returned to them when the loan received is repaid in exchange for things (jewelry).

When the loan is repaid, the following are separated from the security ticket: a voucher for the storeroom, a payment voucher and a warrant for the cashier's office. The voucher for the storeroom is given to the storekeeper to remove items (jewelry) from safekeeping; the payment slip serves as the basis for the controller to draw up reports on redemptions made during the day; transfer of the order to the cashier is the basis for the cashier to receive money from the pledgor. On all three coupons, the cashier makes a note about payment and redemption date.

The second copy (copy of the pledge ticket), after filling out the cash order in it, which serves as the basis for the cashier to issue a loan to the pledgor, is used to compile analytical accounting registers.

The third copy (inventory of things) is stored together with things (jewelry) in the storeroom until they are redeemed by the pledgor. When a coupon arrives at the storeroom, the storekeeper finds things (jewelry), takes them out to the checkout inspector, who signs on the control coupon for receiving the items. The control coupon is returned to the storekeeper and kept by him for three years.

Form BO-8

Form BO-8

Form BO-8 is used to register pawnshop services when accepting items and jewelry for storage; it is issued by the controller in triplicate as a carbon copy.

The first copy (safety receipt) is given to the depositor when accepting things (jewelry) for storage; at the bottom of the safekeeping receipt, a calculation is made of the storage fee paid by the depositor to the cash desk at the time of registration of storage. The safe receipt is returned by the deliverer to the pawnshop upon redemption of items (jewelry) from storage.

When issuing items (jewelry) from storage, the following are separated from the safe receipt: a voucher for the storeroom, a payment voucher and a voucher for the cash register. The voucher for the storeroom serves as the basis for the storekeeper to release items (jewelry) from safekeeping; The payment slip serves as the basis for the controller to draw up reports on disbursements made during the day. A cash order is the basis for the cashier to issue (or receive) money to the depositor. On all coupons, the cashier makes a note about payment for storage.

The second copy (a copy of the safekeeping receipt), after filling out a cash order in it, which is the basis for receiving a storage fee from the deliverer at the time of acceptance of things, is used by the accounting department to compile analytical accounting registers.

The third copy (inventory of things) is stored along with things (jewelry) in the storeroom until it is released from safekeeping. When a coupon arrives at the storeroom, the storekeeper finds the items and takes them to the checkout controller. The controller signs the receipt of the items on the control coupon, and returns the coupon itself to the storekeeper. The control coupon is kept by the storekeeper for three years.

Form BO-9

Form BO-9

Form BO-9 “Cash receipt receipt of revenue” is used to process urgent and minor repairs in the presence of the customer, as well as when performing photographic work under a contractual form of organization and labor incentives. When using the BO-9 form, the customer must be given a receipt from a cash register or a tear-off part of the BO-11 form (02). In this case, in the column of the BO-9 form “token number” the number of the cash receipt or the number of the BO-11 form (02) is entered.

The statement serves as the basis for drawing up a material report for writing off sold products, consumed materials and payroll.

Form BO-10 DM

Form BO-10 DM

Form BO-10 DM is used when placing individual orders for repairs and production of jewelry made of precious metals and stones. The form is filled out by the receiver in triplicate as a carbon copy.

The first copy (work order - order) accompanies the order in production and is the basis for calculating wages and writing off materials. In the section “Name of work and additional payments”, if necessary, additional payments for affixing the sample, postage costs, etc. are reflected. The copy has a special area for sketching.

The second copy (receipt) is handed over to the customer and serves as the basis for receiving the finished product and assessing the quality.

The third copy (copy of the receipt) is attached to the cash report to record revenue. In addition, this copy has a warranty card, which is given to the customer.

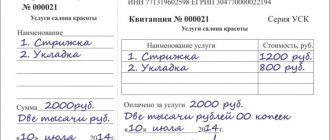

Form BO-11

Form BO-11

Form BO-11 (01) is used to record hairdressing services for each performer in men's and women's salons, beauty, manicure and pedicure rooms.

“Production accounting sheets” are filled out daily by the foreman and are used to monitor the receipt of revenue, pay wages to performers and write off consumed materials. The cashier checks the accuracy of the recording of the cost of services and signs in the appropriate box. Production accounting sheets are recorded daily in the “Cashier's Report”.

When working without a cash register, it is necessary to use coupon BO-11 (02); the master fills out the coupon upon completion of the provision of services to the client. The tear-off part of the coupon is given to the client, and the data of all coupons used during the shift are recorded in the master’s production record sheet BO-11 (01) in the column “Item number according to the price list.” The number of the cash receipt is entered in the same column when using a cash register. If you have a cash register, the BO-11 (02) form is not required.

Coupon BO-11 (02) is also used for all types of household services where the BO-9 form is used in the absence of a cash register. The service provider enters in the BO-9 form all the necessary details of the service provided, and in the “token number” column the number of the coupon BO-11 (02) is entered, the detachable part of which is given to the client.

When selling related products at consumer service enterprises, it is possible to use coupon BO-11 (02) together with form BO-9 instead of a cash register. The procedure for filling out these forms is similar to that used when providing services.