» IP management

The activities of individual entrepreneurs are closely related to the acquisition of various goods from legal entities and individuals. Such sales of goods are clearly regulated by tax and civil legislation, since such transactions are subject to taxation, and this business activity must be clearly documented.

If it is easier for an individual entrepreneur to manage his paperwork, especially if he is on a simplified taxation system, then for a legal entity, all movement of his inventory must be reflected in special accounting documentation, which is constantly checked by regulatory authorities. In order to understand how goods are sold to individual entrepreneurs, this publication was written.

- 2 Document flow of legal entities that sell various goods

- 3 Sales of products in cash

- 4 Cashless payment system

- 5 Some features of payment for products

Documentation of sales of goods in wholesale trade.

⇐ PreviousPage 8 of 32

Wholesale trade organizations operate under both purchase and sale and supply contracts. The shipment of goods by wholesale trade enterprises is carried out to customers in accordance with concluded contracts. Depending on the method of shipment, various documents are drawn up for the release of goods: invoices, specifications, waybills, railway invoices and other documents; In this case, invoices must be issued. Data from primary documents are reflected in secondary accounting documents, on the basis of which accounting registers are compiled. Analytical accounting of sales is carried out in the context of goods, financially responsible persons, and buyers. Financially responsible persons combine the results of goods release in a commodity report, in which each expense document is recorded on a separate line, after which the total amount of goods consumption for the reporting period is calculated. All supporting documents confirming the movement of goods are submitted by financially responsible persons, along with a commodity report, to the accounting department of the trade organization.

Accounting for the movement of goods in a warehouse is usually kept separately for each item in quantitative and cost terms. When maintaining warehouse records by batch (goods received under one document), you can determine the purchase price of goods released for sale based on primary documents. With the grading method of accounting in a warehouse, it may be difficult to determine the price of shipped goods due to different prices for batches of the same grade. Therefore, most often, to determine the purchase price of received goods (hence, the cost at which goods are written off for sale), one of the methods is used:

• at the cost of each unit.

• at average cost;

• at the cost of the first purchases (FIFO method).

The valuation method based on the cost of a unit of goods is the most accurate, but in retail trade it is used to a limited extent due to the complexity (or labor intensity) of determining the cost of purchasing a specific unit of goods sold.

The average cost valuation method is the most common in practice. The average cost at which goods are written off is calculated by dividing the purchase price of goods of one name (one group of goods) without VAT for the month, taking into account the value of the balance of goods of this name (group) at the beginning of the month by their quantity, consisting of the balance of goods at the beginning of the month and goods received this month.

The valuation method based on the cost of goods purchased first in time (FIFO) involves writing off goods of one name (group) that arrived earlier than others, first, i.e. First, the first batch of acquisition is written off, then the second, etc. If there are not enough goods in the first batch, then some of the goods from the second batch are written off, etc.

In accounting, using the journal order form of accounting, the disposal of goods and containers is reflected in the journal order on the credit of account 41 “Goods”. Records in the register are kept not for each primary document separately, but for the product report as a whole. Each report is allocated one line, which shows the balance of goods at the beginning of the reporting period, the debit and credit turnover of account 41 “Goods” indicating the corresponding accounts and the balance of goods at the end of the period. The turnover on the credit of this account must be equal to the total amount of goods consumed in the same report. The balances of goods at the beginning and end of the reporting period in the accounting register must coincide with the corresponding indicators in the commodity report.

At the end of the month, the totals are calculated in the accounting register for account 41 “Goods”, which are compared with the corresponding indicators of the accounting registers for other accounts.

The total cost of goods sold at sales prices represents turnover. Accounting for turnover is kept on account 90 “Sales”. The debit of account 90, subaccount 2 “Cost of sales” reflects the purchase price of goods sold, sales expenses related to goods sold; on the debit of account 90, subaccount 3 “VAT” - value added tax. On the credit of account 90, subaccount 1 “Revenue”, the sales value of goods sold, including VAT, is recorded. At the same time, in account 90, transactions are reflected at different times depending on the moment of accounting for sales recorded in the accounting policy of the enterprise. The generally accepted moment for determining the sale of goods is the moment of shipment of the goods (option 1). Table 16 shows the four most common options for paying for goods and transferring ownership of them.

Table 7

Options for paying for goods and switching to them

ownership

| Option number | Moment of transfer of ownership | Moment of payment for goods |

| Transfer of goods to the buyer | After transfer of goods | |

| Transfer of goods to the buyer | Before transfer of goods | |

| Payment for goods | After transfer of goods | |

| Payment for goods | Before transfer of goods |

Table 8

Accounting for the sale of goods under a supply agreement

| Record number | Fact of economic life | Account correspondence | |

| Dt | CT | ||

| Option 1 | |||

| 1.1 | Shipment of goods to the buyer (at sales price including VAT) | 90-1 | |

| 1.2 | Sold goods are written off (at accounting prices) | 90-2 | 41-1 |

| 1.3 | VAT charged on goods sold | 90-3 | |

| 1.4 | Received money from the buyer for goods | ||

| Option 2 | |||

| 2.1 | The buyer made an advance payment for the goods | 62po | |

| 2.2 | VAT charged on prepayment | ||

| 2.3 | Shipment of goods to the buyer | 90-1 | |

| 2.4 | Sold goods are written off | 90-2 | 41-1 |

| 2.5 | Accrued VAT is written off to reduce gross profit from the sale of goods | 90-3 | |

| 2.6 | Prepayment is written off to reduce the buyer's debt for goods | 62po | |

| Option 3 | |||

| 3.1 | Goods shipped to buyer | 41-1 | |

| 3.2 | VAT charged on shipped goods | ||

| 3.3 | Received money from the buyer for goods | ||

| 3.4 | The sale of goods is reflected in accounting | 90-1 | |

| 3.5 | Sold goods written off | 90-2 | |

| 3.6 | Accrued VAT is written off to reduce gross profit from the sale of goods | 90-3 | |

| Option 4 | |||

| 4.1 | The buyer made an advance payment for the goods | 62po | |

| 4.2 | The sale of goods is reflected in accounting | 62po | 90-1 |

| 4.3 | Sold goods written off | 90-2 | 41-1 |

| 4.4 | VAT charged on goods sold | 90-3 | |

| 4.5 | Goods that have become the property of the buyer are credited to an off-balance sheet account | ||

| 4.6 | Goods shipped to buyer |

Document flow of legal entities that sell various goods

Due to the fact that in most cases the income of various legal entities that are engaged in economic activities is formed precisely through the sale of various goods and services, including to individual entrepreneurs, according to tax legislation it is subject to taxes. So that state tax authorities can track this, special accounting documents have been introduced into the document flow that allow keeping records of such transactions. There are two ways to sell goods:

- individuals;

- subjects of economic relations (legal entities and individual entrepreneurs).

In the first case, a simple cash receipt or an account certificate is sufficient. A cash receipt is a financial document that is issued to the buyer, which indicates the cost of the goods, including VAT (if applicable). An invoice certificate is a special form of a financial document, which can indicate not only the purchase of goods, but also its cost including taxes (VAT), as well as permission to issue the goods at the warehouse by the storekeeper. Typically, this is resorted to by various companies that sell goods at wholesale prices, or sell products from warehouses. In tax documentation, such transactions are recorded in separate accounting records and are confirmation of the purchase and sale. The second method involves the sale of goods to other legal entities or entrepreneurs. Here comes another form of reporting, which includes two forms of calculation:

- spot;

- cashless payments.

Each of them has its own workflow, so each option will be considered in more detail.

It is important to know that individual entrepreneurs have a special status, since when purchasing goods they can act as an individual or as a business entity. If an individual entrepreneur buys products and positions this acquisition for his own needs, then the company can limit itself to a sales receipt. If the acquisition of individual entrepreneurs’ products occurs for commercial purposes (subsequent sale to the public), then such transactions are carried out using other financial documents.

Some companies and individual entrepreneurs are trying to evade taxation and follow the path of selling products to individual entrepreneurs, for their own needs, without subsequent commerce, although the initial goals are subsequent resale of the goods. But the tax authorities are carefully monitoring this, and if such a transaction becomes known, the legal entity and individual entrepreneurs will expect large penalties.

Agreement for the sale of finished products

A transaction for the sale of products is accompanied by certain documents: letters, applications from the client, invoices for payment, and an agreement. The method for determining revenue from the sale of products depends on the form of the contract. The subtleties of revenue recognition are affected by the moment of transfer of ownership of the product from the seller to the buyer. This nuance, in turn, determines the recognition of revenue in the accounting records of the enterprise. In contractual relations, the following methods of transferring ownership rights are used:

- On the day of shipment. Namely, the date of preparation of shipping documents for delivery. Revenue is recognized on the day when finished products are shipped according to an invoice, application or upon payment by the buyer.

- On the day of receipt. Namely, on a specific day or period, which is necessarily discussed in the contract. This may be the moment the products arrive at the buyer's warehouse.

What documents accompany the purchase and sale?

All primary documentation that the company uses in its work meets the requirements specified in the accounting law No. 402-FZ. In case of selling products, you will need to fill out:

- Consignment notes in the form TORG-12;

- Invoices;

- Waybills;

- UPD – universal transfer document;

- Certificates, specifications, other documents provided for in the contract.

Documents for products are drawn up in two copies. If a special transfer of ownership rights is provided for the product, then it is more convenient to draw up three copies of shipping documents. On the part of the receiving party, the supplier must receive a mark on acceptance of the products: date, signature, seal of the purchasing company.

Invoices are issued by the seller if he is a VAT payer or tax agent. Invoices serve as confirmation of the transfer of rights to property (goods, products). In accounting, they will serve as the basis for accepting products for accounting and writing off the acquisition cost as expenses when calculating profits. Starting from October 21, 2013, it is allowed to use the universal transfer document UPD for purchase and sale transactions, for registration of services and works provided. The UPD is issued in two copies and serves as an alternative replacement for documents: TORG-12 and invoices. The UTD form for filling has the form of an invoice. The document is certified by the persons responsible for the shipment of products, as well as by the person responsible for the correct registration of the facts of the economic life of the enterprise.

Postings of sold products:

Dt 90.2 Kt 43 – sales of products

Dt 90.3 Kt 68 – VAT payable is charged

Dt 62 Kt 90.1 – accounts receivable formed

Dt 50/51 Kt 62.1 – payment received from the buyer.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

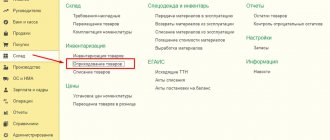

Sales of goods and services in 1C 8.3 - examples with postings

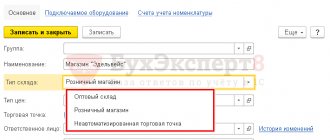

Write-off of sold goods from the organization’s warehouse occurs according to the “Sales” document. Let's take a step-by-step look at how this is done in 1C Accounting 8 edition 3.0. In the menu on the left we find “Sales” and select the journal “Sales (acts, invoices)”. In the window that opens, press the “Implementation” button. From the drop-down list, select “Products (invoices)”:

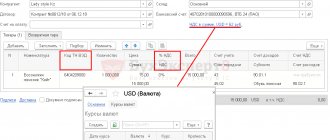

A form opens to fill out:

The following fields are required:

- Counterparty is the organization for which the sales document needs to be made.

- Contract for the counterparty.

- An invoice for payment is filled out if an invoice was previously issued to this counterparty and it was paid.

- Payments – here the number of the current account for making an advance payment to which the payment has been received is displayed.

- The price type is entered automatically based on the contract data filled in the counterparty card.

- Field with a list of goods. It can be filled in using the “Select” button.

Let's consider creating a “Sales” document based on a previously issued invoice. Go to the “Customer Accounts” journal and select the required document. Let's open it. At the top we find the “Create on the basis” button and from the drop-down list select “Implementation (act, invoice)”:

The window for selecting the document form appears again:

Select “Goods (invoice)”. And the program itself creates a fully completed “Sales based on the selected account” document. All that remains is to issue an invoice. To do this, at the bottom of the screen we find the inscription “Invoice” and press the “Write an invoice” button. The document is generated automatically and the invoice number and date will appear in this place:

You can view this document by clicking on the same link or in the “Sales” section of the “Invoices issued” journal. Everything is filled out and all that remains is to submit the document.

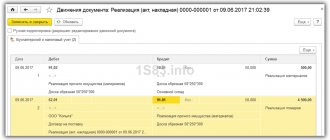

Now let's see what transactions have been created in the system. To do this, click the small button in the top panel “Show transactions and other document movements”:

A window with generated transactions opens:

- Dt 90.02.1 - Kt 41 (43) - reflection of the cost of goods (or finished products);

- Dt 62.02 - Kt 62.01 - offset of the advance payment (if there was one);

- Dt 62.01 - Kt 90.01.1 - reflection of revenue;

- Dt 90.03 – Kt 68.02 – VAT accounting.

You can make changes to transactions manually. To do this, check the “Manual adjustment” box. It is not recommended to do this, as the program itself distributes everything based on previously filled in data.

To print documents on the created implementation, you need to click the “Print” button in the top panel. As a rule, a set of documents consists of a consignment note (Trading 12) and an invoice. Select them one by one from the drop-down menu and print. Or you can print everything at once; to do this, select “Set of documents”. After clicking, a selection window appears:

Here we put a checkmark next to the name of the required document and indicate the number of copies.

If you check the “Directly to printer” checkbox, the entire set will be immediately sent for printing without preview.

If there is a need to print a delivery note or a delivery note (T-1), then they can be printed from the above drop-down window:

To enter additional delivery details, at the bottom of the “Implementation” document itself, there is a “Delivery” link. The consignee and consignor are indicated here - if they differ from those stated, the delivery address, which transport company is delivering the goods - if the cargo is not transported by the selling organization, the car number, driver details, name of the cargo and a list of accompanying documents:

After filling out, click OK and send for printing.

Reflection of the transaction in tax accounting

Information on the receipt and sale of products is reflected in accounts BU 40 and 43 with some differences. In the accounting policy of the enterprise, the accountant chooses whether to use account 40 in accounting or not. To do this, it is necessary to determine how to keep records of GPs:

- By direct types of costs;

- According to the actual cost of production of GP;

- At standard/registration prices using account 40.

If the choice is made in favor of the planned/standard cost, then the accounting will need to track the presence of the following operations:

Dt 43 Kt 20,23,29 - for the amount of capitalized GP from production.

Or

Dt 43 Kt 40 – for the amount of GP produced from production,

Dt 40 Kt 20 - for the amount of the actual cost of manufactured products.

The planned cost of GP, which is released from production, often differs from the actual one. And on the credit or debit balance of account 40, an amount difference is formed, which at the end of the month is written off to the financial result of the company’s activities with the following entries:

Dt 90-2 Kt 40 - the amount of the debit balance of account 40, which shows the excess of actual costs over planned ones,

Dt 90-2 Kt 40 - the amount of the credit balance of account 40, which is the result of savings in actual production costs.

Documentary accounting of finished product production

Providing production with the necessary materials, as well as tools and components/semi-finished products, is carried out by the manufacturing company, both by purchasing materials in cash and by non-cash payment. The company's suppliers submit an invoice - application - to the accounting department for payment from the company's current account. In the case of cash payments, the employee draws up a written application addressed to the manager with a request to release cash for production needs on account.

Purchases are accounted for on the basis of primary invoices in the TORG-12 form, cash register and sales receipts attached to the advance report.

Warehouse accounting of received materials is maintained in accounting cards in form M-17. The basis for the transfer of raw materials and supplies to production is also a demand invoice certified by the person responsible for storage and processing.

The production result in the form of finished products is transferred to the warehouse for subsequent sale based on production reports for the shift. They also generate information about the costs of raw materials and the actual cost of production.

GLAVBUKH-INFO

Trade organizations are considered organizations whose main activity is the acquisition of goods for the purpose of their further sale.Goods are part of inventories purchased or received from other legal entities and individuals and intended for sale.

The movement of goods in trade organizations, as a rule, includes two main stages:

- receipt of goods by purchasing them from suppliers;

- sale of goods to customers - legal entities and individuals.

All operations involving the movement of goods in trade organizations must be documented with primary accounting documents.

For registration and accounting of trade operations, the following main unified forms of primary accounting documentation are provided:

Form No.

| Form name | |

| TORG-1 | Certificate of acceptance of goods |

| TORG-2 | Act on the established discrepancy in quantity and quality when accepting inventory items |

| TORG-3 | Act on established discrepancies in quantity and quality when accepting imported goods |

| TORG-4 | Certificate of acceptance of goods received without a supplier's invoice |

| TORG-5 | Certificate of receipt of packaging not specified in the supplier's invoice |

| TORG-6 | Container curtain act |

| TORG-11 | Product label |

| TORG-12 | Packing list |

| TORG-1 z | Invoice for internal movement, transfer of goods, containers |

| TORG-15 | Act on damage, damage, scrap of inventory items |

| TORG-16 | Certificate of write-off of goods |

| TORG-18 | Journal of goods movement in the warehouse |

| TORG-28 | Card of quantitative and cost accounting |

| TORG-29 | Product report |

| TORG-ZO | Container report |

All forms for recording trade operations are presented in full in the Album of unified forms of primary accounting documentation for recording trade operations, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

The purchase of goods from suppliers is carried out on the basis of sales and purchase agreements.

Goods from suppliers, as a rule, arrive at the organization with their accompanying documents (invoices, invoices, etc.).

Acceptance of goods received from suppliers is carried out according to the goods acceptance certificate (form No. TORG-1). This act formalizes the acceptance of goods in terms of quality, quantity, weight and completeness in accordance with the rules for acceptance of goods and the terms of the contract.

The act is drawn up by members of the selection committee authorized to do so by the head of the organization.

Goods are accepted based on actual availability. If deviations in quantity, quality, or weight are detected, the organization is obliged to suspend acceptance, ensure the safety of the goods, take measures to prevent its mixing with other similar goods, and call a representative of the supplier (shipper) to draw up a bilateral act.

To formalize the acceptance of domestic and imported goods that have quantitative and qualitative discrepancies in comparison with the data of the supplier’s accompanying documents, the act on the established discrepancy in quantity and quality when accepting inventory items (form No. TORG-2) and the act on the established discrepancy in quantity and quality when accepting imported goods (form No. TORG-3).

These acts are the legal basis for filing a claim with the supplier.

Acceptance of goods by the recipient in terms of quantity, quality and completeness of goods from transport organizations and postal items from communication organizations is formalized by an act in accordance with the rules in force in transport and communication organizations.

Acts on the acceptance of goods by quantity are drawn up based on the correspondence of the actual availability of goods to the data contained in transport, accompanying or payment documents, and when accepting them by quality and completeness - in accordance with the requirements for the quality of goods provided for in the agreement or contract.

Acts are drawn up based on the results of acceptance by members of the commission and an expert of the organization entrusted with carrying out the examination, with the participation of representatives of the supplier and recipient organizations or a representative of the recipient organization with the participation of a competent representative of a disinterested organization.

Acts are drawn up separately for each supplier for each consignment of goods received under one transport document.

Inventory assets for which no discrepancies in quantity and quality have been established are not listed in the acts.

When accepting inventory items, acceptance certificates with attached documents (invoices, delivery notes, etc.) are transferred to the accounting department against signature and for sending a letter of claim to the supplier or transport organization that delivered the goods.

An act in form No. TORG-2 is drawn up for domestic goods in four copies. An act in form No. TORG-3 is drawn up for imported goods in five copies.

If inventory items arrive at the organization without a supplier's account, then they are accepted according to the act of acceptance of goods received without a supplier's account (form No. TORG-4).

Valuables are accepted according to this act based on actual availability. The act is drawn up in two copies by members of the commission with the participation of the financially responsible person. The first copy is transferred to the accounting department, the second remains with the financially responsible person.

To register the acceptance and posting of containers, as well as packaging materials received during unpacking of goods, in the case when they are not shown separately in the supplier’s invoices and their cost is included in the price of the goods, an act on the receipt of containers not indicated in the supplier’s invoice (form No. TORG-5).

The act is drawn up in two copies. The first copy is transferred to the accounting department, and the second remains with the financially responsible person.

When receiving goods from suppliers, they are delivered in net weight.

When registering certain goods, the net weight (net) is determined by subtracting the tare weight according to the marking from the total weight of the goods (gross).

After the container is released from under the goods, it is weighed. If the actual weight of the container is greater than the weight of this container indicated in the labeling, a difference in the weight of the goods arises, which is called the container weight.

A curtain of containers can occur due to the absorption of goods into it and for other reasons.

The curtain of containers is drawn up with a special act on the curtain of containers (form No. TORG-6) in two copies. The second copy, along with the complaint, is sent to the supplier for reimbursement.

In this case, a mark is made on the container (paint, chemical pencil, ink) indicating the number and date of the act of veiling in order to prevent repeated actuation of the same container.

Received goods are transferred for storage to the organization's warehouse.

To record goods in places of their storage, the forms given in the Album of unified forms of primary accounting documentation for accounting of products, inventory items in storage places, approved by Resolution of the State Statistics Committee of Russia dated 08/09/1999 No. 66, are used.

The organization of warehouse accounting of goods depends on the method of their storage.

There are batch and varietal storage methods and, accordingly, batch and varietal accounting of inventory items.

For the batch storage method, a batch card is used (form No. MX-10). This form is drawn up for each batch of goods to control the receipt and shipment of goods by quantity, weight, grade, cost, received by various types of transport (road, rail, water, air, etc.).

The batch card is issued in two copies for each batch of goods by the financially responsible person. All necessary details of the sender, recipient, sender station, number and date of the act of acceptance of the goods, as well as the name, article, grade, price, quantity, weight of the goods are indicated.

One copy of the batch card remains in the warehouse and serves as a register of goods inventory, the second is transferred to the accounting department. As goods are released, the financially responsible person indicates in the batch card the date of release, the number of the supply document and the quantity (weight) of the goods released.

The full consumption of each batch of goods is documented in a batch card with the signatures of authorized persons, indicating data on the application of natural loss norms and the final result of accounting for goods. After the complete disposal of a given batch of goods, the warehouse batch map is transferred to the accounting department for verification and making an appropriate decision.

To record goods in places of their storage, a product label is attached to them (form No. TORG-11). The product label is filled out in one copy by the financially responsible person for each item, indicating the serial number of the label. The product label is stored with the product at its location. The product label data is used to fill out the inventory list of goods.

For analytical accounting of goods that are accounted for in quantitative and cost terms, cards of quantitative and cost accounting are used (form No. TORG-28).

The card is kept separately for each name and type of product. In quantitative and cost accounting, homogeneous goods for different purposes, but having the same retail price, can be recorded together on one card. Entries in the card are made in quantitative and monetary terms on the basis of verified documents submitted to the accounting department by financially responsible persons.

To record the movement and balances of goods and containers in the warehouse, a journal is used to record the movement of goods in the warehouse (form No. TORG-18). The journal is maintained by the financially responsible Person by name, grade, quantity and price.

Entries in the journal are made on the basis of receipt and expenditure documents or accumulative statements for accounting for the release of goods and packaging for the day.

When selling goods to other organizations, goods are released from the warehouse using invoices (form No. TORG-12).

The consignment note is drawn up in two copies. The first copy remains with the organization selling the goods and is the basis for their write-off. The second copy is transferred to the purchasing organization and is the basis for the receipt of these values.

To record commodity documents in trade organizations for the reporting period, a commodity report (form No. TORG-29) and a container report (form No. TORG-30) are used.

These primary documents are drawn up in two copies by the financially responsible person, indicating the number and date of documents for the receipt and disposal of goods and packaging.

A commodity report, as a rule, is prepared using the balance method of accounting for goods. Signed by the accountant and the financially responsible person. The first copy of the report with the attached documents on the basis of which the report is drawn up is transferred to the accounting department, the second copy remains with the financially responsible person.

To account for the internal movement of inventory items between structural divisions or materially responsible persons, an invoice for internal movement, transfer of goods, containers is used (form No. TORG-13).

In the event of damage, damage, or scrap of inventory items for one reason or another, they are subject to markdown or write-off, which is documented in an act of damage, damage, or scrap of inventory items (form No. TORG-15).

The act is drawn up in triplicate and signed by members of the commission with the participation of a representative of the organization’s administration, a financially responsible person or, if necessary, a representative of sanitary supervision. The act is approved by the head of the organization. The first copy is sent to the accounting department and is the basis for writing off losses of inventory items from the financially responsible person, the second copy remains in the department, the third - with the financially responsible person.

If losses from damage to goods are detected during the inventory, the act of writing off goods (form No. TORG-16) is used to write them off.

To register the markdown of goods in the event of obsolescence, a decrease in consumer demand, or detection of signs of deterioration in quality for various reasons, an act on markdown of inventory items (form No. MX-15) is used.

The act is drawn up and signed in two copies by the responsible persons of the commission. One copy is sent to the accounting department, the second is transferred to the financially responsible person for storage or is attached to the invoice for transfer to a trade organization for resale of inventory items at lower prices or for returning them to the supplier (manufacturer).

| < Previous | Next > |

Reflection of products in financial statements

The company's products are reflected in the balance sheet at the cost adopted by the accounting policy. If at the reporting date the organization has balances of unsold products, then its total expression is recorded in the balance sheet asset line 1210 “Inventories”.

The detail of this period is determined by the company independently and may consist of the total balances of all assets that have not been sold as of the date of preparation of the balance sheet.

In conclusion, we can say that the sale of products should be systematic and documented in the specified primary documentation. This will help to create a clear picture of the financial benefits of producing a specific product.

Documents on finished products: receipt and current accounting

The document flow of finished products is based on schemes for organizing the production process, release of finished products and their movement, incl. implementation. These schemes depend on the type of production, scale of activity, management style and many other factors.

Like any other facts of economic life, operations with finished products in an organization are subject to registration with primary accounting documents (Part 1, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

At the same time, the organization is not obliged to use unified primary accounting documents, but can develop such documents independently (Part 4 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ, Information of the Ministry of Finance No. PZ-10/2012). In any case, the primary document used to document the movement of finished products and goods must be enshrined in the accounting policy of the organization for accounting purposes.

Let's talk about some forms of primary accounting documents used by organizations to account for finished products. The specific list of such documents depends on the specifics of the organization.

Documentation of the release of finished products is based on delivery notes, acts and other similar documents that confirm the production of finished products, their acceptance and delivery to the warehouse. At the same time, in these documents, accounting of manufactured finished products must be kept both in quantitative terms and in monetary terms. As a primary accounting document confirming the transfer of finished products from production to storage places (to a warehouse), a unified form of invoice for the transfer of finished products to storage places (form No. MX-18) can be used (Decree of the State Statistics Committee dated 08/09/1999 No. 66).

To control the movement of finished products in the warehouse, a warehouse accounting card can be created, entries in which are made on the basis of receipt and expenditure documents for the movement of finished products. To develop such a card, the form of the unified materials accounting card No. M-17 can be used (Decree of the State Statistics Committee of October 30, 1997 No. 71a).

To document finished products in terms of their intra-warehouse movement, a demand invoice (form No. M-11) can be used. This document can formalize the transfer of finished products from one MOL to another. For the same purposes, an organization can use a consignment note for internal movement, transfer of goods, containers (form No. TORG-13) (Decree of the State Statistics Committee of December 25, 1998 No. 132).

How to confirm the quality of the delivered goods

The law obliges the supplier to provide the customer with goods of proper quality. This fully applies to government procurement. How can you prove that the delivered product is truly of high quality? In practice, the supplier and the customer may have opposing opinions on this issue. Can the customer require the supplier to document the quality of the product, and what documents will be required for this?

As you already understood from the title, in this article, experts from the Credit Insurance Agency will talk about how a supplier should confirm the quality of a product and whether he is always obliged to do this. Why are these issues so important in government and corporate procurement conducted in accordance with federal laws No. 44-FZ and No. 223-FZ? Yes, because most such purchases are carried out through competitive procedures. And in this case, the law obliges customers to enter into contracts with suppliers who offer the lowest price, which often affects the quality of the goods supplied.

Sometimes things reach the point of absurdity. There is a known case when a laboratory test of dairy products supplied to preschool institutions could not detect natural milk in the product. He simply wasn't there. And such situations are not as rare as we would like.

What documents confirm product quality?

The answer to this question is given by Federal Law No. 184-FZ of December 24, 2002. "On technical regulation". According to Article 20 of this law, there are two types of documents confirming the quality and safety of goods:

1. Certificate of conformity.

2. Declaration of conformity.

For some products, obtaining such documents is mandatory. Their list was approved by Decree of the Government of Russia No. 982 dated December 1, 2009. When selling such products, the seller is obliged to transfer to the buyer copies of certificates or declarations, certified by a seal. If the contract is concluded for the supply of medicines or medical devices, then in addition to documents confirming the quality of the products, the supplier provides the buyer with information about state registration.

Certificate of conformity

A certificate of conformity is a document confirming product quality, which is issued by a specialized accredited certification center. The center's specialists check the sample of goods handed over to them for compliance with the requirements established by law and issue an appropriate conclusion drawn up on a standardized form.

Sometimes there is such a thing as a “certificate of quality”. In terms of its semantic content, it is identical to the concept of “certificate of conformity”. However, one must understand that in the law “On Technical Regulation” and other official documents the term “certificate of conformity” is used.

There are two types of product certification:

Mandatory certification - applies to goods included in the List approved by the Russian Government. It mainly includes products that may affect the safety of people. Mandatory certification is carried out through testing and laboratory research. In the absence of a certificate for a product subject to mandatory inspection, the supplier does not have the right to sell it.

Voluntary certification – carried out at the request of the manufacturer, confirms the product’s compliance with quality and safety requirements. Allows you to strengthen the business reputation of the supplier and expand the sales market. With certified products, he can participate in government procurement without any problems. Voluntary certification can be carried out, for example, according to ISO standards, confirming the compliance of a product with international standards. Or according to EAC standards - product compliance with the requirements of the Customs Union.

Product certification is paid. The cost will depend on the type of certificate, the complexity of the tests performed, the need for a specialist to visit the production site and other factors.

Procedure for obtaining a certificate of conformity

It is necessary to obtain a certificate of conformity for imported goods before importing them into Russia. For domestic products, this must be done before putting them on the market. Voluntary certification can be carried out at any time.

The document can be obtained by the manufacturer, official distributor or seller. It is beneficial for the manufacturer to order a document for a series of goods. It allows shipment of an unlimited number of products within a certain period of time. Importers often receive a certificate for a batch of purchased goods. The seller can also order the document if the manufacturer has not done so.

The process of obtaining a certificate consists of several stages:

1. Preparation by the applicant of the necessary package of documents. This includes copies of the TIN and OGRN certificates of the company, the charter, technical conditions or GOST according to which the products were manufactured, and a description of the goods presented. An application for obtaining a certificate is attached.

2. Submitting an application, prepared documentation and product samples to an accredited certification center.

3. Conducting the necessary research and issuing a certificate of conformity.

If during testing of a product it is revealed that it does not comply with at least one quality or safety requirement, the applicant is denied a certificate. Once the identified deviations have been corrected, you can resubmit your application.

Declaration of Conformity

The declaration of conformity of goods with quality and safety requirements is a document issued according to simplified rules. Its purpose and rules of use are exactly the same as the certificate of conformity.

There are several distinctive features of the declaration from the certificate of conformity:

The declaration is printed on a regular A4 sheet that does not have any security elements. Certificates are always issued on specialized forms.

To obtain a declaration, the applicant can submit to the accredited certification center, along with a package of necessary documents, test reports conducted in its own laboratories. This significantly speeds up and reduces the cost of obtaining a document.

During certification, a check is carried out to ensure that the product meets all established standards. During the declaration, the applicant can independently determine the list of standards that the products must comply with.

A correctly completed declaration of conformity has the same legal force as a certificate of conformity. The validity period of the document is set by the seller in accordance with the expected sales period.

The requirements for providing declarations of conformity during public procurement are similar to the rules established for certificates. It is allowed to transfer copies certified by the supplier with the goods.

Obligation to provide a certificate of conformity or declaration

The customer has the right to require participants to submit certificates or declarations if, by law, the goods are subject to mandatory certification or declaration. This is confirmed by the letter of the Ministry of Economic Development of Russia dated June 22, 2016 No. D28i-1710. In this case, the participant will be obliged to provide the customer with an appropriate certificate of conformity or declaration of conformity. The customer's requirement that the procurement object comply with voluntary certification documents must be justified in the procurement description, otherwise it may be perceived as a restriction of competition. If there is such a requirement in the procurement documentation, the procurement participant is also required to provide the corresponding certificate.

Authentication of certificates and declarations

Information about all issued certificates and declarations is entered into the relevant registers posted on the website of the Federal Accreditation Service (https://fsa.gov.ru/). The register contains the details of the document, its validity period, information about the product itself and the tests carried out. Any user can verify their authenticity by entering the certificate or declaration number in the appropriate form. Registers are maintained according to the rules established by Decree of the Government of the Russian Federation No. 201 of April 10, 2006 “On the procedure for creating and maintaining a unified register of certificates of conformity, providing the information contained in the specified register and paying for the provision of such information.”

It must be taken into account that information about issued certificates and declarations appears in the register with some delay, which can be up to 10 days. This is due to the technical features of maintaining the register. Therefore, when receiving documents from a certification center, it is advisable to ask employees about the possible timing of the appearance of information in the register.

The experts of the Credit Insurance Agency wish you good luck and victories in tenders.

Credit and Insurance Agency - we make government purchases accessible !

Documentation of product sales

Documentation of the sale of finished products, as a rule, consists of filling out a consignment note in form No. TORG-12 (Decree of the State Statistics Committee of December 25, 1998 No. 132). This invoice is usually drawn up in 2 copies. The first copy remains with the selling organization (is the basis for writing off the products), and the second is transferred to the buyer (is the basis for the receipt of purchased goods).

We discussed in a separate article what documents are compiled when taking inventory of finished products.

What is important to remember

- The document must be drawn up in 2 copies. One of them is left at the organization’s point of sale. The other is sent to the accounting department. There, the products are written off from financially responsible employees and reported to the head of the store, sales tent or other point.

- The act in form SP-36 must be kept for 5 years.

- Factual errors often occur when filling out the form. To correct them, you need to: cross out the erroneous information, write the correct version next to or on top, write in the margins “Believe the corrected information” and sign. Other signatories must be notified of changes.

What are “primary documents”

Federal Law 402-FZ “On Accounting” describes all accounting and primary documents. They are needed mainly for tax purposes - as documents that confirm the expenses you have incurred and the correctness of determining the tax base.

Primary documents must be stored for 4 years. During this time, the tax office may request them at any time to check you or your counterparties. “Primary” is also used in litigation in disputes with counterparties.

Primary accounting documents are drawn up at the time of business transactions and indicate their completion. The list of documents accompanying a particular transaction may vary depending on the type of transaction. The preparation of all necessary primary documents is usually carried out by the supplier. Particular attention should be paid to those documents that arise during transactions where you are the buyer, because these are your expenses, and therefore you are more interested in complying with the letter of the law than your supplier.

Separation of primary documents by business stages

All transactions can be divided into 3 stages:

Stage 1. You agree on the terms of the deal

The result will be:

- contract;

- an invoice for payment.

Stage 2. Payment for the transaction occurs

Confirm payment:

- an extract from the current account, if the payment was made by bank transfer, or by acquiring, or through payment systems where money is transferred from your current account;

- cash receipts, receipts for cash receipt orders, strict reporting forms - if payment was made in cash. In most cases, this payment method is used by your employees when they take money on account. Settlements between organizations are rarely in the form of cash.

Stage 3. Receipt of goods or services

It is imperative to confirm that the goods have actually been received and the service has been provided. Without this, the tax office will not allow you to reduce the tax on money spent. Confirm receipt:

- waybill - for goods;

- sales receipt - usually issued in conjunction with a cash receipt, or if the product is sold by an individual entrepreneur;

- certificate of work performed/services rendered.

I put in the primary, I figured it out right away

“I enter the primary data into the Accounting Department, and the accountant handles the accounting and reporting. The service has a very convenient and intuitive interface, I figured it out right away, without any help. Very well made, made for people! And, of course, it’s convenient that you can log into the system from anywhere, from any device.”

Marat Imanov, director at Dialog LLC, St. Petersburg.

Mandatory primary documents

Despite the variability of transactions, there is a list of mandatory documents that are drawn up for any type of transaction:

- contract;

- check;

- strict reporting forms, cash register, sales receipt;

- invoice;

- certificate of work performed (services rendered).

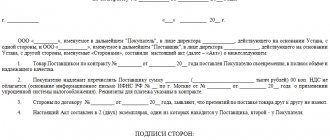

Agreement

When carrying out a transaction, an agreement is concluded with the client, which specifies all the details of the upcoming business transactions: payment procedures, shipment of goods, deadlines for completing work or conditions for the provision of services.

The contract regulates the rights and obligations of the parties. Ideally, each transaction should be accompanied by a separate contract for the supply of goods or services. However, with long-term cooperation and the implementation of similar operations, one general agreement can be concluded. The agreement is drawn up in two copies with stamps and signatures of each party.

Some transactions do not require a written contract. For example, a sales contract is concluded from the moment the buyer receives a cash or sales receipt.

An invoice for payment

An invoice is an agreement under which a supplier fixes the price of its goods or services.

The buyer accepts the terms of the agreement by making the appropriate payment. The form of the invoice for payment is not strictly regulated, so each company has the right to develop its own form of this document. In the invoice, you can specify the terms of the transaction: terms, notification of advance payment, payment and delivery procedures, etc.

In accordance with Article 9-FZ “On Accounting”, the signature of the director or chief accountant and seal are not required for this document. But they should not be neglected in order to avoid questions from counterparties and the state. The invoice does not allow you to make demands on the supplier - it only fixes the price of the product or service. At the same time, the buyer retains the right to demand a refund in the event of unjust enrichment of the supplier.

Payment documents: cash receipts, strict reporting forms (SSR)

This group of primary documents allows you to confirm the fact of payment for the purchased goods or services.

Payment documents include sales and cash receipts, financial statements, payment requests and orders. The buyer can receive the order from the bank by paying by bank transfer. The buyer receives a cash or goods receipt from the supplier when paying in cash.

Bill of lading or sales receipt

Sales receipts, as we said above, are issued when selling goods to individuals or by the individuals themselves.

Invoices are used primarily by legal entities to register the release/sale of goods or inventory items and their further receipt by the client.

The invoice must be prepared in two copies. The first remains with the supplier as a document confirming the fact of transfer of goods, and the second copy is transferred to the buyer.

The data on the invoice must match the numbers on the invoice.

The authorized person responsible for the release of goods must put his signature and the organization’s seal on the invoice. The party receiving the goods is also obliged to sign and certify it with a seal on the delivery note. The use of a facsimile signature is permitted, but this must be recorded in the contract.

Certificate of services rendered (work performed)

An act is a two-sided primary document that confirms the fact of a transaction, the cost and timing of services or work.

The act is issued by the contractor to his client based on the results of the provision of services or work performed. This primary document confirms the compliance of the services provided (work performed) with the terms of the concluded contract.

We fill out the act according to form SP-36

Conventionally, the document can be divided into three parts. The first is data about the document, company, recipient. The second contains a table with information about the products being transferred. The third part is the conclusion - the positions and signatures of the responsible persons.

The first part contains the following information:

- name of the company, retail outlet, recipient;

- Date of preparation;

- OKPO code.

The tabular part is intended for entering the following information:

- Number in order.

- Name and type of transferred products.

- Name of units of measurement.

- Name of the sending company.

- Quantity of goods.

- Price and total amount.

- Result: here they write the total quantity and amount for all senders.

The table is located on the front and back sides. On the reverse side, they summarize the total in the table: by the amounts for each sender and the total. Next, the employees who handed over and accepted the products put their signatures. Then they indicate data on the correspondence of accounts - this is done by the organization’s accountant.

At the end, the store manager and accountant put their signatures (the document is handed over to him after it is completed). Do not forget to put the date of completion and indicate the attached documents (sales notes, delivery notes).

The last action will be approval of the document. On the first sheet in the upper right corner, the head of the company puts his signature and the date of signing the act.