⭐ ⭐ ⭐ ⭐ ⭐ Good afternoon, readers of my blog, now we will comprehend the necessary topic for everyone - In Personal Income Tax 3 Which Object to Specify When Building a House and Buying a Plot. Perhaps you may still have questions after you read, so it is best to ask them in the comments below, or even better - get advice from practicing lawyers on all types of law from our partners.

We constantly update information and monitor its updates, so you can be sure that you are reading the latest edition.

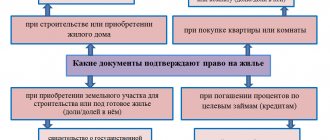

A property tax deduction for the construction of a house is a monetary compensation paid from the state budget in the amount of the amounts of money that you actually spent on the construction of a country house. This government payment is made in the form of a refund of the income tax previously withheld from your salary in the amount of 13%.

An example of filling out form 3-NDFL when purchasing a home

4. Next, go to the “Deductions” tab.

It consists of 4 pages, each of which contains information respectively on standard, social and property deductions, as well as on deductions for carrying forward losses from transactions with securities and transactions with financial instruments of futures transactions. A window opens in front of us that needs to be filled out: enter the name of the tax agent, INN, KPP, OKATO code. This information can be taken from the certificate of income and withheld amounts of taxes issued by tax agents at the request of the taxpayer. Check the box “Calculate standard deductions using this source” and click “Yes”.

How to fill out 3-NDFL when building a house ↑

It is very important to fill out the documents correctly when building a house. Since if there are any errors, tax authorities have the right to refuse a tax deduction based on the presence of inaccuracies in the calculations.

This will lead to the need to collect documents and submit them again, which will lead to considerable loss of time.

Document structure

Today, when submitting a 3-NDFL certificate, a new form is used; it contains 24 pages: the first two pages are title pages, the next four are numbered sections.

What the 3-NDFL declaration looks like, see the article: sample of filling out 3-NDFL. What is 3-NDFL, read here.

They contain all calculations relating to the income of the person who needs the deduction. Section No. 5 contains the final calculation of personal income tax - it indicates the full amount required to be paid.

Section No. 6 contains amounts that must be transferred to the budget or returned from the budget - it all depends on the BCC (budget classification code).

It is this section that contains all the mandatory information regarding the amount of the tax deduction. The sheets marked with the letters A, B, B1 and B2 are especially important.

They contain information about the income of the person submitting this document:

| Cell | Content |

| Sheet A | Contains data on income on which tax is required to be paid in the territory of the Russian Federation (with the exception of those received as a result of business activities) |

| Sheet B | Income from conducting any activity outside the Russian Federation (exception – entrepreneurial activity, private practice) |

| Sheet B1 | Filled out by individual entrepreneurs |

| Sheet B2 | Required for individuals with profitable private practice |

In addition to those listed above, there are as many as 12 sheets. All of them have a letter designation (from G to L) and are necessary:

- to fill out the first 6 sheets;

- to calculate the amount of tax deductions.

Each sheet of 12 has the following individual purpose:

| Cell | Description |

| Sheet G | Required to calculate those income of the taxpayer that are not subject to income tax (clauses 28, 33, Article No. 217 of the Tax Code of the Russian Federation) |

| Sheet D | It is used to perform calculations for various types of deductions due for works of authorship, inventions obtained at various competitions and under other conditions |

| Sheet E | The tax deduction provided for under civil law agreements is calculated |

| Sheet G1 | Filled out if there are deductions due from the sale of any property owned |

| Sheet Zh2 | Used to calculate deductions received as a result of the sale of property rights |

| Sheet Z | Used to calculate the tax base for an agreement for the purchase and sale of securities (resale of shares, business assets) |

| Sheet I | Contains information similar to sheet 3, but only taking into account the fact that all operations are performed by a trusted person |

| Sheet K1 | Used to calculate standard tax deductions |

| Sheet K2 | Used to calculate social tax deductions |

| Sheet K3 | Used to calculate social taxes (Clause 1, Article No. 219 of the Tax Code of the Russian Federation) |

| Sheet K4 | Necessary for calculating social taxes paid to a non-state pension fund |

In the last sheet, designated as L, the tax deduction is calculated based on the amounts spent on the purchase of residential real estate: an apartment, a private house.

This sheet also displays all information regarding the costs of constructing a residential building.

Calculation of amounts

To correctly fill out 3-NDFL, it is necessary to correctly calculate all amounts. This is required in almost all sheets.

Item No. 5.6 of sheet A (calculation of the amounts of taxes that reduce the tax base is calculated by adding the following indicators):

| Index | Normative base |

| Amounts of deductions that are mandatory | Article No. 221 of the Tax Code of the Russian Federation |

| Amounts of tax deductions arising as a result of the construction of residential real estate or the acquisition of such property in finished form | Article No. 220 of the Tax Code of the Russian Federation |

| Amounts of social and standard deductions | Article No. 218, 219 of the Tax Code of the Russian Federation |

| Amounts of professional deductions | Article No. 221 of the Tax Code of the Russian Federation |

Item No. 2 of sheet B:

| Line | Content |

| №140 | The amount of income received in foreign currency in terms of rubles (determined by adding all lines 070) |

| №150 | The amount of tax received in foreign currency, recalculated in rubles (all values of lines 110 are added together) |

| №160 | The total amount of tax accrued in the Russian Federation (all lines 120 are added together) |

| №170 | The amount of tax required to be offset in the Russian Federation (all lines 130 are added together) |

The remaining sheets of the tax return also contain various types of calculations. But the most important ones are those designated by the letters A and B.

Especially the amount of tax deductions resulting from the entry into force of Article No. 220 of the Tax Code of the Russian Federation. This item should display the most accurate information regarding the costs of constructing a residential building.

Filling example

You must fill out the 3-NDFL tax return yourself or with the help of a qualified accountant.

Find out the amount of water tax from the article: water tax rates. Read all about the water tax return here.

Who is the water tax payer, see here.

If there is no suitable specialist nearby, you can simply carry out the calculation based on the sample. Its presence greatly simplifies this process.

Refund of property deduction for personal income tax when building a house

Tax reimbursement for building a house has many subtleties and nuances. Thus, when calculating the actual expenses of the taxpayer, the auditing specialist independently determines the possibility of attributing to expenses the amounts indicated in the payment documents. Often during construction, the number of such documents can reach several hundred, and the emergence of questions from inspectors may be inevitable. The taxpayer has the right to defend his interests, including in court, which must be used in the event of controversial situations.

If the desk audit results are positive, the funds are credited to the current account specified by the taxpayer. If the tax return is returned for adjustment, the taxpayer must either correct the detected deficiencies or challenge them.

Sample of filling out a declaration when building a house

Tax refund when building a house

3 simple steps to receive a tax deduction when building a house

Have you built a house and want to get back some of the money spent on construction?

Despite popular belief, it is simple - just apply for a property deduction when building a house.

Of course, for an ignorant person this procedure will seem complicated and lengthy. But only with the Pollux service you need to take 3 simple steps to receive a tax deduction. And nothing more.

In order to make sure that the procedure is simple, we will tell you how it actually happens, without outside help. And then you will decide for yourself whether it is worth contacting us for a tax refund when building a house. Let's start?

Sample 3-NDFL (13%) for property tax deduction for the construction or purchase of new housing

You only need to fill out page 1, page 2, section 1, section 6_13, sheet A_13, sheet G1, sheet I.

How to fill?

New form for 2015 (approved in December 2014 (12/30/14)). Declaration 3-NDFL.XLS (all sheets)

When determining the tax base, if the apartment (house, plot) being sold was owned for more than three years, the property tax deduction in this case will be equal to the amount of income received. There is no need to pay personal income tax.

When selling property that was owned by the taxpayer for less than 3 years, it is necessary to pay personal income tax. The size of the tax base can be reduced by the amount received by the taxpayer from the sale of property, but not more than 2,000,000 rubles. when selling a home and 250,000 rubles. from the sale of other property.

There was no maximum mortgage interest deduction until 2014. From 2014 it will amount to 3 million rubles.

When purchasing housing and paying interest on a loan for it (new construction, residential building, apartment, room or share(s) in them, land plots provided for individual housing construction, land plots on which the purchased residential buildings are located, or a share ( shares) in them). The total amount of the property tax deduction provided for by this subclause cannot exceed 2,000,000 rubles, excluding amounts used to repay interest. Those. The amount of tax deduction for interest is unlimited.

Property deductions can be obtained for unfinished housing. Don't rush to deduct. After all, you can only get it once. And after the house is completed, it will be possible to deduct expenses not only for the purchase of real estate, but also for its completion.

When purchasing several apartments, a property deduction can be obtained for any of them.

From January 1, 2014, the property deduction can be used several times, and for several apartments in houses. And the maximum mortgage amount will be RUB 3,000,000.

TIN: you need to enter it only on the main page, on the rest it will be added automatically.

Taxpayer category codes: Code 720 - individual entrepreneur Code 730 - notary Code 740 - lawyer Code 760 - other individual Code 770 - individual entrepreneur head of a peasant (farm) enterprise

Country code: Code 643 - Russia.

Document type code: Code 21 - passport.

Tax period (code): 34 (year).

Sample of filling out the 3-NDFL declaration page 1 (Title page)

Sample of filling out the 3-NDFL declaration page 2

Initial data

The employee worked at Romashka LLC throughout 2010 and received 6,000 per month. Also, for 6 months he received a standard tax deduction of 400 rubles

New form since 2012 (approved in November 2011 (11/10/11)). 3-NDFL.XLS sample filling for property tax deduction. Correct the data in red in the form to your own.

Step-by-step instruction:

STEP 1 Fill out Sheet G1 Standard tax deductions

Sample of filling out the 3-NDFL declaration Sheet G1

STEP 2 Fill out Sheet A_13

In lines 10-70 we indicate the organization and the income that was received. There can be many such organizations

line 70 equals 60 if income tax has been paid

Sample of filling out the 3-NDFL declaration Sheet A_13

STEP 3 Fill out the Sheet and Property Tax Deductions

1.1. Object name code (010)

1 - residential building

3 - room

4 - share(s) in a residential building, apartment, room, land plot

5 - land plot provided for individual housing construction

6 - land plot on which the purchased residential building is located

Sample of filling out the declaration 3-NDFL Sheet I

STEP 4 Fill out section 1.

Sample of filling out the 3-NDFL declaration Sec. 1

STEP 5 Fill out section 6 based on section 1.

KBK 1821 0100 110 Personal income tax on income taxed at the tax rate established by paragraph 1 of Article 224 of the Tax Code of the Russian Federation, with the exception of income received by individuals registered as individual entrepreneurs, private notaries and other persons engaged in private practice

Sample of filling out the 3-NDFL declaration Section 6_13

New form for 2013 (approved in November 2013 (14.11.13)). Declaration 3-NDFL.PDF (all sheets without filling out) (from 2014 you need to indicate OKTMO)

New form for 2015 (approved in December 2014 (12/30/14)). Declaration 3-NDFL.XLS (all sheets)

Refund of property deduction for personal income tax when building a house

Accounting for house construction costs and the right to tax deductions

Tax deductions can be provided to citizens of the Russian Federation who pay taxes and have never used the right to a refund (disclaimer: tax refunds are allowed before Chapter 23 of the Tax Code of the Russian Federation came into force - that is, until 2001). One object under construction equals one right to a tax deduction, regardless of how many tax periods payments will be made.

Personal income tax compensation for the construction of a house on the territory of the Russian Federation can be provided to:

- Based on the actual expenses of the developer, which include:

- payment to third parties for the creation of design documents and development of estimates

- payment for necessary building materials

- expenses for purchasing a house whose construction is not completed

- expenses for finishing or completing a house that is not yet completed (if it is confirmed that similar materials were not available when purchasing the house)

- payment for work on connecting to all types of utility networks or for the construction of autonomous sources of electricity and other benefits.

- Based on actual payment of interest accrued on credit or borrowed funds received from authorized organizations of the Russian Federation. Loan funds must be spent only on the facility under construction.

- When acquiring (purchasing) a plot of land for individual residential construction and if there is a certificate of ownership of the taxpayer for the house that is being built on this land.

- Payment for expenses was not made from personal funds (if government subsidies, financial assistance from the employer, or maternity capital funds were used).

- The purchase of an unfinished house was made from an interdependent individual (relationships in accordance with the Family Code of the Russian Federation - parents and children, spouses, guardians and wards).

Only those expenses incurred by the taxpayer after registration of ownership can be claimed for refund. Confirmation of expenses can be bank payment documents, sales receipts, receipts from the heads of contractor organizations in receiving money from the taxpayer-applicant.

The maximum allowable amount of expenses allowed for calculating the amount of tax deductions for construction is 2 million rubles. Accordingly, the amount of tax refunded is 13% or in ruble equivalent - 260 thousand. This amount does not take into account the actual payment of interest on loans.

Taxpayers cannot take advantage of the tax deduction in the following cases:

Procedure for preparing and submitting documents

Refunding personal income tax during the construction of a house includes collecting the necessary documents and filling out a tax return for the year preceding the year in which the refund was applied for.

Set of documents required for collection:

- A copy of the passport pages with the photograph and permanent registration of the applicant-owner of the property.

- A certificate from the place of employment in form 2-NDFL for the exact year for which the tax refund is planned to be made.

- Documents confirming ownership of the facility under construction.

- Documents confirming construction costs.

- Details of a personal account in a state bank (Sberbank of the Russian Federation and savings book are a priority).

Once the documents are collected, you will need to fill out a tax return. It can be filled out in handwriting or using a special computer program.

At the beginning of the calendar year following the reporting period, a special program is posted on the official websites of the tax service of the Russian Federation, which is as convenient as possible for use and easy to work with. To use it, you need to carefully read the manual and note for yourself which pages of the declaration must be filled out specifically for deductions for the construction of a house, since the program is universal and includes filling out a declaration for all types of deductions.

If the taxpayer is unable or unwilling to deal with the intricacies of filling it out on his own, he can use the services of third parties.

When submitting documents, you need to know that one taxpayer can submit documents for tax deductions only once. That is, if a tax refund is expected for several past years, documents, including several tax returns—one for each year—must be organized by tax periods. If an individual himself discovers an error or inaccuracy in the declaration, the taxpayer has the right to submit an updated version for verification.

Implementation of personal income tax refund

In accordance with the requirements of Article 88 of the Tax Code of the Russian Federation, a desk audit of the tax return must be completed within three months from the date of filing the return. A desk audit is an examination of the tax return and all documents attached to it and submitted by the applicant-taxpayer. The audit is carried out by a tax specialist.

After the expiration of the specified period (in rare cases, in practice, earlier), the tax authorities are obliged to notify the taxpayer in writing about the results of the audit and the decision to return the funds paid. The notice period is not limited and can reach three months. As a rule, the results of audits are not communicated to taxpayers in any other form.

If the desk audit results are positive, the funds are credited to the current account specified by the taxpayer. If the tax return is returned for adjustment, the taxpayer must either correct the detected deficiencies or challenge them.

Tax reimbursement for building a house has many subtleties and nuances. Thus, when calculating the actual expenses of the taxpayer, the auditing specialist independently determines the possibility of attributing to expenses the amounts indicated in the payment documents. Often during construction, the number of such documents can reach several hundred, and the emergence of questions from inspectors may be inevitable. The taxpayer has the right to defend his interests, including in court, which must be used in the event of controversial situations.

What should I do if the amount of expenses exceeds the amount of tax paid for the past year? In this case, part of the unreimbursed expenses is transferred to the next reporting period, and so on until the debt to repay the funds is fully repaid. That is, if a taxpayer has the right to a refund of the maximum amount - 260 thousand rubles, but in the reporting period he paid only 90 thousand personal income tax rubles, then the amount of 260-90 = 170 thousand rubles will be transferred to the next reporting period, and 90 thousand will be returned after the office checking the declaration.

Sample of filling out the 3-NDFL declaration when purchasing a land plot

Since a tax deduction for the purchase of only a land plot is not provided (it is necessary that the land plot “interacts” with a residential building), the 3-NDFL tax return for the purchase of a land plot is filled out in the same way as a declaration for the purchase of housing.

How to fill out the 3-NDFL declaration for the purchase of a residential building?

We will show you a sample of filling out 3-NDFL when purchasing a plot of land and building a residential building.

To fill out a tax return, we recommend that you use a convenient service that will help you generate the document.

The convenience of the program is that the taxpayer must correctly answer the proposed questions, and the declaration will be generated “independently.”

What “windows” should be filled out?

1) Let's start with the most important thing - your personal data. We immediately draw the attention of taxpayers - if you do not know your Taxpayer Identification Number, then you do not need to fill out the corresponding field; in this case, the program will “understand” what needs to be done and will ask you to indicate your passport details and date of birth.

2) Next - if you are filling out a tax return for the first time, then you need to note this, as shown in our figure, but if you decide to make corrections (adjustments) to a previously submitted return, then you must fill out and submit the corrective 3-NDFL. If the adjustment is submitted for the first time, then its number will be, accordingly, No. 1.

Here is an example of filling out the corrective tax return number No. 2:

We would like to pay special attention to filling out the TIN and address. The TIN (as we wrote above) must be filled out only if it is known. If not, then the program will ask for passport data. When filling out the address, you need to be careful; you don’t need to write the name of the region yourself - there is an “arrow” on the right that will help you select the desired region and by clicking on it, it will automatically “go” to the desired line.

As soon as you fill out one virtual page of the program, there is a “Save and Continue” button at the bottom. By clicking on it, you save all the completed data (no need to re-type).

3) Let’s move on to the data set about the code of the Federal Tax Service and OKTMO (OKATO). The figure shows that there is a special “Search” service with which you can select the desired code. We recommend that you first select the tax office code, which the program will find for you along with the OKTMO (OKATO) code and transfer automatically to the program. To search, you need to enter your registration address (according to your passport) into the search engine. Please note that the territorial OKTMO code must be noted in declarations, starting with the 3-NDFL declaration for 2013.

4) Since we are considering the procedure for filling out a tax return in the service using the example of receiving a property deduction, you must indicate the sources of income for the past year. But, as we know, in order to receive a property deduction, it is necessary to indicate income that was subject to personal income tax at a rate of 13%. In our example, this income is work. We tick the required item and move on to filling out the next section.

5) Data about your employer is being filled out. A certificate in form 2-NDFL, which the accountant at your job is required to give you, will help you fill out this section. When requesting a TIN, in this section you must indicate your employer’s TIN, not yours, since filling out personal data is already over. Now we describe the employer - the tax agent.

What numbers – the amount of income – should be indicated? Many people ask: should all the standard deductions that were provided for last year be included in the amount of income?

The answer is no, it’s not necessary. The filling procedure is as follows:

– to the program question “Total amount of income for the year,” you indicate the amount of income reflected in paragraph 5.1 of the 2-NDFL certificate

– to the question of the program “Tax base (taxable amount of income) for the year” you indicate the amount of income reflected in paragraph 5.1 of the 2-NDFL certificate

– to the program question “Amount of tax withheld,” you put the figure indicated in paragraph 5.4 of the 2-NDFL certificate.

6) Next, we must select the type of tax deduction - in our case, we select “Deduction for the purchase of housing”.

7) And now we come to filling out the main step, during which that very “difficult” sheet “I” of the tax return is formed. The first part is filling out a description of the purchased property. We answer the questions asked. When purchasing a plot of land and building a residential building on it, you must select “Residential building with land.”

Below are lines for the type of property, the date of registration of property rights, and an indication of the address where the property is located.

Next, we come to filling out the line “Costs for purchasing housing”. As we previously indicated, you need to add up the cost of purchasing a plot of land and construction costs. But remember, if you spent more than 2 million rubles. then the maximum deduction amount will be 2 million rubles.

After the data is entered in the required lines, you must click the “Save and Continue” button and the program will offer to fill out an application for a tax refund. We recommend that you select this function so that the program will automatically generate a document for you.

In addition to the application, the program generates a register of documents, which we also

We recommend filling it out. This register is necessary so that in the future you can prove the fact of submitting a declaration for education to the tax authority. The function for creating a register must also be selected with a tick.

Now the 3-NDFL declaration for the construction of a residential building is ready.

When creating a declaration in our service, tax consultants will help you not only fill out the declaration, but also answer all your questions. We invite you to fill out the 3-NDFL tax return in the NDFLka.ru wizard.

Good luck with your declaration!

Registration of real estate under the dacha amnesty declaration

The construction of a dacha on a plot of land is not complete without filling out a dacha amnesty declaration. Without it, it is impossible to legally record the fact of construction.

In the future, unregistered houses may be subject to demolition, so you need to understand the procedure for filling out this document in advance.

The content of the article:

Who can apply?

The dacha amnesty is essentially a simplified scheme for registering the right to own housing built with your own hands. The right to use the procedure is granted to:

All of the above persons receive the right to undergo the dacha amnesty free of charge. Subsequently, they will be able to secure ownership rights to all objects erected by the owner, which will allow them to fully dispose of them. Without registering a building, it cannot be sold, exchanged, donated or rented out.

Why fill out a declaration?

A declaration of real estate is a document that helps record the fact that houses have been built on the land. Based on this paper, local authorities register housing for the owner of the land. For this reason, filling out the declaration must be taken responsibly.

The laws of the Russian Federation provide for the preparation of a standard declaration in all cases of dacha amnesty. You need to bring 2 copies to Rosreestr, which will contain the following information:

to contents ^

General provisions

According to the current legislation on the dacha amnesty, the declaration for the house must be filled out by hand, with a blue or black pen. You cannot use abbreviations, but you can write common abbreviations, for example OVD. In a declaration that requires filling out printed cells, one cell must always contain one character. Empty cells act as spaces between words.

If there is no data for construction, then a dash is placed on the form. However, this applies only to specific sections of the declaration, where additional information about the house is recorded. In the section where you need to tick the appropriate options, only one answer option is allowed.

The state does not accept the declaration if:

to contents ^

Explanations

The declaration consists of 7 parts. The first part contains the location of the constructed object. You must indicate the district, town, street and site number. The information must be truthful, otherwise the declaration will not be accepted by government agencies.

In the second part of the document, the homeowner selects the type of facility built on his land. This could be a house, garage or outbuilding. If a greenhouse is built on the site, then this object is called a structure.

The third part describes the purpose of the construction project. If an object is intended for permanent residence of people, then it is called residential. Otherwise, the owner needs to check the box next to the inscription “non-residential”.

In the fourth paragraph, write down the cadastral number of the plot. Immediately after it comes a paragraph with a technical description of the object. Here they record the area of the house, the number of floors, the year of construction, the material used for the external walls, the presence of water supply, electricity, sewerage, etc.

The declaration ends with the provision of information about the copyright holder of the site. Record his passport details, registration address, identification number and company name if the site belongs to a legal entity.

You can view and download a sample with an example and a form for filling out a declaration on a dacha amnesty here.

Assigning an address to the new house

New holiday villages usually have only one, or at most several, streets. The house must be assigned an address, since without this it is difficult to identify it. This is also important when registering residents in this property.

Municipal authorities are responsible for assigning addresses. To do this, the land owner needs to bring documents establishing his ownership of the plot and the constructed house. After 30 days, the building will receive an official address that can be used to register residents.

Immediately after completing this stage, the owner of the house issues a cadastral passport, which indicates not the location, but the exact address of the house. Then a certificate of ownership of the house is issued, which will also contain the new address.

Conclusion

The dacha amnesty declaration is one of the most important documents when registering ownership rights to real estate built on a plot of land. Without it, the state registry authorities will not be able to register ownership of the house, and the owner will not be able to fully dispose of the building. The declaration must be filled out in duplicate by hand and without errors.

To find out how to get permission to build a summer house on your site, you need to read this: https://zhil-vopros.com/dacha/amnistiya/razreshenie-na-stroitelstvo.html.

Sources: pollux.ru, ipipip.ru, www.it-nv.ru, ndflka.ru, zhil-vopros.com

Next:

Property tax deduction for building a house

In the case of construction of housing with a mortgage before January 1, 2014, income tax on expenses for paying mortgage interest is refunded in full, without restrictions. If the mortgage loan for construction was issued after January 1, 2014, then the interest deduction is limited to 3 million rubles (that is, you can return a maximum of 3 million rubles from mortgage interest x 13% = 390 thousand rubles. ).

- redevelopment or reconstruction of an already built house;

- reconstruction of an already built house (a floor or extension was added);

- installation of plumbing, shower, gas or other equipment;

- construction of additional buildings or structures on the site (for example, a garage, fence, bathhouse, barn, etc.)

How to fill out a personal income tax declaration on the costs of building a private house

In this case, the costs of completing and finishing the acquired residential building or share(s) in it are taken into account if the agreement on the basis of which such acquisition was made provides for the acquisition of an unfinished residential building or share(s) in it. When using borrowed (credit) funds for the purchase (construction) of a residential building, interest costs are taken into account in accordance with the target loan (credit, including on-lending) agreement. (see subparagraphs 3, 5, paragraph 3, Article 220 of the Tax Code of the Russian Federation).

We recommend reading: Is it possible to queue for kindergarten without registration?

According to paragraph 3 of Art. 220 of the Tax Code of the Russian Federation, a property tax deduction is provided in the amount of expenses actually incurred by the taxpayer for new construction on the territory of the Russian Federation of one or more property items specified in subparagraph 3 of paragraph 1 of Art. 220 of the Tax Code of the Russian Federation, not exceeding 2,000,000 rubles.

Filling out 3-NDFL. Property deduction for shared construction

Question:

We are talking about obtaining a property deduction when participating in shared construction. Part of the payment was made before construction began, and a mortgage was taken out for the remainder.

When filling out Appendix 7 to Form 3-NDFL for a certain period, line 1.8 indicates the amount of the down payment (SPV) plus the amount paid in installments (CP) for this period. The amount actually paid for the period (CP) is greater than the amount specified in the payment repayment schedule (SGR).

What do we indicate in line 1.8: SPV+SR or SPV+SGR, provided that SR>SGR?

Questions are answered by specialists from Intercom-Audit Ekaterinburg LLC

Answer:

In accordance with paragraph 3 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation, when determining the size of the tax base, the taxpayer has the right to receive a property tax deduction in the amount of expenses actually incurred by the taxpayer for the acquisition of residential houses, apartments, rooms or share(s) in the territory of the Russian Federation them.

According to paragraph 4 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation, the taxpayer has the right to receive a property tax deduction in the amount of expenses actually incurred by the taxpayer to repay interest on targeted loans (credits) actually spent on the purchase of a residential house, apartment, room in the territory of the Russian Federation or share(s) in them, as well as to repay interest on loans (loans) received from banks (or organizations, if such loans were issued in accordance with assistance programs for certain categories of borrowers for mortgage housing loans (loans) that found themselves in financial difficulties situations approved by the Government of the Russian Federation) for the purpose of refinancing (on-lending) loans for the purchase of a residential building, apartment, room or share(s) in them on the territory of the Russian Federation.

According to paragraph 1 of paragraph 3 of Article 220 of the Tax Code of the Russian Federation, a property tax deduction is provided in the amount of expenses actually incurred by the taxpayer for new construction or for the acquisition of one or more property objects in the territory of the Russian Federation, but not exceeding 2,000,000 rubles.

A deduction for repayment of interest on a target loan (credit) is provided in the amount of actual interest expenses incurred, not exceeding 3,000,000 rubles (clause 4 of Article 220 of the Tax Code of the Russian Federation).

In accordance with paragraphs. 6, 7 clause 3, clause 4 art. 220 to confirm the right to a property tax deduction, the taxpayer submits to the tax authority:

- an agreement for participation in shared construction and a transfer deed or other document on the transfer of a shared construction object by the developer and its acceptance by a participant in shared construction, signed by the parties - when acquiring rights to a shared construction object (an apartment or a room in a house under construction);

- documents confirming the emergence of the right to deduction, payment documents drawn up in the prescribed manner and confirming expenses incurred by the taxpayer (receipts for receipt orders, bank statements about the transfer of funds from the buyer’s account to the seller’s account, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents).

Thus, in the event of concluding an agreement for participation in shared construction, the taxpayer can reduce taxable income by the expenses actually incurred:

— for the acquisition of rights to a shared construction project, but not more than 2,000,000 rubles;

- to repay interest actually paid on target loans (credits), but not more than 3,000,000 rubles.

Order of the Federal Tax Service of Russia dated October 3, 2018 N ММВ-7-11/ [email protected] “On approval of the form of the tax return for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return for tax on personal income income of individuals in electronic form”, the declaration of form 3-NDFL for 2021 was approved.

According to the Procedure for filling out Appendix 7 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate” to form 3-NDFL in paragraphs. 1.8 (line 80) indicates the amount of expenses actually incurred for new construction or acquisition of an object (excluding interest on loans (credits), but not more than the maximum amount of property tax deduction (RUB kopecks).

Thus, in paragraphs. 1.8 of Appendix 7 to Form 3-NDFL indicates the cost of the shared construction project established by the agreement of participation in shared construction , but more than 2,000,000 rubles.

So, if the cost of a shared construction project is 3,250,000 rubles, then in paragraphs. 1.8 of Appendix 7 to Form 3-NDFL indicates the amount of 2,000,000 rubles.

Mortgage payments when filling out paragraphs. 1.8 Appendix 7 to Form 3-NDFL are not taken into account.

According to the Procedure for filling out Appendix 7 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate” to form 3-NDFL in paragraphs. 1.9 (line 90) indicates the amount of interest actually paid on loans (credits), but not more than the maximum amount of property tax deduction (RUB kopecks).

When filling out paragraphs. 1.9 of Appendix 7 to Form 3-NDFL, the amount of interest actually paid (based on a bank certificate) is taken into account, and not the amount of interest specified in the payment schedule.

04.09.2020

Property deduction when building a house

It is not established by law what documents confirming payment for construction materials must be submitted. According to clarifications of the Ministry of Finance of the Russian Federation dated December 20, 2013 No. 03-04-07/56452, such a document can be a sales receipt for the supply of construction and finishing materials issued to the buyer (an individual without indicating his last name, first name and patronymic), with the obligatory presence of a cash register a check indicating payment of funds for construction materials.

Returning a tax deduction from the construction of a country house has its own characteristics. It is necessary to carefully look at how the property is recorded on the certificate. In accordance with paragraph 6, paragraph 3 and paragraph 2, paragraph 1 of Article 220 of the Tax Code of the Russian Federation and letter of the Ministry of Finance No. 03-04-05/7-652 dated October 29, 2010, part of the amount can only be returned for a residential building, in which registration (registration) is allowed.

Property deduction for the purchase (construction) of housing

Two types of property deductions

In connection with the acquisition (construction) of housing, taxpayers have the right to two property deductions:

1. In the amount of expenses actually incurred by the taxpayer:

- for new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them;

- land plots provided for individual housing construction;

- land plots on which the purchased residential buildings are located, or shares in them.

2. For interest repayment:

- for targeted loans (credits) received from Russian organizations or individual entrepreneurs and actually spent on new construction or the acquisition of the above-mentioned housing and land plots;

- for loans received from banks located on the territory of the Russian Federation for the purpose of refinancing (on-lending) loans for new construction or the purchase of housing and land.

What expenses are taken into account when providing deductions?

The actual costs of new construction or the acquisition of a residential building or share(s) in it include:

- costs for the development of design and estimate documentation;

- expenses for the purchase of construction and finishing materials;

- expenses for the purchase of a residential building, including unfinished construction;

- expenses associated with construction work or services (completion of a house that has not been completed) and finishing;

- costs of connecting to electricity, water, gas supply and sewerage networks or creating autonomous sources of electricity, water, gas supply and sewerage;

- other expenses directly related to the purchase (construction) of a house.

The actual costs of purchasing an apartment, room or share(s) in them may include:

- expenses for purchasing an apartment, room, share(s) in them;

- expenses for acquiring rights to an apartment or room in a house under construction;

- expenses for the purchase of finishing materials;

- expenses for work related to the finishing of an apartment, room, share(s) in them, as well as expenses for the development of design and estimate documentation for finishing work.

Note! Acceptance for deduction of expenses for the completion and finishing of an acquired house or finishing of an acquired apartment or room is possible if the agreement on the basis of which such acquisition was made specifies the acquisition of an unfinished residential building, apartment, room (rights to an apartment, room) or share(s) in them without finishing.

Deduction amount

A deduction for the purchase (construction) of housing and land is provided in the amount of expenses actually incurred, but not more than 2,000,000 rubles.

When purchasing property in common shared or common joint ownership, the total amount of the deduction is distributed among the co-owners:

- in accordance with their share(s) of ownership;

- when purchasing a residential building, apartment, room into common joint ownership - in accordance with their written application.

Interest deduction is provided in the amount of interest actually paid in 2013.

Note! Starting from income for 2014, a deduction for interest will be provided in the amount of interest actually paid, but not more than 3,000,000 rubles. In this case, the amount of deduction for interest received by the taxpayer earlier will not be taken into account when determining the maximum amount of deduction.

Procedure for providing a deduction

The deduction is provided to the taxpayer when he submits a declaration in Form 3-NDFL to the tax authority at his place of residence. The declaration is submitted at the end of the year in which the taxpayer purchased (built) housing.

If a property tax deduction cannot be used in full during a tax period, then its balance is transferred to subsequent tax periods until it is fully used.

The taxpayer has the right to receive the remainder of the deduction from his employer upon submission of the “Notification of Confirmation of the Taxpayer’s Right to a Property Tax Deduction.” The notification form was approved by Order of the Federal Tax Service of Russia dated December 25, 2009 No. MM-7-3/ [email protected] The notification is issued by the tax authority within a period not exceeding 30 calendar days from the date of submission of a written application by the taxpayer and documents confirming the right to receive a property tax deduction.

For taxpayers receiving pensions in accordance with the legislation of the Russian Federation, if they do not have income taxed at a rate of 13%, the balance of the property deduction can be carried forward to previous tax periods, but not more than three.

Note! Repeated provision of a property tax deduction to a taxpayer for the purchase (construction) of housing is not permitted.

List of documents that must be submitted to the tax authority to receive a deduction

To receive deductions, the taxpayer must provide the following documents (originals and copies) to the tax authority at the place of residence along with the tax return in Form 3-NDFL:

1. When purchasing an apartment or room on the secondary market:

- agreement for the purchase of an apartment (or room) with annexes and additional agreements to it (if concluded) (for example, a purchase and sale agreement, an exchange agreement);

- documents confirming payment (for example, payment orders, bank statements about the transfer of funds from the buyer’s account to the seller’s account, etc.);

- documents confirming ownership of an apartment (or room) (for example, a certificate of state registration of rights);

- application for distribution of deductions between spouses (in case of purchasing an apartment or room as joint property of spouses;

- application for a personal income tax refund (if the tax return has calculated the amount of tax to be refunded).

2. When purchasing an apartment under an agreement for participation in shared construction (investment), an agreement for the assignment of rights of claim:

- an agreement for participation in shared construction (investment) or an agreement for the assignment of rights of claim with appendices and additional agreements to it (if concluded);

- a document confirming the transfer of an apartment by the developer to a participant in shared construction, executed after receiving permission to put into operation an apartment building (for example, an acceptance certificate) or a certificate of state registration of the right to an apartment;

- documents confirming payment (for example, payment orders, bank statements about the transfer of funds from the buyer's account to the seller's account, cash receipts, receipts for receipt orders, etc.);

- application for distribution of deductions between spouses (in case of purchasing an apartment as joint property of spouses;

- application for a personal income tax refund (if the tax return has calculated the amount of tax to be refunded).

3. When purchasing a land plot with a residential building located on it:

- agreement for the acquisition of a land plot with a residential building with annexes and additional agreements to it (if concluded) (for example, a purchase and sale agreement, an exchange agreement);

- documents confirming payment (for example, payment orders, bank statements about the transfer of funds from the buyer's account to the seller's account, cash receipts, receipts for receipt orders, etc.);

- documents confirming ownership of a residential building (for example, a certificate of state registration of title);

- documents confirming ownership of the land plot (for example, a certificate of state registration of rights);

- an application for the distribution of the deduction between spouses (submitted in the case of the acquisition of a land plot with a residential building in the joint ownership of the spouses);

- application for a personal income tax refund (if the tax return has calculated the amount of tax to be refunded).

4. To receive a deduction for the cost of paying interest on a targeted loan (credit) aimed at purchasing housing:

- loan agreement with annexes and additional agreements thereto (if concluded)

- documents confirming payment of interest on a target loan (credit) (for example, a certificate from a bank);

- application for a personal income tax refund (if the tax return has calculated the amount of tax to be refunded).

Note 1. When deducting expenses for new construction, as well as for the completion and finishing of a purchased house or finishing of a purchased apartment (room), sales and cash receipts, acts on the purchase of materials from individuals indicating the address and seller's passport details.

Note 2. Documents confirming payment may be missing if an exchange agreement is concluded, under which property is exchanged without additional payment.

Note! When purchasing land plots provided for individual housing construction, or a share(s) in them, a property tax deduction is provided after the taxpayer receives a certificate of ownership of the house.

Who is not entitled to receive a deduction?

Property tax deduction does not apply in the following cases:

a) payment of expenses for the construction or acquisition of a residential building, apartment, room or share(s) in them for the taxpayer is made at the expense of:

- funds of employers or other persons;

- maternal (family) capital funds allocated to ensure the implementation of additional measures of state support for families with children;

- through payments provided from the federal budget, budgets of constituent entities of the Russian Federation and local budgets;

b) the purchase and sale transaction of a residential building, apartment, room or share(s) in them is made between individuals who are interdependent in accordance with Art. 105.1 Tax Code of the Russian Federation.

Note. According to paragraphs. 10 and 11 paragraph 2 art. 105.1 of the Tax Code of the Russian Federation the following are recognized as interdependent:

- individuals in the event that one individual is subordinate to another individual due to official position;

- an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward.

Tax deduction for building a house - plastic windows do not count

To receive a tax deduction when building a house, it is not necessary that the expenses be incurred in cash. Expenses in kind can also be deducted. For example, in payment for construction work, some property was transferred, as well as rights to securities (bills). Therefore, if you paid for building materials or work on building a house with a bill of exchange, then you can safely include the amount indicated in the bill of exchange as part of the deduction for building a house.

- Expenses for the development of design and estimate documentation

- Expenses for the purchase of construction and finishing materials

- Expenses for work and services related to the completion of a house

- Costs for connecting to electricity, water and gas networks

- Costs for sewerage installation

Will personal income tax be refunded when purchasing land and building a house?

The costs of purchasing a plot of land and building a house include: the cost of acquiring land for construction, the cost of drawing up design and estimate documentation, the cost of purchasing building and finishing materials, carrying out construction and finishing work, as well as the cost of installing water and gas supplies , sewerage and electricity.

– Are tax interest refundable for the purchase of land and construction (later) of a house? And what you need to do?

The procedure for obtaining a property deduction is no different from the procedure for obtaining a deduction when purchasing housing. If it was not possible to spend the entire deduction amount during the year, then the remaining amount can be transferred to the next year, but to do this you will have to re-file the 3-NDFL declaration or register a deduction with the employer.

Any citizen of the Russian Federation who receives taxable income has the right to submit an application. Filling out 3-NDFL when buying a house and cottage does not make sense only if you are unemployed or receive income on which tax is not paid. In all other cases, the cost of housing can be reduced through deductions.

How to get a tax deduction for buying a home

You can also receive a property deduction at your main place of work. However, if a taxpayer had several sources of income in a calendar year from which tax was withheld and the amount of the property tax deduction was not used in full, then he has the right to apply to the tax authority at the end of the year to recalculate the balance of the tax deduction.

Until January 1, 2014, if a person wanted to receive a property deduction not from the inspectorate, but from his place of work, he could apply for it to one of his employers. Now a taxpayer can receive property deductions from one or several employers of his choice. To do this, he must provide each organization where he works with confirmation of the right to deduction from the tax office. The confirmation indicates the amount of property deduction that a person has the right to receive from each employer - his or her tax agent. This can be done with deductions received after January 1, 2014. This provision does not apply to legal relations for the provision of deductions that arose before this date.

We recommend reading: What is the passport in Tatarstan?

Highlights ↑

Today, many people are purchasing land plots to build their own private home.

But before you buy land and start purchasing building materials, you need to carefully familiarize yourself with the tax legislation.

Since you can significantly reduce construction costs with the help of a tax deduction. But to obtain it, you need to collect a package of relevant documents.

Why is this necessary?

In fact, 3-NDFL is a tax return submitted to the tax office at the place of registration of the citizen.

Thanks to it, an individual or legal entity can easily report on their income and expenses and confirm them.

Also, 3-NDFL allows you to receive tax deductions of the following types:

- property;

- social;

- professional;

- standard.

When building a house, a property type deduction is provided. Due to it, it is possible to significantly reduce construction costs by returning part of the funds from the state budget.

Who submits the reports

An important feature of the tax deduction is that only an officially employed person has the right to it.

Since the deduction is paid from the amount of income tax deducted at the rate of 13% from each monthly salary.

If an individual does not have an official place of work, then he does not have the right to receive a tax deduction.

Sometimes the tax authority has some questions regarding the deduction in a situation where payment documents indicate one person, and the deduction is issued to another. This is only possible if both citizens are spouses and are officially employed.

If the tax service refuses to accept the package of documents required for deduction, you should refer to Letter of the Ministry of Finance of the Russian Federation dated July 2, 2009 No. 03-04-07-01/220.

According to it, the expenses of the spouses are considered common. According to tax legislation, there is no right to receive a tax deduction in the following cases:

- during construction, any subsidies from the state, financial assistance from the employer, or something else were used;

- unfinished real estate was purchased from relatives (children, parents, guardians, wards).

Accounting for construction costs

When building a house, it is imperative to keep records of all expenses in documentary form.

Otherwise, it will simply not be possible to confirm them with the tax service, which will lead to the impossibility of obtaining a tax deduction.

Personal income tax compensation for the construction of a house can be paid based on the following payments:

- payment for design and estimate work performed by construction contractors:

- acquisition of all kinds of building materials necessary for the construction of a residential building;

- expenses for construction work performed by hired workers;

- payment for bringing all kinds of utilities to the house (electricity, gas, water supply, sewerage).

Reimbursable expenses also include payments on borrowed funds when taking out a loan for the construction of a private house.

Moreover, when applying for a tax deduction, not only the amount of the loan is taken into account, but also the interest paid to the bank.

It is only important to provide the tax authorities with the relevant supporting documents: a payment schedule approved by a bank seal, a loan agreement.

Sample of filling out the 3-NDFL declaration when purchasing a land plot

We would like to pay special attention to filling out the TIN and address. The TIN (as we wrote above) must be filled out only if it is known. If not, then the program will ask for passport data. When filling out the address, you must be careful; you do not need to write the name of the region yourself - the program will fill in this field automatically

5) Data about your employer is being filled out. A certificate in form 2-NDFL, which the accountant at your job is required to give you, will help you fill out this section. When requesting a TIN, in this section you must indicate your employer’s TIN, not yours, since filling out personal data is already over. Now we describe the employer - the tax agent.

Filling out a declaration for a tax refund when purchasing a plot with a house

- Sheet 1 and sheet 2 are general information about you, mainly passport data and TIN number. They do not contain information about income and expenses, or real estate purchases.

- Sheet Section 1 is intended for calculating the tax base and the amount of refund of previously paid tax during the year.

- In Sheet Section 6 we enter the amount of your income tax refund, which is calculated by you in Section 1, i.e. and we fill it out after the sheet Section 1.

- Sheet A is intended for entering the amount of your official salary from the 2NDFL certificate, as well as the 13% personal income tax you paid for the reporting year, is filled out on the basis of the 2NDFL work certificate you received from your accountant.

- Sheet G1 is filled out if you are provided with standard tax deductions at work; information about them is also indicated in the certificate in a separate column, under the column on monthly income. They are usually provided if there are minor children. If there is no indication about them in the 2NDFL certificate, then you do not need to fill out this sheet. Please note that income is indicated on an accrual basis, that is, the month is added to previous months.

- Sheet I is intended directly to indicate information about a built, acquired or constructed house, or an acquired land plot, its value (but not more than 2,021,000 rubles), location, shares, type of ownership, etc. In the second half of the sheet, the amount of your requested property deduction , equal to the expenses incurred for the acquisition of land or the purchase/construction of a house. Please note that line 120 indicates the amount of interest you paid on the mortgage; the figures are taken from the bank’s certificate of interest paid. Well, if, of course, you used a mortgage when buying a house or land. If not, then the fields are left empty.

- Keep in mind that line 230 cannot be more than your income for the reporting year minus the amount of the standard deduction , i.e. taxable official income.

- Check that the refund amount indicated in the Section 6 sheet is 13% of the amount indicated in line 240.

How to get a tax deduction when building a house in 2021

You can contact the tax office or your employer . In the first case, you need to wait until the end of the tax period; in the second case, this is not required. When contacting your employer, provide him with the documents specified in the previous section. Then contact the tax office and submit an application for a deduction and copies of supporting documents.

- costs for preparing documentation for a construction project or estimates

- purchase of construction and finishing items

- purchase of an unfinished construction project with a view to completing it in the future

- payment for work or services provided in connection with the construction of a house, completion of an unfinished construction project or finishing work (this may include the purchase of necessary materials, payment of workers)

- installation of sewerage, water supply, gas pipes

Is it possible to return income tax when building a new house and how?

Sukhova V.A. purchased land and built a house on it. She registered ownership in December 2014. The total cost of spending amounted to 6.4 million rubles. She took out a mortgage for construction. The overpayment for the year amounted to 230 thousand rubles. In January 2015, she filed for her income tax refund. The amount that she will reimburse for 2014 will be 290 thousand rubles. (260 thousand+30 thousand):

Pensioners who have been retired for more than 3 years before the date of construction of the house. This category of persons can submit documents for an income tax refund only if no more than 3 years have passed before the registration of ownership (hereinafter referred to as the ownership right) for the constructed house.