The TORG-1 invoice is issued during the procedure for the acceptance and transfer of goods from the supplier to the buyer and confirms the fact of transfer in accordance with the terms of the concluded contract. The full name of the document is “Act of Acceptance of Goods”. There are no approved requirements regarding the number of copies in which a document must be drawn up; each organization independently determines this, taking into account the peculiarities of document flow.

The document is drawn up only in the presence of members of the special commission. The composition of the commission is approved by order of the head of the purchasing organization. Representatives of the supplier company and other organizations may be present when drawing up the act. TORG-1 you can at the end of the article.

Filling out the TORG-1 form

The obligation to fill out the unified TORG-1 form occurs upon the actual receipt of inventory items. The responsible person checks the completeness, quality and quantity with the information specified in the form. If inconsistencies and disagreements arose during acceptance, then such facts are reflected in the TORG-2 and TORG-3 acts. The act of acceptance of goods is controlled by a commission appointed by the head of the enterprise.

The TORG-1 form has a title header, a tabular part and a final section, which reflects the comments of the responsible persons and their signatures.

The title part of the document reflects the following information:

- Full name of the company;

- Details of the document on the basis of which the goods acceptance certificate is drawn up;

- The structural unit where goods are received;

- Information about primary accompanying documents (waybill, invoice);

- Information about the shipper (this information is especially important if the manufacturer and supplier are not the same person);

- Method of delivery of goods. This line indicates what type of transport the goods were delivered (by train, refrigerator, ship). If violations were committed during the transportation of valuables, then such goods may not be accepted according to the act.

- For food products subject to veterinary inspection, the date and number of the certificate received are entered.

- If the goods were insured, then the information of the insurance company is reflected in the form;

- Temperature conditions for products to be refrigerated;

- Date of arrival of inventory items.

The second section of the form lists the entire range of goods received, its quantity, weight and cost indicated in the supplier’s accompanying documents. Certification information is also provided for the product. The third section reflects actual data on the availability, quantity and weight of goods. The VAT tax rate and its amount are reflected in a separate column.

If various inconsistencies were discovered during the acceptance process, they are also recorded in the tabular section in the “Deviations” section. Moreover, negative values are reflected with a minus sign. The fourth page of the TORG-1 form contains the conclusion of the selection committee and the signatures of the responsible persons.

If a discrepancy is identified, an explanatory note is made in the form, on the basis of which the head of the company makes his decision on taking the necessary measures. A careful assessment of the received goods, as well as the entry of identified deviations, will become documentary evidence in the event of a dispute with the supplier.

Where can I find the delivery certificate for the goods?

In some particularly difficult cases, when one invoice from the supplier (TORG-12) is not enough or the goods supplied are of particular value, an act for delivery of the goods is drawn up. In this document, the parties not only confirm the fact of delivery, but also certify with their signatures the proper quality of the goods supplied.

The significance of the act is confirmed by the fact that it is signed by top officials or executives specially authorized for this procedure.

For a certificate of delivery of goods, a sample can be downloaded on our website.

How to correctly fill out a goods acceptance certificate

In order to avoid disputes with counterparties and tax authorities, the act of acceptance of goods must be drawn up in accordance with the law. For example, this is especially important when confirming the validity of the deduction of input VAT.

An incorrectly completed TORG-1 form may serve as a reason for refusing to reduce the budget payment.

In order to correctly draw up a document, you must follow the following rules:

- All columns related to a specific item must be filled out.

- The document must be signed by authorized persons.

- If the supplier is a person exempt from the accrual and payment of VAT, then this fact must be noted in the contract.

- When drawing up the act, it is necessary to check the availability of a veterinary certificate, invoice, and delivery note.

If an incorrect completion of the act was discovered, it must be redone. Particular attention should be paid to signing the document. Quite often, a facsimile signature is used in accounting documents, which is not always approved by the tax authorities. In accordance with Art. 160 of the Civil Code of the Russian Federation, such endorsement of documents is quite acceptable, but in order to avoid a conflict situation with regulatory authorities, such documents are not recommended to be taken into account.

Sample

If a defect is detected, you should carefully fill out the table on page 3. An approximate sample of filling out TORG-2 in 2021 if there is a defect looks like this:

Legal documents

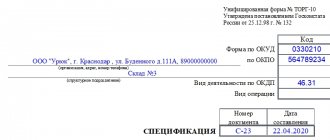

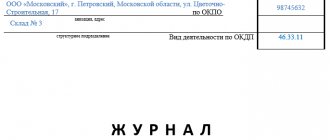

- Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132

- Information from the Ministry of Finance of Russia N PZ-10/2012

Is it possible to change the unified form of the act?

Until recently, it was possible to accept goods only using the unified TORG-1 form. With the entry into force of Federal Law No. 401-FZ, the rules for preparing primary documents have changed. Now companies have the right to independently develop convenient forms of documents that will best suit the specifics of their business. According to accounting rules, samples of such forms must be included in the accounting policy of the enterprise.

Mandatory and optional document details:

| Mandatory | Optional |

| Form name, date and document number | Shipping method |

| Name of company | Availability of a veterinary certificate |

| Product range, quantity | Information about the insurance company |

| Signatures of officials | Place of goods acceptance |

The finalized act of acceptance of goods will have legal force only if all required details are present.

Appendices to the act

Applications to the paper are filled out in a certain way. They indicate product quality requirements. So, the following can be indicated:

- Size;

- Consistency;

- Degree of freshness;

- Color and other characteristics.

Depending on what products are supplied, the quality characteristics . So, for meat it is optimal if the application indicates color, veterinary certificate, aroma, etc. For Christmas tree decorations, other characteristics are selected in the application - size, color, absence of damage, chips.

Grounds for suspending acceptance of goods

The buyer may suspend acceptance of the goods and draw up an act of suspension for the following reasons:

- When registering the goods, a discrepancy in labeling, quality and quantity was discovered;

- The integrity of the packaging is compromised and does not meet the requirements of regulatory and technical documentation;

- Violation of contractual obligations;

- Errors in accompanying documents;

- The product has expired the expiration date indicated on the packaging or is simply missing;

If violations are identified, a report is drawn up that reflects the nature of the identified defects. At the time of the proceedings, the buyer must ensure proper storage of the goods, under conditions that preclude mixing with similar homogeneous goods and materials.

Mandatory clauses of the agreement

The following information must be included:

- Name of product;

- Date of receipt of products;

- Complete data about those who carried out the transaction - their passport details, organizational details, etc.;

- Information about the agreement that served as the reason for drawing up the acceptance certificate;

- Confirmation or refutation of the quality of the product;

- The exact number of units received;

- Information about detected defects, if any;

- Duration of the contract;

- Seal or signature of authorized persons (the former may not be present).

The acceptance certificate can be drawn up both for one product and for a batch . There are no requirements for the number of goods.

Attention! There must be a section in the documentation where claims to the quality of the product will be stated. If there are none, then the counterparty signs accordingly. Leaving this form blank if there are no complaints is prohibited.

In what cases are TORG-15 and TORG-16 compiled?

All movements of goods and material assets are taken into account by the accounting department on the basis of primary accounting documents. In case of damage to the goods or complete unusability, acts are drawn up approved by the Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132 “On approval of unified forms of primary accounting documentation for recording trade operations”:

- Act on damage, damage, scrap of inventory items (TORG-15).

- Act on write-off of goods (TORG-16).

Since January 2013, filling out these forms is optional; however, the tax office may require documentary evidence of a decrease in tax expenses based on the write-off of inventory items or their markdown. Then correctly drawn up papers will be proof of the legality of these expenses.

The act in the TORG-15 form involves further actions with material assets, such as:

- Sale of goods without changing the price.

- Sale of goods at a reduced price.

- Disposal of goods.

- Complete destruction.

- Disposal to landfill.

Reference. The act in form TORG-16 excludes further use of the goods and is drawn up to remove the goods from the organization’s balance sheet. An act of write-off can be drawn up simultaneously with an act of damage, damage, or scrap of goods.

The specified documents are drawn up in cases of detection of commodity losses:

- Normalized, which appeared as a result of inevitable technological and physical processes (melting, drying, grinding, etc.).

- Non-standardized (damage, destruction, breakdown, incorrect storage technology, losses due to fire, accident, etc.).

Filled out by whom?

To carry out an inventory and draw up a report on damage, scrap, and damage to goods, the head of the organization issues an order to create a special commission (at least three people), which includes a representative of the administration and a financially responsible person. The document is filled out by one of the commission members in triplicate.

To draw up a document, you can take a unified form in the TORG-15 form or develop your own template based on it. Practice shows that a unified form is easy to fill out and understandable to representatives of regulatory authorities, so it is better to use the approved TORG-15 form. Let's look at the order of filling it out:

- At the top of the document the full name of the organization is indicated, indicating the legal address, telephone number and structural unit in which the inventory is carried out.

- Below is information about the full name of the supplier, indicating its full details, including bank details (current account, BIC, checkpoint).

- In special columns the document number and the date of its preparation are indicated.

- Title of the document: “Act on damage, scrap, destruction of inventory items.”

- A table consisting of fifteen columns is filled in:

- The name and characteristics are written down. For example, “Gingerbread “Mint”.

- Product code.

- Unit of measurement, name. For example, "pieces."

- Unit of measurement, code OKEY (all-Russian measurement code).

- Product article.

- Variety (category). For example, “1st grade”.

- Quantity (mass).

- The accounting price per unit of goods. For example, "75".

- Total amount for all goods. For example, "750".

- Then there is a section that includes four columns, which indicate:

- quantity (weight) of goods;

- new price (cost after markdown);

- total cost;

- markdown amount (the difference between the total amount for the product before and after the price reduction).

- The 14th column indicates the discount percentage.

- The last column indicates the characteristics of the defect. For example, “packaging violation”.

- The reason for the loss is indicated below the table. If the cause is technological processes or physical conditions, then in the line below, data on the perpetrators is not entered, otherwise the surname, first name, patronymic and position of the person responsible for the fight, scrap or damage to goods are indicated.

- On the back of the form, fill out the section entitled “Credit scrap (scrap).” It contains data about the product if it is impossible to further sell or use it.

- https://online-buhuchet.ru/torg-1-akt-o-priemke-tovarov/

- https://assistentus.ru/forma/torg-1-akt-o-priemke-tovarov/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_torg1_akt_o_priemke_tovarov/

- https://assistentus.ru/forma/torg-2-akt-o-rashozhdenii/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_torg2_blank_i_obrazec/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_torg12_blank_i_obrazec/

- https://arbatcredit.ru/akt-torg-15/

Attention! When filling out, you must fully indicate the name of material assets, information about the supplier, the reasons and circumstances that led to damage to the goods.

Are mistakes acceptable?

The document must be drawn up without blots or errors. In case of corrections, it is better to reissue it. Calculations of markdowns or write-offs of goods must be made correctly, otherwise this will be the basis for the tax service to refuse to include expenses in taxable profit.

In case of errors in filling out and calculations, recovery of damages from the guilty party will be impossible.

Who signs?

The document is drawn up in triplicate and signed by all members of the commission and the financially responsible person. At the bottom of the act, under the calculations made, after checking the correctness of filling, the chief accountant signs. The papers are handed over to the manager, who, after making a decision, puts his signature on the front side of the act at the top of the form near the number and date of preparation.

Sources

Related documents

- Form of a book for recording the movement of work books and inserts in them

- Form of the receipt and expenditure book for recording the forms of the work book and the insert in it

- Calculation note upon termination (termination) of an employment contract with an employee (dismissal). Form N T-61

- Certificate of acceptance of completed work (Unified form N KS-2)

- Act on suspension of construction (Unified form N KS-17)

- Act on dismantling temporary (non-title) structures (Unified Form N KS-9)

- Journal of work performed (Unified form N KS-6a)

- Certificate of cost of work performed and expenses (Unified Form N KS-3)

- Act on the return of inventory items deposited (Unified Form N MX-3)

- Act on a random check of the presence of inventory items in storage areas (Unified Form N MX-14)

- Act on the control check of products, goods and materials exported from storage places (Unified Form N MX-13)

- Act on acceptance and transfer of inventory items for storage (Unified Form N MX-1)

- Record sheet for inventory balances in storage areas (Unified Form N MX-19)

- Journal of receipt of fruits and vegetables at storage sites (Unified form N MX-7)

- Journal of receipt of products, inventory items at storage locations (Unified Form N MX-5)

- Journal of consumption of fruits and vegetables in storage areas (Unified form N MX-8)

- Logbook for recording the consumption of products, inventory items in storage areas (Unified Form N MX-6)

- Journal of accounting of inventory items deposited (Unified Form N MX-2)

- Card for recording vegetables and potatoes in piles (trenches, vegetable storages) (Unified form N MX-16)

- Report on the movement of inventory items in storage areas (Unified Form N MX-20)

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Acceptance Certificate of Goods by Quantity and Quality” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Act of acceptance of goods by quantity and quality”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |