Manufacturers are going online - should you choose an online store or a marketplace?

Bloomberg recently announced that Amazon founder Jeff Bezos was worth more than $100 billion. Bezos became the first billionaire to own more than $100 billion since 1999. Then Bill Gates became the richest entrepreneur.

Amazon has revolutionized the way we consume. Making every effort to digitize the consumer. Nowadays, 2-3 mouse clicks are enough to purchase a product. Fast, convenient and relatively inexpensive.

Not long ago, we published an article about how traditional retail in the United States has to survive in the struggle for customers with online retail. There, a number of experts confirmed the fact that the current situation in Russia is not far off.

A series of events over the past two years confirms this trend:

- The largest and Sberbank are investing in the development of a joint project in the field of e-commerce

- Alibaba launches Tmall Internet platform in Russia

- Regional grocery chains in Russia are going online

- If previously no one believed that it was possible to sell clothes via the Internet, now, according to RBC data for 2021, already 56% of the leading clothing retail operators have their own online stores. The same thing is happening now in the food segment.

Posting example

A very important part in 1C 8.3 is the formation of postings. This is where the accounting records are reflected. In the document form, click on the corresponding button to open a form with the reflection of this document in accounting and tax accounting.

Here we see two wires. Dt 91.02 - Kt 10.01 reflect the cost of goods sold, and Dt 62.01 - Kt 91.01 sales revenue.

If for some reason transactions were generated for the wrong accounts, they can be adjusted manually (the “Manual adjustment” checkbox). It is highly undesirable to do this.

You can also adjust accounting accounts in the header of the document by following the hyperlink in the “Calculations” field.

The most correct way out of this situation would be to set up accounting accounts not in a specific document, but directly for the counterparty, item, item group, etc.

What does “under implementation” mean?

You can often hear the phrase “goods for sale,” but not everyone understands the exact meaning and under what conditions it is used.

Today, “goods for sale” means a type of trade when the supplier himself remains the owner of the goods, but the seller is engaged in the sale.

For the seller, such a system is more than convenient, for the reason that he does not take risks and pays only for those goods that he managed to sell over a certain period.

As a reward for his labor, the seller takes a commission percentage from the sale of each unit.

Accounting for inventory items for sale

Generalized information about the availability of goods and their movement is contained in account 41. Its use in accounting is typical for trade, supply, and distribution enterprises and catering organizations. Industrial organizations use it very rarely and only in cases where it is necessary to take into account products, the cost of which is reimbursed separately by buyers.

Accounting for goods on account 41 can be carried out both at purchase and sale cost. If the receipt is registered using sales prices, an additional account 42 is opened, in which the amount of the markup is reflected.

Cashless payment system

The second method of payment for the goods received is by bank transfer. It is difficult to find a company or entrepreneur who does not have a current account. Nowadays, carrying out non-cash payments is an easy procedure, which boils down to the fact that the parties between whom commercial relations have arisen give the banks where their accounts are opened, payment orders for the transfer and acceptance of funds. Thanks to the Internet, this can be done without leaving your office or office, while complete security is guaranteed. Such relationships occur as follows:

- a legal entity that sells products gives the individual entrepreneur its bank details, where he must transfer money for the goods, and also provides a delivery note or other waybill, which indicates the name of the goods and its cost;

- accordingly, the entrepreneur agrees on the procedure for payment, which can be full or partial, after which he gives an order to his bank (in which he is serviced) to transfer funds, in which he indicates for what services the funds are transferred;

- when the money arrives at its destination, the goods are shipped or delivered to the designated place, and the recipient (in this case, the individual entrepreneur) puts his signature and seal (if any) on one copy of the invoice, and keeps the second for himself.

Thus, each business entity has the necessary financial documents for reporting, from which they will calculate the tax base.

Sales of products in cash

This is a common form of trade turnover in our economic conditions, since most private entrepreneurs carry out their activities by working with cash. Both entities (legal entity and individual entrepreneur) are tax payers, so they must pay taxes on trade turnover. For tax authorities, confirmation of the sale of goods by a legal entity individual entrepreneur will be the following documents:

- waybill, issued when the product is delivered to the place specified by the individual entrepreneur, and payment occurs after delivery, or by agreement between business entities (advance payment, prepayment, full payment before delivery);

- a bill of lading, which is issued to an individual entrepreneur, at the location of the legal entity, before receiving products at a warehouse or other place; payment in this case can be in advance, in full, or with deferred payment.

Confirmation of the acceptance of cash will be the issuance of a cash receipt order, which will indicate the amount received. That is, any payment will occur through the company’s cash desk.

In this case, you need to know that if the company does not have a cash register and the corresponding official personnel, then working with cash will be problematic, since regulatory authorities will regard this as a financial violation, which will lead to fines.

In general, working with cash is an additional problem that can lead to a negative attitude of the tax authorities towards the enterprise, so cash discipline and the regulations that regulate it have their own characteristics that you need to be aware of and strictly follow.

Checking the cost of goods sold

Checking the calculation of write-off of the cost of goods (Fig. 368):

- In accordance with the accounting policy, goods are written off at average cost ;

- Check the correctness of the formation of transactions for writing off goods (Dt 90.02.1 Kt 41.01), for this you need to create a balance sheet for account 41.01 “Goods in warehouses”: Menu Reports - Account balance sheet ;

- Specify the period, select Account (in the example – 41.01);

- Click the “Generate report” .

Rice. 368

Check the calculation of the average cost for the item Horizontal blinds 0.6m*2.5m:

- Average unit cost = RUB 61,111.11. \ 40 pcs. = 1,527.77 rub.\pcs.;

- Amount of goods sold = 1,527.77 rubles\pcs. * 10 pieces. = 15,277.78 rub.

- Exactly the amount is 15,277.78 rubles. reflected in the credit of account 41.01 “Goods in warehouses” according to the nomenclature Horizontal blinds 0.6 m * 2.5 m and an entry for the same amount was made according to document Dt 90.02.1 Kt 41.01 (Fig. 2).

The goods were written off correctly.

Earnings example

70% of retail take goods for sale from the manufacturer . If previously individual entrepreneurs took risks by purchasing goods in bulk from an intermediary or manufacturer, now you can take the goods for sale and remain calm in case of failure. An example is the sale of costume jewelry.

Representatives of the fair sex rarely pass by bright boutiques with jewelry, especially if it is made by hand. The peak of sales falls in the warm season, the target audience is young ladies. The product does not deteriorate and sells out very quickly, so this is an ideal option for making money.

In this case, the principal may be small family contracts that produce home decorations. They set the amount they want to receive from each unit sold, and the commission agent sets a percentage or fixed amount as a reward.

for both parties to cooperate for several reasons: the owner can calmly do what he loves - create, and the commission agent can sell, adding his percentage and extracting maximum profit.

Minuses

The commissioner independently pays for the point or office through which he will carry out sales. Therefore, opening such a business often requires a large starting budget.

In case of unsuccessful cooperation, the commission agent loses time and suffers the main loss - he does not recoup the cost of renting the premises.

However, there is another type of sales that does not require premises - selling goods in apartments and offices, but today it is no longer relevant, since there are social networks.

Creating a new document 1C 8.2 – Sales of goods and services

Creating a document through the menu: Sales – Sales of goods and services – “Add” – transaction type Sales, commission .

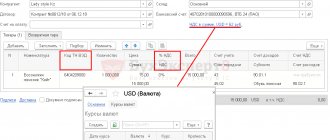

the Products tab (Fig. 366)

- Enter the product (as a rule, the selection is made from the Products ) using the “Selection” . In the Selection of items for document , select the required item. the Request Quantity and Price fields , then the name of the goods, quantity and price will be immediately added to the tabular part;

- Check the quantity, set price, amount, VAT % and VAT amount. In our example, % VAT is indicated as Without VAT, because the organization applies the simplified tax system;

- In the Accounting Account , check the account. In our example, wholesale sales of goods are carried out, so there should be an account 41.01 “Goods in warehouses”;

- In the Income Account , account 90.01.1 “Revenue from activities with the main tax system” is indicated;

- In the Subconto , the required type of goods (activity) from the Nomenclature Groups ;

- In the VAT Account – account 90.03 “Value Added Tax”;

- In the Expense Account – account 90.02.1 “Cost of sales for activities with the main tax system.”

Rice. 366

| STEP 2 |