The concept of forced absenteeism according to the Labor Code of the Russian Federation

The Labor Code does not define the term “forced absenteeism.” Traditionally, it is believed that this is the absence of working days by an employee due to the direct fault of the employer. For example, a boss wants to fire a worker, but the latter does not seek to draw up a resignation letter of his own free will. The employer literally forces the employee to leave by not allowing him to enter the workplace. The worker cannot continue to work, which can be considered forced absenteeism (AF). As a rule, this concept is associated specifically with illegal dismissal.

The concept of forced absenteeism is set out in the following articles of the Labor Code of the Russian Federation:

- Article 373 . Establishes the employer’s obligation, in the event of illegal dismissal, to restore the employee to his previous rights, as well as to pay for all days of forced absence.

- Article 391 . A person, if he cannot get a job due to an illegal entry in the work book or due to failure to issue a work book, can recover through the court from the employer compensation for days of temporary work leave.

- Article 234 . Establishes the need for the employer to pay compensation to the employee in the amount of average earnings for days of temporary work.

The Labor Code of the Russian Federation protects the rights of workers. If an employer infringes on the interests of an employee, the latter may appeal to the labor inspectorate or court.

In what cases does forced absenteeism occur?

Absenteeism may be considered forced in the following circumstances:

- The employer is trying to force an employee to leave the organization by not allowing him to enter the workplace. This fact needs to be confirmed. Witness statements, photos and videos are used as evidence.

- Transferring an employee to a position with less pay without sufficient grounds.

- Refusal to hire a person without any reason.

- An employer illegally dismisses an employee “under an article” (for example, the dismissal occurs due to the worker’s absenteeism, but the fact of failure to appear at the workplace is not confirmed or documented in any way). Due to this, a person cannot get a job.

- The employer does not issue the employee with a work book upon his dismissal. This again makes it difficult to get a job. A person is forced to sit at home rather than continue his work activity.

In all these cases, the employer commits an offense. He is obligated not only to make all necessary payments for the period of VP, but also to eliminate the violation of the law. For example, reinstate an employee or remove a negative entry from his work record.

Forced absenteeism: concept

The Labor Code does not contain a specific definition of forced absenteeism. The regulatory act only indicates the concept of the general category of absenteeism, which implies absence from the workplace or not being within the boundaries of the employee’s workspace, provided for by the employment contract, for 4 hours or more.

Analysis of the lower legal regulations (Government Resolution No. 922 of December 24, 2007, Plenum Resolution No. 2 of March 17, 2004) allows us to determine the characteristic features and differences of forced absenteeism:

- The employee is not at the workplace or does not perform a job function for 4 hours or more;

- The reason for such absence is the illegal actions of the employer, who either, without good reason, does not allow the subordinate to perform work, restricts access to the workspace, or illegally dismisses him.

How is the duration of forced absence determined?

It is extremely important to determine the duration of the VP, since in order to calculate compensation you need to know the time frame for which accruals occur. The period of absenteeism is the time between the date of dismissal (the first forced absence from work) and the date of the decision of the legal structure (court).

Example 1

On May 15, 2021, the person was illegally fired under the article “absenteeism.” He immediately filed a claim in court to restore his rights. On June 15, a court ruling came into force, according to which the employer is obliged to remove the illegal in this case wording of dismissal from the work book, and also reinstate the employee in his position. The period of forced absence in this case is a month. The employer must pay compensation for all these days.

Cases of forced absence

In practice, absenteeism will be considered forced under the following circumstances:

- Dismissal without legal grounds;

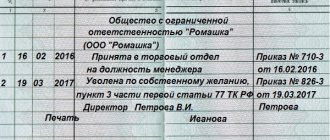

- Making records of dismissal with an incorrect indication of the article of the law;

- Late issuance of a work book to a resigning employee;

- Delay in restoring labor relations by court decision;

- Failure to comply with the procedure for dismissing an employee (also relevant for absenteeism without good reason);

- Removal of an employee from duties without good reason;

- Restricting access to the workplace;

- The employer’s refusal to formalize an employment relationship with a potential employee who arrived by transfer from another branch of the company (a written invitation on behalf of the employer is required).

How is forced absence paid?

For each day of absenteeism through no fault of the employee, compensation equal to the average salary of the employee per shift is accrued. First, the accountant must determine the average salary of the employee.

ATTENTION! The rules for calculating average income are set out in Article 139 of the Labor Code of the Russian Federation. They are also recorded in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

Calculation of payments to an employee during VP

How will the average employee income be calculated in this case? When calculating, the following sources of the worker’s earnings are taken into account:

- Salary.

- Premium.

- Various surcharges.

- Allowances.

ATTENTION! The calculations do not take into account benefit payments and contributions to the pension fund. That is, before determining official earnings, they must be subtracted from the employee’s income.

To determine average income, you must first calculate the employee's total income since the beginning of the year. For example, on February 1 he received 31,700 thousand. From this amount, standard charges to the funds are deducted, amounting to 1,700 rubles. The resulting amount must be divided by the number of days from the beginning of the year. It turns out 1,000 rubles. This is the employee's daily income.

IMPORTANT! When calculating, only the official salary of the employee is taken into account. For example, if a worker officially received only 8,000 rubles, but his unofficial salary was 100,000 rubles, calculations will be made based on the official 8,000 rubles. That is why it is beneficial for an employee to have a “white” salary.

What's next?

The average daily wage of a person is multiplied by the number of days of temporary work. For example, absenteeism due to the fault of the employer was 30 days. The average daily salary is 1,000 rubles. The amount of payments in this case will be 30,000 rubles.

Are payments subject to personal income tax?

Payments for the WP period can be considered a regular salary. Therefore, they will be taxed at the standard rate of 13%.

Payment for forced absence

Organizations only pay for forced absenteeism of employees. Absenteeism due to the employee's fault is not paid.

If a court or labor dispute commission finds the dismissal of an employee illegal, he must be paid the average salary for the entire period of forced absence (Article 394 of the Labor Code of the Russian Federation).

The general procedure for calculating average earnings is established in Article 139 of the Labor Code. And its features were approved by the Government of the Russian Federation by its resolution No. 922 dated December 24, 2007.

Thus, in any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average salary.

When calculating, all types of payments provided for by the remuneration system that are used in the organization are taken into account, regardless of the sources of these payments.

Example. Remuneration for forced absence

Employee A.A. Ivanov was fired on June 10. He considered his dismissal illegal and went to court. On June 27, the court declared the dismissal illegal and reinstated him to his previous place of work.

Ivanov’s monthly salary before his dismissal was 50,000 rubles. The forced absence was 12 working days.

The calculation period for determining average earnings includes the 12 months preceding the month of dismissal, that is, June - December of the previous year and January - May of the current year.

Let’s assume that Ivanov worked this period completely and the total number of working days in the billing period is 250.

The amount of payments for the billing period will be:

50,000 rub. × 12 months = 600,000 rub.

The amount of payment to Ivanov for forced absence will be:

600,000 rub. : 250 days × 12 days = 28,800 rub.

Reflection of payments in accounting

Data in accounting, according to the Letter of the Ministry of Finance dated June 17, 2021, must be entered simultaneously with the elimination of the offense against the employee. For example, if an illegal dismissal occurs, the accountant enters information simultaneously with the employee’s reinstatement and the order for his dismissal is cancelled. Payments for the period of forced absence and accrued insurance premiums can be included in expenses in the general manner.

Example 2

The employee was illegally fired in February. He went to court to restore his rights. The court upheld his claim and ordered the employer to pay 110,000 rubles for the period of temporary detention. The employee was reinstated and received funds in full. As of the date of compensation:

- The employee does not have the right to a standard personal income tax deduction.

- The amount of compensation does not exceed the maximum amount accepted for calculating insurance premiums.

The accountant makes the following entries:

- DT20 (25, 26, 44) KT70. Explanation: calculation of average earnings. Amount: 110,000 rubles.

- DT20 (25, 26, 44) KT69. Explanation: calculation of insurance premiums. Amount: 33,220 rubles (110,000 * 30.2%).

- DT70 KT50. Explanation: payment of compensation to an employee. Amount: 110,000 rubles.

- DT70 KT68. Explanation: personal income tax withholding. Amount: 14,300 rubles (110,000 * 13%).

This is the standard procedure for recording information in accounting.

Confirmation of forced absence

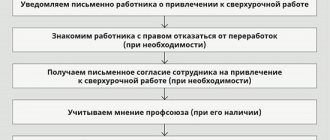

An employee may assess the employer’s actions as a violation of his rights, resulting in forced absenteeism. To exercise the rights and protest the employer’s decision, the employee’s opinion alone is not enough; it is necessary to have official confirmation. To assert rights, an employee can contact:

- To the enterprise's labor dispute commission. If there is no permanent commission, the employee must declare the need to create one. The commission has the right to evaluate the actions of the manager and cancel his decision on illegal dismissal. The commission does not make a demand for payment for forced absence. The decision to pay compensation is made only by the State Tax Inspectorate or the judicial authorities.

- GIT. The inspectorate considers the complaint within 10 days after the employee’s complaint. The State Labor Inspectorate has the authority to issue an order to reinstate an illegally dismissed employee and pay him compensation for downtime.

- To the court of first instance located at the place of registration of the employee or location of the enterprise. The judicial authority is given broad powers to determine the legality of the employer's actions. During the trial, decisions are made on replacing the wording of dismissal, reinstatement, payment of compensation to the VP and on other employment issues.

Court decisions on the reinstatement of employees in case of illegal dismissal come into force immediately after their adoption. If the execution is refused or the deadline is missed, the employer incurs administrative liability in the form of a fine.

Additional compensation

The employee can also count on additional compensation for moral damage caused. The decision on the obligation to pay it is made by the court. The amount of compensation depends on the employee’s requirements, as well as the judge’s decision. For example, a worker may request a million rubles, but the judge will assess the moral damage caused as a lesser amount and oblige the employer to pay 10,000 rubles.

IMPORTANT! When such cases are initiated, compensation does not automatically accrue. To receive them, you must indicate the corresponding requirement in your claim.

Calculation of average earnings during forced absence

Whatever the circumstances of absenteeism, this time is not considered working time. If forced absenteeism is recognized, the person is obliged to receive compensation based on average earnings.

This is the basic salary and all bonuses and allowances; benefits and other social payments are excluded. When calculating, only official income is taken into account; if any payments were made illegally, they are not taken into account.

To determine the amount of the incentive, the average income per day is first calculated. To do this, the amount for the period worked from the beginning of the year to the day the absence began is divided by the total number of days. Then, the resulting value is multiplied by the number of days on which the employee was forced not to work.

Example: dismissal took place on March 1. The salary for two months (60 days) totaled 60,000 rubles. The time of forced absence from the moment of dismissal until reinstatement was two months (61 days). It turns out that the average daily income is: 60,000 rubles: 60 days = 1,000 rubles per day. 1000 rubles *61 days = 61,000 rubles compensation for forced absence.

Forced absenteeism under the Labor Code of the Russian Federation

The provisions of the Labor Code do not directly define the term “forced absenteeism.” At the same time, modern judicial practice and decisions of the State Labor Inspectorate (SLI) define forced absenteeism as the absence of an employee from work due to circumstances beyond his control. In other words, absenteeism is considered forced provided that the employee was absent from work due to the fault of the employer or third parties.

Common examples of forced absenteeism are the absence of an employee from the workplace for the following reasons:

- illegal dismissal;

- preventing an employee from performing official duties without explanation;

- illegal actions of third parties, as a result of which the citizen was unable to arrive at the workplace and perform official duties.

What is forced absenteeism?

Forced absenteeism is a temporary period of a certain duration during which the employee could not perform his job duties due to the fault of the employer.

Circumstances that allow one to consider simple absenteeism as forced are:

- dismissal of an employee in violation of labor laws. This technique is often used by the enterprise administration to settle scores with unwanted specialists;

- unlawful transfer of a person to another job. For example, an order is issued to move an employee to a lower-paid position or a job that does not correspond to his professional education and work skills;

- removal of a citizen from performing labor duties for far-fetched reasons. The legislator determines the possibility of suspension in cases of alcohol or drug intoxication, expiration of a license, detection of mental illness, etc.;

- an incorrect entry in the work book about the grounds for dismissal or a delay in issuing it upon dismissal.

A citizen who considers his labor rights to be violated may decide to file a claim in court for:

- issuing a determination on reinstatement;

- monetary compensation for the entire period of forced downtime;

- recovery of compensation for moral damage.

Important

The claim must be filed within 3 months from the date of leaving work.

What is the formula for calculating payment for forced absence?

The calculation of the average monthly salary for the period of illegal deprivation of the opportunity to work should be carried out according to the general rules - based on the average daily earnings and the number of days of the paid period (clause 9 of the Resolution of the Government of the Russian Federation of December 24, 2007 No. 922, clause 62 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of March 17, 2004 No. 2).

The calculation period is 12 months preceding the month the forced absence began.

If, at a time when the worker was deprived of the opportunity to work, the company carried out a massive increase in wages, the average monthly earnings obtained as a result of the calculation are subject to indexation.

When and how to index average earnings, see the article “Average monthly salary and its calculation when increasing salaries.”