No financial system will operate stably if banks do not have free commercial cash at their disposal. Obliging a business entity to hand over the surplus balance, rather than storing the money in its cash register, turned out to be possible only by force with the prospect of applying administrative liability. Thus, any amount in the cash register in excess of the prescribed limit will result in an unpleasant surprise of up to 5,000 rubles for officials and up to 50,000 rubles for the legal entity itself. Cash balance limit for 2021 for small businesses latest news

In March 2014, the Directive of the Bank of Russia announced the abolition of several provisions regarding the conduct of cash transactions for small businesses, and from June 1, 2014, funds can be stored in the company's cash desk without restrictions on the amount and time period.

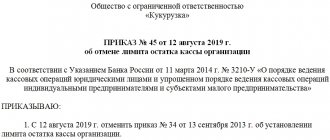

Order on cash limit for 2021

There are regulations of the Central Bank of the Russian Federation on the procedure for establishing this parameter. It is calculated according to the standards described in the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions...”.

Since November 30 last year, the instruction has been in effect in the new edition dated 10/05/2020 No. 5587-U. The changes affected the procedure for depositing and withdrawing cash, the rules for transactions with imprest amounts, the abolition of the three-day deadline for submitting an advance report, etc.

Cash limits at the cash desk are established by administrative document. The difference between receipts and write-offs affects the method of calculation. Any amount above this amount is deposited with the bank to avoid administrative sanctions.

Who must approve the cash balance limit?

As a rule, this operation is performed by the head of the organization. He is also responsible for violations along with the chief accountant.

A legal entity is required to agree on this parameter by law. Otherwise, the company and its officials face fines.

How often should a company recalculate its cash limit?

The law does not require regular updating of the order. However, many people prefer to install it again in order to more effectively track the movement of cash in the enterprise.

Does this need to be done every year?

If there are no changes in the organization’s work regarding the amount of money in the cash register, the order can be approved once and adhered to for several years. All that matters is strict adherence to the established limit.

Cancel limit

The cash limit for small businesses and individual entrepreneurs was abolished three years ago, but in 2021 some entrepreneurs continue to adhere to it.

To cancel the limit, it is necessary to issue a corresponding decree and notify all employees. Even a self-employed individual entrepreneur, in order to avoid questions from regulatory authorities, should not easily stop observing the limit, but first of all issue a canceling order.

You can view and download a sample order for an individual entrepreneur:

Then it is recommended to issue an order according to which, from a certain date, the cash balance limit is not set. Or this point can be immediately included in the text of the order.

How to calculate the cash limit for 2021

The norms established by law presuppose a certain calculation method. There are two formulas. The use of one of them depends on the characteristics of the company.

If an organization often writes off cash but rarely deposits it, the limit on the cash balance in the cash register is calculated based on the amount of spending.

In cases where a company receives more funds than it spends, the calculation is based on the volume of receipts.

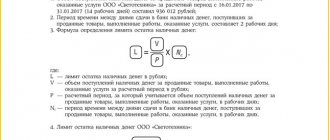

Formula for determining the limit from the volume of receipts

Quantities:

- KP - volume of receipts;

- N — number of working days;

- P is the frequency of depositing money into the bank.

What period should I take for calculation? The calculation procedure assumes that the parameter H should not be more than 92.

The limit is determined using the following formula:

KP ÷ R × R

Calculation example

We take the billing period for a trading company: August 1–October 20, 2021. If the company operates daily, this is 81 working days.

We count cash receipts at the cash desk:

August - 7,430,000 rubles; September - 7,840,000 rubles; October - 6,810,000 rubles. Total: 22,080,000 rubles.

With daily delivery of revenue, parameter P will be 1.

The organization's cash limit in this case is calculated as follows:

22,080,000 ÷ 81 × 1 = 272,593 rubles

Formula for determining the limit from the volume of costs

Quantities:

- KR - volume of expenses minus salaries;

- N — number of working days;

- P - frequency of depositing money into the cash register from the current account.

Formula for calculating the limit based on write-offs:

KR ÷ R × P

Calculation example

Let’s take the billing period of a manufacturing company: August 1–September 30, 2021. With a five-day work week, this is 43 working days.

We calculate costs taking into account salaries:

August - 1,350,000 rubles; September - 1,540,000 rubles. Total: 2,890,000.

From this amount you need to subtract the salaries of all employees:

August - 200,000 rubles; September: 287,000 rubles. Total: 487,000 rubles.

2 890 000 ⁻ 487 000 = 2 403 000

Based on the fact that withdrawals occur once every five-day week, the frequency (P) is 5. In this case, determining the limit from the amount of expenses looks like this:

2 403 000 ÷ 43 × 5 = 279 419

For calculations, you can also use special online services, for example, a calculator for calculating the cash limit for 2021.

Cash limit calculation form

Features of drawing up an order

Before drawing up an order, the organization must choose a suitable calculation formula for itself. If a company accepts payment for goods and services in cash, then the calculation must be made based on the volume of receipts, otherwise - on the amount of payments made minus wages and benefits.

Next, the corresponding calculations are made. They are usually included in a separate application. The text of the order itself will be the same in both cases. It must contain the following details:

- full name of the organization;

- number and name of the order;

- date of compilation;

- city of compilation;

- period of validity (this can be not only a year, but also a quarter, a month, you don’t have to specify a time frame at all, but then the document will be valid until a new order is adopted or the current one is cancelled);

- the size of the established limit (indicated in rubles);

- the period between the delivery or receipt (depending on the payment method) of cash is indicated in working days.

Such a document is signed by the head of the organization. It is important to specify who will control the execution of the order. Here you can specify the chief accountant, for example. If the manager monitors the execution himself, then a note must be made that he reserves responsibility and control over the implementation of the order.

What is the penalty for exceeding the cash limit?

In this case, the tax authorities apply the sanctions described below:

- Warning on first offense for small businesses.

- A fine of 4,000–5,000 rubles for an official and 40,000–50,000 rubles for an enterprise. The sanction does not apply to the cashier, but may apply to the chief accountant or the head of the company.

Punishment must follow within two months from the date of excess (Administrative Code of the Russian Federation). If the inspection reveals a violation later than this period, the business entity will not face fines due to the expiration of the statute of limitations.

What is the document for?

If the company does not meet the criteria of a small enterprise (for example, the staff is more than 100 people or other conditions such as annual revenue are not met), then determining and complying with the cash limit is still mandatory for it. But the paper is formatted a little differently.

From time to time, the company may face inspections by regulatory authorities.

Important! In case of non-compliance with the rules, the organization and its employees will face administrative punishment in the form of fines, which are regulated by Art. 15 Code of Administrative Offenses of the Russian Federation.

Moreover, if an official “gets off” with 4-5 thousand rubles, then a legal entity will be fined 40-50 thousand rubles. for every violation.

Previously, limits in this area were regulated by Regulation No. 343-P of the Bank of Russia dated October 12, 2011. Now the legal basis for this has changed, so it is advisable to redo the existing orders.

For better interaction with the regulatory authority, it is better to refer to Directive No. 3210-U or even issue an order to remove the cash limit (if the enterprise has moved to another category).

If previously the company issued an order establishing a cash limit, but has now become a small business entity, then it is mandatory to issue replacement papers. They may be an order on a cash limit of a different form or an order to cancel the cash limit.

basic information

An experienced accountant who works with cash at an enterprise has often encountered the concept of a cash limit in his work, but correctly calculating and filing documentation will not be difficult for him.

Novice accountants who do not have experience with this kind of calculations may encounter problems with deductions and errors in documentation are possible. The admission of inaccuracies or incorrect calculations in accounting is unacceptable, which may lead to the imposition of an administrative penalty on the enterprise and the responsible person.

It is worth taking into account that changes and clarifications are constantly being made to the legislation, which must be constantly monitored.

Coordination

The order is an internal document of the organization. There is no need to coordinate it with the bank or tax authorities (although it is advisable, in order, for example, to prevent an unscheduled arrival of collectors).

However, if it is nevertheless developed and exists (even with reference to Regulation No. 343-P of the Bank of Russia dated October 12, 2011 and without an appendix), then for failure to comply with the rules regarding restrictions on cash held in the cash register, the institution or person will face administrative liability in in the form of such a nuisance as a fine.

How does an individual entrepreneur make cash payments?

All payments made by a businessman with contractors are documented and accounted for in accordance with the legislation of the Russian Federation.

Skyword:2220641000w.jpg

Let's consider methods for making cash payments in accordance with the legislation of the Russian Federation:

- It is mandatory for any entrepreneur using a cash payment method to use a cash register in carrying out their activities. This condition is established by Article 1.2 of the Federal Law “On the use of cash register equipment when making cash payments and (or) payments using payment cards” No. 54-FZ dated May 22, 2003.

- Instead of cash receipts, use strict reporting forms. This rule is provided only for entrepreneurs providing services to the population of the Russian Federation. A businessman can, at his own discretion, develop his own form containing the necessary details. The creation of strict reporting forms must be carried out in a special program; the use of standard software for these purposes is prohibited.

- Businessmen who have special specifics of their activities in accordance with clause 2 of Art. 2 of Federal Law No. 54-FZ of May 22, 2003, they have the opportunity to refuse to use cash register equipment, as well as documents in order to make cash payments.

- Businessmen who are in the simplified or patent taxation system have the right to refuse to use cash register equipment, but if they issue payment receipts to clients indicating their details

Such methods can be used by businessmen to make cash payments to their clients.

Cash Payment Basics

The legislator does not establish a ban on the use of cash by an entrepreneur for settlements with his counterparties (Article 861 of the Civil Code of the Russian Federation). Also, Decree of the Central Bank of Russia No. 3073-U “On cash payments” dated 10/07/2013 regulates the relationships and payments made in cash by a businessman with his counterparties, including people.

The Central Bank of Russia does not supervise the following operations:

- Settlements with the participation of the Central Bank of the Russian Federation as a party;

- Payments made for banking operations;

- Payment from customs services;

- Issuance of salaries to employees and other social benefits;

- Cash withdrawal for personal needs of individual entrepreneurs not related to the activities carried out.

Various financial transactions of a businessman with civilians are not controlled by anyone, but with organizations there is a clearly established limit under one written agreement, limited to the amount of one hundred thousand rubles, this is the current norm for 2021.