What to do if the tax office suspects your counterparty of dishonesty? For example, it may be considered a one-day operation due to the lack of assets and personnel, registration at a mass address and the transit of funds through its accounts. Transactions that the company conducted with such a counterparty may be considered unrealistic, and the company itself may be accused of receiving an unjustified tax benefit. The result will be additional charges, penalties and fines.

If this happened and your business suffered due to an unreliable counterparty, you have the opportunity to defend your case in court . In this article, we will look at the arguments and documents with which taxpayers have recently been able to convince the court that transactions with suspicious partners were real.

More documents, good and different

When it comes to the reality of the transaction and the good faith of the counterparty , it is advisable to present to the court as many different documents as possible confirming this.

Invoices, contracts and other documents confirming the relationship of the disputed counterparty with its other business partners may be used.

This is exactly the approach that a company from the North Caucasus Federal District chose, trying to prove that the transaction was actually carried out. In addition to the usual documents that confirmed the relationship between him and the unreliable (in the opinion of the Federal Tax Service) counterparty - contracts, invoices, delivery notes - the court was presented with papers confirming the transportation of goods:

- invoice for payment of carrier services;

- certificate of services rendered;

- invoice;

- printouts from 1C complaints about defects;

- photographs of defective goods and more.

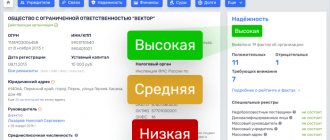

In this case, the court also found that the company had exercised due diligence , as supported by the vendor's due diligence report based on various IRS resources. As a result, the court considered that the company and the disputed counterparty carried out real transactions, since the Federal Tax Service did not prove otherwise (resolution of the North Caucasus District Court of March 20, 2018 in case No. A53-25393/201).

A company from Moscow took a similar approach, but it went even further. Information was submitted to the court in which the taxpayer reflected the purchase of building materials from different suppliers. Among them was one whose integrity the tax inspectorate had doubts about. Attached to the table were primary documents - contracts, invoices, acts, certificates, invoices and others that confirmed the information contained in the statement.

Thus, the taxpayer demonstrated to the court that he purchased construction materials both from the disputed counterparty and from many others. And these materials were used in construction work that the company carried out for customers (resolution of the Moscow District Court dated February 16, 2018 in case No. A40-249120/2016).

So, you should not dwell on a standard set of documents, trying to prove the reality of the transaction or other circumstances due to which the Federal Tax Service imposes taxes and fines. Moreover, judicial practice shows that the tax authorities themselves, trying to prove that they are right, attract all kinds of evidence .

For example, when proving the unreality of the fact of transportation of goods, they can provide information from the mobile operator that the driver’s device did not leave his home region, as well as data from surveillance cameras and from pass logs that he did not enter the buyer’s territory.

Prudence: legal basis

The concept of due diligence is not legally defined anywhere.

Read more about the current regulation of the concept of “tax benefit” in this article.

However, there are criteria developed by the Federal Tax Service of Russia (order dated May 30, 2007 No. MM-3-06/333), according to which the most likely candidates for an on-site tax audit are selected from among taxpayers. Among these criteria there is also such as conducting activities with a high level of tax risk, the description of which (clause 12 of Appendix 2 to the Federal Tax Service order No. MM-3-06/333) contains a list of characteristics that form the basis for assessing counterparties in terms of possible risks working with them.

For a complete list of criteria for selecting taxpayers for audit, see here.

Additional information about the signs of dubious counterparties can be found in the letters:

- Ministry of Finance of Russia dated December 17, 2014 No. 03-02-07/1/65228 - regarding the characteristics of one-day companies;

- Federal Tax Service of Russia dated February 11, 2010 No. 3-7-07/84 - about information that a taxpayer can request from its counterparties, and measures taken by the tax service to inform about persons unreliable for interacting with them;

- Federal Tax Service of Russia dated October 17, 2012 No. AS-4-2/17710 and dated March 16, 2015 No. ED-4-2/4124 - on available official sources of data on legal entities and individual entrepreneurs, as well as on the qualitative assessment of information reflected in the Unified State Register of Legal Entities;

- Federal Tax Service of Russia dated May 12, 2017 No. AS-4-2/8872 - on the study of certain characteristics of a counterparty when assessing tax risks.

However, formal adherence to the provisions of these documents does not always guarantee the taxpayer the absence of claims from the tax authorities. They are increasingly successfully proving the unreality of dubious business transactions reflected in the accounting, including using arguments that complement the criteria developed by the Federal Tax Service of Russia. And increasingly, the point of view of the Federal Tax Service is supported by judges.

Evidence of the supplier's reality

If the Federal Tax Service insists that the counterparty exists only on paper, you need to convince the court of the opposite. As evidence, one can cite the testimony of his other business partners . Naturally, this does not eliminate the need to submit all documents, including those mentioned above.

An example is the resolution of the Arbitration Court of the Ural District No. F09-260/18 dated March 19, 2018 in case No. A76-32147/2016. In this dispute, the taxpayer was able to prove that he made a tax deduction justifiably. Confirming the real existence and conduct of activities of the disputed counterparties, the taxpayer indicated the following:

- all transactions were reflected in tax and accounting records;

- goods purchased from disputed suppliers were used in the company’s business activities;

- these counterparties themselves conduct real activities , as evidenced by the contracts they have concluded for fuel transportation, their execution and payment;

- The individual entrepreneurs with whom the contracts specified in the previous paragraph were concluded confirmed that they transported fuel.

The tax department insisted that the disputed counterparties were managed by nominees, and the VAT amounts in transactions with them were not reflected in the invoices. In addition, documents from these companies were signed by unidentified persons, and the companies themselves were not located at their registered addresses.

According to the arbitrators, representatives of the Federal Tax Service were unable to convincingly prove their assumptions, as well as the fact that the company and the counterparty acted in collusion and carried out nominal transactions with the goal of obtaining an unjustified tax benefit.

Another example is the resolution of the Arbitration Court of the North-Western District dated 02/08/2018 in case No. A13-12372/2016. In this case, the company entered into an agreement with the carrier through intermediaries . This caused attention from the Federal Tax Service - the inspectors considered the intermediaries to be a nominal link. The outcome of the case was decided by the entrepreneur, who ultimately carried out the transportation in the interests of the taxpayer . He spoke about the details of the transaction and convinced the court that the intermediaries were not nominees.

To confirm the reality of the counterparty’s activities, you can use a variety of information. For example, information from the Internet and the media . In addition to the organization’s website, you can use industry and regional resources, catalogs, directories, and so on. Reviews from customers or clients will be a good help, especially if they were left over different years.

Due diligence when choosing a counterparty:

May 12, 2021

How to manifest and does it really matter?

Interest in the issue of exercising due diligence when choosing a counterparty intensified after the release of Letter of the Federal Tax Service of Russia dated March 10, 2021 N BV-4-7 / [email protected] “On the practice of applying Article 54.1 of the Tax Code of the Russian Federation,” which radically changed the approach of the tax authorities used since August 2017. It turned out that due diligence is important for assessing the receipt of an unjustified tax benefit, must be exercised by taxpayers and assessed by tax authorities. Meanwhile, due diligence, of course, did not disappear anywhere even during the period of “disbelief” in it by tax officials and was important not only in tax, but also in civil law disputes.

Since the release of Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53, paragraph 10 of which introduced the concept of due diligence, the opportunities for its manifestation have increased many times over. Read about the practical significance of due diligence and ways to demonstrate and record it in our new article.

In 2006, the Plenum of the Supreme Arbitration Court of the Russian Federation, in the famous Resolution No. 53, which still largely determines the courts’ assessment of an unjustified tax benefit, indicated that a tax benefit can be recognized as unjustified if the tax authority proves that the taxpayer acted without due diligence and caution and he must was aware of violations committed by the counterparty, in particular, due to the relationship of interdependence or affiliation of the taxpayer with the counterparty.

Since then, taxpayers have tried to find out from the Federal Tax Service and the Ministry of Finance how to exercise this diligence, to which they received one answer: there is no universal algorithm for checking counterparties, business activities are carried out by business entities independently and at their own risk, tax authorities are not responsible for the taxpayer’s choice of counterparties and possible in this regard, the onset of unfavorable consequences for him, including tax ones[1].

In August 2021, the tax authority literally interpreted the content of Art. 54.1 of the Tax Code of the Russian Federation reported [2] that “it should be taken into account that Federal Law dated July 18, 2017 N 163-FZ does not provide for the evaluative concept of “failure to exercise due diligence.” And many taxpayers mistakenly believed that it was no longer necessary to show it and put paper on the dossiers of counterparties.

Meanwhile, the typical position of the courts on the issue of due diligence is as follows[3]: when entering into legal relations, choosing a partner in a transaction, the taxpayer is free to choose a counterparty. But the buyer must proceed from the fact that a civil transaction also entails tax consequences for him. When choosing a counterparty, not only the commercial terms of the transaction should be assessed, but also business reputation, as well as the risk of non-fulfillment of obligations and the availability of the counterparty with the necessary resources and appropriate personnel. At the same time, providing only extracts from the Unified State Register of Legal Entities, etc., as evidence of due diligence, does not indicate its manifestation.

At the same time, due diligence is not always an argument of the tax authorities, so making a decision in favor of the taxpayer, the court[4], among other things, noted that before concluding supply contracts for each supplier, the applicant collected a set of documents confirming his diligence in choosing contractors (a positive decision was adopted, of course, not because of the exercise of prudence, but as a result of the tax authority’s failure to prove the unreality of the transaction and its execution by undeclared counterparties, but it was an additional argument in favor of the taxpayer).

At the same time, due diligence is important not only in tax disputes, but the Supreme Court of the Russian Federation, refusing to invalidate the transaction to the plaintiff, indicated that when concluding contracts, the plaintiff acted unreasonably, did not show due diligence and did not take the necessary actions in order to eliminate doubts about the correctness of understanding them the terms of contracts[5].

In another decision, the defendant was not recognized as a bona fide purchaser because, having acquired the property several months after its acquisition by the seller at a price six times lower than the market value, in the absence of any reasonable reasons for determining such a price, he should have exercised due diligence and carried out additional checking the legal fate of the property and finding out that the seller does not have the right to sell the disputed property[6].

The bankruptcy trustee in a “bankruptcy” case improperly fulfilled his duties because he did not show due diligence and conscientiousness when taking measures to ensure the safety of the debtor’s property, which resulted in the loss of part of the latter’s property, as a result of which the bankruptcy estate was reduced and losses were caused to the debtor and his creditors[7 ].

But let's return to tax prudence. In March 2021, Letter of the Federal Tax Service of Russia dated March 10, 2021 N BV-4-7/ [email protected] , the fourth section of which is entirely devoted to due diligence and its assessment. And here it is important to note the following: when assessing whether a taxpayer has received an unjustified tax benefit, the question of whether he exercised due diligence when choosing a counterparty is raised only after it has been established that the transaction is real, performed by a party to the agreement, and the taxpayer did not have the intent to evade taxes:

When applying paragraph 2, paragraph 2 of Art. 54.1. The Tax Code of the Russian Federation has legal significance not only that the counterparty could not execute the transaction, but also whether the taxpayer should have known about this, taking into account the specifics of this transaction.

The taxpayer’s awareness of the failure to fulfill an obligation by a person who is a party to the agreement is assumed when a critical set of circumstances characterizing the counterparty as a “technical” company is established, and the tax authority proves that these circumstances are the result of an assessment of the counterparty based on the requirements presented in property turnover when making a specific transaction , should have been clear to the taxpayer.

The letter was not without guile: for example, in paragraph 14, the standard of prudent behavior in civil (economic) transactions is equated with tax prudence, which is not true: for example, the supplier is ready to ship goods with 100% postpayment and at a favorable price. For the buyer, from the point of view of civil circulation, the quantity, quality of the goods and the timing of its delivery are important, while how many employees the counterparty has, whether he has fixed assets and a website on the Internet, does not matter. But it does from the point of view of tax prudence.

The letter lists signs of failure to exercise due diligence, which form a “critical set of circumstances.” Almost all of these signs repeat those previously indicated in the Letter of the Federal Tax Service of Russia dated March 23, 2017 N ED-5-9 / [email protected] (everything new is well-forgotten old), but an important reservation is made (formulated by the RF Armed Forces in the Definition of the SCES of the RF Armed Forces dated 05/14/2020 in case No. A42-7695/2017 “Zvezdochka”): the degree of requirements for choosing a counterparty cannot be the same for ordinary transactions and purchases of expensive assets:

The tax authority especially draws attention to the fact that the Federal Tax Service website contains a large amount of open information about taxpayers. And this is true, first of all – the Transparent Business website (https://pb.nalog.ru/index.html) and the State Information Resource of Accounting (Financial) Reporting (https://bo.nalog.ru). Both resources are free and allow you to obtain important information about the counterparty. It should be taken into account that the information has a certain inertia, so the balance sheet and financial results for 2021 may change in 2021, as well as the average headcount, as well as the amount of taxes paid. Even within one quarter, a counterparty can change the color in the VAT-2 ASK from green to red, let alone for a whole year. In addition, non-payment of VAT most often does not occur at the level of the first-line counterparty.

When due diligence is exercised, a side effect arises - refusal to enter into an agreement with startups that do not have a business reputation and excellent balance sheet indicators and, from the point of view of tax prudence (in the interpretation of the Federal Tax Service), cannot be suppliers or performers at all, especially when it comes to deductions for VAT.

To demonstrate the possibility of exercising due diligence using the services of the Federal Tax Service, let’s take a randomly selected organization that uses the OSN, registered in Moscow and carrying out cargo transportation.

Let's analyze the data on the average number of employees:

Taxes paid:

Data on income and expenses:

Balance indicators:

As can be seen even from a superficial analysis, the organization has no employees, wages are not paid even to the director, there are no fixed assets (including vehicles for transporting goods), and a low tax burden (on the Transparent Business website there is a convenient calculator for calculating it). Taking into account the specifics of the industry, it can be said with a high degree of probability that the taxpayer will not pay VAT. Of course, everything may be completely different: the taxpayer has concluded contracts with contractors, VAT is paid in full, the balance sheet is positive (receivables are greater than creditors), employees are not required, since the activity is intermediary in nature.

And yet: is it possible to entrust the transportation of goods to such a contractor, even from the point of view of commercial prudence, and why does the taxpayer choose an unnamed intermediary rather than the final contractor? Because the final executor is not a VAT payer, but the intermediary applies the OSN and will provide an invoice that the taxpayer will accept as a deduction?

In any case, it is obvious that only information from electronic resources (both free and paid) may be sufficient to exercise due diligence when concluding minor contracts, which, among other things, do not carry significant tax risks (although here it should be noted that that the amount of the disputed VAT in the Zvezdochka case was 390 rubles).

For larger transactions, an in-depth analysis is required, an example of which is indicated in the Letter of the Federal Tax Service of Russia dated March 23, 2017 N ED-5-9 / [email protected] , so the tax authority must request from the taxpayer documents and information regarding the taxpayer’s actions when choosing a counterparty: documents recording the results of search, monitoring and selection of a counterparty; source of information about the counterparty (website, advertising materials, proposal for cooperation, information about the counterparty’s previously performed work); results of monitoring the market for relevant goods (works, services), studying and assessing potential counterparties; a documented justification for the selection of a specific counterparty (a fixed procedure for monitoring the selection and risk assessment, the procedure for conducting a tender, etc.); business correspondence. All these documents and information will be requested in the tax request outside the scope of the audits and in the interests of the taxpayer for them to be available.

Thus, when choosing between the positions “it’s useless to exercise due diligence, it’s just a waste of time, they’ll charge you extra anyway” and “if we show due diligence, we’ll improve judicial prospects,” the second seems more justified.

[1]Letter of the Federal Tax Service of Russia dated 06/05/2017 N ED-4-15/10588

[2]Letter of the Federal Tax Service of Russia dated August 16, 2017 N SA-4-7/ [email protected]

[3] Decision of the Moscow Court of Justice dated 06/07/2019 in case A40-193046/2017 (after the Ruling of the Supreme Court of the Russian Federation on transferring the case to the court of first instance), Ruling of the Supreme Court of the Russian Federation dated 02/04/2021 N 302-ES21-347 in case No. A19 -3836/2019, Ruling of the Supreme Court of the Russian Federation dated November 17, 2020 N 308-ES19-5668 in case N A63-13694/2017 and others.

[4] Resolution 10 of the AAS dated 03/11/2020 in case A41-108989/2017 (upheld by the Moscow District Arbitration Court on 07/09/2020, but without mention of due diligence)

[5] Ruling of the Supreme Court of the Russian Federation dated February 18, 2021 N 305-ES20-24123 in case N A40-297380/2019

[6] Ruling of the Supreme Court of the Russian Federation dated April 10, 2020 N 301-ES20-3739 in case N A17-5432/2016

[7] Ruling of the Supreme Court of the Russian Federation dated January 20, 2021 N 309-ES20-22420 in case N A47-11073/2013

We will tell you how to safely structure your business and legally optimize taxes in our new intensive course “Business in an era of change 2021”

, which will take place on May 25-26, 2021 in Moscow. As always - only current solutions, no templates, maximum visualization, without “water”, miracles and outdated and well-known facts.

You can find out more and sign up using the link below.

Sign up for the intensive course Return to news list

Accounting for previously rendered court decisions

In the decision of the Administrative Court of the North Caucasus District dated February 13, 2018 in case No. A53-32464/2016, another court decision was used as evidence of the reliability of the counterparty. While checking the taxpayer, the Federal Tax Service found connections in his transactions with one-day companies. However, in the heat of the moment, the inspectors classified completely respectable partners of the organization as such. Confirming their reliability, the company provided evidence of its long-term cooperation with them. In addition, their good faith had previously been confirmed by the court in other proceedings.

A similar situation arose in another case, in respect of which a resolution of the Volga District Court No. F06-30805/2018 dated 04/03/2018 was issued in case No. A12-17016/2017.

What to do to reduce risks

To reduce the chance of many of the events described above, experts recommend an integrated approach:

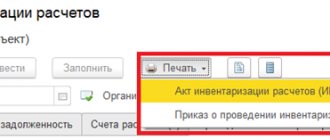

- Implement electronic document management in the company. This will allow you to receive invoices in electronic form and automatically post their indicators across the purchase and sales books.

- Before sending your VAT return to the tax office, check invoice data with your counterparties. There are special services for this, for example, “VAT +” from SKB Kontur. Invoices are uploaded to the service, then a comparison is made in the same way as the Federal Tax Service information system does. If a discrepancy is identified, the parties should correct it promptly.

- Implement a transaction verification system. Ideally, it should be carried out in two directions: verification of the counterparty and verification of the company employee responsible for the transaction. The latter is necessary in large organizations where there are many specialists who carry out transactions with counterparties. In practice, there are cases when, for a certain fee, the employees themselves cooperate with scammers and drag the company into gray schemes.

But the main thing is to carefully check each counterparty. You can do this manually using various registries that are available on the Internet in open form. But it is more convenient to use specialized services for checking counterparties, for example, Kontur.Focus . It collects data from all open sources, including information published by the Federal Tax Service, Arbitration Courts, the Bailiff Service and other bodies.

When checking counterparties, it is important to take into account the criteria that tax authorities use when determining the level of reliability of the organization. Here are the main ones:

- mass founder or director;

- mass registration address or lack of information about the actual location in the register;

- presence of the organization in the register of unscrupulous suppliers;

- presence of a director or founder in the register of disqualified persons;

- transition from one tax office to another, that is, migration;

- the counterparty lacks the resources necessary to fulfill the contract - warehouse or production facilities, employees, licenses and permits;

- inability to personally contact the head of the counterparty.

It would also be a good idea to periodically check yourself to see how your company looks in the eyes of your partners. In this case, you can find out, for example, that a record has been made in the register about the absence of data on the actual location. For several years now, the Federal Tax Service has been conducting checks of legal addresses. If the company is not found in the specified location, an entry is made in the register stating that there is no information about the address. In this case, you need to immediately visit the tax office and make changes to the data.

It is important to monitor not only new contractors, but also those with whom relationships have already been established . After all, circumstances can change. Using the Kontur.Focus system will allow you to quickly track all changes in the required companies. And it will not only show them, but also conduct an analysis of the counterparty. And also, by analogy with a traffic light, the Federal Tax Service will paint them with the appropriate colors.

If a transaction with increased risk is carried out

So, the counterparty has been verified. It turned out that he is not ideal, but still, for some reason, you will have to cooperate with him. There are a couple of important recommendations for this case.

Firstly, you need to make it a rule that all parties involved in the operation are specified in the contract . Let us recall the condition from Article 54.1 - the transaction must be completed by the person with whom the agreement was concluded. Therefore, if in fact the goods are delivered to the warehouse by a transport company, this must be stated in the agreement, including its name. It would also be a good idea to take the contact information of the driver who brought the goods.

Secondly, during the transaction, or rather, even during preparation, you need to collect all kinds of evidence of its reality . In particular, save correspondence with the counterparty, screenshots of his website with product offers, advertising materials, Internet search results, circumstances of negotiations, deliveries and everything else.

Among other things, you need to have a justification for why this particular counterparty was chosen. And also identify the persons who are responsible for analyzing its integrity.

Evidence of real need for goods and services

Sometimes taxpayers follow this tactic: they prove that there was a transaction because the purchased goods were needed for the activity. And most importantly, they show that these goods were actually used for business : they were sold or went into production. Moreover, as evidence, it is advisable to present not only documents, but also testimonies of employees - both your own and the counterparty who supplied the controversial points of view to the Federal Tax Service.

Let's give an example - the resolution of the Volga District Court No. F06-28668/2017 dated February 13, 2018 in case No. A12-10631/2017. The Federal Tax Service suspected the company of purchasing products from unscrupulous suppliers. However, the taxpayer was able to prove that the purchased goods—vegetables and fruits—were supplied to retail chains.

Invoices and fragmentary invoice cards for the disputed suppliers were selectively checked. As a result, it turned out that the network supplied exactly those products, the purchase of which raised doubts among the Federal Tax Service.

Additional evidence of the reality of the supply was the fact that the taxpayer rented special premises for storing the purchased vegetables and fruits.

The tax office presented standard arguments - the suppliers lacked property, transport, employees and were not located at the registered address. The court pointed out that all this does not mean that the counterparties and transactions are unrealistic, and sided with the taxpayer.

Intent

If one of the participants in the transaction is a technical company, the Federal Tax Service will look into whether the taxpayer entered into an agreement with it intentionally or through negligence.

What facts indicate the taxpayer's intent?

Cash withdrawal

Using the same IP addresses

Stamps and documents of the technical company in the taxpayer's office

Errors in documents indicating their formal preparation

Atypical document flow

If the inspection has proven intent, income tax expenses and VAT deductions can be made under one condition. It is necessary that the taxpayer disclose who actually executed the contract, and also provide information and documents confirming this. This is called a tax overhaul.

The actual performer (supplier, contractor) must also confirm that it was he who performed the contract.

If the taxpayer fulfilled the obligation himself and admitted this, the tax office may take into account expenses and VAT deductions for acquired material and other resources not related to wages.

Help from a supplier of a disputed counterparty

It would be good if it was possible to involve in the proceedings the organization or individual entrepreneur who supplied the disputed counterparty with goods that subsequently ended up in the hands of the taxpayer. In recent judicial practice, there is an example of how this could tip the scales on the company’s side (resolution of the Ural District Court No. F09-197/18 dated February 15, 2018 in case No. A76-31970/201).

The Federal Tax Service accused the taxpayer of working with an unnecessary intermediary. However, the supplier of this intermediary told the court that he was their regional representative and worked in good faith. The fact of cooperation was confirmed by supply agreements and a dealer agreement. As a result, the court declared the decision of the Federal Tax Service invalid.

How a conscientious payer can fall into an illegal scheme

Sometimes, in practice, a company may find out that it has become involved in a gray tax optimization scheme when a requirement to pay additional tax was received or the current account was blocked. Then it turns out that an updated VAT return was filed , in which a fictitious transaction appears. But the point is that this clarification was not submitted by the company, but by scammers who sent the Federal Tax Service on a false trail, thereby gaining time to complete their scheme.

The question arises - how can a third party file a VAT return for a company? The answer is simple - the scheme always involves a fictitious power of attorney . There are two options:

- an electronic signature certificate is issued using it;

- The fraudster sends a fake power of attorney to the Federal Tax Service by letter, on the basis of which he can then submit reports on behalf of the company.

Next, an updated declaration is filled out, into which the transaction required by the fraudster is built in . The report is signed with an electronic signature and sent to the tax office via EDI. Moreover, it is impossible to verify the legality of submitting a clarification at the operator level. The tax office also has no doubt that the report was filed legally, even if it was received through another operator (one company may have several of them).

According to the updated declaration, it turns out that the company carried out the transaction and charged VAT. Thus she got into this chain. But since the tax was never paid, the Federal Tax Service has logical questions. And while a conscientious company deals with them and distracts the tax authorities, the fraudster receives the money, and meanwhile the period of the desk audit is coming to an end.

What to do? The only way to make sure that no one has filed fictitious reports for your company is to periodically request the amount of tax accruals from the Federal Tax Service . If it is clear that according to the inspection data you need to pay the same amount as according to the company, then everything is in order. If the request shows that the tax amount has increased, you need to urgently submit an updated declaration. You also need to contact the EDF operator and explain the situation.

The best defense is offense

The Federal Tax Service is convinced that the company is cooperating with fly-by-night companies. The taxpayer decides to take an unexpected move - instead of denying it, he himself attacks the tax authority and points out its shortcomings. This tactic was used during the proceedings in case No. A71-2901/2017, in which the Arbitration Court of the Ural District issued resolution No. F09-66/18 dated 02/08/2018.

The taxpayer insisted: the Federal Tax Service did not take into account that the Tax Code does not make the right to apply a VAT deduction dependent on the actions of the counterparty . He pointed out the following:

- The fact that the counterparty violated its tax obligations does not confirm that the taxpayer received an unjustified tax benefit.

- When claiming the right to a deduction, the taxpayer does not have to provide documents confirming the actual payment of tax by the entire supply chain.

- The tax authority did not prove that the disputed counterparties did not include the revenue received from the taxpayer in the VAT base.

- The Federal Tax Service did not prove that the taxpayer and his counterparty acted in conspiracy to obtain an unjustified tax benefit.

The court recognized that the company was right and noted that the Federal Tax Service was unable to prove its bad faith.

How the Federal Tax Service will establish unjustified tax benefits in 2021

Letter of the Federal Tax Service dated March 10, 2021 No. BV-4-7/ [email protected] - essentially instructions for tax inspectorates on the application of Art. 54.1 Tax Code of the Russian Federation. It has complex legal language. This is a generalization of judicial practice, main theses and trends in the application of Art. 54.1 of the Tax Code of the Russian Federation, as the Federal Tax Service sees it. Taxpayers may be put off by the intricacies of legal and tax terminology, however, this letter is useful for companies and individual entrepreneurs. It establishes fairly clear rules by which the tax authorities will play in the coming years and which you will not find in the Tax Code or other laws.

Let's figure it out: what is remarkable about the March letter?

The Federal Tax Service explains that a tax benefit is justified if three conditions are met:

the taxpayer did not misrepresent information about the transaction;

obligations under the transaction have been fulfilled by the proper person (who is specified in the contract);

tax benefit is not the main purpose of the transaction.

In the letter, the Federal Tax Service also provides examples of distortions:

in order not to pay property tax, the company does not take into account the fixed asset that has already been built,

the taxpayer deliberately divides a single business between individuals who are independent only on paper. The business division is formal, only so that these new companies can comply with established limits and apply special regimes.

The criteria by which the Federal Tax Service will evaluate transactions:

- the reality of the transaction, that is, whether the transaction took place in reality or was carried out only on paper,

- whether the obligation was fulfilled by the proper person,

- what was the actual economic meaning of the operation,

- presence of a business goal.

Let us consider in detail the abstracts of the letter.

Prove due diligence

If a taxpayer is serious about selecting contractors and suppliers, it is always to his advantage - the courts take into account the exercise of due diligence .

In the following example from judicial practice (resolution of the Arbitration Court of the Ural District No. F09-8685/17 of 02/08/2018 in case No. A60-9439/2017), the company was looking for contractors to renovate a shopping center. An open competition was announced, applications were reviewed and a winner was selected, who subsequently seemed nominal to the Federal Tax Service. He did not carry out the repairs himself, but hired subcontractors to do this.

Tax officials pointed out that the subcontractors did not have qualified personnel, equipment, or other facilities to carry out repair work. The court found that this has no legal significance, since the Federal Tax Service did not prove that the taxpayer knew about it .

The inspection came to the conclusion that the contractor is a nominal organization based on the testimony of the manager, who denied any involvement in the activities of this company. However, the Federal Tax Service was unable to document this fact. Also, the unsubstantiated arguments of the inspectorate that the counterparty company cashed out funds or carried out their transit were not taken into account.

But the taxpayer was able to prove that the work was actually carried out. Security guards and other employees of the Shopping Center came to the rescue and confirmed in writing that the repairs were being carried out.

Reality and unreality

To be honest, the taxpayer always knows whether the transaction is real or not. If the transaction is not real, that is, it exists only on paper, both income tax expenses and VAT deductions will be deducted. You can completely forget about any tax preferences.

To establish the unreality of the operation, inspectors will make sure whether the counterparty has experience in similar operations and whether there are resources to execute the transaction.

Tax officials may question the head of the counterparty. If he does not understand the relevant terminology for the transaction, does not know about the existence of your company, does not conduct activities at all, or does not conduct the one described in the contract, things are bad.

Forgetting the events of three years ago is not a sin

I must admit, it looks quite strange when company employees repeat, word for word, circumstances that took place 2-3 years ago. The thought latently arises that this is not a matter of excellent memory at all, but of careful preparation.

Meanwhile, the courts recognize that it is quite normal to forget the circumstances that occurred 3 years ago. An example is the resolution of the Arbitration Court of the Ural District No. F09-1549/18 dated 04/03/2018 in case No. A76-18751/2016. In it, the judges referred to the fact that more than 3 years had passed since the transaction, which is why the participants were confused in their testimony. The arbitrators decided that this did not mean the deal was unrealistic.

Business fragmentation

What does the tax office look at if a group of companies runs a business under special regimes? Inspectors evaluate whether companies conduct business independently, using their own resources, or whether such companies act only formally, but in fact another person conducts business for them.

Risky if:

companies do not perform real functions and only draw up documents on their own behalf;

the group of companies has the same employees and common resources;

firms interact closely with each other;

companies conduct different businesses, but this is a single production process that is aimed at obtaining a common result.

How to compose - step-by-step instructions

Drawing up a letter of request for the provision of documents can be presented in the form of step-by-step instructions:

- It is necessary to create a “header” for the document.

As a rule, the details of the organization making the request are indicated in the upper left corner, and the addressee is indicated in the upper right corner.Required sender details include:

- its full name;

address;

- contact number.

- Next, you must indicate the date and registration number of the document in the outgoing correspondence journal.

Some organizations also indicate the subject of the letter (for example, about obtaining an archival certificate). - In the center of the paper it is necessary to place an address to the addressee of the document. As a rule, it looks like this: “Dear ……..!”

- Writing the main content of the letter.

At the beginning of the text, it is advisable to place a clear explanation of the reason for your application, and then request specific documentation. If the question is urgent, it makes sense to tactfully mention that the answer to this request should be provided within a short time. - Next, the signature of the head of the organization is affixed, as well as a seal.

In addition, at the very end of the request, you must indicate the executor of the document, as well as a contact phone number where you can contact him in case of questions.

ATTENTION. A letter of request is usually written to the head of the organization to which it is sent.

Checking counterparties

The regulations must indicate under what conditions it is advisable to conduct an inspection of counterparties. This issue should be resolved at the campaign level based on the ratio of financial costs and results. For example, the counterparty should be checked if a transaction is planned above a certain amount, if an agreement is concluded for a long period, or other circumstances arise. It is also advisable to specify in the regulations those responsible for conducting the inspection - a division of the company or individual employees.

In what cases is it written?

It should be noted that in the course of business activities, it often becomes necessary to write a request for documents or prepare a response to correspondence of this kind. Here are some of the most common cases when such a letter is written:

- if necessary, obtain financial statements from a business entity (the request can be sent by the tax inspectorate or state statistics bodies);

- if the buyer wishes to familiarize himself with the full price list of the selling organization;

- in correspondence between business partners (for example, one party may request from the other a copy of the agreement);

- judicial authorities may request from a business entity documents related to the case as evidence of an incident;

- a banking institution, before issuing a loan, may request an answer from another bank regarding the client’s business reputation, etc.