When filling out the “Calculation of Insurance Premiums” report, you must comply with the rules approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551 (Appendix No. 2). In order for the payer to be absolutely confident in the correctness and correctness of all indicators, the finished calculation must undergo additional verification. Where and how to check the calculation of insurance premiums in order to submit it without problems and on time, in case of which violations of the control ratios the Federal Tax Service will not accept the reports - our article will answer these and other questions.

Programs for checking the calculation of insurance premiums for 0 rubles. 0 kop.

How to check the calculation of insurance premiums in 2020-2021?

This question worries not only novice accountants, but also experienced professionals. The control ratios for checking calculations have been supplemented several times recently, so for successful completion of the calculation it is important to use up-to-date and preferably free checking programs. The Internet is replete with offers for free verification of insurance premium calculations. Are they all really free? What exactly is offered to policyholders - a full check of the calculation or a stripped-down version that does not allow them to see the details of the errors?

Would you like to receive exclusive information about how a desk audit of insurance premium calculations is carried out? Detailed explanations about this are given by 2nd class adviser to the State Civil Service of the Russian Federation E. S. Grigorenko. You can view them in ConsultantPlus, trial access to which can be obtained for free.

Among the truly absolutely free programs for checking the calculation of insurance premiums are the services of the Federal Tax Service. There are many such useful free services on the official website of this department.

Taxpayers and policyholders hold in high esteem the free service for generating and checking “Taxpayer Legal Entity” reports. This program allows policyholders to:

- fill out the calculation of insurance premiums;

- check it for errors;

- do not worry about the relevance of its form;

- do not be afraid of incorrect electronic format.

Another available and free program for checking insurance premium calculations in 2021 is the Tester program. It can be downloaded in the public domain on the Federal Tax Service website at the following link:

All offered services (both paid and free) for checking insurance calculations are based on more than 300 control ratios, with the help of which shortcomings, inconsistencies and discrepancies in calculation data are identified.

In addition to the programs of the Federal Tax Service, the calculation of insurance premiums can be checked in other ways - we will talk about them further.

How to check RSV data in 1C:ZUP

Most of the innovations approved by this order of the Federal Tax Service concern amendments made to the current Tax Code. Changes affecting the calculation of insurance premiums (DAM) should help tax services provide more complete control over the correct use of reduced and zero tariffs by small businesses. They were introduced in the spring of this year in connection with the COVID-19 pandemic.

In the coming year, accountants will no longer be required to provide separate data on the average number of employees of a business. According to the adopted adjustments, from now on this information is reflected in the DAM. A separate column appears on the title page of the Calculation in which it is necessary to indicate the average number of employees for the past year.

Especially for companies engaged in the IT field, Appendix 5.1 appears. It is intended for calculating compliance with the conditions for applying the reduced tariff of insurance premiums by taxpayers specified in paragraph 3 of paragraph 1. Art. No. 427 NKRF. This application was introduced in connection with the reduction of rates to 7.6% , instead of the previously used 14%.

The accounting department of IT companies must fill out a new application with information from section No. 1 of the DAM starting from the reporting period for the first quarter. 2021 In the reporting for 2021 You do not need to fill out this application.

Other changes expected by accountants in the coming year include updating insurance coding. The following codings are introduced for insured persons, depending on their categories:

- KB – employees whose insurance contributions from their income are calculated at a zero rate, in accordance with Federal Law No. 172.

- MC – employees of the organization, insurance contributions from the cash payments they receive are calculated by payers classified as SMEs.

- EKB - employees whose insurance contributions from their income are calculated by enterprises specializing in the field of high technology. These are designers and developers of computer databases and radio-electronic products.

In 2021, due to the coronavirus pandemic, a number of business sectors were, according to the classifier, recognized as affected. As a result, such enterprises were given the opportunity to pay insurance premiums at reduced or zero rates. For the IT industry, a tax maneuver was carried out to reduce the rate to 7.6% .

For the listed organizations that have received the right to preferences, separate codings are introduced:

- For small and medium-sized enterprises (SMEs) - code 20.

- For SME organizations that, according to the OKVED classifier, belong to the industries most affected by restrictions due to COVID-19. They, in accordance with Federal Law No. 172, received the right to apply zero tariffs for insurance contributions from April to June 2021 inclusive - code 21.

- For insurance premium payers employed in the high technology sector - code 22.

Innovations in the procedure for recording the payment of insurance premiums will allow the Federal Tax Service to exercise closer control over enterprises receiving benefits. Thus, the range of opportunities for abuse of the preferences provided to them by the state will be reduced.

If you find an error

Please select a piece of text and press Ctrl + Enter

CTRL + ENTER

Calculation of insurance premiums in 2021 must be submitted no later than the 30th day of the month following the end of the quarter. The deadlines are:

- for the 1st quarter of 2021 – April 30;

- for the half year - July 30;

- for 9 months - October 30;

- The RSV for 2021 must be submitted no later than February 1, 2021 (the deadline has been postponed due to a holiday).

Calculation of insurance premiums in 2021 on paper can only be submitted to those employers who pay income to no more than 10 persons. The rest are required to report electronically.

The calculation of insurance premiums for 2021 consists of many sections, subsections and applications. However, the minimum composition of the calculation is the title page and Section 1. In this form, the zero form of the DAM is submitted if there is no activity. If the DAM contains indicators, then in addition to the mentioned sheets you need to fill out:

- Section 1, Appendix 1, Subsections 1.1 and 1.2;

- Section 1, Appendix 2;

- Section 3.

There will be more sheets if the following circumstances occur:

- pension contributions were paid at additional rates - in this case, Subsection 1.3 of Section 1 is completed;

- contributions were paid for additional support for certain categories of workers (coal industry, flight crews) - Appendix 1.1;

- social benefits were paid - Appendix 3;

- payments were made to their budget - Appendix 4;

- there is a right to reduced tariffs for the IT sector - Appendix 5;

- the calculation is filled out by a non-profit organization - Appendix 6;

- activities related to animation products - Appendix 7;

- income was paid to foreign citizens staying in the Russian Federation temporarily - Appendix 8;

- payments were made to students hired under GPC - Appendix 9;

- The document is filled out by the head of the peasant farm - Section 2 and Appendix 1 to it.

The new DAM form is applied from reporting for the 1st quarter of 2021. But if you need to submit a corrective DAM for previous periods, then fill out the form from the order of 10.10.2021 No. MMV-7-11/

Download the new RSV 2021 form

The new RSV form, which is submitted in 2021, differs little from its predecessor. For example, let’s fill out a form for an organization with the following parameters:

- name - LLC "Success";

- number of employees - 1 (director);

- salary - 60,000 rubles.

Using the link below you can download the DAM completed for the 1st quarter of 2021.

RSV for LLC for the 1st quarter of 2021

Next, we will describe the process of generating the calculation. The sheets are filled out in the following order: title page, section 3, appendices to section 1, section 1. It is more convenient to fill out this way because section 1 contains the results, and the other sheets contain introductory information and calculations.

The first sheet reflects information about the payer and the Federal Tax Service:

- TIN/KPP (individual entrepreneurs fill out only the TIN);

- adjustment number if the DAM is submitted to the Federal Tax Service again (for the initial calculation 0);

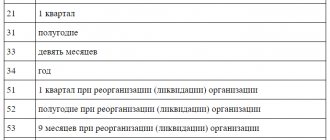

- period code - 21 (this is 1st quarter, data is taken from Appendix No. 3 to the procedure for filling out the calculation);

- Federal Tax Service code;

- code at the place of registration - 214 (means the organization at the place of its registration);

- Company name;

- activity code;

- a note indicating that the company was reorganized or liquidated. The code from Appendix 2 to the Procedure, TIN/KPP of the reorganized entity or closed division is indicated;

- telephone;

- number of calculation pages, as well as attached copies of documents.

Next, you need to confirm the completeness and correctness of the information. If the 2021 DAM will be signed by the director of an organization (or individual entrepreneur), then code 1 is entered. If the signature will be put by a proxy, code 2 is indicated, his full name and details of the power of attorney are indicated.

When do you need to pay money to check an insurance calculation?

Most companies and individual entrepreneurs prepare calculations for insurance premiums (as well as other tax reporting) electronically. This usually happens using a program used for accounting purposes.

The most well-known programs of this kind are products. The programs allow you to automate and keep tax and accounting records up to date, including the preparation of mandatory (regulated) reporting.

We will tell you how to automate accounting and generate reporting using 1C in these publications:

- “Maintaining separate accounting for VAT in 1C (nuances)”;

- “How to generate a SZV-M report in 1C (nuances)»;

- “The procedure for forming 6-NDFL in the 1C program”.

It provides its users with the opportunity to check the calculation of insurance premiums without any additional fees. However, a commercial product cannot have zero cost. Only those users who have already paid for access to the main accounting program can identify calculation errors for free using the 1C family program.

Other companies providing similar services have a similar approach.

Trap for policyholders: free and paid services

Some websites invite insurance premium payers to use a free service to check insurance premium calculations. To check, you just need to upload a report in xml format into the program offered by the service.

After checking it, the control result is issued. In any form? See the picture below:

It's good if there are no errors in your calculation. You will achieve your goal - make sure that after sending the report to the tax authorities there will be no claims. Everyone is happy: the service was provided, the report was checked, there were no errors.

If at least one control relationship is not met when checking a calculation, you will receive a warning that:

- errors were found in the calculation;

- not all control ratios converged;

- the calculation needs to be revised;

- If the errors are not corrected, the calculation will not pass the desk audit, you will have to submit explanations, pay a fine, and submit an updated calculation.

At this stage, a trap awaits you: the report has been checked, the presence of errors in it has been determined, but you do not know:

- how many control ratios did not converge;

- in which specific lines you made a mistake and how to make corrections.

It’s good if you are subscribers of a publication that offers this free service (for example, the magazines “Accounting for IP”, “Vmenenka”, “Uproshchenka”). Subscribers are offered an advantage when using the service - access to error details. If you are not one of the subscribers, you are not destined to find out:

- in what relationships the calculation does not converge;

- what is the cause of the error.

Moreover, no one will tell you what to do if a particular error is detected. To have access to all this useful information, you need to become a subscriber to the publication. This is a modern free-to-pay service.

Results

A program for checking the unified calculation of insurance premiums is available (Tester program). Users of the free service “Legal Taxpayer” have the opportunity to monitor their calculations for errors without any additional payments in this program.

Many electronic accounting publications offer to check your calculations for free. But a detailed description of errors can only be obtained by being a subscriber to such a publication. For other users of the service, if the test result is negative, the program will issue a warning about the presence of errors without detailing them.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Check RSV for 2021 online

Appendix 2 calculates contributions for temporary disability and in connection with maternity. The filling principle is similar, but there are important nuances:

- in column 002 you should enter the payment indicator (direct payments or offset system);

- on the second page you need to reflect the costs of paying insurance coverage and the amounts received from the Social Insurance Fund.

The program is capable of checking the following reporting forms:

- quarterly report RSV-1, RSV-2, RSV-3

- documentary personalized accounting S3V-6-1, S3V-6-2, ADV-6-2, S3V-6-4, SPV-1, ADV-11.

Submission of reporting material is implemented through constant updating of the program. You should always check for the latest updates before launching the application. This is especially important when working with the personalized accounting form RSV-1.

To familiarize yourself in detail and work with a specific report, you need to move the file from the directory to the working window using the mouse or by clicking on . The screen will display detailed data and information about the currently selected file (name, format, number of documents in the block).

Important: If the file cannot be verified, a text box will appear saying “The selected file is not a valid XML file.”

To check and review information on a specific file, you need to launch the panel labeled “Check selected file.” If you need to batch test several documents at the same time, then all files should be placed in one folder.

The CheckPFR verification module works on the function of reconciling indicators for two types of reporting forms (Calculation RSV-1 and Inventory of information ADV-6-2). If a difference in values for two parameters of one type of reporting is detected or appears, the reporting documents are rejected by the control authorities and returned for revision.

Important: All comments in the documents being created that are identified as erroneously should be corrected before being transferred to the Pension Fund authorities. Otherwise, you will need to provide a written explanation for the discrepancies and submit detailed reports, in accordance with the decree of the Pension Fund.

- The list of supported operating systems includes: Windows XP (Service Pack 1-3), Windows Vista, Windows 7 (x32/x64 bit);

- Minimum RAM – 1 GB RAM;

- Required free hard disk space – 1078 Mb;

- Minimum screen resolution 1024x768;

- Mandatory presence of MSXML0 on a personal computer;

- Availability of connection to the Internet 7.0 electronic channel.