How to start a business from scratchOrganizing the sale of goods and services

You've probably come across wallpaper, power tools, building materials, windows, doors, groceries, etc. stores on the streets of your city. All of these are retail outlets selling certain groups of goods. Let's look at the essence and features of retail organization, as well as its pros and cons.

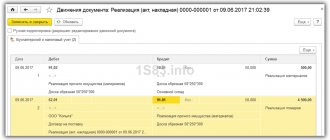

Organization of document flow

Despite widespread computerization, trading enterprises are required to have printed documents reflecting trade turnover, the movement of goods and materials and cash, as well as the formation of markups, mutual settlements with debtors and creditors.

Organization of document flow is the task of the head of the enterprise. Document flow rules must be specified in the company's accounting policies. Together with her, the leader states:

- forms of non-unified primary documents used in the enterprise;

- forms of internal reporting documents;

- frequency of reporting;

- accounting data processing technology.

When organizing document flow, the size and internal structure of the company, the frequency of business transactions, and the specifics of the activity are taken into account. In any case, the rules of internal document flow should not violate the current Regulations on Documents and Document Flow in Accounting. Organization of document flow involves the development of rules for the formation and movement path for each document. For this purpose, management determines the responsible persons at each stage of document creation, schedules for transferring documentation to other structural units, and the frequency of reporting.

Every document in an organization must go through the following path:

- Creation,

- transfer of the document to the accounting department,

- document verification and processing,

- archiving.

Basic documents used in trade

Each operation must be confirmed by the appropriate document. Typically, unified forms of documents are used as primary ones. If an enterprise, at the direction of management, uses non-unified forms of primary documents, they must in any case be drawn up in compliance with current rules and, at a minimum, must have the number and date of compilation, information about the organization in the form of its details, the content of the business transaction and the signature of the responsible persons with transcript. The SBU is responsible for checking the correctness of the primary documents. Only correctly drawn up documents have legal force and can be accepted for accounting.

Results

Electronic document management has long been a way to simplify and speed up the exchange of documents, using all the advantages of the Internet, accessible everywhere and distributed everywhere.

Some companies independently decided to work in a new way, appreciating the advantages of EDI, others were forced to master the system, since such document flow became mandatory when trading goods subject to mandatory labeling.

In any case, special programs are designed to make the process simpler and more convenient. And the market makes it possible to choose the optimal product for organizing e-document flow, based on the company’s objectives and budget.

—

The article was prepared by PORT retail experts. Information support: Sergey Khorosh.

If you have questions regarding EDI, automation and labeling, write in the comments to the material and on social networks.

Receipt of goods

The goods arrive to the trading company according to shipping documents, which include:

- a regular, freight or railway invoice from the supplier, one copy of which with the signature of the person responsible for delivery remains with the trade organization;

- invoice from the supplier;

- act of acceptance of goods with signatures of the transferring and receiving parties;

- a statement or act of identifying discrepancies in the quantity and quality of goods.

The package of documents is filed with the product report or transferred to the accounting department separately.

Sale and movement of commodity and monetary assets

When selling and moving goods, the following are formalized:

- invoices in the form TORG-12 or 1-T (TTN) in case of transport delivery, indicating the form of payment,

- invoices for returning goods,

- invoices for the movement of goods,

- invoices,

- cash receipts for completed and paid transactions,

- acts of write-off of goods.

Every day for each outlet at the end of the day the following are formed:

- commodity report reflecting the balance of goods at the beginning of the day, the arrival of goods, data on sales, returns, write-offs and transfers of goods;

- cash report, reflecting the balance of funds in the cash register at the beginning and end of the day, transactions of receipt and issue of funds, confirmed by the cash register tape.

The data from the cash and product reports on transactions for the day must necessarily converge. Depending on the specifics of the trading enterprise’s activities, the commodity report can be confirmed by primary documents (invoices, acts of return, write-off and acceptance and transfer of goods).

Attached to the product report:

- register of current prices relevant for a given date (price list);

- sales statement;

- a list of markups, if they are formed directly at the point of sale and the report is compiled taking into account;

- statement of revaluations during the day.

The cash report also, depending on the specifics of the retail outlet’s activities, may, in addition to the cash register tape and the cash register report at the beginning and end of the day, contain cash receipts and debit orders, and a statement of cash withdrawals by collection.

EDI in retail: difficulties of transition, checklist for implementation and nuances associated with labeling

Retail is a business area that readily absorbs innovation. But how ready is it for the massive transition to electronic document management? What difficulties and barriers arise? These and other questions are answered by Elena Aparina, head of the department for work with corporate and key clients at Taxcom, one of the largest e-document flow operators in Russia.

Have you noticed lately an increased interest in the topic of EDI among customers specifically from the retail sector? What are your observations?

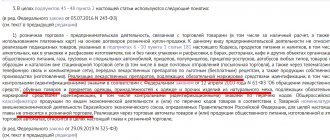

Legislation on product labeling has contributed to the popularization of EDI among retail representatives. Thus, the Government of the Russian Federation issued Decrees on mandatory labeling of goods, implying the mandatory use of EDI when trading labeled goods. Moreover, interest in EDI has increased not only among chains, but also among retail stores. Let me remind you that from July 1, 2021, labeling has become mandatory for a large retail segment - tobacco and footwear sellers.

The coronavirus pandemic has also had an impact. During this period, there were a number of restrictions in the work of courier services and mail: it was necessary to look for new solutions so as not to stop business. EDI during a pandemic has significant advantages:

—

you can avoid touching paper that may have a virus on it;

—

You can work with documents from home from your own computer, smartphone or tablet.

According to our data, connection to Taxcom services for electronic document management for the period April-September 2021 increased five times compared to the same period last year.

Thus, in April 2021, the demand for the electronic document management program Taxcom-Filer increased by more than 150%, and in May - eight times compared to last year.

Why haven’t all companies switched to EDI yet? What's stopping retail representatives?

EDI must be clearly divided into legally significant (USEDO) and simply the exchange of electronic messages of a single format that are part of EDI. Such messages are order, order confirmation, price list, shipping notification and others. EDI has been used in retail for a long time – about ten years. But this is not YUZEDO. Over time, operators began to include USEDO in their EDI offerings. Some networks use UTD (universal transfer document) as another document as part of the document flow.

Those networks that have not yet switched to USEDO, in connection with the issued Resolution, were forced to start using it, namely, to use the universal transfer document (UTD). It includes both a delivery note and an invoice.

Sooner or later, all product groups will switch to mandatory labeling. If a company has switched to EDI for at least one product group, then it makes sense to switch to EDI with all suppliers, since separating paper and electronic document flow is impractical and difficult.

Many companies supply not only tobacco, but also other products, and sell them together. For example, the largest tobacco distributors have an assortment of snacks, water, energy drinks, lighters, and tobacco related products. When shipping a delivery, they include in the UTD not only tobacco, but the entire assortment that the client orders.

What advantages will a trading company receive when switching to EDI?

Using EDF means reducing the time for signing and approving documents, minimizing the risks associated with errors due to human factors, confirming the correctness of the document in its format and reducing the cost of paper and courier service fees.

What difficulties does food retail face when trying to completely switch to EDI?

When a retailer previously received a delivery, he accepted it by recalculating the quantity with further acceptance based on quality. Labeling obliges acceptance of goods by scanning DataMatrix codes on the goods. This increases the time for accepting goods, but eliminates the possibility of accepting goods with invalid codes or codes that do not correspond to the data in the UPD. “Advanced” retailers have been accepting goods for a long time using a barcode scanner, and thus the quantity of goods is verified. Therefore, if the point of sale is prepared for scanning, then there are no problems.

If the receiving site is not equipped with a 2D scanner or a data collection terminal (DCT), then there is a need to purchase them. Many people do not want to incur additional costs. Another problem for the retailer is that not all suppliers want to switch to EDI until the mandatory regulation is regulated by one or another resolution.

However, if we talk about working with labeled goods, then the supplier is already obliged to use EDI, and before him – the manufacturer. This chain of sequence for introducing EDI “manufacturer-supplier-seller” is already well established in the labeling system.

When is TSD used instead of a scanner?

When a large quantity of goods arrives. It is also possible to upload an electronic document (invoice) into it and compare it with the codes on the goods at the acceptance point. And the scanner simply scans and sends this information to the accounting system, without visualizing the document at the acceptance site. For example, if you have connected the Taxcom-Filer web solution, you can use either our mobile application, or a scanner, or TSD, that is, Filer supports the operation of these devices.

In addition to a scanner or TSD, the receiving location must be equipped with a computer.

When we say EDI, do we also mean EDI? Or does it all depend on the specific company and its business area? Is it necessary for retail to have both EDI and EDI?

Yes, it depends on the specific company. For networks, for example, EDI is an integral part of working with suppliers. EDI helps the chain receive exactly the quantity and range of goods it orders. And from this, further planning should be done on the stock of goods, based on the turnover of goods on the shelf. But EDI is not mandatory. EDI is necessary for all retail if its assortment includes goods subject to mandatory labeling.

Is it enough to have only CRM to switch to EDI?

CRM has nothing to do with electronic document management. CRM is a customer relationship management system or application software for an organization. CRM automates internal business processes.

To switch to electronic document flow, first of all, it is necessary to reflect this in the company’s accounting policy. Next, analyze all document flow patterns in the company: all stages, the number of employees involved, identify all the bottlenecks and make a decision to stop using paper. Select an operator and determine the technical solution that is suitable for you: either a web version or integration with your accounting system. Well, the last step is to connect your counterparties to EDI.

Is it necessary to follow this order: first establish internal EDI, then external? Or can you change the order? What does this choice depend on?

Internal EDI cannot be legally significant, because the company does not sell anything internally or provide services. Internal EDI is the routing and coordination of documents between departments and divisions; it is often part of CRM systems or an internal program. It is absolutely not connected with external electronic document flow. Therefore, it makes no sense to talk about priority or choice.

YuZEDO with counterparties implies a well-functioning document routing chain: it will go to the signature of the employee who has the right to sign documents and is responsible for this.

If a company is required by law to use EDI or decides to abandon paper document flow, then it connects an external EDI. At the same time, he can use the internal electronic document flow for some of his own purposes and needs. Nowadays, HR EDI is actively developing on the market, when employees have the opportunity to remotely sign an application for leave or transfer to another position, etc. This is also a separate area of electronic document management.

What first steps does a retailer need to take to switch to EDI? Will it be necessary to introduce any new information systems? If yes, which ones?

First, you need to organize a working group that will include all interested parties and company employees (accountant, manager, IT specialist - if necessary).

It is necessary to document the transition to EDI with your counterparties, i.e., stipulate this in supply contracts or in agreements to existing contracts. Select an electronic document management operator, select a suitable operator solution. Equip the warehouse with scanners or TSD for receiving goods.

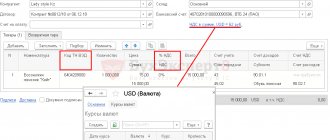

If we talk about information systems, today every network or retail outlet already has some kind of accounting system, and EDI is built into this system: then there is no need to install anything additional. For example, most retailers use the 1C accounting system. EDO Taxcom is integrated with 1C, so to use it, you just need to activate this functionality. This product is called 1C-Taksk. It implies that EDF will work directly from the client’s 1C accounting system.

If the 1C accounting system is not updated and cannot be integrated with the EDF service, then you will need to purchase additional solutions - for example, a Scanning Station (a solution on the 1C platform). It allows you to download documents and data from your accounting system.

If the point of sale did not have an accounting system, you can use web solutions and work with electronic documents without complicating the processes.

An electronic signature is also a necessary attribute of EDI, but if a company already submits reports electronically, then it has one. Electronic signature for reporting is also suitable for working with electronic documents.

When implementing EDI, it is necessary to identify employees authorized to sign the UPD and issue an electronic signature for them.

Recommend how to choose an EDI operator specifically for the retail sector?

If a retail network already uses the EDI of some operator, then it no longer needs to choose another one; you can connect YuZEDO from it. Incumbent EDI operators mostly supported this functionality.

What if the company does not yet use EDI or is it a new business? How to choose an operator?

A new business needs to first decide how it will work with suppliers? Does it need EDI? If yes, then as part of the EDI he will also receive YUZEDO. You need to look at how long the operator has been on the market, how many counterparties he works with, what functionality the service he provides, and how well it meets the needs of the business. And, of course, the price.

The company can also pay attention to the operator through which it submits reports electronically - many of them also offer EDI services. Taxcom, for example, provides both products for reporting via the Internet and for EDI with counterparties. The reporting rates already include packages of outgoing messages via EDI.

Another selection criterion is what services the operator provides for working with the labeled product. As I have already said, the massive transition to EDI is now associated precisely with the legislation on the transition to EDI when trading marked goods.

Labeling is supported by all Taxcom services - these are web solutions: Taxcom-Filer, Taxcom-Store; integration modules, solutions on the 1C platform, mobile applications. After all, EDI is an integral part of the marking and traceability system.

Since 2000, the Taxcom company has specialized in the development, implementation and maintenance of secure electronic document management systems for submitting reports to regulatory authorities, as well as for the exchange of electronic documents in the B2B and B2G segments, performs all types of work on the issuance and maintenance of electronic signature key certificates for legal and individuals throughout Russia.

In September 2021, the company received the status of fiscal data operator. According to the CNews Analytics research group, Taxcom OFD is in 2nd place in the ranking of the largest fiscal data operators in terms of the number of connected cash registers.

EDI marking electronic document management

Send

Stammer

Tweet

Share

Share