The posting of goods is a standard operation in a trading organization. However, when it is reflected in the 1C 8.3 program, there are many nuances.

From the article you will learn:

- how to capitalize goods in 1C;

- How does a warehouse affect the posting of goods in 1C?

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

Program settings

In 1C there is a division of warehouses into:

- Wholesale warehouse ( Warehouse type - Wholesale warehouse );

- Automated point of sale ( Warehouse type - Retail store );

- Manual retail outlet ( Warehouse type - Manual retail outlet ).

An automated point of sale (ATP) is a retail outlet where cash register receipts are issued during the day. At the end of the shift, the cash register is closed and a detailed report on retail goods sold is generated.

A non-automated retail outlet (NTP) is a retail outlet in which cash register receipts are not generated in the database during the day, and only a detailed report on goods sold for a certain period is entered into it.

For retail warehouses (ATT and NTT), the Price Type .

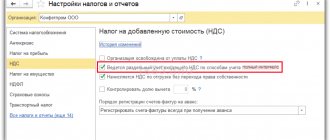

For retail trade, setting up accounting policies is also important - Method of valuing goods in retail (Main - Settings - Accounting policies):

- At acquisition cost - goods in the warehouse are accounted for at cost, while the trade margin on account 42 “Trade margin” is not taken into account. The cost of goods is recorded on account 41.02 “Goods in retail trade (at purchase price)”.

- At sales price - goods in the warehouse are accounted for at the selling price, while the trade margin on goods is reflected in account 42 “Trade margin”. Accounting for the cost of goods is carried out: for ATT - 41.11 “Goods in retail trade (in ATT at sales value)”;

- for NTT - 41.12 “Goods in retail trade (in NTT at sales value).”

Registration of receipt of goods to the warehouse depends on the Type of warehouse and the Method of valuing goods in retail .

If you are a subscriber to the BukhExpert8: Rubricator 1C Accounting system, then read additional material on the topic:

- Program functionality

- Setting up a chart of accounts - Retail goods accounting

How goods are accepted from KiZ

When accepting goods with KIZ (marking barcode), it is necessary to check whether all data is indicated in the UPD correctly. To do this, you need to read each code with a 2D scanner, a special data collection terminal (TSD) or a mobile phone (if such functionality is provided by your EDF operator). Then you need to check the data with the received UPD. In most cases, the EDI system does this reconciliation automatically.

How many barcodes will you have to scan? It depends on the packaging in which the product arrived. The labeling system supports aggregation. The marking code can be applied both to each product unit - for example, a pack of cigarettes - and to the packaging: pallet, box, etc.

After confirming the fact that the goods have been moved to the retail outlet, EDI is no longer involved in this process. The sale of goods occurs through an online cash register and information that it is out of circulation is transmitted to the labeling website by the OFD.

As we can see, the most common EDI operation performed by a retailer is confirmation of incoming UPD.

It creates outgoing documents and sends them to the supplier only when a return occurs. https://youtu.be/https://www.youtube.com/watch?v=jRUs4E3_3DY

Arrival of goods at the wholesale warehouse in 1C 8.3 Accounting: step-by-step instructions

The organization entered into an agreement with the Russian supplier MebelLand LLC for the supply of kitchen furniture in the amount of 194,700 rubles.

On April 17, the goods were received into the warehouse and accepted for accounting:

- Chair “Sonata”—20 pcs. at a price of RUB 4,720. (including VAT 18%);

- Table “EDT 45”—5 pcs. at a price of RUB 20,060. (including VAT 18%).

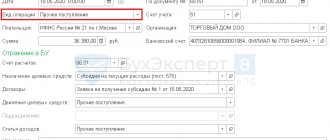

Reflect the posting of goods to the warehouse with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

In the header please indicate:

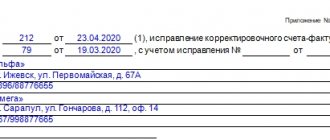

- Invoice No. from - invoice number and date specified by the supplier;

- Warehouse - a warehouse or storage location where goods are received. Selected from the Warehouses .

If ownership of the goods has transferred to the Organization, but the goods have not actually arrived at the warehouse, then we recommend using a virtual warehouse, for example, Goods on the way .

In the tabular part of the invoice, reflect the goods received from the supplier: indicate their name from the Nomenclature , quantity, purchase price, VAT amount, accounts for goods and VAT.

Learn in more detail Guide to filling out all fields in the document Receipt (act, invoice) transaction type Goods (invoice)

Postings

Documenting

The organization must approve the forms of primary documents, including the document on the receipt of goods. In 1C, a Receipt Order in form M-4 is used.

The receipt order is signed by the employee who accepted the goods (for example, a storekeeper) and the person who handed over the goods (for example, a cargo carrier, an accountable person).

The form can be printed by clicking the Print button - Receipt order (M-4) of the document Receipt (act, invoice) . PDF

If you are a subscriber to the BukhExpert8: Rubricator 1C Accounting system, then read additional material on the topic:

- Typical scheme for purchasing goods

- Purchase of goods under contracts in conventional units: legislation and 1C

What is needed to accept marked goods

In order to accept marked goods in accordance with the letter of the law, the store must have access to some kind of electronic document management system (EDF). It is impossible to do without this. Information about the movement of marked goods from the supplier (or manufacturer) to the retailer can be transmitted exclusively in electronic form, with the mandatory use of an electronic document management service. The main document in this case is the UTD (universal transfer document).

When the goods are shipped, the supplier generates a UPD in its EDI and sends this document to the store’s EDI. When an employee in a store accepts a delivery, he must receive an electronic version of the UPD from the supplier in his EDI. He can confirm it or, if any discrepancies are found, reject it.

Fig.1. Displaying incoming documents in EDF

Receipts in any EDI system are displayed as incoming documents. This may look, for example, as shown in Figure 1. The UPDs themselves (if you click on them and open them) contain all the details about the delivery: names of goods, quantity, etc. The work scheme is similar to the Unified State Automated Information System, where it is also necessary to additionally confirm the fact of acceptance of the goods in a specialized application.

If you use an automation system in your activities and it integrates with your electronic document flow, you can accept marked goods directly in it. For example, the retail business automation system SUBTOTAL and the EDI systems Kontur.Diadoc or Taxcom have similar integration.

SUBTOTAL is a convenient online service with which you can fully automate all business processes in the shortest possible time. SUBTOTAL supports labeling, EGAIS and easily integrates with almost all online cash registers on the market, being an official partner of leading cash register manufacturers.

How to capitalize retail goods in 1C

Capitalization of goods at acquisition cost

The organization entered into an agreement with the supplier Riviera LLC for the supply of goods in the amount of 300,900 rubles.

On March 22, the goods were received into the warehouse and accepted for accounting:

- Roller blind “BLACKOUT FIBER” – 50 pcs. at a price of RUB 2,950. (including VAT 18%);

- Thread curtains “Africa” – 100 pcs. at a price of RUB 1,180. (including VAT 18%);

- Blinds “Plastic (white)” – 20 pcs. at a price of RUB 1,770. (including VAT 18%).

The receipt of goods to the warehouse at the cost of purchase is processed in the same way as the receipt of goods to the wholesale warehouse. Only goods accounting accounts for a retail warehouse are automatically established - 41.02.

In this option, it does not matter whether the goods are received in ATT or NTT.

Register the posting to the retail warehouse with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

Postings

Receipt of goods at sales price

The organization entered into an agreement with the supplier Riviera LLC for the supply of goods in the amount of 649,000 rubles.

- Fabric “Jacquard Sylvia” – 1,000 pcs. at a price of 177 rub. (including VAT 18%);

- Fabric “Blackout Scarlett” – 1,000 pcs. at a price of 472 rubles. (including VAT 18%).

On March 22, the goods were received into the warehouse and taken into account at their sales price.

Sales price as of 05/01/2018:

- Fabric “Jacquard Sylvia” - 236 rubles. (including VAT 18%);

- Fabric “Blackout Scarlett” - 826 RUR. (including VAT 18%).

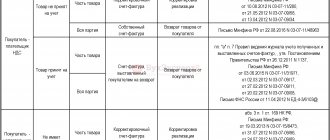

If the accounting policy provides for a method for valuing goods in retail By sales value , then upon receipt of goods the retail price for the received goods must initially be set, and then its receipt must be formalized. This must be done in order for the program to calculate the trade margin.

You can set the retail price using the document Setting item prices in the Warehouses - Prices - Setting item prices section.

Register the posting to the retail warehouse with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

Accounting accounts in the document are not specified by the user, but are determined automatically when posting the document according to the Warehouse Type :

- Retail store (ATT) - 41.11 “Goods in retail trade (in ATT at sales price)”;

- Manual point of sale (NTP) - 41.12 “Goods in retail trade (in NTT at sales value).”

If goods are received at the NTT warehouse, then the Receipt document (act, invoice) may not display the Nomenclature , but simply indicate the total amount of goods received and their retail value.

This situation is regulated by the Retail Goods Accounting setting.

Postings

The difference between the cost of sales and the cost of acquisition will be reflected in Kt 42.01 (42.02).

Test yourself! Take the test:

- Test. Purchasing goods from a separate division with delivery costs included in their price

- Test. Accounting for delivery costs of purchased goods, which are accounted for separately and are not included in their cost

- Test. Typical scheme for purchasing goods in wholesale trade in 1C

How to choose EDF

There are quite a lot of offers on the market for services for connecting to e-document flow, so choosing the best will not be easy. Give yourself some time to think.

Before signing an agreement, evaluate the chosen system and tariff using these simple criteria:

- incoming and outgoing limits,

- roaming cost,

- cost of incoming and outgoing when limits are exhausted.

Calculate the number of incoming documents per month using historical data or based on projected sales. Will this limit be enough for you?

Estimate the number of outgoing messages per month. Remember how often you make returns to suppliers with whom you plan to work in the future through EDI. Let the average be your guide.

Find out the cost of roaming, i.e. sending UPD to clients of other EDI. Sometimes, when sending documents to a supplier who uses another EDF, an additional fee may be charged for this operation. Check the price of such a service when choosing a tariff.

See what the price of each incoming and outgoing document is, if at some point you run out of the limits provided for the current period.

To connect to EDF, an electronic digital signature (EDS) is enough, which you will have to issue in any case if you work with markings.

Also, you can contact your fiscal data operator (FDO), if it provides this type of service, and connect to the EDF through it.

First filling option

The document is filled out by the system independently, based on the previously entered document based on the results of the audit, which must reflect a positive deviation (surplus) in the “Actual quantity” column. Filled out by the financially responsible person, it must contain a figure exceeding the accounting quantity. The result is that the surplus of goods is reflected in the “Deviation” column.

Fig.2 Document with audit results

Now, simply by clicking on “Create based on” and selecting capitalization, we receive an already completed document.

Fig.3 Creation based on

We see that data on items of goods for which surpluses were discovered as a result of the audit are entered in the appropriate fields. The income item is “Capitalization of surplus”, but if necessary, this can be corrected. Here you can generate a printed form of the invoice.

Fig.4 Capitalization of surplus and invoice for it

Fig.5 Printed form of the invoice for posting

Please note that in some cases it may be necessary to reflect the arrival of alcoholic beverages and send the data to the EGAIS system, for which our document has a button “Upload to EGAIS”, from where the “USAIS Balance Sheet Act” is generated.

Fig.6 Button “Upload to EGAIS”

Fig. 7 Certificate of registration on the balance sheet of the Unified State Automated Information System

The generated EGAIS document is carried out by clicking “Exchange Protocol”, and sent by clicking on “Transfer data”.

Fig.8 Exchange protocol with EGAIS

Receipt of goods

Capitalization transactions are carried out through the “Purchases” tab with a further transition to the “Receipts (acts, invoices)” section.

Next, the user is given access to all previously created documents in this group. To create a new record, you need to click on “Receipt” and select the appropriate operation from the drop-down list.

The user is offered the following options:

- Goods – applied when accepting goods accounted for on account 41.01

- Services – applied when reflecting services received

- Goods, services, commission – used to reflect transactions related to commission sales or acceptance of returnable packaging

- Materials for processing - used for the toll scheme, when all transactions made are carried out through off-balance sheet accounts

- Equipment and construction projects - used to reflect receipts on accounts 08.03 and 08.04

- Leasing services - used to reflect transactions carried out on account 76

Receipt of services

This time, when creating a document, select the type of operation “Services (act)”. We will not consider filling out this document in detail due to the fact that everything here is similar to the previous method. Only here item items with the “Service” type are added.

We attributed our lawn mowing service to account 26 and indicated the cost item “Other costs.”

In the case when you need to immediately reflect the receipt of both goods and services, use the “Goods, services, commission” transaction type.