Any violations of the rules for filling out documents used to calculate VAT are fraught with trouble. This is due to the fact that the tax return is checked by the Federal Tax Service automatically. The verification occurs not only according to internal control ratios - the data of buyers and sellers is compared. Therefore, it is extremely important that they are identical.

Continuing the topic of common errors when preparing and registering invoices, which then end up in the books of purchases and sales, as well as in the VAT return, we will talk about frequent violations in transactions with prepayment. We will also provide the correct procedure for filling out invoices and registering them in the purchase and sales books.

What is said in the Tax Code of the Russian Federation about the deduction of VAT on an advance invoice

Based on paragraphs.

1st and 12th Art. 171 of the Tax Code of the Russian Federation, the buyer has the right to deduct VAT calculated when paying an advance on account of future deliveries. As a general rule, the right to claim VAT for deduction is available within three years from the moment such an opportunity arises (clause 2 of Article 173 of the Tax Code of the Russian Federation). However, specifically in terms of deductions for advances, this rule is not applicable, and transfer of the deduction to later periods (quarters) is not allowed (letter of the Ministry of Finance of the Russian Federation dated 04/09/2015 No. 03-07-11/20290).

Find out more about the general procedure for deducting VAT on advances.

Invoice for advance payment in 1C

Content:

1. Accounting for settlements with customers

2. Correction of accounting errors

3. Corrected invoices

Accounting for settlements with customers

Payments to customers can be made in the following ways:

· Payment for goods supplied (work performed, services rendered).

· Prepayment (advance payment) for upcoming deliveries of goods (performance of work, provision of services).

Accordingly, in the first case, when accounting for settlements with customers, supporting documents are invoices, acts, and so on. And in the second - contracts.

When reflecting the receipt of funds from the buyer, it is necessary to determine whether it is payment or prepayment.

If the buyer has a receivable, then this receipt is regarded as payment, and if there is no debt, then as an advance payment.

In case of payment, a posting is generated to the debit of account 51 “Settlement accounts” and the credit of account 62.01 “Settlements with buyers and customers” for the entire amount of funds received to the current account.

In case of prepayment, two transactions are generated:

— The first posting is generated by the document Receipt to the current account - on the debit of account 51 “Current accounts” and the credit of account 62.02 “Advances received from buyers and customers in rubles” - for the entire credited amount.

— The second posting is generated by the document Invoice issued - on the debit of account 76.AB “Calculations for VAT on advance payments received” and on the credit of account 68.02 “Value added tax” - for the amount of VAT calculated from the amount of the advance payment received.

To generate analytical reports to reflect the transactions described above, you can use a report, for example, “Account Analysis”.

— Analysis of account 76.AB

— Analysis of account 62.02

From 2021, in connection with the transition to a new VAT rate of 20%, new rules have been introduced for the generation of adjustment invoices in 1C for advance payments. Namely: upon receiving an additional payment to the advance in the amount of 2% VAT for valuables that will be shipped, starting from 2021, the Federal Tax Service recommends drawing up adjustment invoices for the advance in 1C. The tabular part contains a link to a previously issued invoice for an advance payment, the amount, the VAT rate and the VAT amount from the source document, the new value for the amount of two advance payments.

A registered advance invoice can be immediately distinguished from an invoice issued upon shipment of goods or provision of services. According to the letter of the Ministry of Finance of Russia dated October 26, 2012 No. 03-07-11/427, there are no special requirements for the numbering of documents for advance payments. However, to make it easier to identify such documents, a letter designation can be added to the number.

If, when registering an invoice, the last day of the deadline falls on a weekend or holiday, then the document must be issued no later than the next business day. In line 5 you must indicate the date and number of the payment order or the date and number of the cash receipt on the basis of which the advance payment was received. But if the advance was received by several payment documents, then all of them can be listed in one invoice (provided the issuance deadline is met).

In column 1 of the main table, you should indicate the name of the goods supplied or the type of services performed, property rights for which the advance was received. You cannot write standard phrases such as “advance payment” or “advance payment for goods” on the advance invoice. It is necessary to indicate the general name of the product group and type of service. You can also additionally specify the details of the contract. This is done in order to clearly identify the purpose of the advance. When simultaneously issuing an advance invoice for the supply of goods and performance of work, it is necessary to reflect both the name of the goods and a description of the work.

When receiving an advance at different VAT rates, they must be shown in separate lines in the document. For each line, enter your rate and tax amount for the sale of goods (work, services, property rights).

Correcting accounting errors

If the funds received from the buyer were mistakenly recognized as prepayment under agreement No. 1, and not as payment for goods shipped to the buyer under agreement No. 2, then correction of errors in accounting and registration of the operation to clarify the purpose of the received funds is carried out using the document Adjustment of debt (section Sales - subsection Settlements with counterparties).

After posting the document, an accounting entry is generated:

Debit 62.02 from subaccount “Dog.No.1” Credit 62.01 from subaccount “Dog.No.2”

- the amount of the prepayment to be counted.

Since the funds received were erroneously recognized as an advance payment and an advance invoice was issued, VAT was erroneously calculated on the day they were received (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation). The discovered error led to an overestimation of the VAT tax base on the received prepayment amount and, consequently, the amount of tax payable to the budget.

Correction of an error in issuing an invoice and registering it in the sales book (operations: “Reversal of VAT accrual on advances received”, “Canceling an entry for an erroneous invoice from the sales book”) in the 1C program: Enterprise accounting is registered using the Operation document with the type of operation in 1C Reversal of document.

The corresponding reversal accounting entry is reflected on the “Accounting and Tax Accounting” tab:

Debit 76.AB Credit 68.02

— the amount of VAT calculated on the prepayment received.

The corresponding reversal entry is automatically entered into the Sales VAT register.

Since the cancellation of a registration entry for an erroneously issued invoice must be made in an additional sheet of the sales book for the period of receipt of funds, it is necessary to make an adjustment in the entries in the VAT Sales register.

After recording the Transaction document, an entry about the cancellation of the erroneously issued advance invoice will be made in an additional sheet of the book.

It should be noted that an erroneously issued invoice itself cannot be canceled (withdrawn, destroyed). According to the Federal Tax Service of Russia, establishing a mechanism for canceling invoices is inappropriate, since if an erroneously issued invoice is not registered in the sales book, then it is not accepted for accounting (letter of the Federal Tax Service of Russia dated April 30, 2015 No. BS-18-6 / [email protected ] ).

When making a decision to submit an updated VAT tax return for the operation “Formation of an updated VAT return,” such an updated return will include the same sections as the primary declaration (clause 2 of the Procedure for filling out a VAT tax return, approved. by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ).

In this case, the title page of the declaration will indicate the adjustment number “1” and the date of signature.

In Section 3 of the updated tax return on line 070 there will be no tax base and the amount of calculated tax.

In addition, the updated declaration will additionally include Appendix 1 to Section 9, which will reflect information from the additional sheet of the sales book. Since there was no such information in the primary declaration, the line “Previously submitted information” will be marked with o, which corresponds to the relevance indicator “0” and means that in the previously submitted declaration this information under Section 9 was not provided (clause 48.2 of the Procedure for filling out a tax return according to VAT).

Since no changes were made to the sales book itself, the information from Section 9 does not need to be re-uploaded to the tax office. It is enough to set in the line “Previously submitted information” about, which corresponds to the relevance sign “1” and means that the information previously submitted by the taxpayer to the tax authority is relevant, reliable, cannot be changed and is not submitted to the tax authority (clause 47.2 of the Procedure for filling VAT return).

Corrected invoices

The seller, having received an advance payment under the contract from the buyer, paid VAT on it. If changes are made to this agreement and the advance is returned to the buyer, the Tax Code allows the seller to accept VAT on the returned advance as a deduction on the date of return.

Of course, the Code says that the money must be returned. But at the same time, the transfer of the advance can be equated to its return. However, inspectors during an on-site inspection may disagree with this and consider that the return of money should be made exclusively by transferring it back to the counterparty. Therefore, if inspectors find a deduction from the seller in such a situation, then there may be claims. Although the courts have long been on the side of taxpayers in such cases. And specialists from the Federal Tax Service now already agree with the deduction if VAT is again calculated on the advance payment transferred to another agreement.

Seller's actions.

For the seller, the advance was and remains so. The only thing he needs to do is issue a corrected invoice and cancel the original one.

The corrected invoice is dated (line 1a) on the day of receipt of the letter from the buyer clarifying the purpose of the advance payment. In this case, the information indicated in column 1 “Name of goods (description of work performed, services provided), property rights” will change in the invoice.

The seller makes entries regarding both the registration of the corrected invoice and the cancellation of the original invoice:

• if the advance was received in the current quarter - in the sales book as of the date the invoice is corrected;

• if the advance was received in past periods - in an additional sheet of the sales book for the required last quarter.

Specialist

Elena Chernenko

What does the Ministry of Finance say about deducting VAT from an advance payment if the invoice was received in a different period

Along with the conclusion that transferring the advance deduction to other periods is generally unacceptable, the Ministry of Finance also clarifies the situation when, at the time of closing the VAT period, there is no VAT invoice yet.

In a letter dated 04/16/2019 No. 03-07-09/27004, officials clarify that if preliminary (partial) payment is made by the buyer in one tax period, and the invoice is received by the buyer in the next tax period, the VAT deduction should be made when actually invoice received.

The procedure for making corrections to an invoice after the end of the tax period

According to paragraph 1 of Article 81 of the Tax Code of the Russian Federation, a taxpayer who has discovered in the declaration submitted to the tax authority that information is not reflected or is incompletely reflected, as well as errors:

- is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority if errors (distortions) led to an understatement of the amount of tax payable;

- has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority if errors (distortions) do not lead to an understatement of the amount of tax payable.

If in the current tax (reporting) period errors (distortions) are discovered in the calculation of the tax base that relate to previous tax (reporting) periods, then the tax base and tax amount are recalculated for the period in which these errors (distortions) were made (para. 2 clause 1 article 54 of the Tax Code of the Russian Federation).

At the same time, the taxpayer has the right to recalculate the tax base and the tax amount in the tax (reporting) period in which errors (distortions) were identified if (paragraph 3, clause 1, article 54 of the Tax Code of the Russian Federation):

- it is impossible to determine the period of commission of these errors (distortions);

- such errors (distortions) led to excessive payment of tax.

When applying these provisions to the calculation of VAT and the presentation of tax reporting, the following features must be taken into account:

- the norm of paragraph 1 of Article 54 of the Tax Code of the Russian Federation does not apply to those errors that were made due to incorrect reflection of tax deductions. This is due to the fact that by using tax deductions the taxpayer reduces the amount of tax already calculated from the tax base (clause 1 of Article 171 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 25, 2010 No. 03-07-11/363);

- recalculation of the tax base for VAT in the period of discovery of an error made in previous tax periods is not provided for by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Resolution No. 1137).

As defined by the Rules for Maintaining the Sales Book, approved. Resolution No. 1137, when corrections are made to an issued invoice after the end of the tax period, registration of the corrected invoice and cancellation of the entry on the original invoice are made in an additional sheet of the sales book for the tax period in which the invoice was registered before entering into it corrections (clause 3, clause 11 of the Rules for maintaining the sales book, approved by Resolution No. 1137).

Despite the fact that these norms of Resolution No. 1137 correlate the procedure for correcting the sales book only with making corrections to invoices, the use of additional sheets of the sales book is prescribed in relation to any changes to the sales book for expired tax periods (letter of the Federal Tax Service of Russia dated September 6, 2006 No. MM- 6-03/ [email protected] , dated 04/30/2015 No. BS-18-6/ [email protected] ).

The data from such additional sheets is used to make changes to the VAT tax return (clause 5 of the Rules for filling out an additional sheet of the sales book). At the same time, the updated tax return, in addition to those sections that were previously submitted to the tax authority, includes Appendix 1 to Section 9 (clause 2 of the Procedure for filling out a VAT tax return, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7- 3/ [email protected] ).

We accept VAT deduction on an advance invoice: conditions for different periods

We summarize the explanations of the Ministry of Finance and practical experience in applying VAT deductions not during the period of actual transfer of the advance.

In order to easily deduct VAT on an advance invoice received in the period following the advance payment period, you need to have:

- an agreement with fixed terms of advance payment;

- confirmation of the payment itself (payment order, bank statement);

- invoice from the supplier;

- confirmation that the invoice was actually received in the next tax period.

How to confirm the date of actual receipt of an advance invoice?

You need to confirm the receipt of the invoice with an additional document, if possible, “from a third party.” There are several options depending on the situation:

- You can agree with the supplier to send the document by postal or courier service, with a description of the shipment and delivery against signature. This path is suitable for situations where receipt of a document is delayed due to some circumstances on the part of the supplier. For example, the supplier technically does not have time to issue and send an invoice on time. Documents from the service that delivered it will serve as confirmation of the date of receipt of the invoice.

- You can keep a log of incoming documents and record there the date of actual receipt of the invoice. There is an old, but still valid letter from the Federal Tax Service in Moscow dated 08/03/2009 No. 16-15/79275, in which taxpayers are offered exactly this confirmation option. However, it should be remembered that such a journal will have to be created in advance and entries will be made in it for all incoming correspondence. Let us add that to register invoices (incoming and outgoing) there must be another journal. But the presentation of this journal as evidence is not considered by regulatory agencies.

- An invoice can be sent electronically through an EDI operator. Then confirmation of the date of actual receipt can be requested from the EDF operator.

Please note that since the procedure for confirming the date of receipt of an invoice is not established by law, the Ministry of Finance in its clarifications recommends fixing the selected option(s) for confirming the date in the accounting policy.

Check if everything is correct in the accounting policy - 2020 .

Canceling an erroneous invoice for an advance payment in “1C: Accounting 8” (rev. 3.0)

We will consider the procedure for correcting accounting and tax accounting data in the 1C: Accounting 8 version 3.0 program, starting from clarifying the purpose of received funds to generating an updated VAT return, using the following example.

Example

| The organization TF-Mega LLC, which applies the general taxation system, on May 3, 2017, after submitting a VAT tax return for the first quarter of 2021, discovered the fact of erroneous recognition of funds received from Clothes and Shoes LLC in advance and, accordingly, erroneous registration issued advance invoice in the sales book for the first quarter of 2017. The organization decided to make corrections to the accounting and tax records, cancel the extra registration entry for the invoice in the sales book and submit an updated VAT return for the first quarter of 2021. |

The sequence of operations is given in Table 1.

Receipt of funds from the buyer. Accounting for “advance” VAT

The receipt of advance payment for the upcoming delivery of goods (operation 1.1 “Receipt of advance payment from the buyer”) is reflected in the program using the document Receipt to the current account with the transaction type Payment from the buyer, which is generated:

- based on the document Invoice for payment to the buyer (section Sales - subsection Sales - journal of documents Invoices to buyers);

- or by adding a new document to the Bank Statements list (section Bank and cash desk - subsection Bank - document journal Bank Statements).

As a result of posting the document Receipt to the current account, the following accounting entry will be generated:

Debit 51 Credit 62.02

- the amount of advance payment received by the seller from the buyer.

In accordance with paragraphs 1 and 3 of Article 168 of the Tax Code of the Russian Federation, the seller must issue an invoice to the buyer of goods who has transferred the prepayment amount no later than five calendar days, counting from the date of receipt of the prepayment.

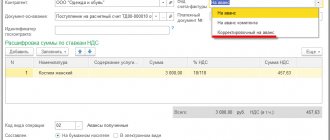

An invoice for the received prepayment amount (operation 1.2 “Issuing an invoice for the prepayment amount”) in the program is generated on the basis of the document Receipt to the current account using the Create based button. Automatic generation of invoices for advances received from customers can also be done using the processing Registration of invoices for advances (section Banks and cash desk).

In the new Invoice document issued, the basic information will be filled in automatically according to the base document:

- in the from field - the date of preparation of the invoice, which by default is set to the same date as the date of generation of the document Receipt to the current account;

- in the Counterparty, Payment document No. and from fields - the relevant information from the basis document;

- in the Invoice type field – the value For advance;

- in the tabular part of the document - the amount of the received prepayment, the VAT rate and the VAT amount, respectively.

In addition, the following will be automatically entered:

- in the Transaction type code field - value 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] );

- the Compiled switch is set to On paper, if there is no valid agreement on the exchange of electronic invoices, or In electronic form, if such an agreement has been concluded;

- flag Issued (transferred to the counterparty) indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the flag and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

- The Manager and Chief Accountant fields are data from the Responsible Persons information register. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory Individuals.

To correctly draw up an invoice, as well as to correctly reflect the document in the accounting system, it is necessary to enter the name (or generic name) of the goods supplied in the Nomenclature field of the tabular part of the document in accordance with the terms of the contract with the buyer.

This information is filled in automatically indicating:

- names of specific item items from the Invoice for payment document, if such an invoice was previously issued;

- a generic name, if such a generic name was defined in the agreement with the buyer.

By clicking the Print document Invoice issued, you can go to view the invoice form and then print it in two copies.

According to the Rules for filling out an invoice, approved. By Decree No. 1137, the invoice for the prepayment amount received indicates:

| Invoice | Data |

| Line 5 | Details (number and date of preparation) of the payment and settlement document (clause "h" clause 1 of the Rules for filling out) |

| Box 1 | Name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Filling Rules) |

| Column 8 | The amount of tax calculated on the basis of the tax rate determined in accordance with paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause “h” of paragraph 2 of the Rules for filling out) |

| Column 9 | The amount of advance payment received (clauses “and” clause 2 of the Filling Rules) |

| Lines 3 and 4 and columns 2 - 6, 10 - 11 | Dashes (clause 4 of the Rules for filling) |

As a result of posting the issued Invoice document, the following accounting entry will be generated:

Debit 76.AB Credit 68.02 - for the amount of VAT calculated on the received advance payment from the buyer in the amount of RUB 10,800.00. (RUB 70,800.00 x 18/118).

The Invoice document issued will be registered in the sales VAT accumulation register. Based on the entries in the VAT Sales register, a sales book is formed for the first quarter of 2021 (Section Sales - VAT subsection) (see Fig. 1).

Rice. 1. Sales book for the first quarter of 2021

Also, based on the issued Invoice document, an entry is made in the information register Invoice Log.

Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, register entries in the Invoice Log are used to store the necessary information about the issued invoice.

The invoice issued upon receipt of advance payment is registered in the sales book for the first quarter of 2021 (Fig. 1).

A VAT-taxable transaction related to the receipt of an advance payment amount is reflected on line 070 of Section 3 of the VAT tax return for the first quarter of 2021 (approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended. Order of the Federal Tax Service of Russia dated December 20, 2016 No. ММВ-7-3/ [email protected] ) (operation 1.4 “Formation of a VAT return for the first quarter of 2021).

Information from the sales book is reflected in Section 9 of the VAT return.

Results

If an advance is transferred to a supplier in one tax period, and an invoice for the advance is received in the next, you can deduct VAT on the advance in the period when the invoice is actually received. However, this will require fulfilling a number of conditions, the main of which is to confirm the date of actual receipt of the invoice.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.