Using intermediaries in business helps optimize tax payments. However, thanks to the efforts of the Federal Tax Service and Rosfinmonitoring, this scheme is acquiring negative consequences that can jeopardize not only the business of the intermediary itself, but also its counterparties.

Let us remember what distinguishes an agency agreement from others. Under an agency agreement, one party ( agent ) undertakes, for a fee, to perform behalf of the other party ( principal ) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal (Clause 1 of Article 1005 of the Civil Code of the Russian Federation).

We will consider an agency agreement, under the terms of which the agent, in relations with a third party, acts on his own behalf, albeit at the expense of the principal. The rules on commission agreements are applicable to such an agreement if these rules do not contradict the provisions of the chapter of the Civil Code of the Russian Federation on agency or the essence of the agency agreement (Article 1011 of the Civil Code of the Russian Federation).

Next, we will touch on the individual terms of the agency agreement, as well as other points that we recommend paying attention to.

Let us note that the essential terms of the agency agreement (that is, those without the agreement of which the agreement is not considered concluded) are only the subject of the agreement - these are legal and/or actual actions that the agent must perform on behalf of the principal.

The absence of agreement in the contract of other conditions does not qualify the contract as not concluded, and such inconsistent points will be determined in accordance with the provisions of the Civil Code of the Russian Federation (accordingly, if you need a clearer definition of the conditions that are important for you, or the general norms of the Civil Code of the Russian Federation are not beneficial, these conditions should also be included into the contract you enter into).

Let's look at the wiring

Let's consider an example: an agent receives payment (remuneration) directly from the principal on the terms of 50 percent advance. The following entries are made in accounting:

Debit 51 Credit 62 (76)

— 1000 rubles – an advance on the agent’s fee was received;

Debit 62 (76) Credit 68.2

— 152.54 rubles – VAT is charged on the advance payment;

Debit 62 (76) Credit 90

— 2000 rubles – the agent’s income is recognized at the moment the principal accepts the agent’s report;

Debit 90 Credit 20

— 800 rubles – if there are direct expenses of the transaction agent, they are recognized in the cost price;

Debit 90 Credit 68.2

— 305.09 rubles – VAT is charged on the entire amount of the agent’s remuneration;

Debit 68.2 Credit 62 (76)

— 152.54 rubles – VAT accrued on the advance payment is accepted for deduction;

Debit 51 Credit 62 (76)

— 1000 rubles – the agent’s services are paid for by the principal.

In the absence of an advance payment, the agent's accounting is limited to entries 3, 4, 5 and 7 (for the entire amount of the remuneration). If the agent uses the simplified tax system, we exclude VAT transactions (2, 5 and 6).

Withholding amounts

Now let’s consider the procedure for recording transactions when the agent withholds remuneration from the amounts received from the buyer of goods (services, works) of the principal:

Debit 62 (76) Credit 90

— 2000 rubles – the agent’s income is recognized at the moment the principal accepts the agent’s report;

Debit 90 Credit 20

— 800 rubles – if there are direct expenses of the transaction agent, they are recognized in the cost price;

Debit 90 Credit 68.2

— 305.08 rubles – VAT is charged on the entire amount of the agent’s remuneration;

Debit 76 Principal Credit 62 (76) Principal

— 2000 rubles – the agent’s remuneration is withheld from funds received from buyers to the principal.

Accordingly, if the agent uses the simplified tax system, then it is necessary to exclude the posting for VAT calculation.

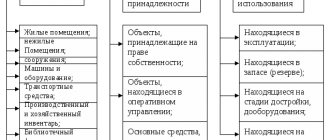

Distinction between the property of the agent and the principal

Things received by the intermediary from the principal (or acquired by the intermediary at the expense of the principal) are the property of the principal.

In this case, the agent is responsible to him for the loss, shortage or damage of this property (clause 1 of Article 996, clause 1 of Article 998, Article 1011 of the Civil Code of the Russian Federation). In relation to, for example, the principal's goods, the parties usually have no questions - the intermediary accepts them for off-balance sheet accounting. But with regard to other objects of civil rights, the situation is not so clear.

By virtue of Article 128 of the Civil Code of the Russian Federation, the objects of civil rights include:

— things, including cash and documentary securities, other property, including non-cash funds, uncertificated securities, property rights;

— results of work and provision of services;

— protected results of intellectual activity and means of individualization equivalent to them (intellectual property);

- intangible benefits.

From this article it follows that, for example, non-cash funds refer to other property, and not to things. And this causes difficulties for the parties to the agency agreement in a situation where the intermediary is involved in the settlements, and the third party, for one reason or another, did not fulfill its contractual obligations (for example, delayed payment) or, on the contrary, transferred an advance (and then did not contact for more than three years, or was liquidated).

On the one hand, based on the wording of Article 128, 996 of the Civil Code of the Russian Federation, the principal does not have ownership rights to non-cash funds received from the buyer to the agent’s account.

At the same time, with regard to the commission agreement, the Supreme Arbitration Court of the Russian Federation explained (clause 9 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 17, 2004 N 85) that, within the meaning of Art. 999 of the Civil Code of the Russian Federation, in the absence of an agreement between the parties to the contrary, the commission agent is obliged to transfer to the principal the amounts received from the sale of goods owned by the latter as they are received, and not based on the results of the execution of the principal’s instructions in full. This means that the obligation to transfer to the principal the amounts received from third parties arises from the commission agent immediately at the time of receipt of these amounts and is subject to fulfillment within a reasonable time, unless otherwise established by the commission agreement.

It turns out that all amounts (including advances) that the commission agent received from the buyer under the purchase and sale agreement (concluded on behalf of the principal) must be transferred to the principal. This obligation arises immediately upon receipt of the amount, while the contract may agree on the period during which such amounts are transferred to the principal.

If a third party has violated its obligations under an agreement concluded with an intermediary, then clause 2 of Article 993 of the Civil Code of the Russian Federation establishes a general rule, according to which in the event of a third party’s failure to fulfill a transaction concluded with him by the commission agent, the commission agent is obliged to immediately notify the principal about this, collect necessary evidence, as well as, at the request of the principal, transfer to him the rights under such a transaction in compliance with the rules on the assignment of claims.

Since the rules established for a commission agreement are also applicable to an agency agreement (Article 1011 of the Civil Code of the Russian Federation), the amounts of payment received from third parties and held by the agent should be considered as an obligation of the agent to the principal. The agent has no right to keep them. Similarly, the intermediary transfers the debts of third parties to the principal.

Moreover, if there is a debt of the principal to the agent, the intermediary has the right to withhold the amounts due to him under the agency agreement from all amounts received by him at the expense of the principal (Articles 410, 997, 1011 of the Civil Code of the Russian Federation).

Agent's report

Thus, in an agent’s accounting, the main document on the basis of which income is reflected and the tax bases for VAT and income tax or simplified taxation system are formed is the agent’s report. The report is provided within the time limits established by the contract. The report is considered accepted by the principal if, within the period established in the contract, the latter has not received any objections to the data reflected in the document. Since the deadline for submitting the agent’s report is not established by law, and 30 days are allotted for the principal’s objections under the Civil Code of the Russian Federation, it is advisable to establish by agreement the frequency or deadline for the submission of agency reports, as well as a reasonable period for its consideration by the principal.

The form of such a report is not fixed by law, but it is subject to general requirements for mandatory details for primary accounting documents. To avoid disagreements at the stage of accepting the agent’s services, it is better to agree on the reporting form as an annex to the contract. According to existing business practices, the fact that the agent provides services is additionally documented in an act of provision of services, and this act can also be made part of the report. The condition for signing the act or its combination with the report must be fixed in the contract.

Principal's counterparties

The terms of the contract may provide for the participation of an agent in settlements between the principal and buyers or suppliers. The cash flow in this case does not generate income or expenses for the agent, but transits through account 76 “Settlements with various debtors and creditors.” In addition, the principal’s assets may be transferred to him for subsequent sale to the buyer, or the agent may accept from suppliers assets purchased on behalf of the principal. In this case, ownership of the assets does not pass to the agent, and if there are documents on the transfer of assets to him (acts, TTN, etc.), he reflects the assets in off-balance sheet accounts 004 “Goods accepted for commission” or 002 “Inventory accepted for commission” for safekeeping."

Subject of the agreement

The only essential condition, without which a transaction is considered not concluded, for an agency agreement is an object that does not have a material expression, but represents a number of significant legal actions performed by one party on behalf of the other. If a standard purchase and sale transaction involves settlement with the buyer and settlement with the seller, as with two independent contractors, then an agency agreement with an individual or business entity provides for the conclusion of another agreement linking the principal and the final buyer.

The subject of the agency agreement is exclusively intermediary services paid by the principal. The specifics are determined by contractual terms, and in the absence of specifics, by the norms of civil law. However, it is important for the agent to detail the actions in order to avoid recharacterization of the agreement into a standard transaction with additional tax liabilities during audits.

The order given to the agent may include the following actions:

- searching for wholesale and retail buyers for the owner’s products with subsequent sales on behalf of the principal or one’s own;

- finding performers to perform a specific type of work or provide services ordered by the principal;

- concluding agreements with prospective buyers or sellers in the interests and at the expense of the principal.

Unlike standard bilateral transactions, a mediation agreement involves the involvement of a third party. For example, an agency agreement for the provision of legal services provides for the conclusion of another transaction between the customer and the law firm. As a result, the customer will pay for information, consulting or other legal services, and the agent will receive a fee for intermediary services in attracting a client.

Agent Summary

The agent organizes and establishes in the accounting policy the procedure for reflecting transactions and analytics for accounting for agency fees, settlements with the principal and his counterparties, and document flow for these transactions.

VAT for payment to the budget is calculated by the agent (if he does not use the simplified tax system) only on the amounts of the corresponding remuneration. To calculate income tax (tax under simplified taxation system), the agent takes into account only the agency fee in income, and his current expenses in expenses. In addition, all settlements in the interests of the principal are carried out in the agent’s accounting through account 76, without participating in the calculation of income, expenses and tax bases. And the assets of the principal transferred to the agent do not become his property; in accounting they are reflected in an off-balance sheet account.

The accounting records of the principal reflect separately transactions on agent remuneration and separately transactions on the purchase and sale of assets in which the agent is involved.

note

30 days are allotted to receive the principal’s objections in accordance with the Civil Code of the Russian Federation.

Documentation of such transactions depends on the type of agency contract, but according to the general principle, if an agent acts on his own behalf, then all primary documents and invoices for the main transaction are issued in his name, and he also transfers their certified copies to the principal for the latter to reflect transactions in your account. If the company acts on behalf of the principal, then the final documents are also drawn up on his behalf (in the person of an agent by proxy) and their originals serve as the basis for recording transactions in accounting.

Also, if the agency agreement provides, in addition to remuneration, compensation for the agent’s expenses incurred in the interests of the principal, copies of documents confirming expenses, including invoices, are attached to the corresponding report. Based on it and copies, expenses are reflected in the principal’s accounts.

Features and content of the agency agreement

You can count at least about 56 types of standard contracts for various situations. It is regulated by art. 1005 of the Civil Code of the Russian Federation.

Civil Code of the Russian Federation Article 1005. Agency agreement

1. Under an agency agreement, one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal. Under a transaction made by an agent with a third party on his own behalf and at the expense of the principal, the agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction. In a transaction concluded by an agent with a third party on behalf and at the expense of the principal, the rights and obligations arise directly from the principal. 2. In cases where an agency agreement concluded in writing provides for the general powers of the agent to carry out transactions on behalf of the principal, the latter, in relations with third parties, does not have the right to refer to the agent’s lack of appropriate powers, unless he proves that the third party knew or should have known about the limitation of the agent's powers. 3. An agency agreement may be concluded for a specific period or without specifying its validity period. 4. The law may provide for specific features of certain types of agency agreements.

The most difficult thing in the principal-agent-buyer scheme (conditionally) is accounting, the money transfer system, the calculation of interest or fees for real labor, the type of transactions and tax contributions. All this, under the general name “accounting”, should be very carefully described in the contract.

Both sides are interested in ensuring that cooperation is mutually beneficial and does not create problems. Therefore, before signing, it is important to read the text carefully and ask any questions.

When concluding an agreement with a large company, usually, in addition to the manager, there is also an accountant. It is he who will answer all questions regarding the implementation of the financial and material side of the matter. On average, apart from the specifics of a particular area, the form should contain standard items.

Key points of the agreement

The document states:

- subject of the contract and data of both parties;

- mutual responsibilities;

- the procedure by which remuneration will be made. This point should be especially carefully spelled out;

- responsibility;

- actions under force majeure circumstances;

- how disputes will be resolved;

- Peculiarities of changing or terminating the contract. This point is important - the agency agreement is concluded for a long time. The deadlines are determined by the participants;

- the final part indicates the articles of the law on which the contract is based, the conditions for the transfer of data from the agent to the principal, the terms of entry into force of the document and other points, the number of copies, etc.;

- All legal details are indicated on both sides. persons, addresses and passport details of the agent;

- The document is sealed with the signatures of the parties. Here you will learn how to sign a document with an electronic signature.

Why do you need an agent report?

A mandatory condition of the contract is the agent's report on the work done. The terms of provision are negotiated by the parties and depend on the specifics of the work. For example, for a large enterprise whose products are represented by an agent to potential clients, reports must be submitted monthly.

This is important, since in the Tax Code of the Russian Federation, a situation where a repeated contract is concluded with a person (legal entity, individual), with whom it was already concluded several months ago, is interrupted, and then the same one is concluded again, is regarded as a fraudulent act. We need strong evidence that contact with the object is possible only through an agent.

In such cases, the agent often explains the situation to the buyer and he decides what to do. In practice, such buyers contact the director of the enterprise directly or pay for purchases through the accounts of their friends.

Features of accounting for the principal

Let's consider the transactions when the agent sold the principal's non-residential real estate:

Debit 26, 91 Credit 60

— 1000 rubles – based on the agent’s response, the expenses for the agent’s remuneration are reflected;

Debit 19 Credit 60

— 180 rubles – based on the report and invoice, VAT on agency fees is reflected;

Debit 26, 91 Credit 60

— 300 rubles – based on the copies of documents attached to the agent’s report, notary expenses, fees, and appraiser services are reflected;

Debit 19 Credit 60

— 36 rubles – based on the attached report, a copy of the invoice from the appraisal organization reflects VAT on appraisal services;

Debit 68.2 Credit 19

— 216 rubles (180 + 36) – VAT is accepted for deduction;

Debit 60 Credit 51

— 1516 rubles – the agent was paid a fee and compensated for additional expenses;

Debit 62 Credit 90

— 11,800 rubles – at the time of transfer of ownership rights, proceeds from the sale of property are recognized;

Debit 90 Credit 68.2

— 1800 rubles – VAT accrued on the sale of property;

Debit 90 Credit 41 (01)

— 6,500 rubles – the cost of sold property is written off.

Thus, the principal has the following formed on OSNO:

- costs for calculating income tax on the services of an agent and compensation for his expenses;

- “input” VAT;

- tax base for VAT in terms of proceeds from the sale of property;

- tax base for income tax as the difference between income and expenses from the operation of selling property.

note

The agent organizes and establishes in the accounting policy the procedure for reflecting transactions and analytics for accounting for agency fees, settlements with the principal and his counterparties, and document flow for these transactions.

With the simplified tax system, accounting will be somewhat simpler. First, we generate income and expenses without charging VAT and including “input” VAT in expenses, or generally take into account only income from the disposal of property if we use only income as the tax base under the simplified tax system.

Participation in settlements

Let's consider another example when the agent sells the principal's goods and at the same time participates in the settlements.

Debit 45 Credit 41

— 20,000 rubles – goods are transferred to the agent for sale (act or TORG-12);

Debit 44 Credit 60

— 1000 rubles – based on the agent’s report, remuneration expenses are reflected;

Debit 19 Credit 60

— 180 rubles – based on the report and invoice, VAT on agency fees is reflected;

Debit 90 Credit 45

- 10,000 rubles - according to the report and copies of documents for the sale of goods, the cost of products sold is reflected;

Debit 62 Credit 90

— 17,700 rubles – based on the report and copies, sales revenue is reflected;

Debit 90 Credit 68.2

— 2700 rubles – VAT is charged on the sale of goods;

Debit 60 Credit 51

— 1180 rubles – the agent has been paid a fee;

Debit 51 Credit 62

— 17,700 rubles – funds received from the agent for goods sold.

Mediation services under contract

Each type of service follows a specific pattern.

Scheme No. 1. Simple mediation - searching for buyers of goods or services when the agent is an individual. face:

| Parties | Actions | |||

| Principal | Gives assignments, booklets, price list | Waiting for results | Sells goods and receives payment for them | Transfers a percentage or agreed remuneration to the agent's account. May gain a regular customer |

| Agent | Receives brochures, price list | Actively searches for buyers, advertises and convinces them of the need to purchase services/products | Brings the consumer to the manufacturer | Receives remuneration and incentive for further activities. If the client becomes a regular customer, he can receive a percentage of each purchase (if the agreement provides) |

| Consumer/Buyer | Does not yet know about the manufacturer and product | Interested in the product and wants to purchase | Buys goods and pays | May become a regular customer |

This is the simplest scheme, which is used by many organizations that need cheap but massive advertising.

The simplest example is a call center. For a tiny percentage, operators call mobile phone owners and offer their company’s services or products. According to this principle, the relationship between an actor and his agent, for example, develops.

More serious and complex scheme No. 2 – Agency services with sales.

It is carried out in two ways.

- The agent sells a product/service by indicating the principal's bank account. He, from each transaction or at the end of the month, based on the results of interest calculation, transfers the agent’s remuneration, minus taxes, to a bank card or account. You will learn how an individual entrepreneur can withdraw money from a current account in this article.

- It is beneficial for an agent to become an individual entrepreneur and have a personal or individual entrepreneur current account. He sells the product/service himself on his own behalf. Depending on the initial capital, an advance payment or payment is made after the buyer receives the goods. Interest on sales is calculated by the agent himself and remains on his account. The remaining amount is transferred to the principal. The agent pays taxes as an individual entrepreneur.

There is a third option, which is used by agents with extensive experience, developing a wide network of services as a legal entity.

Sample of filling out an agency agreement for the sale of goods.

Agency agreement to carry out actions to find buyers.

This scheme is used most often. The basis of network Internet sales, such as the Oriflame company, with the subsequent registration of an individual entrepreneur, is an agency agreement. Somewhat simplified to understand, mixed with a pyramid scheme.