FZ-54

Transition to online cash registers for UTII

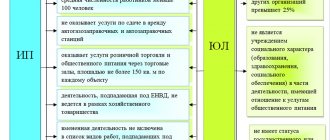

Previously, there was no legislative requirement for entrepreneurs and organizations to use cash register systems. However, after changes to the law on cash register technology came into force, all taxpayers were equal in their obligations to issue checks to customers and clients. According to Law No. 54 Federal Law, the transition to online cash registers for UTII

required for:

- Entrepreneurs who are payers of the single tax on imputed income (UTII).

- Organizations that are payers of UTII.

- Entrepreneurs who use the patent tax system.

You must start using the new type of cash register before July 1, 2021. Until this period, individual entrepreneurs and LLCs have the right to do without using such equipment. In this case, a mandatory condition is the issuance of a document confirming the receipt of funds to buyers and clients. Such a document can be checks or receipts. They must indicate:

- name of the product or service;

- number of goods purchased;

- cost of 1 unit;

- VAT rate.

For certain categories of entrepreneurs, other deadlines for transition to the new order have been established. This applies to individual entrepreneurs and LLCs whose activities are related to the sale of excisable goods. Separately, it is necessary to highlight entrepreneurs who are engaged in the retail trade of alcoholic products.

Time frame for installing online cash registers for UTII

In 2018-2019, cash register systems will connect retail outlets that use UTII or PSN as a tax system.

As previously planned, in 2021 all small business representatives were required to purchase a cash register. However, entrepreneurs asked to delay the transition date. According to 54-FZ, with the help of Federal Law No. 337-FZ of November 27, 2021, some owners of retail outlets will connect online cash registers in 2021, and the rest - in 2021.

From 07/01/2018 you are required to use online cash registers:

- catering organizations on OSNO or USN

- organizations on UTII when carrying out trading activities and providing catering services

- Individual entrepreneur on UTII or Patent when carrying out trading activities or providing catering services with hired employees.

- online stores when paying through the website using payment systems

- organizations and individual entrepreneurs with hired employees when trading through vending machines

From 07/01/2019 online cash registers will be connected

- organizations and individual entrepreneurs on the OSN and simplified tax system when providing services to the public (until July 1, 2021 they can issue BSO)

- organizations on UTII and individual entrepreneurs on UTII and PSN when providing services to the population

- Individual entrepreneur on UTII and PSN retail and catering without hired employees

- Individual entrepreneur on UTII and PSN without hired employees, when trading through vending machines

CCP reform

CCT reform is an integral part of the Federal Tax Service’s strategy for automated tax administration, which is aimed at creating the most convenient environment for citizens and businesses to communicate with tax authorities and ensuring an increase in revenues to budgets of all levels without increasing the tax burden.

This was reported in a report by tax officials prepared as part of recent public hearings.

The main objectives of the reform are:

— providing taxpayers who are users of cash registers with the opportunity to carry out all registration actions with cash registers and other legally significant document flow regarding the use of cash registers through the taxpayer’s personal account on the Federal Tax Service website;

— creation of modern tools for civil (popular) control in the field of CCP application;

— ensuring the transfer of information on calculations recorded and stored in the form of fiscal data in fiscal drives in electronic form to the tax authorities through the fiscal data operator (FDO) online and the creation of innovative tax administration tools.

Seminar “Reform of CCP. The Finish Line" will take place on December 13 in Moscow.

Experienced consultant M.A. Klimova will talk about changes in the law on cash registers and new requirements for the use of online cash registers.

Come!

Online cash register for sellers of beer and cigarettes on UTII

Beer and cigarettes have become excisable goods since 2021. Organizations and individual entrepreneurs cannot trade excisable goods on UTII, but in practice this is not the case at all. Representatives of the Federal Tax Service assume that there will be a letter from the Ministry of Finance that will give precise recommendations on this issue. Most likely, they will make an exception for this group of goods. But if we return to the timing of the transition to online cash registers, we recommend installing it before 07/01/2018 in order to avoid possible fines until the situation is clarified.

Online cash register receipt details for UTII

- LLCs on UTII or Patent are required to print the nomenclature on receipts.

- Individual entrepreneurs on UTII are exempt from printing nomenclature on checks until 2021, if there are no excisable goods on sale (cigarettes, beer and other products)

What needs to be done to make the transition?

The law not only stipulates the need to use online cash register systems, but also provides requirements for the new technology, the procedure for its use and the content of the checks that are issued by it.

Requirements for devices

A new type of memory module must be installed in the cash register - fiscal storage (FN) . It is designed to record and encrypt information about sales made, as well as further transmission to the Tax Service through the fiscal data operator (FDO) via the Internet. If the cash register is operated autonomously, then the FN only encodes and stores data.

Cash desks located far from communication networks in areas where no more than 10 thousand people live may not send information to the Federal Tax Service. The list of such settlements and localities is approved directly by the regions of the Russian Federation.

All cash registers that are not strictly intended for processing online payments must be equipped with a receipt printing device . In addition, the cash register must have the function of printing a QR code - this is necessary so that the user can personally check the purchase made on the Tax Service website. The QR code displays information such as the date and time of calculation, its amount and attribute, number and attribute of the fiscal document, and serial number of the financial fund.

Also, the cash register must be equipped with a built-in clock that displays the exact time. This is necessary to print on the receipt the real date and time corresponding to the time zone related to the address of the device’s location.

What should be on the check

The receipt must display the name of the product, the name of the serving cashier, the rate and amount of VAT and many other details specified in law 54-FZ (Article 4.7) . It is noteworthy that individual entrepreneurs under special regimes, if there are no excisable products in their assortment, may not print the names of goods and services and their quantities on receipts until February 1, 2021

Who can not use CCT?

- traders of bottled drinks from tanks: kvass, milk, etc.

- traders in markets, mobile stalls, fairs, etc.

- ticket sellers

- sellers of postage stamps, newspapers, etc.

- securities traders

- persons engaged in peddling trade

- watch, shoe or electronics repairers, key makers

- nurses, nannies

- people providing services for plowing gardens, etc.

- porters at train stations and airports

- people renting houses

Advances and sales

The organization received a 100 percent advance payment for the goods in cash from the buyer and issued him a cash receipt.

What to do when shipping goods against the advance received? You need to run another check, the Federal Tax Service explained.

Clause 1 of Article 4.7 of Federal Law No. 54-FZ defines the mandatory details that must contain a cash receipt, including the payment indicator (receipt of funds from the buyer (client) - receipt, return to the buyer (client) of funds received from him - return receipt, issuance of funds to the buyer (client) - expense, receipt of funds from the buyer (client) issued to him - return of expense).

In the case of full prepayment before the transfer of the payment item, you should punch out a cash receipt with the payment attribute “receipt” and the payment method attribute “Advance payment 100%”.

When shipping goods that have been paid in advance, the buyer is given a cash receipt with the payment attribute “receipt” and the payment method attribute “Transfer on credit.”

What are the penalties for not having an online cash register for UTII?

- absence of cash register - 75-100% of the amount received without a cash register - about 30 thousand rubles.

- repeated work without a cash register - closure of the enterprise for up to 90 days (with total revenue without cash registers of about 1 million rubles)

- refusal to present documents to the cashier upon request - a warning or a fine in the amount of 5-10 thousand rubles.

- the cash register does not meet the requirements of the law or is incorrectly registered - a warning or a fine of 5-10 thousand rubles.

- absence of a receipt or BSO - a fine of 10 thousand rubles.

Wrong VAT on the receipt

The individual entrepreneur on the simplified tax system noticed after the end of his shift that the check erroneously indicated 18% VAT.

What to do? In this case, you should punch out a cash receipt with the calculation sign “return of receipt”, indicating the amount of the check in cash or electronically, as well as the VAT rate and amount. Subsequently, you should enter a correct cash receipt indicating in the details “VAT rate” - “VAT not subject to.”

Such actions are provided for by methodological recommendations for the application of the Federal Tax Service order No. ММВ-7-20/ [email protected] “On approval of additional details of fiscal documents and formats of fiscal documents required for use.”

Online cash registers for UTII: review of models

Key Features

The Dreamkas Start online cash register is an ideal budget solution for retail stores and beer outlets who have a computer or laptop at the outlet. Free cash register software (software) and a fiscal registrar is all you need to start operating a retail outlet according to the rules of 54-FZ and EGAIS 171-FZ

- full compliance with 54-FZ

- receipt tape width 57 mm

- presence of an auto-cutter

- ability to connect a 2D barcode scanner

- small dimensions

| Online cash register Wiki micro – an excellent option at a competitive price, which is suitable for outlets specializing in the sale of beer and alcohol. Key Features:

|

| Online cash register LiteBox 5 – an interesting model with a convenient touch screen that works without recharging for 10 hours. Main characteristics:

|

| Smart terminal Evotor 5 – ideal solution for courier service Main advantages

Evotor online cash registers are smart terminals with a built-in fiscal recorder, suitable for small and medium-sized retail spaces. |

Main advantages

- acceptable price

- touchscreen

- adding and storing product range

- maintaining basic inventory records

- Availability of a cloud product database

- possibility of connecting scales, bank terminals, etc.

Acceptance of “cash” for reimbursement

Renters of the company's vehicles deposit cash into its cash desk as compensation for payment of amounts for traffic police fines in case of violation of traffic rules by the client.

Is it necessary to use CCT? No, the Federal Tax Service responded.

Considering that the acceptance of funds as compensation for losses caused does not constitute the acceptance or payment of funds for goods sold, work performed, services provided for the purposes of Federal Law No. 54-FZ, the specified acceptance of funds does not require the use of cash register systems.

In this case, when cash is posted to the organization's cash desk, a cash receipt order is issued.

Do you need an online cash register for UTII? Question-answer block

When does the transition for UTII take place?

Enterprises on UTII can operate without a cash register until July 1, 2021 or July 1, 2021. However, upon the client’s request, they are obliged to issue the client a document confirming payment: a sales receipt or a receipt.

What document should you issue to clients if you work without a cash register?

If you offer services, issue BSO. If your company specializes in the sale of goods, issue a sales receipt or receipt according to the old rules.

Can organizations on UTII sell alcoholic beverages without a cash register?

No. From July 1, 2021, all alcohol dealers use cash registers and use them to record sales in the Unified State Automated Information System.

You can buy an online cash register for UTII from the Multikas company at a low price in St. Petersburg, Moscow. We offer delivery throughout Russia. Professional engineers will help you choose the cash register model required for your enterprise, and will also provide assistance in its installation and connection.

Documents for registering an online cash register with the Federal Tax Service

If you want to personally submit an application to the Federal Tax Service, do not forget to take the following documents with you:

- Passport of the online cash register that you will register

- Passport of the fiscal data storage device

- A document that reflects information about your powers

It is unlikely that you will be asked for them, but they will be useful to you when filling out the documents. There is no territorial connection to a specific tax authority; any Federal Tax Service can accept the application.

The cash register registration card will be prepared within 5 working days after the application is accepted by the inspectorate.

Trade in non-food products under UTII

In April 2021, the government approved a list of non-food products that cannot be sold without cash registers. The ban applies to all trading territories. CCP will have to be used when selling such goods not only in stores, but also in retail markets, fairs and exhibition complexes. The type of taxation and form of organization do not provide for any concessions, therefore this prohibition also applies to UTII.

When should you start using the cash register when selling goods from the list? According to the letter of the Federal Tax Service dated April 28, 2021 N ED-4-20 / [email protected] , “imputed” persons need to comply with this resolution from July 1, 2018.

Scroll

| 1. Carpets and rugs |

| 2. Clothing, except: underwear, handkerchiefs made of textile materials, except knitted or knitted, knitted or knitted hosiery |

| 3. Leather and leather products, except: parts of shoes made of leather; insoles, heel pads and similar products; gaiters, gaiters and similar products and their parts. |

| 4. Wood and wood products and cork, except furniture; products made of straw and weaving materials, except: wooden dining and kitchen utensils; basketry and wickerwork |

| 5. Chemicals and chemical products |

| 6. Medicinal products and materials used for medical purposes |

| 7. Rubber and plastic products |

| 8. Other non-metallic mineral products |

| 9. Computer, electronic and optical equipment |

| 10. Electrical equipment |

| 11. Machinery and equipment not included in other groups |

| 12. Vehicles, trailers and semi-trailers |

| 13. Transport means and equipment, other |

| 14. Furniture |

| 15. Musical instruments |

| 16. Sports goods, except: items of equipment for fishing tackle and rods; artificial baits and their equipment. |

| 17. Orthopedic devices |