What are shipping costs

Transport costs represent the totality of the company's costs associated with organizing the transportation of goods. At the same time, they can include any types of services that ensured the arrival of the goods at their destination intact and safe, in particular the services:

- for loading/unloading;

- on completing documentation at customs (if the goods cross the border of the Russian Federation);

- storage;

- insurance;

- and other similar operations.

Trading companies face transportation costs everywhere.

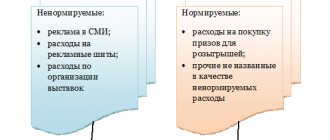

There are two types of costs under consideration:

- related to the transportation of purchased goods,

- incurred during transportation of sold goods.

Based on each type of service, companies resort to different options for organizing accounting. The basic rules for recording such transactions from 2021 are regulated by FAS 5/2019 “Inventories” (until 2021, PBU 5/01 “Accounting for Inventory”).

ConsultantPlus experts spoke in detail about the innovations in the accounting procedure for inventories introduced by the new FSBU 5/2019. If you do not have access to the K+ system, get trial online access for free and proceed to the material.

How can you estimate transport costs?

Transport maintenance includes the following types of expenses:

- expenses for fuel and lubricants;

- expenses for the purchase of spare parts for the vehicle;

- vehicle repair costs;

- insurance costs (CASCO, OSAGO);

- parking costs.

Transport maintenance costs can be taken into account as follows:

| Expenses | A comment | Normative act |

| Expenses for fuel and lubricants* | Other costs associated with production | Art. 264 Tax Code of the Russian Federation |

| Direct expenses | letter of the Ministry of Finance of Russia dated June 10, 2011 No. 03-03-06/4/67 | |

| Purchase of spare parts and vehicle repairs** | Indirect costs | Art. 260 Tax Code of the Russian Federation |

| OSAGO insurance | Indirect costs | Art. 263 Tax Code of the Russian Federation, art. 272 Tax Code of the Russian Federation |

| CASCO insurance | other expenses | Art. 263 Tax Code of the Russian Federation |

| Parking*** | Indirect costs | Art. 264 Tax Code of the Russian Federation |

| Vehicle rental**** | Other expenses – expenses associated with production and sales. Direct expenses – the vehicle is used for its main purpose. Indirect costs - administrative staff services | Art. 264 Tax Code of the Russian Federation |

| Use of employee transport | Indirect costs | Art. 317 Tax Code of the Russian Federation |

* If the vehicle delivers goods to customers, the cost of fuel and lubricants is included in material costs, and if the vehicle transports employees, the cost of fuel and lubricants is included in other expenses and indirect costs.

** Costs for vehicle repairs are made on the basis of the following documents:

- certificate of completion;

- invoice;

- payment documents;

- estimate;

- invoice for the release of spare parts from the warehouse;

- act of writing off worn-out spare parts.

*** Parking costs can be taken into account if you have the following documents:

- parking receipt;

- cash receipt;

- sales receipt;

- the act of providing services;

- car rental agreement.

**** Cost accounting is carried out on the basis of the following documents:

- contract;

- payment documents;

- acts of acceptance and transfer of the vehicle;

- waybills.

If, according to the terms of the company, an employee must use a personal car to perform his official or work duties, the employer must reimburse the costs of maintaining the vehicle. In accordance with Art. 264 of the Tax Code of the Russian Federation, in this case, the employer has the right to write off expenses, but with some restrictions:

| Vehicle | Amount of expenses (rub. per month) |

| Passenger cars with engine capacity up to 2000 cc inclusive | 1200 |

| Passenger cars with engine capacity over 2000 cc inclusive | 1500 |

| Motorcycles | 600 |

Which account should I use to record the transportation costs of purchased goods?

Accounting for transportation costs for purchased goods can be carried out in one of the following ways:

- by including them in the actual cost (clause 11 of FSBU 5/2019, until 2021 - clause 6 of PBU 5/01);

- reflected in selling costs (clause 21 of FSBU 5/2019, until 2021 - clause 13 of PBU 5/01).

In this case, the selected option must be specified in the accounting policy.

Important! Explanations from ConsultantPlus Do not include in the actual cost of goods the costs of storing them after they arrive at the organization’s warehouse, as well as other costs that are not necessary for the purchase of goods (clauses “c”, “d” of paragraph 18 of FSBU 5/2019). Read more in K+. Trial access to the system can be obtained for free.

For specifics of accounting by trade organizations, see the publication “Trade of goods with and without VAT (nuances).”

Example 1 (delivery included in price)

The main activity of Oval LLC is the wholesale sale of furniture. In March, the LLC purchased furniture in the amount of 660,800 rubles. (including VAT RUB 110,133.33). Delivery — 53,100 rub. (including VAT RUB 8,850) - accounting at actual cost on account 41 “Goods”.

Oval LLC reflected:

- Dt 41 Kt 60 - cost of furniture - 550,666.67 (660,800 −110,133.33) rub.

- Dt 19 Kt 60 — VAT on goods — RUB 110,133.33.

- Dt 41 Kt 60 — delivery — 44,250 (53,100 – 8,850) rub.

- Dt 19 Kt 60 - VAT allocated on transportation of 8,850 rubles.

Example 2 (delivery - selling costs)

Operations from example 1, however, transport costs are accounted for separately using account 44 “Sales expenses”.

Records of Oval LLC:

- Dt 41 Kt 60 - cost of furniture - 550,666.67 (660,800 −110,133.33) rub.

- Dt 19 Kt 60 — VAT — RUB 110,133.33.

- Dt 44 Kt 60 - transportation costs - 44,250 (53,100 - 8,850) rub.

- Dt 19 Kt 60 — VAT on transportation services — RUB 8,850.

When self-pickup of goods, the costs considered may include the following costs:

- according to the salary of the employee who delivered the goods;

- on insurance contributions from wages;

- for the purchase of fuel;

- depreciation charges for the car;

- other expenses.

It should be noted that the costs of transporting goods, collected in a separate account, are subject to monthly distribution, based on sales indicators and the balance of goods. The method of distribution of these expenses is reflected in Art. 320 Tax Code of the Russian Federation. Based on the provisions of this norm, the amount of transportation costs that can be written off at the end of the reporting period is determined by the formula:

TPop = TRnm + TRm – Trot,

Where:

TPop - transportation costs to be written off for the current month;

ТРм — delivery costs for the current month;

TRnm - the balance of transport expenses at the beginning of the month (debit balance of account 44);

Trot - transportation costs attributable to the balance of goods at the end of the reporting month.

Trot is calculated using the formula:

Trot = STot × Av%,

Where:

STot - the cost of the balance of goods at the end of the reporting period (debit balance account 41);

Av% - the average percentage for determining the amount of expenses related to the balance of goods.

The average percentage can be calculated using the formula:

Av% = (TRnm + TRm) / (STm + STot) × 100%,

Where:

TRnm - the balance of transport expenses at the beginning of the month (debit balance of account 44);

TRm - transportation costs for the current month;

STm - cost of goods sold per month;

CTot is the cost of unsold goods.

Established amount of payments

Labor legislation does not limit the amount of compensation payments, so this issue is resolved individually between the employer and employee.

The main provisions on this issue are fixed by the internal acts of the enterprise and the terms of the employment agreement. When taxing, compensation for costs associated with the use of vehicles is included in the item “other expenses” and cannot exceed the following values:

- motorcycles - 600 rubles;

- cars with an engine capacity of up to 2 liters - 1,200 rubles;

- cars with an engine capacity of more than 2 liters - 1,500 rubles.

Amounts are indicated for a billing period equal to one calendar month.

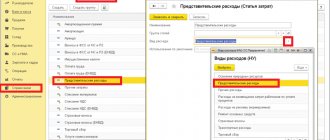

Example

Let’s imagine a situation where sales representative Ivanov entered into an agreement with the manager for the use of personal vehicles for the needs of the enterprise. The terms of the agreement are as follows:

- compensation for car operation - 5,000 rubles monthly;

- payment for fuel and lubricants at the rate of 7 rubles per 100 km.

During the month of work, Ivanov traveled 800 kilometers. In this case, he is entitled to:

- 5,000 - 1,200 = 3,800 rubles for operating the car;

- 7 * 800: 100 * 45 (average price of a liter of fuel) = 2,520 rubles compensation for fuel and lubricants.

How to reflect transportation costs of goods sold in accounting

Transportation of sold goods also has various options for recording.

Some buyers may carry out the delivery themselves, then the supplier does not need to take into account transport costs due to the fact that they do not arise in such a situation.

A large number of contracts provide for the transportation of goods by a supplier or intermediary. Features of accounting for such transactions depend on the delivery conditions that were provided for in the contract between the counterparties:

- delivery may “sit” in the price of the product,

- The cost of delivery is stated as a service separate from the sale.

Example 3 (delivery included in price)

Oval LLC sold furniture in April; revenue, including delivery, amounted to 885,000 rubles. (including VAT RUB 147,500). LLC delivery costs - 59,000 rubles. The purchase price of the goods sold is RUB 560,000. In the same month, the LLC purchased furniture in the amount of RUB 236,000. (including VAT RUB 39,333.33). The amount of transportation costs for the purchase of goods amounted to 35,400 rubles. (including VAT 5,900 rubles), balance on account 44.1 as of 04/01/2019 is 160,000 rubles, balance on account 41 as of 30/04 is 260,000 rubles. Please note that transportation costs for purchased goods are reflected in account 44.1, and for goods sold - in account 44.2.

Postings in the seller's accounting:

- Dt 62 Kt 90.01 - sale of furniture - 885,000 rubles.

- Dt 90.03 Kt 68.02 - VAT charged RUB 147,500.

- Dt 90.02 Kt 41 - write-off of the cost of furniture sold - 560,000 rubles.

- Dt 90.02 Kt 44.2 - write-off of transportation costs - 59,000 rubles.

- Dt 41 Kt 60 - cost of furniture - 196,666.67 (236,000 - 39,333.33) rubles.

- Dt 19 Kt 60 — VAT — RUB 39,333.33.

- Dt 44.1 Kt 60 - transportation costs - 29,500 (35,400 - 5,900) rub.

- Dt 19 Kt 60 — VAT on transportation services — RUB 5,900.

Let's determine the amount of transportation costs for purchased goods to be written off in April, taking into account the above formula:

Average percentage of expenses for remaining goods = 23.11% ((160,000 + 29,500) / (560,000 + 260,000) × 100).

The amount of transportation costs for the remaining goods = 60,086 rubles. (260,000 × 23.11%).

Amount of transportation expenses to be written off = RUB 129,414. (160,000 + 29,500 – 60,086)

Dt 90.2 Kt 44. 1 - expenses for transporting purchased goods were written off in the amount of RUB 129,414. This amount will be taken into account as expenses when calculating income tax.

Example 4 (delivery is taken into account as furniture sold in April, revenue amounted to 826,000 rubles (including VAT 137,666.67 rubles). The LLC carried out the delivery on its own, expenses for it amounted to 59,000 rubles, of which salary driver - 40,000, insurance premiums - 12,000, fuel - 7,000. Delivery under the contract is paid by the buyer separately. To reflect revenue from the sale of transport services, LLC uses account 90.04.

- Dt 62 Kt 90.01 - revenue from the sale of furniture - 826,000 rubles.

- Dt 90.03 Kt 68 - VAT charged RUB 137,666.67.

- Dt 90.02 Kt 41 - write-off of the purchase price of 560,000 rubles.

- Dt 44 Kt 70 - transportation costs - driver's salary 40,000 rubles.

- Dt 44 Kt 69 - transportation costs - insurance premiums 12,000 rubles.

- Dt 44 Kt 10 - transportation costs - fuel 7,000 rubles.

- Dt 62 Kt 90.04 - revenue from delivery of goods to the buyer - 59,000 rubles.

- Dt 90.03 Kt 68 - VAT charged on delivery services - RUB 9,833.33.

- Dt 90.02 Kt 44 - write-off of transportation costs - 59,000 rubles.

Topic 7. costs of a transport enterprise. cost price

Otherwise, it will be difficult to divide expenses into those that are related to the cost price and those that are not related to it.

- If the economic effect of attributing the costs of own transport to the cost price is higher than the time spent on it.

Here it would also be useful to consult with the accounting department. Why do we need fundamentally significant differences between the procedure for accounting for transportation costs in accounting and management accounting? Often this is completely unjustified.

- Transport costs for delivery of goods related to commercial expenses.

This is the most interesting group. Most often, mistakes occur when making a decision to assign transport costs to the first group discussed above and to this group.

Results

Costs represented by transportation costs are encountered by any business entity, especially a large share of them falls on organizations engaged in trading activities.

To account for such expenses, it is very important to correctly draw up an accounting policy, from which the main points for reflecting this type of costs follow. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Posting examples

The company sold products worth 900,000 rubles. VAT amounted to 150,000 rubles. The purchase price of the products was 700,000 rubles (VAT – 100,000 rubles). Transportation costs are 20,000 rubles. Let's look at the main wiring:

- Purchase of products by the seller: DT19 KT60, DT68 KT19 100,000 rubles.

- Purchase of products by the buyer: DT62 KT90-1,900,000 rubles, DT90-3 KT68 150,000 rubles.

These postings are relevant when the seller contacts intermediary companies.

The cost of freight transportation in the estimate

When drawing up estimates for construction and installation work financed from the federal or municipal budget, collections of estimated prices for the transportation of goods by road are required. These collections were developed in databases based on the price level for 2001 (FER, TER, etc.) and are translated into the current level through indexation.

However, in the calculations between the Customer and the Contractor, the actual costs of transporting goods at current market prices in a particular region can be used, but this is only possible if there is no competitive type of transportation in the price collections or this type of work is financed from a non-state budget. In these cases, a calculation is also drawn up justifying the actual transportation costs.

The procedure for calculating estimated prices for the transportation of goods by road in 2021 is determined by Order of the Ministry of Construction of Russia No. 517/pr dated September 4, 2019 “On approval of Methodological Recommendations for determining estimated prices for materials, products, structures, equipment and prices of services for the transportation of goods for construction » section 3.

This order explains in detail how to correctly and accurately calculate the cost of transporting goods by road, depending on the class of cargo, types of vehicles, transportation distance and types of roads along which transportation is carried out.

Questions and answers

- An employee working on official transport was issued a fine for violating traffic rules. What expenses can we attribute them to?

Answer: the costs of paying a fine for violating traffic rules cannot be classified as any expenses - they cannot be taken into account in tax reporting.

- For the use of personal transport, the employee is paid 8,000 rubles monthly as compensation. Can we take all 8,000 rubles into account in transportation costs?

Answer: Based on Art. 264 of the Tax Code of the Russian Federation, you can write off expenses as follows: for passenger cars with an engine capacity up to 2000 cc inclusive - 1200 rubles per month, for cars with an engine capacity over 2000 cc inclusive - 1500 rubles per month.