Regardless of the purpose of the payment - state duty, fine or tax - banking institutions and terminals are required to fill out the UIN column. This detail helps the system automatically determine the payment and who it is intended for. For state duties, as for other types of payments, a personal identifier is provided, consisting of a unique digital set. If the payer does not know what a UIN is when paying state duty or does not have its exact meaning, we recommend checking the combination with the payee.

What is UIN?

UIN is an abbreviation that stands for “Unique Accrual Identifier”. As of 2021, the use of UIN is regulated by Order of the Ministry of Finance No. 107n “On approval of the Rules on the approval of orders for the transfer of funds to the budget system of the Russian Federation.”

Reference! The UIN was used until 2014, when the Order of the Ministry of Finance came into force. The new law only introduced minor adjustments to the use of the identifier and its placement on receipts.

UIN is a payment detail that consists of 20 or 25 characters, although in some payment orders 23 free cells are left, where the first three are for the lettering of the abbreviation (UIN). The value is digital, but in some cases it is possible to generate an alphanumeric code where Russian or Latin letters are used.

UIN is used only for payments to the account of budgetary organizations. This unique number is assigned to each transaction to track the payment of a specific payment.

Example. A citizen needs to pay a transport tax. He receives a corresponding notification from the Federal Tax Service with the specified UIN. A citizen pays tax at the bank. The UIN from the notification is duplicated in the generated payment slip. When the money arrives at the account of the local Federal Tax Service department, the system automatically checks the payment UIN with the data from the mailing and marks the payment.

Thanks to the UIN, the payment system has become fully automated. The human factor and any possible errors are excluded.

When to specify a unique payment identifier

Cases when affixing the UIP code in a payment order is mandatory are listed in the aforementioned Regulation on the Rules of Money Transfers No. 383-P of the Bank of Russia. In accordance with this document, the UIP is included in the payment if it has already been assigned by the recipient of the funds. And the assignment of a UIP to a payment is possible in 2 cases:

- The identifier is assigned to the payment by the recipient of the funds, and he is obliged to provide this information to the payer in accordance with the agreement. In this case, the recipient’s bank, on the basis of a banking service agreement, can control the correctness of the reflection of the UIP in the order for the transfer of funds (for example, when paying for government services to the payer, including an individual, the UIP is reported to transfer funds).

- When an obligated person pays contributions to extra-budgetary funds and taxes on the basis of a demand for payment. The UIP code is reflected in the requirement and is required to be included in the payment order.

When transferring sums of money, the UIP is indicated on the payment slip only when it is known to the payer. If there is no information about this detail, then put “0” in field 22, since it is unacceptable to leave it blank. The bank will not accept payment orders with unfilled mandatory details.

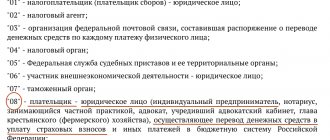

For groups of taxpayers such as individual entrepreneurs, lawyers, notaries, farm managers, etc., there are some special features when filling out the details for 22 payments. When transferring funds to the budget in the payment order, they indicate:

- or your TIN in the “Payer TIN” field;

- or UIP in the “Code” field.

If the document contains a TIN, then a zero is entered in the “Code” detail. In such cases, banks do not have the right to require simultaneous completion of both details, as happens in some cases. Explanations on this issue are given in the letter of the Federal Tax Service No. ZN-4-1/6133 dated April 8, 2021.

Also see “UIN in payment orders: sample”.

How to find out the UIN for payments to the budget?

The UIN is used only to identify budget payments. These include:

- taxes;

- state fees;

- fines;

- fines;

- fees, etc.

You can find out the code from the notification receipt sent by the relevant organization. If the receipt has not arrived, you can personally visit the regional department of the Federal Tax Service and clarify this information at the reception. A corresponding receipt with all details, including UIN, will be printed for the visitor.

Below we will discuss in detail examples of where to get a UIN for specific situations.

ATTENTION!

UIN is a dynamic value. This means that the receipt for payment of fees for the Pension Fund for January and February will have different values, even if the recipient is the same.

Unknown UIN for state duty

The abbreviation “UIN” means Unique Accrual Identifier. In the payment document, its value ranges from 20 to 25 digits and is entered in the “Code” column:

The main need for the identifier in question is among bank employees and Treasury employees. Knowing the exact code allows you to make a payment for its intended purpose without confusing it with another addressee and/or reason. This is where the name itself comes from - UIN. Since the combination of numbers is unique, it protects against errors when filling out a payment document and guarantees that funds are sent to their destination.

If the UIN for the state duty is unknown to the payer, the bank or terminal may not accept such a payment due to the lack of correctly entered data. There are several options for the development of events:

- Find out the identifier from the payee or a bank employee, if possible.

- Enter the number “0” (zero) in the “Code” column, on the basis of which the payment can be credited using other details - address, current account, BIC, etc.

- Leave the “Code” column empty (the riskiest choice).

If there is no effect from one of the listed actions, the payer can perform them all one by one until he gets the result. The best option is still to fill the column with the current identifier, since leaving it empty or with the value “zero”:

- the payment may be mistakenly transferred to another organization;

- will be rejected altogether.

Also see “Procedure for generating UIN for payment orders”.

UIN code in a payment order: what is it?

In the section “What is a UIN” we have already discussed the definition of a unique identifier and the purpose of this code. This chapter will examine the UIN compilation system in more detail.

A unique accrual identifier is generated automatically for each payment that is created by the budget authority. But this set of numbers is not completely random. It consists of blocks where certain information is encrypted. Here is an analysis of the UIN of the State Inspectorate for Real Estate, indicated on the Mos.ru portal:

- The first character is M, the same for all payment orders of the State Inspectorate for Real Estate;

- Characters 2-7 - recipient code, i.e. State inspectorates;

- Symbols from 8 to 20 are a unique payer code that is generated automatically for each transaction.

In the case of payment of traffic fines, information about the protocol of the offense and the date is “embedded” in the block with the payer code. However, this does not mean that the UIN can be calculated independently.

Reference! Different budget organizations draw up their own protocols for creating UIN, so the section by blocks may not correspond to what is stated.

How to find the UIN in the traffic police resolution?

Similarly, a unique identifier will be required to pay an administrative fine for violating traffic rules. In the traffic police resolution, the UIN function is performed by the 20-digit number of the resolution itself. It can also be found on the fine payment receipt, which the traffic police sends by mail, including if the violation is recorded by cameras. There, the 20-digit code is indicated in the “Resolution” detail.

In some old-style receipts, the identifier is directly indicated - UIN. There is also a receipt format where the UIN is indicated in the “Code” column.

In relation to traffic police fines, payment by UIN is also available - through the State Services website. It is enough to enter a 20-digit code, and the system itself generates the accrual, details and the required amount for payment. All that remains is to pay the fine online.

Decoding the number of the traffic police fine

For an example of decryption, let’s take UIN No. 18810064170502666274, where:

- 188 – code of the revenue administrator, traffic police;

- 1 – department code, traffic police;

- 0 – payment code;

- 0 – the decision was made on printed form. If “1” is indicated, then the resolution is generated automatically from the camera, if “2” is typed on a PC and printed on a printer, if “3” is drawn up manually, “4” is issued by the court;

- 64 – region code;

- 17 – year in which the protocol was drawn up;

- 0502 – month and date;

- 66627 – serial number of the resolution;

- 4 – category UIN.

Where can I get a UIN for payment orders to organizations?

The use of UIN for a payment order by a legal entity is regulated by Order of the Ministry of Finance No. 107n. And the Rules cover several situations:

- payment of current taxes;

- payment of non-tax contributions.

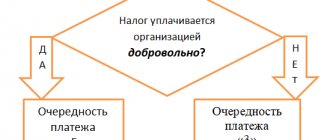

In the first case, the UIN is not generated. The order of the Ministry of Finance does not have clear instructions in this regard, therefore there is an official clarification from the Federal Tax Service, which states that when forming tax payments, legal entities do not receive a UIN and do not indicate it accordingly. The “Code” field is set to 0.

For non-tax transfers to budgetary organizations, the standard rules from Appendix No. 2 to the Order of the Ministry of Finance apply. If a payment order generated by a government agency has a UIN, it is duplicated by the payer in the details. If a field with a UIN is missing (missing) in the payment, 0 is entered in the corresponding block.

What if field 22 in the payment slip is not filled in?

A generated payment slip with field 22 empty will not be processed by the bank. He will return it without execution, and indicate the reason as “Field 22 is not filled in.”

Important! If the subject does not know the UIN, then it is enough to put “0” in this field. This will not be considered a violation. However, the subject must understand that such a payment will take longer to process if the order had a completed UIN.

This may lead to arrears in payment for a certain time, the accrual of penalties, litigation with a bank, government agency, etc.

Help us promote the project, it's simple: Rate our article and repost!

(

2

ratings, average:

5,00

out of 5)

UIN for individual entrepreneurs: where to get it

The status of an individual entrepreneur is viewed from different angles in different legislative acts. Most often, it is placed in a separate category along with individuals and legal entities. However, in the Order of the Ministry of Finance, individual entrepreneurs are not included in a separate category, therefore they are automatically equated to organizations, this means:

- When paying taxes on behalf of an individual entrepreneur, a UIN is not required;

- when listing other types of fees, the UIN is indicated if it is formed by a budget organization and is indicated in the notice.

Note! An individual entrepreneur pays taxes separately both as an individual entrepreneur (organization) and as an individual.

UIN: where to get it for individuals

As in the case of legal entities and individual entrepreneurs, a citizen can find all the necessary details for payment to budgetary organizations in the payment receipt, which is generated by the relevant government agency.

But there is also a difference. An individual also uses the UIN when paying taxes. Below are examples of where the UIN is located in payments and other ways to obtain it, including tax fees.

ATTENTION!

The main and practically the only way to obtain a UIN is by payment. It is sent to the place of registration of the citizen along with the rest of the mail. Therefore, it is important to change your registration in a timely manner and enter correct data into the database of budgetary organizations about your place of residence.

UIN on the receipt: what is it?

There is one difficulty when searching for UIN - it may have a different name on different receipts. The abbreviation UIN is not always used; the notice may state:

- document index (at the top of the form above the barcode with the payment number or on the tear-off block above the payer information);

- code (on the right side of the payment card in the block with other details).

The relationship between the document index and the UIN is quite complex. These are not different names for the same identifier. Most receipts with an index are payments for utility services. The index here serves the same purpose as the UIN, but it is a different system that uses its own algorithm.

Where can I get the UIN to pay the state duty?

UIN is a convenient payment identifier, but it is not always used to pay state fees. It was previously said that citizens mainly receive UIN from receipts and notifications. But to pay the state duty, a payment order is not always generated. Typically, this requires a personal visit to a budget organization and a requirement to issue a receipt for payment.

Even in such cases, the citizen can only be provided with general details, without creating a unique identifier. However, if an individual receipt is created, then it will definitely contain a UIN.

Where can I get a UIN to pay a fine?

The number of the decision on the offense and the UIN for paying the traffic police fine usually coincide. If you have a resolution on hand, you can see the number next to the barcode, i.e.:

- top line of the document;

- the bottom block of the receipt with payment details, but the barcode is located above this block.

Although the UIN for the resolution (and its number) are generated automatically, they usually consist of the exact time and date the offense was recorded. Those. If desired, you can compose it yourself. This applies to protocols that are compiled on site, since their numbers do not correspond to the identifier number.

The UIN for fines is formed according to one formula 188 1 1 AA ВВВВВВВВВВВВВ С, where:

- AA - date of offense;

- B...B - number of the protocol or other document about the offense;

- C is a symbol to exclude 2 identical UINs.

Although it is possible to compile a UIN using this formula, it is problematic. Therefore, it is better to look for details in the receipt or decree.

Where can I get the UIN when paying taxes?

To transfer taxes, individuals receive a receipt indicating the amount and purpose of payment with all the necessary details. A citizen can receive such a notice:

- via Russian Post (to the mailbox at the place of registration);

- in your personal account on the Federal Tax Service website.

To receive a notice in the LC on the Federal Tax Service website, you must register. If you have a confirmed account on the State Services portal, you can log in (even without prior registration on the tax service website) using it. The electronic notice can be printed for convenience. The advantage of an electronic receipt is that it always arrives on time.

There is a practice when, after registering on the Federal Tax Service website, the taxpayer stops receiving paper receipts by mail. You can write an application to resume mailing at your place of registration at the regional department of the Federal Tax Service.

The taxpayer does not have to wait for a notification with details. You can pay taxes and create a payment slip directly on the tax service website. When you select payment “By details”, the UIN will be generated automatically and “attached” to the online receipt.

What's the problem and what to do

Very often, tax authorities send an enterprise/individual entrepreneur a resolution or demand for payment of arrears, penalties, or fines. And the UIN is indicated in it. However, when filling out the payment at the bank, it turns out that there is no such field, but there is a field for the UIP. So, UIN and UIP are the same thing?

In practice, in a decree for a tax or other payment, it is usually the accrual identifier that is indicated, and when you see the payment slip in front of you, there is no detail with the accrual identifier, but only the payment identifier. What should I do?

This is interesting: Russian healthcare hotline around the clock

It’s been a long time since you have to worry about where to get the UIP/UIN. It is necessary to indicate the UIN in the order for payment. To do this, you need to transfer the value of the UIP field from the resolution.

The computer programs that most accountants work with have long since not given much importance to the difference between UIN and UIP. Many of them have already replaced the field in question with a general one called “Payment ID”.

The main thing is that the UIP/UIN code in 2021, when generating a payment order, has a unique composition of symbols. This will allow the money not to get stuck in the payment system and reach the recipient on time. And the most important thing: the administrator of this payment (for example, the Tax Service of the Russian Federation) will understand exactly what debt to the treasury or sanction is covered by the funds sent by the person.

The code field in question has the format for filling out the UIN as follows: it should be 20 or 25 characters. In this case, there cannot be only zeros. If there is no code, put one sign “0” (zero).

When transferring amounts of current taxes, fees, and insurance premiums calculated by the payer independently, their additional identification is not required. In this case, the identifiers are KBK, INN, KPP and other details of payment orders. In field 22 “Code” it is enough to indicate “0”.

- cannot refuse to execute such an order;

- does not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service dated 04/08/2016 No. ZN-4-1/6133).

As for the UIP, it is only 20 characters. It must be reflected in the payment if 2 conditions are met (clause 1.1 of the instruction of the Central Bank of the Russian Federation dated July 15, 2013 No. 3025-U):

- If it is installed by the recipient of funds.

- Its value is communicated to the payer.

Accordingly, when this payer identifier is unknown at the time of money transfer, you can leave the field empty.

If you find an error, please select a piece of text and press Ctrl+Enter.

Is it possible to come up with a UIN yourself?

To create a UIN, budgetary organizations have their own protocols and systems. This means that the details can only be created by the payee. The “expected” payment is registered under this number. And if it does not arrive, the system will automatically start counting the delay.

The payer does not have the opportunity to independently come up with a UIN. If you write a random set of numbers in this column in the payment slip, in the best case scenario, the money will be returned to the sender. At worst, the funds will remain in the system. However, they will not be transferred to the budget organization and it will be difficult to return them to the recipient.

There are no services or catalogs on the Internet where you can view your UIN for payment. The only option is to independently draw up a UIN to pay the traffic police fine. The standard scheme applies here, described in the corresponding section of the article.

What needs to be done if the UIP was entered incorrectly

When making a payment, it may be discovered that the UIP code was not entered in the required column. In this case, you can carry out the payment transaction further, and leave the space for the code either empty or fill all fields with zeros.

However, there are situations such that the UIP code indicated in the column was initially entered incorrectly, and this happened due to the negligence and inexperience of the financial employee of the structure. In such a situation, the following steps must be taken:

- Re-enter the correct code and repeat the payment;

- It is necessary to draw up and send a statement that it is necessary to return the funds sent by mistake in order to transfer them to another financial institution. It is also necessary to write an application to a government agency;

- Indicate the card number or other bank details where the funds sent by mistake will need to be returned.

However, this refund formula is not universal. Most often, you have to start from what the payment was and for what financial structure it was originally intended.

Fresh materials

EVERYTHING CONCERNING THE COMPANY BURMISTR.RU CRM system KVARTIRA.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSRESISTER AND CONDUCTING…

Traffic police fines - check and pay Photos and videos of rule violations Along with the fine you...

Tax planning in an organization Tax planning can significantly influence the formation of the financial results of an organization,…

Is it possible to use one UIN for different payments?

For each payment, the system generates a unique identifier. Even if the payments themselves came from the same budget organization, the UIN will be indicated in them differently. The same applies to the time period, i.e. UIN for paying taxes for 2021 and 2021 are different details. And you cannot pay taxes for the new billing period using the old UIN. This is equivalent to a self-invented UIN - it will lead to an error and money hanging in the system.

If the UIN is not included in the new receipt, you must follow the instructions in the section below. It is prohibited to use old codes.

UIP - what is it?

UIP is a unique payment identifier that is set by the recipient of the funds. For example, it is assigned by counterparties from among budgetary organizations.

You need to indicate the UIP in field 22 if your counterparty assigned it to the payment. If not, field 22 is left blank.

You will find a complete list of cases when the UIP field is filled in in ConsultantPlus, and you will also find out whether the bank may not accept a payment if the UIP is not specified or is specified incorrectly. Get trial access to the legal system for free and proceed to the material.

What to do if the UIN is not known?

Although the UIN assignment system was created specifically for budgetary organizations, it is not used everywhere. For example, in some payments only KBK is indicated (code of a budgetary organization, consists of 20 digits). If the payment with updated details has not arrived or there is a receipt, but the UIN is missing for some reason, the procedure is as follows:

- All known details are filled in (duplicated from the payment slip).

- The code field is entered as 0.

- In case of payment through the terminal, the field can be left blank.

ATTENTION!

If there is no UIN, only one digit is entered in the form - 0. If the system does not allow it, you can leave the field empty, but it is prohibited to indicate all 0 to fill out the column.

Decoding UIN

This code is a combination of 20 characters. Each of them is very important.

The code is divided into four blocks:

- The first three mean the government agency that acts as the payment administrator - that is, it indicates who the recipient of the money is. For example, code 183 is used to designate the tax office, social insurance - 393, etc.

- The fourth character is most often designated 0. Since currently the fourth digit is not used for specific identification.

- The fifth to nineteenth digits are used to indicate the unique index of the document, which is assigned to it at the time of accrual.

- The twentieth digit is formed by the relevant authorities using a special algorithm. This is a control value that is used to check the correctness of the UIN.

When is it necessary to indicate the UIN when paying taxes?

The UIN is indicated when paying tax if this detail is indicated in the payment receipt. Although, according to an explanatory note from the Federal Tax Service, legal entities do not need this detail when paying current tax fees, it can be indicated on the payment slip, which means it is required when entering details for the transfer if a payment notice has been received from the Federal Tax Service:

- arrears;

- fines;

- fine

The use of an identifier in such payments is explained by their urgency. The system will “see” the standard payment document much later, and the transfer using the UIN is automatically counted almost instantly. Timely deposit of money guarantees that penalties and other penalties will stop accruing.

The requirements are different for individuals. UIN indication is required when paying several types of taxes:

- transport;

- land

In case of arrears or a fine, the taxpayer, as well as the legal entity, will receive a notification with the specified UIN.

The meaning of the identifier components

Each number included in the identifier has its own meaning:

- The first three numbers. Assigned by the Treasury.

- The fourth number. Indicates the department from which the request for funds transfer came.

- Fifth number. Represents the payment code.

- Sixth and seventh numbers. Date of payment.

- Numbers from 8th to 12th. Series and number.

- The twentieth. Needed to increase the uniqueness of the identifier. Assigned to a specific payment card.

What UIN should I indicate in the payment order for payment of state duty ?

The identifier is approved by the recipient of the funds. Its formation is an automatic process. The code must be unique for each payment document.

IMPORTANT! The payer cannot generate the code independently using arbitrary numbers. If the UIN code is simply invented, the funds will not reach their recipient.

ATTENTION! Sometimes, if a person does not know his or her ID, you can enter “0”. In some cases, the UIN code is supplemented with letter designations. These can be Russian or Latin letters.

What does the ID on the receipt mean?

The code serves to identify the payment. It contains this information:

- Who issues the payment?

- Payment addressee.

- What exactly are the funds paid for?

The bank employee can decipher the code, after which he sends the payment to its recipient. All accruals to the budget are recorded in the GTS GMP system. The presence of the code allows you to immediately record the payment.

When is the UIN not used when paying taxes?

Dealing with payment orders is very simple. The unique accrual identifier is not used in cases where it was not initially specified by the budget organization. The reason may be:

- For legal entities and individual entrepreneurs - the manager’s obligation to pay taxes according to the declaration.

- For individuals - to pay property tax.

In these cases, KBK (budget organization code) is used to track the payment. However, if the Federal Tax Service indicated the UIN in the receipt for payment of property tax, it should also be moved to the payment slip. This will simplify the search for payment in the system; the details will not be superfluous.

The difference between UIP and UIN

Another code that may need to be specified is the UIN. Such an abbreviation can be deciphered as a universal identifier for charges. The UIN and UIP of the payment are extremely similar, since both options have 20 characters.

If you want to know how the UIN differs from the UIP, it should be noted that they are almost completely identical to each other.

However, unlike UIP, its analogue has a more transparent structure. It provides that the first 3 characters represent the payment authority/administrator code, 5-19 are the document index, and the last character is a verification of information. This feature allows the UIN to be unique every time.

The difference between these concepts is insignificant - UIP is more often used when transferring funds to non-state entities. UIN, on the contrary, is for budget payments of a particular government agency.

When filling out payment documentation, it is allowed to indicate one identifier instead of another. However, most often, such details already contain receipts and similar papers requesting payment.