Payer status codes for 2021

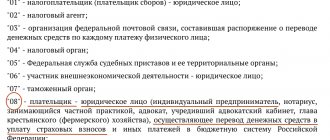

Until September 2021 inclusive, the following values apply:

- “01” - taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - legal entity;

- “02” - tax agent;

- “06” - participant in foreign economic activity (FEA) - legal entity;

- “08” - payer - a legal entity (individual entrepreneur, lawyer, notary, head of a farm), transferring funds to the budget system except for taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” - the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “13” - an individual paying taxes, fees for the performance of legally significant actions by tax authorities, insurance premiums and other payments administered by tax authorities;

- “16” - participant in foreign trade activities - an individual;

- “17” - participant in foreign economic activity - individual entrepreneur;

- “18” - a payer of customs duties who is not a declarant;

- “19” - organizations and their branches that transfer funds withheld from the wages (income) of a debtor - an individual to repay debts on payments to the budget on the basis of an executive document;

- “21” - responsible participant in the consolidated group of taxpayers (CGT);

- “22” - member of the group;

- “24” - payer - an individual transferring funds to pay fees, insurance premiums administered by the Social Insurance Fund, and other payments to the budget (except for fees for the performance of legally significant actions by tax authorities and other payments administered by tax and customs authorities);

- “28” - participant in foreign trade activities - recipient of international mail.

Starting October 1, 2021, the values "09", "10", "11" and "12" cannot be used. For all individuals (including individual entrepreneurs, lawyers, etc.) the same value will remain - “13” (see “How to fill out payments for taxes and contributions in 2021: do not miss important innovations”).

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

What to indicate

The corresponding status of the originator in the payment order for personal income tax in 2021 and in the future is indicated in accordance with Appendix No. 5 to Order of the Ministry of Finance No. 107n of 2013.

By the way, we note that since the end of April 2021, this regulatory document has been in force in a new edition (Order of the Ministry of Finance No. 58n dated 04/05/2017, valid from 04/25/2017 and partially from 10/02/2017). The reason is amendments to the tax legislation, where from 01/01/2017 most of the rules on insurance contributions to extra-budgetary funds (except for the Social Insurance Fund for injuries) were transferred. Therefore, the status of the compiler when paying personal income tax must be indicated taking into account these changes.

The table below will help you understand the status of the preparer in the 2021 personal income tax payment.

| Payment of personal income tax 2021: status of the document preparer | |

| Code | Situation |

| 02 | An organization/individual entrepreneur fulfills its duties as a tax agent for personal income tax (Article 226 of the Tax Code of the Russian Federation, etc.). That is, it calculates, withholds and transfers personal income tax to the treasury from the income of its staff and other individuals to whom it was paid by this company or businessman. |

| 09 | Individual entrepreneur transfers income tax to the treasury for himself |

| 10 | A private notary transfers income tax to the treasury for himself |

| 11 | The lawyer (advocate office) transfers income tax to the treasury for himself |

| 12 | The head of a peasant farm transfers income tax to the treasury |

| 13 | An ordinary individual pays income tax for himself as a result of self-declaration (3-NDFL) of his third-party income |

| 26 | As part of bankruptcy, it is necessary to repay the personal income tax debt, which is included in the register of claims. This is done by: · founders (participants) of the debtor; · owners of the property of the debtor - a unitary enterprise; · third parties. |

In other cases, the status of the originator in the personal income tax payment order is indicated by the relevant credit institutions and paying agents.

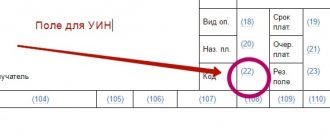

Where to indicate taxpayer status in a payment order

The status is entered in field 101 of the payment. Its form is given in Appendix No. 3 to the Bank of Russia Regulation No. 383-P dated June 19, 2012.

ATTENTION. If you fill out field 101 incorrectly, the money will fall into the category of unexplained payments, and the organization or individual entrepreneur will have a debt. Then you will have to make clarification. To do this, you need to submit an application to the tax office, indicate the payment details and report that an error was made in field 101. The Federal Tax Service will carry out a reconciliation and offset the funds against the arrears of the required tax, fee or insurance premiums.

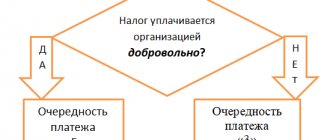

Basis of payment - 2nd feature of the penalty payment

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in the Ready-made solution from ConsultantPlus. Samples of filling out payment forms are provided for each of them.

Read more about payment details in this article.

Features of payer status for individual entrepreneurs

In January-September 2021, individual entrepreneurs enter the following payer status codes:

- “09” - when paying taxes (except personal income tax on employee salaries) and fees;

- “02” - when paying personal income tax on employees’ salaries;

- “09” - when paying insurance premiums “for yourself”;

- “09” - when paying insurance premiums from employees’ salaries.

Starting from October 2021, codes for individual entrepreneurs will be as follows:

- “13” - when paying taxes (except personal income tax on employee salaries) and fees;

- “02” - when paying personal income tax on employees’ salaries;

- “13” - when paying insurance premiums “for yourself”;

- “13” - when paying insurance premiums from employees’ salaries.

Fill out a free payment slip for individual entrepreneurs with the current details for today

Feature 3 – field 107 “Tax period”

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2019 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

Sample payment order with payer status

IP Feofanov uses a simplified taxation system. He employs two employees.

In February, Feofanov transferred pension contributions from the salaries of his employees for January 2021. He entered “09” in field 101 of the payment slip.

Feofanov transferred the contributions “for himself” in March 2021. At the same time, in field 101 he put the code “09”. The same value is indicated in the payment order for the payment of a single “simplified” tax for 2020. And when transferring personal income tax from the salaries of employees, the individual entrepreneur reflects the payer status “02”.

Please note: errors when filling out payment slips for taxes and insurance premiums can be avoided if you generate payment slips automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in one click based on data from the declaration (calculation) or the request for tax payment (contribution) sent by the inspectorates. All necessary details - codes for payer status, KBK, UIN, recipient data - are updated automatically in the service, without user participation. When filling out the payment slip, the current values are entered automatically.

"01" or "02"

Practice shows that many people are confused as to whether the originator’s status should be indicated on the personal income tax payment – “01” or “02”. The logic here is simple, and there cannot be two options.

Thus, code “01” is intended exclusively for legal entities as entities that are responsible for paying taxes on their activities and income. But with regard to income tax, organizations do not have such an obligation. They act only as a kind of intermediary between the budget and the staff/other individuals to whom the income is paid.

Thus, organizations perform only the duties of tax agents under personal income tax. This means that in most cases, in the payment order for this tax, the code “02” is entered in field 101.

Also see “Field 101 “Status of the originator” of the payment order.”

Calculation procedure

Before filling out a payment order form regarding personal income tax penalties, the organization must independently calculate their amount. In this case, there is a dependence on the date of occurrence of the penalty, which is a penalty. The occurrence of tax arrears before October 1, 2021 will require the application of the following formula: amount of unpaid tax * number of days overdue * 1/300 * refinancing rate in effect at the time of default. It will be easier to do this if you use a calculator, available free of charge on many sites, it will help determine how much you need to pay.

The number of days can be calculated from the day following the date of the last payment of tax to the budget. The end of accrual of penalties by the tax inspectorate occurs on the day when the arrears were actually paid and their execution occurred. If arrears arise after October 1, 2021, the above formula is applied in the first 30 days. And then (on the 31st day and in the subsequent period), a new increased coefficient is used - 1/150 of the bet.

You can carry out all the calculations yourself

Compilation example

When filling out a payment document that will transfer penalties accrued under personal income tax, you must be guided by the above standards. Also, the payment for penalties for personal income tax in 2019 has a certain form, a sample of which can be easily found on the Internet. The number of the order and the date of its formation must be written down, after which the factual information is entered. The payment order is drawn up in the form of a table, where information about the payer is first provided.

It is necessary to indicate its full name, Russian Taxpayer Identification Number (TIN) and checkpoint, after which the amount on the right is specified (an explanation in words is required in addition to numbers), and the payer’s account number. The cells below provide information about the payer’s bank, its BIC and the client’s account number. The same information is entered about the recipient and his bank, and the financial account number of the government institution is also indicated. Other codes, grounds for payment and the period for transferring funds are specified below, all this was described above, this is how the correct agreement with the bank is formed.

The ability to correctly make payments for penalties generated for personal income tax and insurance plays a big role for correct accounting. It is better to draw up a payment order for tax penalties in 2021 using a correctly prepared sample. Moreover, if penalties are listed with an error in the details, they will still continue to accrue, and as a result, provided that the payer is not familiar with the problems, the penalty will increase several times. Therefore, it is important to pay attention to payment orders regarding penalties in order to avoid problems with the Federal Tax Service.

:

Payment order

The video will explain how to fill out a payment order:

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Free consultation with a lawyer Request a call back Still have questions? Call the number and our lawyer will answer all your questions for FREE

Personal income tax KBK penalties