Current as of February 13, 2021

The key change is the abolition of 2-NDFL certificates; now all information will be contained in the annual report itself.

Note! For 2021, 6-NDFL calculations must be submitted using the old form, as well as 2-NDFL certificates.

What other important changes appeared in the report:

- Section 1 now indicates “Data on the obligations of the tax agent.” This is the deadline for the transfer and the amount of tax; it is no longer necessary to indicate the dates of actual receipt of income and tax withholding;

- Section 1 has been supplemented with columns to indicate data on personal income tax returned in the last three months of the reporting period (amount and date of tax refund);

- Section 2 contains general information about calculated, withheld and transferred personal income tax amounts, incl. Now there is a breakdown of income amounts under labor and civil service agreements.

The new calculation form was approved by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/

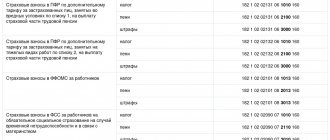

KBK for payment of insurance contributions to the Pension Fund for employees

| TAX | KBK |

| Insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | 182 1 02 02010 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | 182 1 02 02131 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons engaged in heavy types of work on list 2, for payment of the insurance part of the labor pension | 182 1 02 02132 06 1010 160 |

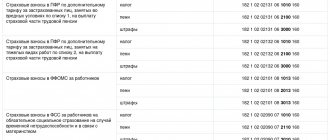

KBK for payment of penalties on insurance contributions to the Pension Fund for employees

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | penalties | 182 1 02 02010 06 2110 160 |

| fines | 182 1 02 02010 06 3010 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | penalties | 182 1 02 02131 06 2100 160 |

| fines | 182 1 02 02131 06 3000 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons engaged in heavy types of work on list 2, for the payment of the insurance part of the labor pension | penalties | 182 1 02 02132 06 2100 160 |

| fines | 182 1 02 02132 06 3000 160 | |

In FFOMS

KBC insurance premiums for 2021: tables

In general, KBK are 20-digit digital codes used to group income, expenses and sources of financing budget deficits at all levels (clause 1 of Article 18 of the Budget Code of the Russian Federation). Although companies and entrepreneurs most often encounter these codes when they draw up payment documents for the transfer of taxes, fees and contributions to the budget system of the Russian Federation. In them, BCC is a mandatory requisite that allows you to determine the identity of the payment.

Thus, in the payment order, a special field 104 is provided to indicate the BCC (Appendix No. 3 to the Regulations of the Bank of Russia dated June 19, 2012 No. 383-P, clause 5 of Appendix No. 2 to the Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n) .

Try to fill out details “104” correctly so that you don’t have to clarify the payment later (clause 7 of Article 45 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145). To do this, let us remember the important changes that have occurred in the KBK regarding insurance premiums since 01/01/2017.

Firstly, now all budget classification codes (BCC) for paying contributions to compulsory health insurance, compulsory health insurance and compulsory social insurance in the case of VNiM begin with the number 182 . It denotes the administrator code, which has become the Federal Tax Service of Russia since 2017. (Until 2021, this administrator was the Pension Fund and the Social Insurance Fund with codes 392 and 393, respectively.)

Secondly, the code of the income subtype group has changed (in the KBK these are numbers from 14 to 17). For example, if previously the code 1000 was indicated when sending current payments for pension contributions, now the numbers 1010 are entered.

Thirdly, there are now not two, but four CSCs for paying contributions to OPS at additional rates for “harmful” employees, and they depend not only on the type of heavy, harmful and dangerous work, but also on whether a special assessment has been carried out at the enterprise working conditions or not.

All current BCCs for insurance premiums can be found in the Instructions on the procedure for applying the budget classification of the Russian Federation, approved. By Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n, as well as in the tables presented below.

Table 1 – BCC for payment of insurance premiums (penalties and fines thereon) for employees and other individuals in 2018

| Payment | KBK payments | ||

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | for compulsory social insurance (OSI) | |

| Contributions | 182 1 02 02010 06 1010 160 | 182 1 02 02101 08 1013 160 | 182 1 02 02090 07 1010 160 |

| Penalty | 182 1 02 02010 06 2110 160 | 182 1 02 02101 08 2013 160 | 182 1 02 02090 07 2110 160 |

| Fines | 182 1 02 02010 06 3010 160 | 182 1 02 02101 08 3013 160 | 182 1 02 02090 07 3010 160 |

Table 2 - BCC for payment by employers of pension contributions at the additional rate (penalties and fines for them) for employees in 2018

| Payment | KBK payments on OPS | |

| the tariff does not depend on the special assessment | the tariff depends on the special assessment | |

| For insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

| For insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

You can learn more about insurance premium rates for 2021 from this consultation.

Table 3 – BCC for individual entrepreneurs’ payment of insurance premiums “for themselves” (penalties and fines for them) in 2018

| Payment | KBK payments | |

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | |

| Fixed contributions | 182 1 02 02140 06 1110 160 | 182 1 02 02103 08 1013 160 |

| Contributions of 1% on income over RUB 300,000. | — | |

| Penalty | 182 1 02 02140 06 2110 160 | 182 1 02 02103 08 2013 160 |

| Fines | 182 1 02 02140 06 3010 160 | 182 1 02 02103 08 3013 160 |

The KBK of insurance premiums to the Social Insurance Fund for accidents at work and occupational diseases did not change. What codes were in 2016, they remain the same in 2021 and will be in 2021.

Table 4 – BCC for payment of contributions “for injuries” (penalties and fines for them) for employees in 2021

| Payment | KBK of payments for compulsory social insurance against accidents at work and occupational diseases |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

KBK for payment of penalties on insurance contributions to the Social Insurance Fund for employees

| PENES, FINES | KBK | |

| Penalties and fines on insurance contributions to the Social Insurance Fund for employees for compulsory social insurance in case of temporary disability and in connection with maternity | penalties | 182 1 02 02090 07 2110 160 |

| fines | 182 1 02 02090 07 3010 160 | |

| Penalties and fines for insurance contributions to the Social Insurance Fund for workers from industrial accidents and occupational diseases | penalties | 393 1 02 02050 07 2100 160 |

| fines | 393 1 02 02050 07 3000 160 | |

FILES

What violations do the funds detect?

Despite the fact that the payment of most insurance premiums has long been supervised by tax officials, some checks are still carried out by fund employees.

Thus, the costs of compulsory social insurance in case of temporary disability and in connection with maternity are checked by the FSS. He also controls contributions “for injuries”. And the Pension Fund checks personalized reporting: forms SZV-M, SZV-STAZH and SZV-TD. Fill out, check and submit SZV-TD, SZV-M and SZV-STAZH via the Internet

If during an inspection, fund employees identify a violation, they draw up an administrative act and take the case to court. If guilt is confirmed, the judge decides on an administrative fine (see Table 1).

Table 1

What violations do the funds detect and what fines are provided?

| Violation | Amount of fine | Article of the Code of Administrative Offenses of the Russian Federation |

| Failure to comply with the procedure and deadlines for submitting personalized reports to the Pension Fund | for officials - from 300 to 500 rubles. | Art. 15.33.2 |

| Late notification to the Social Insurance Fund of information about opening (closing) a bank account | for officials - from 1,000 to 2,000 rubles. | Part 1 Art. 15.33 |

| Failure to comply with deadlines for submitting a report in Form 4-FSS Fill out and submit 4‑FSS online using the current form | for officials - from 300 to 500 rubles. | Part 2 Art. 15.33 |

| Failure to submit information to the Social Insurance Fund for verification of contributions “for injuries” (or submission in incomplete or distorted form) | for officials - from 300 to 500 rubles. | Part 3 Art. 15.33 |

| Failure to submit information to the Social Insurance Fund to verify expenses for social insurance in case of temporary disability and in connection with maternity (or submission in incomplete or distorted form) | for officials - from 300 to 500 rubles. | Part 4 Art. 15.33 |

A payment to pay a fine can be generated in a few clicks Find out more

Summing up the application of these BCCs

An entrepreneur who employs employees must make mandatory contributions for them to extra-budgetary funds. Which BCC should I indicate in the relevant payment orders? The amount of deductions, as well as coding, depend on the conditions in which employees work.

Contributions to employee pension insurance

The budget classification code does not depend on whether the employer’s income from the use of the labor of hired employees exceeds the maximum base value (300 thousand rubles). Deductions for employees with a base value both less and more than the maximum must be paid according to the following BCC: 392 1 0200 160. Separate codes for this type of payment have been cancelled. According to this BCC, the following types of contributions to the Pension Fund for the payment of an insurance pension are credited:

- main payment;

- outstanding principal payment;

- debt on canceled payment;

- the resulting arrears;

- recalculation payment.

Sanction payments for insurance contributions to the Pension Fund of Russia

- Fines - must be transferred according to KBK 392 1 02 02010 06 3000 160.

- Penalties are credited according to KBK 392 1 0200 160.

If employees work under special conditions

For employers who provide employees with harmful and/or dangerous working conditions, there is an additional rate of contributions to the Pension Fund, since the law will allow employees “for harmfulness” to retire earlier than the age prescribed. It is the deductions of these additional contributions that will help in the future to calculate the moment from which employees will be entitled to early retirement.

1. Hazardous work requires deductions for employees according to KBK 392 1 0200 160.

- Penalties for late payments are according to KBK 392 1 02 02131 06 2100 160.

- Fines for such contributions are according to BCC 392 1 0200 160.

2. For those employed in difficult working conditions, KBK 392 1 02 02132 06 1000 160.

- Peni – KBK 392 1 0200 160

- Fines – KBK 392 1 0200 160.

Contributions for hired employees to the Federal Compulsory Compulsory Medical Insurance Fund

Deductions for compulsory health insurance for employees are required by KBK 392 1 0211 160.

Penalties for this payment are according to KBK 392 1 0211 160.

Fines, if any, are assessed - according to KBK 392 1 0211 160.

Changes have been made to budget classification codes from 2021

The BCC for payments is set for the entire list as a whole.

Additional pension contributions at tariff 1 (clause 1, part 1, article 30 of the law of December 28, 2013 No. 400-FZ)

| Additional tariff that does not depend on the results of the special assessment | Additional tariff depending on the results of the special assessment | |

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Additional pension contributions at tariff 2 (clause 2-18, part 1, article 30 of the law of December 28, 2013 No. 400-FZ)

| Additional tariff that does not depend on the results of the special assessment | Additional tariff depending on the results of the special assessment | |

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Contributions to the Health Insurance Fund and Social Insurance Fund for employees

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes.

Get free access for 14 days

The KBK 2021 and 2021 for transferring funds to the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund from employee salaries have not changed, and the codes for maternity contributions remain the same, so we use the same codes as before. Let's remind them.

| Contributions for temporary disability and maternity | |

| Contributions | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Contributions to the Social Insurance Fund for injuries and occupational diseases | |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

| Contributions to the FFOMS for compulsory health insurance | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes.

Get free access for 14 days

If you do not employ hired labor, then you pay insurance premiums only for yourself. Now entrepreneurs pay all pension contributions to one KBK. The codes for crediting funds to the FFOMS and the Social Insurance Fund have not changed, so we use the same codes as before.

Please note that individual entrepreneurs pay insurance premiums even if no business activity was carried out.

| Pension insurance | |

| Contributions | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Health insurance | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

To transfer contributions in the amount of 1% of revenue exceeding 300,000 rubles per year, use the same code as for the fixed part - 182 1 0210 160.

Individual entrepreneurs can pay contributions for voluntary insurance in case of temporary disability and maternity according to the KBK - 393-1-17-06020-07-6000-180. There are no penalties or fines for them.

Author of the article: Yulia Khairulina

Transfer contributions in the cloud service Kontur.Accounting. The service itself will calculate contributions and personal income tax based on your salary, generate payment slips, and remind you of payment deadlines. Submit reports on employees, do accounting, send reports from the service. Use the support of our experts, get rid of rush jobs and routine, and use the service for free for 14 days.

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we use the KBC: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we use the KBC: 18210202103081013160

- If we pay 1% of an amount exceeding 300,000 rubles of annual income, then we use KBK: 18210202140061110160 . Please note that it coincides with the KBK for individual entrepreneurs’ contributions to pension insurance.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |