According to current legislation, a taxpayer has the right to reduce VAT by the amount of tax deductions due to him. If the amount of such deductions exceeds the amount of accrued VAT, the difference must be returned to the taxpayer from the budget. However, in practice, in such a situation, Federal Tax Service specialists are extremely reluctant to recognize deductions. Leaving outside the scope of this article fraud and “gray” schemes used by unscrupulous taxpayers, we will consider the most common formal reasons for the refusal of tax services to obtain a VAT deduction, as well as the positions of the courts on these issues.

Errors in documents

This reason is the most common for refusing a VAT refund, but at the same time the easiest to appeal in court. In such cases, there are the most positive court decisions for taxpayers.

Due to the fact that one of the grounds for applying a VAT deduction is the invoice, the most errors, as a rule, are found in this document. The standard grounds for refusal to apply the right of deduction, and, accordingly, VAT refund in such cases are:

- Signing of a document by unauthorized persons. Judicial practice on the possibility of deducting VAT on an invoice signed by an unauthorized person is contradictory. When the tax authority manages to convince the judges that the invoice was signed by a person who did not have the right to do so, the courts most often refuse to apply the deduction (resolutions of the FAS ZSO dated 02/05/2014 in case No. A27-279/2013, FAS MO dated 08/06. 2013 in case No. A40-143375/12-108-225 and others).

See also “Invoice with facsimile: new clarifications from the Ministry of Finance.”

The court also sided with the inspectors in a case where the customer, performing an intermediary role, incorrectly issued an invoice. These actions violated paragraph 6 of Article 169 of the Code in terms of the signing of the invoice by officials or authorized persons of the supplier, and not the intermediary (decision of the Moscow City Court of May 29, 2013 No. A40-9840/13-39-33).

Find out if one person can sign an invoice here.

At the same time, there are also decisions in which judges accept as justification for VAT deductions invoices signed by unauthorized (unidentified) persons (resolution of the Supreme Arbitration Court dated April 20, 2010 No. 18162/09, FAS North-West District dated February 1, 2011 No. A66 -3490/2010, FAS CO dated November 16, 2010 No. KA-A40/2493-09).

- Indication of the actual address of the buyer instead of the legal address given in the Charter. In most cases, this is considered an error, since the law does not separate the addresses of legal entities - there is one, which is indicated in the constituent documents. Therefore, judicial practice on challenging denials of deductions due to this error is ambiguous. There are many negative decisions for taxpayers, but there is also positive practice, which is based on the judges’ opinion that Article 169 of the Tax Code, in particular paragraphs 5 and 6, does not clearly state which address should be indicated. Therefore, this reason for the tax authorities’ refusal to deduct is not sufficient for judges to justify the decision (Resolution of the Federal Antimonopoly Service of the Moscow Region dated 04/08/2009 No. KA-A40/2493-09).

- Discrepancy between the amount of the cost of goods and that calculated by the inspectors or indicated in the contract (without taking into account changes made later). In this case, we are talking about situations where inspectors compare the cost of goods in the invoice with that stated in the contract, but do not take into account changes made later to the contract. Or when the tax inspector himself calculated, for example, the work performed from the documentary information available to him, and this amount did not coincide with the one that was displayed in the invoice. Traditionally, deductions are denied using the justification contained in paragraphs. 8 clause 5 art. 169 of the Tax Code of the Russian Federation. However, if it is possible to prove in court that the inspectors’ opinion is wrong and document this, then there is a possibility of obtaining a positive decision.

- Errors in the counterparty's checkpoint number, lack of numbering of sheets if the document is multi-page. However, for these and other similar reasons, tax inspectors cannot refuse a deduction, since this contradicts paragraph 2 of Article 169 of the Tax Code.

- Cases when the invoice reflects little information, in particular, some information is missing (for example, about quantity, units of measurement, tariff, amount excluding VAT or conditions for advance payment), but the rest of the documents were in perfect order and all other conditions for accepting VAT for deduction were met. Typically, such errors in registration lead to denial of the right to deduction, and judicial practice confirms the conclusions of inspectors.

But there is a case when the FAS ZSO, in its resolution dated February 14, 2013 No. A03-1222/2012, came to the conclusion that such shortcomings in the preparation of the invoice did not lead to the receipt of an unjustified tax benefit. The court proceeded from the presumption of good faith of the taxpayer, and it was also found that the information specified in the tax returns was reliable. The court referred to the decision of the Constitutional Court of October 16, 2003 No. 329-O.

See also our material “What errors in filling out an invoice are not critical for VAT deduction?”

However, there are also negative court decisions taken not in favor of taxpayers. However, this was due to such severe cases that such decisions are not surprising. In particular, the tax service justifiably refused to refund the tax in a situation where a deduction was accepted from a company that had not been registered as a legal entity (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 01.02.2011 No. 10230/10 and decisions of the courts of first instance).

Lack of documents

Another common reason for refusal of VAT refund is the lack of documents, in particular invoices (Form 1-T). In this case, there is contradictory judicial practice, but there are also decisions that are positive for taxpayers - for example, Resolution of the Federal Antimonopoly Service of the Moscow Region dated December 17, 2010 No. KA-A40/15868-10. The court referred to the fact that the basis for registering goods is the TORG-12 form, and not 1-T.

We also recommend that you read our material “Primary document: requirements for the form and the consequences of its violation”

This subgroup of common reasons for refusing a tax refund also includes situations when inspectors do not receive documents from counterparties confirming the fact of a transaction.

In their decision, the fiscal authorities refer to the fact that the taxpayer consciously seeks to obtain a tax benefit on transactions that cannot be verified (for example, if the counterparty has managed to be liquidated by this point).

The court's decision in this case will please taxpayers. In particular, the resolution of the Federal Antimonopoly Service of the North-Western District dated May 21, 2012 No. A56-54176/2011 states that failure by the counterparty to provide documents is not grounds for denial of the right to deduction. It should be taken into account that in this court decision the court established the reality of business transactions, the absence of unjustified tax benefits, and the presence of properly executed documents confirming the right of the company to apply deductions for value added tax.

What to do

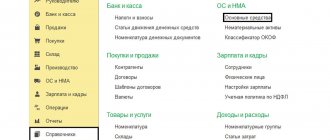

First of all, an internal review should be carried out to understand whether any violation is taking place.

Need to check:

- the correctness of invoices from counterparties and the extent to which they correspond to the original receipt documents;

- analyze counterparties for integrity (extracts from the Unified State Register of Legal Entities, constituent documents, accounting, etc.);

- beneficiaries who are exempt from VAT or have a 0% rate must ensure separate accounting.

If everything is in order, you need to start the appeal process.

You should choose the following procedure:

- begin the appeal process to the Federal Tax Service;

- if there are no results, it will appeal to the arbitration court.

Errors in reporting

Quite often, tax inspectors do not bother to request additional information from the taxpayer and, if an error is discovered in the tax return, they simply refuse a refund. When challenging their actions, the tax service refers to the fact that, in accordance with Article 88 of the Tax Code of the Russian Federation, they are only vested with the right to demand an explanation from the taxpayer, but are in no way obliged to do so.

In counterbalance to such arguments, one can refer to the decision of the Constitutional Court of July 12, 2006 No. 267-O.

There are also situations when the fiscal authorities force the taxpayer to submit an updated declaration to reflect previously omitted information on invoices that were submitted for deduction at a later period. If you refuse to clarify a return that has already been submitted, the tax service also refuses a refund.

In this case, as an argument, you can use the Resolution of the Federal Antimonopoly Service of the Moscow District dated February 15, 2013 No. A40-36661/12-20-180, in which the court came to the conclusion that failure to submit a “clarification” is not a reason for deprivation of the right to deduction and, accordingly , compensation provided that the taxpayer complies with all other conditions, in accordance with Articles 169, 171 and 172 of the Tax Code of the Russian Federation.

In 2014, the Plenum of the Supreme Arbitration Court of the Russian Federation came to a similar conclusion. Paragraph 27 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 states that tax deductions can be reflected by the taxpayer in the tax return for any of the tax periods included in the corresponding three-year period. In 2015, the taxpayer’s right to transfer deductions to any tax period within a three-year period was enshrined in law. And if the three-year period is missed, the refusal to deduct will be legal and the courts will support the tax authorities (Decision of the Supreme Court dated September 4, 2018 No. 308-KG18-12631)

See also “Three years to deduct VAT: a trap in the Tax Code of the Russian Federation.”

Unregistered agreement

Another common reason for refusing a VAT refund is an agreement that has not passed state registration . Under such an agreement, money was obviously transferred to the counterparty, but the agreement itself was not registered in the prescribed manner. Tax officials refer to the provisions of the Civil Code: a lease agreement for a building or structure concluded for a period of at least a year is subject to state registration and is considered concluded from the moment of such registration (clause 2 of Article 651 of the Civil Code of the Russian Federation). In other words, until a long-term lease agreement is registered, it will not be considered concluded. And since the agreement has not been concluded, then there can be no question of a deduction. However, even in this situation one must fight: it is possible to deduct “input” VAT in this situation (of course, if all other conditions for deduction stipulated in the Tax Code of the Russian Federation are met). After all, civil law does not provide that the lack of proper registration makes the lease agreement invalid. Thus, the legislative establishment of mandatory state registration of rights to real estate determines only the rights and obligations of the parties to the agreement and has goals not related to taxation issues. The Code does not make the tenant's right to deduct input VAT dependent on the fact of state registration of the lease agreement. Thus, if the conditions necessary for the deduction are met (the service is provided and reflected in the tenant’s accounting, there is an invoice from the lessor, the object is used in activities subject to VAT), then, despite the absence of state registration of the agreement, the tenant has the right to deduct the “input” VAT. There are examples of court decisions where judges came to a similar conclusion (see, for example, Resolution of the Federal Antimonopoly Service of the Volga District dated December 6, 2005 N A55-1586/05-51).

Errors in registration

When justifying the refusal to provide a VAT refund, tax inspectors often do not recognize the fact of registration due to incorrectly executed documents.

Thus, inspectors may consider acts of acceptance and transfer of inventory items unacceptable if they do not contain a seal. However, the imprint is not a mandatory requisite when preparing primary documents - this is precisely the indication contained in the album of unified documents, approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. In addition, taxpayers themselves can develop their own forms of documents, which may lack any optional details.

Tax authorities also refuse to allow developers to recognize VAT deductions during the phased capitalization of work on a construction site based on forms KS-3 and KS-2. In the opinion of the Ministry of Finance, which is expressed in its letters dated 10/14/2010 No. 03-07-10/13 and 03/05/2009 No. 03-07-11/52, these documents are not the basis for recording the completed volume of work during construction in progress, and serve only as a basis for calculations.

At the same time, there is also positive judicial practice. For taxpayers who want to exercise their right and are ready to defend their case in court, the conclusions drawn by the decisions of the Federal Antimonopoly Service of the Moscow District dated 04/19/2012 in case No. A40-77285/11-107-332 and 04/07/2011 No. KA-A40 may be useful. /2227-11 in case No. A40-60156/10-35-331.

Accounting for property through account 08, and not directly at 01, is also, according to the tax authorities, a basis for refusing to apply a VAT deduction. This position is set out by the Russian Ministry of Finance in letter dated January 29, 2013 No. 03-07-14/06. When challenging a tax authority’s decision to refuse to apply a deduction, one should turn to positive judicial practice in resolving similar issues. It is worth familiarizing yourself with the following court decisions: FAS Volga-Vyatka District dated 05/13/2014 in case No. A11-3359/2013, FAS Moscow District dated 08/21/2013 in case No. A40-134549/12-108-179, FAS North-Western District dated January 27, 2012 in case No. A56-10457/2011, FAS of the Ural District dated August 24, 2011 in case No. A07-18288/2010.

Liquidation and return

In general, the company independently fulfills the obligation to pay taxes and fees, unless otherwise established by law and agreement (Clause 1, Article 45 of the Tax Code of the Russian Federation). Excessively paid or excessively collected taxes, fees (penalties, fines) are subject to return directly to the payer in the absence of debt (Article 78). The Ministry of Finance of Russia, in letter dated April 12, 2021 No. 03-02-07/1/24222, explained that upon liquidation of an organization, only the liquidated company itself can return the overpayment of any tax. The owner will be denied a return, since this is not provided for by law. This was indicated by the Constitutional Court of the Russian Federation back in 2015 in the Determination of the Constitutional Court of the Russian Federation of June 23, 2015 No. 1233-O. Therefore, you need to write an application for a tax refund in advance, before the organization is excluded from the Unified State Register of Legal Entities.

Other errors

Also, the reasons for refusal of VAT refund may be:

- Purchase of goods through subsidies from the federal budget. In this case, VAT, according to paragraphs. 6, paragraph 3, Article 170 of the Tax Code of the Russian Federation, must be restored and attributed to the source of financing, regardless of whether the purchased goods will be used in activities subject to VAT.

- Lack of sales in a given tax period. In case of refusal to refund VAT for this reason, when defending, you can refer to the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 3, 2006 No. 14996/05 and the letter of the Ministry of Finance of the Russian Federation dated November 19, 2012 No. 03-07-15/148, which was communicated to the tax authorities by a letter from the Federal Tax Service Russia No. ED-4-3/ [email protected] This letter is posted on the Federal Tax Service website in the section “Explanations of the Federal Tax Service, mandatory for use by tax authorities.”

- Capitalization of work that has improved the condition of the leased property, if these improvements cannot be separated. The refusal to deduct for goods purchased for these purposes can easily be challenged by referring to paragraph 26 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 .

Also, enterprises that are required to keep separate records of transactions that are and are not subject to VAT often encounter such refusals.

Advice for taxpayers would be the need to develop and approve a clear accounting policy, which would clearly state what deductions and in what volume should be attributed to a particular type of activity.

Tax gap

Tax officials compare the data of counterparties and if there is a gap with the supplier’s data, the deduction may be denied. A tax gap may occur if the counterparty:

- will not submit the declaration;

- will indicate different information from the incoming invoice in the sales ledger;

- will submit a zero declaration.

The tax authorities will ask for clarification and if the error is not corrected, you will have to submit an amendment.

Refusal to refund VAT occurs if suppliers fail to pay VAT. And there is even judicial practice that is not entirely pleasant for taxpayers. Thus, the Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated January 27, 2009 No. 9833/08, indicated that there is a connection between the receipt of tax into the budget from the supplier and the right to deduct this tax by the buyer. That is, such a connection is considered as fulfillment of the norms specified in Articles 171 and 172 of the Tax Code regarding the reality of a business transaction.

Nevertheless, there are also court decisions that are positive for taxpayers. The courts justified their position by the fact that taxpayers cannot be held responsible for the actions of third parties. In addition, the Tax Code does not directly link the taxpayer’s right to a tax refund with the fact of payment of this tax by the counterparty.

Thus, in the resolution of the Federal Antimonopoly Service of the Moscow District dated December 17, 2010 No. KA-A40/15868-10, the court sided with the taxpayer who challenged the refusal to refund VAT due to non-payment of taxes by subsuppliers.

The FAS Moscow District, in its resolution dated January 26, 2010 No. KA-A40/14474-09, supported the taxpayer in a dispute over the right to a tax deduction, concluding that the tax authority could not prove that the taxpayer received a tax benefit from a transaction with a suspicious counterparty and knew about the violations committed by the counterparty.

In another resolution - dated October 25, 2010 No. KA-A40/13657-10 - the FAS Moscow District relied on the fact that the current tax legislation does not stipulate the connection between the acquisition of the right to deduction by the buyer and the fulfillment of the obligation to pay tax by the seller.

Reasons for making a decision to charge tax

The Interdistrict Tax Inspectorate of the Vologda Region audited the quarterly tax return of Center for Innovative Technologies LLC for VAT.

The audit showed that the Company did not fully pay the tax to the budget due to the unlawful use of a tax deduction. The debt, according to MIFTS calculations, amounted to 70.7 thousand rubles. From the declaration it followed that the tax amount for the first quarter of 2018 amounted to 691.4 thousand rubles. The company applied a tax deduction for a total amount of 501 thousand rubles. An analysis of the documents showed that the Company’s purchase book contains invoices issued by Egida LLC. According to the completed transactions, the specified counterparty supplied construction materials to CIT LLC and provided transport services in the amount of 2.3 million rubles. Invoices, delivery notes and acts issued by the counterparty from January to March 2021 were attached as supporting documents. The tax office examined the materials and came to the conclusion that there were signs of a tax offense under Part 1 of Art. 122 of the Tax Code of the Russian Federation (non-payment or incomplete payment of VAT). The inspection justified its conclusions as follows:

- the counterparty had signs of “bad faith” due to the lack of property and employees, own or leased equipment and vehicles;

- the supplier’s office at the legal address was absent;

- the last quarterly tax reporting was submitted by the counterparty with zero values;

- Egida LLC did not make transfers to the current account;

- receipts to the supplier's account for the period under review amounted to only 250 thousand rubles.

Cash payments for this transaction also could not be carried out due to the existing ban. In October 2013, the Bank of Russia issued Directive No. 3073-U, according to which cash in organizations can be issued for strictly defined purposes:

- for the payment of wages, benefits and various social benefits;

- for settlements between legal entities for transactions not exceeding 100 thousand rubles. under one agreement;

- as a refund of money for purchased goods or services received, deposited by customers into the company’s cash desk (within 100 thousand rubles);

- payment of insurance compensation to individuals if payment was made in cash.

The audit established that money was deposited into the companies' bank accounts to pay for goods or services totaling 1.4 million rubles.

However, after 1-2 days this amount was cashed out by the only employee of Egida LLC, V.V. Kudinov. and director of CIT LLC V.I. Chernikov. The defendant could not explain why the counterparty did not reflect the transaction concluded between them in its books. He explained that he purchased goods from the seller, part of which he sold. Both parties to the transaction knew each other well and did not attach importance to the paperwork of shipping documentation. The Director of the Company could not explain the fact of the existence of a debt to the seller.

The tax office also drew attention to the fact that some of the invoices and delivery notes of Egida LLC were signed by a certain A.N. Morozov, who is not related to the company. Thus, the seller did not have sources to purchase the goods and resell them to the Company. All of the above led to the bringing of CIT LLC to tax liability and additional VAT charges in the amount of 70.7 thousand rubles. The company filed a complaint with the higher tax authority, which reduced the fine to 35 thousand. The company was not satisfied with this decision, so it applied to the arbitration court for its cancellation.

Work of interdependent companies

In practice, the tax inspectorate often expands the signs of interdependence of enterprises, which are listed in Articles 20 and 105.1 of the Tax Code of the Russian Federation. Thus, inspectors suspect taxpayers are dependent on each other if the following can be traced in transactions:

- the use of borrowed funds from the lender to pay for goods supplied by him as a supplier;

- carrying out payment transactions in one bank;

- registration at one legal address;

- the fact that the founders of the counterparty companies previously worked in the same company.

But fiscal officials are not always able to prove interdependence, and therefore coordination of actions to obtain illegal tax benefits. Often, inspectors use only formal characteristics. This means that in court the taxpayer has every chance to prove his case. This was the case when the FAS Moscow District issued a resolution dated 02/06/2013 No. A41-11892/12, when the judges considered the VAT deduction to be justified even if there were some signs of interdependence.

Results

The main reasons why the tax service denies taxpayers a VAT refund include:

- errors in the preparation of accounting documents;

- special interpretations of those checking the validity of registering goods;

- application of deductions in relation to non-VAT-taxable transactions.

But today, in most cases, the reasons for refusing a refund for this tax are formal and far-fetched.

To substantiate his legal position and protect the right to apply a VAT deduction, the taxpayer should go to court. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Appeal period

The time allotted for filing a complaint is 12 months from the date of notification of the taxpayer about the adoption of the disputed decision of the inspectorate. If a complaint is filed with the Federal Tax Service, a decision to consider it (to leave it without consideration) is made within 5 days.

The allotted time for consideration by the Federal Tax Service of the complaint is one month. This period may be extended if it is necessary to supplement the package of documents or explanations, but not longer than one month. The participation of the taxpayer is not required, but he can submit the missing documents to the case.

The outcome of the procedure can be either leaving the complaint unsatisfied or canceling the decision of the Federal Tax Service inspection (full or partial), as well as at the same time independently issuing a new decision on VAT compensation. The taxpayer will be notified of this within three days.

In case of non-consideration (dissatisfaction) of the appeal, the taxpayer will be notified within 3 days, after which it is possible to re-submit (by correcting the shortcomings) or file a claim in the arbitration court.