When filling out the 2nd personal income tax declaration, the accountant does not understand how to reflect travel and daily expenses, and what code to indicate. This is a serious issue and requires a detailed approach. Certificate 2 of personal income tax relates to tax reporting, and any error is fraught with penalties, both for the performer and for the organization as a whole. The report with attribute 1 reflects profit that is subject to taxation, with attribute 2 - if personal income tax cannot be withheld. Let's look at the features of filling out a certificate for travel and daily expenses.

Excess daily allowances and their taxation

If it is impossible to withhold personal income tax from the taxpayer during 2021, the tax agent must submit to his tax office, and also transfer 2-NDFL certificates to the individual himself no later than 03/01/2018, indicating in the certificates the sign “2” (clause 5 of Article 226 of the Tax Code RF).

Let us remind you that the current form of the 2-NDFL certificate was approved by order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485. However, a new form of certificate 2-NDFL has been prepared, which must be used when submitting certificates for 2017 to the Federal Tax Service. The old form will not pass format and logical control or will not be accepted by the inspector. Download the new form 2-NDFL in 2018.

And if an employee was involved in work on a business trip on a day off or was on the road, the average earnings for such days are not saved. Weekends are paid at least double or single, but with the right to “take off” the day off afterwards (see Art.

Based on the order to send an employee on a business trip, he is given an advance in the amount of daily allowance, as well as upcoming travel expenses. So, on the day the advance report is approved, the excess daily allowance must be registered in the employee’s personal income tax database in the 1C: Salary and Personnel Management program.

In this article we will tell you how to calculate, take into account and pay insurance premiums to organizations on OSNO.

As part of the advance document, the employee is not required to report either daily allowances for business trips within Russia, or daily allowances for business trips outside the Russian Federation, or for one-day or any other business trips. There are no supporting documents for daily allowance. The employer pays a daily allowance of x rubles, the employee spends it at his own discretion.

If more is transferred to the employee than is due, there may be problems with the payment of various benefits compensated from the budget.\n\n\n\n\n\n\n\nImportant\n\n\n\n\nErrors in application codes may lead to underestimation or overestimation of vacation pay, travel allowance, sick leave and other payments “tied” to average earnings.

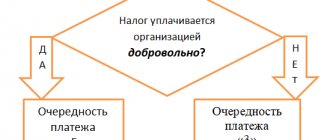

The date of actual receipt of income for daily allowances subject to personal income tax is the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Thus, this date must be indicated on line 100 “Date of actual receipt of income” of form 6-NDFL.

The need to change the 2-NDFL certificate and the procedure for filling it out, as follows from the explanations to the project, is due to the fact that the “old” form of the certificate did not allow the submission of information about the income of individuals for a tax agent by his legal successors.

Moreover, bonuses are reflected in tax registers and in 2-NDFL certificates using three different codes.\n\n\n\nThe main code is 2002. This, in turn, threatens the tax agent with a fine of 500 rubles. for each incorrectly completed income certificate (Article 126.1 of the Tax Code of the Russian Federation, clause 3 of the Federal Tax Service letter dated 08/09/16 No. GD-4-11/14515).\n\n\n\n\n\n\n\nAttention\ n\n\n\n\nFor 2021, tax agents must submit income certificates in Form 2-NDFL no later than March 1, 2021. Further, the 2-NDFL certificate as a separate document will cease to exist.

The date of tax withholding (line 110) will be the date of actual payment of income from which personal income tax was withheld (clause 4 of Article 226 of the Tax Code of the Russian Federation). It is important to keep in mind that this date cannot be earlier than the last day of the month, because personal income tax cannot be withheld if income is not received.

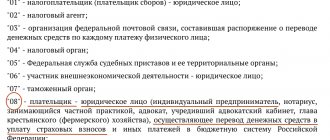

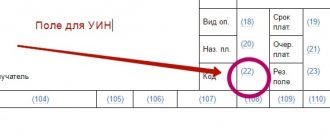

New codes in payment cards

According to the amendments made to the Law “On Enforcement Proceedings” No. 229-FZ dated October 2, 2007, employers must indicate the income code in payment orders if the payment is made to an employee under an employment contract or to individuals working under GPC contracts. The income code allows bank employees and bailiffs to understand which payments can be deducted under executive documents and which cannot. Read more about the restriction on debt collection by bailiffs from June 1, 2021 here.

There are only three such codes, they were approved by Directive of the Central Bank of the Russian Federation No. 5286-U dated October 14, 2019:

- for wages and other income for which the amount of deductions is limited by Article of Law No. 229-FZ (bonuses, vacation pay, dividends, etc.), code “1” is used;

- if funds are transferred that cannot be levied, the income code “2” is indicated - in Art. 101 of Law No. 229-FZ provides an exhaustive list of such income;

- for amounts transferred in connection with compensation for harm to health and state compensation for victims of radiation and man-made disasters, of which only child support and compensation for harm in connection with the death of the breadwinner are allowed to be withheld, code “3” is provided (clauses 1, 4, clause 1 , 2 Article 101 of Law No. 229-FZ).

Depending on the type of income transferred to an individual, one of these codes is indicated in the “Name” field of the payment. pl.” (field 20).

New form 2-NDFL in 2021

Art. 168 of the Labor Code of the Russian Federation states that an employer who sends a specialist on a business trip is obliged to compensate him for additional expenses associated with living away from home - to pay daily allowance. Their size is set by the company independently based on financial capabilities and ideas about fairness. It is fixed in the internal acts of the organization, for example, in a collective agreement.

If, according to internal regulations, the employer issues large amounts of daily allowance, then everything issued in excess of the limit is subject to personal income tax. Accordingly, taxable income must be reflected in 6-NDFL.

Moreover, this must be done not only by dates and amounts, but also by type of income using special codes.

If, according to internal regulations, the employer issues large amounts of daily allowance, then everything issued in excess of the limit is subject to personal income tax. Accordingly, taxable income must be reflected in 6-NDFL.

In 2000, he graduated with honors from the Moscow State Law Academy with a specialization in Taxes and Taxation.\n\r\n\r\n\nFrom 2000 to 2005, he worked in the newspaper “Accounting.Taxes.Pravo”, where he worked his way up from expert editor to deputy editor-in-chief.

When filling out both the 2-NDFL income certificate and the 6-NDFL form in 2021, the same income type codes are used.

Is it necessary to reflect daily allowances in excess of the norm in 4FSS in 2020?

The employee is paid an average salary for the period of the business trip, and travel expenses must also be reimbursed.

In almost every organization there is a need to send certain employees on a business trip. Such a work trip on the instructions of the employer requires a particularly careful approach to documentation and accounting.

For example, if a specialist traveled by train, he presents a ticket to the hiring company. If the business trip involved air travel, you can attach an electronic ticket receipt and a scan of your passport with border crossing marks to the advance report. To confirm expenses for taxis and airport services, you need to save receipts.

The fact is that any business trip is inevitably associated with additional costs, which include, for example, travel and accommodation costs for the employee at the place of business trip.

Pay taxes, fees and submit reports without leaving your home! The service will remind you of all reports.

Income code 2300 with decoding

If the amount exceeds 50,000 for each child, but for both parents, then tax is charged on the excess amount.

For some specific payments to employees, the Tax Code of the Russian Federation does not contain clarifying information regarding the deadlines for a particular transaction with personal income tax. However, logical conclusions can be reached using the explanations of the Federal Tax Service, which are becoming more and more numerous and which, we hope, will soon answer all the accumulated questions about filling out the calculation.

In this case, the employee receives the final payment and work book before the vacation, and does not return to the previous employer after the vacation. However, from the point of view of labor legislation, the transferred amounts are vacation pay, and not compensation for unused vacation.

The final payment was 35,964 rubles. (RUB 76,000 – RUB 30,000 – RUB 9,880 – RUB 156). Personal income tax was transferred to the budget on time (08/08/2016). There were no other payments in the reporting period.

Such payments represent travel expenses, which must be paid equally by both enterprises and individual entrepreneurs, and this does not depend on the taxation regime.

The daily allowance standards established by law sometimes do not allow a business trip employee to feel comfortable during a business trip.

When uploading data from the “1C: Salary and Personnel Management” program to the “1C: Accounting” program, the “1C: Accounting” program doubles the amount of daily allowance paid in excess of the limit.

In other words, when traveling within the Russian Federation for daily allowances over 700 rubles, insurance premiums will need to be calculated. And for business trips abroad, insurance premiums are calculated from daily allowances exceeding 2,500 rubles per day of business trip.

The employer must withhold tax (p. 110) when the next payment of funds to the employee occurs after the date of receipt of income (clause 4 of Article 226 of the Tax Code of the Russian Federation). The Federal Tax Service does not allow tax to be withheld before this date (letter of the Federal Tax Service dated July 25, 2014 No. BS-4-11/).

In 2021, adjustments were made to Article 422; they are dedicated to daily allowances in excess of taxation standards in 2021. They also need to pay personal tax. However, in addition to these tax contributions, companies are required to make payments to the Social Insurance Fund. The exception is payments that are related to employee injuries.

Please note that the indicators for wages and excess daily allowance in Section 2 are collapsed, since all dates in lines 100-120 of Section 2 in relation to these payments coincided. Changes in the field of taxation were made in accordance with the fact that from the beginning of 2021 the Federal Tax Service is responsible for insurance payments. The only exception is if you are injured. All insurance transfers according to the new rules are made to the tax service, and not to the Social Insurance Fund.

Is it necessary to reflect daily payments for a business trip in 6 personal income taxes?

An employee sent on a business trip incurs additional inconvenience and costs of living in another city, the employer compensates for this by paying per diem. Are these amounts the income of the employee from whom tax must be withheld and does the accountant need to show the daily allowance in Form 6 of the personal income tax?

- 1 Payment procedure

- 2 Reflection of payments in calculations

Payment procedure

During the period of stay in another location on work matters, the employee retains the average salary and is reimbursed for all expenses associated with the trip. Upon returning from a business trip, the employee submits an advance report.

Reference! The employee does not report where he spent his daily allowance and can spend it at his own discretion.

Daily allowances are paid for all days of a business trip, taking into account non-working days and days on the road. Compensation payments for one-day business trips are not provided for by law. Daily allowance rates have been established, based on one day, which are not subject to taxation.

They depend on the location:

- 700 rubles – for trips within the country;

- 2500 rubles – for stay abroad.

Each organization independently sets the amount of daily allowance; it may exceed the established standards. The amount of compensation is fixed in the company’s local regulatory documents. An organization can also pay its employees daily allowances for one-day business trips.

Important! Daily allowances within the norms are not taxed; if they are higher, personal income tax is withheld from the difference. The organization is obliged to show the corresponding amounts from which tax was withheld in its reporting.

The question arises whether it is necessary to withhold tax if the daily allowance was paid for a one-day business trip within the limits of the standards, because such payments are not provided for by law.

Despite the fact that there is no general opinion on this issue, the tendency is that the purpose of payments is to compensate for the employee’s travel expenses, therefore they are not recognized as income (within established standards) and personal income tax is not withheld.

Reflection of payments in calculations

If an organization pays compensation to seconded employees that does not exceed the standard (700 and 2500 rubles), the amounts are not shown in the reporting, because personal income tax is not withheld from them.

Daily allowances in excess of the norm are taxed and are reflected in the reporting accordingly. In the first section of the calculation, they are reflected on line 020, along with other income.

Moreover, only the amount exceeding the limit is indicated. For example, an employee went on a business trip to Rostov for 3 days. The organization pays compensation in the amount of 900 rubles for one day.

It turns out that only 600 rubles (900 X 3) - (700 X 3) will need to be reflected in the calculation.

The option of reflecting the full cost in field 020 and the non-taxable part in field 030, as is done when paying financial assistance, is not suitable, since line 030 reflects the amounts in accordance with deduction codes.

Now let's look at how to show excess daily allowances in section 2 6 of personal income tax. Money is issued, as a rule, in advance before a business trip; accordingly, the trip itself has not yet taken place, and later it may be reduced or even canceled, in which case the funds issued will be returned back.

In this regard, the date of receipt of income (line 100) is not considered the day the money was received, but the last day of the month in which the advance report was approved. The tax withholding date in field 110 cannot be earlier than the date of its receipt, therefore personal income tax on excess daily allowances must be withheld upon the next transfer of money to the employee. The tax payment date (120) is the next day after it was withheld.

An example of filling out daily allowances in excess of the norms in 6 personal income taxes.

Sleptsov O.D. went to conduct an inspection at another division of the company, located in a neighboring region. The business trip lasted for 5 days, from November 9 to 13.

The employee was allocated 5,000 rubles (1,000 X 5) to reimburse travel expenses and was paid on November 8. The amount of daily allowance above the norm amounted to 1,500 rubles (5,000 – (700 X 5)).

The advance report was approved by the General Director on November 25. On December 1, the employee received vacation pay in the amount of 8,600 rubles.

In this case, the day of receipt of income (per diem) will be November 30, since personal income tax is withheld on the same day or later, it cannot be withheld and transferred earlier than November 30. Tax will be withheld from vacation pay, since the next day (December 2) is a day off, the transfer of personal income tax from daily allowance to the budget will be shown in the calculation on December 4.

Let's slightly modify our example, let's say that the employee should not have gone on vacation and the next cash payment after the business trip is the salary for November in the amount of 35,490 rubles, paid on December 8.

Situations like this most often happen in practice. In this case, the dates of receipt of income, withholding and transfer of personal income tax for both payments will coincide.

The daily allowance will be reflected in 6 personal income taxes together with the salary, in a single amount.

Payments that do not exceed the standards are not subject to taxation and do not require accounting. Daily allowances in excess of the norm are subject to tax. It is necessary to reflect such payments in the form and deduct fees from them to the budget after the employee returns and provides them with an advance report.

Source: //ndflexpert.ru/6/sutochnye-v-6-ndfl.html

How are daily personal income tax and insurance premiums assessed?

As for the payments themselves, you can find out about remunerations under the GPA from 2-NDFL (they will be indicated with code 2010). But this will not mean that “injury” contributions were paid from such payments. But for excess daily allowance there is no separate code in 2-NDFL.

Accordingly, the part of the daily allowance exceeding the above standard must be calculated and paid to the personal income tax budget.

We believe that the code 2003 will need to indicate, for example, a bonus for a holiday at the expense of the profit of a legal entity. Accountants will need new codes when issuing a 2-NDFL certificate.

Generate a 2-NDFL certificate automatically in the online service Kontur.Accounting. Here you can keep records, pay salaries and submit reports.

Income code 2010 with decoding

Since daily allowances in 1C 8.3 ZUP are taken into account as income in kind, they are not added to the amount for payment, i.e. the amount of accrued daily allowance will not be reflected in the statement (the fact of payment of daily allowance is recorded in 1C Accounting).

In accordance with the provisions of Art. 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee at the direction of his employer to perform an official task outside his place of permanent work for a specific period. As a rule, personal income tax on excess daily allowances is withheld on the day the salary is issued for the month in which the advance report is approved. The tax transfer (page 120) is made the next day after the withholding (clause 6 of Article 226 of the Tax Code of the Russian Federation).

How to reflect daily allowances in excess of the norm in 6 personal income taxes

The Federal Tax Service does not allow tax to be withheld before this date (letter of the Federal Tax Service dated July 25, 2014 No. BS-4-11/). As a rule, personal income tax on excess daily allowances is withheld on the day the salary is issued for the month in which the advance report is approved. Tax transfer (p.

120) is done the next day after the deduction (clause 6 of Article 226 of the Tax Code of the Russian Federation). For information about possible innovations in legislation relating to business trips, read the article “Will the daily allowance be abolished for business trips in 2021?”

Daily allowances in excess of the norm in 6-NDFL: examples Let's consider various situations of drawing up calculations with excess daily allowances.

- Is it possible to withhold personal income tax after the advance report is approved, but until the end of the month?

Example An employee was on a business trip within the country for 5 days, from August 1 to August 5, 2021. On July 29, he received an advance payment for the trip, including a daily allowance of 1,300 rubles. per day, total 6,500 rubles.

How to correctly reflect daily allowances in excess of the norm in 6-personal income tax?

But be careful: the procedure for paying for “children’s” sick leave remains the same!

So who has the right to work without a cash register until the middle of next year?

An exception is the situation when an employee is sent on a one-day business trip abroad.

Is it necessary to reflect daily payments for a business trip in 6 personal income taxes?

Expenses for business trips of an individual entrepreneur who works alone, without staff, are not compensated, since he himself is an employer. For accounting purposes, expenses for business trips are documented in an advance report.

At the same time, the accounting department takes into account all expenses that the employer decides to reimburse. Moreover, there may not be documentary evidence here.

Attention: Excessive travel allowances, personal income tax and general mandatory contributions for 2021.

The employer has the right to send an employee on a business trip in Russia or abroad. The business traveler is compensated daily for travel expenses. The date of payment of daily allowances is the day they are accrued.

The day of approval of the business trip report is the date of receipt of income (in the form of daily allowance). Coming in 2021

Reflection of daily allowances in the calculation of 6-personal income tax in 2021

Line How to fill out Line 020 - amount of income Show the amount exceeding the established norm of 700 or 2500 rubles. Here you cannot display the full amount and then make a deduction on line 030, because there is no such deduction code in the order. Important: Federal Tax Service No. ММВ-7-11/387.

Line 100 – day of actual receipt of income Indicate the last day of the month in which the advance report was provided and approved (upon the employee’s return from the trip) Line 110 – date of personal income tax withholding When reflecting daily allowances in excess of the norm in 6-personal income tax, the day of transfer of taxable income is noted in this line. Its date cannot be earlier than the last day of the month, since personal income tax is withheld at the next payment or immediately on the next working day (explanations of the Federal Tax Service No. BS-4-11/7893). EXAMPLE 1 K.V. Orlov, who works in (located in Moscow), went on a business trip to Kaliningrad for 5 days.

Daily allowance above the norm: 6-NDFL

Business trip to 6 personal income tax from 2021 example of filling out Important Form 6-NDFL Entries are made based on available information on income, deductions, personal income tax. The tax agent must enter the information. He also submits the completed document to the Federal Tax Service.

The rules for filling out this form are determined and formalized by the Federal Tax Service of the Russian Federation. Amounts and details are required to be filled out. If there are not enough pages for the information that needs to be entered, then the required number of pages is taken to fill out. In familiar places that are not filled in, dashes are added. The form can be filled out on a computer and printed. Then dashes are not placed in empty positions. The font used is Courier New 1 (6-18 points). The date is written on each completed page and the signature of the head of the organization (individual entrepreneur, notary, lawyer, representative of the tax agent) is affixed.

Rules for excess daily allowance

- Reflection of daily allowances in the calculation of 6-personal income tax in 2021

- Is it necessary to reflect daily payments for a business trip in 6 personal income taxes?

- How to correctly reflect daily allowances in excess of the norm in 6-personal income tax?

- Online magazine for accountants

- Daily allowance above the norm: 6-NDFL

- Business trip to 6 personal income taxes from 2021 example of filling

- 8 questions about 6-personal income tax removed: prizes, business trips, civil servants, vacation pay, benefits, errors

- The Federal Tax Service explained how to reflect average earnings in 6-personal income tax

- Characteristics of excess daily allowance in 6-personal income tax

Reflection of daily allowance in the calculation of 6-personal income tax in 2021 Attention In the line called “Adjustment number” enter 000, if the primary calculation is submitted, if corrected, then indicate the serial number of corrections, for example, 001 or 002. Per diem in excess of the norm: 6-personal income Issue to the resigning person the employee is not allowed a copy of SZV-M. According to the law on persuasive accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

Source: //advokat-zulfigarov.ru/kak-v-6-ndfl-otrazit-sutochnye-sverh-normy/